Register to save time now and in the future

The password must be 8-50 characters.

Can not include your user id. Must contain one character from three of the following groups:

- Upper case letter (A-Z),

- Lower case letter (a-z),

- Number (0-9),

- Special characters like ! # $ % & ' * + - / = ? ^ _ ` { | } ~ . @ .

- No spaces allowed.

Your cart is empty.

Problems and Solutions for Federal Income Taxation

Select subscription type

Terms & conditions.

Subscribers receive the product(s) listed on the Order Form and any Updates made available during the annual subscription period. Shipping and handling fees are not included in the annual price.

Subscribers are advised of the number of Updates that were made to the particular publication the prior year. The number of Updates may vary due to developments in the law and other publishing issues, but subscribers may use this as a rough estimate of future shipments. Subscribers may call Customer Support at 800-833-9844 for additional information.

Subscribers may cancel this subscription by: calling Customer Support at 800-833-9844; emailing [email protected]; or returning the invoice marked "CANCEL".

If subscribers cancel within 30 days after the product is ordered or received and return the product at their expense, then they will receive a full credit of the price for the annual subscription.

If subscribers cancel between 31 and 60 days after the invoice date and return the product at their expense, then they will receive a 5/6th credit of the price for the annual subscription. No credit will be given for cancellations more than 60 days after the invoice date. To receive any credit, subscriber must return all product(s) shipped during the year at their expense within the applicable cancellation period listed above.

Subscription are automatically renewed without any action on the subscriber's part

Subscribers receive the product(s) listed on the Order Form and any Supplementation releases, replacement volumes, new editions and revisions to a publication ('Updates') made available during the annual subscription period, included in the annual price. Shipping and handling fees are not included in the annual price.

Under the automatic renewal option, at least 60 days before each renewal date, subscribers will receive a renewal notice, which include the cost of the next annual subscription. The renewal price will likely include a small increase over the prior year's subscription rate.

If Subscriber selects the automatic Shipment Subscription program,they will receive and be billed for future updates without any action on their part.The total price includes the product(s) listed in the Order Form and any updates for a limited period(minimum period of 30 days) after order is placed ("Order Window").Shipping and handling fees are not include in the grand total price.

After Order Window,all Updates will be automatically shipped to subscriber with an invoice at the then-current grand total price on a semi annual or annual basis as the Updates become available.Subscriber can expect a price increase over the current retail price.The retail price does not and will not include shipping and handling.

Subscriber are advised of the number of updates that were made to the particular Publication the prior year.The number of Updates may vary due to developments in the law and other publishing issues,but Subscriber may use use this as a rough estimate of future shipments.Subscribers may call Customer Support at 800-833-9844 for additional information on update frequency and price.

All shipments may be returned, at subscribers expense, for full credit of the grand total price within 30 days of receipt.

Shipments may not be returned, and no credits will be issued, more than 30 days after receipt.

Return of a shipment, other than the initial purchase, will not cancel subscribers' subscription.

Subscribers' enrollment in the Automatic Subscription Program may be cancelled anytime by: returning the invoice marked "CANCEL SUBSCRIPTION"; calling Customer Support at 800-833-9844; or emailing [email protected].

Print Terms and Conditions

Product description

View a sample of this title using the ReadNow feature

The third edition of Problems and Solutions for Federal Income Taxation is a problem-based, transaction-oriented treatment of the basics of federal taxation that incorporates developments in the law through 2022, including the Inflation Reduction Act. Changes since the second edition include new treatments of clean energy and climate change tax credits, pandemic tax relief, loan forgiveness, sexual harassment settlements, the charitable deduction, retirement plans, and education tax credits.

This edition includes more than 400 problems with complete solutions. Each problem set is introduced with a concise overview. The book contains 42 chapters that are accessible by topic, code section, case name, or keyword. No matter the main text assigned, this comprehensive problem set will aid students in assessing and refining their knowledge of the federal income tax and its application to typical fact patterns. Coverage includes treatments of individual and family income tax principles, business taxation, real estate taxation, intellectual property taxation, deferred compensation, characterization of income and losses, and tax procedure. The final chapters include introductions to corporate and partnership taxation, international taxation, and federal transfer taxation.

epub is protected by Adobe DRM.

eBooks, CDs, downloadable content, and software purchases are noncancelable, nonrefundable and nonreturnable. Click here for more information about LexisNexis eBooks. The eBook versions of this title may feature links to Lexis+® for further legal research options. A valid subscription to Lexis+® is required to access this content.

9781531027223

Related products

- Questions? Chat with us! Books or CPE CPE (offline) available Mon - Fri between 9 a.m.-7 p.m. ET" data-placement="bottom" class="chat-tooltip-top chat-link-text graybutton" id="liveagent_button_online_5731C0000008Zmi_3" href="javascript:;"> CPE

Tax Problems and Solutions Handbook (Currently Unavailable)

Author(s): Jim Buttonow

- Chapter 1: IRS Practice: Working with the IRS After Filing

- Chapter 2: IRS Audits and Underreporter Notices

- Chapter 3: IRS Collection

- Chapter 4: IRS Penalties and Penalty Relief

- Chapter 5: IRS Unfiled and Past-Due Returns

- Chapter 6: Spousal Issues

NEW! Get $100 back at filing when a Full Service expert does your taxes. Must file by 3/31 | Get started

7 Common Tax Problems (With Solutions)

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to print (Opens in new window)

Written by TurboTaxBlogTeam

- Published Jan 16, 2024

When it comes to doing your taxes, it’s natural to feel stressed out. Although most people can breathe a sigh of relief after filing their annual returns, tens of millions of taxpayers face a variety of tax problems that extend the stress every year.

We go over the top tax problems Americans face today to help you prepare for whatever may come your way. Learn what each problem is and how to solve them with our helpful tax tips .

Hoping to avoid these tax issues altogether? TurboTax helps you accurately report your income, claim deductions, and credits so that you can feel confident about filing.

Top Tax Issues Taxpayers Face Today

After digging into the most recent data from the IRS, we’ve compiled the most prevalent tax problems affecting taxpayers today.

Table of Contents

Note: All statistics in this post are from the IRS Data Book , unless another source is listed.

1. Tax Penalties

When you fail to comply with the tax code, you’re subject to IRS penalties . Penalties exist for not following filing, reporting, or payment requirements outlined by the IRS. The typical consequence for tax code mistakes is a civil penalty. And though it is not common, criminal prosecution is also possible depending on the circumstances.

In 2021, the IRS assessed nearly 41 million civil penalties amounting to $37 billion in taxpayer dollars. About 82% of these penalties came from individual and estate and trust tax returns. Of the individual and estate and trust penalties, the two most common were for failing to pay (51%) and estimated tax penalties for self-employed individuals (33%).

- Failure to pay penalty

- Estimated tax penalty

- Failure to file penalty

- Bad check penalty

How to fix it:

If you receive a notice of a tax penalty from the IRS, you should comply with all instructions. You’ll want to read through the letter to verify that the information is correct and make sure to respond by the specified date.

For example, if you received a penalty for tax non-payment , you can either pay what you owe or request a penalty waiver. If you’re requesting penalty relief , make sure you gather the necessary documentation to support your claim.

2. Unpaid Taxes

Millions of taxpayers filed their tax returns, owed additional taxes , and didn’t pay by the deadline. When you have unpaid taxes, you’re hit with a 0.5% penalty for every month the amount isn’t paid in full. On top of this, the IRS will charge interest on the balance you owe.

Recent data from the IRS shows taxpayers owe more than $120 billion in assessed taxes, penalties, and interest from over 9 million delinquent accounts. If you’re in this situation, find out about your options for resolving this issue below.

Recently, the IRS announced that it was granting relief for nearly 5 million tax returns for 2020-2021 to help those who owe back taxes.

The best course of action to resolve unpaid taxes is to pay the full amount to the IRS as soon as possible. Doing so will mean that you owe less in added penalties and interest over the long term.

Not everyone can pay in full right away, so check out these other options for solving unpaid taxes.

- Apply for a long-term payment plan to pay in monthly installments

- Look into an offer of compromise , which allows you to settle your debt for less than the amount you owe

- Try requesting a temporary delay in collections if you expect your financial situation to improve

3. Math Error Notices

There are a number of reasons why people find doing their taxes stressful and crunching the numbers is one of them. Last year, the IRS sent math error notices to millions of taxpayers for mistakes like computational errors, incorrect values, missing entries, and failing to meet eligibility requirements. TurboTax takes the guesswork out of taxes, just answer simple questions and upload your documents or meet with an expert to avoid errors.

When it comes to math errors, the IRS has more freedom to go ahead and correct your mistakes without you having to adjust anything. Read the section below to see what you need to do if you get a math error notice in the mail.

When you receive a math error notice, read it carefully. Depending on which notice you received, you may owe taxes, have your refund adjusted, or your tax balance may be zero (i.e., you don’t owe anything but also don’t get a refund).

You need to respond to the notice within 60 days of receiving it. If you owe taxes, you should pay them by the deadline. If you don’t owe anything, you still need to respond, but you won’t need to pay.

4. Non-Filers

Every year, millions of individuals and businesses fail to file their required tax returns by the tax deadline. The IRS uses third-party information returns (e.g., W2s or 1099s) to identify non-filers, create substitute tax returns, and assess what taxes, penalties, and interest are owed.

If you miss the regular or extended tax deadline , you should file your taxes as soon as possible. Then it’s crucial to pay any taxes owed in full, as soon as you can. You’ll be charged a failure to file penalty of 5% on any outstanding taxes for each month you’re late, in addition to interest.

If you have yet to file but don’t owe taxes (i.e, you expect a refund), you won’t be charged any penalties or interest.

5. Tax-Related Identity Theft

Tax-related identity theft happens when someone steals your personal information (e.g., your Social Security number) to file a tax return and fraudulently claim a tax refund. Millions of Americans are suspected to be or are victims of tax-related identity theft every year.

In 2021, the IRS issued nearly five million Identity Protection Personal Identification Numbers (IP PIN) to taxpayers dealing with identity theft. IP PINs help verify your identity with the IRS so that you can file your return.

It’s important to still file your taxes on time, even if you’re the victim of tax-related identity theft. You should receive a CP01A Notice containing your IP PIN, and you can use it to file your taxes. If you need an IP PIN, use the IRS’s Get an IP PIN tool to obtain one.

Remember to respond immediately to any notices from the IRS, and don’t forget to go to IdentityTheft.gov to learn what steps you should take to protect your other financial information as a victim of identity theft.

6. Underreported Income

When an individual’s tax return doesn’t match third-party information returns, this is considered underreported income. Underreported income is the leading contributor to America’s tax gap, which is the difference between the amount of taxes owed to the government and the amount that is actually paid voluntarily and on time.

Not only is the tax gap a large amount of lost revenue, but the IRS must also spend time and resources on resolving income discrepancies. In 2021, over two million cases were closed under the IRS’s Automated Underreporter Program, but it’s still estimated that $600 billion is lost annually.

If you’ve received a Notice of Underreported Income (Notice CP2000), you should review the information carefully before deciding how to respond. If you agree with the proposed changes, mark this in your response and send it out on time. You’ll need to pay any outstanding taxes, penalties, and interest.

Even if you disagree with the notice, you should still respond on time and provide an explanation of why you disagree and any supporting documents. From there, you’ll work with the IRS to resolve any discrepancies.

7. Tax Audits

A recent tax refund stress survey found that a quarter of American taxpayers are worried that a mistake on their annual tax return will cause them to get audited by the IRS. In reality, much fewer people are actually audited. In fact, less than one percent (~739,000 taxpayers) were audited in 2021.

Although tax audits sound scary, they’re really just an examination of your tax return. The IRS checks your return to make sure that the information you report is verified and accurate. Learn about what to do in case the IRS audits your tax return below.

First, read through your letter to see what information the IRS is requesting from you. Next, you’ll need to gather your requested documents and send them to the IRS for verification. Make sure you respond in a timely manner and don’t miss the deadline specified in your letter.

Audits conclude in one of three ways: no change, agreed, or disagreed.

- No change means that your information is verified and no changes are needed.

- Agreed means that you understand and accept the IRS’s proposed changes.

- Disagreed means you understand but don’t accept their proposed changes, and will undergo further review.

Don’t forget that you can contact TurboTax Audit Support for help if you’re ever unsure of what to do with a tax audit.

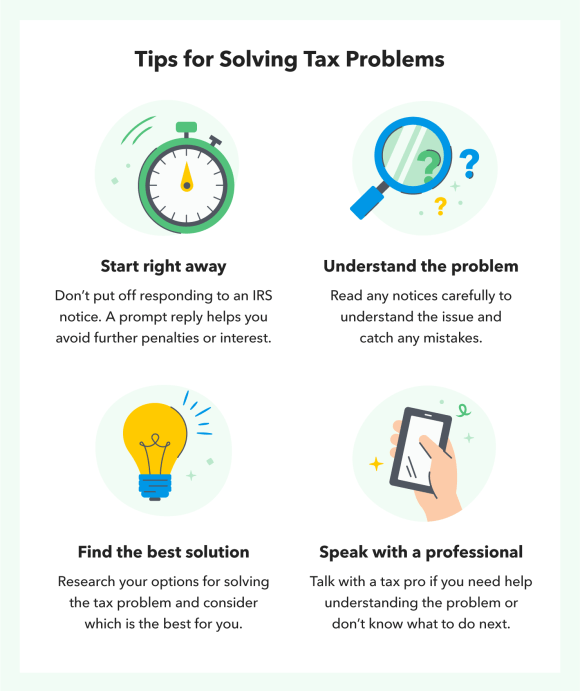

How To Solve Tax Problems: 4 Essential Tips

Whether you’re dealing with a tax audit or have unpaid taxes, tax problems may seem daunting to resolve. It’s important to take a deep breath and remember that these issues are more common than you’d think. Follow these tips to help you down the right path to fix your situation.

Get Started As Soon As Possible

If you’ve received a notice or letter from the IRS, plan to respond by the designated deadline. Replying in a timely manner and supplying the necessary documentation helps avoid miscommunication with the IRS.

The IRS will examine your response and any evidence you provided to back up your claims. This process can take months to resolve, and starting right away prevents it from going on longer than is necessary.

Understand the Problem

Understanding the issue is essential to resolving it. Always read your letter carefully to see what the tax problem is and what steps you should take to fix it. Even if you don’t agree with it, follow all instructions for responding and provide evidence and records that back up your claim.

Find the Best Solution for Your Situation

Remember to always do some research on what solutions are available to you. It’s possible to appeal many types of tax problems like a tax audit or underreported income. You can also discuss ways to waive penalties or accommodate your financial situation through payment plans.

No matter what moves you made last year, TurboTax will make them count on your taxes. Whether you want to do your taxes yourself or have a TurboTax expert file for you, we’ll make sure you get every dollar you deserve and your biggest possible refund – guaranteed.

Sources: IRS 1 2 3 4 5 6 7 8

Previous Post

Golden Globe Swag Bags: What Are the Tax Implications?

Tax Year 2023: Does Your State Have an Extended Deadline?

More from TurboTaxBlogTeam

Leave a Reply Cancel reply

Browse related articles.

- Tax Planning

Married or Divorced? Tips for Filing Your Taxes if You …

Seven tax tips for newly married couples.

I Love You, You’re Perfect, Now Let’s File Join…

Together in life and taxes too, 4 ways filing your taxes early can pay off big [infogra….

Tips to Help Stop Procrastinating (on Your Taxes)

Tax Tips for Same-Sex Couples

Podcast: First Time Filing Taxes? Start Here!

Last-minute tax tips.

Six Tips to Beat the October 15th Extended Tax Deadline

- Students, Learn & Study

- Account & Ebooks

- Bookstores & Libraries

- Browse Subjects

- Browse Authors

- Africana Studies

- Anthropology and Archaeology

- Business and Accounting

- Community College

- Criminal Justice

- Logic and Mathematics

- Medicine, Health, and Nutrition

- Political Science

- Regional Interest

- Sociology and Religion

- Sports and Risk Management

This book has been replaced by a newer edition:

Problems and Solutions for Federal Income Taxation, Third Edition

by John A. Miller , Jeffrey A. Maine

2023, 384 pp, paper, ISBN 978-1-5310-2721-6

Capital Gains Problems and Solutions, Income Tax Solved Practical Problems AY 2022 - 23

Capital gains problems and solutions income tax solved practical problems.

1. Compute the taxable Capital Gains of Mrs. Geeta for the Assessment Year, 2020–21: DU 2020

Ans: Calculation of Total Taxable Capital Gain of Mrs. Geeta for the previous year 2019 – 20 (Assessment Year 2020 – 21)

2. Miss Priya sells agricultural land situated in an urban area for Rs. 11, 31,000 (brokerage paid @ 2%) on 31 st March, 2020. (Cost of acquisition was Rs. 3, 82,000 on 1 st March, 2006. It was used for agricultural purposes, from 2010 to date of sale.). On 31 st March, 2020, she owns only one residential house property. On 6 th April, 2020, she purchases the following assets: DU 2020

(i) Agricultural land for Rs. 1, 20,000.

(ii) A residential house property for Rs. 5, 00,000.

Find out the capital gain chargeable to tax for the Assessment Year, 2020-21. CII for the Financial Year, 2005-06 is 117.

Ans: Calculation of Total Taxable Capital Gain of Miss Priya for the previous year 2019 – 20 (Assessment Year 2020 – 21)

3. Mr. Arindam owns two houses at Jorhat and Dibrugarh. He transfers the following long-term capital assets during 2017-18: DU 2019

Mr. Arindam purchases the following assets:

Ascertain the amount of capital gain chargeable to tax for the Assessment Year, 2018-19. Can Mr. Arindam claim exemptions under Sections 54, 54EC and 54F?

Ans: Calculation of Taxable Capital Gain

4. Mr. S submits the following particulars about the sale of assets during the year, 2014-15: DU 2018

Calculate the amount of capital gain chargeable to tax for the assessment year 2015-16 if CII for 2014-15 is 1024.

Solution: Calculation of Long Term Capital Gain

5. Mr. Anurag owns two residential houses one at Jorhat and other at Dibrugarh. He submits the following information about sale of assets during previous year, 2015-16 (CII-1081) DU 2017

Cost Inflationary Index for

1990-91 – 182

2000-01 – 406

2001-02- - 426

2015-16 – 1081

You are required to compute taxable capital gain of Mr. Anurag for the Assessment year, 2016-17.

Solution: Computation of Capital Gains for the assessment year 2016-17

Note: Exemption u/s 54F has been allowed out of capital gain of plot as there is no capital gain left from any other asset. If there had been capital gain from other assets as well the exemption u/s 54F shall be calculated in such a manner, which is most beneficial to the assessee.

Purchases Value of House = 13, 00,000

Exemption claimed u/s 54 = 2, 38,000

Exemption u/s 54 F = [(10, 62, 000/11, 20,000)*1, 69,670] = 1, 60,884 (Upto available income)

6. Mr. A transfer the following capital assets: DU 2016

Determine the amount of capital gain chargeable to tax for the assessment year, 2015-16 considering CII of 1984-85, 2012-13 and 2014-15 at 125, 852 and 1024 respectively.

7. Following are the particulars of assets head by Vandana during the previous year, 2014 – 15: DU 2015

Calculate the taxable amount of capital gain if CII for 2014 – 15 is 1024. Security transaction tax on sale of shares has been paid.

Ans: Similar to Q.N. 8

8. During the year ended on 31st March, 2013, Mr. A sold the following assets: DU 2014

a. Shop purchased in 1985 – 86 (cost inflation index 133) for Rs. 18,000 was sold for Rs. 1, 70,000.

b. Machinery purchased in 1983 – 84 (cost inflation index 125) for Rs. 50,000 (written down value on 1-4-12 Rs. 35,000) was sold for Rs. 60,000.

c. Furniture purchased on 1-5-2012 for Rs. 1,000 was sold for Rs. 1,300.

d. Machinery purchased on 1-5-2012 for Rs. 10,000 was sold for Rs. 12,000.

e. Agricultural land in Agra purchased in 1979 – 80 for Rs. 10,000 [(fair market value on 1-4-81 (cost inflation index 100) being Rs. 15,000] was sold for Rs. 1, 60,000.

f. One residential house purchased in 1987 – 88 (cost inflation index 150) costing Rs. 30,000 was sold for Rs. 2, 20,000.

During the year, he bought another house for his residence for Rs. 4, 00,000. Compute the amount of taxable capital gain for the assessment year 2013-14.

Computation of CG for the Assessment year 2013-14

Computation of STCG

(Note: In case of depreciable asset, only WDV in the beginning is considered. No depreciation in the year of sale)

Calculation of Long term Capital Gain

Capital Gains:

STCG = 27,300

LTCG = Nil

Total = 27,300

Posted by Kumar Nirmal Prasad

You might like, 0/post a comment/comments.

Kindly give your valuable feedback to improve this website.

Post a Comment

Contact form.

IMAGES

VIDEO

COMMENTS

Practical Problems (Solution) in Income tax (2021-22) Dr. R. K. Jain, ,CA Nikhil Gupta,2021-10-09 1..Important Definitions 2. Assessment on Agricultural Income, 3. Exempted Incomes, 4.Residence and Tax Liability 5. Income from Salaries 6. Income from Salaries (Retirement and Retrenchment) 7. Income from House Property 8.

top income tax bracket your income falls into as set by law. While useful in some contexts, statutory marginal tax rates do not paint a complete picture. "Effective" marginal tax rates are useful to calculate because they account for the multiple layers of taxes (such as the income tax and payroll tax) alongside relevant deductions and credits.

The problems and solutions in this book can be used with any regular tax text-book to assist the student in learning federal tax law. This is because, in addition to a word index and a table of contents, this book contains tables that allow a student to access the appropriate problems and solutions by code section number, case name,

The problems and solutions in this book can be used with any regular tax text-book to assist the student in learning federal tax law. This is because, in addition to a word index and a table of contents, this book contains tables that allow a student to access the appropriate problems and solutions by code section number, case name,

The salient features of the present edition are:All the Problems and Solutions have been thoroughly revised in the light of up-to-date amendments in Income tax Law and Rules for Assessment Year 2020-21.Almost all numerical questions given at the end of the chapters of the authors' other publications on Income-tax (viz., Income-tax Law and Accounts, Aaykar Vidhan evam Lekhe, Law and Practice ...

The third edition of Problems and Solutions for Federal Income Taxation is a problem-based, transaction-oriented treatment of the basics of federal taxation that incorporates developments in the law through 2022, including the Inflation Reduction Act. Changes since the second edition include new treatments of clean energy and climate change tax ...

1. Multi-Bracket Personal Income Tax Systems and Solution Federal tax systems have had multi tax brackets (from 1 to 56) during the past 150 years. The existing tax system has 7 tax brackets, 224 (7×4×8) withholding formulas, and 21-page Withholding Tables for withholding taxes and 28 taxable income ranges, 28 formulas, and 12-page Tax Table ...

system has 7 tax brackets, 224 (7×4×8) withholding formulas, and 21-page Withholding Tables for withholding taxes and 28 taxable income ranges, 28 formulas, and 12-page Tax Table for tax returns. Two simple slope formulas are used to match/simplify complex income tax brackets, 224 (7×4×8)

Y Pai. Problems and Solutions in Income Tax (including Short Questions) Dr. H. C. Mehrotra, Dr. S. P. Goyal,2020-07-01 The. salient features of the present edition are: All the Problems and Solutions have been thoroughly revised in the light of up-to-date amendments in Income tax Law and Rules for Assessment Year 2020-21.

The Tax Problems and Solutions Handbook covers a range of taxpayer problems encountered in 50 state jurisdictions and the District of Columbia. It is the ideal guide to common tax problems faced by individuals and the possible solutions practitioners can implement on their clients' behalf. Order a softcover copy today.

Income Tax Act, 1961 provides for levy, administration, collection and recovery of Income Tax. It provides ... The computational / practical problems have been solved on the basis of the provisions of income tax laws applicable for AY 2020-21 i.e. FY 2019-20. The study material is relevant for the students for June, 2020 examinations ownward. ...

5. Tax-Related Identity Theft. Tax-related identity theft happens when someone steals your personal information (e.g., your Social Security number) to file a tax return and fraudulently claim a tax refund. Millions of Americans are suspected to be or are victims of tax-related identity theft every year.

1..Important Definitions 2. Assessment on Agricultural Income, 3. Exempted Incomes, 4.Residence and Tax Liability 5. Income from Salaries 6. Income from Salaries (Retirement and Retrenchment) 7. Income from House Property 8. Depreciation 9. Profits and Gains of Business or Profession 10. Capital Gains 11. Income from Other Sources 12.

The third edition of Problems and Solutions for Federal Income Taxation is a problem-based, transaction-oriented treatment of the basics of federal taxation that incorporates developments in the law through 2022, including the Inflation Reduction Act. Changes since the second edition include new treatments of clean energy and climate change tax credits, pandemic tax relief, loan forgiveness ...

The income tax act of 1961 has been in effect from the first day of April 1962 (sec 1). It contains 298 sec, sub sections, schedules etc. the income tax rules of 1962 was framed by ... Solution: Calculation of taxable income of Mr. Raja S.No Income O.R N.O.R N.R. 1 Dividend from Indian company - - - 2 Dividend from foreign company, received in ...

The second edition of Problems and Solutions for Federal Income Taxation reflects the many significant changes made by the Tax Cuts and Jobs Act for years 2018 and beyond. This edition includes more than 400 problems with solutions. Each problem set is introduced with a concise overview. The book contains 42 chapters that are accessible by topic, code section, case name or keyword.

Feedback is solicited and welcome so that further student-friendly features may be introduced in the book from time to time. 22 Deepali, Pitampura, Delhi - 110034. Email : [email protected] Phone ...

Solutions: August 20 Selling price P180, (1) August 20, 2021 (2,000 shares) Less: Cost ... Sample Problems- Income Tax. PROBLEM (LOSSES) Destroy and Build Company purchased a piece of land with a building thereon for P2,500, allocated under a contract of sale at P1,500,000 for the land and P1,000,000 for the building. It had no use for the ...

The salient features of the present edition are:All the Problems and Solutions have been thoroughly revised in the light of up-to-date amendments in Income tax Law and Rules for Assessment Year 2022-23.Almost all numerical questions given at the end of the chapters of the authors' other publications on Income-tax (viz., Income-tax Law and Accounts, Aaykar Vidhan evam Lekhe, Law and Practice ...

Didde Corp. prepared the following reconciliation of income per books with income per tax return for the year ended December 31, 2015: Book income before income taxes $1,200, Add temporary difference Construction contract revenue which will reverse in 2016 160, Deduct temporary difference Depreciation expense which will reverse in equal amounts ...

The least of the following is exempt from tax: 50% of salary, (residential house situated at Mumbai, Kolkata, Delhi or Chennai) and 40% of salary where residential house is situated at any other place; Actual house rent allowance received by the employee; Excess of rent paid over 10% of salary Leave Encashment [S. 10(10AA)]

Capital Gains Problems and SolutionsIncome Tax Solved Practical Problems. 1. Compute the taxable Capital Gains of Mrs. Geeta for the Assessment Year, 2020-21: DU 2020. Rs. Ans: Calculation of Total Taxable Capital Gain of Mrs. Geeta for the previous year 2019 - 20 (Assessment Year 2020 - 21) 2. Miss Priya sells agricultural land situated ...

The Income tax Act 1961 which came into force on 1st April 1962, The Income Tax Rules 1962 and Finance Act passed by the parliament every year, govern the income tax law in India. The rates of tax for a financial year are determined by the Finance Act. Question and Answers (2 Marks) Who is liable to pay income tax?