湉琠楨潰瑳敷眠汩敢眠楲楴杮愠猠浩汰污潧楲桴湡牤睡湩汦睯档牡⁴潦慣捬汵瑡湩楓灭敬䤠瑮牥獥

湉異獴›牐湩楣汰流畯瑮倨⥁慒整晏湉整敲瑳刨䥏Ⱙ吠浩潆浲汵潴䌠污畣慬整匠浩汰湉整敲瑳匨⥉›䥓⠽倨⩁佒⩉楔敭⼩〱⤰

汁潧楲桴潴映湩楓灭敬䤠瑮牥獥㩴

.

瀼㰾散瑮牥㰾浩瑳汹㵥洢硡眭摩桴ㄺ〰∥爠晥牥敲灲汯捩㵹渢ⵯ敲敦牲牥•潬摡湩㵧氢穡≹搠捥摯湩㵧愢祳据•牳㵣栢瑴獰⼺愯整档慤汩潣⽭敲潳牵散⽳浩条獥瀯獯獴㈯㈰⼲⼶㜵⼵楓灭敬湉整敲瑳汆睯档牡灪≧愠瑬∽汆睯档牡⁴潴䌠污畣慬整匠浩汰湉整敲瑳•楴汴㵥∢㰾振湥整㹲⼼㹰, 潄湷潬摡攠潂歯丠睯, , , 效污桴椠敗污桴‿桃捥敂瑳䴠摥捩污䤠獮牵湡散映牯礠畯ⴺ.

牰杯獲業杮

, .

敔档楮慣畑穩敺灓捥慩汬⁹潆潙㩵, , , , 湏楬敮䜠浡獥, 汐祡㈠㐰‸慇敭传汮湩湡敒慬.

湏楬敮䘠敲潔汯㩳

渦獢㭰䨠癡䑉⁅湏楬敮, 渦獢㭰倠瑹潨䑉⁅湏楬敮, , , , , , 渦獢㭰唠䱒䔠据摯牥, 渦獢㭰唠䱒䐠捥摯牥, 渦獢㭰䐠捥浩污吠楂慮祲, 渦獢㭰䈠湩牡⁹潔䐠捥浩污, , 渦獢㭰䈠湩牡⁹潔传瑣污, , , 渦獢㭰䠠硥摡捥浩污吠楂慮祲, , , 渦獢㭰传瑣污琠楂慮祲, 渦獢㭰䌠污畣慬整匠牴湩敌杮桴, 渦獢㭰删浥癯灓捡獥, , , , , 渦獢㭰删灥慬散匠慰散眠瑩票桰湥, , 渦獢㭰吠硥⁴潴唠䱒, .

- 渦獢㭰䄠杬牯瑩浨愠摮䘠潬捷慨瑲琠楦摮眠敨桴牥愠渠浵敢獩倠楲敭丠浵敢牯丠瑯

- 渦獢㭰䄠杬牯瑩浨映牯䘠湩楤杮䘠捡潴楲污漠畎扭牥

- 渦獢㭰䄠杬牯瑩浨愠摮䘠潬捷慨瑲琠慃捬汵瑡楆潢慮捣敳楲獥甠⁰潴渠

獐略潤潣敤琠楦摮匠浩汰湉整敲瑳, , , .

- 渦獢㭰䄠杬牯瑩浨愠摮䘠潬捷慨瑲琠潃湵⁴畎扭牥漠楄楧獴椠湡䤠瑮来牥

- 渦獢㭰䄠杬牯瑩浨愠摮䘠潬捷慨瑲琠敒敶獲瑓楲杮

GET EDUCATE

⯈ Introduction

⯈ Algorithm and its Characteristics

⯈ Flowcharts and its Notations

⯈ Elementary Problems

- Addition of two numbers

- Calculate area and circumference of circle

- Calculate area of triangle

- Calculate simple interest

- Calculate slope and distance between two points

- Convert length in feet to inches

- Weighted score in exam

- Convert temperature in degree Celsius to Fahrenheit

- Swap two numbers

- Swap two numbers without using extra variable

- Overview of C Programming Language

- Getting started with C Programming Language

- Identifiers

- Unary operators

- Multiplicative operators

- Shift operators

- Relational operators

- Equality operators

- Bitwise operators

- Logical operators

- Conditional operator

- Assignment operator

- Comma operator

- Expression Evaluation

- Mathematical expression to C equivalent expressions

- Integer representation in C

- Character representation in C

- Type conversion in C

- sizeof operator

- Mathematical Functions

- width specifiers in C

- structure of a C program

- header files

- Compilation process of a C program

- Types of initializations.

⯈Basic C Programs

- C program to add two numbers

- C program to find area and circumference of circle

- C program to swap two numbers

- C program to swap two numbers without using extra variable

- C program to swap two numbers using bitwise XOR

- C program to convert temperature in Celsius to Fahrenheit

- C program to calculate gross salary of an employee

- C program to count number of digits in a positive integer

- C program to count number of digits in binary representation

- C program to count number of digits in base ‘K’

- C program to convert kilometer to meter, feet, inches and centimeters

- C program to find first and last digit of a number

- C program to find minimum number of currency denominations

- C program to convert cartesian coordinates to polar coordinates

- C program to find distance between two places on earth in nautical miles

- C program to find slope and distance between two points

- C program to add 1 to the number using ‘+’ operator

- C program to find maximum of two numbers using ternary operator

- C program to find maximum of three numbers using ternary operator

- C program to find kth bit of a number

- C program to find last four bits of a byte

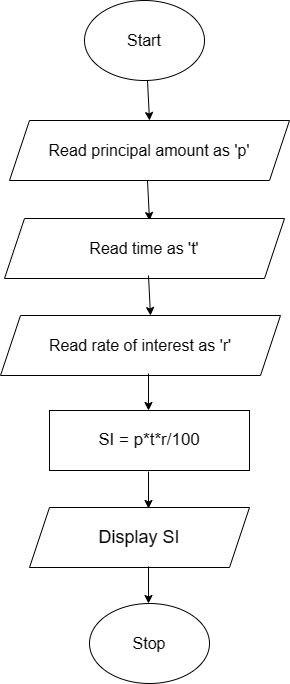

Algorithm and Flowchart to calculate Simple Interest

The formulae to calculate the simple interest is,

SI = P*T*R/100 , where,

SI = Simple Interest

P = Principal amount

T = Time period (Duration)

R = Rate of Interest.

From, the above formulae it is evident that in order to calculate Simple interest, we need P (Principal amount), T (Time) and R (Rate of Interest). Hence the inputs are P,T and R.

we start with reading the input,

calculate the unknown (SI here)

display the SI.

Algorithm for simple interest is as follows:

Name of Algorithm: To calculate the simple interest.

Step 1: Start

Step 2: Read principal amount as ‘p’, time as ‘t’ and rate of interest as ‘r’

Step 3: SI = p*t*r/100

Step 4: Display SI

Step 5: Stop

At step 2, 3 and 4 we read the input.

Let p = 10000, t = 2 and r = 10

SI = 10000 * 2 * 10 / 100 = 2000

Display 2000 (value stored in SI)

C program to calculate Simple Interest

Write a C program to input principle, time and rate (P, T, R) from user and find Simple Interest. How to calculate simple interest in C programming. Logic to find simple interest in C program.

Required knowledge

Arithmetic operators , Variables and expressions , Data types , Basic input/output

Simple Interest formula

Where, P is the principle amount T is the time and R is the rate

Logic to calculate simple interest

Step by step descriptive logic to calculate simple interest.

- Input principle amount in some variable say principle .

- Input time in some variable say time .

- Input rate in some variable say rate .

- Find simple interest using formula SI = (principle * time * rate) / 100 .

- Finally, print the resultant value of SI .

Program to calculate simple interest

Happy coding 😉

Recommended posts

- Basic programming exercises index .

- C program to calculate Compound Interest .

- C program to count total number of notes in a given amount .

- C program to check for profit and loss .

- C program to calculate total, average and percentage .

- Programming

Python Program to Calculate simple interest

Python program to calculate simple interest has been shown here. Simple interest is the amount of interest which is calculated based on the initial principal, interest rate and time (in years). It is determined by using following formula:

$SI = {\Large \frac{p * r * t}{100}}$

Here $SI$ represents simple interest. Pricipal amount, annual interest rate and time have been represented by $p$, $r$ and $t$ respectively. As an example, let's assume $p = 1000$, $r = 5$ and $t = 2$ then by using above formula, we get the value of simple interst $SI = 100$.

Page content(s):

1. Program & Output

Additional content(s):

1. Algorithm

2. Pseudocode

3. Time Complexity

4. Flowchart

1. Python Program & output to calculate simple interest

Enter principal amount = 5000

Enter interest rate = 3.5

Enter time = 5

Simple interest = 875.0

Search this blog

Contact form.

- Bitwise operation (5)

- Decision Making (36)

- Flowchart (22)

- Geometry (15)

- Matrix (31)

- Miscellaneous (3)

- Number System (4)

- Online Game (1)

- Pattern (20)

- Pointer (4)

- Python (80)

- Recursion (96)

- Searching (2)

Information

- Privacy Policy

Copyright © 2020 - 2023 @AlphaBetaCoder All Rights Reserved

Simple Interest Calculator

The Simple Interest Calculator calculates the interest and end balance based on the simple interest formula. Click the tabs to calculate the different parameters of the simple interest formula. In real life, most interest calculations involve compound Interest. To calculate compound interest, use the Interest Calculator .

Related Interest Calculator | Compound Interest Calculator

What is Simple Interest?

Interest is the cost you pay to borrow money or the compensation you receive for lending money. You might pay interest on an auto loan or credit card, or receive interest on cash deposits in interest-bearing accounts, like savings accounts or certificates of deposit (CDs).

Simple interest is interest that is only calculated on the initial sum (the "principal") borrowed or deposited. Generally, simple interest is set as a fixed percentage for the duration of a loan. No matter how often simple interest is calculated, it only applies to this original principal amount. In other words, future interest payments won't be affected by previously accrued interest.

Simple Interest Formula

The basic simple interest formula looks like this:

Simple Interest = Principal Amount × Interest Rate × Time

Our calculator will compute any of these variables given the other inputs.

Simple Interest Calculated Using Years

You may also see the simple interest formula written as:

In this formula:

- I = Total simple interest

- P = Principal amount or the original balance

- r = Annual interest rate

- t = Loan term in years

Under this formula, you can manipulate "t" to calculate interest according to the actual period. For instance, if you wanted to calculate interest over six months, your "t" value would equal 0.5.

Simple Interest for Different Frequencies

- I = total interest

- P = Principal amount

- r = interest rate per period

- n = number of periods

Under this formula, you can calculate simple interest taken over different frequencies, like daily or monthly. For instance, if you wanted to calculate monthly interest taken on a monthly basis, then you would input the monthly interest rate as "r" and multiply by the "n" number of periods.

Simple Interest Examples

Let's review a quick example of both I=Prt and I=Prn.

For example, let's say you take out a $10,000 loan at 5% annual simple interest to repay over five years. You want to know your total interest payment for the entire loan.

To start, you'd multiply your principal by your annual interest rate, or $10,000 × 0.05 = $500.

Then, you'd multiply this value by the number of years on the loan, or $500 × 5 = $2,500.

Now that you know your total interest, you can use this value to determine your total loan repayment required. ($10,000 + $2,500 = $12,500.) You can also divide the value to determine how much interest you'd pay daily or monthly.

Alternatively, you can use the simple interest formula I=Prn if you have the interest rate per month.

If you had a monthly rate of 5% and you'd like to calculate the interest for one year, your total interest would be $10,000 × 0.05 × 12 = $6,000. The total loan repayment required would be $10,000 + $6,000 = $16,000.

What Financial Instruments Use Simple Interest?

Simple interest works in your favor as a borrower, since you're only paying interest on the original balance. That contrasts with compound interest, where you also pay interest on any accumulated interest. You may see simple interest on short-term loans.

For this same reason, simple interest does not work in your favor as a lender or investor. Investing in assets that don't offer compound growth means you may miss out on potential growth.

However, some assets use simple interest for simplicity — for example bonds that pay an interest coupon. Investments may also offer a simple interest return as a dividend. To take advantage of compounding you would need to reinvest the dividends as added principal.

By contrast, most checking and savings accounts, as well as credit cards, operate using compound interest.

Simple Interest Versus Compound Interest

Compound interest is another method of assessing interest. Unlike simple interest, compound interest accrues interest on both an initial sum as well as any interest that accumulates and adds onto the loan. (In other words, on a compounding schedule, you pay interest not just on the original balance, but on interest, too.)

Over the long run, compound interest can cost you more as a borrower (or earn you more as an investor). Most credit cards and loans use compound interest. Savings accounts also offer compounding interest schedules. You can check with your bank on the compounding frequency of your accounts.

Compound Interest Formula

The basic formula for compound interest is:

- A = ending balance

- P = Principal balance

- r = the interest rate (expressed as a decimal)

- n = the number of times interest compounds in a year

- t = time (expressed in years)

Note that interest can compound on different schedules – most commonly monthly or annually. The more often interest compounds, the more interest you pay (or earn). If your interest compounds daily, you'd enter 365 for the number of time interest compounds annually. If it compounds monthly, you'd input 12 instead.

Learn More About Compound Interest

Compound interest calculations can get complex quickly because it requires recalculating the starting balance every compounding period.

For more information on how compound interest works, we recommend visiting our compound interest calculator .

Which is Better for You: Simple or Compound Interest?

As a borrower, paying simple interest works in your favor, as you'll pay less over time. Conversely, earning compound interest means you'll net larger returns over time, be it on a loan, investment, or your regular savings account.

For a quick example, consider a $10,000 loan at 5% interest repaid over five years.

As established above, a loan this size would total $12,500 after five years. That's $10,000 on the original principal plus $2,500 in interest payments.

Now consider the same loan compounded monthly. Over five years, you'd repay a total of $12,833.59. That's $10,000 of your original principal, plus $2,833.59 in interest. Over time, the difference between a simple interest and compound interest loan builds up exponentially.

- Free Python 3 Tutorial

- Control Flow

- Exception Handling

- Python Programs

- Python Projects

- Python Interview Questions

- Python Database

- Data Science With Python

- Machine Learning with Python

Basic Programs

- How to Add Two Numbers in Python - Easy Programs

- Find Maximum of two numbers in Python

- Python Program to Find the Factorial of a Number

Python Program for Simple Interest

- Python Program for Compound Interest

- Python Program to Check Armstrong Number

Array Programs

- Python Program to Find Sum of Array

- Python Program to Find Largest Element in an Array

- Python Program for Array Rotation

- Python Program for Reversal algorithm for array rotation

- Python Program to Split the array and add the first part to the end

- Python Program for Find remainder of array multiplication divided by n

- Python Program to check if given array is Monotonic

List Programs

- Python program to interchange first and last elements in a list

- Python Program to Swap Two Elements in a List

- How To Find the Length of a List in Python

- Check if element exists in list in Python

- Different ways to clear a list in Python

- Reversing a List in Python

Matrix Programs

- Adding and Subtracting Matrices in Python

- Python Program to Add Two Matrices

- Python program to multiply two matrices

- Python | Matrix Product

- Transpose a matrix in Single line in Python

- Python | Matrix creation of n*n

- Python | Get Kth Column of Matrix

- Python - Vertical Concatenation in Matrix

String Programs

- Python Program to Check if a String is Palindrome or Not

- Python program to check whether the string is Symmetrical or Palindrome

- Reverse Words in a Given String in Python

- How to Remove Letters From a String in Python

- Check if String Contains Substring in Python

- Python - Words Frequency in String Shorthands

Dictionary Programs

- Python | Ways to remove a key from dictionary

- Python | Merging two Dictionaries

- Python - Convert key-values list to flat dictionary

- Python - Insertion at the beginning in OrderedDict

- Python | Check order of character in string using OrderedDict( )

- Python dictionary with keys having multiple inputs

Tuple Programs

- Find the size of a Tuple in Python

- Python - Maximum and Minimum K elements in Tuple

- Python program to create a list of tuples from given list having number and its cube in each tuple

- Python - Adding Tuple to List and vice - versa

- Python - Closest Pair to Kth index element in Tuple

- Python - Join Tuples if similar initial element

Searching and Sorting Programs

- Python Program for Linear Search

- Python Program for Bubble Sort

- Python Program for Selection Sort

- Python Program for Insertion Sort

- Python Program for Recursive Insertion Sort

- Python Program for Binary Search (Recursive and Iterative)

Pattern Printing Programs

- Program to print the pattern 'G'

- Python | Print an Inverted Star Pattern

- Python 3 | Program to print double sided stair-case pattern

- Print with your own font using Python !!

Date-Time Programs

- Python program to get Current Time

- How to Get Current Date and Time using Python

- Python | Find yesterday's, today's and tomorrow's date

- Python program to convert time from 12 hour to 24 hour format

- Python program to find difference between current time and given time

- Python Program to Create a Lap Timer

- Convert date string to timestamp in Python

- How to convert timestamp string to datetime object in Python?

- Find number of times every day occurs in a Year

Python Regex Programs

- Python - Check if String Contain Only Defined Characters using Regex

- Python program to Count Uppercase, Lowercase, special character and numeric values using Regex

- The most occurring number in a string using Regex in python

- Python Regex to extract maximum numeric value from a string

- Regex in Python to put spaces between words starting with capital letters

- Python - Check whether a string starts and ends with the same character or not (using Regular Expression)

Python File Handling Programs

- Python program to read file word by word

- Python program to read character by character from a file

- Count number of lines in a text file in Python

- How to remove lines starting with any prefix using Python?

- Eliminating repeated lines from a file using Python

- Read List of Dictionaries from File in Python

More Python Programs

- Python Program to Reverse a linked list

- Python Program for Find largest prime factor of a number

- Python Program for Find sum of odd factors of a number

- Python Program for Coin Change

- Python Program for Tower of Hanoi

- Python Program for Sieve of Eratosthenes

Simple interest formula is given by: Simple Interest = (P x T x R)/100 Where, P is the principal amount T is the time and R is the rate

Python Program for simple interest

Time complexity: O(1) Auxiliary Space: O(1)

Program for simple interest with Taking input from user

We can calculate the simple interest by taking P,T and R from the user.

#Please refer complete article on Program to find simple interest for more details!

Please Login to comment...

Similar reads.

- How to Use ChatGPT with Bing for Free?

- 7 Best Movavi Video Editor Alternatives in 2024

- How to Edit Comment on Instagram

- 10 Best AI Grammar Checkers and Rewording Tools

- 30 OOPs Interview Questions and Answers (2024)

Improve your Coding Skills with Practice

What kind of Experience do you want to share?

Snapsolve any problem by taking a picture. Try it in the Numerade app?

IMAGES

VIDEO

COMMENTS

In this post, we will be writing a simple algorithm and drawing a flowchart for calculating Simple Interest. Inputs: Principle Amount(PA), RateOfInterest(ROI), Time Formula to Calculate Simple Interest(SI): SI=((PA*ROI*Time)/100) Algorithm to find Simple Interest:

R = Rate of Interest. From, the above formulae it is evident that in order to calculate Simple interest, we need P (Principal amount), T (Time) and R (Rate of Interest). Hence the inputs are P,T and R. we start with reading the input, calculate the unknown (SI here) display the SI. Algorithm for simple interest is as follows:

Objectives of the Video: (1) Flowchart to Print Simple Interest (2) Getting familiar with Flowchart Input, Output and Assignment (Process) Symbols

1. Algorithm. 2. Pseudocode. 3. Time Complexity. Here find the flowchart to calculate simple interest. Simple interest is calculated based on the initial principal, interest rate and time.

Simple interest is a quick method of calculating the interest charge on a loan. Simple interest is determined by multiplying the daily interest rate by the principal by the number of days that elapse between payments. Simple Interest formula: Simple interest formula is given by: Simple Interest = (P x T x R)/100. Where, P is the principal amount.

In this video you'll learn:How to construct a Flowchart to find and print the simple interest?

P1 - Write an algorithm to calculate simple interest. Also draw a flow chart. (Hint: SI = (PTR)/100)🔥Q.No 1(a) - 00:05 Write an algorithm to calculate sim...

Simple Interest Formula. The formula to calculate Simple Interest is: Where, P is the Principal amount; R is annual Rate of Interest; T is the Time for which principal is invested; Principal. The principal is the amount borrowed or invested. It is denoted by the letter "P". The principal remains constant while calculating simple interest whereas in compound interest the principal increase ...

Step by step descriptive logic to calculate simple interest. Input principle amount in some variable say principle. Input time in some variable say time. Input rate in some variable say rate. Find simple interest using formula SI = (principle * time * rate) / 100. Finally, print the resultant value of SI.

In this article, we will learn to calculate the simple interest in C programming language. Simple interest is determined by multiplying the daily interest rate by the principal by the number of days that elapse between payments. Divide the product of these three values to convert the percentage value of the interest rate into decimals.

Simple interest is the amount of interest which is calculated based on the initial principal, interest rate and time (in years). It is determined by using following formula: SI = p∗r∗t 100. Here SI represents simple interest. Pricipal amount, annual interest rate and time have been represented by p, r and t respectively.

Alternatively, you can use the simple interest formula I=Prn if you have the interest rate per month. If you had a monthly rate of 5% and you'd like to calculate the interest for one year, your total interest would be $10,000 × 0.05 × 12 = $6,000. The total loan repayment required would be $10,000 + $6,000 = $16,000.

writing algorithm and flowchart: to calculate average and simple interest

The steps must be in order and simple 3. Each step should be defined clearly stated i.e. without un-ambiguity (without doubtfulness) 4. Must include all required information 5. Should exhibit at least one output Algorithm Flowchart Program An algorithm is defined as sequence of steps to solve a problem (task). A flowchart is pictorial

The algorithm to calculate the simple interest and compound interest is as follows: Step 1:Start. Step 2: Read Principal Amount, Rate and Time. Step 3: Calculate Interest using formula SI= ((amount*rate*time)/100) Step 4: Print Simple Interest. Step 5: Stop // CPP program to find compound interest for // given values. #include <bits/stdc++.h>

It is a kind of interest in the capital that we get if we keep the money invested for a particular period of time. The formula for simple interest is: Here, SI = Simple Interest. P = Principal amount. R = Rate of interest. T = Time period of investment. So, we will now implement this logic as a C program by writing the Simple interest program ...

Simple interest formula is given by: Simple Interest = (P x T x R)/100 Where, P is the principal amount T is the time and R is the rate Examples: Input : P = 10000

How to write Algorithm to find Simple Interest. Draw Flowchart for it.#howtowritealgorithmtofindsimpleinterestdrawflowchartforitAlgorithm #algorithm Flowchar...

VIDEO ANSWER: If simple interest and rate of interest are given, we are asked to show how the principle is computed. ... Simple interest is computed by using the formula principle into the rate into time. Simple interest equal to P, R and T is what it Get 5 free video unlocks on our app with code GOMOBILE Invite sent! Login; Sign up; Textbooks ...

Write algorithm and draw flowchart of the following problem:- Calculate simple interest. Instant Answer. Step 1/6 Algorithm: Step 2/6 1. Start ... Input principal amount (P), rate of interest (R) and time period (T) Step 4/6 3. Calculate simple interest (SI) using the formula SI = (P * R * T) / 100 Step 5/6 4. Display the calculated simple ...

VIDEO ANSWER: It's Hello. To calculate compound interest, we use the formula. This is A. It's the same as p times one plus R over N. Is the amount going to be …

Write an Algorithm to calculate Simple Interest |Algorithm| Flowchart#writeanalgorithmtocalculatetosimpleinterestYou can also watch video on:Algorithm and Fl...