World Fuel Services Corp (INT) SEC Filing 10-K Annual Report for the fiscal year ending Saturday, December 31, 2022

Sec filings, int valuations.

- Select PDF Feature:

- Include Exhibits

- Highlight YoY Changes

- Highlight Sentiment

February 2023

December 2022

November 2022

October 2022

Last10K.com | 10-K Annual Report Fri Feb 24 2023

World fuel services corp.

Please wait while we load the requested 10-K report or click the link below:

https://last10k.com/sec-filings/report/789460/000162828023005058/int-20221231.htm

View differences made from one year to another to evaluate World Fuel Services Corp's financial trajectory

Compare this 10-K Annual Report to its predecessor by reading our highlights to see what text and tables were removed , added and changed by World Fuel Services Corp.

Assess how World Fuel Services Corp's management team is paid from their Annual Proxy

- Voting Procedures

- Board Members

- Executive Team

- Salaries, Bonuses, Perks

- Peers / Competitors

SEC Filing Tools

Read 10-K Annual Reports Better Last10K.com and Stocksnips.net computationally analyzes management discussions inside annual and quarterly reports to determine if they are bullish , bearish or neutral on the company's finances and operations. View Rating for FREE "> Rating Learn More

We provide 5 of these remarks for FREE. To see all the remarks without having to find them in the 10-K Annual Report, become a member of Last10K.com

However, a significant or prolonged period of high inflation, particularly when combined with rising interest rates due to actions taken by governments to attempt to control inflation, could adversely impact our results if costs, including employee compensation driven by competitive job market conditions, were to increase at a rate greater than the increase in the revenues we generate.

The increase in operating expenses was partially attributable to increased compensation and employee benefit costs, the addition of Flyers' operating expenses of $66.3 million, as well as higher general and administrative costs as business activity continued to normalize.

However, to the extent that a rising cost environment impacts our results, there are typically offsetting benefits either inherent in certain parts of our business or that may result from proactive measures we take to reduce the impact of inflation on our net operating results.

Net cash provided by financing activities for the year ended December 31, 2022 was primarily attributable to net borrowings of $333.6 million, primarily driven by incremental borrowings under our Credit Facility related to the acquisition of Flyers and increased working capital requirements, partially offset by $48.7 million in purchases of our common stock and dividend payments of $31.0 million.

These benefits can include higher commodity prices that typically result in a constrained credit environment, often creating favorable market conditions that increase demand for our services, as well as our ability to renegotiate prices due to many of our sales contracts being 12 months or less in duration.

For these reasons, the increased... Read more

For the year ended December... Read more

Furthermore, when fuel prices increase... Read more

The $34.7 million decrease in... Read more

See "We extend credit to... Read more

Finally, our land segment has... Read more

Our marine segment income from... Read more

This can occur due to... Read more

We continue to focus on... Read more

The increase in operating expenses... Read more

Our intention is to become... Read more

Any write-off of accounts receivable... Read more

The increased prices and volumes... Read more

If our estimates of fair... Read more

Consolidated total operating expenses for... Read more

Accounts Receivable and Allowance for... Read more

The increase in revenue was... Read more

While we generally enter into... Read more

Land Segment We believe our... Read more

As part of our growth... Read more

Aviation Segment Our aviation segment... Read more

Changes in projected future earnings... Read more

Additionally, we take measures to... Read more

We had outstanding bonds that... Read more

In addition, since our business... Read more

As of December 31, 2022,... Read more

Revenues in our land segment... Read more

In addition, if forecasts supporting... Read more

Our land segment gross profit... Read more

Our marine segment gross profit... Read more

We also have accounts receivable... Read more

Based on the information currently... Read more

As a result of the... Read more

Measurement of the fair value... Read more

Financial Statements, Disclosures and Schedules Inside this 10-K Annual Report

Material Contracts, Statements, Certifications & more World Fuel Services Corp provided additional information to their SEC Filing as exhibits

Ticker: INT CIK: 789460 Form Type: 10-K Annual Report Accession Number: 0001628280-23-005058 Submitted to the SEC: Fri Feb 24 2023 4:17:16 PM EST Accepted by the SEC: Fri Feb 24 2023 Period: Saturday, December 31, 2022 Industry: Wholesale Petroleum And Petroleum Products No Bulk Stations

Intrinsic Value Calculator

Our Intrinsic Value calculator estimates what an entire company is worth using up to 10 years of financial ratios to determine if a stock is overvalued or not

Never Miss A New SEC Filing Again

Receive an e-mail as soon as a company files an Annual Report, Quarterly Report or has new 8-K corporate news

We Highlighted This SEC Filing For You

Read positive and negative remarks made by management in their entirety without having to find them in a 10-K/Q

Widen Your SEC Filing Reading Experience

Remove data columns and navigations in order to see much more filing content and tables in one view

Uncover Actionable Information Inside SEC Filings

Read both hidden opportunities and early signs of potential problems without having to find them in a 10-K/Q

Adobe PDF, Microsoft Word, Excel and CSV Downloads

Export Annual and Quarterly Reports to Adobe Acrobat (PDF), Microsoft Word (DOCX), Excel (XLSX) and Comma-Delimited (CSV) files for offline viewing, annotations and analysis

Financial Stability Report

Our Financial Stability reports uses up to 10 years of financial ratios to determine the health of a company's EPS, Dividends, Book Value, Return on Equity, Current Ratio and Debt-to-Equity

Get a Better Picture of a Company's Performance

See how over 70 Growth, Profitability and Financial Ratios perform over 10 Years

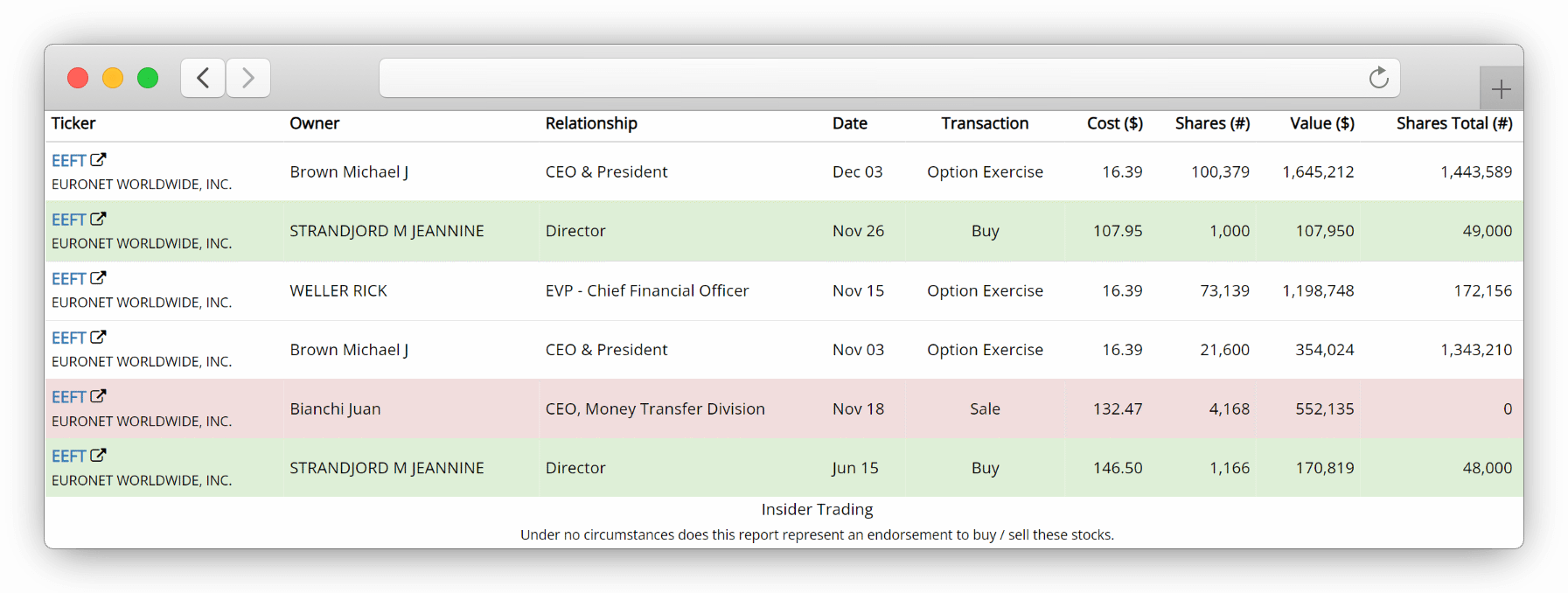

See when company executives buy or sell their own stock

Use our calculated cost dollar values to discover when and how much registered owners BUY , SELL or excercise their company stock OPTIONS aggregated from Form 4 Insider Transactions SEC Filings

See how institutional managers trade a stock

View which hedge funds, pension / retirement funds, endowments, banks and insurance companies have increased or decreased their positions in a particular stock. Includes Ownership Percent, Buy versus Sell comparison, Put-Call ratio and more

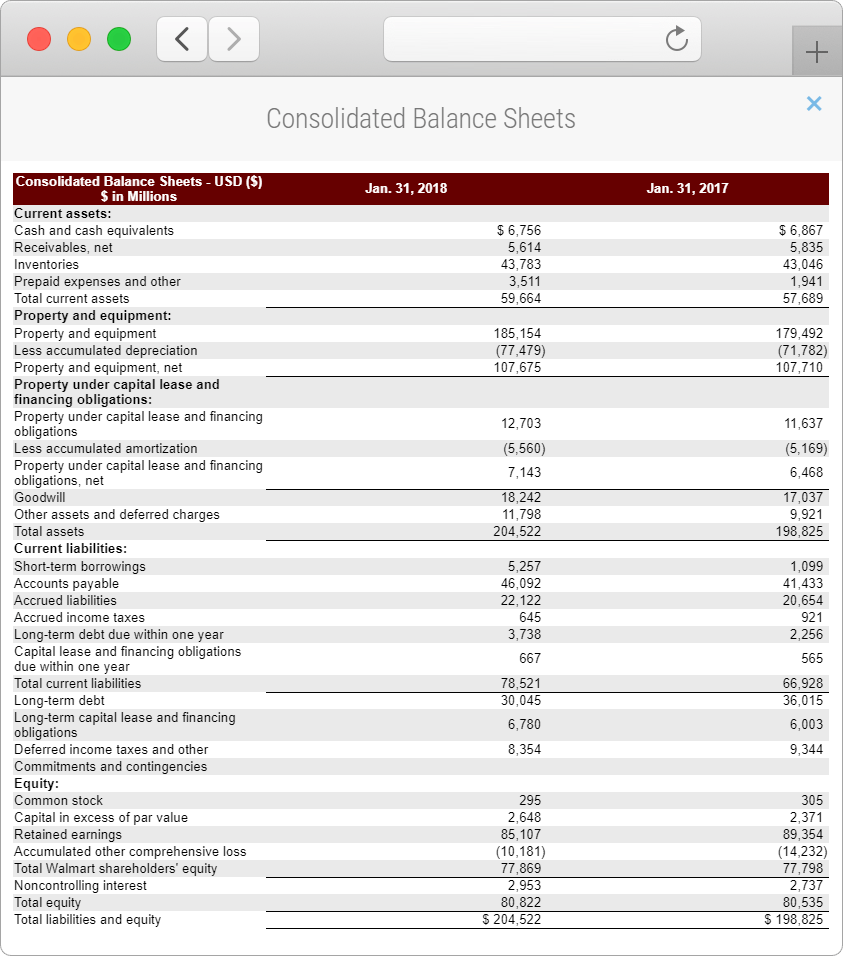

FREE Financial Statements

Get one-click access to balance sheets, income, operations and cash flow statements without having to find them in Annual and Quarterly Reports

SEC Filing Exhibit

Loading SEC Filing Exhibit...

SEC Filing Financial Summary

Loading SEC Filing Financial Summary...

World Fuel Services Corporation Ira M Birns, 305-428-8000 Executive Vice President & Chief Financial Officer

Glenn Klevitz, 305-428-8000 Vice President, Treasurer & Investor Relations

- Market data

- Connectivity

- News and events

- Investor Relations

- Presentations

- Financial statements

Annual reports

- Reporting and presentations

Create an account

Create a free IEA account to download our reports or subcribe to a paid service.

A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas

About this report

Measures implemented this year could bring down gas imports from Russia by over one-third, with additional temporary options to deepen these cuts to well over half while still lowering emissions.

Europe’s reliance on imported natural gas from Russia has again been thrown into sharp relief by Russia’s invasion of Ukraine on 24 February. In 2021, the European Union imported an average of over 380 million cubic metres (mcm) per day of gas by pipeline from Russia, or around 140 billion cubic metres (bcm) for the year as a whole. As well as that, around 15 bcm was delivered in the form of liquefied natural gas (LNG). The total 155 bcm imported from Russia accounted for around 45% of the EU’s gas imports in 2021 and almost 40% of its total gas consumption.

Progress towards net zero ambitions in Europe will bring down gas use and imports over time, but today’s crisis raises specific questions about imports from Russia and what policy makers and consumers can do to lower them. This IEA analysis proposes a series of immediate actions that could be taken to reduce reliance on Russian gas, while enhancing the near-term resilience of the EU gas network and minimising the hardships for vulnerable consumers.

A suite of measures in our 10-Point Plan, spanning gas supplies, the electricity system and end-use sectors 1 , could result in the EU’s annual call on Russian gas imports falling by more than 50 bcm within one year – a reduction of over one-third. These figures take into account the need for additional refilling of European gas storage facilities in 2022 after low Russian supplies helped drive these storage levels to unusually low levels. The 10-Point Plan is consistent with the EU’s climate ambitions and the European Green Deal and also points towards the outcomes achieved in the IEA Net Zero Emissions by 2050 Roadmap, in which the EU totally eliminates the need for Russian gas imports before 2030.

We also consider possibilities for Europe to go even further and faster to limit near-term reliance on Russian gas, although these would mean a slower near-term pace of EU emissions reductions. If Europe were to take these additional steps, then near-term Russian gas imports could be reduced by more than 80 bcm, or well over half.

The analysis highlights some trade-offs. Accelerating investment in clean and efficient technologies is at the heart of the solution, but even very rapid deployment will take time to make a major dent in demand for imported gas. The faster EU policy makers seek to move away from Russian gas supplies, the greater the potential implications in terms of economic costs and/or near-term emissions. Circumstances also vary widely across the EU, depending on geography and supply arrangements.

Reducing reliance on Russian gas will not be simple, requiring a concerted and sustained policy effort across multiple sectors, alongside strong international dialogue on energy markets and security. There are multiple links between Europe’s policy choices and broader global market balances. Strengthened international cooperation with alternative pipeline and LNG exporters – and with other major gas importers and consumers – will be critical. Clear communication between governments, industry and consumers is also an essential element for successful implementation.

- Download the summary infographic Download "Download the summary infographic"

- Report + infographic (French) Download "Report + infographic (French)"

- Report + infographic (German) Download "Report + infographic (German)"

- Report + infographic (Italian) Download "Report + infographic (Italian)"

- Report + infographic (Japanese) Download "Report + infographic (Japanese)"

- Report + infographic (Spanish) Download "Report + infographic (Spanish)"

- Report + infographic (Chinese) Download "Report + infographic (Chinese)"

- Summary infographic (Polish) Download "Summary infographic (Polish)"

1. No new gas supply contracts with Russia

- Gas import contracts with Gazprom covering more than 15 bcm per year are set to expire by the end of 2022, equating to around 12% of the company’s gas supplies to the EU in 2021. Overall, contracts with Gazprom covering close to 40 bcm per year are due to expire by the end of this decade.

- This provides the EU with a clear near-term window of opportunity to significantly diversify its gas supplies and contracts towards other sources, leveraging the options for imports provided by its large LNG and pipeline infrastructure.

Impact: Taking advantage of expiring long-term contracts with Russia will reduce the contractual minimum take-or-pay levels for Russian imports and enable greater diversity of supply.

2. Replace Russian supplies with gas from alternative sources

- Complementing the point above, our analysis indicates that production inside the EU and non-Russian pipeline imports (including from Azerbaijan and Norway) could increase over the next year by up to 10 bcm from 2021. This is based on the assumptions of a higher utilisation of import capacity, a less heavy summer maintenance schedule, and production quotas/caps being revised upwards.

- The EU has greater near-term potential to ramp up its LNG imports, considering its ample access to spare regasification capacity. 2 LNG trade is inherently flexible, so the crucial variables for the near-term are the availability of additional cargoes, especially those that have some contractual leeway over the destination, and competition for this supply with other importers, notably in Asia.

- The EU could theoretically increase near-term LNG inflows by some 60 bcm, compared with the average levels in 2021. However, all importers are fishing in the same pool for supply, so (in the absence of weather-related or other factors that limit import demand in other regions) this would mean exceptionally tight LNG markets and very high prices.

- Considering current forward prices and the LNG supply-demand balance, we have factored into our 10-Point Plan a 20 bcm increase in the EU’s LNG imports over the next year. The timely procurement of LNG can be facilitated by enhanced dialogue with LNG exporters and other importers, increased transparency, and efficient use of capacities at LNG regasification terminals.

- The increases in non-Russian pipeline and LNG deliveries assume a concerted effort to tackle methane leaks, both across Europe, where leaks are estimated at 2.5 bcm a year from oil and gas operations, and among other non-European suppliers - especially those that flare significant quantities of gas today.

- There is limited potential to scale up biogas and biomethane supply in the short term because of the lead times for new projects. But this promising low-carbon sector offers important medium-term upside for the EU’s domestic gas output. The same consideration applies to production of low-carbon hydrogen via electrolysis, which is contingent on new electrolyser projects and new low-carbon generation coming online. Increased output of low-carbon gases is vital to meet the EU’s 2030 and 2050 emissions reduction targets.

Impact: Around 30 bcm in additional gas supply from non-Russian sources.

3. Introduce minimum gas storage obligations to enhance market resilience

- Gas storage plays a key role in meeting seasonal demand swings and providing insurance against unexpected events, such as surges in demand or shortfalls in supply, that cause price spikes. The value of the security provided by gas storage is even greater at a time of geopolitical tensions.

- The current tight seasonal price spreads in European gas markets do not provide sufficient incentive for storage injections ahead of the 2022-23 heating season, as demonstrated by the results of the recent gas storage capacity auctions in the EU. A harmonised approach to minimum storage obligations for commercial operators in the EU’s single gas market, together with robust market-based capacity allocation mechanisms, would ensure the optimal use of all available storage capacity in the EU.

- Our analysis, based on the experience of recent years, suggests that fill levels of at least 90% of working storage capacity by 1 October are necessary to provide an adequate buffer for the European gas market through the heating season. Given the depleted levels of storage today, gas injection in 2022 needs to be around 18 bcm higher than in 2021.

- Regional coordination of gas storage levels and access can provide an important element of solidarity among EU member states and reinforce their gas supply security ahead of the next winter season.

Impact: Enhances the resilience of the gas system, although higher injection requirements to refill storage in 2022 will add to gas demand and prop up gas prices.

Power sector

4. accelerate the deployment of new wind and solar projects.

- In 2022, record additions of solar PV and wind power capacity and a return to average weather conditions are already expected to increase the EU’s output from these renewable sources by over 100 terawatt-hours (TWh), a rise of more than 15% compared with 2021.

- A concerted policy effort to fast-track further renewable capacity additions could deliver another 20 TWh over the next year. Most of this would be utility-scale wind and solar PV projects for which completion dates could be brought forward by tackling delays with permitting. This includes clarifying and simplifying responsibilities among various permitting bodies, building up administrative capacity, setting clear deadlines for the permitting process, and digitalising applications.

- Faster deployment of rooftop solar PV systems can reduce consumer bills. A short-term grant programme covering 20% of installation costs could double the pace of investment (compared with the IEA’s base case forecast) at a cost of around EUR 3 billion. This would increase annual output from rooftop solar PV systems by up to 15 TWh.

Impact: An additional 35 TWh of generation from new renewable projects over the next year, over and above the already anticipated growth from these sources, bringing down gas use by 6 bcm.

5. Maximise generation from existing dispatchable low-emissions sources: bioenergy and nuclear

- Nuclear power is the largest source of low emissions electricity in the EU, but several reactors were taken offline for maintenance and safety checks in 2021. Returning these reactors to safe operations in 2022, alongside the start of commercial operations for the completed reactor in Finland, can lead to EU nuclear power generation increasing by up to 20 TWh in 2022.

- A new round of reactor closures, however, would dent this recovery in output: four nuclear reactors are scheduled to shut down by the end of 2022, and another one in 2023. A temporary delay of these closures, conducted in a way that assures the plants’ safe operation, could cut EU gas demand by almost 1 bcm per month.

- The large fleet of bioenergy power plants in the EU operated at about 50% of its total capacity in 2021. These plants could generate up to 50 TWh more electricity in 2022 if appropriate incentives and sustainable supplies of bioenergy are put in place.

Impact: An additional 70 TWh of power generation from existing dispatchable low emissions sources, reducing gas use for electricity by 13 bcm.

6. Enact short-term measures to shelter vulnerable electricity consumers from high prices

- With today’s market design, high gas prices in the EU feed through into high wholesale electricity prices in ways that can lead to windfall profits for companies. This has significant implications for the affordability of electricity, as well as for the economic incentives for the broader electrification of end-uses, which is a key element of clean energy transitions.

- We estimate that spending by EU member states to cushion the impact of the energy price crisis on vulnerable consumers already amounts to a commitment of around EUR 55 billion.

- Increases in electricity costs are unavoidable to a certain extent when gas (and CO 2 ) prices are high. But current wholesale markets create the potential for profits for many electricity generators and their parent companies that are well in excess of the costs related to operations or capital recovery. Current market conditions could lead to excess profits of up to EUR 200 billion in the EU for gas, coal, nuclear, hydropower and other renewables in 2022. 3

- Temporary tax measures to raise rates on electricity companies’ windfall profits could be considered. These tax receipts should then be redistributed to electricity consumers to partially offset higher energy bills. Measures to tax windfall profits have already been adopted in Italy and Romania in 2022.

Impact: Brings down energy bills for consumers even when natural gas prices remain high, making available up to EUR 200 billion to cushion impacts on vulnerable groups. 4

End-use sectors

7. speed up the replacement of gas boilers with heat pumps.

- Heat pumps offer a very efficient and cost-effective way to heat homes, replacing boilers that use gas or other fossil fuels. Speeding up anticipated deployment by doubling current EU installation rates of heat pumps would save an additional 2 bcm of gas use within the first year, requiring a total additional investment of EUR 15 billion.

- Alongside existing policy frameworks, targeted support for investment can drive the scaling up of heat pump installations. Ideally, this is best combined with upgrades of the homes themselves to maximise energy efficiency gains and reduce overall costs.

- Replacing gas boilers or furnaces with heat pumps is also an attractive option for industry, although deployment may take longer to scale up.

- A shift from gas to electricity for heating buildings could have the corresponding effect of pushing up gas demand for power generation, depending on the situation. However, any increase would be much lower than the overall amount of gas saved. Such a shift would also transfer seasonal swings in demand from the gas market to the power market.

Impact: Reduces gas use for heating by an additional 2 bcm in one year.

8. Accelerate energy efficiency improvements in buildings and industry

- Energy efficiency is a powerful instrument for secure clean energy transitions, but it often takes time to deliver major results. In this plan, we consider how to pick up the rate of progress, focusing on measures that can make a difference quickly.

- At present, only about 1% of the EU’s building stock is renovated each year. A rapid extension to an additional 0.7%, targeting the least efficient homes and non-residential buildings, would be possible through standardised upgrades, mainly via improved insulation. This would save more than 1 bcm of gas use in the space of a year and would also bring benefits for employment, though it would require parallel efforts to improve supply chains for materials and workforce development.

- This boost to the near-term rate of building retrofits and heat pump deployment accelerates changes that are part of EU policy frameworks. By 2030, the European Union’s Energy Efficiency Directive and Energy Performance of Buildings Directive, within the Fit for 55 framework, are projected to reduce gas demand in buildings by 45 bcm per year compared with today.

- Many households are installing smart heating controls (smart thermostats) to reduce energy bills and improve home comfort, and this is a simple process that can be scaled up quickly. Tripling the current installation rate of about one million homes per year would reduce gas demand for heating homes by an extra 200 mcm a year at a total cost of EUR 1 billion. These devices can be incentivised through existing programmes such as subsidies to households or utility obligation schemes.

- Annual maintenance checks of gas boilers can be used to ensure hot water boilers in homes are set at a temperature that optimises efficiency, no higher than 60 °C.

- Helping small businesses (SMEs) become more efficient will save energy and also help protect those businesses from price volatility. Many EU states have effective programmes to offer energy efficiency audits and advice to SMEs that can save energy quickly and effectively. Scaling these up to offer them to 5% of SMEs would deliver immediate annual energy savings of 250 mcm.

Impact: Reduces gas consumption for heat by close to an additional 2 bcm within a year, lowering energy bills, enhancing comfort and boosting industrial competitiveness.

9. Encourage a temporary thermostat adjustment by consumers

- Many European citizens have already responded to Russia’s invasion of Ukraine in various ways, via donations or in some cases by directly assisting refugees from Ukraine. Adjusting heating controls in Europe’s gas-heated buildings would be another avenue for temporary action, saving considerable amounts of energy.

- The average temperature for buildings’ heating across the EU at present is above 22°C. Adjusting the thermostat for buildings heating would deliver immediate annual energy savings of around 10 bcm for each degree of reduction while also bringing down energy bills.

- Public awareness campaigns, and other measures such as consumption feedback or corporate targets, could encourage such changes in homes and commercial buildings. Regulations covering heating temperatures in offices could also prove to be an efficient policy tool.

Impact: Turning down the thermostat for buildings’ heating by just 1°C would reduce gas demand by some 10 bcm a year.

Cross-cutting

10. step up efforts to diversify and decarbonise sources of power system flexibility.

- A key policy challenge for the EU in the coming years is to scale up alternative forms of flexibility for the power system, notably seasonal flexibility but also demand shifting and peak shaving. For the moment, gas is the main source of such flexibility and, as such, the links between gas and electricity security are set to deepen in the coming years, even as overall EU gas demand declines.

- Governments therefore need to step up efforts to develop and deploy workable, sustainable and cost-effective ways to manage the flexibility needs of EU power systems. A portfolio of options will be required, including enhanced grids, energy efficiency, increased electrification and demand-side response, dispatchable low emissions generation, and various large-scale and long-term energy storage technologies alongside short-term sources of flexibility such as batteries. EU member states need to ensure that there are adequate market price signals to support the business case for these investments.

- Flexibility measures to reduce industrial electricity and gas demand in peak hours are particularly important to alleviate the pressure on gas demand for electricity generation.

- Domestically sourced low-carbon gases – including biomethane, low-carbon hydrogen and synthetic methane – could be an important part of the solution, but a much greater demonstration and deployment effort will be required.

Impact: A major near-term push on innovation can, over time, loosen the strong links between natural gas supply and Europe’s electricity security. Real-time electricity price signals can unlock more flexible demand, in turn reducing expensive and gas-intensive peak supply needs.

Additional fuel switching options

Going faster and further – additional fuel switching options in the power sector.

Other avenues are available to the EU if it wishes or needs to reduce reliance on Russian gas even more quickly – but with notable trade-offs. 5 The main near-term option would involve switching away from gas use in the power sector via an increased call on Europe’s coal-fired fleet or by using alternative fuels – primarily liquid fuels – within existing gas-fired power plants.

Given that these alternatives to gas use would raise the EU’s emissions, they are not included in the 10-Point Plan described above. However, they could displace large volumes of gas relatively quickly. We estimate that a temporary shift from gas to coal- or oil-fired generation could reduce gas demand for power by some 28 bcm before there was an overall increase in the EU’s energy-related emissions.

The larger share of this potential decrease in gas demand would be possible through gas-to-coal switching: an additional 120 TWh in coal-fired generation could cut gas demand by 22 bcm in one year. In addition to opportunities to run on biomethane, nearly a quarter of the EU’s fleet of gas-fired power plants is capable of using alternative fuels – nearly all in the form of liquid fuels. Taking advantage of this capability could displace another 6 bcm of natural gas demand a year, depending on sufficient financial incentives to switch fuels and the availability of those fuels.

If this fuel-switching option were to be fully exercised in addition to the complete implementation of the 10-Point Plan described above, it would result in a total annual reduction in EU imports of gas from Russia of more than 80 bcm, or well over half, while still resulting in a modest decline in overall emissions.

We have not included additional near-term measures to curb industrial demand, because of the risk of wider knock-on effects on the European economy.

The EU has access to more than 200 bcm per year of regasification capacity, including the possibility to bring in gas via UK LNG terminals. However, there is limited interconnection capacity in some areas, notably from Spain to France, which constrains the use of Spanish regasification capacity for imports to other European countries.

Assuming gas prices of EUR 22/MMbtu and CO 2 prices of EUR 90/tonne.

The amounts would depend on how the measures are designed, as well as on other factors affecting the overall profitability of the electricity companies.

We also examined the possibilities to bring down industrial use, especially for feedstocks. On the latter, there is limited scope to improve conversion yields, so a reduction in feedstock gas demand would in practice mean reduced chemical production, with important potential knock-on effects along value chains (e.g. in 2021, the food industry in some countries was disrupted because the supply of CO 2 to food-packing companies was sourced from ammonia plants, which stopped production because of high natural gas prices).

Reference 1

Reference 2, reference 3, reference 4, reference 5, cite report.

IEA (2022), A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas , IEA, Paris https://www.iea.org/reports/a-10-point-plan-to-reduce-the-european-unions-reliance-on-russian-natural-gas, Licence: CC BY 4.0

Share this report

- Share on Twitter Twitter

- Share on Facebook Facebook

- Share on LinkedIn LinkedIn

- Share on Email Email

- Share on Print Print

Subscription successful

Thank you for subscribing. You can unsubscribe at any time by clicking the link at the bottom of any IEA newsletter.

Switch language:

Global fragmentation and uncertainty are hurdle to energy transition – report

The World Energy Council’s 2024 World Energy Issues Monitor report details analysis of the energy transition by nearly 1,800 energy leaders in more than 100 countries.

- Share on Linkedin

- Share on Facebook

The World Energy Council has published its annual World Energy Issues Monitor report, Redesigning Energy in 5D, detailing analysis of the energy transition by nearly 1,800 energy leaders in more than 100 countries, who were surveyed in early 2024 following the conclusion of the COP28 energy conference in Dubai.

The report shows that fragmented leadership across the global energy landscape, fuelling disorderly energy transitions, is driving uncertainty about the transition.

Go deeper with GlobalData

Middle East Energy Transition Market Analysis by Sectors (Power, El...

Africa energy transition market analysis by sectors (power, electri..., premium insights.

The gold standard of business intelligence.

Find out more

Specifically, the surveyed leaders highlighted competing global and regional geopolitical agendas, the evolution of energy security concerns to encompass critical minerals and demand-driven energy shocks and disruptions, and the varying regional nature of climate action priorities that have converged to shape a distinctly uncertain path to achieving net zero.

For a smoother energy transition, the report lists five key areas of change: decarbonisation programmes, digitalisation schemes, demand-side management, diversification of energy sources and a more decentralised approach to energy transitions. It also identified transmission grid strengthening and expansion, flexible energy storage solutions, new mixes of policy and regulations, and social inclusivity as globally recognised areas of focus and action.

Dr Angela Wilkinson, secretary-general and CEO of the World Energy Council, said: “While the direction towards zero-emissions energy systems is clear, the journey to a sustainable future is fraught with challenges. This year’s World Energy Issues Monitor edition reflects global uncertainty about the collective ability to manage clean and inclusive energy transitions at speed and scale. The context of an increasingly fragmented energy leadership landscape and competitive geopolitics is exacerbating uncertainties.”

Across the world, apart from in North America, volatile commodity prices are seen as a key source of concern, with 34% of European respondents to the survey describing it as an area of extreme uncertainty. Stakeholder communication around engaging diverse communities to develop renewable energy sources was considered significant, with 50% of respondents claiming it is an area of high impact. A third of respondents, of which 41% were from Europe and 26% from Asia, cited that risk to peace and ongoing wars also drives a high level of uncertainty.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

The World Energy Council is hosting its 2024 World Energy Congress in Rotterdam, the Netherlands, gathering around 5,000 delegates and 18,000 attendees to discuss the revolutionary innovations and pressing concerns of the global energy sector.

If you have not done so already, you can register for the 26th World Energy Congress here .

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

Copenhagen Infrastructure Partners acquires majority stake in Elgin Energy

World energy congress 2024: power technology’s upcoming coverage, landinfra and eiffel link for 1.8gw clean energy projects in sweden, dominion energy gets 764mw of new solar capacity approved in virginia, sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

Future Power Technology : Power Technology Focus (monthly)

Thematic Take (monthly)

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

Content Search

2024 regional human development report: a complex landscape of progress and challenges - pacific island countries, attachments.

To strengthen the future outlook for our Blue Pacific, human development must be mainstreamed across the region

5 April 2024

Suva, Fiji: Pacific Island Countries continue to grapple with a complex development landscape, states a new report launched in Suva today. While progress across several key indicators has been made, the UN Development Programme (UNDP) 2024 Asia-Pacific Human Development Report, launched at the Pacific Islands Forum Secretariat, highlights that persistent disparities and ongoing disruptions threaten to derail further advancement.

The report shows that since the early 2000s there has been a regression on key human development indicators across the Pacific, with heightened human insecurity, and a potentially more turbulent future creating an urgent need for change.

Income inequality remains deeply entrenched, both within Pacific Islands Countries and when comparing the Pacific against its neighbors in Asia. Hundreds of thousands across the Pacific remain confined to the informal sector; in Tonga alone the informal sector accounts for 97 percent of the country’s workforce.

The pandemic saw numerous Pacific Island Countries suffer serious losses in income from tourism, remittances and manufacturing that employ many informal workers. The hardest hit in these already poor households were women, who have suffered serious setbacks in gender equality and empowerment.

The Pacific has seen its worst decline in gender equality in two decades. On current trajectory, the 2030 agenda is projected to be realized some 35 years late – in 2065 – with crucial action needed on Goal 5 (Gender Equality) where not a single indicator has been achieved thus far.

The Pacific grapples with entrenched gender inequalities manifested in limited political participation, economic disparity, and a disturbing prevalence of gender-based violence. However, positive trends in girls' education and the commitment of Pacific nations to address the aforementioned issues offer a glimmer of hope for achieving gender equality.

Other points of note from the report include:

The Pacific has seen a surge in adult literacy rates from 1990 to 2022, moving from 87.6 percent in 1990 to 94.2 percent in 2022. Tertiary education completion rates also improved, rising from 4.5 to 5.3 percent across the same reporting period.

Under-five mortality rates improved from 88.3 live births per thousand in 1980 to 38.9 per thousand in 2022, with life expectancy rising from 64 to 72 years in the same reporting period.

40 percent of the region's people are digitally excluded, with notable gender and urban-rural inequities.

While the Pacific contributes 0.1 percent of total carbon emissions, the region has seen the largest impact of climate shocks. The fiscal measures required to tackle this crisis are on the verge of exhaustion, with six out 10 Pacific Island Countries at risk of high debt distress.

Every US$1 invested in risk reduction and prevention can save up to US$15 in post-disaster recovery. Every US$1 invested in making infrastructure disaster-resilient saves US$4 through fewer disruptions and reduced economic impacts.

To catch up on the human development backlog and confront the turbulent times that lie ahead, the region’s development strategies need to focus more on improving the lives of both current and future generations.

UNDP Pacific Office in Fiji Resident Representative, Munkhtuya Altangerel, said that to advance indicators across the Pacific our focus must be placed on mainstreaming human development, leveraging technology and innovation, and the creation of a governance space that is fit for the future.

“In a world defined by uncertainty, we need a renewed sense of solidarity to tackle our interconnected challenges. We must focus on both empowering people today and prioritizing the well-being of our young people – the future stewards of our Blue Pacific. This means making smart investments in their human development: education, health, and opportunities that will equip them to thrive and tackle challenges yet to come.

“Revitalizing our development strategies to close existing gaps and boost human security is essential: an unrelenting focus on governance, the politics of reform, and on the day-to-day practice of delivery all being required should we wish to boost sustainable development across our Blue Pacific.

“Our work is far from complete, and we must listen to and amplify the voices of Pacific peoples, as they are leading the way toward a future where no one is left behind,” Ms. Altangerel said.

To view the full report, visit: https://www.undp.org/asia-pacific/publications/making-our-future-newdirections-human-development-asia-and-pacific

To view the Pacific Snapshot of the regional report, visit: https://www.undp.org/pacific/publications/2024-pacific-snapshot-asia-pacific-human-development-report

For more information contact : Nick Turner | Communications and Advocacy Specialist, UNDP Pacific Office in Fiji | [email protected]

Related Content

Unhcr global report 2022, rapport global 2022.

World + 47 more

Foresight Africa: Top Priorities for the Continent In 2023

World + 41 more

ADB Annual Report 2022: Building Resilience in Challenging Times

- Motorcycles

- Car of the Month

- Destinations

- Men’s Fashion

- Watch Collector

- Art & Collectibles

- Vacation Homes

- Celebrity Homes

- New Construction

- Home Design

- Electronics

- Fine Dining

- Costa Palmas

- L’Atelier

- Reynolds Lake Oconee

- Scott Dunn Travel

- Wilson Audio

- 672 Wine Club

- Sports & Leisure

- Health & Wellness

- Best of the Best

- The Ultimate Gift Guide

- George Lucas Is the World’s Richest Celebrity Billionaire: Report

Taylor Swift, Michael Jordan, Jay-Z, and Rihanna also made the list.

Abby montanez, abby montanez's most recent stories.

- Signed Contracts for Manhattan Homes Priced at $20 Million and Above Rose 140 Percent From a Year Ago: Report

- Jeff Bezos Just Dropped $90 Million on a Third Indian Creek Island Property

- Share This Article

George Lucas’s decision to sell his production company back in 2012 has certainly paid off.

Related Stories

- Steve Cohen Thinks a 4-Day Workweek Is Coming, So He’s Investing in Golf

KISS Just Sold Its Music Catalog and Name for Over $300 Million

- The 8 Best Blue-Light Glasses to Protect Your Eyes From All Those Screens

Fellow filmmaker Steven Spielberg, best known for cinematic blockbusters including Jaws and Jurassic Park , came in second place with an estimated $4.8 billion career earnings. Spielberg built his fortune by taking home a percentage of gross box office sales for each of his movies, Forbes reported. As of 2018, he holds the title of the world’s highest-grossing director, per the Wrap .

Three other TV and film legends made the list as well, including Peter Jackson ( The Lord of the Rings , The Hobbit) , who became the seventh richest celeb with a $1.5 billion net worth. Actor, director, and producer Tyler Perry secured the eighth spot with $1.4 billion, and Dick Wolf, the creator of long-running crime franchises such as Law & Order , landed in 13th place with an estimated $1.2 billion career earnings.

Back at the top, former NBA star Michael Jordan nabbed third with a $3.2 billion net worth. The 61-year-old basketball player became the first billionaire athlete in 2015 thanks in large part to his many, many brand partnerships including his lucrative deal with Nike. Last summer, he also cashed in on his investment in the Charlotte Hornets and offloaded his majority stake in the team for an eye-watering $3 billion valuation.

Three additional sports stars managed to crack the top 14—including Tiger Woods, who landed in the 10 spot with a net worth of $1.3 billion. Close behind were LeBron James and Magic Johnson, who sat for 11th and 12th place, respectively, with career earnings of $1.2 billion.

Similarly, pop star Rihanna made her $1.4 billion fortune thanks to her two uber-successful brands. There’s Fenty Beauty, which was founded under LVMH, along with her lingerie company, Savage X Fenty. Last (but not least) was Taylor Swift , who, unlike the Barbados-born singer, became a first-time billionaire off her music and concert earnings alone. Forbes estimated her net worth at $1.1 billion, the bulk of which came from record-breaking ticket and merchandise sales from the Eras Tour and the film that followed.

Abigail Montanez is a staff writer at Robb Report. She has worked in both print and digital publishing for over half a decade, covering everything from real estate, entertainment, dining, travel to…

Read More On:

- Billionaires

- kim kardashian

- Michael Jordan

- Taylor Swift

Ryan Reynolds and Rob McElhenney Bought a U.K. Soccer Club in 2021. It Now Owes Them $11 Million.

Kim Kardashian Is Being Sued By the Judd Foundation. Here’s Why.

This New 131-Foot Catamaran Comes With See-Through Hulls

Culinary Masters 2024

MAY 17 - 19 Join us for extraordinary meals from the nation’s brightest culinary minds.

Give the Gift of Luxury

Latest Galleries in News

The History of Luxury in 50 Objects, From Cleopatra’s Barge to Louis Vuitton Trunks

The 25 Best Robb Report Stories of the Year, According to Our Editors

More from our brands, groupe clarins acquires domain for integrated and responsible sourcing, coyotes making one last attempt to build an arena in arizona, amazon prime video extends wnba exclusive streaming pact for two more years, early kaws painting apparently owned by fashion mogul marc eckō to hit the auction block at sotheby’s, this best-selling under-desk walking pad is over $100 off on amazon today.

IMAGES

VIDEO

COMMENTS

World Fuel Services Corporation (the "Company") was incorporated in Florida in July 1984 and along with its consolidated subsidiaries is referred to collectively in this Annual Report on Form 10-K ("2020 10-K Report") as "World Fuel," "we," "our" and "us."

The Investor Relations website contains information about World Kinect Corporation's business for stockholders, potential investors, and financial analysts.

World Kinect Investor Day March 13, 2024. World Kinect (NYSE: WKC) is a leading global energy distribution and management company, offering a broad suite of solutions across the energy product spectrum. In addition to delivering our core energy and fuel solutions, we are advancing the energy transition by increasing access to renewable energy ...

World Fuel Services Corporation is a leading global energy management company that provides fuel, logistics, and payment solutions to various industries. In this report, you can find detailed financial and operational information about the company's performance in 2020, including its segments, markets, and strategies.

MIAMI --(BUSINESS WIRE)--Feb. 24, 2022-- World Fuel Services Corporation (NYSE: INT) Fourth-Quarter 2021 Highlights Total gross profit of $215.2 million , up 30% year-over-year GAAP net income of $15.4 million , or $0.25 per diluted share Adjusted net income of $17.6 million , or $0.28 per diluted

subsidiary of World Fuel Services UK Holding Company II Limited, also incorporated in England and Wales in the United Kingdom, which is a wholly-owned subsidiary of World Kinect Corporation (formerly known as World Fuel Services Corporation), (the "Ultimate Parent Undertaking"), incorporated in the state of Florida, in the United States of America.

World Fuel Services Corporation Reports Fourth Quarter and Full Year 2022 Results. Full year gross profit of $1.1 billion, up 38% vs prior year. Net income of $21 million for the quarter and $114 ...

Our principal executive office is located at 9800 Northwest 41 st Street, Miami, Florida 33178 and our telephone number at this address is 305‐428‐8000. Our internet address is https://www.wfscorp.com and the investor relations section of our website is located at https://ir.wfscorp.com.

Inside World Fuel Services Corp's 10-K Annual Report: Revenue - Product Highlight. However, beginning in the latter part of the first quarter of 2020 and continuing through 2021, we experienced a material decline in volume and related profitability primarily due to the impact of the COVID-19 pandemic on the marine transportation industry.

The following information was filed by World Fuel Services Corp (INT) on Thursday, February 23, 2023 as an 8K 2.02 statement, which is an earnings press release pertaining to results of operations and financial condition. ... Inside World Fuel Services Corp's 10-K Annual Report: Financial - Expense Highlight. However, a significant or prolonged ...

Fourth-Quarter 2020 Highlights. Total gross profit of $165.2 million, down 42% year-over-year. GAAP net loss of $3.6 million, or $0.06 per diluted share. Adjusted net income of $1.1 million, or $0 ...

World Fuel Services Annual Report 2023 Form 10-K (NYSE:INT) Published: February 24th, 2023 PDF generated by stocklight.com . Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ...

At World Kinect, we ensure energy is there exactly when and where the world needs it today while investing in accelerating a more sustainable tomorrow. Keeping everything moving by solving complex challenges with a robust, scalable distribution platform across air, land, and sea. This is who we are. This is what we do. Every minute. Every hour ...

financial statements of World Fuel Services Aviation Limited (the "Company") for the year ended 31 December 2022. Principal activities The Company, limited by share capital and incorporated in England and Wales in the United Kingdom, is a wholly-owned subsidiary of World Fuel Services Europe, Ltd., which is a wholly-owned subsidiary of

MIAMI--(BUSINESS WIRE)-- World Fuel Services Corporation (NYSE: INT) today announced that it has published its 2020-2021 Sustainability Report, which provides a comprehensive overview of the company's progress in environmental, social and governance areas of critical importance to its business, employees, customers, suppliers, shareholders and other stakeholders.

Kinect Corporation (formerly known as World Fuel Services Corporation) , the Ultimate Parent Undertaking, are discussed from page 8 of the 2022 annual report on Form 10-K which does not form part of this report but is publicly available. World Fuel Services European Holding Company I, Ltd Strategic Report for the Year ended 31 December 2022 1

A fuel for the trading strategy. Market Data Policy. The purposes and forms of MOEX market data usage. ... IR-services. IR-notifications subsription and meeting request forms. Investor Relations. Investor Relations. ... Annual Report of Open Joint Stock Company "Moscow Exchange MICEX-RTS" for 2012 (pdf, ...

Russia's oil output strategy, as it has been formulated in ES-2035, sets the upper limit of production at a relatively flat level of 560 tons per annum from 2024 to 2035, in the optimistic scenario. In 2018, Russia's oil output amounted to 555.7 million tons, capped by the OPEC+ agreement.

Fuel report — March 2024 World Energy Outlook 2023. Flagship report — October 2023 Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach ... could result in the EU's annual call on Russian gas imports falling by more than 50 bcm within one year - a reduction of over one-third. These figures take into account the need for ...

First-Quarter 2021 Highlights. Total gross profit of $191.6 million, down 26% year-over-year. GAAP net income of $18.9 million, or $0.30 per diluted share. Adjusted net income of $20.7 million, or $0.33 per diluted share. Adjusted EBITDA of $61.9 million. "One year after the onset of the pandemic, we are optimistic about a continuing ...

Water Quality Reports. The City of Moscow, as a regulated Public Drinking Water System, is required to provide a Consumer Confidence Report (CCR) to its customers annually. The water we supply is tested regularly to ensure compliance with state and federal safe drinking water regulations.

The World Energy Council has published its annual World Energy Issues Monitor report, Redesigning Energy in 5D, detailing analysis of the energy transition by nearly 1,800 energy leaders in more than 100 countries, who were surveyed in early 2024 following the conclusion of the COP28 energy conference in Dubai.. The report shows that fragmented leadership across the global energy landscape ...

Other points of note from the report include: The Pacific has seen a surge in adult literacy rates from 1990 to 2022, moving from 87.6 percent in 1990 to 94.2 percent in 2022.

George Lucas's decision to sell his production company back in 2012 has certainly paid off. The Star Wars creator now is the world's richest celebrity billionaire with a whopping $5.5 billion ...

MIAMI--(BUSINESS WIRE)--Oct. 27, 2022-- World Fuel Services Corporation (NYSE: INT) . Third-Quarter 2022 Highlights. Total gross profit of $322.3 million, up 63% year-over-year ; GAAP net income of $42.5 million, or $0.68 per diluted share ; Adjusted net income of $41.8 million, or $0.67 per diluted share ; Adjusted EBITDA of $122.5 million "We delivered solid results across all of our ...

World Fuel Services also offers natural gas and electricity, as well as energy advisory services, including programs for ... Exchange Commission ( SEC ) filings, including the Company s most recent Annual Report on Form 10-K filed with the SEC . Actual results may differ materially from any forward-looking statements due to risks and ...