The Thrifty Business Model of Aldi

Suppose you ask people to recall the first brand that comes to mind while online shopping; the answer would unanimously be Amazon. Similarly, when you ask them to recognize a brand name in the offline retail space, the chances are that the answer would be Walmart. These two are often known as the Big Daddies of the retail world (online and offline).

So, when the CEO of Walmart, Greg Foran (2014 – 2019), uses adjectives like “fierce,” “clever,” and “good” when talking about a competitor he admires, these words are not being used about Amazon but rather for Aldi, you sit up and notice.

A grocery business that started in a small town in Germany is today a giant in the retail world with almost 12,000 stores globally. In 2021, Aldi Group’s net sales amounted to just under 134 billion U.S. dollars, a 15.3 percent growth compared to the previous year .

So, what has made Aldi such a force to reckon with?

Before we understand Aldi’s business model and pricing approach, it makes sense to delve into its history. So, where and how did it all begin?

It started with two brothers obsessed with Frugality

After World War II, brothers Theo and Karl Albrecht decided to expand their family’s grocery business from a small-town Essen in Germany. They were pretty clear from early on that they would grow their business and do better than the competition by providing the best prices to their customers.

To do that, the brothers knew that they had to keep their costs low, and hence they were mindful of every little expense at their store. In fact, Theo was switching off the store’s lights in the daytime and taking copious notes on every deal. They also kept the store design to a bare minimum. These principles of the brothers continue to remain the foundation of Aldi to date.

However, the union between the brothers did not last. A dispute in 1961 on whether Aldi should sell cigarettes or not led to the brothers splitting the business into two: Aldi Nord (North Germany) and Aldi Sud (South Germany). Funnily enough, the area that divides the Aldi Nord and Aldi Sud regions in Germany is known as the ‘Aldi Equator.’

Even though the Albrecht brothers passed away, the two businesses remain separate. They operate in 18 countries between the two chains and are often known as just Aldi, irrespective of whether it is Aldi Nord or Aldi Sud. Together the two Aldi companies are the eighth biggest retailer in the world.

Aldi operates with the motto: “the best quality at the lowest price.”, and its 203,000 employees around the world live this motto every day.

Aldi SWOT Analysis

Aldi’s business model of keeping prices low

There are three key components of Aldi’s business model that help the brand keep low prices: Low Operating Cost, High Margin through Private brands & Limited SKUs. Let’s understand each one in detail.

1. Low Operating Costs :

One of the big reasons for Aldi to be able to keep its prices low is by deploying tactics that keep its operating costs as low as possible. These include:

- Essential Customer Experience Only : If you are looking for a delightful customer experience, then maybe you should remove Aldi from your itinerary because keeping the customer experience to a bare minimum is part of Aldi’s strategy to keep its costs low.

This means that Aldi customers are expected to go through a few inconveniences: change to rent a shopping cart, paper, and plastic bags at a fee and packing your groceries. As a result, Aldi does not need to have employees or their time going in retrieving shopping carts as the customer is incentivized/penalized if they do not return the cart. This practice is not new as supermarkets in Europe have been doing this for years, but the American customers find this an inconvenience from Aldi.

- Smart Design Principles : Aldi employs several key design details that maximize efficiency at checkout, too. Aldi puts supersized barcodes on many of its products and prints them on multiple sides. This makes scanning relatively easy and quick. Once the billing is done, the cashier drops the groceries directly into the shopping cart. Aldi doesn’t waste time bagging groceries. It is left to the customers to bag their purchases, and each bag comes at a fee.

Much of the Aldi store merchandise is put up in their original cardboard shipping boxes rather than individually. This saves a lot of employee time, which otherwise would go in stocking shelves with individual products.

Not a single lie was told. pic.twitter.com/jFRhUE1T3r — Momba (@TMikaMouse) December 24, 2020

- Lower Real Estate : Aldi does not carry as many SKUs as its competitors. Hence, it can keep its store size limited to 12,000 square feet on average compared to 178,000 square feet for Walmart and 145 000 square feet for Costco. The benefit is that its returns per square foot are much higher, and there is less inventory storage, refilling, ordering, and cleaning. As a result, Aldi stores do not need to keep as much staff as their competitors.

Costco is a membership-only retail company, which offers goods in bulk at competitive prices. What is Costco’s business model?

- Employees do more than one role : Aldi does not follow the conventional approach like other supermarkets of dividing labor as per roles – cashiers, clerks, operators, etc. At Aldi, employees are cross-trained to do various jobs at the store. Aldi also does not want its staff to answer calls, so it does not publicly share its phone numbers. As a result, quite often, an Aldi store might just have three to five employees in a store, saving them significant money.

All these savings are passed on to customers as discounts or lower prices.

2. High Margins through Private Brands :

90% of Aldi’s portfolio in its stores comes from private labels. This helps them keep their marketing and distribution costs low and gives them flexibility on pricing and margins. In fact, the products and packaging of some of these private labels look pretty similar to the big brands. So do not be surprised if you find a ‘Tandil’ laundry detergent that reminds you of the ‘Tide’ brand.

% of Revenue from Private Label Goods (Store Brand) Aldi: 90% Trader Joe's: 85% Save-A-Lot: 60% Dollar Tree: 30% Kroger: 29% Costco: 25% Walgreens: 25% CVS: 25% Target: 24% Walmart: 19% Amazon: 1% pic.twitter.com/VtwPMNWq17 — Alec Stapp (@AlecStapp) November 10, 2020

3. Limited SKUs :

Instead of providing its customers a wide range and aisles of products, Aldi carries only about 1,400 SKUs per store compared to the 40,000 traditional supermarkets carry and 100,000 Walmart supercenters hold. This allows Aldi to have a much faster turnaround of its inventory and helps the customers to make choices faster.

USA: Exploiting The Retail Playground

Even though Aldi is from Europe, knowing the potential of the USA, Aldi Sud has been quite aggressively expanding its base and now has 2,100+ stores spread across 35 states of the country. It has ambitions to have 2,500 stores by the end of 2022, becoming America’s third-largest supermarket chain behind Walmart and Kroger. Illinois has 201 Aldi stores, which is 9% of all Aldi stores across the United States.

Aldi as a strong competitor

One of the biggest mistakes retail chains have made in many different markets is dismissing Aldi’s entry and expansion and not considering it a significant threat to their own business.

Some of them were naïve enough to think that Aldi’s pricing and business model is different from theirs will cater to another segment of customers. This is where they were wrong, and as a result, countries like the USA, Hungary, Ireland, Switzerland, and United Kingdom are places where Aldi has really taken a massive chunk of the market, and the grocers realized this too late.

Aldi not only caters to the low- or mid-income shoppers but also targets the wealthy shoppers. Walmart’s previous CEO, Greg Foran, marveled that he saw so many BMWs and Mercedes in the parking lot of the Aldi store he visited in Australia once. In fact, luxury cars like Jaguar and Tesla Model X are often seen in the parking lots of Aldi stores in the USA.

Aldi has noticed this profile of shoppers as well, and it has smartly ramped up its portfolio and offer by keeping exotic items like brioche from France, Irish cheese, imported items, organic products, pastas from Italy, and much more, which not only helps it to get the high-income shopper but also allows it to earn high margins.

Trader Joe’s has no online presence, discounted sales, loyalty rewards, or membership program but is thriving with its 3 critical pillars in its business model. What are they?

Aldi’s Marketing strategy of connecting with the millennials shoppers

Purpose, private brands, great marketing.

Today’s Millennial and Gen-Z shoppers are much more mindful of the products they buy and more than the brand name; what matters to them are the authenticity of ingredients, the purpose behind the company, and of course, low prices and convenience. Aldi’s reliance on private labels ticks all these boxes and helps them win that set of consumers.

100% of ALDI-exclusive chocolate bars and chocolate confectionery are from sustainable sources, and all of its coffee will be sustainably sourced by 2022.

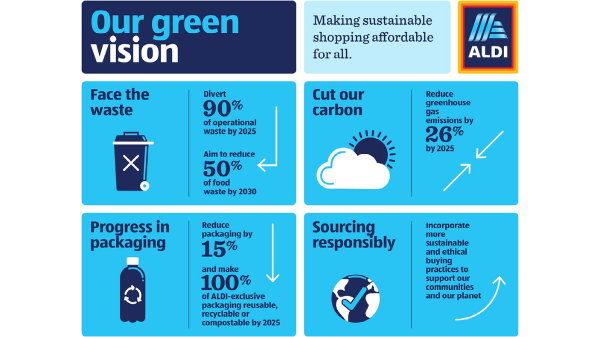

Aldi understands society and its customers’ needs and keeps their priorities at the forefront. It has several eco-friendly initiatives. ALDI has also been recognized by the EPA (Environmental Protection Agency) for its record-breaking green efforts . The retail giant is dedicated to sustainable business practices while delivering high-quality products and affordable prices.

We believe in acting with integrity and are dedicated to reducing our environmental impact. We’re committed to reducing, reusing and recycling waste , increasing energy efficiency, decreasing our carbon footprint and improving our green building standards across all of our stores and operations. Aldi’s Website On Environment

In fact, Aldi has a robust Corporate Responsibility Program that comprises of five main areas:

- Employee Appreciation

- Supply chain responsibility

- Resource conservation

- Social commitment

- Dialogue promotion

If you thought that a low-priced chain would not be doing great marketing, let me tell you that Aldi’s ad was crowned 2021’s most effective Christmas ad . Research done by Kantar declared Aldi’s ad of reimagining Charles Dickens’ ‘A Christmas Carol,’ featuring Kevin the Carrot and new character Ebanana Scrooge, as the Christmas ad that would most likely deliver on long and short-term measures for the brand.

These are the perfect recipe to keep the millennials and Gen-Z customers hooked to the chain and coming back for more.

Building Fan Following

With such a business model, you would expect customers not to be delighted with an Aldi experience other than the price benefits. Contrary to expectations, Aldi scores much higher on customer satisfaction surveys than Walmart and other supermarket chains.

In fact, as per Bain & Company, Aldi has one of the highest NPS of ~45 (Net Promoter Scores), which is an excellent indication of how likely customers are going to promote and advocate the brand to others. To give you a perspective, Walmart has an NPS of 16 .

Walmart is known for its EDLP or Everyday Low Pricing. However, such is the aura of Aldi that every time a new Aldi opens up, especially in the USA, it results in hundreds of people flocking to the opening as the prices are sometimes even lower than Walmart.

This aura is not limited to people interested in Aldi’s low prices. Such is the cult following of Aldi that there is a fan blog called Aldi Nerd (run by a stay-at-home mom of three kids), and there are people who love to buy Aldi Nerd merchandise. The community has 1.4 Mn members on Facebook .

Unchartered Territories

Aldi opened its first store in China only in 2019 and, to date, has a meager presence of 6 stores in the entire country where retail and e-commerce are part and parcel of everyday living. Aldi has not even made an in-roads into the Indian market as yet.

So other than the frontiers that Aldi is crossing every year, there are still two huge markets that the retail chain has not even tapped into. Aldi’s business model shows you the brand’s potential and why all retail brands should continue watching their shoulder as soon as they see the presence of Aldi in their vicinity.

A marketer by profession, a writer by heart and a traveller from the soul. Kunal calls himself a 'Collector of Experiences', who strongly observes human behaviour and societal truths. Kunal is an experienced professional across categories and countries in B2C and B2B industries. Currently, he is the Global Director: Marketing & Communication at DSM Nutritional Products, Switzerland and he has also worked in companies like Nestle, Britannia and Arvind Brands. Building and growing brands is a challenge that he enjoys and he is always on the lookout for great marketing, advertising or innovation stories from around the world. He regularly posts about these case studies on his LinkedIn.

Related Posts

How does Instacart work and make money: Business Model

What does Zscaler do | How does Zscaler work | Business Model

What does Chegg do | How does Chegg work | Business Model

What does Bill.com do | How does Bill.com work | Business Model

What does Cricut do | How does Cricut work | Business Model

What does DexCom do? How does DexCom business work?

What does CarMax do? How does CarMax business work?

What does Paycom do? How does Paycom work?

What does FedEx do | How does FedEx work | Business Model

How does Rumble work and make money: Business Model

Dollar General Business Model & Supply Chain Explained

What does C3 AI do | Business Model Explained

What does Aflac do| How does Aflac work| Business Model

How does Booking.com work and make money: Business Model

What does Okta do | How does Okta work | Business Model

What does Alteryx do | How does Alteryx work | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

How Aldi Became A Global Supermarket Giant

Table of contents.

The Albrecht brothers had a vision to bring affordable food and goods to the people of Germany at the end of World War II. Their unique approach to bring a low-cost, no-frills business model has helped them stand out with their loyal customer base. Important Stats to Know About Aldi:

- Aldi employs 203,600 employees around the world

- Headquartered in Essen and Mülheim, Germany

- The combined brand generates about $80 billion each year

- Operates over 12,000 grocery stores worldwide

- Aldi is family-owned and not publicly traded

{{cta('eed3a6a3-0c12-4c96-9964-ac5329a94a27')}}

The History of Aldi

In 1913, Anna Albrecht opened a small grocery store in Essen, Germany. The store remained relatively unchanged and even survived the widespread bombings and destruction in Germany during World War II. In 1946, her sons, Karl and Theo Albrecht took over the business with the goal of expanding its operations. By 1950, the brothers had grown the business to 13 locations across the Ruhr Valley.

Aldi’s Early Discount Strategy

The economic conditions in Germany following the war were difficult. The Albrecht brothers were frugal people and believed that consumers should have the opportunity to purchase high-quality food and goods at affordable prices.

At the time, people who wanted to purchase inexpensive goods would normally participate in a discount cooperative. These cooperatives would provide members with rebate stamps with each purchase that could be redeemed at a later date to get a portion of their money back. The challenge was that this process was time-consuming and painful to track. The Albrecht brothers decided on a different approach. Instead of making their customers pay full price and get their money returned later, they decided to offer the discount before the sale. This discount was restricted to 3% which was the maximum legal rebate amount allowed at the time. Thus, making Aldi one of the first discount stores on the planet.

The brothers were diligent to monitor their inventory to identify which products sold quickly and removed those that didn’t sell. Other retailers would often lose money if a product didn’t sell. In order to get the unpopular item off their shelves, they would have to spend money on advertising or discount them. Karl and Theo Albrecht refused to pay for any advertisements at all and removed items from their shelves that didn’t sell easily.

Times after the war were tough in Germany. The brothers chose to carry only non-perishable food items. This benefited the grocery store chain by reducing the risk of losing money from spoilage.

Another strategy was to keep the average store small compared to some of its competitors. With a smaller store, there was no need to spend large amounts of money on inventory to keep the shelves full. The brothers also didn't have the overhead (rent, utilities, etc.) of a larger commercial space. This allowed them to focus on keeping their shelves full of only the most popular items.

Interesting Fact

The albrecht brothers refused to pay for telephones to be installed in their stores until the 1990s. until this time, employees were required to use a local payphone to make business calls., splitting the company and creation of the aldi brand.

By 1960, the brothers had about 300 locations in operation. As the chain continued to expand, the Albrecht brothers needed to make some decisions to continue growing the company. Theo proposed that the stores start carrying cigarettes and other tobacco products to boost sales. Karl disagreed and felt that carrying these types of products would attract shoplifters.

This dispute led to the brothers making the decision to amicably split the company. While the two brothers would operate their own grocery store chains, they chose to both operate under a unified brand name. In 1962, the name Aldi (often shown in all caps, ALDI) was introduced as a shortened version of Albrecht Diskont . By 1966, the company was officially financially and legally separated.

Key Takeaways

- Karl and Theo Albrecht understood that the people of post-World War II Germany needed access to inexpensive products. They launched the first discount store that was not formed as a cooperative by offering discounts before the sale rather than post-sale rebates.

- The chain of stores focused on a no-frills experience to keep costs down. Strategies included removing unpopular items from shelves, reducing overhead through smaller stores, and spending no money on advertising.

- Despite its popularity, the Albrecht brothers chose to divide the company after a dispute over whether to sell cigarettes. The brothers wisely chose to continue operating the two separate companies under the same brand name — Aldi.

Two Companies, One Brand

When Aldi split into two entities, the companies were officially named Aldi Süd and Aldi Nord. Aldi Süd took the stores that were located in the south of Germany, while Aldi Nord took the northern stores. This dividing line is commonly referred to as the Aldi-Äquator (which literally means Aldi equator).

Both companies took a similar approach in the way they organized their extensive network of grocery stores. Stores are divided into regions. These regions are operated as limited partnerships that are managed by a regional manager. The regional manager then reports directly to the parent company headquarters — Aldi Nord in Essen or Aldi Süd in Mülheim. In Germany, Aldi Nord consists of 35 regional branches that operate approximately 2,500 stores. Aldi Süd comprises 31 regional branches with about 1,900 stores.

Although the two companies operate separately, they do work together in some respects. For example, they share many of the same marketing and store design strategies. The company even has a common company website — www.aldi.com — which redirects users to the appropriate site depending on the country they select. This effort appears seamless and has helped the Aldi brand reach millions of customers in numerous markets.

International Expansion of the Aldi Brand

Aldi began expanding beyond the borders of Germany in 1967 when Aldi Süd purchased the Hofer grocery chain in Austria. Aldi Nord followed suit shortly after and opened its first international location in the Netherlands in 1973.

In its early years, Germany was still separated into East and West Germany. This limited Aldi’s ability to expand internationally, but once the Iron Curtain fell and Germany was reunified in 1990, growth accelerated rapidly.

To avoid competing against one another, Aldi Nord and Aldi Süd avoid operating in the same markets or countries. Today, Aldi Nord operates in Denmark, France, Benelux (Belgium, Netherlands, and Luxembourg), Portugal, Spain, Poland. Aldi Sud operates in Ireland, the UK, Hungary, Switzerland, Australia, China, Italy, Austria, and Slovenia.

The combined Aldi brand currently has over 12,000 locations around the globe. Aldi Nord and Aldi Süd together make up the fourth-largest grocery chain by the number of stores.

Growth in the United States

Outside of Germany, the only shared market is the United States. Aldi Süd opened the first US-based Aldi store in Iowa in 1976. Aldi stores quickly expanded throughout the Midwest and Eastern United States.

Aldi Nord also expanded operations to the United States in the same year but chose a different approach. Instead of using the Aldi name, Theo Albrecht found that the California-based Trader Joe’s had a loyal customer base and was committed to a similar mission to providing its customers with low-priced goods. In 1976, Aldi Nord purchased Trader Joe’s.

Between the Aldi and Trader Joe’s brand, the US operation makes up about 10 percent of Aldi’s global footprint.

Current Ownership of Aldi

The companies continue to be privately owned and are not traded on any public stock exchange. The Albrecht brothers ran their respective companies as CEO until they both retired in 1993. Upon their retirement, the control of the company was transferred to private family foundations. The Siepmann Foundation controls Aldi Süd and the Markus, Jakovus, and Lukas Foundation controls both Aldi Nord and Trader Joe’s.

The significant growth of the Aldi brand has led to Karl and Theo Albrecht being ranked among the wealthiest people on the planet. In 2010, Theo was ranked by Forbes magazine as the 31st richest person with a net worth of over $16 billion. Around the same time, Karl was ranked as the 21st richest person by the Hurun Report. Today, the Albrecht family is estimated to be worth a combined $53.5 billion.

Having a lot of money made the Albrecht brothers a target. In 1971, two kidnappers successfully abducted Theo and held him for ransom for 17 days. A ransom of 7 million Deutschmarks (about $3.5 million) was paid for his release. Following the incident, the brothers became very reclusive and would travel in armored cars to and from the office.

- With the company split into Aldi Nord and Aldi Süd, the Albrecht brothers agreed to divide the territory and work under a unified brand.

- Both companies focused their growth on international markets and agreed to not operate in the same countries to reduce competition with one another (Germany and the United States are the exceptions).

- In the United States, Aldi Süd opened stores under the Aldi name. Aldi Nord purchased the small grocery chain Trader Joe’s and expanded operations under this brand.

Trader Joe’s Recipe for Success

Theo Albrecht’s decision to purchase Trader Joe’s was a smashing success. What started as a handful of stores in Southern California has expanded to over 500 locations nationwide. The brand is recognized as having one of the highest sales per square foot of store space compared to its competitors. Despite making up less than 5 percent of the total number of Aldi-owned stores, Trader Joe’s accounts for approximately 16 percent of the total revenue. While Trader Joe’s does follow some of the similar strategies of the Aldi brand, there are a few differences.

Fun Atmosphere

When a customer walks into Trader Joe’s, they will immediately notice the island or tiki-themed decor. The brand works hard to give their customers a feel-good experience when they shop. Employees are referred to as “crew members” and can be seen wearing Hawaiian shirts (managers are called “captains”). They also have nautical bells that they use to communicate instead of the traditional PA system found in most grocery stores.

The original owner, Joe Coulombe, felt that his stores were too similar to boring convenience stores at the time. He set out to create something unique and different that customers would remember. Joe was obsessed with the South Pacific, so he went with that theme. While the island theme is found in all Trader Joe’s stores, most mix in elements from the local community. For example, a Trader Joe’s in Denver might feature artwork that has mountains.

Unique and Specialty Products

Trader Joe’s has a wide range of products that you can't find anywhere else such as their apple chicken sausage links or Indonesian salsa. They are big on having plenty of specialty options that are vegetarian, vegan, gluten-free, and other dietary restrictions. Customers can usually find free samples throughout the store. Employees are encouraged to try as many of the store’s products as possible so they can easily describe or make recommendations to customers.

Low Prices Through Trader Joe’s Branding

In a Trader Joe’s store, customers won’t see a lot of name-brand products. The reason for this is that about 80 percent of products sold in the store carry the Trader Joe’s brand. Many of these products are name-brand goods under the generic label. This helps Trader Joe’s secure lower pricing from its suppliers. Trader Joe’s has strict privacy agreements with its suppliers to not make their relationship known to the public.

Cult Following

While the Aldi and Trader Joe’s brands are known for low prices, they both attract a different type of crowd. Aldi is popular among low-income or blue-collar workers. Trader Joe’s has focused on catering to higher-income families and college students. They do this by constructing stores in more affluent neighborhoods. This has attracted more of a cult following. Trader Joe’s customers are extremely loyal to the brand.

Social Responsibility

Trader Joe’s is known for responding well to feedback and criticism from the local community. For example, it removed some Chinese-based food products due to consumer health concerns.

The chain also eliminated six unsustainable fish species from its shelves to help protect the environment. This helped earn Trader Joe’s the 3rd spot (up from the 15th spot) on Greenpeace’s CATO (Carting Away from Oceans) scale.

- Trader Joe’s has become a significant contributor to Aldi’s annual revenue by offering a unique set of products, catering to a specific customer base, and deploying a memorable tiki-theme in their stores.

- Their strategic placement of stores in affluent neighborhoods and near college campuses has allowed them to secure a cult following in many areas around the country.

A Brand Built on Frugality

There isn’t much known about the Albrecht brothers outside of their involvement in building the Aldi brand. However, they are known for being extremely frugal individuals despite being worth billions of dollars at the peak of their lives. This frugality bled over into their business model helping them create a company that was dedicated to keeping prices low while minimizing risk and overhead costs.

No Frills Shopping Experience

Theo and Karl Albrecht understood that every business expense must be charged back to the customer. For this reason, Aldi has focused on creating a shopping environment that provides customers with high quality, low-cost products, and nothing more.

Aldi has historically viewed any form of advertising as a wasted expense. Outside of their sales ad that shows the deals going on that week and social media presence, very little money is spent on marketing or advertising. Aldi has stuck to this stance from the very beginning. When you enter an Aldi store, you will see promotion of the company’s mission and value statement but nothing advertising the actual products.

While the brand has recently started investing money in the look of their stores, many traditional Aldi locations display goods in their original shipping boxes. This reduces the cost of paying store clerks to transfer the goods from boxes to the shelves.

Aldi also encourages its shoppers to bring their own grocery bags. Even in areas where this is now mandated by law, Aldi is historically charged for plastic or paper bags. Customers are also responsible for bagging their own groceries saving the salary of a bagger. Customers will often simply use empty or discarded boxes found throughout the store. This also reduces the cost for the store for garbage disposal.

Most grocery stores are forced to hire staff to go into the parking lot to collect shopping carts and bring them back for the next customers to use. Aldi took a unique approach to this by installing devices on the carts that lock them together. When a customer wants to use the cart, they must insert a coin (like a quarter). The customer then gets this coin back when they return the cart. Example below.

Aldi also carries far fewer products than a traditional grocery store. Many popular competitors can carry tens of thousands of different products. For Aldi, the store size is kept small (about 12,000 square feet) with approximately 1,400 products. Many of these products are displayed with Aldi’s brand name on the packaging. This helps keep the costs of goods low since customers aren’t paying for popular name brands.

- The Albrecht brothers were known for being extremely frugal. These practices heavily influenced the way that Aldi is operated and has led to much of its success.

- The interior of Aldi stores provides a no-frills experience with food displayed in shipping boxes and no advertising. This helps to keep the cost low for consumers.

- Aldi relies on the customer to provide their own bags and labor to keep costs low. For example, customers participate in bagging their own groceries, removing empty boxes from the store, and returning shopping carts for the next customer.

The Future and Innovation of the Aldi Brand

.jpg)

Aldi has an ambitious goal to continue growing in the near future. This is especially true in the United States. Aldi US (Aldi Süd’s United States division) announced that it planned to become the third-largest grocery chain in the United States after Walmart and Kroger by the end of 2022. Aldi currently ranks 9th when compared by revenue to other grocery store chains in the United States. The company hopes to achieve this by focusing on new opportunities to expand services and take advantage of e-commerce. They also plan to rapidly expand the number of operating stores.

Embracing the COVID-19 Pandemic

Aldi has taken advantage of and adapted well to the COVID-19 pandemic. With workers across the globe transitioning to remote work, there has been a higher demand for groceries. While other foodservice businesses struggled, Aldi US seized the opportunity to expand their services to capture new market share including curbside pickup at hundreds of stores, alcohol sales, Instacart deliveries, and other e-commerce initiatives.

Expanding Product Lines

In 2020, Aldi announced that it would break from its approach of stocking many non-perishable food items and expand fresh food options by 40%. Due to consumer demands and changing diets, Aldi has made additional produce, meat, organic items, and prepared foods available to its customers. This is especially critical as Aldi expands into agriculture hubs like California that is known for its readily available fresh fruits and vegetables.

Creating Strategic Partnerships

Aldi is known for coming up with creative solutions to keep costs low and tackle challenges. The labor shortage coming out of the COVID-19 pandemic is no exception. With many companies laying off workers or reducing hours, Aldi partnered with the fast-food giant McDonald’s to share employee resources. This was a win-win for everyone involved — Aldi could get much-needed help with increased demand for groceries, employees would be able to maintain their income, and McDonald’s would be able to retain those employees for when economic conditions improved.

Rumors of a Consolidation

Since Aldi is privately owned, they don’t often share their strategies openly with the public. However, both Aldi Nord and Aldi Süd have made efforts in recent years to better align their product offerings to be more similar. Many speculate that this could be an indicator that the two entities plan to combine once more in the near future.

The company could potentially benefit from being publicly traded. An IPO (Initial Public Offering) could help generate some additional funding to be used toward the expansion and remodeling of existing stores.

- Aldi plans to continue to grow its market share by opening a large number of new stores by the end of 2022.

- The brand has worked diligently to adapt and capture new opportunities that came with the COVID-19 pandemic including curbside pickup, e-commerce, and labor sharing partnerships.

- Some rumors exist that Aldi could be making moves to boost its market strength by combining Aldi Nord and Aldi Süd into a single entity.

Final Thoughts and Key Takeaways

The Aldi brand is a true powerhouse in the grocery store industry. While other brands have focused their efforts on traditional approaches such as paying for expensive advertising or trying to stock the largest variety of products, Aldi has taken the opposite approach. From its frugal beginnings, the brand has captured the attention of consumers across the globe. In many cases, Aldi’s strategy has kept pricing so low that competitors have been forced to slash their prices. This has helped Aldi continue to gain a foothold in new markets around the world.

Quick Comparison of Aldi Brands

- The Aldi brand started as a small, family-owned grocery store owned by Anna Albrecht. Once her sons took over the business in the 1940s, the business grew rapidly and expanded across Germany.

- The early strategy was to offer discounts to customers before the sale. This was a new approach at the time as most consumers purchased inexpensive food products from cooperatives.

- The Albrecht brothers decided to split the business into two separate companies after a dispute over whether to sell tobacco products. The two companies would continue to operate under the combined brand Aldi (short for Albrecht Diskont).

- The two Aldi companies avoid operating in the same countries to avoid competition. The only exception is Germany and the United States. In the US, Aldi Nord operates under the Trader Joe’s brand while Aldi Süd uses the Aldi name.

- Both Aldi companies are still family-owned and have never been publicly traded.

- The Trader Joe’s brand is extremely popular in the United States and makes up a sizable portion of the brand’s annual revenue.

- Aldi gives its customers a no-frills shopping experience to keep costs low including generic brands, products displayed in original shipping boxes, and making customers bag their own groceries.

- Aldi stores are much smaller than their competitors and carry far fewer products. This allows them to focus their efforts on stocking only products that sell quickly.

- The Aldi brand plans to continue rapid expansion efforts around the globe. In the United States, the brand plans to open hundreds of new locations, securing them the number three spot after Walmart and Kroger.

- Aldi has used the pandemic to launch new initiatives and create special partnerships to strengthen and grow the brand.

The Leading Source of Insights On Business Model Strategy & Tech Business Models

ALDI Business Model Analysis

By the end of World War II, Theo and Karl Albrecht took over the small grocery store of their mother to make it become one of the most successful discount supermarket chains in the world. ALDI operates according to the motto “the best quality at the lowest price .” The company generated €24.2 billion in revenues in 2020.

Table of Contents

The ALDI origin story: the low-cost business model

In 1913, Frau Anna opened a small grocery store in the suburb of Essen, Germany. By the end of World War II, Karl and Theo, Anna’s soon took over their mother’s business , and run it with the motto “the best quality at the lowest price .” That motto would become the company’s vision for decades to come.

By 1948, opening the two brothers had opened four stores in the local area. They managed to keep prices extremely low by only stocking non-perishable items and by selecting the things that sold the most from the shelves while removing the slow-sellers.

By that time Theo and Karl Albrecht decided to focus on developing a chain of small stores. In 1954, the brothers opened Germany’s first self-service store. By 1960, Theo and Karl Albrecht owned 300 stores with an annual turnover of millions of dollars.

The split over a cigarette

In the 1950s the brothers split the chain into two separate groups, presumably over a dispute about whether to sell cigarettes. Theo headed Albrecht-Diskont Nord, which sold cigarettes. Karl instead became the CEO of Albrecht-Diskont Süd, which did not sell cigarettes.

Albrecht-Diskont store became ALDI

In 1962, despite the disagreement kept working together and changed the name of the. group to Aldi Nord and Aldi Süd. The taken from the first two letters of Al brecht and Di skont. The two businesses became financially and legally separate in 1966. By this time, there were 200 Aldi Süd stores in Germany.

The Trader’s Joes acquisition by Aldi Nord

In 1979, a trust headed by Aldi Nord’s Theo Albrecht bought the chain Trader Joe’s, which now operates 475 stores in the US .

The full story of Trader Joe’s below, in our podcast series:

How does Aldi keep its prices low?

Aldi uses a set of strategies to keep its prices low while maintaining a high quality:

- Aldi lists 1,300 items in each store every day, which is very limited compared to other supermarket chains. That keeps waste to a minimum

- Aldi also stocks a lot of their own brands, with some becoming successful, which lowers the sales and marketing cost

- 90% of the products are Aldi-exclusive brands, which makes it easy for the chain to market them, with more flexibility on. price and distribution

- ALDI in a way retains a. self-service attitude, where customers bring their own bags or can buy reusable bags at the store. Also, they must bag their own groceries. This lower the costs of serving clients for the company compared to other chains

- Limiting store hours and keeping their stores small (about 15,000-20,000 square feet)

ALDI Mission and Core Values

As the company highlights :

ALDI Nord is an internationally successful discounter. We provide broad groups of consumers in nine countries with high-quality products at consistently low prices. “Simplicity, responsibility and reliability” – these values guide our actions and have been codified in our “Simply ALDI” mission statement . The mission statement provides a clear sense of direction for more than 69,000 ALDI employees.

Back in 2017, the company announced its restructuring of the stores, according to the ALDI Nord Instore Konzept (ANIKo) program, aimed as it explained , at creating:

An atmosphere that makes our customers feel right at home – that is the goal at the heart of our new stores. The renovation is the largest project to date in the history of the ALDI North Group. A majority of the 4,700 stores are slated for an update in the next two to three years. Many changes immediately stick out, while others are being made unseen behind the scenes. Our virtual tour reveals all that awaits ALDI North customers in the freshly renovated stores. But that’s not all: it also shows where we are making our product range increasingly sustainable – both in brand -new and already existing stores. Because whether already modernised or not, customers will find a bigger selection, greater freshness and more sustainable products at the proven ALDI price at all of our stores.

ALDI North in numbers

Source: cr-aldinord.com

As reported by ALDI North official report:

The ALDI North Group is represented in nine European countries with companies as independent legal entities. In Germany, the ALDI North Group as a group of subsidiaries is comprised of legally independent regional companies, in each case with the legal form of a GmbH & Co. KG, which means that the managing directors of the independent regional companies have equal status in casting votes at regular board meetings. ALDI Einkauf GmbH & Co. oHG is engaged by these regional companies to provide various services. This company is also the licensor of the ALDI brand for the legally independent foreign companies of the ALDI North Group operating in the ALDI North Group countries. This arrangement ensures a uniform market profile.

The motto remains “ offering high-quality groceries at everyday low prices. ”

In 2020 ALDI North Group recorded sales for 24.2 billion euros, compared to 22.8 billion in 2019.

ALDI North has more than 54,000 employees.

One of the secrets for ALDI’s business model success is to keep its price low is the own brand ’s portfolio, which as you can see spans anywhere from 65% in Denmark, up to 90.5% in the Netherlands.

ALDI North corporate responsibility program

ALDI North follows a corporate responsibility program, which comprises five main areas:

- Employee appreciation.

- Supply chain responsibility.

- Resource conservation.

- Social commitment.

- Dialogue promotion.

ALDI’s founders are among the wealthiest businessmen in Germany

As reported on thelocal.de the top ten richest Germans are:

1. Karl Albrecht and family (Aldi Süd) €17.20 billion

2. Berthold and Theo Albrecht junior and family (Aldi Nord) €16 billion

3. Dieter Schwarz (Lidl, Kaufland) €11.50 billion

4. Otto family (Otto mail order) €9.00 billion

5. Susanne Klatten (BMW, Altana) €8.90 billion

6. Reimann family (Reckitt Benckiser, Coty) €8 billion

7. Reinhold family Würth (Würth) €7.20 billion

8. Günter and Daniela Herz (Germanischer Lloyd) €7 billion

8. Oetker family (Oetker) €7 billion

10. Rethmann family (Remondis) €6 billion

This makes the total personal wealth from ALDI founders at over 33 billion euros (about $38 billion at current rate).

ALDI as a private company

Aldi might well be among the largest private companies in the world. As a private company, ALDI has total control over its strategy without focusing on quarter results. Also, ALDI can keep its number relatively secret from its competition.

Key Highlights

Origins and Business Model:

- ALDI was founded by Theo and Karl Albrecht, who took over their mother’s grocery store after World War II.

- Motto: “The best quality at the lowest price .”

- Started with a focus on non-perishable items and fast-moving products.

- Introduced self-service in 1954 and expanded to own hundreds of stores with significant annual turnover.

Low Price Strategies:

- Limited selection with around 1,300 items to reduce waste.

- Strong emphasis on own brands, with about 90% of products being Aldi-exclusive.

- Self-service approach, where customers bring their own bags and bag their groceries.

- Smaller store sizes and limited store hours.

Corporate Values and Initiatives:

- Guided by values such as simplicity, responsibility, and reliability.

- Introduced the ALDI Nord Instore Konzept (ANIKo) program in 2017 for store updates and sustainability.

- Focus on offering a wider product range, freshness, and sustainability.

Financial Performance and Wealth:

- ALDI North Group achieved €24.2 billion in sales in 2020.

- ALDI’s founders, the Albrecht family, are among the richest Germans.

Private Company Status:

- Operates as one of the largest private companies globally, enabling greater strategic control.

- Keeps company information confidential.

Corporate Responsibility Program:

- ALDI follows a comprehensive corporate responsibility program encompassing employee appreciation, supply chain responsibility, resource conservation, social commitment, and dialogue promotion.

Business Model Recap

Aldi’s related case studies, costco business model.

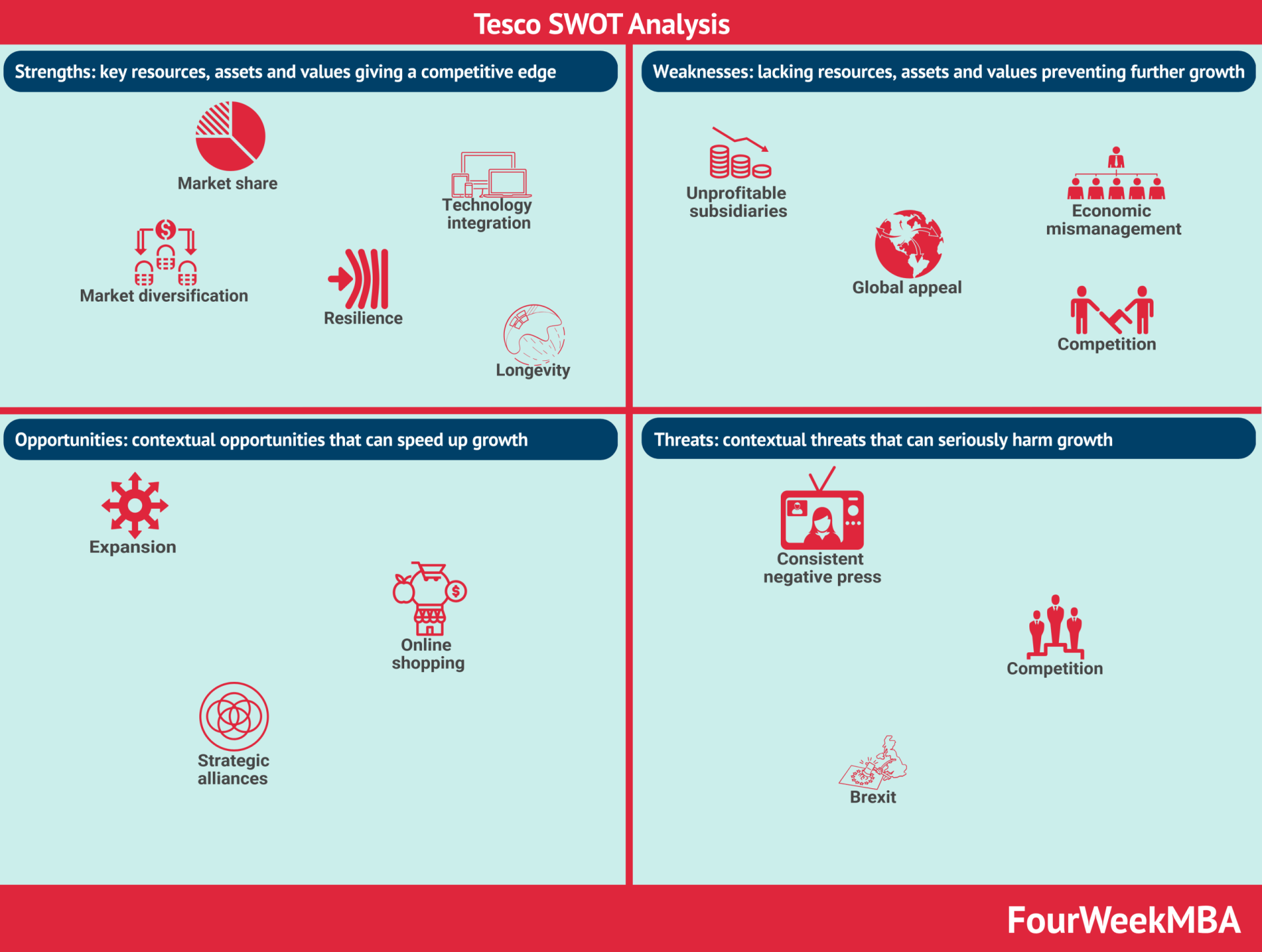

Tesco SWOT Analysis

Tesco PESTEL Analysis

Walmart Business Model

Walmart Mission Statement

Walmart SWOT Analysis

- Amazon Business Model

Amazon Subsidiaries

Who Owns Whole Foods

Main Free Guides:

- Business Models

- Business Strategy

- Business Development

- Digital Business Models

- Distribution Channels

- Marketing Strategy

- Platform Business Models

- Revenue Models

- Tech Business Models

- Blockchain Business Models Framework

What is Aldi's business model?

With the motto “the best quality at the lowest price ” ALDI operates a low-cost business model , where it stocks a relatively small list of items available in its store every day, thus keeping waste at a minimum, while also prioritizing on its own brands, which can get distributed with more flexibility in terms of price and distribution .

What is Aldi's business culture?

Aldi’s core purpose is to “provide value and quality to customers by being fair and efficient in all it does.” And it follows three core values: consistency, simplicity, and responsibility. According to Aldi consistency leads to reliability. Simplicity creates efficiency. And responsibility stands for its commitment towards people, customers, partners, and the environment.

More Resources

About The Author

Gennaro Cuofano

Leave a reply cancel reply, discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- 70+ Business Models

- Airbnb Business Model

- Apple Business Model

- Google Business Model

- Facebook [Meta] Business Model

- Microsoft Business Model

- Netflix Business Model

- Uber Business Model

ALDI’s marketing strategy: The key growth ingredients of the FMCG titan

A giant in the UK’s grocery industry, ALDI prides itself in selling the most economical quality items. Over the past decade, ALDI’s marketing strategy has aimed at aggressive growth globally, trying to ensure everyone has nearby ALDI stores or a nearby ALDI supermarket. This mindset has helped the company become the third-largest grocery brand in Australia and has placed it on track to become the third-largest in the U.S. by the end of 2022 .

This ALDI case study will dive into ALDI’s marketing strategy and analyze its eCommerce page to help other companies learn about marketing strategies for supermarkets and see the kind of growth that the brand has been enjoying.

Table of Contents

- > ALDI through the years: how the retail titan was created

- > ALDI marketing strategies that unlocked its growth.

- > ALDI’s eCommerce website

- > New tech that would be a service to ALDI’s customer engagement strategy

- > Engrossing technology tools that ALDI is utilizing

- > Fresh news of the supermarket retailer

- > Insightful ALDI statistics to check

ALDI through the years: how the retail titan was created

Once a small German grocery store that two brothers took over for their mother in 1945, ALDI’s brand positioning of selling quality low-cost products grew out of its environment. Since World War II had just ended, Germany’s economy was weak and many citizens couldn’t spare much money for groceries.

To reclaim money from other market leaders at the time, customers had to collect rebate stamps to send to their local co-operative at regular intervals. ALDI, then called Albrecht, thrived by subtracting the legal maximum rebate of 3% before all sales, eliminating the process to entice customers. To save costs further, the store didn’t spend on any advertising, and items that didn’t sell would promptly come off the shelves to conserve space for only what people wanted.

By 1960, the brothers jointly owned 300 shops, leaving no one wondering why ALDI is the best.

ALDI then began expanding internationally, building its first American store in Iowa. Today, just in America, the chain has grown to over 2,000 stores across 35 states, managing more than 25,000 employees . The company has received over 1,200 product awards and recognitions since 2017, including BrandSpark American Trust Study’s most trusted Discount Grocery Store Chain.

The ALDI marketing strategies that unlocked its growth.

ALDI’s growth clearly came from 9 key factors. We’ve spotted and analyzed them below, so feel free to try the same strategies for your business.

Key Strategy #1: Omnichannel transformation

A strong, consistent omnichannel presence reduces friction along the customer journey, building and strengthening brand associations quickly. ALDI’s omnichannel strategy has been to meld its online and offline channels, investing in services like click-and-collect, letting a customer shop online and pick up their order from the store.

As a part of this effort, ALDI partnered with delivery services like Deliveroo and Instacart, which let shoppers who live far from its stores buy items as though they were physically present. Some of these services also let people access features such as click-and-collect, so they can customize their experience to best fit their needs and wants.

Key Strategy #2: Choosing the optimum target market

The grocery giant positions itself as the most cost-effective retail store to target the middle-income group worldwide. ALDI’s pricing strategy of maintaining the lowest possible prices and no-frills discounts encourages men and women in low and mid-level income groups and economical shoppers around the world to become regular customers.

To better cater to this market, ALDI continuously finds ways to reduce operational costs. For instance, it introduced a cart rental system. Shoppers would pay a quarter to unlock a cart from a corral at the front of the store, and they would get it back once they returned their cart. This added no charge to the customer but allowed ALDI to avoid hiring employees just to manage the carts.

Key Strategy #3: Creating an “As Is” map of the supply chain

ALDI maintains an “as is” map of its supply chain for some of its products to accurately pinpoint areas for expansion, as well as potential process breakdowns and risks. It also makes this information public on its website , letting its customers hold it accountable, which helps position ALDI as a transparent, trustworthy brand that values ethical product sourcing.

Key Strategy #4: Differentiation: The ‘Good Different’ new brand positioning

ALDI’s low prices make it stand out against all other major retailers. To raise consumer awareness about its uniqueness, ALDI’s marketing strategy in Australia incorporated new brand positioning, “Good Different,” which reinforced that the company’s low prices are a result of conscientious business practices — for instance, it sources products ethically and treats staff and suppliers with respect.

The “Good Different” campaign told customers that ALDI’s prices are better because the company is better, quelling any concerns over why it can charge so little.

Key Strategy #5: Social responsibility

ALDI understands the brand expectations that millennial and Gen-Z shoppers hold. They want a brand they support to take interest in its impact on the world. As a result, ALDI focuses on and constantly discusses its CSR efforts, such as sourcing all of its ALDI-exclusive chocolate bars and confectionery sustainably.

This focus also helps the brand build earned media, which is more influential than either paid or owned media. For instance, the EPA has ranked ALDI 15th on its Green Power Partnership’s “National Top 100 List” for its record-breaking green efforts. This ranking will attract more customers than ALDI Tweeting about its environmental awareness.

Key Strategy #6: Simple, cost-effective distribution

ALDI was able to open roughly one store every week in Britain, largely because its product distribution is uncomplicated. It purchases items in bulk and stores them in local warehouses, minimizing transit time and waste disposal while transporting goods.

Key Strategy #7: Ads promote USP

Though there is no ALDI marketing department in Germany, ALDI’s promotion strategy in the U.S., UK, and Australia, makes significant use of print, electronic, and display media to promote its stores. In these countries, it runs copies like “Swap and save” and “Like brands, only cheaper” to entice customers to switch from competitors’ brands to their own and build trust in its products.

Key Strategy #8: Simplified in-store layout

ALDI keeps its layout as simple as possible to drive down operational costs. Customers can generally find and pick out products on their own, reducing the number of employees necessary to assist them. ALDI’s marketing strategy also includes keeping only a limited amount of high-quality, name-brand products, so customers don’t have many options to confuse them, reducing their selection time.

Key Strategy #9: Engaging with followers

By engaging with its followers, ALDI can build brand loyalty. For instance, it has run a “Fan-Favorite Survey” since 2019 , where fans can enroll in a lottery for up to $1,000 in ALDI gift cards by voting for their favorite ALDI product. This loyalty helps the brand activate its following, turning its fans into marketers by encouraging people to use its hashtags for its products, which helps it access people its efforts hadn’t reached previously.

Social media lets a brand reach a far wider pool of potential customers than any other tool. ALDI maintains a strong social media presence — boasting 2.8 million Facebook followers, 830,000 Instagram followers, and 106,000 Twitter followers at the time of writing — to get its brand in front of the internet-savvy section of its target audience.

ALDI’s eCommerce website

ALDI is undoubtedly one of the most highly evaluated retail brands out there. To achieve this, they mastered the art of eCommerce conversions. Or not? We’ve analyzed four-page templates of their site to identify eCommerce best practices and mistakes you should avoid.

A. Analyzing ALDI’s Home Page

What we liked:

- Noninvasive offers: Pop-ups still boast an average conversion rate of 3.9% , and the main barrier preventing retailers and CRMs from using pop-up ads is their invasiveness. Because the offer appears on a bright banner that feels native to the page, it still catches a visitor’s eye but doesn’t irritate them, which can help increase conversions.

- Attractive deals: ALDI’s website reinforces the brand positioning by placing copy about ALDI’s low prices against a bold, eye-catching red background. Even if the customer doesn’t consciously register it, this reinforces the brand image in their mind.

- UX design: The page focuses strongly on user intent, letting customers start adding items to their cart directly from the home page. This removes friction between arriving at the home page and making a purchase, speeding customers along in the sales funnel.

- Search bar: A search bar is available on every page, letting the customer redirect their journey at any point if they decide they want a different item. The ubiquity of search bars reduces friction points, too. A customer can start searching for items quickly from the home page.

What we didn’t:

- Slow to load: Because it uses dynamic elements, the page loads slowly. As the user scrolls down, sections load in, freezing the page for seconds. The sidebar also sometimes fails to open when clicked. This increases the site’s bounce rate, since the probability of bounce increases by 32% if a page load time goes just from one to three seconds and by 90% if it reaches five seconds.

- Non-unique design: Though effective, the website interface is identical to Instacart’s. Visitors who have used Instacart before will automatically expect similar functionality, which may exacerbate frustration with the loading times. A website design is also an opportunity to build and reinforce brand associations and maintain consistency across platforms, which enhances the omnichannel experience.

B. Analyzing ALDI’s Category Page

- Sticky cart: The options to add an item to the cart and view the cart are conveniently available no matter where the customer scrolls on the page, empowering users to add items to their cart even if they’re unsure about buying them. A/B testing shows that sticky carts increase orders from the product page by 7.9% and all add-to-carts by 8.6%.

- Sorting options: Letting the user customize their search helps them find the items they want more quickly, reducing churn.

- Useful information on display: By displaying deals available for items on sale and small text for other information, like if a product is gluten-free, this page enhances the customer experience, increasing retention and CLV.

- No filters: Like sorting options, filters help a user customize their search to find items more easily. This category page permits the user to reduce their options to smaller subcategories, but there is no ability to filter items based on features like brand, price, and common dietary restrictions. Adding this would reduce customer choice overload, which otherwise leads to cart abandonment.

C. Analyzing ALDI’s Product Page

- Minimalist presentation: The above-the-fold information is minimal, stopping at the “Favorite” button. However, its design and arrangement make the page still look complete, enhancing the customer experience while reducing extra noise that could complicate their decision-making process.

- Item suggestions: Customers can look through similar products if the current one doesn’t fit their needs, so they can immediately find a better option instead of abandoning their cart. They can also check items that other users frequently buy with the current product, making it easier to pair products while expanding their final cart, increasing ALDI’s revenue.

- Add item to Favorites: The option to add an item to a “Favorites” list boosts CLV by promoting repeated use while adding value to the customer, who can find the item more easily in the future.

- Simple content copy: The product details are simple, laying out the benefits for the customer clearly and without confusing data that might distract or confuse the customer.

- Nutrition facts sometimes missing: Not all food product pages include the nutrition information of the item, which is vital in simulating an in-person grocery shopping experience. Ensuring all food items contain their nutrition facts reduces friction and improves the omnichannel experience.

- No reviews: Almost 50% of people trust consumer reviews like they were recommendations from a family member or friend. Groceries are relatively inexpensive everyday purchases, so fewer customers may read these reviews, but giving customers the ability to leave a review would add to ALDI’s marketing objectives of portraying transparency and confidence in its products.

D. Analyzing ALDI’s Checkout Process

- Pre-checkout suggestions: The pre-checkout suggestions function like point-of-purchase marketing displays, enticing shoppers who are ready to purchase to add just one or two more items to their order.

- Simple steps: Each step in the checkout process is separate and concise, walking the customer through entering all the data necessary without overloading or tiring them.

- Savings callout: Customers who have bought items on sale see their savings in bright red under the final bill. The text color makes them focus on it, prompting them to feel more satisfied with their order even if they only saved $1.

- Multiple available delivery slots: Customers can choose from a wide selection of two-hour delivery slots throughout the day. This increases customer convenience, especially for those working long hours or those who are otherwise only able to receive their order in a specific window of time.

- Several delivery plans are available: Customers have multiple delivery options according to their needs. If they want to place an order in advance, they can set the delivery for a different day. If they need it to reach early, they can pay a small extra fee to get priority delivery within a certain time frame. Having these options available increases customer satisfaction and encourages repeat ALDI site visits.

- Pick-up option: An employee can prepare the order so the customer can simply come to pick it up, combining online and offline channels to enhance customer satisfaction.

- Google/Facebook sign-in: Internet users today expect any website that requires an account to let them connect their social media accounts, saving them the time of entering all their personal information and the trouble of remembering their username and password. If the customer already has an Instacart account, their usual settings will also auto-populate upon their login.

- No way to remove items post-checkout: Though customers can add more items to their order even after checking out, they can’t remove items they may have purchased accidentally. This can make them feel like they’re being valued less post-payment.

- No guest checkout option: However easy it is to become a member, forcing the customer to sign up adds a step in the checkout process and makes them consider the number of company emails they already receive. This increases the risk of checkout abandonment .

New tech that would be a service to ALDI’s customer engagement strategy

ALDI’s eCommerce website is effective but it could be enhanced with the help of some online tools. One tool that would significantly benefit ALDI is ContactPigeon’s Omnichannel Chat solution.

This chat feature helps a brand respond to customers immediately, preventing long waiting times and increasing customer satisfaction and brand loyalty. ALDI could use it as a way to deepen its relationship with its followers, taking a deep dive into its customers’ journey and creating smart types of automation that personalize the eCommerce experience and make users feel as though they were in a physical store.

For instance, if the chatbot recognizes a repeat customer, it can make personalized offers based on their search or order history, appealing to the specific customer’s tastes. Increased personalization is one of the best ways to boost sales effectively and access a high ROI.

Engrossing technology tools that ALDI is utilizing

Using the buildwith tool we scanned the giant’s U.K. website and we highlighted ALDI’s new website tools that we found most interesting:

- Omniture SiteCatalyst Customers: SiteCatalyst, an Adobe subsidiary, tracks visitors and conversions to provide detailed web and mobile usage analytics.

- Dynatrace: Dynatrace is an AI-powered monitoring and analytics tool that captures user journeys on a website.

- Modernizr: Modernizr lets a webpage run several tests on a user’s browser to customize the site according to the HTML, CSS, and JavaScript features they have available.

Fresh news of the supermarket retailer

Upper management at ALDI has been working hard to expand and strengthen the brand’s omnichannel experience. Here are some recent news articles that may help contextualize these efforts:

- ALDI On Track To Join ‘The Big 4’ UK Grocery Brands By 2023 ( Forbes )

- ALDI to expand store numbers in £1.3bn UK investment push ( Financial Times )

- ALDI opens first-ever cashier-less store in Greenwich ( Retail Week )

- Mold: New traffic management system introduced at ALDI store ( The Leader )

Insightful ALDI statistics to check

ALDI has experienced massive growth in multiple countries over the past few years, turning it into the grocery giant it is today. Here are some statistics that help summarize ALDI’s success story at a glance:

- ALDI’s net sales increased from $86.2 billion in 2016 to $133.9 by 2021

- ALDI expanded its UK grocery market share from 6.2% to 9% between January 2017 and January 2022

- There are over 2,100 ALDI stores across 38 states in the U.S.

- ALDI has opened over 1,000 new stores across America in the last decade, with 150 more planned for 2022, which will make it the third-largest U.S. grocery retailer by store count

- ALDI controls a 10.5% market share in Australia , rapid growth from just 4% in 2009

- ALDI was the first discount grocery store in the world

Discover more resources about FMCG retailers

- Sainsbury’s Marketing Strategy: Becoming the Second-Largest Supermarket Chain in the UK

- Tesco Case Study: How an Online Grocery Goliath Was Born

- The Marks and Spencer eCommerce Case Study: 3 Growth Lessons for Retailers

- The Ocado marketing strategy: How it reached the UK TOP50 retailers list

- ASDA’s marketing strategy: How the British supermarket chain reached the top

- Walmart Marketing Strategy: Decoding the Success of the US Multinational Retailer

- Analyzing Lidl’s Marketing Strategy: How the Discount Supermarket Leader Scaled

- FMCG Marketing Strategies to Increase YOY Revenue

Differentiate and grow like ALDI

ALDI didn’t become one of the most dominant grocery brands worldwide by luck. It identified its brand values early and built itself around them. Though this sounds simple, the difficulty comes from decades of consistency that was possible because of a consistent, brilliant, passionate, and exceptionally executed business plan that has now been successfully replicated in ALDI’s digital marketing strategy.

The pandemic has drastically changed the world , accelerating the integration of technology into all aspects of business. It has created an opportunity for rapid growth — for companies that can quickly incorporate technology to create an omnichannel experience that improves customer satisfaction while reinforcing brand values.

Before investing in a powerful customer engagement platform , however, it’s important to conduct deep market research and evaluate the benefits of the platform’s tools. Book a free 30-minute retail customer engagement consultation with ContactPigeon’s experts and incorporate an omnichannel strategy that will bring a high ROI to your business.

Let’s Help You Scale Up

Spending time on Linkedin? Follow us and get notified of our thought-leadership content:

Loved this article? We also suggest:

Sofia Spanou

Sign up for a demo.

- Harvard Business School →

- Faculty & Research →

- February 2014 (Revised December 2016)

- HBS Case Collection

Aldi: The Dark Horse Discounter

- Format: Print

- | Language: English

- | Pages: 17

About The Author

Eric J. Van den Steen

Related work.

- March 2014 (Revised December 2016)

- Faculty Research

- Aldi: The Dark Horse Discounter By: Eric Van den Steen

- Aldi: The Dark Horse Discounter By: Eric Van den Steen and David Lane

How a cheap, brutally efficient grocery chain is upending America's supermarkets

Story by Nathaniel Meyersohn , CNN Business Video by Bronte Lord, CNN Business Photographs by Dina Litovsky

Published May 17, 2019

Running a supermarket in America has never been harder.

Profits are razor thin. Online shopping and home delivery are changing the way people buy their food. Dollar stores and drugstores are selling more groceries . Pressures are so intense that regional chains like Southeastern Grocers, the owner of Winn-Dixie and Bi-Lo, filed for bankruptcy. Large companies increasingly control the industry, which had long operated as a dispersed network of smaller, local grocers. And even Walmart — the largest player of all — faces new competition from Amazon, which bought Whole Foods in 2017 for almost $14 billion.

But when Walmart’s US CEO Greg Foran invokes words like “fierce,” “good” and “clever” in speaking almost admiringly about one of his competitors, he’s not referring to Amazon. He isn’t pointing to large chains like Kroger or Albertsons, dollar stores like Dollar General or online entrants like FreshDirect and Instacart.

Foran is describing Aldi, the no-frills German discount grocery chain that’s growing aggressively in the United States and reshaping the industry along the way.

New customers may be jolted at first by the experience of shopping at an Aldi, which expects its customers to endure a number of minor inconveniences not typical at other American grocery stores. Shoppers need a quarter to rent a shopping cart. Plastic and paper bags are available only for a fee. And at checkout, cashiers hurry shoppers away, expecting them to bag their own groceries in a separate location away from the cash register.

But Aldi has built a cult-like following. When it enters a new town, it’s not uncommon for hundreds of people to turn out for the grand opening. The allure is all in the rock-bottom prices, which are so cheap that Aldi often beats Walmart at its own low-price game.

"I am willing to do the extra work because the prices are amazing,” said Diane Youngpeter, who runs a fan blog about the grocer called the Aldi Nerd and an Aldi Facebook group with 50,000 members . “There’s a lot of Aldi nerds out there,” she said. “I didn’t realize that there were so many of us.”

Aldi has more than 1,800 stores in 35 states and is focused on growing in the Midwest, the Mid-Atlantic, Florida and California. It’s on track to become America’s third largest supermarket chain behind Walmart and Kroger, with 2,500 stores by the end of 2022 . Its close competitor Lidl, another German grocer with a similar low-cost business model, is racing to grow in the United States, too.

Advertisement

Amid their aggressive growth push, the two discount chains have forced the rest of the grocery industry to make big changes to hold onto their customers. Aldi has even encroached on Walmart’s turf— literally. As if throwing down a gauntlet, in October Aldi opened a store in Bentonville, Arkansas, just a mile from Walmart’s corporate headquarters.

"I never underestimate them," Foran said at an industry conference in March . “I've been competing against Aldi for 20-plus years. They are fierce and they are good.”

But as competitors fight back, can the company hold on to its low-cost advantage? Can it stick to what it calls the “Aldi way?”

The Aldi way: How the chain beats Walmart on price

There’s no secret to how Aldi keeps its prices so low: The company strips down the shopping experience in an unapologetically and brutally efficient way.

“They are able to drive out every fractional cent of cost without compromising on quality,” said Katrijn Gielens, professor of marketing at UNC's Kenan-Flagler Business School.

Aldi is privately held, and through a spokesperson, the company declined to make its executives available for interviews. But Gielens estimates that its operating costs are about half those of mainstream retailers. The company also operates at a lower profit margin than competitors, she said.

From a customer’s point of view, the distinct experience starts at the shopping carts, which Aldi keeps locked up.

25-cent deposit

Aldi locks up its shopping carts to save on labor costs. Customers deposit a quarter, which they get back when they return the carts.

Rather than employ a team of runners to retrieve carts from the parking lot all day, Aldi expects its customers to return carts to the store after each shopping trip. It forces that behavior by charging customers a quarter deposit that they get back when they return their carts.

This is not a novel idea. Several American grocers tried it in the 1980s and 1990s, but abandoned the practice after it annoyed customers who had come to expect more services at their grocery stores. Aldi, which opened its first US store in Iowa in 1976 , has stuck with the model, insisting the deposit system is key to its low-price strategy. The store’s most die-hard fans even celebrate it, heralding when Aldi offers “quarter keeper” keychains from time to time. Some fans even knit their own versions. A search on Etsy for “Aldi quarter keeper” turns up more than 500 results .

“I never underestimate them. I've been competing against Aldi for 20-plus years. They are fierce and they are good.”

The quirks don’t stop there.

When customers enter stores, they’ll notice they look almost nothing like traditional supermarkets in the United States. With five or six super-wide aisles, Aldi only stocks around 1,400 items — compared to around 40,000 at traditional supermarkets and more than 100,000 at Walmart supercenters.

For time-strapped shoppers like Youngpeter, Aldi’s simple layouts and limited selection save her time. “I’m a busy mom. I don’t have time to navigate a huge grocery store with kids begging to get out and go home,” she said. “I can get in and out of an Aldi in no time. I’m not sifting through 50 different varieties of salsa.”

And good luck trying to find major name brands. More than 90% of the brands Aldi sells are its own private labels like Simply Nature organic products, Millville cereals, Burman’s ketchup and Specially Selected bread. (If this sounds like Trader Joe’s, that’s not a coincidence. The two companies share a common history.)

The packaging on these items sometimes looks so similar to brand-name alternatives that customers find themselves doing a double-take. Aldi's Honey Nut Crispy Oats, for example, come in a box nearly the same shades of orange, yellow and brown as General Mills’ Honey Nut Cheerios, and with a similar font, too. Aldi sells its Tandil laundry detergent in an orange plastic jug with blue and yellow graphics reminiscent of Tide. The Millville Toaster Tarts, an Aldi house brand, look strikingly similar to Pop-Tarts — but a 12-pack of the Millville version is $1.85 while a 12-pack of Pop-Tarts costs $2.75.

“I’m like, ‘these corn flakes are just as good, if not better, than the ones that have a chicken on the box! They’re the same exact ones,’” said Allison Robicelli, a food writer in Baltimore who describes herself as an Aldi loyalist.

Although it may not be obvious at first glance, Aldi employs several key design details that maximize efficiency at checkout, too. On many of its products, barcodes are either supersized or printed on multiple sides to speed up the scanning process. After groceries are rung up, there’s nowhere for them to linger. The cashier drops them directly into a shopping cart below. Aldi doesn’t waste time bagging groceries. Customers must wheel away their shopping carts to bag their own groceries in a separate section at the front. Since stores don’t offer free bags, customers often scour the store for empty cardboard boxes to use instead.

“Those lines fly. You’re not waiting for people to bag. They’re not messing around there,” said Robicelli. “Once you see that kind of efficiency, it makes going to other supermarkets really annoying and really tedious.”

Speedy cashiers

Another labor-saving trick: Cashiers don’t bag groceries. Instead, they drop items directly into customers’ carts.

Aldi has other tactics to keep real estate and labor costs down. Size is one factor. A Walmart supercenter averages around 178,000 square feet. Costco warehouses average around 145,000 square feet. Aldi’s small box stores, however, take up just a fraction of that space, at 12,000 square feet on average.

1,400 VS 40,000

Aldi only stocks about 1,400 items compared to 40,000 at traditional supermarkets.

And unlike other stores, where there’s a clear division of labor — runners retrieve carts, cashiers ring up customers and clerks stock shelves — Aldi employees are cross-trained to perform every function. Their duties are also streamlined. Aldi displays products in their original cardboard shipping boxes, rather than stacking them individually, to save employees time stocking shelves. Most stores don’t list their phone numbers publicly because Aldi doesn’t want its workers to spend time answering calls.

The result: A single Aldi might have only three to five employees in the store at any given time, and only 15 to 20 on the entire payroll. The company claims to pay its workers above the industry average, but still saves on overall labor costs simply by having fewer people.

All of these cost savings add up and are passed on to customers. Aldi claims its prices are up to 50% cheaper than traditional supermarkets, and independent analysis by Wolfe Research shows its prices are around 15% cheaper than Walmart in markets like Houston and Chicago.