Market Insights

- Receive briefings and highlights on market movements most relevant to you, including focuses on ESG, digital assets, emerging markets, and more

- Access curated content and analytics on the web, mobile via GS Now, or on Marquee Desktop

- Filter commentary based on the asset classes relevant to your trading interests

- Subscribe to The Narrative, our weekly briefing, for the latest insights on the Goldman Sachs floor

- Read live market updates and insights on Marquee web, Marquee Desktop, or mobile via GS Now

- Enjoy unparalleled access to Goldman Sachs FICC and Equities’ authors via their respective author pages

- Follow an author, browse their other posts, or email them directly

- Attend Goldman Sachs' exclusive webcasts, calls, and events on the web or on the GS Now app

- No services available for your region.

- GS Dynamic Municipal Income Fund

- GS Core Fixed Income Fund

- GS GQG Partners International Opportunities Fund

- See All Mutual Funds

- GS S&P 500 Core Premium Income ETF (GPIX)

- GS Access Ultra Short Bond ETF (GSST)

- GS Small Cap Core Equity ETF (GSC)

- See All ETFs

- Liquidity Solutions

- Separately Managed Accounts

- Variable Insurance Trust

- Interval Fund

- Investment Centers

- Alternatives

- Buy-Write Strategy

- Emerging Markets

- Exchange-Traded Funds

- Fixed Income

- Model Portfolios

- Municipal Bonds

- Retirement (DCIO)

- Workplace Retirement Solution

In The Spotlight

Alternatives - Private Credit

- Macro & Market Views

- Investment Strategy

- ESG/Sustainable Investing

- ETF Investing

- Quantitative Investing

- By Asset Class

- Perspectives

- GSAM Connect

- All Insights

- Goldman Sachs Global Investment Research

- Product Collateral

- Product Brochures

- Investment Solutions

- Fund Commentaries

- Advisor Resources

- Strategic Advisory Solutions

- Asset Allocation PRISM

- Practice Management

- Client Service Account Access

- Documents and Forms

- Tax Information

- Forms & Applications

- Regulatory Documents

- All Documents

- Municipal Solutions Tool

- Diversified Investment Allocation Tool

- Floating Nav Vs. Stable Nav

Our In-Depth Commentary Could Help You Gain a Competitive Edge

Stay on top of the latest market developments, key themes, and investment ideas affecting your portfolio and practices.

- News and Media

- Company Sites

- Goldman Sachs

- Private Wealth Management

- Personal Financial Management

- Internal View

Explore how we can help you

Market Insights

Please log in to gain access to this feature.

Please enter a name to save your selection

Saved %% to your saved filters

Please note that you cannot undo this action.

Filter articles by topic.

Select one or more topic(s)

- Money Markets

Filter articles by date range.

Select date range(s)

- Past Quarter

Filter articles by publication type.

Select one or more perspective(s)

- All Macro Economic Views

- All Investment Strategy

- Market Monitor

- Market Pulse

- Macro Insights

- Market Know-How

Fixed Income Macro Views

- Money Market Views

- Corporate Credit Views

- Securitized Market Views

- Global Fixed Income Outlook

- Global Equity Outlook

Selections Made:

Evolution of Growth Investing in Europe

February 09, 2022

How is the growth equity landscape evolving in Europe? The heads of our Growth Equity team shared their views at a recent Alternative Investment Forum.

November 22, 2021

The US Department of Labor recently announced a proposed rule that would make it easier for retirement plan fiduciaries to consider climate change and other ESG factors when selecting investments. These proposed “rules of the road” are designed to guide Employee Retirement Income Security Act (ERISA) fiduciaries who are considering ESG incorporation within their investment process.

Read Full Report

Hear from our experts, what's latest in municipal bond market.

Goldman Sachs Research

Follow trends in the global economy, including policy issues and analysis of economic development from Goldman Sachs Global Investment Research.

CONTACT US See More

Products & investment centers.

- Mutual Funds

Tools & Resources

Note: Separate multiple email addresses with a comma or semicolon.

Your Email Address

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

Top Research Reports for Apple, Goldman Sachs, & Applied Materials

May 25, 2021 — 03:27 pm EDT

Written by Sheraz Mian for Zacks ->

Tuesday, May 25, 2021

The Zacks Research Daily presents the best research output of our analyst team. Today's Research Daily features new research reports on 16 major stocks, including Apple Inc. (AAPL), Goldman Sachs (GS), and Applied Materials (AMAT). These research reports have been hand-picked from the roughly 70 reports published by our analyst team today.

You can see all of today’s research reports here >>>

Apple shares have lagged the market this year, with the stock down -4.4% this year vs. the +12.4% gain for the S&P 500 index. Driving this underperformance is the sentiment shift away from the large-cap Tech stocks and rotation into cyclical and 'value'-oriented stocks. That said, Apple’s second-quarter fiscal 2021 results did reflect continued momentum in the Services segment, driven by a robust performance of App Store, Cloud Services, Music, advertising and AppleCare.

Moreover, iPad, Mac and Wearables contributed strongly to the quarterly results. Further, iPhone sales increased due to strong demand for iPhone 12 devices. China and Japan iPhone sales increased significantly.

The Zacks analyst believes that Apple’s near-term prospects are bright, driven by new iPhones that support 5G, revamped iPad and Mac line-up of devices, health-focused Apple Watch and robust growth in the Services business. However, increasing scrutiny and legal woes over App Store is a headwind.

(You can read the full research report on Apple here >>> )

Shares of Goldman Sachs have gained +55.7% in the last six months against the Zacks Financial - Investment Bank industry’s gain of +45.4%. In fact, the company has an impressive earnings surprise history, having outpaced the Zacks Consensus Estimate in each the trailing four quarters.

The Zacks analyst believes that the company’s first-quarter 2021 results benefited from robust capital markets performance and reserve release. Goldman’s solid position in announced and completed M&As across the world will keep strengthening the business. Also, business diversification, including digital platforms, helps sustain growth. Efforts to expand consumer lending business are encouraging. Steady capital deployment activities remain a tailwind.

With a strong liquidity position, it remains less exposed to credit risk in case of any economic downturn. However, legal issues, high dependence on overseas revenues and volatile client-activity might impede top-line growth.

(You can read the full research report on Goldman Sachs here >>> )

Shares of Applied Materials have outperformed the Zacks Semiconductor Equipment - Wafer Fabrication industry in the last one-year period (+144.0% vs. +119.0%). The Zacks analyst believes that Applied Materials is driven by strong momentum across Semiconductor Systems and Applied Global Services. Further, solid demand for silicon in several applications across various markets remains a tailwind. Additionally, growing momentum among long-term service agreements is contributing well.

Furthermore, increased customer spending in foundry and logic on the back of rising need for specialty nodes in automotive, power, 5G rollout, IoT, communications and image sensor markets, is a major positive. Also, strong momentum in conductor etches is benefiting the company’s position in DRAM and NAND. However, market uncertainties continue to persist. Further, mounting expenses are concerns. Also, rising competition poses risk to the company’s market position.

(You can read the full research report on Applied Materials here >>> )

Other noteworthy reports we are featuring today include Snap Inc. (SNAP), Exelon Corporation (EXC) and The Travelers Companies, Inc. (TRV).

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Sheraz Mian

Director of Research

Note: Sheraz Mian heads the Zacks Equity Research department and is a well-regarded expert of aggregate earnings. He is frequently quoted in the print and electronic media and publishes the weekly Earnings Trends and Earnings Preview reports. If you want an email notification each time Sheraz publishes a new article, please click here>>>

Today's Must Read

Robust Portfolio, Services Strength to Benefit Apple (AAPL)

Digital Lending Platform Aids Goldman (GS), High Costs Ail

Applied Materials (AMAT) Rides on Foundry & Logic Spending

Featured Reports

Regulated Investments & Cost Mangement Aid Exelon (EXC)

Per the Zacks analyst Exelon's cost management initiatives will have positive impact on margins and its planned $27B investments through 2024 will strengthen its operation.

Onto Innovation (ONTO) Rides on 5G Momentum Amid Competition

Per the Zacks analyst, Onto Innovation is well positioned to benefit from market strength in memory and radio frequency communications for 5G handsets along with the acceptance of new products.

Auto, Homeowners Business Aid Travelers (TRV), Cat Loss Ails

Per the Zacks analyst, consistent progress and strong market of the auto and homeowners business have driven revenues.

Strength in Glaukos' (GKOS) iStent Product Line Aids Q1 Sales

The Zacks analyst is upbeat about Glaukos' commercial rollout of the iStent inject W. New agreement with Santen Pharmaceutical for PRESERFLO MicroShunt buoys optimism.

Gibraltar (ROCK) Rides on Segmental Performance, Cost Hurt

Per the Zacks analyst' robust performance of Residential, Renewable and Infrastructure segments are likely to boost Gibraltar's margins.

Solid User Growth & Premium Content Demand Aids Snap (SNAP)

Per the Zacks analyst, Snap benefits from an improving user growth driven by strong adoption of Augmented Reality (AR) Lenses and demand for premium Discover content and Shows.

Backlog Boosts Huntington Ingalls (HII), Import Tariff Woes

Per the Zacks analyst, solid backlog count for Huntington Ingalls boosts its revenue growth prospects. Yet expansion of tariffs steel and aluminum import might push up its expenses.

New Upgrades

Electrification & Cost Cuts to Drive American Axle (AXL)

Collaborations with Inovance and REE Automotive are likely to boost American Axle's electrification revenues. Cost cut efforts is also aiding the firm's near-term profits, per the Zacks analyst.

Capri Holdings' (CPRI) Digital Endeavors to Aid Top Line

Per the Zacks analyst, deployment of resources to upgrade distribution infrastructure and e-commerce platform, and expand product offerings bode well for Capri Holdings' sales.

Rising Loans Aid First Republic (FRC), Capital Level Solid

Per Zacks analyst, rising loan and deposit balances along with improving net interest income are likely to aid First Republic's financials. Also, strong capital position remains a favorable factor.

New Downgrades

Biohaven's (BHVN) Reliance on Nurtec Burden Amid Competition

Per the Zacks analyst, Biohaven is solely dependent on successful commercialization of Nurtec for its near-term growth. However, it faces stiff competition from several large pharma companies.

Golar LNG (GLNG) Plagued By Low LNG Demand & Weak Liquidity

The Zacks analyst is concerned about Golar LNG's soft LNG demand, which continues to be hurt by coronavirus-led woes. The company's weak liquidity position is also worrisome.

Phillips 66 (PSXP) to be Hurt by Lower Throughput Volume

Phillips 66 Partners' declining profits due to lower pipeline throughput volumes of crude oil concerns the Zacks analyst. Moreover, its levered balance sheet is troublesome.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

More Related Articles

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

Mark Cuban Getting Fired And Sleeping On The Floor Helped Make Him A Billionaire: "If You've Got Nothing, That's The Perfect Time To Start A Business"

Starting your own business is risky, so most shy away from the experience. Roughly 20% of businesses fail in the first year alone. By year 10, that number goes up to 70%. Dedicating a year — or decade — of your life to something that might leave you worse off than a low-paying job and no income security is a daunting reality. But it's one that millions of Americans pursue every year in hopes of achieving the American dream. Starting your own business allows for unlimited earnings potential and f

Unveiling Tilray Brands (TLRY) Q3 Outlook: Wall Street Estimates for Key Metrics

Besides Wall Street's top -and-bottom-line estimates for Tilray Brands (TLRY), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended February 2024.

Earnings Growth & Price Strength Make Micron (MU) a Stock to Watch

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

Why AMD Stock Is Down Over 20% From Its Peak

Advanced Micro Devices believes its AI chip, the MI300x, will be its biggest growth opportunity.

- Goldman Sachs-stock

- News for Goldman Sachs

Goldman Sachs Group (GS) Gets a Buy from Evercore ISI

Evercore ISI analyst Glenn Schorr maintained a Buy rating on Goldman Sachs Group ( GS – Research Report ) yesterday and set a price target of $435.00. The company’s shares closed yesterday at $406.25.

Schorr covers the Financial sector, focusing on stocks such as Bank of New York Mellon Corporation, BlackRock, and Citigroup. According to TipRanks , Schorr has an average return of 7.5% and a 61.73% success rate on recommended stocks.

In addition to Evercore ISI, Goldman Sachs Group also received a Buy from Seaport Global’s James Mitchell in a report issued yesterday. However, on March 26, RBC Capital maintained a Hold rating on Goldman Sachs Group (NYSE: GS).

The company has a one-year high of $419.20 and a one-year low of $284.98. Currently, Goldman Sachs Group has an average volume of 2.33M.

Based on the recent corporate insider activity of 22 insiders, corporate insider sentiment is negative on the stock. This means that over the past quarter there has been an increase of insiders selling their shares of GS in relation to earlier this year.

TipRanks has tracked 36,000 company insiders and found that a few of them are better than others when it comes to timing their transactions. See which 3 stocks are most likely to make moves following their insider activities.

Goldman Sachs Group (GS) Company Description:

Founded in 1869, Goldman Sachs Group, Inc. is a leading global investment banking, securities, and investment management firm. The company provides a range of financial services to clients including corporations, financial institutions, governments and individuals. The company operates through four segments: Investment Banking, Global Markets, Asset Management, and Consumer & Wealth Management.

Read More on GS:

- Q2 2024 Bullish for Bitcoin, Says Coinbase

- Goldman Sachs price target raised to $460 from $432 at HSBC

- Top Wall Street Names Explore Fresh Opportunities Amid Muted M&A Flow

- Reddit (NYSE:RDDT) Prices IPO at $34 Per Share

- Analysts and Technical Indicators Agree: These 3 Stocks Are “Strong Buys” – 03/21/2024

Goldman Sachs News MORE

Related stocks.

Legal and finance jobs are among the most at risk from AI, while construction and trade jobs face minimal influence, studies suggest

- Generative AI could lead to the widespread automation of jobs, new research found.

- But blue-collar roles in manufacturing and construction face minimal influence, data indicates.

- Here's why some industries will likely be more affected than others by the technology.

Rapid advances in artificial intelligence are stoking employee concerns about the automation of jobs.

Generative AI , a type of AI capable of generating text and other content in response to user prompts, has exploded in popularity in recent months following the launch of OpenAI's ChatGPT. Some companies have already tapped the chatbot to take on content-producing roles.

A recent report from Goldman Sachs found the tech could significantly disrupt the labor market, with it affecting about 300 million full-time jobs or 18% of work. Another recent study , from OpenAI with the University of Pennsylvania, found OpenAI's AI chatbot ChatGPT could affect around 80% of jobs in the US. White-collar roles could be among the worst hit, the study also found.

While the studies predicted advances in AI tech could also improve labor productivity and create jobs, they said some industries would likely be more affected than others.

Legal services

The legal industry has been cited in multiple studies as one of the industries most exposed to automation.

A study released in March by researchers at Princeton University, the University of Pennsylvania, and New York University, estimated that legal was the industry most likely influenced by AI tech like ChatGPT. The researchers used a benchmark that matched specific work tasks with AI capabilities to calculate the results.

Manav Raj, one of the authors of the study and an assistant professor of management at the Wharton School of the University of Pennsylvania, told Insider this was because the industry was made up of a relatively small number of occupations already exposed to automation, such as legal assistants.

The report from Goldman Sachs, which relies on an analysis of data on occupational tasks in the US and Europe, also highlighted legal workers as especially at risk from the new tech.

University education and research

Education was one of the first areas to witness some of the effects of ChatGPT, and institutions, especially those in higher education, are scrambling to deal with the consequences of the technology.

The study led by Princeton University, which was authored by Raj, Ed Felten, and Robert Seamans, identified postsecondary teachers as some of the workers highly exposed to large language models.

Professors across a variety of subjects made up eight of the top 10 affected occupations, while junior colleges were ranked the 17th most likely sector to be influenced. Raj said this was because AI chatbots tended to be very good at research tasks such as identifying patterns and writing reports.

Related stories

The research from Goldman Sachs, which was written by Joseph Briggs and Devesh Kodnani, estimated almost 30% of work tasks in education instruction and library services in the US and Europe could be automated.

Administration

Administrative roles have particularly high exposure to automation, Goldman researchers found. They estimated that about 46% of work tasks in the sector could be automated.

Wharton's Raj said that sectors like administration, where there's a "relatively high prevalence of white-collar roles, tended to be more exposed" to advanced AI technology. But the effect of AI on the labor market will be "multifaceted," Raj said, in some cases complementing human work.

Finance

Banks are already incorporating AI tech into their day-to-day business operations.

More than half of banks say they've used the tech for revenue generation, according to the Cambridge Centre for Alternative Finance and the World Economic Forum. Financial quantitative analysts were also identified in a study led by OpenAI and the University of Pennsylvania as one of the occupations highly exposed to advanced AI technology.

AI chatbots like ChatGPT have excelled at writing code. The new programs can analyze numbers and produce code, often at a faster rate than humans can.

The study led by Princeton University ranked software publishers as the 11th most likely sector to be affected by tech like ChatGPT, something Raj put down to the chatbot's impressive coding abilities. The Goldman researchers estimated that about 29% of computing and mathematical tasks in the US and Europe could be automated.

Construction

Sectors with a high number of blue-collar roles, such as construction, scored relatively low on Goldman Sachs' report. In the US and Europe, the researchers estimated less than 10% of work tasks in the sector were exposed to automation.

Construction and related workers were also ranked some of the least influenced occupations on the list compiled by researchers at Princeton University, the University of Pennsylvania, and New York University.

Trade workers

Trade workers are also projected to be relatively untouched by the tech.

Trade work requires practical, hands-on experience and specialized training, and many of the tasks involve manual labor.

Craft and related trade workers had the lowest share of industry employment exposed to automation in Europe, Goldman Sachs found. The researchers estimated that only 4% of the industry was exposed to automation by AI in the region.

Axel Springer, Business Insider's parent company, has a global deal to allow OpenAI to train its models on its media brands' reporting.

Watch: What is ChatGPT, and should we be afraid of AI chatbots?

- Main content

Rating Report

Goldman Sachs México, Casa de Bolsa, S.A. de C.V.

Mexico Tue 02 Apr, 2024 - 9:48 AM ET

Las calificaciones de Goldman Sachs México, Casa de Bolsa, S. A. de C. V. (GSMX) están impulsadas por la opinión de Fitch Ratings sobre la propabilidad de que la casa de bolsa reciba soporte extraordinario, si es necesario, de su accionista en última instancia, The Goldman Sachs Group, Inc. (GS, el accionista).

- MY CONTENT HOME

- YOUR PROFILE HOMEPAGE

- MACRO MARKETS

- PORTFOLIO STRATEGY

- COMMODITIES

- CREDIT STRATEGY

- EMERGING MARKETS

- MACRO FORECASTS

- PROPRIETARY INDICATORS

- STOCK SCREENER

- CONVICTION LISTS

- THEMES HOMEPAGE

- TOP OF MIND

- RECESSION RISK

- CHINA REOPENING

- INFLATION REDUCTION ACT

- ARTIFICIAL INTELLIGENCE

- MORE THEMES VIA THE THEMES TRACKER

- PUBLICATIONS

- US Economics Analyst

Data Quality Is Still a Problem: Seasonal Distortions and Falling Response Rates (Walker)

Data quality is still a problem: seasonal distortions and falling response rates, the us economic and financial outlook.

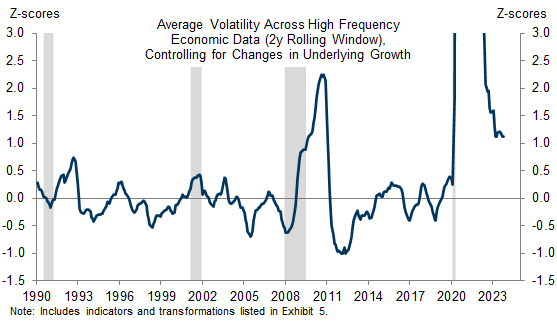

The market’s sensitivity to individual data releases has increased sharply over the last couple of years, as those releases will ultimately decide Fed policy. However, two data quality issues have made assessing the implications of data releases for the outlook in real time more difficult.

First, distortions to seasonal adjustment factors caused by level shifts and much larger than usual swings in data early in the pandemic can bias our perception of the state of the economy. These distortions are most apparent in continuing jobless claims—which have predictably risen over the last couple of months because of seasonal adjustment issues—and Census retail sales—which will likely underperform “true” consumption activity during the holiday season—but likely affect a broader set of economic indicators.

We assess whether revisions to pre-pandemic seasonal factors for 22 indicators have introduced new seasonal distortions. Our analysis suggests that, on average, residual seasonality boosts seasonally-adjusted economic indicators by 0.2 standard deviations between March and May—the period when economic activity declined most sharply in 2020—and weighs them down during the rest of the year. On average, the effects are modestly smaller than when we conducted the same analysis last year and should continue to fade in future years.

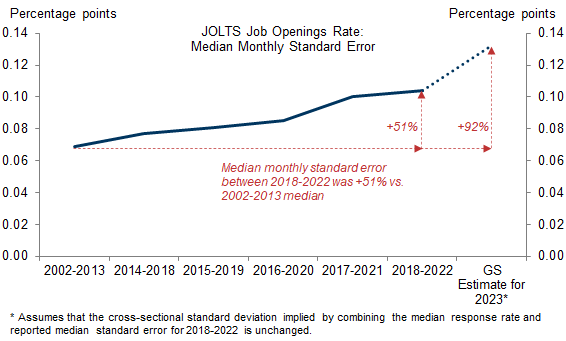

Second, falling response rates to government statistical surveys can increase the uncertainty around the reported state of the economy. For example, the response rate to the Job Openings and Labor Turnover Survey (JOLTS) has plummeted almost 30pp since the start of the pandemic to just over 30%. The resulting smaller sample size has likely boosted its median monthly standard error—a measure of the expected discrepancy between a sample estimate and the true value of a population—by more than 90% relative to 2002-2013 (equivalent to a 90% confidence interval of roughly 700k).

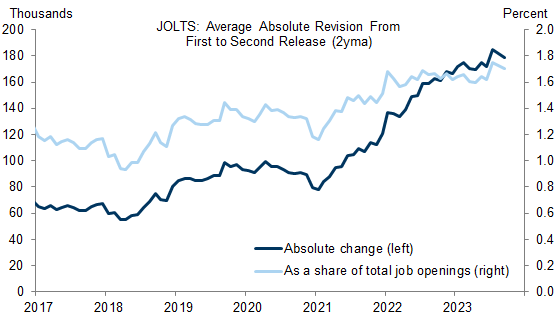

Lower response rates have also likely contributed to larger-than-usual data revisions, as incremental responses can have a greater influence on updated estimates. For example, JOLTS job openings have been revised by an average of 180k in the second print over the last couple of years, double what was typical four years ago and more than triple what was typical six years ago.

Understanding these data quality problems introduced by the pandemic has been vital to interpreting the economic data over the last few years. In particular, it has enabled investors to see through several misleading signals sent by fluctuations in the jobless claims and official job openings data. We have addressed these challenges by calculating our own seasonal adjustment factors when necessary and supplementing official data plagued by low response rates with alternative data based on much larger sample sizes.

The market’s focus on and sensitivity to individual data releases has increased sharply over the last couple of years, as those releases will ultimately determine Fed policy. Unfortunately, the increased scrutiny comes at a time when data quality issues have made assessing the implications of data releases for the outlook in real time more difficult. In this week’s Analyst , we discuss two data quality issues. First, we explore the extent to which seasonal distortions could be biasing our perception of the state of the economy. Second, we assess the impact of falling response rates to government statistical surveys, which can increase the uncertainty around a reported state of the economy.

Residual Seasonality: Seasonal Echoes of the Pandemic

Almost all US economic data are presented in a seasonally adjusted format. At its most basic level, seasonal adjustment involves comparing unadjusted values in a given month with the average value in other months; months that typically see weaker activity (e.g. housing starts in the winter) are adjusted up, while months that typically see strong activity (e.g. starts in the summer) are adjusted down—with the overall impact roughly netting out over the full year.

While seasonal adjustment allows economists to look through typical seasonal patterns and extract the underlying signal from economic indicators, as we wrote last year, the large swings in economic data during the pandemic have introduced distortions to several series, for two main reasons.

First, if a series is adjusted “multiplicatively”—that is, if seasonal swings are assumed to happen in proportion to the series’ level—a rapid level shift in that series will result in a proportional swing in the seasonal factors. But if the magnitude of seasonal changes remains similar to what it was before the shift, the seasonal factors will over-correct the series’ typical fluctuations, leading it to look higher in months when it is typically lower and vice-versa.

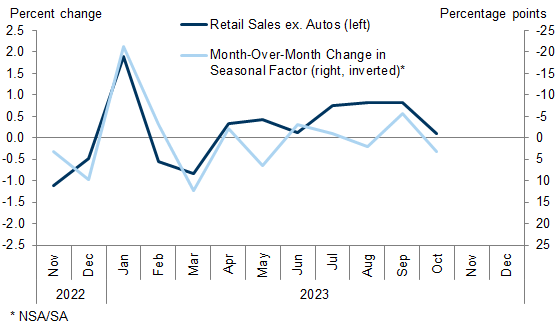

We find that this issue continues to distort seasonally-adjusted nominal retail sales ex. autos, which are multiplicatively seasonally adjusted. Retail sales ex. autos have increased to 35% above Feb. 2020 levels as consumer spending has seen a persistent shift away from services and towards goods. The series’ multiplicative seasonal factors have not meaningfully changed since 2019, meaning that the amplitude of the implied additive seasonal factors has grown substantially as a result of the higher year-round level of spending. For example, the December seasonal hurdle increased by $6bn year-over-year in 2021 and by $2bn in 2022.

It seems unlikely that the typical seasonal increases in spending around the holidays should rise proportionately with the increased year-round level of spending: the fact that consumers buy 35% more goods today does not necessarily imply that they will also buy 35% more at Christmas relative to how much they bought during the rest of the year. If, instead, consumers increased their demand for goods year-round but the typical dollar-increase that happens in the holidays remained unchanged (e.g. a consumer decides to buy a computer to work from home but does not buy more computers for her relatives at Christmas), the “true” seasonal swing would thereby be additive to the level of retail sales, and using a multiplicative seasonal factor would distort the series.

Even almost four years since the start of the pandemic, it is still hard to gauge which of these descriptions—additive or multiplicative—applies to retail sales. The increase in retail sales driven by higher prices—~13pp of the 35% increase—probably should be multiplicatively adjusted while it's less obvious for the remaining 22pp. But if the seasonal “truth” lies somewhere in between, a purely multiplicative approach would result in a meaningful deceleration in retail sales following the strength in the fall, other things equal. And indeed, as shown in Exhibit 1, seasonally-adjusted retail sales declined sharply last November and December, when the seasonal hurdle became sharply more punitive, before reversing the decline in January and February, when the seasonal hurdle swung back in the other direction. Seasonal fluctuations are often very large relative to seasonally-adjusted changes, and as a result, estimates of seasonally-adjusted changes can be very sensitive to any imperfections in the seasonal adjustment factors.

Exhibit 1 : Retail Sales Growth Disappointed Last Holiday Season, as Spending Did Not Grow Proportionally with the Elevated Level of Retail Sales

Source: Department of Commerce, Goldman Sachs Global Investment Research

A second issue that can distort seasonal factors is the large swings in many economic indicators at the height of the pandemic. While the pandemic was the shortest recession on record, it was also the deepest in post-war history, with most economic indicators hitting their lows by the start of 2020Q2. Unless special measures are taken, seasonal adjustment programs react to this plunge in activity by generating more of a “boost” for data in surrounding years during those early spring months; adjustment factors for the months of the rapid plunge (those surrounding March 2020) will “help” more and those in other months will become more negative. However, if the underlying seasonal patterns have not actually changed, seasonally-adjusted data will then look stronger in the early part of the year and weaker thereafter.

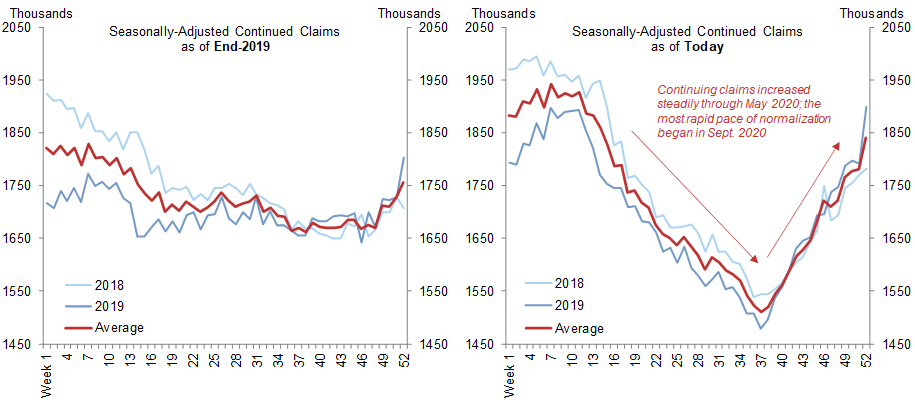

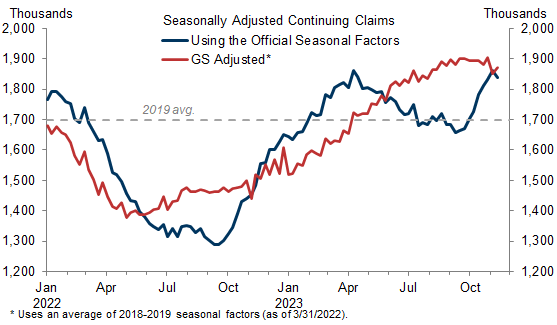

The left panel of Exhibit 2 shows seasonally-adjusted continuing jobless claims that were reported as of the end of 2019. The right panel shows the seasonally-adjusted series as of today. After the BLS recalculated the old seasonal factors with pandemic era data, a distinct seasonal pattern emerged in the 2018 and 2019 seasonally-adjusted series. In those years, the revised continuing claims series shows a steeper decline from March through September followed by a rebound in September through March.

Exhibit 2 : Seasonal Patterns Emerged Across Seasonally-Adjusted Continuing Claims Following the Recalculation of Seasonal Factors With Pandemic Era Data

Source: Department of Labor, Goldman Sachs Global Investment Research

These revisions could in principle simply be the result of properly evolving seasonal factors. “True” seasonal patterns often change over time; when they do, seasonal factors should change with them. For example, there has been a gradual shift in not-seasonally-adjusted retail sales from December to October and November over many years as consumers started holiday shopping earlier. The evolution in the seasonal factors for retail sales has taken that shift into account, as it ought to, and the resulting change in seasonal adjustment was therefore not the result of residual seasonality.

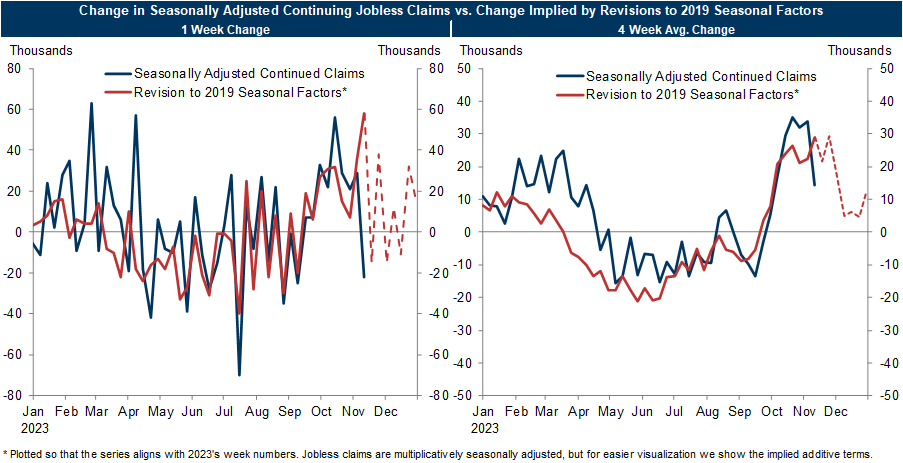

However, naturally-evolving seasonal changes are unlikely to explain the predictable seasonal patterns introduced by the revisions shown in Exhibit 2. As evidence of residual seasonality, Exhibit 3 compares the revisions to pre-pandemic seasonally-adjusted continuing claims [ 1 ] to the latest vintages of seasonally-adjusted continuing claims in 2023. The high degree of correlation shown (0.45 on a w/w basis, 0.80 on a 4w change basis) indicates that the changes to seasonal factors that arose from the pandemic are likely continuing to have undue influence on this year’s seasonally-adjusted data. Exhibit 4 shows that if taken at face value, this exercise suggests that essentially all of the 182k increase in continuing claims over the last couple of months is attributable to residual seasonality.

Exhibit 3 : Revisions to Pre-Pandemic Data Arising From the Recalculation of Seasonal Factors Have Predicted Changes in Seasonally-Adjusted Continuing Claims This Year

Exhibit 4 : Seasonal Distortions Can Alter Our Perception of the State of the Economy: Continuing Claims Have Been Flat Over the Last Couple of Months if Properly Adjusted

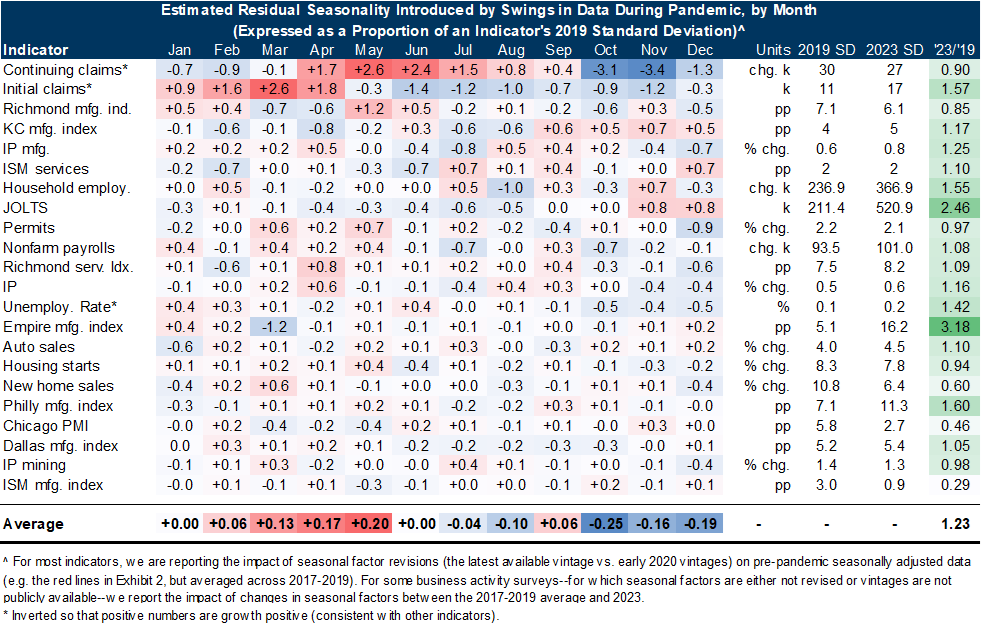

We can apply this same analysis—using revisions to pre-pandemic seasonal factors as a measure of residual seasonality—to a broader suite of economic indicators. Exhibit 5 shows the results of this exercise, expressed relative to the standard deviations of each indicator in 2019 (e.g. residual seasonality boosts seasonally-adjusted continuing claims by 0.7 standard deviations on average in January; note that we flip the sign for claims so that lower levels, which are a positive signal about growth, show up as positive residual seasonality) and ordered so that indicators with greater average absolute residual seasonality are at the top of the table.

Jobless claims appear at the top of the list, which is unsurprising for two reasons. First, the increase in claims at the outset of the pandemic was particularly outsized and thus the impact on the estimation of seasonal factors should be similarly outsized. Second, government statisticians sometimes remove obvious outliers from seasonal calculations, leading some series to be less likely to be distorted by pandemic-related residual seasonality. These kinds of adjustments were made earlier this year to jobless claims, meaningfully reducing the seasonal distortions in initial claims —which topped the list last year—but inadvertently amplifying them in continuing claims—which received special adjustments to a similar set of weeks despite evolving differently in 2020 and 2021. Seasonal distortions are also much more apparent in continuing claims than initial claims today because the series’ underlying volatility has fallen to below pre-pandemic levels while initial claims’ remains ~60% above.

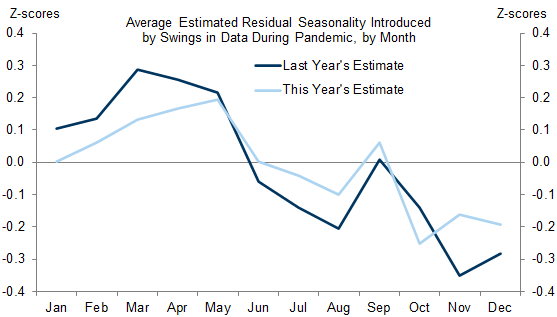

Consistent with adjustment factors evolving to “help” more in the months that experienced the most rapid plunges at the start of the pandemic, our analysis suggests that residual seasonality is most supportive of measured activity in March-May (+0.2 standard deviations on average) and more punitive in the rest of the year, particularly in October-December (-0.2 standard deviations on average).

On average, these estimated effects are modestly smaller than when we conducted the same analysis last year and should continue to diminish with time (Exhibit 6). However, at the same time, the underlying data has become less volatile (the avg. standard deviation is 23% above 2019 levels in 2023 vs. 55% in 2022), suggesting that seasonal distortions could explain a greater share of the data’s variation going forward.

Exhibit 5 : On Average, We Estimate That Residual Seasonality Boosts Seasonally-Adjusted Economic Indicators by 0.2 Standard Deviations in March-May and Lowers Them During the Rest of the Year

Source: Goldman Sachs Global Investment Research

Exhibit 6 : Our Estimates of the Impact of Residual Seasonality on Seasonally-Adjusted Economic Indicators Have Declined in Magnitude Relative to Last Year

Falling Response Rates: Would You Answer the Call?

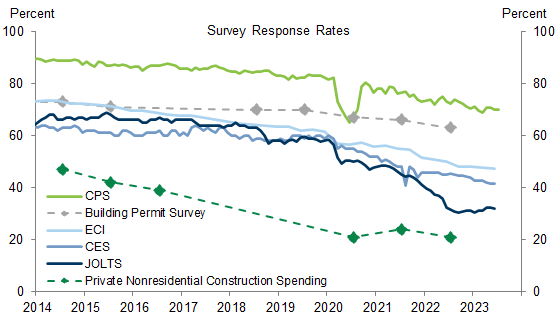

Response rates to government statistical surveys have fallen sharply during the pandemic, accelerating a downward trend seen over the past decade (Exhibit 7). We see two main channels through which a lower response rate can impact economic data. The first is through nonresponse bias (i.e. a declining response rate can bias medium-term trends if the probability of nonresponse is correlated with respondents’ answers). Earlier this year, we showed that nonresponse bias may have been modestly boosting the reported level of job openings, and a few studies from Fed and government economists have suggested that select series have been impacted by nonresponse. [ 2 ] However, we do not have reason to think that the broader set of data has been biased by nonresponse.

Exhibit 7 : The Pandemic Accelerated the Secular Decline in Response Rates to Economic Surveys

Source: Department of Labor, Department of Commerce, Goldman Sachs Global Investment Research

Second, a lower response rate reduces the sample size, which can increase month-to-month volatility (see Appendix) and widen the confidence interval around point estimates. For this point, we focus on the Job Openings and Labor Turnover Survey (JOLTS). The decline in the JOLTS response rate has been particularly severe, falling from roughly 70% a decade ago to just under 60% in 2019 and just over 30% by the end of last year. Exhibit 8 shows that, as a result, the median monthly standard error—a measure of the expected discrepancy between a sample estimate and the true value of a population—for the JOLTS job openings rate has likely increased by over 90% relative to 2002-2013. [ 3 ] An increase of this magnitude translates to a 90% confidence interval of roughly 700k around the latest job openings reading.

Exhibit 8 : A Lower Response Rate Has Likely Pushed the Median Monthly Standard Error for the Job Openings Rate More Than 90% Higher Relative to 2002-2013

A smaller sample size can also lead to larger revisions in previously reported data, as incremental responses have a greater influence on updated estimates. Exhibit 9 shows that JOLTS job openings have been revised by an average of 180k in their second reading over the last couple of years, double what was typical four years ago and more than triple what was typical six years ago.

Exhibit 9 : The Magnitude of Revisions to JOLTS Has Risen Meaningfully Over the Last Few Years

Understanding these data quality problems introduced by the pandemic has been vital to interpreting the economic data over the last few years. In particular, it has enabled investors to see through several misleading signals sent by fluctuations in the jobless claims and official job openings data. We have addressed these challenges by calculating our own seasonal adjustment factors when necessary and supplementing official data with alternative data. The decline in response rates to government surveys has increased the relative value of administrative and alternative data (e.g. jobless claims and web-based measures of job openings) that are immune from declining response rates and often calculated from much larger samples . However, as we have highlighted for many years, those series often have their own issues and are often best thought of as complements and cross-checks to the official government statistics.

Ronnie Walker

Economic data remains more volatile vs. pre-pandemic—even after controlling for changes in growth—potentially in part because of lower response rates to economic surveys.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix , or go to www.gs.com/research/hedge.html .

Disclosure Appendix

We, Jan Hatzius, Alec Phillips, David Mericle, Spencer Hill, CFA, Ronnie Walker, Tim Krupa and Manuel Abecasis, hereby certify that all of the views expressed in this report accurately reflect our personal views, which have not been influenced by considerations of the firm's business or client relationships.

Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Goldman Sachs' Global Investment Research division.

Disclosures

Regulatory disclosures, disclosures required by united states laws and regulations.

See company-specific regulatory disclosures above for any of the following disclosures required as to companies referred to in this report: manager or co-manager in a pending transaction; 1% or other ownership; compensation for certain services; types of client relationships; managed/co-managed public offerings in prior periods; directorships; for equity securities, market making and/or specialist role. Goldman Sachs trades or may trade as a principal in debt securities (or in related derivatives) of issuers discussed in this report.

The following are additional required disclosures: Ownership and material conflicts of interest: Goldman Sachs policy prohibits its analysts, professionals reporting to analysts and members of their households from owning securities of any company in the analyst's area of coverage. Analyst compensation: Analysts are paid in part based on the profitability of Goldman Sachs, which includes investment banking revenues. Analyst as officer or director: Goldman Sachs policy generally prohibits its analysts, persons reporting to analysts or members of their households from serving as an officer, director or advisor of any company in the analyst's area of coverage. Non-U.S. Analysts: Non-U.S. analysts may not be associated persons of Goldman Sachs & Co. LLC and therefore may not be subject to FINRA Rule 2241 or FINRA Rule 2242 restrictions on communications with subject company, public appearances and trading securities held by the analysts.

Additional disclosures required under the laws and regulations of jurisdictions other than the United States

The following disclosures are those required by the jurisdiction indicated, except to the extent already made above pursuant to United States laws and regulations. Australia: Goldman Sachs Australia Pty Ltd and its affiliates are not authorised deposit-taking institutions (as that term is defined in the Banking Act 1959 (Cth)) in Australia and do not provide banking services, nor carry on a banking business, in Australia. This research, and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman Sachs. In producing research reports, members of Global Investment Research of Goldman Sachs Australia may attend site visits and other meetings hosted by the companies and other entities which are the subject of its research reports. In some instances the costs of such site visits or meetings may be met in part or in whole by the issuers concerned if Goldman Sachs Australia considers it is appropriate and reasonable in the specific circumstances relating to the site visit or meeting. To the extent that the contents of this document contains any financial product advice, it is general advice only and has been prepared by Goldman Sachs without taking into account a client's objectives, financial situation or needs. A client should, before acting on any such advice, consider the appropriateness of the advice having regard to the client's own objectives, financial situation and needs. A copy of certain Goldman Sachs Australia and New Zealand disclosure of interests and a copy of Goldman Sachs’ Australian Sell-Side Research Independence Policy Statement are available at: https://www.goldmansachs.com/disclosures/australia-new-zealand/index.html . Brazil: Disclosure information in relation to CVM Resolution n. 20 is available at https://www.gs.com/worldwide/brazil/area/gir/index.html . Where applicable, the Brazil-registered analyst primarily responsible for the content of this research report, as defined in Article 20 of CVM Resolution n. 20, is the first author named at the beginning of this report, unless indicated otherwise at the end of the text. Canada: This information is being provided to you for information purposes only and is not, and under no circumstances should be construed as, an advertisement, offering or solicitation by Goldman Sachs & Co. LLC for purchasers of securities in Canada to trade in any Canadian security. Goldman Sachs & Co. LLC is not registered as a dealer in any jurisdiction in Canada under applicable Canadian securities laws and generally is not permitted to trade in Canadian securities and may be prohibited from selling certain securities and products in certain jurisdictions in Canada. If you wish to trade in any Canadian securities or other products in Canada please contact Goldman Sachs Canada Inc., an affiliate of The Goldman Sachs Group Inc., or another registered Canadian dealer. Hong Kong: Further information on the securities of covered companies referred to in this research may be obtained on request from Goldman Sachs (Asia) L.L.C. India: Further information on the subject company or companies referred to in this research may be obtained from Goldman Sachs (India) Securities Private Limited, Research Analyst - SEBI Registration Number INH000001493, 951-A, Rational House, Appasaheb Marathe Marg, Prabhadevi, Mumbai 400 025, India, Corporate Identity Number U74140MH2006FTC160634, Phone +91 22 6616 9000, Fax +91 22 6616 9001. Goldman Sachs may beneficially own 1% or more of the securities (as such term is defined in clause 2 (h) the Indian Securities Contracts (Regulation) Act, 1956) of the subject company or companies referred to in this research report. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Goldman Sachs (India) Securities Private Limited Investor Grievance E-mail: [email protected]. Compliance Officer: Anil Rajput |Tel: + 91 22 6616 9000 | Email: [email protected]. Japan: See below. Korea: This research, and any access to it, is intended only for "professional investors" within the meaning of the Financial Services and Capital Markets Act, unless otherwise agreed by Goldman Sachs. Further information on the subject company or companies referred to in this research may be obtained from Goldman Sachs (Asia) L.L.C., Seoul Branch. New Zealand: Goldman Sachs New Zealand Limited and its affiliates are neither "registered banks" nor "deposit takers" (as defined in the Reserve Bank of New Zealand Act 1989) in New Zealand. This research, and any access to it, is intended for "wholesale clients" (as defined in the Financial Advisers Act 2008) unless otherwise agreed by Goldman Sachs. A copy of certain Goldman Sachs Australia and New Zealand disclosure of interests is available at: https://www.goldmansachs.com/disclosures/australia-new-zealand/index.html . Russia: Research reports distributed in the Russian Federation are not advertising as defined in the Russian legislation, but are information and analysis not having product promotion as their main purpose and do not provide appraisal within the meaning of the Russian legislation on appraisal activity. Research reports do not constitute a personalized investment recommendation as defined in Russian laws and regulations, are not addressed to a specific client, and are prepared without analyzing the financial circumstances, investment profiles or risk profiles of clients. Goldman Sachs assumes no responsibility for any investment decisions that may be taken by a client or any other person based on this research report. Singapore: Goldman Sachs (Singapore) Pte. (Company Number: 198602165W), which is regulated by the Monetary Authority of Singapore, accepts legal responsibility for this research, and should be contacted with respect to any matters arising from, or in connection with, this research. Taiwan: This material is for reference only and must not be reprinted without permission. Investors should carefully consider their own investment risk. Investment results are the responsibility of the individual investor. United Kingdom: Persons who would be categorized as retail clients in the United Kingdom, as such term is defined in the rules of the Financial Conduct Authority, should read this research in conjunction with prior Goldman Sachs research on the covered companies referred to herein and should refer to the risk warnings that have been sent to them by Goldman Sachs International. A copy of these risks warnings, and a glossary of certain financial terms used in this report, are available from Goldman Sachs International on request.

European Union and United Kingdom: Disclosure information in relation to Article 6 (2) of the European Commission Delegated Regulation (EU) (2016/958) supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council (including as that Delegated Regulation is implemented into United Kingdom domestic law and regulation following the United Kingdom’s departure from the European Union and the European Economic Area) with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest is available at https://www.gs.com/disclosures/europeanpolicy.html which states the European Policy for Managing Conflicts of Interest in Connection with Investment Research.

Japan: Goldman Sachs Japan Co., Ltd. is a Financial Instrument Dealer registered with the Kanto Financial Bureau under registration number Kinsho 69, and a member of Japan Securities Dealers Association, Financial Futures Association of Japan Type II Financial Instruments Firms Association, The Investment Trusts Association, Japan, and Japan Investment Advisers Association. Sales and purchase of equities are subject to commission pre-determined with clients plus consumption tax. See company-specific disclosures as to any applicable disclosures required by Japanese stock exchanges, the Japanese Securities Dealers Association or the Japanese Securities Finance Company.

Global product; distributing entities

Goldman Sachs Global Investment Research produces and distributes research products for clients of Goldman Sachs on a global basis. Analysts based in Goldman Sachs offices around the world produce research on industries and companies, and research on macroeconomics, currencies, commodities and portfolio strategy. This research is disseminated in Australia by Goldman Sachs Australia Pty Ltd (ABN 21 006 797 897); in Brazil by Goldman Sachs do Brasil Corretora de Títulos e Valores Mobiliários S.A.; Public Communication Channel Goldman Sachs Brazil: 0800 727 5764 and / or [email protected]. Available Weekdays (except holidays), from 9am to 6pm. Canal de Comunicação com o Público Goldman Sachs Brasil: 0800 727 5764 e/ou [email protected]. Horário de funcionamento: segunda-feira à sexta-feira (exceto feriados), das 9h às 18h; in Canada by Goldman Sachs & Co. LLC; in Hong Kong by Goldman Sachs (Asia) L.L.C.; in India by Goldman Sachs (India) Securities Private Ltd.; in Japan by Goldman Sachs Japan Co., Ltd.; in the Republic of Korea by Goldman Sachs (Asia) L.L.C., Seoul Branch; in New Zealand by Goldman Sachs New Zealand Limited; in Russia by OOO Goldman Sachs; in Singapore by Goldman Sachs (Singapore) Pte. (Company Number: 198602165W); and in the United States of America by Goldman Sachs & Co. LLC. Goldman Sachs International has approved this research in connection with its distribution in the United Kingdom.

Goldman Sachs International (“GSI”), authorised by the Prudential Regulation Authority (“PRA”) and regulated by the Financial Conduct Authority (“FCA”) and the PRA, has approved this research in connection with its distribution in the United Kingdom.

European Economic Area: GSI, authorised by the PRA and regulated by the FCA and the PRA, disseminates research in the following jurisdictions within the European Economic Area: the Grand Duchy of Luxembourg, Italy, the Kingdom of Belgium, the Kingdom of Denmark, the Kingdom of Norway, the Republic of Finland and the Republic of Ireland; GSI - Succursale de Paris (Paris branch) which is authorised by the French Autorité de contrôle prudentiel et de resolution (“ACPR”) and regulated by the Autorité de contrôle prudentiel et de resolution and the Autorité des marches financiers (“AMF”) disseminates research in France; GSI - Sucursal en España (Madrid branch) authorized in Spain by the Comisión Nacional del Mercado de Valores disseminates research in the Kingdom of Spain; GSI - Sweden Bankfilial (Stockholm branch) is authorized by the SFSA as a “third country branch” in accordance with Chapter 4, Section 4 of the Swedish Securities and Market Act (Sw. lag (2007:528) om värdepappersmarknaden) disseminates research in the Kingdom of Sweden; Goldman Sachs Bank Europe SE (“GSBE”) is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) and Deutsche Bundesbank and disseminates research in the Federal Republic of Germany and those jurisdictions within the European Economic Area where GSI is not authorised to disseminate research and additionally, GSBE, Copenhagen Branch filial af GSBE, Tyskland, supervised by the Danish Financial Authority disseminates research in the Kingdom of Denmark; GSBE - Sucursal en España (Madrid branch) subject (to a limited extent) to local supervision by the Bank of Spain disseminates research in the Kingdom of Spain; GSBE - Succursale Italia (Milan branch) to the relevant applicable extent, subject to local supervision by the Bank of Italy (Banca d’Italia) and the Italian Companies and Exchange Commission (Commissione Nazionale per le Società e la Borsa “Consob”) disseminates research in Italy; GSBE - Succursale de Paris (Paris branch), supervised by the AMF and by the ACPR disseminates research in France; and GSBE - Sweden Bankfilial (Stockholm branch), to a limited extent, subject to local supervision by the Swedish Financial Supervisory Authority (Finansinpektionen) disseminates research in the Kingdom of Sweden.

General disclosures

This research is for our clients only. Other than disclosures relating to Goldman Sachs, this research is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Other than certain industry reports published on a periodic basis, the large majority of reports are published at irregular intervals as appropriate in the analyst's judgment.

Goldman Sachs conducts a global full-service, integrated investment banking, investment management, and brokerage business. We have investment banking and other business relationships with a substantial percentage of the companies covered by Global Investment Research. Goldman Sachs & Co. LLC, the United States broker dealer, is a member of SIPC ( https://www.sipc.org ).

Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients and principal trading desks that reflect opinions that are contrary to the opinions expressed in this research. Our asset management area, principal trading desks and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research.

We and our affiliates, officers, directors, and employees will from time to time have long or short positions in, act as principal in, and buy or sell, the securities or derivatives, if any, referred to in this research, unless otherwise prohibited by regulation or Goldman Sachs policy.

The views attributed to third party presenters at Goldman Sachs arranged conferences, including individuals from other parts of Goldman Sachs, do not necessarily reflect those of Global Investment Research and are not an official view of Goldman Sachs.

Any third party referenced herein, including any salespeople, traders and other professionals or members of their household, may have positions in the products mentioned that are inconsistent with the views expressed by analysts named in this report.

This research is focused on investment themes across markets, industries and sectors. It does not attempt to distinguish between the prospects or performance of, or provide analysis of, individual companies within any industry or sector we describe.

Any trading recommendation in this research relating to an equity or credit security or securities within an industry or sector is reflective of the investment theme being discussed and is not a recommendation of any such security in isolation.

This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Clients should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, if appropriate, seek professional advice, including tax advice. The price and value of investments referred to in this research and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments.

Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors. Investors should review current options and futures disclosure documents which are available from Goldman Sachs sales representatives or at https://www.theocc.com/about/publications/character-risks.jsp and https://www.fiadocumentation.org/fia/regulatory-disclosures_1/fia-uniform-futures-and-options-on-futures-risk-disclosures-booklet-pdf-version-2018 . Transaction costs may be significant in option strategies calling for multiple purchase and sales of options such as spreads. Supporting documentation will be supplied upon request.

Differing Levels of Service provided by Global Investment Research: The level and types of services provided to you by Goldman Sachs Global Investment Research may vary as compared to that provided to internal and other external clients of GS, depending on various factors including your individual preferences as to the frequency and manner of receiving communication, your risk profile and investment focus and perspective (e.g., marketwide, sector specific, long term, short term), the size and scope of your overall client relationship with GS, and legal and regulatory constraints. As an example, certain clients may request to receive notifications when research on specific securities is published, and certain clients may request that specific data underlying analysts’ fundamental analysis available on our internal client websites be delivered to them electronically through data feeds or otherwise. No change to an analyst’s fundamental research views (e.g., ratings, price targets, or material changes to earnings estimates for equity securities), will be communicated to any client prior to inclusion of such information in a research report broadly disseminated through electronic publication to our internal client websites or through other means, as necessary, to all clients who are entitled to receive such reports.

All research reports are disseminated and available to all clients simultaneously through electronic publication to our internal client websites. Not all research content is redistributed to our clients or available to third-party aggregators, nor is Goldman Sachs responsible for the redistribution of our research by third party aggregators. For research, models or other data related to one or more securities, markets or asset classes (including related services) that may be available to you, please contact your GS representative or go to https://research.gs.com .

Disclosure information is also available at https://www.gs.com/research/hedge.html or from Research Compliance, 200 West Street, New York, NY 10282.

© 2023 Goldman Sachs.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of The Goldman Sachs Group, Inc.

- Jan Hatzius

- Economics Research

- United States

How to diversify as global stock markets grow more concentrated

Stock market concentration has increased dramatically in recent years at the market, sector, and stock level. However there are ways investors can diversify their portfolios while maintaining exposure to market leaders, according to Goldman Sachs Research.

“Market dominance is not unprecedented and is only a problem if it is not supported by fundamentals,” Peter Oppenheimer, chief global equity strategist and head of Macro Research in Europe for Goldman Sachs Research, writes in the team’s report. “That said, at the stock level in particular, dominant companies rarely stay the best performers over long periods of time.” ( Listen to the Goldman Sachs Exchanges podcast on rising stock market concentration .)

Why is the US stock market so strong?

The US stock market has consistently been the world’s biggest over the past 50 years, but its share has been steadily climbing in the aftermath of the global financial crisis (GFC). It now captures around 45% of the global equity market, compared with about 30% in 2009.

The longer-term rise in the relative size of the US equity market has reflected the strength of the US economy, but its dominance has accelerated dramatically since the GFC, outstripping increases in market capitalization in Asia and Europe. Relative to GDP, the US share of equity market capitalization has risen steadily as well, though part of this reflects the fact that many non-US companies are now in the US stock market.

The stellar earnings growth of US companies over this time further explains their relative outperformance, Oppenheimer writes. Both share prices and earnings per share have consistently declined for non-US companies relative to their US-listed counterparts. In addition, the US stock market has more exposure to faster growing industries than the rest of the world, the reinvestment rate of companies in the US stock market is higher than in most other markets, and it enjoys greater liquidity that helps reduce the risk premium.

“The US economy is bigger and stronger than others and the growing trend towards US listings by foreign-based companies has added to this effect,” Oppenheimer writes.

While the US equity market has become increasingly expensive relative to the rest of the world, the premium being placed on US stocks is justified by superior rates of return, and the US valuation premium isn’t extreme when adjusting for its higher level of profitability and returns on equity, according to Goldman Sachs Research. Furthermore, diversifying outside the US isn’t always straightforward — other markets may be correlated with the US.

That said, “there are many quality growth companies” in other regions, and they should be considered as part of a diverse portfolio, Oppenheimer writes. The report cites Japan as a potentially attractive market among developed markets, and our analysts say there may be opportunities in India (notably growth stocks) and China (value stocks).

Goldman Sachs Research also recommends an overweight allocation to Europe’s consumer-cyclical stocks — companies whose performance is closely linked to the state of the economy and the business cycle — as the region’s activity rebounds (European consumers have high savings and real wage growth).

Tech sector domination could continue

Another source of increasing market concentration is among sectors, as technology, media, and telecom stocks have continued to capture a rising share of the global stock market, particularly in the US but also in other markets such as Asia.

While global technology profits have surged since the GFC, other sectors in aggregate have made “virtually no progress,” Oppenheimer notes. This dynamic was exacerbated by the pandemic, which enforced social distancing and drove demand for technology relative to other parts of the economy.

“While the rise in interest rates over the past couple of years dented the relative earnings growth of the technology sector, its superior growth rate has resumed over the past year,” Oppenheimer writes. Tech firms’ significant cash piles have given them a further advantage from the recent rise in interest rates, as they have reinvested their cash at a very high rate.

The level of tech concentration is not unprecedented among dominant sectors in the past, according to Goldman Sachs Research. The current tech sector is about the same size as the energy sector was at its height in the mid-1950s, for example, and it remains smaller than both transportation (which dominated in the 20th century) and finance and real estate (which drove the stock market in the 19th century).

“Over the past 200 years, the biggest industry represented in the stock market at each point in time has reflected the major driver of economic growth,” Oppenheimer writes.

While our researchers recommend overweight allocations to technology stocks in all regions, they see good opportunities for investors to hedge technology dominance by diversifying tech exposure with selected fast growing, or “growth” stocks, that are cheaper. There may be opportunities in healthcare in all regions except Japan, due to a combination of attractive valuations and high growth prospects, Oppenheimer writes. Likewise European GRANOLAS — 11 of the largest companies in the STOXX 600 — as a group is relatively cheaper than their Magnificent Seven counterparts in the US. These European stocks have similarly strong balance sheets, high profits, and high and stable margins, according to the report.

To diversify further among sectors, investors can increase exposure to “ex tech compounders” — the term the team uses for companies that have market capitalizations above $10 billion and share certain key factors. These include high margins, high profitability, strong balance sheets, low volatility, strong growth prospects, and a decade’s worth of consistent earnings growth behind them.

Finally, quality growth stocks can be complemented with some value stocks — companies that trade at relatively cheap valuations compared to their growth and earnings potential. Some examples of these equities include energy and financials in the US, and consumer cyclicals in Europe, according to Goldman Sachs Research.

Can the Magnificent Seven hold on?

Oppenheimer and his colleagues also take a look at the investment implications of a small handful of companies dominating the stock market. Separate analysis by Goldman Sachs Research finds that the US stock market has often rallied after bouts of high concentration. Oppenheimer and his team find similar patterns of high concentration in other markets, including Europe (the group of GRANOLAS stocks account for nearly one quarter of the value of the 600 biggest companies).

“While high stock market concentration may be a sign of a bubble, it does not necessarily mean there is one,” Oppenheimer writes. High stock concentration isn’t unusual, and many of the dominant companies of late have high profits and strong balance sheets.

Even so, today’s dominant companies are far from assured of having such a high share of market capitalization further down the line. Only 52 companies have appeared every year in the Fortune 500 since 1955, according to Goldman Sachs Research, and it predicts that almost all of today’s top companies will be missing from the list when it’s released 70 years from now.

“Historically, with new entrants emerging, few companies remain unscathed as competition either forces companies to disappear, merge, or be acquired,” the authors write. “From this perspective, a market that becomes dominated by a few stocks becomes increasingly vulnerable to either disruption or anti-trust regulation.”

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Explore More Insights

Sign up for briefings, a newsletter from goldman sachs about trends shaping markets, industries and the global economy..

Thank you for subscribing to BRIEFINGS: a newsletter from Goldman Sachs about trends shaping markets, industries and the global economy.

Some error occurred. Please refresh the page and try again.

Invalid input parameters. Please refresh the page and try again.

Connect With Us

IMAGES

COMMENTS

Goldman Sachs Research analysts estimate that the risk of the economy entering a recession in the next year is 30% in the US, 40% in the Euro area, and 45% in the UK. In this report, they revisit key facts about the frequency and severity of recessions by analyzing 77 recessions in advanced economies since 1961.

This research, and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman Sachs. In producing research reports, members of the Global Investment Research Division of Goldman Sachs Australia may attend site visits and other meetings hosted by the ...

The latest from your favorite Goldman Sachs' authors, alerts for their publications, and ability to contact them directly, all on the Marquee platform. Enjoy unparalleled access to Goldman Sachs FICC and Equities' authors via their respective author pages. Follow an author, browse their other posts, or email them directly.

This research, and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman Sachs. In producing research reports, members of Global Investment Research of Goldman Sachs Australia may attend site visits and other meetings hosted by the companies and other ...

See Goldman Sachs equity research reports for company -specific 4Q analysis on . AMZN, AAPL, GOOGL, MSFT, META, TSLA. The forward path of the Magnificent 7 is one of the most common client questions we receive. The group has outperformed YTD by 534 bp, returning 7.9% vs. 2.6% for

Macro at a Glance covers the latest developments in growth, inflation, and labor markets, while Policy Picture and Central Bank Snapshot details our outlook for monetary and fiscal policies. Navigating Fixed Income summarizes how our view of the world and financial markets informs and impacts our investment views. GOLDMAN SACHS RESEARCH.

The US stock market is more concentrated than it's been in decades, with a small number of stocks accounting for an unusually large share of market capitalization. While it's making some investors uneasy, Ben Snider, a senior strategist on the US portfolio strategy team in Goldman Sachs Research, and Peter Callahan, who covers the US ...

Goldman Sachs Group, Inc. (The) Analyst Report: The Goldman Sachs Group, Inc. Goldman Sachs is a leading global investment banking and asset management firm. Approximately 20% of its revenue comes ...

We'll send you an email with a code for access. Goldman Sachs Support: US & Canada: 1-866-727-7000: The Americas: 1-212-357-9994

This research, and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman Sachs. In producing research reports, members of Global Investment Research of Goldman Sachs Australia may attend site visits and other meetings hosted by the companies and other ...

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by GSAM and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR).

Today's Research Daily features new research reports on 16 major stocks, including Apple Inc. (AAPL), Goldman Sachs (GS), and Applied Materials (AMAT). These research reports have been hand-picked ...

3 Stocks About to Book Gains on Building Products Demand; The Goldman Sachs Group, Inc. (NYSE:GS - Free Report) - Equities researchers at Seaport Res Ptn reduced their Q1 2024 earnings estimates for shares of The Goldman Sachs Group in a research note issued on Thursday, April 4th.Seaport Res Ptn analyst J. Mitchell now expects that the investment management company will post earnings of $9.19 ...

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a. result, investors should be aware that the firm may have a conflict of interest that could affect the . objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

The report suggested three potential solutions for biotech firms: "Solution 1: Address large markets: Hemophilia is a $9-10bn WW market (hemophilia A, B), growing at ~6-7% annually." "Solution 2 ...

This research, and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman Sachs. In producing research reports, members of Global Investment Research of Goldman Sachs Australia may attend site visits and other meetings hosted by the companies and other ...

Evercore ISI analyst Glenn Schorr maintained a Buy rating on Goldman Sachs Group (GS - Research Report) yesterday and set a price target of $435.00. The company's shares closed yesterday at ...

A recent report from Goldman Sachs found the tech could significantly disrupt the labor market, with it affecting about 300 million full-time jobs or 18% of work. Another recent study, from OpenAI ...

Goldman Sachs Support. Email: [email protected] ... Marquee Regulatory Disclosures Important Disclosure Information About Goldman Sachs Research Please review our ...

Mexico Tue 02 Apr, 2024 - 9:48 AM ET. Las calificaciones de Goldman Sachs México, Casa de Bolsa, S. A. de C. V. (GSMX) están impulsadas por la opinión de Fitch Ratings sobre la propabilidad de que la casa de bolsa reciba soporte extraordinario, si es necesario, de su accionista en última instancia, The Goldman Sachs Group, Inc. (GS, el ...