12 CV cover letter examples

A cover letter for your CV, or covering note is an introductory message that accompanies your CV when applying for a job.

The purpose of the cover letter is simple… Persuade the reader to open your CV.

Learn how to write a cover letter properly, and you will hugely increase your chances of getting responses and landing job interviews.

This guide, with 12 annotated cover letter examples will show you everything you need to know about creating a winning cover note.

CV templates

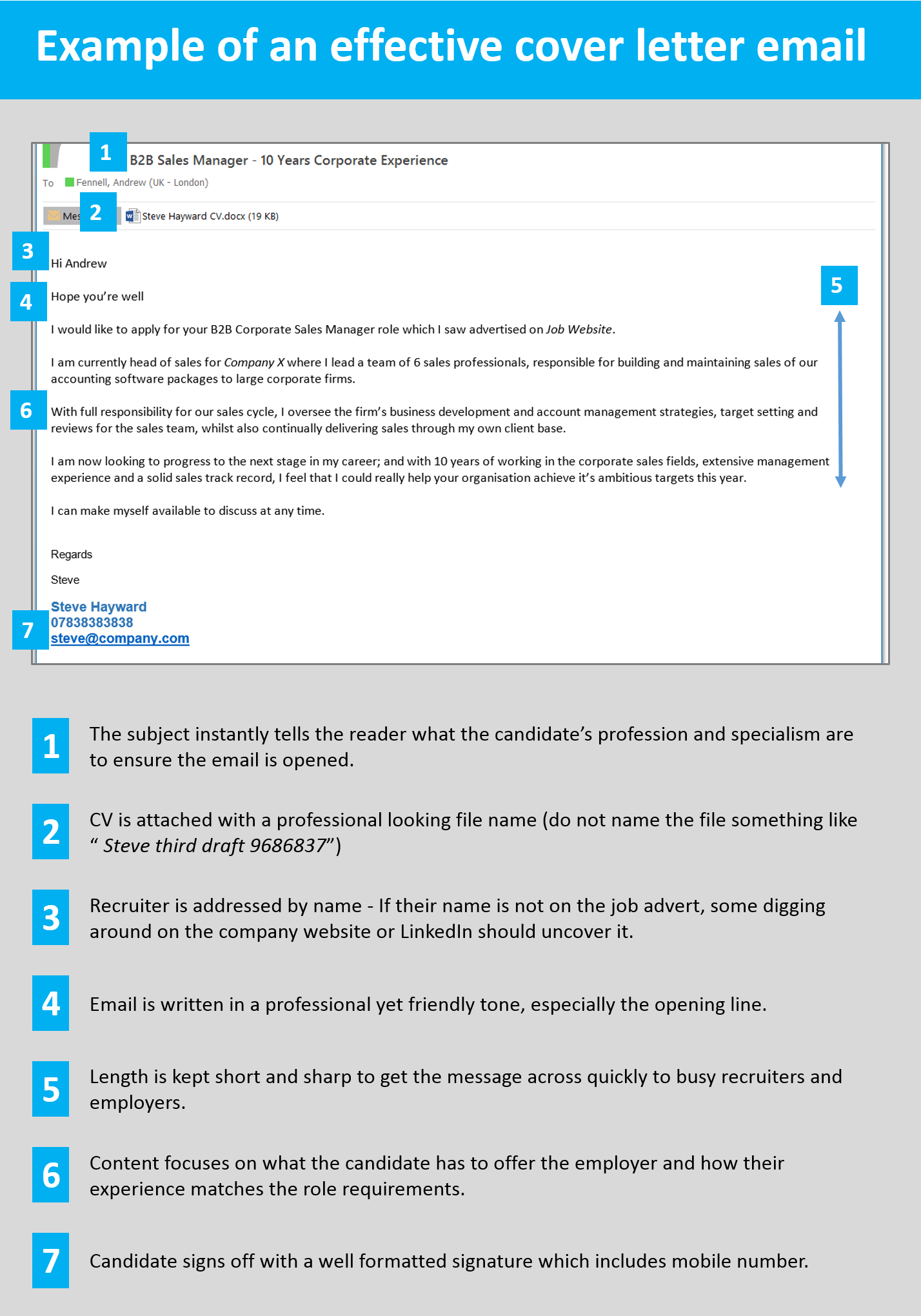

How to layout a cover letter for your CV

This annotated example of a cover letter shows you how you should structure your cover letters, and the type of information you should be including.

You should always write your CV in the body of your email (or j ob site messaging system) so that it can be read instantly. Never attach it as a separate document, or the recipient probably won’t open it.

Example CV cover letters

These 11 example CV cover letters from a range of industries should give you some good inspiration for creating your own cover letter.

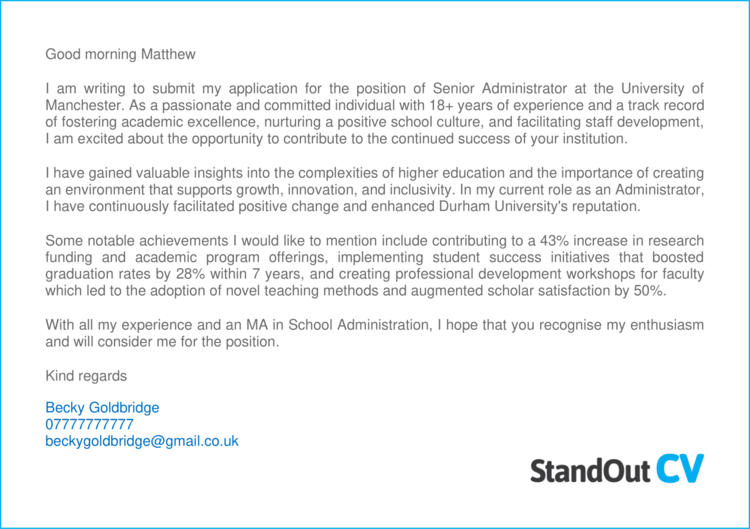

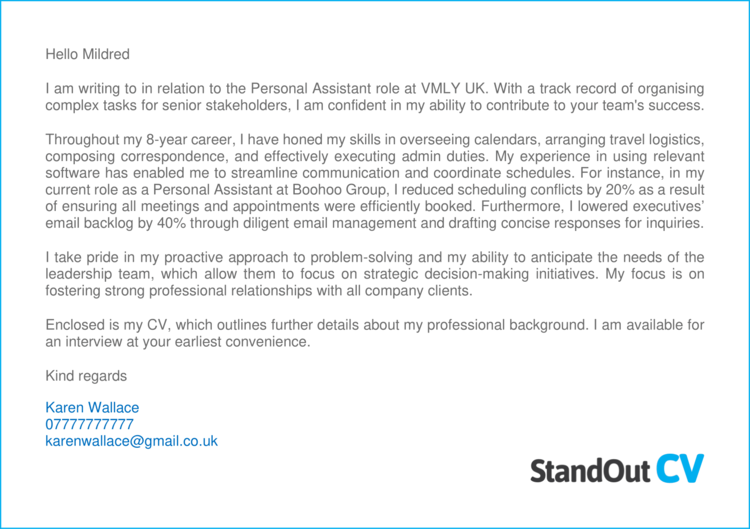

Admin CV cover letter

This cover letter is aimed at administrative roles , so it highlights the candidate’s abilities in efficiency, report writing and meeting deadlines, whilst demonstrating the types of environments they have worked in.

Learn how to write a cover letter step-by-step here.

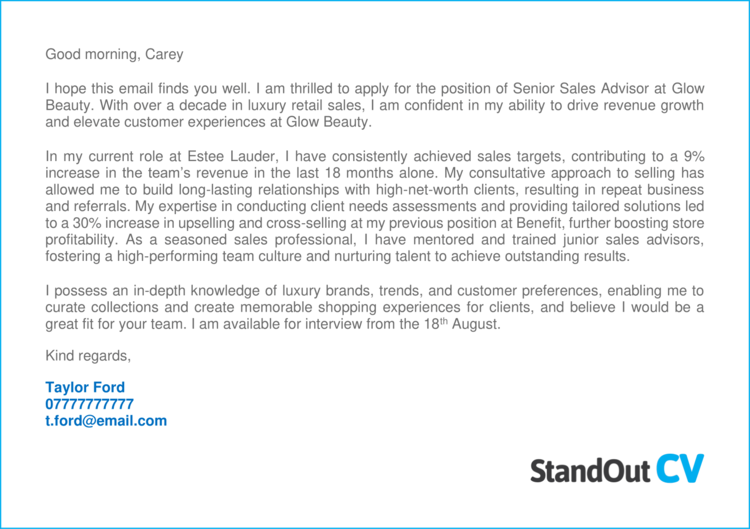

Customer service CV cover letter

This customer service cover letter briefly explains the candidate’s length of experience in the field and highlights some of the more important customer service skills such as call handling, order taking and complaint resolution.

This gives the reader an excellent introduction to the candidate and should certainly encourage them to open the CV.

See our full customer service cover letter guide, sales assistant cover letter example and waiter/waitress cover letter example .

Finance CV cover letter

As a finance professional, it’s important to highlight your specialisms within finance, the types of companies you’ve worked for, and high level functions you’ve carried out within your cover letter. This will give the hiring manager a good overall feel of your abilities, and if it’s well tailored to the role, should provide them with enough info to excite them about your CV.

Quick tip: Use our job application tracker spreadsheet to track your applications and follow up with employers who don’t respond.

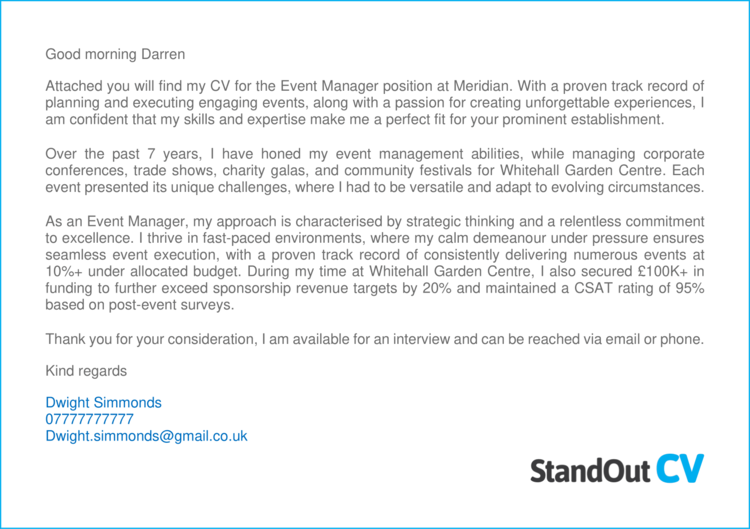

Events CV cover letter

This events manager candidate has done a great job of summarising the type and size of events they manage, along with details of core skills such as leadership, project delivery and stakeholder management.

This certainly provides enough info to create a buzz around the CV attached and encourage the recipient to open it.

Executive assistant CV cover letter

This executive assistant CV cover letter provides a good high level intro to the candidate showing the reader key business support knowledge in areas such as admin, diary management and document management. It also shows that the candidate is confident supporting senior business figures.

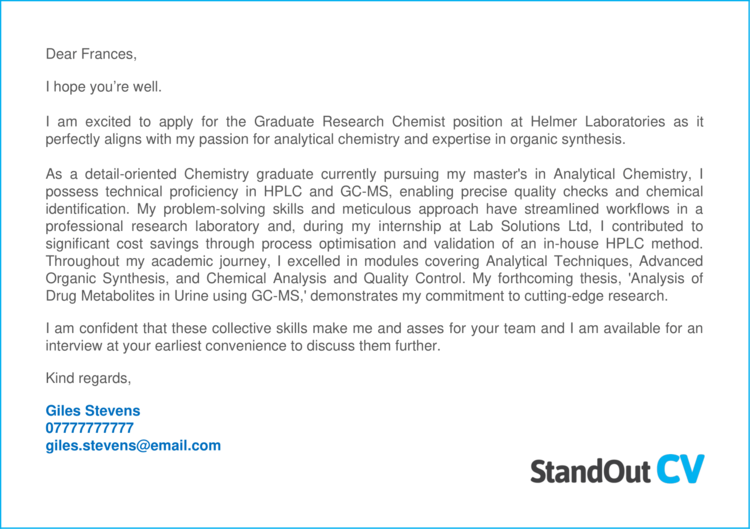

Graduate CV cover letter

As a graduate , your cover letter will need to be a little longer than an experienced candidates, to compensate for your lack of experience and really sell yourself.

This candidate speaks in lots of detail about their education, qualifications, and extra-curricular work which relates to the roles they are applying for.

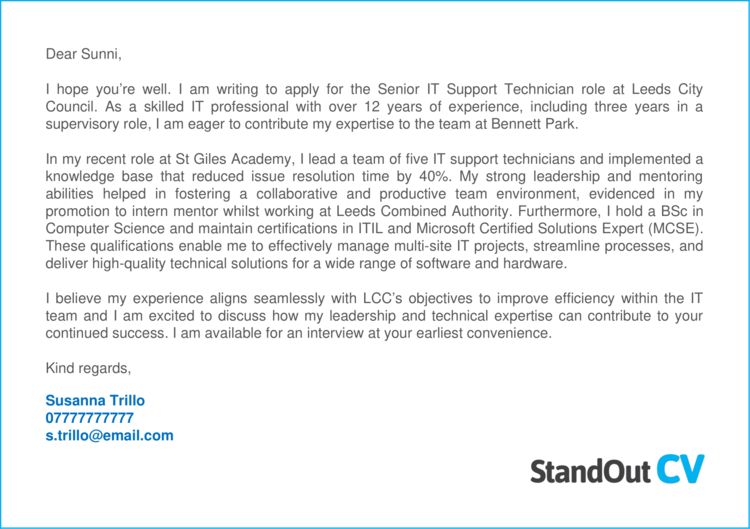

IT CV cover letter

As an IT candidate, it’s important not only to highlight your technical skills, but also show how you apply those skills in the workplace to translate real benefits for your employer.

This candidate gives a good overview of the candidates technical abilities and the types of projects they apply them to, along with results they achieve.

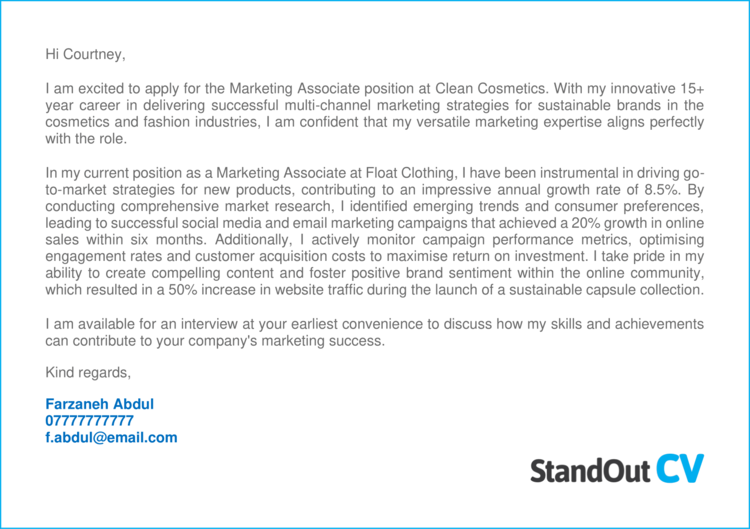

Marketing CV cover letter

This marketing cover letter provides readers with a summary of the candidate’s core marketing abilities such as media planning, brand awareness and cost reduction. It also explains the types of marketing campaigns and companies they have experience with – a great high-level intro.

Cover letter examples

Warehouse Operative cover letter – Training Contract cover letter – Cleaning Job cover letter – Nursery Assistant cover letter – Recruitment Consultant cover letter – Dental Nurse cover letter –

Chef cover letter – Editorial Assistant cover letter – Aircraft Mechanic cover letter – Biomedical Science cover letter – Cabin Crew cover letter – Finance Assistant cover letter – Hotel Receptionist cover letter – Asset Management cover letter – Assistant Psychologist cover letter – Beauty Therapist cover letter – Cafe Worker cover letter – HR Administrator cover letter – NQT cover letter – Quantity Surveyor cover letter

More cover letter examples

- Academic cover letter

- Account Manager cover letter

- Accountant cover letter

- Accounting cover letter

- Accounts Assistant cover letter

- Acting cover letter

- Admin Assistant cover letter

- Administrator cover letter

- Apprenticeship cover letter

- Architecture cover letter

- Assistant Manager cover letter

- Banking cover letter

- Bar Staff cover letter

- Barclays cover letter

- Barista cover letter

- Bartender cover letter

- Business Analyst cover letter

- Business Development Manager cover letter

- Car Sales Person cover letter

- Care Assistant cover letter

- Career Change cover letter

- Catering Assistant cover letter

- Civil Engineer cover letter

- Computer Science cover letter

- Consulting cover letter

- Copywriter cover letter

- Cyber Security cover letter

- Data Entry Clerk cover letter

- Data Scientist cover letter

- Delivery Driver cover letter

- Digital Marketing cover letter

- Electrician cover letter

- Engineering cover letter

- Estate Agent cover letter

- Event Manager cover letter

- Exam Invigilator cover letter

- Executive Assistant cover letter

- Fashion Designer cover letter

- Finance cover letter

- Financial Analyst cover letter

- Google cover letter

- Graduate cover letter

- Graduate Engineer cover letter

- Graduate Scheme cover letter

- Graphic Design cover letter

- Health Care Assistant cover letter

- Hospitality cover letter

- HR Assistant cover letter

- HR cover letter

- Interior Designer cover letter

- Internal Position cover letter

- Internship cover letter

- Investment Banking cover letter

- Investment Manager cover letter

- IT Support cover letter

- Journalist cover letter

- JP Morgan cover letter

- Lawyer cover letter

- Legal Assistant cover letter

- Legal cover letter

- Library Assistant cover letter

- Manager cover letter

- Marine Engineer cover letter

- Marketing Assistant cover letter

- Marketing cover letter

- Marketing Intern cover letter

- Marketing Manager cover letter

- McKinsey cover letter

- Mechanical Engineer cover letter

- Medical Receptionist cover letter

- Medical Writer cover letter

- Model cover letter

- Nanny cover letter

- Nurse cover letter

- Nursing cover letter

- Office Assistant cover letter

- Office Manager cover letter

- Operations Manager cover letter

- Optical Assistant cover letter

- Paralegal cover letter

- Part Time cover letter

- PE Teacher cover letter

- Personal Assistant cover letter

- Personal Trainer cover letter

- Pharmacist cover letter

- Pharmacy Assistant cover letter

- PHD Application cover letter

- Photographer cover letter

- Placement cover letter

- Private Equity cover letter

- Product Manager cover letter

- Production Assistant cover letter

- Production Operator cover letter

- Project Coordinator cover letter

- Promotion cover letter

- PWC cover letter

- Quantity Surveyor cover letter

- Receptionist cover letter

- Research Assistant cover letter

- Researcher cover letter

- Retail Assistant cover letter

- Retail cover letter

- Retail Manager cover letter

- Sales Advisor cover letter

- Sales Executive cover letter

- Sales Manager cover letter

- Scrum Master cover letter

- Security Officer cover letter

- Ski Season cover letter

- Social Media Executive cover letter

- Social Media Manager cover letter

- Software Developer cover letter

- Software Engineer cover letter

- Speculative cover letter

- Student cover letter

- Support Worker cover letter

- Teaching Assistant cover letter

- Team Leader cover letter

- Trainee Dental Nurse cover letter

- University cover letter

- UX Designer cover letter

- Volunteer cover letter

Project manager CV cover letter

A project manager’ s cover letter needs to quickly explain to recipients the types of projects they lead and the technical expertise they bring to the projects. It’s also important to describe level of experience, seniority and background.

See full project manager cover letter example + writing guide

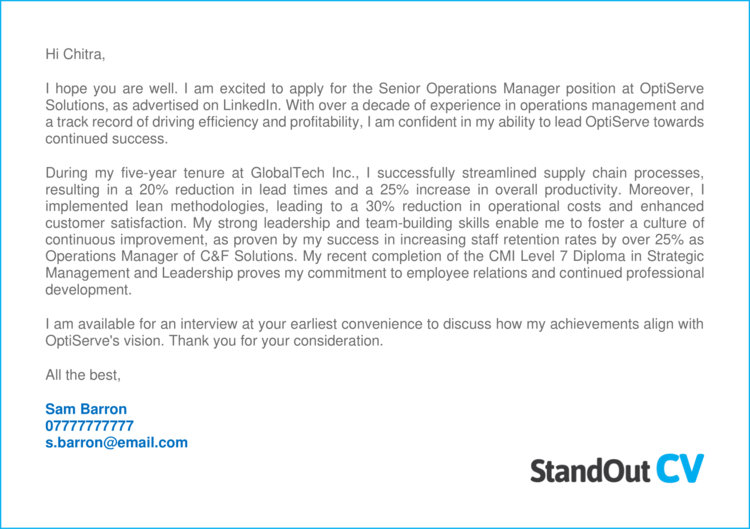

Operations manager cover letter

This operations management CV provides a brief introduction to the types of operations the candidate manages and the firms they work for.

They also touch upon some core operations skills such as efficiency, logistics and ROI improvement.

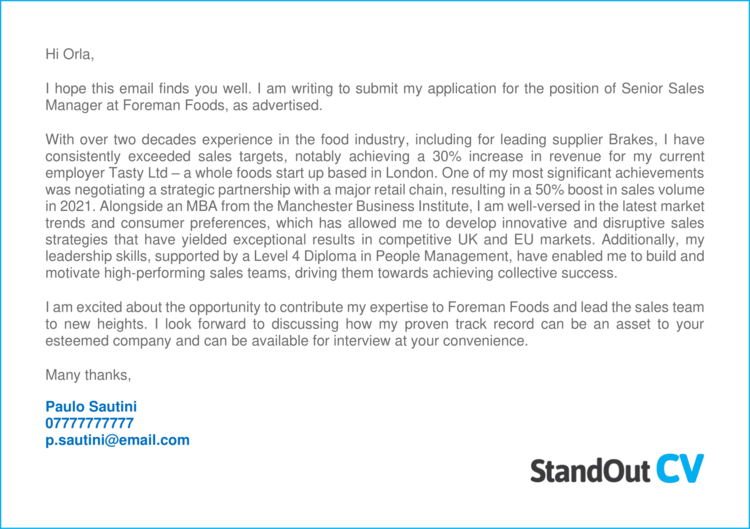

Sales CV cover letter

As a sales candidate, this cover letter shows the types of business this person can generate and the size and scale of the impact they create by highlighting some sales results.

It also mentions some core sales skills like business development, presenting, working under pressure and closing deals.

Cover letter templates

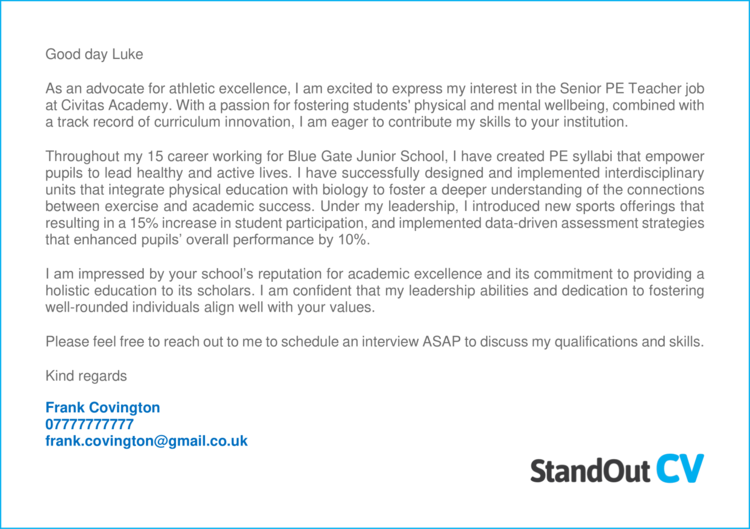

Teacher cover letter

This teacher cover letter does a great job of introducing the candidate, and showing the recipient the key facts they will be looking for, such as; the age group they teach, subject specialisms, and the results they have achieved.

The cover letter is brief and gets to the point quickly, so that readers will instantly look to open the attached CV .

How to write your CV cover letter

Now that you’ve seem good examples of cover letters to accompany your CV (or resume if you are in the USA) this guide will show exactly how to write your own, and the content that needs to be included .

Send your CV cover letter in email format (when possible)

When applying for jobs online you usually have 2 choices…

1) Send a message via the job website’s messaging system

2) Send the recruiter an email directly

If you can find an email address for the recruiter, then I would always recommend sending an email directly because it gives you more control.

When you send a message through a job website, it will transfer into an email with basic formatting and an auto-generated headline , which will look like this when the recruiter receives it.

If you cannot find an email address for the recruiter on the job advert, then try searching LinkedIn or the company website to find the relevant contact.

You may not always be able to find an email address, but when you can – always send a job application by email .

Make your subject line appealing

As you can see in the picture above, a bad subject line can kill your chances of actually having your email read in the first place.

Your subject line should stand out and give the recruiter a reason to open your email.

When recruiters look into their inbox, they are looking for one thing; a candidate who can do the job they are advertising – so give that to them in your subject line.

Your subject line should be a short summary of your experience that relates directly to the job you are applying for.

The following are good subject line examples;

KS2 Teacher with 5 years experience

Front End Web developer with HTML, HTML & JavaScript experience

Junior Graphic designer with 1st BA Hons Graphic Design

If your subject line shows that you have one or two of the most important requirements for the job, your email should get opened every time.

Address the recruiter by name

To get the relationship off on the right foot, you should try to address the recruiter by name if you can.

Often the recruiter’s details will appear on the job advert but sometimes you may have to check out the company website or do some digging around on LinkedIn.

If you really can’t find the name, then it’s not the end of the world – just start with a simple friendly opening like “ Hi ”

(If you applying to a more traditional organisation such as an academic post for a university, you may want to use something a bit more formal like “ Dear sir or madam ”)

Use a friendly yet professional tone

It’s important to sound professional when writing a cover letter but you also need to demonstrate your ability to communicate with other people and show some personality.

If your email is too casual and written in an over-familiar tone, then you will come across us un-professional.

But on the other hand, if your email is too formal and shows no signs of rapport building, you risk appearing as somebody who lacks social skills.

So when writing your cover letter, try to strike a nice balance of professionalism and friendliness.

Opening with a line such as “ hope you’re well ” is a nice way to breathe a bit of personality into your cover letter.

Ensure that your spelling and grammar is perfect throughout your cover letter because sloppy mistakes are a huge red flag for recruiters.

Quick tip: If you struggle with spelling and grammar, try our quick-and-easy CV Builder

Keep it brief

Unless the job advert specifies otherwise; keep your cover letter short and sweet.

Recruiters and employers receive hundreds of job applications per week, so they don’t want to read a 2 page cover letter.

Depending on the role, around 2-4 sentences should be enough for the content of the cover letter.

You just need to write enough to persuade them to open your CV – It should roughly contain the same amount of information as your CV profile or personal statement.

Show how your skills match the job

To ensure that recruiters open your CV, you simply need to explain how your skills and experience match the job requirements from the advert.

Scan the job advert to discover what the most important candidate abilities are, and show how your previous experience has prepared you to cover these.

In particular, look out for any requirements that are essential to the job .

Focus on what you have to offer at this stage and not what you want.

At this stage, your covering letter is simply a means of getting the recruiter to open your CV, so it’s too early to talk about salary demands etc. Save that for your initial conversation with the recruiter.

Include a professional signature

End your cover letter with a friendly salutation such as “Regards” and a smart signature which includes your name and most direct contact method (usually mobile phone for most people)

A professional email signature will show recruiters that you understand business-email etiquette and ensure they have a means of contacting you – even if they can’t open your CV for any reason.

Writing a CV cover letter

Hopefully this guide has given you everything you need to create a winning cover letter that will ensure you CV gets opened every time you send it.

Just remember to keep it brief, be friendly, tailor it towards your target role, and give recruiters some good reasons to be interested in you.

Good luck with the job hunt!

Free cover letter generator.

Save time and stand out with a quick and easy custom cover letter made in Adobe Express. No experience required.

Land your dream job with a cover letter made in Adobe Express.

Cover letters are a great opportunity to go beyond the bullet point format of your resume and provide a deep dive of your experiences and achievements in a more personal way. Capture your potential employer’s attention and give them a taste of what you have to offer with Adobe Express free cover letter templates at your side. Explore the many styles we have to offer, from modern to traditional style templates, then customize your letter with your favorite color schemes and add icons or sub out the font. Stand out even more when you upload your personal brand logo. Make as many cover letters as you’d like, for free.

Template IDs

(To pull in manually curated templates if needed)

Orientation

(Horizontal/Vertical)

( Full, Std, sixcols )

(number of templates to load each pagination. Min. 5)

Most Viewed

Rare & Original

Newest to Oldest

Oldest to Newest

(true, false, all) true or false will limit to animated only or static only.

(true, false, all) true or false will limit to premium only or free only.

Stand out with Adobe Express.

A cover letter is one of the best opportunities to create a standout statement from your peers in the job application process. While your resume follows a somewhat strict structure, your cover letter offers much more space for you to let your personality and experience shine. Let this be the letter that drives the message home – you are the best candidate, and your enthusiasm for this role is unrivaled. Give them a taste of what you have to offer, show off previous accomplishments, and craft it in a way that is unique to you. That’s where Adobe Express comes in.

Discover even more.

Curriculum Vitae

Online Portfolio

Business Card

Presentation

How to make a cover letter.

Land your dream job with an eye-catching cover letter.

No editing know-how is necessary to make an impressive cover letter in Adobe Express, so you can focus your time on making something that represents who you are in minutes. Go beyond the traditional Times New Roman, black-and-white cover letters with the Color Theme tool on your side. Search by color, mood, or style to find tons of unique color combos to apply in a snap. Duplicate and edit as many cover letters as you’d like.

Add your own personal flair with the easy-to-use cover letter builder.

Save time and showcase your professional background and personality with free, fully customizable cover letter templates to get you started. Settle on one that suits your style then drag and drop icons, shapes, and more. Apply unique borders, add images, and even choose from thousands of professional-looking Adobe Fonts to communicate your message in a stylish way. When you’re done, print and send it off to hiring managers or save it as a PDF to share online.

Stand out with a custom cover letter design.

Your cover letter is your chance to stand out and share your professional story with an authentic, personal touch. With free, fully customizable templates at your side, it’s easy to make a sleek cover letter design whether you’re a beginner or seasoned design expert. Have fun with all the customization options you have at your fingertips. Weave in action-oriented words to discuss the impact you’ve made in organizations and highlight areas of expertise to tell your story succinctly to hiring managers. Make your interview a breeze with Adobe Express on your side.

Showcase who you are in a visually appealing way.

Adobe Express takes out all the guesswork of creating a visually appealing cover letter, so you can focus on the job hunt instead. Say goodbye to the complicated process of making sure your text and spacing align on one page. With Adobe Express, it’s as simple as dragging and dropping elements exactly where you need them to be without technical constraints. Spend more time writing a compelling cover letter for your readers and let Adobe Express take care of the rest.

Go beyond cover letters with Adobe Express at your side.

Give hiring managers something to reference visually as you walk them through your professional background and achievements in your cover letter. Once you’ve settled on a theme in your file, duplicate your cover letter and start customizing your resume in the same place for a consistent look and feel. You can even add additional pages to the same project to start building your portfolio, too.

Frequently asked questions.

More From Forbes

Writing Cover Letters For A Career Change: Tips And Examples

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Embarking on a career change is a pivotal moment, fraught with uncertainty but brimming with potential. And especially in cases where your resume might not directly align with the job at hand, your cover letter becomes the narrative that connects the dots. A well-crafted cover can illuminate your strengths, align your past experiences with your future aspirations, and persuade potential employers to see the value you bring.

The Importance Of A Cover Letter In Career Changes

In career transitions, your cover letter is your storyteller. It explains the why and the how of your career change, showcasing your enthusiasm and demonstrating how your background equips you with unique perspectives and transferable skills. It addresses potential concerns about your career shift head-on, presenting your transition as an asset rather than a liability.

Tips For Writing A Career Change Cover Letter

1. Personalize Your Approach : Address the letter to a specific person whenever possible. Doing so demonstrates attention to detail and a genuine interest in the position. You want to show that you’re not conducting a generic job search, but that you’ve done your research. You’ve perused (not skimmed) the company website and you read that 20-page yearly report from the CEO. You’ve even read their blog and can quote freely from it. You’ve educated yourself.

2. Emphasize Transferable Skills : Highlight the skills and experiences from your previous roles that are relevant to the new position. Be specific and quantify achievements where possible.

3. Show Enthusiasm and Commitment : Employers want to know that you are genuinely interested in the new field. Express your passion for the career change and your eagerness to contribute.

Apple Just Released A Major Upgrade For Samsung Galaxy Watch 6, Pixel Watch

Trump posts 175 million bond thanks to billionaire don hankey, caitlin clark erupts for 41 points as iowa advances to final four with revenge win over lsu.

4. Tailor Your Narrative : Connect your past experiences to the job you're applying for, demonstrating how your unique background can bring a fresh perspective to the role.

5. Address Potential Concerns : Be upfront about your career change, framing it as a positive decision guided by clear motivation and a strong understanding of the new field.

6. End with a Strong Call to Action : Conclude by expressing your desire to discuss your application further in an interview, showing proactivity and determination.

7. Use Strategic Language : Avoid clichéd adjectives. Opt for vivid, specific language that paints a clear picture of your capabilities and achievements.

Example: General Career Change Cover Letter

Dear [Hiring Manager's Name],

I am excited to apply for the [Position] at [Company], transitioning from a career in [Current Industry] to [New Industry]. My experience in [Current Industry] has equipped me with valuable skills that I am eager to apply in [New Industry]. For instance, while working as [Previous Position], I developed a keen ability to [transferable skill], resulting in [specific achievement].

In [Current Industry], I honed my skills in [relevant skill] and demonstrated my ability to [relevant achievement], directly benefiting my team by [specific outcome]. I am particularly drawn to [New Industry] because [reason for interest], and I am enthusiastic about the opportunity to bring my [specific skill] and [another skill] to the [Position] at [Company].

[Your Name]

Tweaks For Various Career Stages

Whether you are making a change early in your career or transitioning later, your cover letter should reflect your rationale and excitement for this new path.

Example: Early Career Cover Letter

As someone at the early stages of my career, I am eager to leverage the foundational skills I gained in [Initial Field], such as [specific skill], in [New Field]. My recent role as [Previous Position] allowed me to develop [relevant skills or experiences], which align closely with the requirements of the [Position] at [Company].

Example: Late Career Cover Letter

Transitioning into [New Field] at this point in my career is a deliberate and enthusiastic choice, driven by my deep-seated interest in [aspect of New Field]. With extensive experience in [Previous Field], I bring a wealth of knowledge and a unique perspective that can contribute to innovative solutions and strategies at [Company].

Tweaks For White And Blue-Collar Roles

Transitioning between white and blue-collar roles offers a unique opportunity to highlight diverse skills and experiences.

Example: White To Blue Collar Cover Letter

I am eager to apply the strategic and managerial skills honed in my white-collar career to the hands-on, dynamic environment of [Blue Collar Field]. My experience in [White Collar Role], where I developed [specific skills], aligns well with the challenges and responsibilities of the [Blue Collar Position] at [Company].

Example: Blue To White Collar Cover Letter

Transitioning from [Blue Collar Field] to [White Collar Field], I bring practical, on-the-ground experience that can inform and enhance the strategic decisions in [White Collar Role]. My background in [Blue Collar Role], where I mastered [specific skills], equips me with a unique perspective beneficial for the [White Collar Position] at [Company].

Including A Career Change Statement On Your Resume/CV

While your cover letter is the ideal place to elaborate on your career change, your resume/CV should also reflect this transition. A brief career change statement, positioned at the beginning of your resume, can effectively set the context for your career narrative. This statement should succinctly convey your transition, emphasizing your commitment to the new field and highlighting any transferable skills or relevant experiences.

How To Craft A Career Change Statement For Your Resume

1. Objective Statement : Begin with a clear, concise objective that outlines your career goals and demonstrates your enthusiasm for your new field.

2. Summary of Qualifications : Follow your objective with a brief summary of your most relevant qualifications, focusing on skills and experiences that transition well into your new career.

3. Highlight Transferable Skills : Clearly identify and emphasize any skills from your previous career that are pertinent to your new path. This not only demonstrates your capability but also shows your proactive approach in aligning your skill set with the new role's requirements.

4. Tailor Your Experience : Adjust the descriptions of your past positions to highlight the responsibilities and achievements most relevant to your desired career path. Use quantifiable achievements to underscore your adaptability and impact.

5. Education and Training : If you have pursued any education or training relevant to your new field, highlight this prominently on your resume to illustrate your dedication and commitment to your career change.

Make Your Language Unique

To avoid sounding like everyone else, remember to use distinctive and precise adjectives in your cover letter and resume. For instance:

- Instead of "experienced," try "seasoned" or "accomplished," providing specific examples that demonstrate this experience, like spearheading a successful project or leading a team to exceed its targets.

- Replace "passionate" with "enthused" or "committed," detailing a project or initiative you pursued with zeal, which can resonate more authentically with hiring managers.

- Substitute "results-driven" with "outcome-focused," illustrating this with a particular scenario where your focus on results led to tangible success for your organization.

Your cover letter and resume are your advocates, narrating your professional journey and articulating why you are not just seeking a new job, but embarking on a new career with purpose and passion. By carefully crafting these documents to reflect your individual story, you position yourself as a memorable and compelling candidate, someone who stands out from the crowd.

- Editorial Standards

- Reprints & Permissions

- Manage communications

- Mutual Fund & 529 accounts

I invest on behalf of my clients.

I consult or invest on behalf of a financial institution.

I want to learn more about BlackRock.

Larry Fink’s 2024 Annual Chairman’s Letter to Investors

Time to rethink retirement.

When my mom passed away in 2012, my dad started to decline quickly, and my brother and I had to go through my parents’ bills and finances.

Both my mom and dad worked great jobs for 50 years, but they were never in the top tax bracket. My mom taught English at the local state college (Cal Northridge), and my dad owned a shoe store.

I don’t know exactly how much they made every year, but in today’s dollars, it was probably not more than $150,000 as a couple. So, my brother and I were surprised when we saw the size of our parents' retirement savings. It was an order of magnitude bigger than you’d expect for a couple making their income. And when we finished going over their estate, we learned why: My parents' investments.

My dad had always been an enthusiastic investor. He encouraged me to buy my first stock (the DuPont chemical company) as a teenager. My dad invested because he knew that whatever money he put in the bond or stock markets would likely grow faster than in the bank. And he was right.

I went back and did the math. If my parents had $1,000 to invest in 1960, and they put that money in the S&P 500, then by the time they’d reached retirement age in 1990, the $1,000 would be worth nearly $20,000. 1 That’s more than double what they would have earned if they’d just put the money in a bank account. My dad passed away a few months after my mom, in his late 80s. But both my parents could have lived beyond 100 and comfortably afforded it.

Why am I writing about my parents? Because going over their finances showed me something about my own career in finance. I had been working at BlackRock for almost 25 years by the time I lost my mom and dad, but the experience reminded me — in a new and very personal way — why my business partners and I founded BlackRock in the first place.

Obviously, we were ambitious entrepreneurs, and we wanted to build a big, successful company. But we also wanted to help people retire like my parents did. That’s why we started an asset manager — a company that helps people invest in the capital markets — because we believed participating in those markets was going to be crucial for people who wanted to retire comfortably and financially secure.

We also believed the capital markets would become a bigger and bigger part of the global economy. If more people could invest in the capital markets, it would create a virtuous economic cycle, fueling growth for companies and countries, which would, in turn, generate wealth for millions more people.

My parents lived their final years with dignity and financial freedom. Most people don’t have that chance. But they can. The same kinds of markets that helped my parents in their time can help others in our time. Indeed, I think the growth- and prosperity-generating power of the capital markets will remain a dominant economic trend through the rest of the 21 st Century.

This letter attempts to explain why.

I had been working at BlackRock for almost 25 years by the time I lost my mom and dad, but the experience reminded me — in a new and very personal way — why my business partners and I founded BlackRock in the first place.

A brief (and admittedly incomplete) history of U.S. capital markets

In finance, there are two basic ways to get or grow money.

One is the bank, which is what most people historically relied on. They deposited their savings to earn interest or took out loans to buy a home or expand their business. But over time a second avenue for financing arose, particularly in the U.S., with the growth of the capital markets: Publicly traded stocks, bonds, and other securities.

I saw this firsthand in the late 1970s and early 1980s when I played a role in the creation of the securitization market for mortgages.

Before the 1970s, most people secured financing for their homes the same way they did in the Christmas classic It’s a Wonderful Life — through the Building & Loan (B&L). Customers deposited their savings into the B&L, which was essentially a bank. Then that bank would turn around and lend out those savings in the form of mortgages.

In the movie — and in real life — everything works fine until people start lining up at the bank’s front door asking for their deposits back. As Jimmy Stewart explained in the film, the bank didn’t have their money. It was tied up in somebody else’s house.

After the Great Depression, B&Ls morphed into savings & loans (S&Ls), which had their own crisis in the 1980s. Approximately half of the outstanding home mortgages in the U.S. were held by S&Ls in 1980, and poor risk management and loose lending practices led to a raft of failures costing U.S. taxpayers more than $100 billion dollars. 2

But the S&L crisis didn’t cause the American economy lasting damage. Why? Because at the same time the S&Ls were collapsing another method of financing was getting stronger. The capital markets were providing an avenue to channel capital back to challenged real estate markets.

This was mortgage securitization.

Securitization allowed banks not just to make mortgages but to sell them. By selling mortgages, banks could better manage risk on their balance sheets and have capital to lend to home buyers, which is why the S&L crisis didn’t severely impact American homeownership.

Eventually, the excesses of mortgage securitization contributed to the crash in 2008, and unlike the S&L crisis, the Great Recession did harm home ownership in the U.S. The country still hasn’t fully recovered in that respect. But the broader underlying trend — the expansion of the capital markets — was still very helpful for the American economy.

In fact, it’s worth considering: Why did the U.S. rebound from 2008 faster than almost any other developed nation? 3

A big part of the answer is the country’s capital markets .

In Europe, where most assets were kept in banks, economies froze as banks were forced to shrink their balance sheets. Of course, U.S. banks had to tighten capital standards and pull back from lending as well. But because the U.S. had a more robust secondary pool of money – the capital markets — the nation was able to recover much more quickly.

Today public equities and bonds provide over 70% of financing for non-financial corporations in the U.S. – more than any other country in the world. In China, for example, the bank-to-capital market ratio is almost flipped. Chinese companies rely on bank loans for 65% of their financing. 4

In my opinion, this is the most important lesson in recent economic history: Countries aiming for prosperity don’t just need strong banking systems — they also need strong capital markets.

That lesson is now spreading around the world.

Replicating the success of America’s capital markets

Last year, I spent a lot of days on the road, logging visits to 17 different countries. I met with clients and employees. I also met with many policymakers and heads of state, and during those meetings, the most frequent conversation I had was about the capital markets.

More and more countries recognize the power of American capital markets and want to build their own.

Of course, many countries do have capital markets already. There are something like 80 stock exchanges around the world, everywhere from Kuala Lumpur to Johannesburg. 5 But most of these are rather small, with little investment. They’re not as robust as the markets in the U.S., and that’s what other nations are increasingly looking for.

In Saudi Arabia, for example, the government is interested in building a market for mortgage securitization, while Japan and India want to give people new places to put their savings. Today, in Japan, it’s mostly the bank. In India, it’s often in gold.

When I visited India in November, I met policymakers who lamented their fellow citizens’ fondness for gold. The commodity has underperformed the Indian stock market, proving a subpar investment for individual investors. Nor has investing in gold helped the country’s economy.

Compare investing in gold with, let’s say, investing in a new house. When you buy a home, that creates an economic multiplier effect because you need to furnish and repair the house. Maybe you have a family and fill the house with children. All that generates economic activity. Even when someone puts their money in a bank, there’s a multiplier effect because the bank can use that money to fund a mortgage. But gold? It just sits in a safe. It can be a good store of value, but gold doesn’t generate economic growth.

This is a small illustration — but a good one — of what countries want to accomplish with robust capital markets. (Or rather, of what they can’t accomplish without them.)

Despite the anti-capitalist strain in our modern politics, most world leaders still see the obvious: No other force can lift more people from poverty or improve quality of life quite like capitalism. No other economic model can help us achieve our highest hopes for financial freedom — whether we want it for ourselves or our country.

That’s why the capital markets will be key to addressing two of the mid-21 st Century’s biggest economic challenges.

- The first is providing people what my parents built over time — a secure, well-earned retirement. This is a much harder proposition than it was 30 years ago. And it’ll be a much harder proposition 30 years from now . People are living longer lives. They’ll need more money. The capital markets can provide it — so long as governments and companies help people invest.

- A second challenge is infrastructure. How are we going to build the massive amount the world needs? As countries decarbonize and digitize their economies, they’re supercharging demand for all sorts of infrastructure, from telecom networks to new ways to generate power. In fact, in my nearly 50 years in finance, I’ve never seen more demand for energy infrastructure. And that’s because many countries have twin aims: They want to transition to lower-carbon sources of power while also achieving energy security. The capital markets can help countries meet their energy goals, including decarbonization, in an affordable way.

[Retirement] is a much harder proposition than it was 30 years ago. And it’ll be a much harder proposition 30 years from now .

Asking the old age question: How do we afford longer lives?

Last year, Japan passed a demographic milestone. The country’s population has been aging since the early 1990s as the pool of working-age people has shrunk and the number of elderly has risen. But 2023 was the first time that 10% of their people exceeded 80 years old, 6 making Japan the “oldest country in the world” according to the United Nations. 7

This is part of the reason the Japanese government is making a push for retirement investment.

Most Japanese keep the bulk of their retirement savings in banks, earning a low interest rate. It wasn’t such a bad strategy when Japan was suffering from deflation, but now the country’s economy has turned around, with the NIKKEI surging past 40,000 for the first time this month (March 2024). 8

Most aspiring retirees are missing out on the upswing. The country didn’t have anything resembling a 401(k) program until 2001, but even then, the amount of income people could contribute was quite low. So a decade ago, the government launched the Nippon Individual Savings Accounts (NISA) to encourage people to invest even more in retirement. Now they’re trying to double NISA’s enrollment. The goal is 34 million Japanese investors before the end of the decade. 9 It will require the Japanese government to expand their capital markets, which historically had very little retail participation.

Japan isn’t alone in helping more of its citizens invest for retirement. BlackRock has a joint venture — Jio BlackRock — with Jio Financial Services, an affiliate of India’s Reliance Industries. Over the past 10 years, India has built a huge digital public infrastructure network that connects nearly one billion Indians to everything from healthcare to government payments via their smartphones. Jio BlackRock’s goal is to use the same infrastructure to deliver retirement investing (and more).

After all, India is aging, too. The whole world is, albeit at different speeds. Brazil will start seeing more people leave its workforce than enter it by 2035; Mexico will reach peak workforce by 2040; India sometime around 2050.

As populations age, building retirement savings has never been more urgent

Source: Working-age population (ages 15-64): UN “medium trend 10

By the mid-century mark, one-in-six people globally will be over the age of 65, up from one-in-11 in 2019. 11 To support them, governments are going to have to prioritize building out robust capital markets like the U.S. has.

But this isn’t to say the U.S. retirement system is perfect. I’m not sure anybody believes that. The retirement system in America needs modernizing, at the very least.

Rethinking retirement in the United States

This was particularly clear last year as the biotech industry pumped out a rush of new, life-extending drugs. Obesity, for example, can take more than 10 years off someone’s life expectancy, which is why some researchers think that new pharmaceuticals like Ozempic and Wegovy can be life-extending drugs, not just weight-loss drugs. 12 In fact, a recent study shows that semaglutide, the generic name for Ozempic, can give people with cardiovascular disease an extra two years of life where they don’t suffer a major condition like a heart attack. 13

We focus a tremendous amount of energy on helping people live longer lives. But not even a fraction of that effort is spent helping people afford those extra years.

These drugs are breakthroughs. But they underscore a frustrating irony: As a society, we focus a tremendous amount of energy on helping people live longer lives. But not even a fraction of that effort is spent helping people afford those extra years.

It wasn’t always this way. One reason my parents had a financially secure retirement was CalPERS, California’s state pension system. As a public university employee, my mom could enroll. But pension enrollment has been declining across the country since the 1980s. 14 Meanwhile the federal government has prioritized maintaining entitlement benefits for people my age (I’m 71) even though it might mean that Social Security will struggle to meet its full obligations when younger workers retire.

It’s no wonder younger generations, Millennials and Gen Z, are so economically anxious. They believe my generation — the Baby Boomers — have focused on their own financial well-being to the detriment of who comes next. And in the case of retirement, they’re right.

Today in America, the retirement message that the government and companies tell their workers is effectively: “You’re on your own.” And before my generation fully disappears from positions of corporate and political leadership, we have an obligation to change that.

Maybe once a decade, the U.S. faces a problem so big and urgent that government and corporate leaders stop business as usual. They step out of their silos and sit around the same table to find a solution. I participated in something like this after 2008, when the government needed to find a way to unwind the toxic assets from the mortgage crisis. More recently, tech CEOs and the federal government came together to address the fragility of America’s semiconductor supply chain. We need to do something similar for the retirement crisis. America needs an organized, high-level effort to ensure that future generations can live out their final years with dignity.

What should that national effort do? I don’t have all the answers. But what I do have is some data and the beginnings of a few ideas from BlackRock’s work. Because our core business is retirement.

More than half the assets BlackRock manages are for retirement. 15 We help about 35 million Americans invest for life after work, 16 which amounts to about a quarter of the country’s workers. 17 Many are educators like my mom was. BlackRock helps manage pension assets for roughly half of U.S. public school teachers. 18 And this work — and our similar work around the globe — has given us some insight into how a national initiative to modernize retirement might begin.

We think the conversation starts by looking at the challenge through three different lenses.

- What’s the issue from the perspective of a current worker , someone who’s still trying to save for retirement?

- What about someone who has already retired? We have to look at the problem from the retiree’s point of view — an individual who has already saved enough to stop working but is worried the money will run out.

- But first it’s important to look at retirement in America like you’d look at a map of America — a high-level picture of the problem, the kind a national policymaker might look at. What’s the issue for the population as a whole? (It’s demographics.)

[Young people] believe my generation — the Baby Boomers — have focused on their own financial well-being to the detriment of who comes next. And in the case of retirement, they’re right.

The demographics don’t lie

There’s a popular saying in economics: “You just can’t fight demographics.” And yet, when it comes to retirement, the U.S. is trying anyway.

In wealthy countries, most retirement systems have three pillars. One is what people invest personally (my dad putting his money in the stock market). Another is the plans provided by employers (my mom’s CalPERS pension). A third component is what we hear politicians mostly talking about – the government safety net. In the U.S., this is Social Security.

You’re probably familiar with the economics behind Social Security. During your working years, the government takes a portion of your income, then after you retire, it sends you a check every month. The idea actually originates from pre-World War I Germany, and these “old-age insurance” programs gradually became popular over the 20 th Century largely because the demographics made sense.

Think about someone who was 65 years old in 1952, the year I was born. If he hadn’t retired already, that person was probably getting ready to stop working.

But now think about that person’s former colleagues, all the people around his age who he’d entered the workforce with back in the 1910s. The data shows that in 1952, most of those people were not preparing for retirement because they’d already passed away .

This is how the Social Security program functioned: More than half the people who worked and paid into the system never lived to retire and be paid from the system. 19

Today, these demographics have completely unraveled, and this unraveling is obviously a wonderful thing. We should want more people to live more years. But we can’t overlook the massive impact on the country’s retirement system.

It’s not just that more people are retiring in America; it’s also that their retirements are increasing in length. Today, if you’re married and both you and your spouse are over the age of 65, there’s a 50/50 chance at least one of you will be receiving a Social Security check until you’re 90. 20

All this is putting the U.S. retirement system under immense strain. The Social Security Administration itself says that by 2034, it won’t be able to pay people their full benefits. 21

What’s the solution here? No one should have to work longer than they want to. But I do think it’s a bit crazy that our anchor idea for the right retirement age — 65 years old — originates from the time of the Ottoman Empire.

Humanity has changed over the past 120 years. So must our conception of retirement.

One nation that’s rethought retirement is the Netherlands. In order to keep their state pension affordable, the Dutch decided more than 10 years ago to gradually raise the retirement age. It will now automatically adjust as the country’s life expectancy changes. 22

Obviously, implementing this policy elsewhere would be a massive political undertaking. But my point is that we should start having the conversation . When people are regularly living past 90, what should the average retirement age be?

Or rather than pushing back when people receive retirement benefits, perhaps there’s a more politically palatable idea: How do we encourage more people who wish to work longer with carrots rather than sticks? What if the government and the private sector treated 60-plus year-olds as late-career workers with much to offer rather than people who should retire?

One way Japan has managed its aging economy is by doing exactly this. They’ve found new ways to boost the labor force participation rate, a metric that has been declining in the U.S. since the early 2000s. 23 It’s worth asking: How can America stop (or at least, slow) that trend?

Again, I’m not pretending to have the answers. Despite BlackRock’s success helping millions retire, these questions are going to have to be posed to a broader range of investors, retirees, policymakers, and others. Over the next few months, BlackRock will be announcing a series of partnerships and initiatives to do just that, and I invite you to join us.

For workers, make investing (almost) automatic

When the U.S. Census Bureau released its regular survey of consumer finances in 2022, nearly half of Americans aged 55 to 65 reported not having a single dollar saved in personal retirement accounts. 24 Nothing in a pension. Zero in an IRA or 401(k).

Why? Well, the first barrier to retirement investing is affordability.

Four-in-10 Americans don’t have $400 to spare to cover an emergency like a car repair or hospital visit. 25 Who is going to invest money for a retirement 30 years away if they don’t have cash for today? No one. That’s why BlackRock’s foundation has worked with a group of nonprofits to set up an Emergency Savings Initiative. The program has helped mostly low-income Americans put away a total of $2 billion in new liquid savings. 26

Studies show that when people have emergency savings, they’re 70% more likely to invest for retirement. 27 But this is where workers run into another barrier: Investing is complex even if you can afford it.

No one is born a natural investor. It’s important to say that because sometimes in the financial services industry we imply the opposite. We make it seem like saving for retirement can be a simple task, something anyone can do with a bit of practice, like driving your car to work. Just grab your keys and hop in the driver’s seat. But financing retirement isn’t so intuitive. The better analogy is if someone dropped a bunch of engine and auto parts in your driveway and said, “Figure it out.”

At BlackRock, we’ve tried to make the investing process more intuitive by inventing simpler products like target date funds. They only require people to make one decision: What year do they expect to retire? Once people choose their “target date,” the fund automatically adjusts their portfolio, shifting from higher-return equities to less risky bonds as retirement approaches. 28

In 2023, BlackRock expanded the types of target date ETFs we offer so people can more easily buy them even if they don’t work for employers offering a retirement plan. There are 57 million people like this in America — farmers, gig workers, restaurant employees, independent contractors — who don’t have access to a defined contribution plan. 29 And while better investment products can help, there are limits to what something like a target date fund can do. Indeed, for most people, the data shows that the hardest part of retirement investing is just getting started.

Other nations make things simpler for their part-time and contract workers. In Australia, employers must contribute a portion of income for every worker between the ages of 18 and 70 into a retirement account, which then belongs to the employee. The Superannuation Guarantee was introduced in 1992 when the country seemed like it was on the path to a retirement crisis. Thirty-two years later, Australians likely have more retirement savings per capita than any other country. The nation has the world’s 54 th largest population, 30 but the 4 th largest retirement system. 31

Of course, every country is different, so every retirement system should be different. But Australia’s experience with Supers could be a good model for American policymakers to study and build on. Some already are. There are about 20 U.S. states — like Colorado and Virginia — that have instituted retirement systems to cover all workers like Australia does, even if they’re gig or part-time. 32

It’s a good thing that legislators are proposing different bills and states are becoming “laboratories of retirement.” More should consider it. The benefits could be enormous for individual retirees. These new programs could also help the U.S. ensure the long-term solvency of Social Security. That’s what Australia found — their Superannuation Guarantee relieved the financial tension in their country’s public pension program. 33

But what about workers who do have access to an employer retirement plan? They need support too.

Even among employees who have access to employer plans, 17% don’t enroll in them, and the hypothesis among retirement experts is this is not a conscious choice. People are just busy.

It sounds trivial, but even the hour or so it takes someone to look through their work email inbox for the correct link to their company’s retirement system, and then select the percentage of their income they want to contribute can be the unclearable hurdle. That’s why companies should make a conscious effort to look at what their default option is. Are people automatically enrolled in a plan or not? And how much are they auto-enrolled to contribute? Is it a minimum percentage of their income? Or the maximum?

In 2017, the University of Chicago economist Richard Thaler won the Nobel Prize, in part, for his pioneering work around “nudges” — small changes in policy that can have enormous impact in people’s financial lives. Auto-enrollment is one of them. Studies show that the simple step of making enrollment automatic increases retirement plan participation by nearly 50%. 34

As a nation, we should do everything we can to make retirement investing more automatic for workers. And there are already bright spots. Next year, a new federal law will kick in, requiring employers that set up new 401(k) plans to auto-enroll their new workers. Plus, there are hundreds of major companies (including BlackRock) that have already taken this step voluntarily.

But firms can do even more to improve their employee’s financial lives, such as providing some level of matching funds for retirement plans and offering more financial education on the tremendous long-term difference between contributing a small percentage of your income to retirement versus the maximum. I also think we should make it easier for workers to transfer their 401(k) savings when they switch jobs. There is a menu of options here, and we need to explore all of them.

For retirees, help them spend what they saved

In 2018, BlackRock commissioned a study of 1,150 American retirees. When we dug into the data, we found something unexpected — even paradoxical.

The survey showed that after nearly two decades of retirement, the average person still had 80% of their pre-retirement money saved. We’re talking about people who were probably between the ages of 75 and 95. If they had invested for retirement, they were likely sitting on more than enough money for the rest of their lives. And yet the data also showed that they were anxious about their finances. Only 32% reported feeling comfortable about spending what they saved. 35

This retirement paradox has a simple explanation: Even people who know how to save for retirement still don’t know how to spend for it.

In the U.S., this problem’s roots stretch back more than four decades when employers began switching from defined benefit plans — pensions — to defined contribution plans like 401(k)s.

In a lot of ways, pensions were much simpler than the 401(k). You had a job somewhere for 20 or 30 years. Then when you retired, your pension paid you a set amount — a defined benefit — every month.

When I entered the workforce in the 1970s, 38% of Americans had one of these defined benefit plans, but by 2008 the percentage had been cut almost in half. 36 Meanwhile, the fraction of Americans with defined contribution plans almost quadrupled. 37

This should have been a good thing. Beginning with the Baby Boomers, fewer and fewer workers spent their entire careers in one place, meaning they needed a retirement option that would follow them from job to job. In theory, 401(k)s did that. But in practice? Not really.

Anyone who’s switched jobs knows how unintuitive it is to transfer your retirement savings. In fact, studies show that about 40% of employees cash out their 401(k)s when they switch jobs, putting themselves back at the starting line for retirement savings. 38

The real drawback of defined contribution was that it removed most of the retirement responsibility from employers and put it squarely on the shoulders of the employees themselves. With pensions, companies had a very clear obligation to their workers. Their retirement money was a financial liability on the corporate balance sheet. Companies knew they’d have to write a check every month to each one of their retirees. But defined contribution plans ended that, forcing retirees to trade a steady stream of income for an impossible math problem.

Because most defined contribution accounts don’t come with instructions for how much you can take out every month, individual savers first must build up a nest-egg, then spend down at a rate that will last them the rest of their lives. But who really knows how long that will be?

Put simply, the shift from defined benefit to defined contribution has been, for most people, a shift from financial certainty to financial un certainty .

That’s why around the same time we saw the data that retirees were nervous about spending their savings, we started wondering: Was there something we can do about it? Could we develop an investment strategy that provided the flexibility of a 401(k) investment but also the potential for a predictable, paycheck-like income stream, similar to a pension?

It turns out, we could. That strategy is called LifePath Paycheck™, which will go live in April. As I write this, 14 retirement plan sponsors are planning to make LifePath Paycheck™ available to 500,000 employees. I believe it will one day be the most used investment strategy in defined contribution plans.

We’re talking about a revolution in retirement. And while it may happen in the U.S. first, eventually other countries will benefit from the innovation as well. At least, that is my hope. Because while retirement is mainly a saving challenge, the data is clear: It’s a spending one too.

Fear vs. hope

Before I conclude this section on retirement, I want to share a few words about one of the largest barriers to investing for the future. In my view, it’s not just affordability or complexity or the fact that people are too busy to enroll in their employer’s plan.

Arguably the biggest barrier to investing for retirement — or for anything — is fear.

In finance, we sometimes think of “fear” as a fuzzy, emotional concept — not as a hard economic data point. But that’s what it is. Fear is as important and actionable a metric as GDP. After all, investment (or lack thereof) is just a measure of fear because no one lets their money sit in a stock or a bond for 30 or 40 years if they’re afraid the future is going to be worse than the present. That’s when they put their money in a bank. Or underneath the mattress.

This is what happens in many countries. In China, where new surveys show consumer confidence has dropped to its lowest level in decades, household savings have reached their highest level on record — nearly $20 trillion — according to the central bank. 39 China has a savings rate of about 30%. Nearly a third of all money earned is socked away in cash in case it’s needed for harder times ahead. The U.S., by comparison, has a savings rate in the single digits. 40

America has rarely been a fearful country. Hope has been the nation’s greatest economic asset. People put their money in American markets for the same reason they invest in their homes and businesses — because they believe this country will be better tomorrow than it is today.

This big, hopeful America has been the one I’ve known my whole life, but over the past few years, especially as I’ve had more grandchildren, I’ve started to ask myself: Will they know this version of America, too?

As I was finishing this letter, The Wall Street Journal published an article that caught my attention. It was titled “The Rough Years that Turned Gen Z into America’s Most Disillusioned Voters,” and it included some eye-catching — and really disheartening — data.

The article showed that from the mid-1990s through most of the early 21 st Century, most young people — around 60% of high school seniors, to be specific — believed they’d earn a professional degree, would land a good job, and go on to be wealthier than their parents. They were optimistic. But since the pandemic, that optimism has fallen precipitously.

Compared with 20 years ago, the current cohort of young Americans is 50% more likely to question whether life has a purpose. Four-in-10 say it’s “hard to have hope for the world.” 41

I’ve been working in finance for almost 50 years. I’ve seen a lot of numbers. But no single data point has ever concerned me more than this one.

The lack of hope worries me as a CEO. It worries me as a grandfather. But most of all, it worries me as an American.

If future generations don’t feel hopeful about this country and their future in it, then the U.S. doesn’t only lose the force that makes people want to invest. America will lose what makes it America. Without hope, we risk becoming just another place where people look at the incentive structure before them and decide that the safe choice is the only choice. We risk becoming a country where people keep their money under the mattress and their dreams bottled up in their bedroom.

How do we get our hope back?

Whether we’re trying to solve retirement or any other problem, that is the first question we have to ask, although I readily admit that I do not have the solution. I look at the state of America — and the world — and I am as answerless as everyone else. There’s so much anger and division, and I often struggle to wrap my head around it.

What I do know is that any answer has to start by bringing young people into the fold. The same surveys that show their lack of hope also show their lack of confidence — far less than any previous generation — in every pillar of society: In politics, government, the media, and in corporations. Leaders of these institutions (I am one) should be empathetic to their concerns.

Young people have lost trust in older generations. The burden is on us to get it back. And maybe investing for their long-term goals, including retirement, isn’t such a bad place to begin.

Perhaps the best way to start building hope is by telling young people, “You may not feel very hopeful about your future. But we do. And we’re going to help you invest in it.”

Young people have lost trust in older generations. The burden is on us to get it back. And maybe investing for their long-term goals, including retirement, isn’t such a bad place to begin.

The new infrastructure blueprint: Steel, concrete, and public-private partnership

I started traveling to London in the 1980s, and back then, if you had a choice between the city’s two major international airports — Heathrow or Gatwick — you probably chose Heathrow. Gatwick was farther from the city. It was also in a comparative state of disrepair.

But things changed in 2009 when Gatwick was purchased by Global Infrastructure Partners (GIP). They increased runway capacity and instituted commonsense changes, like oversized luggage trays that cut security screening times by more than half.

“The thing about infrastructure businesses... is a lot of them tend not to focus on customer service,” GIP’s CEO Bayo Ogunlesi told the Financial Times . GIP wanted to make Gatwick different. In the process, they also turned the airport into a prime example of how infrastructure will be built and run in the 21 st Century — with private capital. 42

In the U.S., people tend to think of infrastructure as a government endeavor, something built with taxpayer funds. But because of one very big reason that I’ll dive into momentarily, that won’t be the primary way infrastructure is built in the mid-21 st Century. Rather than only tapping government treasuries to build bridges, power grids, and airports, the world will do what Gatwick did.

The future of infrastructure is public-private partnership.

Debt matters

The $1 trillion infrastructure sector is one of the fastest growing segments of the private markets, and there are some undeniable macroeconomic trends driving this growth. In developing countries, people are getting richer, boosting demand for everything from energy to transportation while in wealthy countries, governments need to both build new infrastructure and repair the old.

Even in the U.S., where the Biden Administration has signed generational infrastructure investments into law, there’s still $2 trillion worth of deferred maintenance. 43

How will we pay for all this infrastructure? The reason I believe it’ll have to be some combination of public and private dollars is that funding probably cannot come from the government alone. The debt is just too high.

From Italy to South Africa, many nations are suffering the highest debt burdens in their history. Public debt has tripled since the mid-1970s, reaching 92% of global GDP in 2022. 44 And in America, the situation is more urgent than I can ever remember. Since the start of the pandemic, the U.S. has issued roughly $11.1 trillion of new debt, and the amount is only part of the issue. 45 There’s also the interest rate the Treasury needs to pay on it.

Three years ago, the rate on a 10-year Treasury bill was under 1%. But as I write this, it’s over 4%, and that 3-percentage-point increase is very dangerous. Should the current rates hold, it amounts to an extra trillion dollars in interest payments over the next decade. 46

Why is this debt a problem now? Because historically, America has paid for old debt by issuing new debt in the form of Treasury securities. It’s a workable strategy so long as people want to buy those securities — but going forward, the U.S. cannot take for granted that investors will want to buy them in such volume or at the premium they currently do.

Today, around 30% of U.S. Treasury securities are held by foreign governments or investors. That percentage will likely go down as more countries build their own capital markets and invest domestically. 47

More leaders should pay attention to America’s snowballing debt. There’s a bad scenario where the American economy starts looking like Japan’s in the late 1990s and early 2000s, when debt exceeded GDP and led to periods of austerity and stagnation. A high-debt America would also be one where it’s much harder to fight inflation since monetary policymakers could not raise rates without dramatically adding to an already unsustainable debt-servicing bill.

But is a debt crisis inevitable? No.

While fiscal discipline can help tame debt on the margins, it will be very difficult (both politically and mathematically) to raise taxes or cut spending at the level America would need to dramatically reduce the debt. But there is another way out beyond taxing or cutting, and that’s growth. If U.S. GDP grows at an average of 3% (in real, not nominal terms) over the next five years, that would keep the country’s debt-to-GDP ratio at 120% – high, but reasonable.

I should be clear: 3% growth is a very tall order, especially given the country’s aging workforce. It will require policymakers to shift their focus. We can’t see debt as a problem that can be solved only through taxing and spending cuts anymore. Instead, America’s debt efforts have to center around pro-growth policies , which include tapping the capital markets to build one of the best catalysts for growth: Infrastructure. Especially energy infrastructure.

Energy pragmatism

Roads. Bridges. Ports. Airports. Cell towers. The infrastructure sector contains multitudes, but the multitude where BlackRock sees arguably the greatest demand for new investment is energy infrastructure.

Why energy? Two things are happening in the sector at the same time.

The first is the “energy transition.” It’s a mega force, a major economic trend being driven by nations representing 90% of the world’s GDP. 48 With wind and solar power now cheaper in many places than fossil-fuel-generated electricity, these countries are increasingly installing renewables. 49 It’s also a major way to address climate change. This shift – or energy transition – has created a ripple effect in the markets, creating both risks and opportunities for investors, including BlackRock’s clients.

I started writing about the transition in 2020. Since then, the issue has become more contentious in the U.S. But outside the debate, much is still the same. People are still investing heavily in decarbonization. In Europe, for example, net-zero remains a top investment priority for most of BlackRock’s clients. 50 But now the demand for clean energy is being amplified by something else: A focus on energy security.

Governments have been pursuing energy security since the oil crisis of the 1970s, (and probably as far back as the early Industrial Revolution), so this is not a new trend. In fact, when I wrote my original 2020 letter about sustainability, I also wrote to our clients that countries would still need to produce oil and gas to meet their energy needs.

To be energy secure, I wrote, most parts of the globe would need “to rely on hydrocarbons for a number of years.” 51

I’m hearing more leaders talk about decarbonization and energy security together under the joint banner of what you might call “energy pragmatism.”

Then in 2022, Putin invaded Ukraine. The war lit a fresh spark under the idea of energy security. It disrupted the world’s supply of oil and gas causing massive energy inflation, particularly in Europe. The UK, Norway, and the 27 EU countries had to collectively spend 800 billion euros subsidizing energy bills. 52

This is part of the reason I’m hearing more leaders talk about decarbonization and energy security together under the joint banner of what you might call “energy pragmatism.”

Last year, as I mentioned, I visited 17 countries, and I spent a lot of time talking to the people who are responsible for powering homes and businesses, everybody from prime ministers to energy grid operators. The message I heard was completely opposite to what you often hear from activists on the far left and right who say that countries have to choose between renewables and oil and gas. These leaders believe that the world still needs both. They were far more pragmatic about energy than dogmatic. Even the most climate conscious among them saw that their long-term path to decarbonization will include hydrocarbons, albeit less of them, for some time to come.

Germany is a good example of how energy pragmatism is still a path to decarbonization. It’s one of the countries most committed to fighting climate change and has made enormous investments in wind and solar power. But sometimes the wind doesn’t blow in Berlin, and the sun doesn’t shine in Munich. And during those windless, sunless periods, the country still needs to rely on natural gas for “dispatchable power.” Germany used to get that gas from Russia, but now it needs to look elsewhere. So, they’re building additional gas facilities to import from other producers around the world. 53

Or look at Texas. They face a similar energy challenge – not because of Russia but because of the economy. The state is one of the fastest growing in the U.S., 54 and the additional demand for power is stretching ERCOT, Texas’ energy grid, to the limit. 55

Today, Texas runs on 28% renewable energy 56 – 6% more than the U.S. as a whole. 57 But without an additional 10 gigawatts of dispatchable power, which might need to come partially from natural gas, the state could continue to suffer devastating brownouts. In February, BlackRock helped convene a summit of investors and policymakers in Houston to help find a solution.

Texas and Germany are great illustrations of what the energy transition looks like. As I wrote in 2020, the transition will only succeed if it’s “fair.” Nobody will support decarbonization if it means giving up heating their home in the winter or cooling it in the summer. Or if the cost of doing so is prohibitive.

Since 2020, economists have popularized better language to describe what a fair transition actually means. One important concept is the “green premium.” It’s the surcharge people pay for “going green”: for example, switching from a car that runs on gas to an electric vehicle. The lower the green premium, the fairer decarbonization will be because it’ll be more affordable.

This is where the power of the capital markets can be unleashed to great effect. Private investment can help energy companies reduce the cost of their innovations and scale them around the world. Last year, BlackRock invested in over a dozen of these transition projects on behalf of our clients. We partnered with developers in Southeast Asia aiming to build over a gigawatt of solar capacity (enough to power a city) in both Thailand and the Philippines. 58 We also invested in Lake Turkana Wind Power, Africa’s largest windfarm. It’s located in Kenya and currently accounts for about 12% of the country’s power generation. 59

There are also earlier-stage technologies, like a giant “hot rock” battery being built by Antora Energy. The company heats up blocks of carbon with wind or solar power during parts of the day when renewable energy is cheap and abundant. These “thermal batteries” reach up to 2,400 degrees Celsius and glow brighter than the sun. 60 Then, that heat is used to power giant industrial facilities around-the-clock, even when the sun isn’t shining, or the wind isn’t blowing.

BlackRock invested in Antora through Decarbonization Partners, a partnership we have with the investment firm, Temasek. Our funding will help Antora scale up to deliver billions of dollars worth of zero-emission energy to industrial customers. 61 (One day, their thermal batteries might help solve the kind of dispatchable power problem that Texas and Germany are facing – but without carbon emissions.)

The final technology I’ll spotlight is carbon capture. Last year, one of BlackRock’s infrastructure funds invested $550 million in a project called STRATOS, which will be the world’s largest direct air capture facility when construction is completed in 2025. 62 Among the more interesting aspects of the project is who’s building the facility: Occidental Petroleum, the big Texas oil company.

The energy market isn’t divided the way some people think, with a hard split between oil & gas producers on one side and new clean power and climate tech firms on the other. Many companies, like Occidental, do both, which is a major reason BlackRock has never supported divesting from traditional energy firms. They’re pioneers of decarbonization, too.

Today, BlackRock has more than $300 billion invested in traditional energy firms on behalf of our clients. Of that $300 billion, more than half – $170 billion – is in the U.S. 63 We invest in these energy companies for one simple reason: It’s our clients’ money. If they want to invest in hydrocarbons, we give them every opportunity to do it – the same way we invest roughly $138 billion in energy transition strategies for our clients. That’s part of being an asset manager. We follow our clients’ mandates.

But when it comes to energy, I also understand why people have different preferences in the first place. Decarbonization and energy security are the two macroeconomic trends driving the demand for more energy infrastructure. Sometimes they’re competing trends. Other times, they’re complementary, like when the same advanced battery that decarbonizes your grid can also reduce your dependence on foreign power.

The point is: The energy transition is not proceeding in a straight line. As I’ve written many times before, it’s moving in different ways and at different paces in different parts of the world. At BlackRock, our job is to help our clients navigate the big shifts in the energy market no matter where they are.

BlackRock’s next transformation

One way we’re helping our clients navigate the booming infrastructure market is by transforming our company. I began this section by writing about the owners of Gatwick Airport, GIP. In January, BlackRock announced our plans to acquire them.