Starting a Business | How To

How to Start a Small Business: An Ultimate Guide

Published October 9, 2023

Published Oct 9, 2023

WRITTEN BY: Agatha Aviso

Get Your Free Ebook

Your Privacy is important to us.

This article is part of a larger series on Starting a Business .

Starting A Business?

- 1. Come Up With a Business Idea

- 2. Test Your Business Idea

- 3. Write a Business Plan

- 4. Acquire Funding

- 5. Choose Structure & Register

- 6. Get Business Insured

- 7. Build Team

- 8. Set Up Systems & Software

Bottom Line

Whether you’re starting a part-time business or quitting your corporate job to create your dream biz, you’ll find information in this guide to help you succeed. Throughout this article, you’ll learn how to start a small business from experts in finance, legal, marketing, human resources, software, insurance, as well as expert advice from former small business consultants.

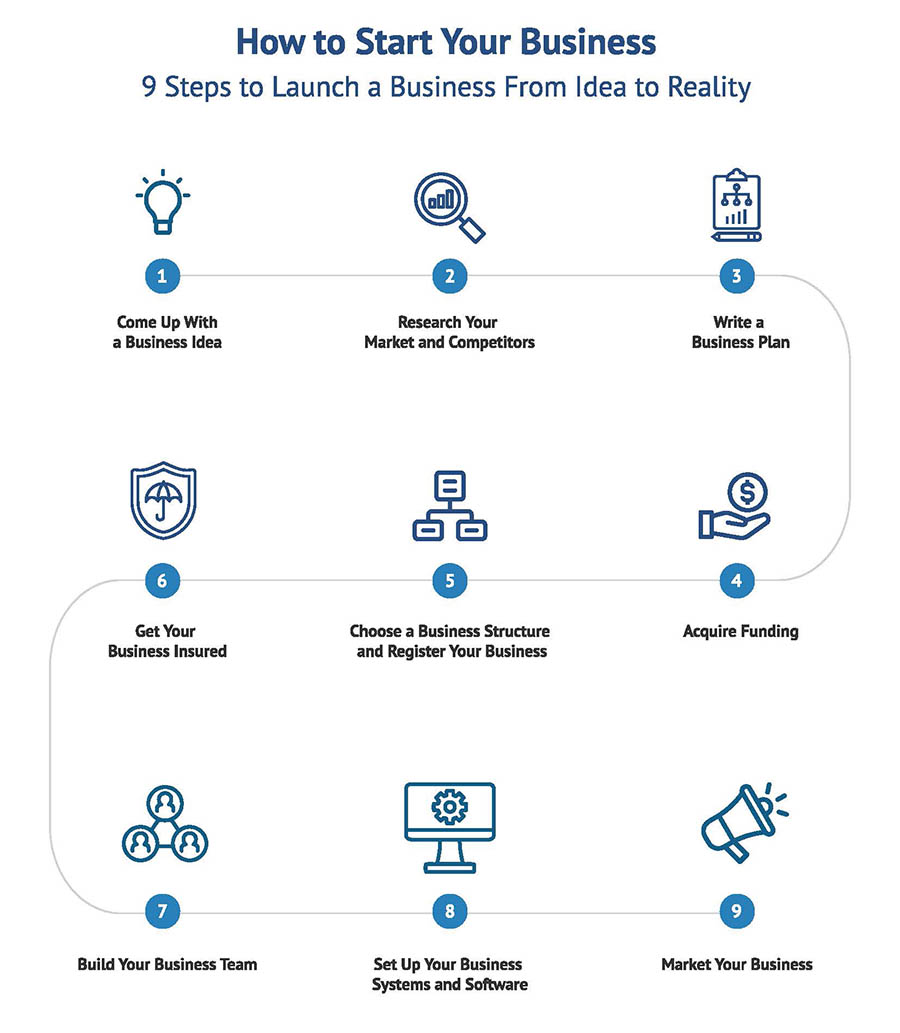

Starting a small business involves coming up with a business idea, testing the idea, writing a business plan, acquiring funding, choosing a business structure, registering the business, getting it insured, making key hires, setting up systems, and finally, marketing and promoting it.

Download Your Free “How To Start A Business” E-book

FILE TO DOWNLOAD OR INTEGRATE

How To Start A Business

Thank you for downloading!

As you’re starting your business, it’s wise to register it as a legal entity, like an LLC. Doing this will protect your personal assets if a lawsuit were to occur against the business. You can register your business as an LLC through an online legal service.

IncFile is an online service that handles and files the paperwork so your business can become an LLC quickly.

Start your business today with IncFile for as little as $0 plus state fees with no contracts and no hidden fees.

Should you start a business? Before coming up with a business, it’s crucial to determine if you’re ready to become a business owner and there are many things to consider. Examine the main points to consider by reading our guide on determining if you should start a business .

“Starting a business is not for everyone. Generally, starting a business, I’d say, No. 1 is to have a high pain threshold. When you first start a company, there’s lots of optimism and things are great. Happiness at first is high, then you encounter all sorts of issues and happiness will steadily decline, and then you will go through a whole world of hurt, and then eventually, if you succeed—and in most cases, you will not succeed—if you succeed then, after a long time, you will finally get back to happiness.” – Elon Musk

Step 1: Come Up With a Business Idea

All businesses start with the same first step— coming up with a business idea . When coming up with an idea for your business, consider your own skills and experiences, as well as business trends and problems or pain points your business could help address.

As you go through your day, you should write down any ideas you have. Look for problems you’re having in your own life. Can you solve that problem yourself and turn the solution into a business?

It’s also important to consider your personality when choosing a business idea:

- Would you like to work at home in silence or talk with customers in a store?

- Would you like to have a lifestyle business, which caps your income, or an eight-figure business with employees?

- Would you like to start from scratch or purchase an existing businesslike a franchise?

- Would you like to work 80-hour weeks and grow a business fast or keep a more balanced life and grow the business slowly?

- Would you like to create products and have other people sell them or sell products that other people have created?

Think about these questions to help you begin with the end in mind. Another personality-based test is to notice your energy levels when doing tasks at work and home. What tasks give you energy, and what depletes your energy? Running a business that gives you energy will be much more likely to succeed.

Business Idea Examples

Browse our list of business ideas for inspiration:

- Best Business Ideas to Make Money

- Best Business to Start

- Best Businesses to Start With Less Than $500

- Mompreneur Business Ideas

- Home-based Business Ideas

- Small Farm Business Ideas

- Low-cost Franchises

- Creative Business Ideas Started During the Pandemic

Additionally, you may want to browse “how to start a business” guides to learn more about a specific business idea:

- Restaurant or catering business

- Cleaning business

- Clothing boutique or a consignment store

- Coffee shop

- Dropshipping business

- FedEx routes

- Ghost kitchen

- Lifestyle blog

- Online store

- Online T-shirt business

- Personal training

- Retail store

Starting From Scratch vs Buying Existing vs a Franchise

One question you may have is if you should start your small business from scratch, buy an existing business, or purchase a franchise? Two things to consider are your business experience and available funds.

If you have no experience running a business or in a particular industry, buying into a franchise can increase your odds of success. When you buy into a franchise , you’re mostly learning how to run the business. If you follow the franchise formula in a well-populated area, you’re likely to succeed.

The same line of thinking applies to an existing business. Purchase an existing business, and you’ll learn how to run the business—plus receive previous customers. This combination makes the likelihood of success higher than you’d have for a brand-new franchise.

The challenge with buying a franchise or an existing business is cost. The high cost is one of the main reasons most new entrepreneurs start their business from scratch. However, keep in mind that there are dozens of franchises that cost under $25,000 .

- Buying a Franchise: How to Buy a Franchise in 8 Steps

- Financing a Franchise: 7 Best Loan Options

- 11 Franchise Marketing Tips to Grow Your Business

- 19 Best Franchises Under 10K

How Much Money Do You Need to Start?

It’s essential to know the answer to this question before starting your business. I’ve met with several people who never got their business off the ground because it required too much money. Remember, if you don’t have the capital available: Dream big, but start small.

To start some businesses, such as residential cleaning or power washing, you may only need $1,000. Use these funds to register the business, purchase supplies, get your first customers, and then, you’ll be in business.

Opening a store with a location is more costly. You’ll need at least $50,000 in funding—possibly several hundred thousand dollars. For a very small retail store, you should plan on earning at least $100,000 a year to cover overhead costs and make a nice profit.

If you need substantial debt to open your first business—over $20,000—you should seriously think about that decision. What’s the worst-case scenario? And how long will it take you to get out of debt? If possible, start part time with the business and acquire the necessary entrepreneurship skills. Or consider waiting. Save up cash, and take on as little debt as possible.

Learn More: How to Choose a Business to Start

Now that you’ve settled on an idea, it is time to really dive into the market.

Step 2: Research Your Market and Competitors

Once you have chosen your business idea, you need to test the idea to determine the likelihood that it will work. The majority of new business owners skip this step—that’s why 20–22% of small businesses fail within the first year according to the Bureau of Labor Statistics .

Don’t skip this step! You may learn valuable information that alters the type of business you start or how you implement it. All the information you collect will go into your business plan (step No. 3).

Validate Your Business Idea

Validating your business idea involves making efforts to ensure the solution you want to sell is something customers will pay for. True validation comes when someone spends their money on your product or service. However, you may not be able to figure out with certainty how well your product will do in the market until it’s created, or your business is open.

This is where research becomes crucial. Consider creating a few focus groups and surveys to gather feedback. Building an audience online is a great way to elicit feedback for your idea. Additionally, starting a crowdfunding campaign is one of the best ways to ensure your business idea is a good one.

- Evaluate your competitors. Consider your top five potential competitors and list their strengths and weaknesses. What strengths do your competitors have that you cannot beat? What weaknesses do they have that you can improve upon? If you have no competitors, that is not always a good sign. Ask yourself why there are no competitors in your area. There may be a reason. For example, the market may be too small to support your idea or people are not willing to pay for your product or service.

- Identify your target demographic. Customer research is key in deciding whether or not the business will work. There must be people willing to pay for your product or service in your area. To narrow down your customers, consider creating customer profiles for each type of customer you will have. Once you are clear on your customers, you want to determine how many of them are in your area. ReferenceUSA is a database you can use to do this research. ReferenceUSA is a powerful tool that allows you to research customers based on demographics. Tens of thousands of local libraries provide free access to ReferenceUSA.

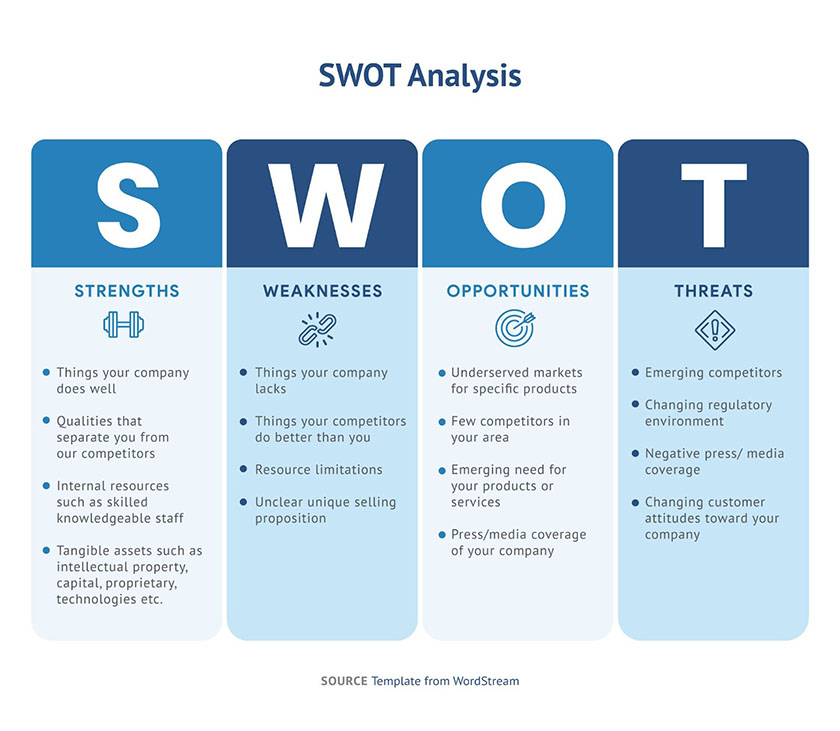

Perform a SWOT Analysis

A SWOT (strengths, weaknesses, opportunities, threats) analysis is an exercise that helps you think critically about your business idea. SWOT analysis may reveal certain aspects of your business you have not considered—both positive and negative.

Go through each section below and list your ideas:

- Strengths: What will the business do well?

- Weaknesses: What may the business not do well?

- Opportunities: What external market opportunities are there—such as less competition and underserved segments?

- Threats: What external factors may make success difficult—such as regulations?

- Identify your competitive advantages. A SWOT analysis helps you identify your own competitive advantages. A question to ask yourself is: “What is my advantage that the competition will struggle to match? ” Is it your quality of product or service, customer service, or knowledge? This question will help you determine if you can be the best at something. Being the best in a certain area of a business makes it more likely that the business will succeed.

Research a Location

If you’re considering an office or storefront, start your research into the location now. You want to start early to make sure you can afford it. Look into potential locations to develop a rough estimate of the build-out cost (renovations) and monthly rent. The information you collect will go into your business plan and financial projections.

Once you have validated your idea, performed in-depth research, identified target demographics and possible locations, and performed competitive analysis, you are ready for the next step. So far, you have put together informal pieces of a business plan. Now, it’s time to write down information in a document as part of a formal business plan.

Step 3: Write a Business Plan

When you’re just starting your business, a business plan, along with a solid business philosophy , can help you plot your future. Additionally, a business plan is an opportunity to show why and how your business will become a success. All businesses need to create a business plan or a strategic roadmap to guide their business decisions.

The business plan contains several elements, including market analysis, competitor analysis, and financial projections. If you’re seeking funding from a bank or investor, you will need a business plan. The plan shows on paper how you will start your own business. After you open, the document keeps you focused and on track with your goals.

A typical business plan may contain over 40 pages of info about your business. You should plan on spending at least 30 hours creating a well-researched business plan. In addition to writing the plan, you will also spend time doing market research and creating financial projections.

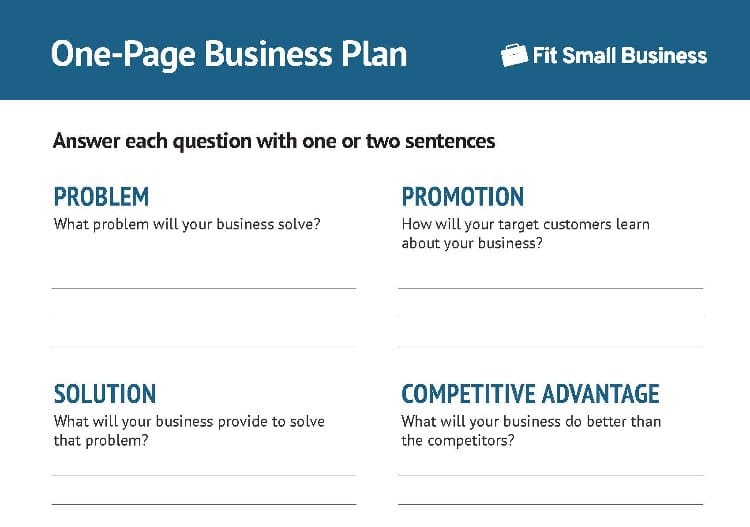

Planning to launch a very small business such as a side business? Creating a one-page business plan might be better. With this plan, you’ll write a couple of sentences for important business concepts. It should include items such as the business model (how will it make money?) and competitive advantage (what will it do better than competitors?).

You should plan on spending around an hour to write out a one-page business plan. The simplified financial projections will be the most challenging and time-consuming. You most likely will need to do research online to get accurate income and expense estimates.

Download our one-page business plan template to start your business planning today.

Most business owners can easily do the research and write the plan. Where most have difficulty are the financial projections, which require creating several financial documents. If you don’t have a financial analysis background or interest, it’s a wise strategy to purchase business plan software that walks you through the financial projection process.

Related: 4 Types Of Business Plans (Plus Software & Writing Services)

Here are nine sections to include in your traditional business plan:

- Opening Organizational and Legal Pages: Cover page, nondisclosure agreement, and a table of contents

- Executive Summary: A summary of the entire business plan in fewer than two pages; Complete this section last

- Company Summary: Basics of the company, such as its history, location, facilities, company ownership, and competitive advantage

- Products and Services: How your business makes money (business model), the products or services it provides, and future products or services

- Market and Industry Analysis: Analysis of potential customers and industry. Include any data here about your current (or ideal) customers, business industry, and competitors

- Marketing Strategy and Implementation Summary: Discussion of marketing, sales, and pricing strategies

- Management and Organization Summary: Business ownership and operation. (If your business isn’t open yet, give a compelling reason why your background will make it a success. Include information on any managers in the business as well.)

- Financial Data and Analysis: Financial projections such as a profit and loss statement, projected cash flow, and business ratios

- Appendix: Any documents or information that doesn’t fit in the above categories goes in the appendix. You may want to include documents such as a floor plan, trademark, or marketing materials.

This might be a big undertaking for some, so there are business plan writing services you can seek help from. Alternatively, Here are some industry-specific business plan templates that can help:

- How To Write an SBA Business Plan [+Free Template]

- 4 Free Retail & Online Store Business Plans

- How to Write a Real Estate Business Plan (+ Free Template)

Learn More: How to Write a Business Plan

Step 4: Acquire Funding

Obtaining financing for your startup business may be the biggest challenge you face in your company’s infancy.

If you don’t have sufficient personal funds to start your business, you’ll need to secure additional funds. There are several funding options available for soon-to-be business owners, including several types of loans, investors, and crowdfunding.

No matter which type of startup financing your business applies for, you can increase the chances of getting a small business loan by preparing a solid business plan, improving your personal credit score , saving up personal capital, building your business’ customer base, and maintaining updated financial projections .

Family & Friends

A popular saying that many in startup financing like to say is, “You should always look to family, friends, and fools for funding before an investor or loan.” The reason is that family and friends (and fools) are the cheapest sources of capital.

The main downside of securing capital from family and friends is the potential for a damaged relationship. To avoid this, draw up an agreement that states how and when you need to pay back the funds.

A loan is a sum of money that needs to be paid back with interest. Business loan amounts can range anywhere from under $1,000 to over $1,000,000.

Just because you may qualify for a loan doesn’t mean you should use it. Start your small business with as little debt as possible. Remember, if your business were to fail, you would still need to pay off the debt you incurred, which could take several years.

Here are several different types of loans to fund your business:

- 10 Best Business Credit Cards for Startups

- 10 Best Sole Proprietorship Business Credit Cards

- 6 Best Instant Approval Business Credit Cards

- 6 Best Credit Cards for New Businesses With No Credit History

- 8 Best LLC Credit Cards

- 13 Best Small Business Credit Cards

- 6 Best Personal Loans for Business Funding

- Business Loans vs Personal Loans: Which Is Best for Your Small Business

See also: 7 Best Rollover for Business Startups (ROBS) Providers

- Home equity loan or line of credit : These loans pull equity out of your home for a loan. They are appealing because of their low-interest rate.

See also: SBA Microloans: What They Are & How to Apply

- SBA Loan Requirements

- How to Get an SBA Loan in 4 Steps

- How to Get an SBA Startup Loan in 6 Steps

- SBA Community Advantage Loan: What It Is & How to Apply

- Understanding the SBA Guarantee Fee

See also: How to Get Unsecured Startup Business Loans in 6 Steps

Find an Angel Investor

An angel investor is typically a wealthy individual who funds early-stage businesses. Investors usually want equity ownership in businesses they invest their money in. Having ownership means they will collect a percent of your profits in exchange for their investment. Read more about the pros and cons of angel investments .

Crowdfunding

Crowdfunding a small business is when you get customers to pre-order products or services. It’s a great way to raise funds before opening your business or creating a product.

Kickstarter and Indiegogo are crowdfunding platforms that assist with raising the money for your business. The cost to use the platforms is 5% of the final price raised plus payment processing fees, which are around 3%.

- Pros and Cons of Business Crowdfunding

- 11 Best Crowdfunding Sites for Small Businesses

Apply for Business Grants

Business grants are funds given to start a business that doesn’t have to be repaid. Federal, state, and local governments are common sources of grants. Many new business owners seek them, but they are hard to find.

A business grant is typically reserved for a particular type of business, such as a research-based business. Grants may also come in forms other than money, such as reduced rent to open a business in a disadvantaged area designated by a city.

- 8 Best Small Business Grants

- 8 Great Minority Small Business Grants

- 13 Best Small Business Grants for Women

Apply for Venture Capital Funding

Venture capital is private equity designed to help startups with long-term growth potential scale. In this arrangement, groups of investors pool money to fund a startup in exchange for equity. Typically, venture capitalist firms also shape the strategies of the companies, provide expertise, and make introductions. Read more about the disadvantages and advantages of venture capital funding .

Learn More: Startup Business Loans: The 7 Best Ways to Fund Your Startup

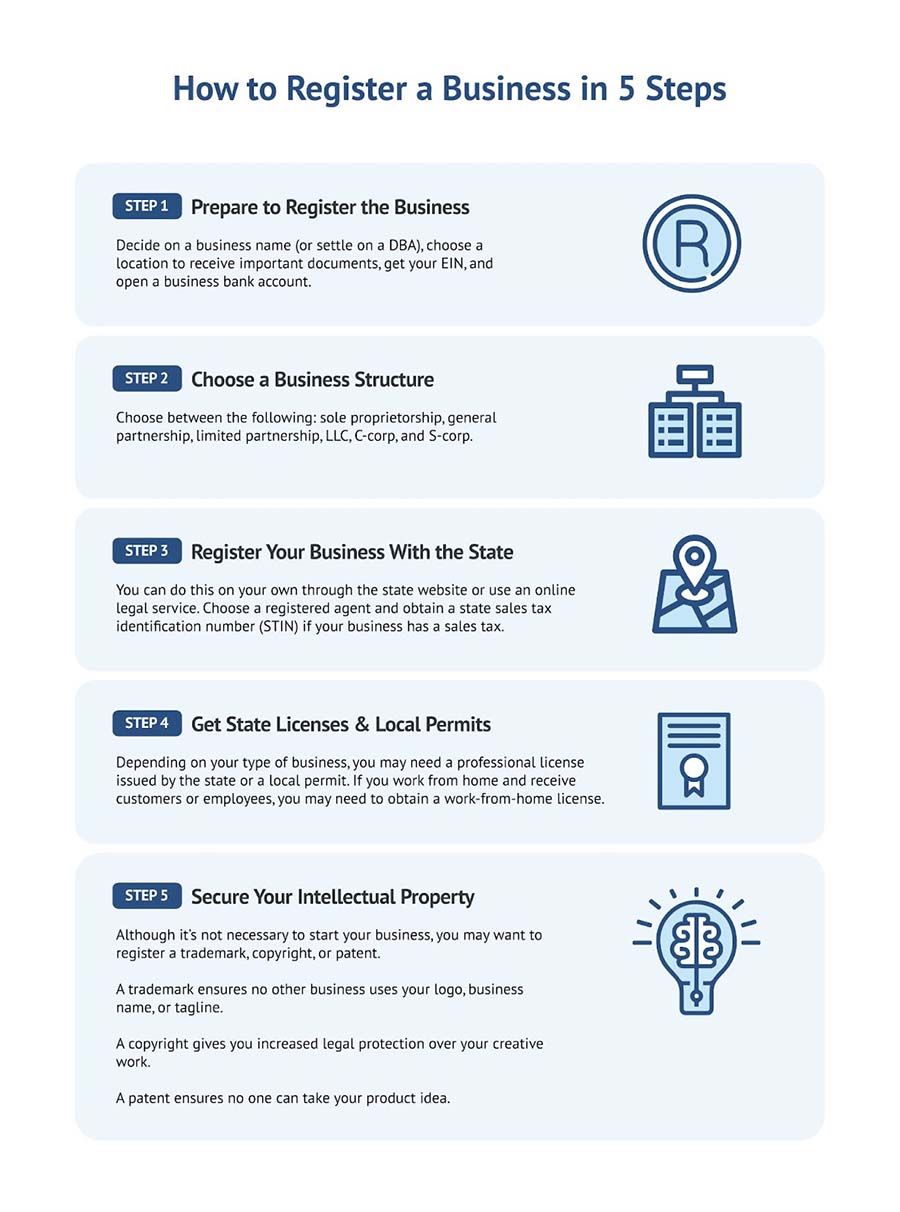

Step 5: Choose a Business Structure & Register Your Business

After acquiring funding, it is time to file the necessary legal paperwork and register your business. You want to take the steps below to comply with city, state, and federal laws. You also want to protect your personal assets if something happens in your business that results in a lawsuit. Additionally, if you have a unique business idea, you want to protect that from competitors.

The cost of registering a business varies between $40 to $500, depending on the state in which you choose to register. You can register through the state’s official business registration website. If you find the website challenging to navigate, use an online legal service such as Rocket Lawyer to assist with the process.

Registering your business is a must-do before taking on your first customer. You don’t want to start your business and not be properly prepared to deal with something like a trademark infringement or a home-based business inspection from a city official. To ensure the business registration process doesn’t become overwhelming, use our checklist to keep track of what has been accomplished and what needs to be completed.

Prepare to Register Your Business

This may only include obtaining an employment identification number (EIN), opening a business bank account, and registering the business as a legal entity in the state in which it operates.

Or registering your business can be several tasks including those above in addition to obtaining a professional business license, getting a State Taxpayer Identification Number, and passing a city health inspection. It’s best to prepare for these tasks in advance to ensure they go smoothly.

- Choose a business name. Before taking any legal steps below, you need to decide on your business name. This is important to do first because your business name will be on all of your legal documents. Know that you don’t have to stick with this name forever. If you’d like to change the public-facing name of your business, you can always file a DBA (doing business as) registration with the state in which your business is primarily located. Try our business name generator if you need help coming up with a name for your business.

- Choose a location to receive important documents. Your city or state may require certain documents to be signed and will mail them to you. Additionally, your state will mail documents to your address every year to remind you to re-register your business. It’s important to re-register on time because the late fee is often higher than the initial registration cost.

- Obtain your Employment Identification Number (EIN ). Your EIN is a federal business number provided by the Internal Revenue Service (IRS) to primarily identify your business for tax purposes. It’s free to obtain your EIN and you will use it on several documents. Many banks require an EIN before opening a business bank account.

See also: Can I Open a Business Bank Account Without an EIN?

- Open a business bank account. It’s important to open a business bank account before incurring any business expenses. This ensures you’re not mixing personal and business expenses. Many banks require a balance of at least $1,500 or they deduct a monthly fee.

Choose Your Business Structure

We recommend all businesses register as a legal entity, such as a limited liability company (LLC), S corporation, or C corporation. Registering your business as a legal entity protects your personal assets if a lawsuit were to ever occur against the business.

Research and determine the right type of legal entity for your business. While these legal entities have different pros and cons , they all achieve the vital goal of separating the business owner from personal financial liability if the business were sued or went bankrupt.

Here are the most common business structures:

- Sole proprietor: If you don’t register your business, this is the default business structure. Typically, only very low liability businesses should stay a sole proprietor, such as a beginner graphic designer or tutor.

- Partnership: Similar to a sole proprietor, except a partnership has two or more owners.

- LLC and LLP (legal entity) : This is similar to that of a sole proprietor, except it provides personal asset protection in the event of a lawsuit or business bankruptcy. An LLP (limited liability partnership) is for multiple partners.

- S corporation (tax status) : Elect your LLC or LLP as an S-corp to save money on taxes. Consider this structure if you are paying yourself more than $20,000 per year from the business.

- C corporation (legal entity) : This business structure provides several benefits, including transferable shares and perpetual existence. You’ll likely need to work with an attorney before forming a C-corp to create the needed documents.

Here is a snapshot of the different business structures you can consider and their key advantages and disadvantages.

Register Your Business With the State

Now that you’ve done the research and chosen your business’ legal entity, it’s time to submit the entity registration to the state it’s operating in. You can do this on your own by navigating to your state government’s business registration website. Or you can use an online legal service to assist you in the process. Additionally, if your business has a sales tax, you’ll want to obtain a state sales tax identification number (STIN).

Get State Licenses & Local Permits

Depending on your type of business, you may need a professional license issued by the state or a local permit. Additionally, if you work from home and receive customers or employees, you may need to obtain a work-from-home license.

- State professional licenses are typically for businesses that may pose a public health risk. Each state may require different professions to obtain a professional license.

- Local license and permit requirements vary by state; however, typically, before opening a physical location you’ll need a local building inspection to ensure the facility is safe for the public.

- A home-based business license is needed if you’re accepting employees and customers or creating products from your home. This license is to ensure the business isn’t causing a public health risk. However, Most businesses that operate from a home won’t need a license.

Secure Your Intellectual Property

Although it’s not necessary to start your business, you may want to register a trademark, copyright, or patent. A trademark ensures no other business uses your logo, business name, or tagline. A copyright gives you increased legal protection over your creative work. A patent ensures no one can take your product idea.

- Trademark Costs: DIY Registration vs Online Service vs Lawyer

- How Much Does a Patent Cost? The Beginner’s Guide

Step 6: Get Your Business Insured

Business insurance is a form of protection small business owners can buy to safeguard their personal or business assets. Getting the appropriate coverage for your operations protects your assets by covering customer lawsuits, property damage, and other perils so the costs following a disaster don’t put you out of business.

Most businesses deal with third parties who may claim your business caused their property damage, bodily harm, or financial loss. Different types of business insurance cover these accusations by paying the associated costs.

Certain small business insurance policies are considered fundamental because they protect against risks that most business owners face. General liability is a good example of this because it covers claims that your business is responsible for someone else’s damages. Many business owners also get commercial property insurance because it pays for damages to their property.

Common Types of Small Business Insurance Policies

How to get business insurance.

Small business owners can get business insurance online through brokers or directly from carriers. To get the appropriate coverage for your business, it’s important to first assess your risks and then to find providers who offer coverage that protects against them.

- 6 Best Small Business Insurance Companies

- 6 Ways To Save Money on Business Insurance

Because no business is immune to general liability claims, getting coverage should be a standard business practice. However, cash-strapped small business owners who are looking for inexpensive general liability insurance should remember that price shouldn’t be the only consideration. Smart business owners evaluate coverage limits, additional fees, and the carrier’s reputation as well.

Step 7: Build Your Business Team

After taking care of the necessary legal steps to get your business registered and protected, it is now time to make key hires. Your first employees will be vital to the success of your business. Additionally, many new business owners overlook the importance of hires outside of the business such as a bookkeeper, attorneys, and mentors.

Connect With a Business Attorney

A business attorney may help you form your new business, create custom forms or contracts, and provide legal advice. Even if you won’t need an attorney for these activities, it’s wise to connect with one before a legal matter occurs in your business. You don’t want the stress of interviewing business attorneys after your company has been served.

Meet With a No-cost Business Adviser

The federal and state government funds several organizations that provide no-cost business consulting and mentoring. The SBDC has over 5,000 consultants across the United States that provide no-cost consulting in a variety of business areas. These consultants typically have advanced education or experience owning a business.

SCORE Advisers are volunteers who typically have previously owned a business. They serve as mentors to business owners. A SCORE Adviser can be a great asset to your business, especially if they have experience in your industry.

Hire Your First Employee

Hiring great employees is the key to growing your business. A thoughtful hiring process includes well-written job descriptions, effective recruitment ads, and strong interview processes, all of which should promote your values and culture and adhere to fair labor practices.

Many first-time business owners find employees online these days —through job boards , LinkedIn , Facebook, and Instagram. You will likely hire your first employee through word-of-mouth or from one of your family members or friends .

- How to Hire Employees

- How to Create a New Hire Checklist [+ Free Template]

- 10 Best Startup Hiring Tips for Finding Top Candidates

- Hiring Bias: 13 Unfair Prejudices & How to Avoid Them

- New Employee Onboarding Best Practices: Steps & Checklist

Hire a Bookkeeper or Accountant

If you’re starting a part-time business, you can likely track your income and expenses with software such as QuickBooks Online. However, if you have a full-time business with multiple products and services and have several expenses to track, you may want to hire a professional.

Many new business owners are unsure if they should hire a bookkeeper or accountant, but most people starting a small business only need a bookkeeper . If you need complicated financial statements or business tax advice, it’s wise to hire a certified public accountant (CPA).

Step 8: Set Up Your Business Systems & Software

As you organize your business, you will find yourself creating systems to manage repeatable tasks and ultimately increase profits . You’ll often find software to assist with the tasks.

Below you’ll find two lists—one with processes and systems that almost all new small businesses will need to implement. The second list includes several systems and software that—if they apply to you—are highly recommended.

Must-have Systems & Software

- Payment processing: You’ll need this to accept credit card payments . Sign up with a merchant service provider before setting this up.

- Bookkeeping: This is how you track income and expenses. If you are managing it yourself, you’ll need accounting software . If not managing yourself, consider hiring a virtual bookkeeper .

- Payroll processing: If you have employees, you’ll use this system to pay them. To make the process easier, consider payroll processing software .

- Business tax payments: It’s a best practice to make business tax payments to the IRS quarterly so you don’t have a large tax bill at the end of the year. Aside from tax software , you can often use your accounting and payroll software to submit early tax payments.

- Business phone number: You’ll want to secure a business phone number so that you can separate personal calls from business calls. You can get a virtual phone line for free or for a small fee .

- Branded business email address: You don’t want potential customers to email a “@gmail,” “@yahoo,” or another alternative. It looks unprofessional. Get a business email that ends with “@yourcompanyname” so that it looks more professional . Google Workspace provides this for $6 a month.

Additional Systems & Software to Consider

- Business website: If potential customers are typing your business name into the search engines, you need a business website . You can set one up yourself and pay around $15 a month. Here are small business website examples you can use for inspiration.

- Sell online: Expand your products’ or services’ reach by selling to customers online . You can build an ecommerce website or use a platform such as Amazon , Facebook Shop , Instagram , or Etsy .

- Customer management: If you have dozens of customers (or more), you’ll need customer relationship management (CRM) software . This software helps you keep track of customer information such as previous communications and contact info.

- Appointment scheduling: Don’t schedule appointments by hand (unless you want to). Use free appointment scheduling software to store your appointments in the cloud. Also, allow clients to schedule online without communicating with you.

- Work from home: COVID-19 is forcing and encouraging many people to work from home for the first time. Set up your home office and manage it so that you can keep up productivity and enjoy your working environment.

- Take video calls: Video meetings and calls have skyrocketed since the pandemic arrived. Give your clients the option to meet through video conferencing software .

Overwhelmed? Don’t be. Free business software helps your company save money and become efficient. You can use free business tools to do accounting, accept payments, and pay employees.

If you’re starting a business, going with free business tools is a great way to keep operating expenses at a minimum. Free business tools are a low-risk test as you figure out the best systems and software for you. If you like them, keep them and possibly expand their features with a paid version. If you don’t like them, stop using the software with no added costs to your business.

Step 9: Market Your Business

Your last step to starting your business is to get customers. You’ll use your marketing strategy to get your new business in front of potential customers.

There are a lot of strategies you can implement to get your business noticed. Don’t get overwhelmed! Remember, you don’t have to implement—and pay for—all of these strategies. A few done well will get your business enough customers to make it a success.

Before diving headfirst into any of the marketing strategies, take time to write a marketing plan . Think through and plan out how you want to market your business. In your plan, outline your brand, such as the logo, colors, font, and tagline.

At a minimum, you’ll want to create business cards to hand out to potential customers and vendors or while networking. Other marketing materials to consider are brochures , flyers , cards , and branded apparel. Many new business owners make the mistake of relying too much on online marketing. Don’t overlook the effectiveness of having physical business marketing materials in someone’s home.

Market Online

- Social media marketing : Connect with your customers where they are spending their time online. Don’t try to grow a following on all social media platforms. Choose one and spend the majority of your time growing your account there.

- Email marketing : Stay in touch with past customers by sending them valuable or entertaining emails . Don’t make your emails all about sales and discounts. You’ll lose subscribers.

- Content marketing : Create and distribute articles, videos, case studies, and other forms of online content created to attract leads, create brand awareness, move prospects through the buying journey, or convert them to customers.

- Google My Business (GMB) listing : This listing is free for all businesses looking for local customers. Many marketers are calling GMB the new small business “homepage.” It’s what customers see on Google before your website when they search for your business.

- Online directories : It’s likely your business can be on several online directories such as Yelp and Yellow Pages . Consider any industry-specific directories as well.

Network With Local Businesses

When you first open, explore networking groups available for local businesses. It’s always a good idea to meet and network with other business owners. Word-of-mouth recommendations and referrals may lead to some of your first customers.

Related: 8 Business Networking Statistics to Generate New Opportunities

Pay for Advertising

You may want to pay to get your business in front of ideal customers. This paid marketing can give your brand recognition a jump-start. You can pay for advertising online or through traditional advertising channels.

- Search engine ads : Pay to get your business at the top of Google or Microsoft . Typically, you will pay every time an interested searcher clicks on your ad. The cost of the click will depend on the number of businesses competing for the ad space.

- Social media ads : Get your social media ad in front of both followers and nonfollowers. Ad cost depends on the competitiveness of the audience you’re targeting.

- Online directory leads: Depending on the directory, you can pay for higher rankings or leads. Yelp provides both options.

- Direct mail : Create cards or brochures and send them to homes of potential customers near your business.

- Radio ads : This type of advertising is an excellent option if your business appeals to an audience in a broad industry such as retail or home improvement.

- Billboards : The cost of a billboard varies depending on location. Pay anywhere from $250 per month for a rural area to over $15,000 per month in a larger market.

Media Package

You want local media to know about your new business. Local media prefers information about your business submitted to them in a press release. A press release is a summary and story of your business. You also want to include owner headshots and photos of the business in the press kit . It’s important to include a hook, which is a way to present your business that creates interest so that the business journalist will cover the opening of your startup.

Learn More: 11 Strategies to Market a New Business

How to Start a Small Business Frequently Asked Questions (FAQs)

Click through the questions below to get answers to some of your most frequently asked starting a small business questions.

How can I start a small business with no money?

A business can be started with no money, but it is not recommended. You aren’t required to spend money to register your business. When you don’t register, it is called a sole proprietorship. The problem with not registering is that your personal assets are at risk. For example, if you’re starting a lawn care business and something costly gets destroyed at a customer’s property, that customer can sue you for damages, and your personal assets are at risk.

What is the easiest business to start up?

The easiest business to start is one that relies on your expertise. People pay you for your expertise because you know more than they do. For example, if you are a social media manager for a business, you can take your social media marketing expertise and charge local businesses to manage their accounts.

There is little cost to this type of business because your time and expertise are the product.

How much does it cost to start a small business?

Starting a business does not need to cost a lot of money. If you’re providing a service like resume writing, the only cost is registering the business in your state. As you add additional components to your business like a website, accounting software, and a branded email address, your business costs will increase. For example, adding a low-cost website is another $100 or more per year. A branded email address will cost another $100 or more per year.

If you’re feeling overwhelmed with all the tasks to start your business, don’t stress! Starting a business is a marathon, not a sprint. Be patient. Give yourself time to absorb and understand the above steps.

“The truth is, success is a process—you can ask anybody who’s been successful.” – Oprah Winfrey

Be proud that you’re learning and trying to figure out this messy world of starting a business. Make your next move today: What micro-step are you taking today to make your idea a reality?

About the Author

Find Agatha On LinkedIn

Agatha Aviso

Agatha Aviso is a retail software expert writer at Fit Small Business. She specializes in evaluating ecommerce and retail software features that help small businesses grow. She has evaluated dozens of the top software for retail SMBs. Agatha has more than 10 years of experience writing online content for both small business owners as well as the marketing industry. She also served as a content strategist and digital marketing manager for many entrepreneurs.

By downloading, you’ll automatically subscribe to our weekly newsletter.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

- Search Search Please fill out this field.

The Importance of Market Research

Creating a business plan, legal requirements, exploring funding options, crafting a marketing strategy, managing and growing your business, how do i start a small business for beginners, how do i create a business plan, what are six ways to grow and scale a business, the bottom line.

- Small Business

- How to Start a Business

Starting a Small Business: Your Complete How-to Guide

From market research to managing growth

:max_bytes(150000):strip_icc():format(webp)/picture-53823-1434118722-5bfc2a8c46e0fb005119858e.jpg)

The U.S. is home to 33.2 million small businesses, which drive over 43% of GDP. If you are looking to start a business, there are key factors to consider—from market research and creating a business plan to scaling your business. These factors are critical to your journey and can make a big difference no matter what stage of the process you are in.

Entrepreneurs who take concrete action can differentiate themselves from competitors, innovate, and grow. For successful entrepreneurs, the execution of the business is often what means the most.

Key Takeaways

- Starting a small business involves extensive market research of your target audience, competitors, and gaining a deep understanding of the industry.

- It is important to build a comprehensive business plan that includes the product or service description, your target customers, financial projections, and all other key details.

- Understanding the legal requirements of starting your business involves knowledge of business registration, permits, licensing, and other regulatory requirements.

- There are various types of funding channels for starting a business, including financing it yourself, securing external funding from your network, and applying for government and corporate grants and loans.

Being clear about your business goals involves doing your research. Successful entrepreneurs often do extensive research on their field. This includes understanding their prospective customers, the technical aspects of the industry, and the challenges other businesses are facing.

Understanding how other players operate in an industry is important. Attending conferences, joining associations, and building a network of people involved in the field can help you learn how decisions are made. Often, comprehensive market research takes six months to a year.

Understanding Your Target Audience

Knowing your target market is critical for many reasons. These are the customers who are most likely to purchase your product, recommend it to friends, and become repeat buyers. Apart from driving your bottom line, having a strong understanding of your target audience will allow you to tailor your offering more effectively, reach your customers more efficiently, and manage customer expectations.

Compiling demographic data on age, family, wealth, and other factors can give you a clearer understanding of market demand for your product and your potential market size.

It’s important to ask, “Why would someone buy this and part with their discretionary income?” or “Will someone love this enough to tell someone about it?” At the heart of these questions is understanding whether your business solves a key problem, as well as whether it delivers the “more” that connects to your audiences’ human emotions.

Assessing Market Trends and Opportunities

To find an advantage in a given market, look at key market trends in customer behavior and the business landscape. Explore the state of business conditions and consumer spending, along with the economic environment and how interest rates may affect financing and business growth.

Several resources are available to dive into market trends across industries, such as Statistics of U.S. Businesses and the U.S. Census Business Builder . To analyze the competitive landscape, and in turn, identify key opportunities, Porter's 5 Forces is a classic model to help businesses build their competitive strategy.

A business plan is a road map for achieving your business goals. It outlines the capital that you need, the personnel to make it happen, and the description of your product and prospective customers.

There are a number of models for creating a business plan. The Small Business Administration (SBA) , for instance, provides a format that includes the following nine sections:

- Executive summary: This should be a description of your company and its potential for success. The executive summary can cover your mission statement, employees, location, and growth plan.

- Company description: This is where you detail what your business offers, its competitive advantages, and your strengths as a business.

- Market analysis: Lay out how your company is positioned to perform well in your industry. Describe market trends and themes and your knowledge of successful competitors.

- Organization and management: Who is running your company, and how is your business structured? Include an organizational chart of your management team. Discuss if your business will be incorporated as a business C or S corporation, a limited partnership, a limited liability company, or a sole proprietorship.

- Service or product line: Here is where you describe how your business will solve a problem and why this will benefit customers. Describe how your product lifecycle would unfold.

- Marketing and sales: Detail your marketing strategy and how this will reach your customers and drive return on investment.

- Funding request: If you're looking for financing, lay out the capital you’re requesting under a five-year horizon and where, in detail, it will be allocated, such as salaries, materials, or equipment.

- Financial projections: This section shows the five-year financial outlook for your company and ties these to your request for capital.

Having a coherent business plan is important for businesses looking to raise cash and crystallize their business goals.

Setting Goals and Strategies

Another key aspect of a business plan is setting realistic goals and having a strategy to make these a reality. Having a clear direction will help you stay on track within specified deadlines. In many ways, it allows companies to create a strategic plan that defines measurable actions and is coupled with an honest assessment of the business, taking into account its resources and competitive environment. Strategy is a top-down look at your business to achieve these targets.

Financial Projections and Budgeting

Often, entrepreneurs underestimate the amount of funding needed to start a business. Outlining financial projections shows how money will be generated, where it will come from, and whether it can sustain growth.

This provides the basis for budgeting the costs to run a business and get it off the ground. Budgeting covers the expenses and income generated from the business, which include salaries and marketing expenses and projected revenue from sales.

Another important aspect of starting a business are the legal requirements that enable you to operate under the law. The legal structure of a business will impact your taxes, your liability, and how you operate.

Businesses may consider the following structures in which to operate:

- Corporation

- Limited Liability Company (LLC)

- Partnership

- Sole Proprietorship

Each has different legal consequences, from regulatory burdens to tax advantages to liability being shifted to the business instead of the business owner.

Registering Your Business

Now that you have your business structure outlined, the next step is registering your business . Your location is the second key factor in how you’ll register your business. In many cases, small businesses can register their business name with local and state government authorities.

If your business is being conducted under your legal name, registration is not required. However, such a business structure may not benefit from liability protection, along with certain legal and tax advantages. Often, registering your businesses costs $300 or less.

Before filing, a business structured as a corporation, LLC, or partnership requires a registered agent in its state. These agents handle the legal documents and official papers on your behalf.

Businesses that are looking to trademark their product, brand, or business, can file with the United States Patent and Trademark Office.

Understanding Permits and Licenses

If your business conducts certain activities that are regulated by a federal agency, you’re required to get a permit or license. A list of regulated activities can be found on the SBA website, and includes activities such as agriculture, alcoholic beverages, and transportation.

There are many different ways to fund a business. One of the key mistakes entrepreneurs make is not having enough capital to get their business running . The good news is that there are several channels to help make this happen, given the vital role entrepreneurs play in creating jobs and boosting productivity in the wider economy.

Self-Funding vs. External Funding

Bootstrapping, the term commonly used to describe self-funding your business, is where companies tap into their own cash or network of family and friends for investment. While the advantage of self-funding is having greater control, the downside is that it often involves more personal risk.

External funding involves funding from bank loans, crowdfunding, or venture capital , among other sources. These may provide additional buffers and enable you to capture growth opportunities. The drawback is less freedom and more stringent requirements for paying back these funds.

Grant and Loan Opportunities

Today, there are thousands of grants designed especially for small businesses from the government, corporations, and other organizations. The U.S. Chamber of Commerce provides a weekly update of grants and loans available to small businesses.

For instance, Business Warrior offers loans between $5,000 and $50,000 to small business owners. As another example, Go. Be. Elevate Fund offers $4,000 to grant recipients who are women and/or people of color business owners to help them grow their businesses.

When it comes to marketing, there is a classic quote from Milan Kundera: “Business has only two functions—marketing and innovation." In order to reach customers, a business needs a marketing strategy that attracts and retains customers and expands its customer base.

To gain an edge, small businesses can utilize social media, email marketing, and other digital channels to connect and engage with customers.

Branding Your Business

Building a successful brand goes hand in hand with building a great experience for the customer. This involves meeting the expectations of your customer. What is your brand offering? Is it convenience, luxury, or rapid access to a product? Consider how your brand meets a customer's immediate need or the type of emotional response it elicits. Customer interaction, and in turn loyalty to your brand, is influenced, for example, by how your brand may align with their values, how it shifts their perception, or if it resolves customer frustration.

Digital Marketing and Social Media

We live in a digital-first world, and utilizing social media channels can help your business reach a wider audience and connect and engage in real time. Given that a strong brand is at the heart of successful companies, it often goes without saying that cultivating a digital presence is a necessity in order to reach your customers.

According to HubSpot’s 2023 report, The State of Consumer Trends, 41% of the 600-plus consumers surveyed discovered new products on social media and 17% bought a product there in the past three months.

Managing a business has its challenges. Finding the right personnel to run operations, manage the day-to-day, and reach your business objectives takes time. Sometimes, businesses may look to hire experts in their field who can bring in specialized knowledge to help their business grow, such as data analysts, marketing specialists, or others with niche knowledge relevant to their field.

Hiring and Training Staff

Finding the right employees involves preparing job descriptions, posting on relevant job boards such as LinkedIn, and effectively screening applicants. Careful screening may involve a supplemental test, reviewing a candidate's portfolio, and asking situational and behavioral questions in the interview. These tools will help you evaluate applicants and improve the odds that you'll find the people you are looking for.

Once you have hired a new employee, training is the next essential step. On average, it takes about 62 hours to train new employees. Effectively training employees often leads to higher retention. While on-the-job training is useful, consider having an onboarding plan in place to make the transition clear while outlining expectations for the job.

Scaling Your Business

Growing your business also requires strategy. According to Gino Chirio, executive vice president at the consultancy group Maddock Douglas, there are six ways that companies can grow their business to drive real growth and expansion:

- New processes: Boost margins by cutting costs.

- New experiences: Connect with customers in powerful ways to help increase retention.

- New features: Provide advancements to your existing product or service.

- New customers: Expand into new markets, or find markets where your product addresses a different need.

- New offerings: Offer a new product.

- New models: Utilize new business models, such as subscription-based services, fee-for-service, or advertising-based models.

With these six ways to grow a business, it is important to consider the risk, investment, and time involved. Improving your margins through new processes is often the most straightforward way to grow. Offering new features is also effective since it is tailored to your existing market with products you have already delivered.

By contrast, offering new products may involve higher risk since these have not been tested in the market. However, they may offer higher reward, especially if you have a first-mover advantage and release your product in the market before the competition.

A good place to start building a business is to understand the following core steps that are involved in an entrepreneur's journey : market research, creating a business plan, knowing the legal requirements, researching funding options, developing a marketing strategy, and business management.

A business plan is made up of a number of primary components that help outline your business goals and company operations in a clear, coherent way. It includes an executive summary, company description, market analysis, organization and management description, service or product line description, marketing and sales plan, funding requests (optional), and financial projections.

Business growth can fall into the following six categories, with each having varying degrees of risk and investment: new processes, new experiences, new features, new customers, new offerings, and new models.

Knowing how to start a small business involves the key steps of market research, setting up a business plan, understanding the legal requirements, exploring funding options, crafting a marketing strategy, and managing your business.

For aspiring small business owners, these steps can help you successfully deliver your product or service to the market, and ultimately grow. While it can take a considerable amount of work, the payoffs are manifold: independence of work, personal fulfillment, financial reward, and following your passion.

U.S. Chamber of Commerce. " The State of Small Business Now ."

U.S. Small Business Administration. " Market Research and Competitive Analysis ."

U.S. Small Business Administration." Write Your Business Plan ."

U.S. Small Business Administration. " Choose a Business Structure ."

U.S. Small Business Administration. " Register Your Business ."

U.S. Small Business Administration. " Apply for Licenses and Permits ."

U.S. Small Business Administration. " Fund Your Business ."

U.S. Chamber of Commerce. " 52 Grants, Loans and Programs to Benefit Your Small Business ."

Ogilvy. " Behind Every Brand Is a Great Experience, and Vice Versa—Why Today's Customer Expects Synergy ."

HubSpot. " The State of Consumer Trends in 2023 ."

Training Magazine. " 2022 Training Industry Report ."

Harvard Business Review. " The Six Ways to Grow a Company ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1327127856-ce97892716b346b99dcf1d14af294a97.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- ProMerchant Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

How to Start a Business: A Step-by-Step Guide

Table of Contents

- You should prepare thoroughly before starting a business, but realize that things will almost certainly go awry. To run a successful business, you must adapt to changing situations.

- Learning how to start your own business involves conducting in-depth market research on your field and the demographics of your potential clientele is an important part of crafting a business plan.

- In addition to selling your product or service, you need to build up your brand and get a following of people who are interested in what your business offers.

- This article is for anyone who wants to learn how to start a business.

Starting a business can be hard work, but if you break down the process of launching your new company into individual steps you can make it easier. Rather than spinning your wheels and guessing where to start, you can follow the tried and true methods of entrepreneurs who’ve done it successfully. If you want to learn how to start your own business, follow this 10-step checklist to transform your business from a lightbulb above your head into a real entity.

Starting a business is a lot of work, but we’re here to help! Check out our useful resources for everything you need to successfully build your business from the ground up.

- 11 Things To Do Before Starting A Business

- Tax and Business Forms You’ll Need To Start A Business

- 20 Mistakes To Avoid When Starting A Business

How to start a business

1. refine your idea..

If you’re thinking about starting a business, you likely already have an idea of what you want to sell online , or at least the market you want to enter. Do a quick search for existing companies in your chosen industry. Learn what current brand leaders are doing and figure out how you can do it better. If you think your business can deliver something other companies don’t (or deliver the same thing, only faster and cheaper), you’ve got a solid idea and are ready to create a business plan.

Define your “why?”

“In the words of Simon Sinek, ‘always start with why,’” Glenn Gutek, CEO of Awake Consulting and Coaching, told Business News Daily. “It is good to know why you are launching your business. In this process, it may be wise to differentiate between [whether] the business serves a personal why or a marketplace why. When your why is focused on meeting a need in the marketplace, the scope of your business will always be larger than a business that is designed to serve a personal need.”

window.bdcQtWidget.init();

Consider franchising.

Another option is to open a franchise of an established company. The concept, brand following and business model are already in place; you only need a good location and the means to fund your operation.

Brainstorm your business name.

Regardless of which option you choose, it’s vital to understand the reasoning behind your idea. Stephanie Desaulniers, owner of Business by Dezign and former director of operations and women’s business programs at Covation Center, cautions entrepreneurs against writing a business plan or brainstorming a business name before nailing down the idea’s value.

Editor’s note: Looking for a small business loan? Fill out the questionnaire below to have our vendor partners contact you about your needs.

Clarify your target customers.

Desaulniers said too often, people jump into launching their business without spending time to think about who their customers will be and why those customers would want to buy from them or hire them.

“You need to clarify why you want to work with these customers — do you have a passion for making people’s lives easier?” Desaulniers said. “Or enjoy creating art to bring color to their world? Identifying these answers helps clarify your mission. Third, you want to define how you will provide this value to your customers and how to communicate that value in a way that they are willing to pay.”

During the ideation phase, you need to iron out the major details. If the idea isn’t something you’re passionate about or if there’s no market for your creation, it might be time to brainstorm other ideas.

Tip: To refine your business idea, identify your “why,” your target customers and your business name.

2. Write a business plan.

Once you have your idea in place, you need to ask yourself a few important questions: What is the purpose of your business? Who are you selling to? What are your end goals? How will you finance your startup costs? These questions can be answered in a well-written business plan .

Fledgling business owners can make a lot of mistakes by rushing into things without pondering these aspects of the business. You need to find your target customer base. Who is going to buy your product or service? What would be the point if you can’t find evidence of a demand for your idea?

This business plan template can help you launch and grow your business the right way.

Conduct market research.

Conducting thorough market research on your field and the demographics of your potential clientele is an important part of crafting a business plan. This involves conducting surveys, holding focus groups, and researching SEO and public data.

Market research helps you understand your target customer — their needs, preferences and behavior — as well as your industry and competitors. Many small business professionals recommend gathering demographic information and conducting a competitive analysis to better understand opportunities and limitations within your market.

The best small businesses have differentiated products or services from the competition. This significantly impacts your competitive landscape and allows you to convey unique value to potential customers.

Consider an exit strategy.

It’s also a good idea to consider an exit strategy as you compile your business plan. Generating some idea of how you’ll eventually exit the business forces you to look to the future.

“Too often, new entrepreneurs are so excited about their business and so sure everyone everywhere will be a customer that they give very little, if any, time to show the plan on leaving the business,” said Josh Tolley, CEO of both Shyft Capital and Kavana.

“When you board an airplane, what is the first thing they show you? How to get off of it. When you go to a movie, what do they point out before the feature begins to play? Where the exits are. During your first week of kindergarten, they line up all the kids and teach them fire drills to exit the building. Too many times I have witnessed business leaders that don’t have three or four predetermined exit routes. This has led to lower company value and even destroyed family relationships.”

A business plan helps you figure out where your company is going, how it will overcome any potential difficulties, and what you need to sustain it. When you’re ready to put pen to paper, use a free template to help.

3. Assess your finances.

Starting any business has a price, so you need to determine how you will cover those costs. Do you have the means to fund your startup, or will you need to borrow money? If you’re planning to leave your current job to focus on your business, do you have savings to support yourself until you make a profit? Find out how much your startup costs will be.

Many startups fail because they run out of money before turning a profit. It’s never a bad idea to overestimate the amount of startup capital you need, as it can take time before the business begins to bring in sustainable revenue.

Perform a break-even analysis.

One way you can determine how much money you need is to perform a break-even analysis. This essential element of financial planning helps business owners determine when their company, product or service will be profitable.

The formula is simple:

- Fixed Costs ÷ (Average Price Per Unit – Variable Costs) = Break-Even Point

Every entrepreneur should use this formula as a tool because it tells you the minimum performance your business must achieve to avoid losing money. Furthermore, it helps you understand exactly where your profits come from, so you can set production goals accordingly.

Here are the three most common reasons to conduct a break-even analysis:

Ask yourself: How much revenue do I need to generate to cover all my expenses? Which products or services turn a profit, and which ones are sold at a loss?

Ask yourself: What are the fixed rates, what are the variable costs, and what is the total cost? What is the cost of any physical goods? What is the cost of labor?

Ask yourself: How can I reduce my overall fixed costs? How can I reduce the variable costs per unit? How can I improve sales?

Watch your expenses.

Don’t overspend when starting a business. Understand the types of purchases that make sense for your business and avoid overspending on fancy new equipment that won’t help you reach your business goals. Monitor your business expenses to ensure you are staying on track.

“A lot of startups tend to spend money on unnecessary things,” said Jean Paldan, founder and CEO of Rare Form New Media. “We worked with a startup with two employees but spent a huge amount on office space that would fit 20 people. They also leased a professional high-end printer that was more suited for a team of 100; it had key cards to track who was printing what and when. Spend as little as possible when you start, and only on the things essential for the business to grow and succeed. Luxuries can come when you’re established.”

Using accounting software can streamline your expense tracking. Read our reviews of the best accounting software to learn more and find the right platform for your needs. Try starting with our Intuit QuickBooks Online review — this vendor is our top pick for small businesses.

Consider your funding options.

Startup capital for your business can come from various means. The best way to acquire funding for your business depends on several factors, including creditworthiness, the amount needed and available options.

- Business loans. If you need financial assistance, a commercial loan through a bank is a good starting point, although these are often difficult to secure. If you cannot take out a bank loan, apply for a small business loan through the S. Small Business Administration (SBA) or an alternative lender. [Read related article: Best Business Loans ]

- Business grants. Business grants are similar to loans, but do not need to be paid back. Business grants are typically very competitive and come with stipulations that the business must meet to be considered. When securing a small business grant , look for ones specific to your situation. Options include minority-owned business grants, grants for women-owned businesses and government grants .

- Startups that require significant funding up front may want to bring on an angel investor . Investors can provide several million dollars or more to a fledgling company in exchange for a hands-on role in running your business.

- Alternatively, you can launch an equity crowdfunding campaign to raise smaller amounts of money from multiple backers. Crowdfunding has helped numerous companies in recent years, and dozens of reliable crowdfunding platforms are designed for different types of businesses.

You can learn more about each of these capital sources and more in our guide to startup finance options .

Choose the right business bank.

When you’re choosing a business bank , size matters. Marcus Anwar, co-founder of OhMy Canada, recommends smaller community banks because they are in tune with the local market conditions and will work with you based on your overall business profile and character.

“They’re unlike big banks that look at your credit score and will be more selective to loan money to small businesses,” Anwar said. “Not only that, but small banks want to build a personal relationship with you and ultimately help you if you run into problems and miss a payment. Another good thing about smaller banks is that decisions are made at the branch level, which can be much quicker than big banks, where decisions are made at a higher level.”

Anwar believes that you should ask yourself these questions when choosing a bank for your business:

- What is important to me?

- Do I want to build a close relationship with a bank that’s willing to help me in any way possible?

- Do I want to be just another bank account, like big banks will view me as?

Ultimately, the right bank for your business comes down to your needs. Writing down your banking needs can help narrow your focus to what you should be looking for. Schedule meetings with various banks and ask questions about how they work with small businesses to find the best bank for your business. [Read related article: Business Bank Account Checklist: Documents You’ll Need ]

Financially, you should perform a break-even analysis, consider your expenses and funding options, and choose the right bank for your business.

4. Determine your legal business structure.

Before registering your company, you need to decide what kind of entity it is. Your business structure legally affects everything from how you file your taxes to your personal liability if something goes wrong.

- Sole proprietorship: You can register for a sole proprietorship if you own the business independently and plan to be responsible for all debts and obligations. Be warned that this route can directly affect your personal credit.

- Partnership: Alternatively, as its name implies, a business partnership means that two or more people are held personally liable as business owners. You don’t have to go it alone if you can find a business partner with complementary skills to your own. It’s usually a good idea to add someone into the mix to help your business flourish.

- Corporation: If you want to separate your personal liability from your company’s liability, consider the pros and cons of corporations (e.g., an S corporation or C corporation ). Although each type of corporation is subject to different guidelines, this legal structure generally makes a business a separate entity from its owners. Therefore, corporations can own property, assume liability, pay taxes, enter contracts, sue and be sued like any other individual. “Corporations, especially C corporations, are especially suitable for new businesses that plan on ‘going public’ or seeking funding from venture capitalists in the near future,” said Deryck Jordan, managing attorney at Jordan Counsel.