Investment Manager Cover Letter Examples & Writing Tips

Use these Investment Manager cover letter examples and writing tips to help you write a powerful cover letter that will separate you from the competition.

Table Of Contents

- Investment Manager Example 1

- Investment Manager Example 2

- Investment Manager Example 3

- Cover Letter Writing Tips

Investment managers are responsible for the management and investment of assets. They work with clients to identify their investment goals and create a plan that meets their needs.

In order to be successful in this field, you need to have a strong understanding of financial markets and investment strategies.

Use these examples and tips to write a cover letter that shows hiring managers that you’re the right person for the job.

Investment Manager Cover Letter Example 1

I am excited to be applying for the Investment Manager position at Topdown Investment. I have more than 10 years of experience in the investment industry and have a proven track record of success in managing and growing investment portfolios. I am confident that I have the skills and experience to be a valuable asset to your team.

In my previous role as an Investment Manager at ABC Investment, I was responsible for the management and growth of a $10 million portfolio. I was able to achieve an annualized return of 15% during my tenure, which outperformed the industry average by 5%. I am also highly proficient in investment analysis and portfolio management software.

I am a strategic thinker with a strong attention to detail. I have a proven ability to make sound investment decisions based on thorough analysis of data. I am also a team player and have a history of working collaboratively with other members of the investment team to achieve common goals.

I believe that my skills and experience would be a valuable addition to Topdown Investment. I look forward to discussing this opportunity further with you and to learning more about your company and its goals. Thank you for your time and consideration.

Investment Manager Cover Letter Example 2

I am writing in regards to the open Investment Manager position at your company. I am confident that I have the skills, experience, and qualifications that would make me the perfect candidate for the job.

I have been working in the investment management industry for the past three years and have a wealth of experience and knowledge in the field. I have a proven track record of success in delivering results and meeting or exceeding goals. I am a strategic thinker and can think outside the box to come up with innovative solutions to problems.

I am also a team player and have a strong track record of working collaboratively with others. I have a positive attitude and am always willing to lend a helping hand. I am also proactive and take the initiative to see tasks through to completion.

I am confident that I have the skills and qualifications that would make me the perfect candidate for the Investment Manager position. I would be grateful for the opportunity to discuss my qualifications in further detail with you. Thank you for your time and consideration.

Investment Manager Cover Letter Example 3

I am writing to express my interest in the Investment Manager position that you have posted. I believe that my experience and education make me a strong candidate for this position.

I have been working as an investment analyst for the past three years at XYZ Bank, where I have gained valuable experience in managing client portfolios. My work has included analyzing stocks, bonds, mutual funds and other securities, as well as recommending changes to existing portfolios. I have also gained experience in communicating with clients about their investments, including providing them with regular updates on their accounts.

My background in finance has given me a solid understanding of how the financial markets work, which has allowed me to develop a strong understanding of how to manage client portfolios effectively. I have also gained valuable experience in using computer programs such as Excel and Quicken to analyze data and create reports.

I believe that my skills and experience would be an asset to your company. I am confident that I can quickly learn any new programs or systems that are necessary for the job. I am also a quick learner who is able to adapt to new situations quickly. I am available to answer any questions that you may have for me.

Thank you for your time and consideration. I look forward to hearing from you soon.

Investment Manager Cover Letter Writing Tips

1. highlight your investment experience.

When writing a cover letter for an investment manager role, it’s important to highlight your investment experience. This can be done by providing specific examples of successful investments you’ve made in the past. You can also talk about how you’ve helped clients achieve their financial goals or increased their portfolio value.

2. Show your understanding of the market

In order to be successful as an investment manager, you need to have a strong understanding of the market. This can be shown in your cover letter by discussing current market trends or how you use data to make informed investment decisions.

3. Tailor your letter to the specific job opening

Each job opening will have different requirements, so it’s important to tailor your letter to the specific job opening. For example, if the job listing asks for someone with experience in a specific type of investment, then highlight any relevant experience you have in that area.

4. Proofread your cover letter

Proofreading your cover letter is essential, as it is one of the first things hiring managers will see. Make sure to spell-check and double-check that there are no errors in your resume or cover letter. Otherwise, you risk being disqualified before the employer even sees your qualifications.

Patent Engineer Cover Letter Examples & Writing Tips

Homeschool teacher cover letter examples & writing tips, you may also be interested in..., sales team leader cover letter examples & writing tips, business development representative cover letter examples, farm worker cover letter examples, hearing aid dispenser cover letter examples & writing tips.

Investment Manager cover letter examples

Are you looking for your next role as an investment manager?

Then you need to show the recruiter why they should invest in you with an engaging cover letter that highlights your most impressive experience in the field.

In this detailed guide, we’ll share our expert advice on how to write an impressive application, along with some investment manager cover letter examples.

CV templates

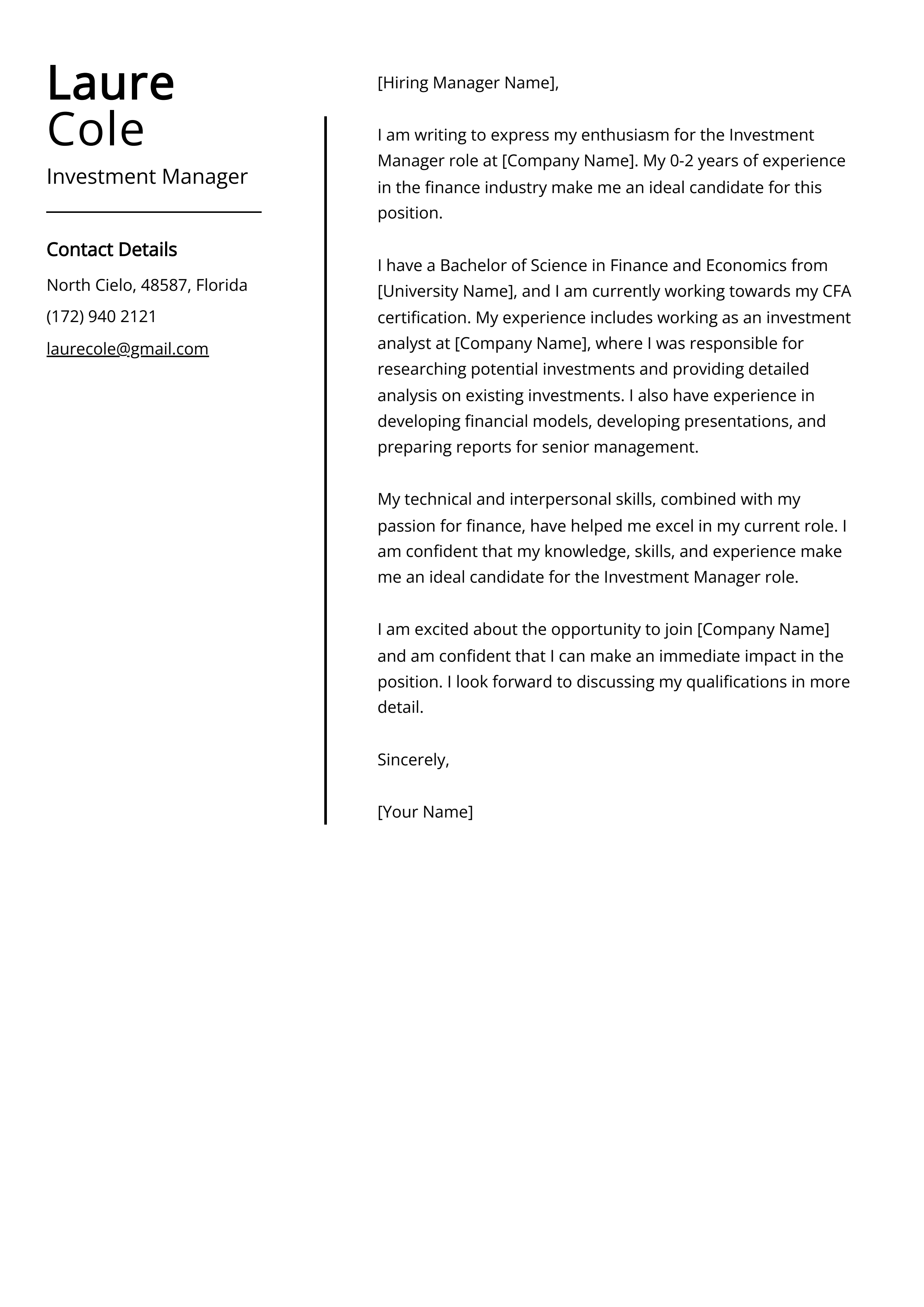

Investment Manager cover letter example 1

Investment Manager cover letter example 2

Investment Manager cover letter example 3

These 3 Investment Manager cover letter example s should provide you with a good steer on how to write your own cover letter, and the general structure to follow.

Our simple step-by-step guide below provides some more detailed advice on how you can craft a winning cover letter for yourself, that will ensure your CV gets opened.

How to write an Investment Manager cover letter

Here’s a simple process to write your own interview-winning cover letter.

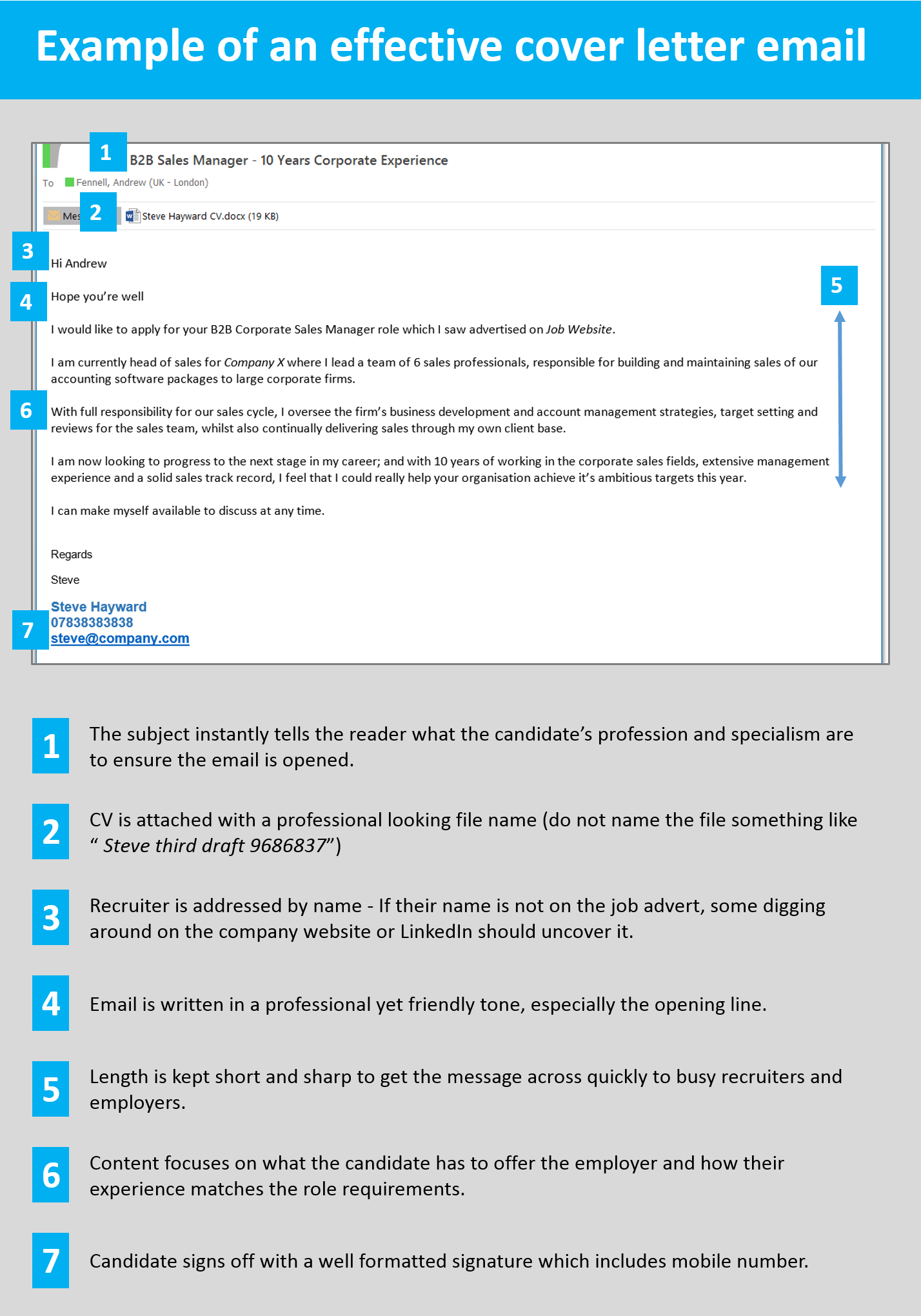

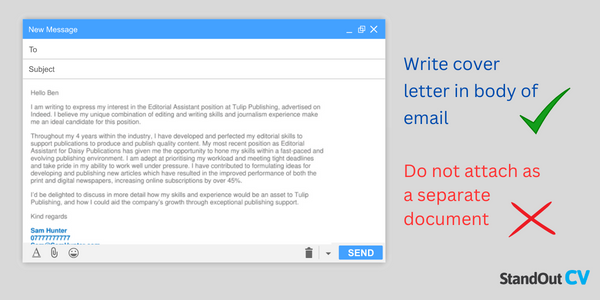

Write your cover letter in the body of an email/message

When writing your Investment Manager cover letter, it’s best to type the content into the body of your email (or the job site messaging system) and not to attach the cover letter as a separate document.

This ensures that your cover letter gets seen as soon as a recruiter or employer opens your message.

If you attach the cover letter as a document, you’re making the reader go through an unnecessary step of opening the document before reading it.

If it’s in the body of the message itself, it will be seen instantly, which hugely increases the chances of it being read.

Start with a friendly greeting

Start you cover letter with a greeting that is professional but friendly.

This will build rapport with the recruiter whilst showing your professionalism.

- Hi, hope you’re well

- Hi [insert recruiter name]

- Hi [insert department/team name]

Avoid overly formal greetings like “Dear sir/madam ” unless applying to very traditional companies.

How to find the contact’s name?

Addressing the recruitment contact by name is an excellent way to start building a strong relationship. If it is not listed in the job advert, try these methods to find it.

- Check out the company website and look at their About page. If you see a hiring manager, HR person or internal recruiter, use their name. You could also try to figure out who would be your manager in the role and use their name.

- Head to LinkedIn , search for the company and scan through the list of employees. Most professionals are on LinkedIn these days, so this is a good bet.

Identify the role you are applying for

Once you have opened the cover letter with a warm greeting, you need to explain which role you are interested in.

Sometimes a recruitment consultant could be managing over 10 vacancies, so it’s crucial to pinpoint exactly which one you are interested in.

Highlight the department/area if possible and look for any reference numbers you can quote.

These are some examples you can add..

- I am interested in applying for the role of Investment Manager with your company.

- I would like to apply for the role of Sales assistant (Ref: 40f57393)

- I would like to express my interest in the customer service vacancy within your retail department

- I saw your advert for an IT project manager on Reed and would like to apply for the role.

See also: CV examples – how to write a CV – CV profiles

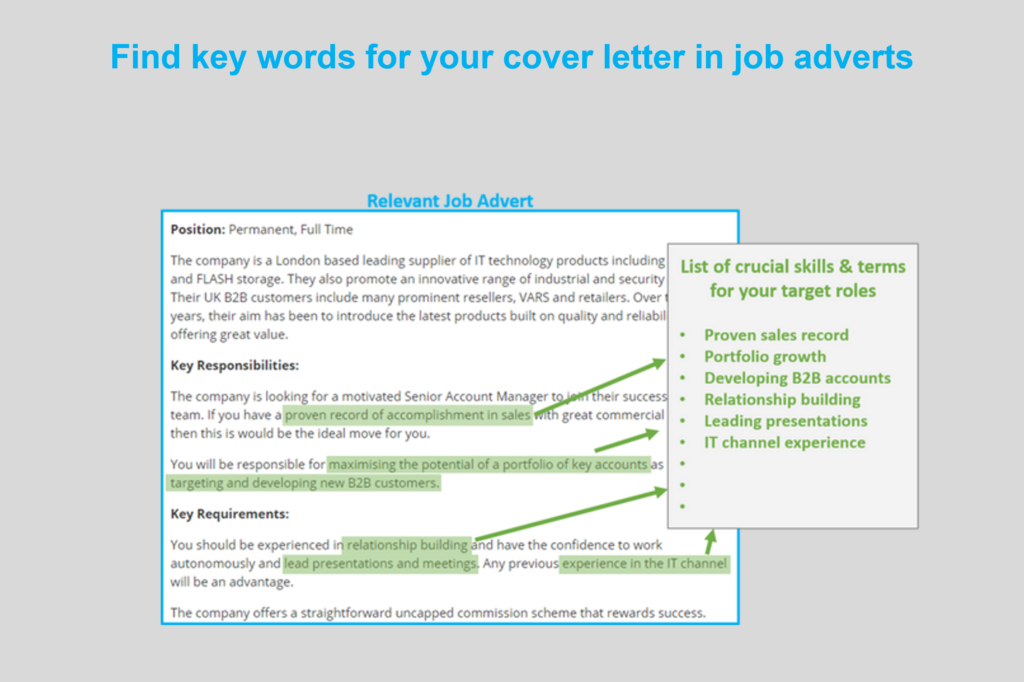

Highlight your suitability

The bulk of your cover letter should be focused around highlighting your suitability for the job you are applying to.

Doing this will show the recruiter that you are suitable candidate and encourage them to open your CV.

The best way to do this, is by studying the job advert you are applying to, and find out what the most important skills and knowledge are.

Once you know the most important requirements, you then need to highlight your matching skills to the recruiter. In a few sentences, tell them exactly why you are a good fit for the job and what you can offer the company.

Keep it short and sharp

When sending a job application to a recruiter or hiring manager, it is important to remember that they will normally be very busy and pushed for time.

Therefore, you need to get you message across to them quickly (in a matter of seconds ideally). So, keep your cover letter short and to-the-point. A long waffling cover letter will overwhelm recruiters when they are running through hundreds of emails in there inbox, but a concise one will get their attention.

So, keep your cover letter to just a few sentences long, and save the extensive detail for your CV.

Sign off professionally

To round of your cover letter, add a professional signature to the bottom, giving recruiters your vital contact information.

This not only gives various means of contacting you, it also looks really professional and shows that you know how to communicate in the workplace.

Include the following points;

- A friendly sign off – e.g. “Warm regards”

- Your full name

- Phone number (one you can answer quickly)

- Email address

- Profession title

- Professional social network – e.g. LinkedIn

Here is an example signature;

Warm regards,

Gerald Baker Senior Accountant 07887500404 [email protected] LinkedIn

Quick tip : To save yourself from having to write your signature every time you send a job application email, you can save it within your email drafts, or on a separate document that you could copy in.

What to include in your Investment Manager cover letter

Your Investment Manager cover letter will be unique to your situation, but there are certain content guidelines you should stick to for best results.

To attract and entice recruiters, stick with the following key subjects in your cover letter – adapting them to fit your profession and target jobs.

- Your professional experience – Employers will be keen to know if your experience is suitable for the job you are applying to, so provide a good summary of it in your cover letter.

- Your qualifications and education – Highlight your most relevant and high-level of qualification, especially if they are essential to the job.

- The positive impact you have made – Employers love to hear about the benefits you can bring to them, so shout about anything impressive you have done, such as saving money or improving processes.

- Your reasons for leaving – Use a few words of your cover letter to explain why you are leaving your current job and ensure you avoid any negative reasons.

- Your availability – Let recruiters know when you can start a new job . Are you immediately available, or do you have a month notice period?

Investment Manager cover letter templates

Copy and paste these Investment Manager cover letter templates to get a head start on your own.

Good morning, Blair

I am writing to express my strong interest in the Junior Investment Manager position at Santander UK, as advertised on SimplyHired. With a recently obtained BSc in Finance from the University of London, coupled with a drive for delivering exceptional results, I am excited about the opportunity to contribute my skills and enthusiasm to your esteemed firm.

Having completed a one-year internship at HSBC Bank in financial analysis, risk management, and portfolio optimisation, my skill set ensures that I can carry out investment research and asset allocation. I also played a role in managing of a £5M balanced portfolio and achieving an annualised return of 12% through outperforming the benchmark index by 3%. Additionally, I helped attain a 95% client retention rate and increase CSAT scores by 25% due to presenting insightful reports to business owners.

I am drawn to your company’s stellar reputation for delivering top-tier investment solutions and its commitment to nurturing young talent. I am excited about learning under experienced professionals.

I am available for an interview anytime next week and would welcome the opportunity to meet with you to discuss my competencies.

Kind regards

Darren Rooney

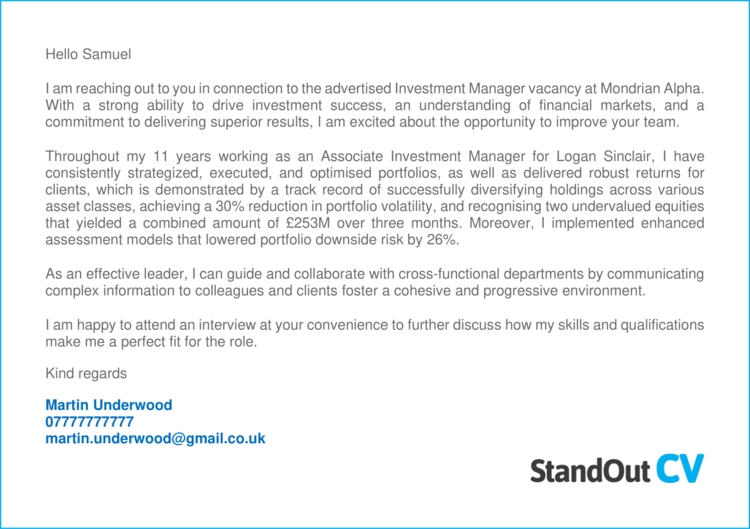

Hello Samuel

I am reaching out to you in connection to the advertised Investment Manager vacancy at Mondrian Alpha. With a strong ability to drive investment success, an understanding of financial markets, and a commitment to delivering superior results, I am excited about the opportunity to improve your team.

Throughout my 11 years working as an Associate Investment Manager for Logan Sinclair, I have consistently strategized, executed, and optimised portfolios, as well as delivered robust returns for clients, which is demonstrated by a track record of successfully diversifying holdings across various asset classes, achieving a 30% reduction in portfolio volatility, and recognising two undervalued equities that yielded a combined amount of £253M over three months. Moreover, I implemented enhanced assessment models that lowered portfolio downside risk by 26%.

As an effective leader, I can guide and collaborate with cross-functional departments by communicating complex information to colleagues and clients foster a cohesive and progressive environment.

I am happy to attend an interview at your convenience to further discuss how my skills and qualifications make me a perfect fit for the role.

Martin Underwood

I am thrilled to apply for the Senior Investment Manager position at Goodman Masson, as advertised on LinkedIn. With 20+ years of progressive experience, a distinguished ability to lead high-performing teams, and a strategic vision for optimising portfolios, I am excited about the opportunity to contribute my expertise to your esteemed organisation.

I have consistently driven investment agendas that deliver exceptional returns and outperform market benchmarks, with a proven track record of overseeing portfolios valued at over £3B, as well as empowering team members, mentoring analysts, and implementing efficient processes that boosted staff productivity by 27%. Furthermore, I created custom solutions which resulted into a 60%+ increase in client assets under management with five months.

I look forward to discussing how my global investment expertise, innovative mind-set, and commitment to achieving superior outcomes that align with your vision. Thank you for taking the time to consider my application, and please do to reach out to me to schedule an interview ASAP.

Taylor Styles

Writing an impressive cover letter is a crucial step in landing a Investment Manager job, so taking the time to perfect it is well worth while.

By following the tips and examples above you will be able to create an eye-catching cover letter that will wow recruiters and ensure your CV gets read – leading to more job interviews for you.

Good luck with your job search!

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Investment Manager Cover Letter Example

Writing a cover letter is an important step in the job application process. It allows you to show your personality, highlight your qualifications and demonstrate why you are the ideal candidate for the role. A well-crafted cover letter can make all the difference in securing an interview and ultimately, a job as an Investment Manager. To help you create a strong and effective cover letter, this guide provides you with essential tips and an example cover letter. With this information, you can create a persuasive cover letter that will help you stand out from the competition.

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples .

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

Investment Manager Cover Letter Sample

Dear [Hiring Manager Name],

I am writing to apply for the Investment Manager position at [Company Name]. With my extensive experience in the financial services industry, I am confident that I am the ideal candidate for this role.

Having worked as an Investment Manager for the past decade, I have a proven track record of successfully managing and developing portfolios. My experience has allowed me to gain a full understanding of the process of researching, analyzing, and investing in various financial instruments. I am also highly experienced in understanding the dynamics of global markets, as well as developing and executing trading strategies for clients.

Furthermore, I have a strong understanding of financial regulations and the importance of compliance. I have a bachelor’s degree in finance and a master’s degree in financial engineering. I have also obtained my Chartered Financial Analyst (CFA) designation and am currently studying for the Certified Investment Management Analyst (CIMA) designation.

I am an extremely organized, methods- driven individual who is able to plan, organize, and manage multiple tasks and priorities. I am also a strong communicator and have experience in building contacts with clients and other professional organizations.

I am confident that I have the right combination of skills and experience to make a success of this role. I am excited about the opportunity to join your team and help your business reach new heights.

I have attached my resume and I look forward to discussing the position in more detail. Thank you for your time and consideration.

[Your Name]

Create My Cover Letter

Build a profession cover letter in just minutes for free.

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Investment Manager cover letter include?

A strong Investment Manager cover letter should emphasize the candidate’s knowledge of financial instruments, their ability to manage assets, their experience in the field, and their professional demeanor.

In addition to providing a brief overview of their qualifications, the cover letter should include specific details about the candidate’s professional experience and accomplishments. Examples could include past investments that were successful, new strategies that were implemented, or specific techniques that were used to maximize returns.

The cover letter should also demonstrate the candidate’s understanding of the Investment Manager role and why they are a good fit for the company. They can mention their understanding of the company’s strategies and goals, as well as any relevant experience they may have that would be beneficial in meeting them.

Finally, the cover letter should be personalized to the individual company, making sure to highlight any qualifications or accomplishments that relate specifically to their operations. This will demonstrate that the candidate has taken the time to research the company and is genuinely interested in the role.

Investment Manager Cover Letter Writing Tips

Writing a cover letter for an Investment Manager position can be challenging, but there are several tips to make the process easier. Here are some tips to keep in mind when creating your cover letter:

- Make sure to explain why you are a great fit for the position. Describe your strengths, skills, and qualifications that make you the ideal candidate for the job.

- Include examples of successful investments you have made in the past and how they benefited the company.

- Highlight any awards or recognition you have received in the past that demonstrate your expertise and success in the field.

- Demonstrate your knowledge of current trends in the investment world.

- Explain why you are passionate about the field and why you want to be an Investment Manager.

- Tailor your cover letter to the specific company and position you are applying for.

- Include concrete examples and avoid using overly general language.

- Maintain a professional yet friendly tone throughout the letter.

- Always remember to proofread and edit your cover letter before sending it in.

Common mistakes to avoid when writing Investment Manager Cover letter

Writing a cover letter for Investment Manager position is essential in order to make a good impression on potential employers. Unfortunately, many jobseekers make common mistakes that can hurt their chances of getting an interview. Below are some of the most common mistakes to avoid when writing a cover letter for Investment Manager position.

- Not addressing the letter to the hiring manager: When applying for a job, it is important to address the cover letter to the right person. Make sure to research the company and use the hiring manager’s name and title in the salutation.

- Not including your contact information: Make sure to include your contact information in the letter. This should include your name, address, phone number, and e- mail address.

- Not customizing the letter for each job: Sending a generic cover letter to every job you apply for is a mistake. You should always tailor the letter to each specific job you are applying for by highlighting the skills and experience that make you the ideal candidate for the job.

- Not conveying enthusiasm: It is important to show your enthusiasm for the job in your cover letter. Make sure to highlight your passion and dedication to the job and the company you are applying for.

- Not focusing on the company: Your cover letter should focus on the company and how you can be an asset to them. Make sure to research the company and include examples of how you can bring value to the company.

- Not following the instructions: Always follow the instructions provided in the job posting. Be sure to include any requested documents or information that is required in the job posting.

- Not proofreading: It is essential to proofread your cover letter before submitting it. It is important to make sure that there are no errors or typos in the letter.

Key takeaways

Cover letters are an essential part of the job application process for Investment Managers. Crafting a well- written cover letter can help you stand out from the competition and increase your chances of landing the job. Here are some key takeaways for writing an impressive cover letter for an Investment Manager position:

- Highlight your qualifications: Investment Managers need to have a keen eye for the markets and a deep understanding of the financial world. Make sure to emphasize your experience in finance and accounting, as well as any certifications or qualifications you have.

- Showcase your track record: Demonstrate your success in past roles, such as any investments you have made that were successful. Mention any awards or accolades you have received for your work.

- Showcase your research skills: Investment Managers need to have strong research skills to stay up to date on the markets. Showcase your research skills by mentioning any reports or analyses you have written.

- Demonstrate your communication skills: Investment Managers need to be able to communicate effectively with clients, so be sure to showcase your excellent communication skills in your cover letter.

- Explain why you are a good fit: Explain why you are the perfect fit for the role, such as why you are the best candidate for the position or why you would be a great addition to the team.

- End on a strong note: Close your cover letter with a call to action and make sure to thank the reader for their time.

Frequently Asked Questions

1.how do i write a cover letter for an investment manager job with no experience.

Writing a cover letter for an Investment Manager position with no experience can be daunting. However, by following a few basic tips, you can create a professional and effective cover letter that tells potential employers why you are the perfect fit for their team.

When writing your cover letter, start by introducing yourself and briefly explaining why you are interested in the position. Next, emphasize the skills and knowledge you can bring to the role, such as a strong educational background in finance, attention to detail, and excellent communication skills. Finally, emphasize your enthusiasm for the job and how you plan to contribute to the success of the organization.

2.How do I write a cover letter for an Investment Manager job experience?

When writing a cover letter for an Investment Manager position with experience, you should use it as an opportunity to showcase your accomplishments and demonstrate how you can be an asset to the organization. Start by introducing yourself and briefly explaining why you are interested in the position. Then, emphasize your relevant experience, such as prior positions you’ve held in the industry, investments you’ve managed, and projects you’ve completed. Additionally, highlight any special skills and knowledge that you can bring to the role. Finally, end your cover letter by expressing your enthusiasm for the position and how you plan to contribute to the success of the organization.

3.How can I highlight my accomplishments in Investment Manager cover letter?

When writing an Investment Manager cover letter, it’s important to highlight your accomplishments. Start by listing any relevant achievements, such as successful investments you’ve managed, projects you’ve completed, or awards you’ve received. Additionally, emphasize any special skills or knowledge you possess that are applicable to the position. Finally, draw attention to any other accomplishments or successes that have made you stand out amongst your peers.

It’s important to highlight your accomplishments when applying for a job. Start by listing any relevant achievements, such as successful investments you’ve managed, projects you’ve completed, or awards you’ve received. Additionally, emphasize any special skills or knowledge you possess that are applicable to the position. This could include programming languages, design software, foreign languages, or any other areas of expertise. You could also list any certifications or professional development courses you’ ve completed that are related to the job.

Include any relevant experiences in your cover letter for a job or internship that showcase your skills and qualifications for the role. Mention any accomplishments you’ve achieved in previous roles or during your academic career that demonstrate your work ethic and proficiency. Focus on tangible, measurable achievements and results that demonstrate your hard work and the impact it had on the projects or organizations in which you were involved.

In addition to this, be sure to check out our cover letter templates , cover letter formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

Let us help you build your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder

Investment Manager Cover Letter: Sample & Guide [Entry Level + Senior Jobs]

Create a standout investment manager cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

Writing a great cover letter is an important step when applying for an investment manager role. Our guide provides the essential tips you need to craft a successful cover letter that will get you noticed and get your foot in the door. Use our advice to write a convincing and engaging cover letter that will help you land your dream job.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Banking Analyst Cover Letter Sample

- Revenue Analyst Cover Letter Sample

- Financial Data Analyst Cover Letter Sample

- Accounting Clerk Cover Letter Sample

- Finance Officer Cover Letter Sample

- Payroll Associate Cover Letter Sample

- Audit Director Cover Letter Sample

- Tax Analyst Cover Letter Sample

- Bursar Cover Letter Sample

- Mortgage Banker Cover Letter Sample

- Junior Loan Processor Cover Letter Sample

- Account Clerk Cover Letter Sample

- Experienced Real Estate Agent Cover Letter Sample

- Mortgage Assistant Cover Letter Sample

- Financial Systems Analyst Cover Letter Sample

- Appraiser Cover Letter Sample

- Tax Associate Cover Letter Sample

- Treasurer Cover Letter Sample

- Finance Coordinator Cover Letter Sample

- Claims Auditor Cover Letter Sample

Investment Manager Cover Letter Sample

Dear [Hiring Manager],

I am writing to apply for the Investment Manager position at [Company Name]. With my passion for financial stability and proficiency in research, analysis, and communication, I believe I am an ideal candidate for the role.

I am a highly motivated individual with an extensive background in investment management. Currently, I am employed at [Current Company] as an Investment Manager. I have been responsible for developing and executing investment strategies for clients with a focus on risk management, asset allocation, and portfolio optimization. My experience includes researching and analyzing market trends, managing client portfolios, and providing financial advice to clients.

My qualifications include:

- A Bachelor’s Degree in Finance from [University]

- Five years of experience in investment management

- Advanced knowledge of financial markets and investment products

- Excellent communication and interpersonal skills

- Proficiency in financial modeling and data analysis

- Ability to develop and execute successful investment strategies

I am confident that my qualifications and experience make me a strong candidate for this role. I am eager to contribute my knowledge and expertise to [Company Name], and I am certain that I can help you reach your investment goals.

I have enclosed my resume and look forward to discussing my candidacy further. Thank you for your time and consideration.

Sincerely, [Your Name]

Why Do you Need a Investment Manager Cover Letter?

- A Investment Manager cover letter is an important tool when applying for a job in the financial services industry.

- It helps to demonstrate your qualifications, skills, and experiences that are relevant for the role.

- It can also help to highlight your qualifications and experiences that are not apparent on your resume.

- A well-crafted cover letter will help you stand out from other applicants and help to give you a better chance at securing an interview.

- It will also show the employer that you have taken the time to research the company and position, and that you are genuinely interested in the job.

- The cover letter should be tailored to each position you are applying for, as it should highlight the skills and experiences that are most relevant to the role.

- A well-written cover letter will also give you the opportunity to explain why you are the best fit for the position, and to express your enthusiasm for the job.

A Few Important Rules To Keep In Mind

- Keep your cover letter brief and to the point; no more than one page.

- Start your cover letter with a strong opening statement that grabs the reader's attention.

- Make sure to highlight any relevant experience or qualifications you have that make you a good fit for the position.

- Include specific examples of times when you have successfully managed investments or demonstrated your financial acumen.

- Explain why you are interested in the company and the position, and why you are the best candidate for the job.

- End the letter with a call to action, such as requesting an interview.

- Proofread your cover letter carefully for any mistakes or typos.

What's The Best Structure For Investment Manager Cover Letters?

After creating an impressive Investment Manager resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Investment Manager cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Investment Manager Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

As an experienced Investment Manager, I am confident that I can deliver results that exceed your expectations. With my expertise in asset management, financial analysis, and risk management, I am well-equipped to make sound decisions and manage portfolios that yield maximum returns.

I have a proven ability to match investor objectives with appropriate investments, and have a track record of success in building strong relationships with clients. I have also demonstrated success in developing strategies to increase profitability and mitigate risk.

I am highly organized and have a keen eye for detail. I am adept at managing multiple projects simultaneously and thrive in a fast-paced environment. I am also an excellent communicator, and I am able to explain complex financial concepts in an understandable way.

I am confident that I can contribute to your team in a meaningful way. I have enclosed my resume and would welcome the opportunity to discuss this position further with you.

- Extensive experience in asset management, financial analysis, and risk management

- Strong knowledge of investment strategies and financial markets

- Able to match investor objectives with appropriate investments

- Excellent interpersonal and communication skills

- Excellent organizational and problem-solving skills

- Proficient in Microsoft Office Suite and financial software

Thank you for your time and consideration. I look forward to hearing from you.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing an Investment Manager Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Not tailoring the cover letter to the specific job opportunity.

- Not addressing the letter to a specific person.

- Using generic language that could apply to any job.

- Exaggerating skills and qualifications.

- Using overly long sentences or paragraphs.

- Leaving out important information such as contact details.

- Not proofreading for typos or grammatical errors.

- Using jargon or technical terms without explaining them.

- Failing to demonstrate enthusiasm for the role.

- Including irrelevant information.

Key Takeaways For an Investment Manager Cover Letter

- Highlight your experience in making investment decisions and managing portfolios.

- Demonstrate your knowledge of the financial markets and current investment trends.

- Showcase your ability to build relationships with clients and maintain client trust.

- Emphasize your understanding of financial regulations and compliance.

- Mention any relevant certifications or qualifications you possess.

- Underline your interpersonal and communication skills.

- Demonstrate your ability to analyze financial data and develop strategies.

- Highlight your organizational and problem-solving skills.

- Showcase your ability to handle multiple tasks simultaneously.

Investment Manager Cover Letter Examples

A great investment manager cover letter can help you stand out from the competition when applying for a job. Be sure to tailor your letter to the specific requirements listed in the job description, and highlight your most relevant or exceptional qualifications. The following investment manager cover letter example can give you some ideas on how to write your own letter.

or download as PDF

Cover Letter Example (Text)

Marcelyn Farnes

(330) 818-3245

Dear Ms. Mccloskey,

I am writing to express my interest in the Investment Manager position at BlackRock, as advertised. With a solid foundation of five years of experience at Vanguard Group, I have honed my skills in asset management, strategic investment planning, and client relations, which I am eager to bring to your esteemed firm.

During my tenure at Vanguard Group, I have managed diverse portfolios, consistently achieving and often surpassing performance benchmarks. My role required a deep understanding of market trends, the ability to conduct comprehensive risk assessments, and the development of innovative investment strategies tailored to our clients' unique financial goals. Through diligent research and a proactive approach to portfolio management, I have successfully navigated various market cycles, delivering robust results that have contributed to the firm's reputation for excellence.

Collaboration and communication have been key to my success. I have worked closely with cross-functional teams, providing leadership and insight that have driven our collective success. My commitment to maintaining transparent and informative relationships with clients has ensured their confidence and trust, resulting in sustained business and referrals.

BlackRock's commitment to providing cutting-edge financial solutions and its reputation for integrity align perfectly with my professional values and expertise. I am particularly drawn to your innovative approach to investment management, including the use of advanced analytics and technology to inform decision-making. I am excited about the opportunity to contribute to your team, leveraging my experience to further enhance BlackRock's portfolio performance and client satisfaction.

I am looking forward to the opportunity to discuss how my background, skills, and enthusiasms can be in line with the ambitious goals of BlackRock. Thank you for considering my application. I am eager to offer more insights into how I can contribute to your team and help foster continued success.

Warm regards,

Related Cover Letter Examples

- Investment Banking Analyst

- Investment Banking Associate

- Investment Accountant

- Investment Advisor

- Investment Analyst

- Investment Associate

Investment Manager Cover Letter

Introduction:

A cover letter is an essential document when applying for a job as an investment manager. It serves as a way to introduce yourself to potential employers, highlight your qualifications, and showcase your enthusiasm for the position. Writing a compelling cover letter can make a lasting impression and increase your chances of landing an interview. In this blog, we will provide you with two examples of investment manager cover letters, answer some frequently asked questions about this topic, and offer a conclusion.

Cover Letter Example 1:

Dear Hiring Manager,

I am writing to apply for the investment manager position at XYZ Financial Services. With a strong background in finance, extensive experience in managing portfolios, and a passion for delivering exceptional client service, I am confident in my ability to contribute to your firm’s success.

In my previous role as an investment manager at ABC Investment Group, I successfully managed a diverse range of client portfolios, ranging from high-net-worth individuals to institutional investors. I consistently achieved above-average returns by carefully analyzing market trends, conducting thorough due diligence, and implementing smart investment strategies. I believe that my track record of generating strong investment performance would be a valuable asset to your firm.

I am highly skilled in conducting rigorous financial analysis, assessing risk, and identifying investment opportunities across various asset classes. Furthermore, my ability to build and maintain strong relationships with clients has allowed me to consistently exceed their expectations and retain their trust. I am confident in my ability to provide the same level of service and results at XYZ Financial Services.

I am excited about the opportunity to join your team and contribute to the growth of your firm. XYZ Financial Services has a strong reputation for excellence in the industry, and I am confident that my skills and experience align with your firm’s values and objectives. Thank you for considering my application.

Sincerely, [Your Name]

Cover Letter Example 2:

Dear [Company Name] Hiring Team,

I am excited to submit my application for the investment manager position at your esteemed organization. With a proven track record of delivering exceptional results and a strong passion for the financial industry, I am confident in my ability to contribute to your firm’s success.

Throughout my career, I have gained valuable experience in managing complex portfolios, analyzing market trends, and identifying investment opportunities that result in strong returns. I believe that my comprehensive understanding of risk management, asset allocation, and portfolio construction will be beneficial in meeting the needs of your clients.

In addition to my technical skills, I am also highly skilled in building and maintaining relationships with clients. I have a strong ability to communicate complex financial concepts in a clear and concise manner, which has helped me develop trust and credibility with my clients. I am passionate about delivering exceptional client service and believe in putting their needs first.

I am particularly impressed with [Company Name]’s reputation for excellence and its commitment to providing innovative investment solutions. I would be honored to contribute to your firm’s growth and to be a part of a team that is dedicated to delivering superior results.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications in further detail.

10 FAQs about Investment Manager Cover Letter:

1. What should I include in an investment manager cover letter? In an investment manager cover letter, you should include your contact information, a salutation, an introduction that highlights your qualifications, a body paragraph explaining your experience and skills, and a conclusion expressing your interest in the position and gratitude for consideration.

2. How long should my cover letter be? Your cover letter should be concise and to the point, typically no longer than one page.

3. Should I customize my cover letter for each application? Yes, it is important to tailor your cover letter to each specific job application. Highlight the skills and experience that are most relevant to the role.

4. Is it important to research the company before writing the cover letter? Yes, conducting thorough research on the company will help you understand their values, culture, and goals. This information can be incorporated into your cover letter to demonstrate your genuine interest in the company.

5. How do I showcase my achievements in a cover letter? You can showcase your achievements by providing specific examples of your past successes. Use numbers and statistics whenever possible to quantify your impact.

6. Should I address my cover letter to a specific person? Whenever possible, address your cover letter to a specific person, such as the hiring manager or the head of the department you are applying to. If the job posting does not include contact information, do some research to find the appropriate person to address your letter to.

7. Is it important to proofread my cover letter? Yes, it is crucial to proofread your cover letter to ensure it is free of errors. A well-written and error-free cover letter demonstrates your attention to detail and professionalism.

8. Can I include personal information in my cover letter? Avoid including personal information that is not directly relevant to the job application. Focus on highlighting your professional achievements and qualifications.

9. Should I mention my salary expectations in my cover letter? It is generally best to avoid mentioning salary expectations in your cover letter. This information can be discussed during the interview process.

10. How do I sign off my cover letter? Common sign-offs for cover letters include “Sincerely,” “Best regards,” or “Thank you.” Choose a professional sign-off that aligns with your personal style.

Conclusion:

A well-crafted investment manager cover letter can significantly enhance your chances of securing an interview. By highlighting your qualifications, showcasing your achievements, and demonstrating your genuine interest in the company, you can stand out from other applicants. Use the provided cover letter examples as templates and customize them to fit your own experiences and skills. With careful attention to detail and a compelling narrative, your cover letter can help you land your dream job as an investment manager. Good luck!

Introducing John Smith: Your Expert Resume Writer, Cover Letter Specialist, and Career Coach. Meet John Smith, your dedicated partner in crafting the perfect resume, compelling cover letter, and charting your career path to success. With a passion for helping individuals reach their professional aspirations, John brings a wealth of expertise to the table as a resume writer, cover letter specialist, and career coach.

Related Posts

Elevate Your Prospects: Accountant Cover Letter Examples and Templates for 2023 – Download Now

Administrative Assistant Cover Letter Examples and Templates for 2023

A Comprehensive Guide to Writing an Amazing Accounting and Finance Cover Letter

Crafting a Standout Actor Cover Letter: Examples and Tips

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

Investment Management Cover Letter

15 investment management cover letter templates.

How to Write the Investment Management Cover Letter

In response to your job posting for investment management, I am including this letter and my resume for your review.

In my previous role, I was responsible for financial analysis for Medtronic’s Corporate Cash Investment Program and supports quarterly reviews by Medtronic’s Investment Management Committee (CFO, Treasurer & Other members).

Please consider my experience and qualifications for this position:

- Previous supervisory experience preferred for general management path

- Previous investment management experience preferred for investment path

- Solid leadership and project management skills

- Familiarity with vendor risk systems such as MSCI/Barra, Yield Book, Barclay’s POINT, RiskMetrics, BlackRock and SunGard APT

- Preferred Other Familiarity with highly regulated insurance space

- Should have or are studying for a professional accounting qualification (ACA, ACCA, CIMA)

- Achieved GCSE Maths Grade B or above

- English language - intermediate (level B1/B2)

Thank you for your time and consideration.

Dallas Flatley

- Microsoft Word (.docx) .DOCX

- PDF Document (.pdf) .PDF

- Image File (.png) .PNG

Responsibilities for Investment Management Cover Letter

Investment management responsible for investment accounting support as directed by Home Office business leaders including participating in projects relating to the investment portfolio.

Investment Management Examples

Example of investment management cover letter.

Please consider me for the investment management opportunity. I am including my resume that lists my qualifications and experience.

In the previous role, I was responsible for pension and 401k investment detail for DTNA accounting colleagues and Daimler pension affiliates for reporting purposes.

My experience is an excellent fit for the list of requirements in this job:

- Skill in the use of PC, MS Office

- Knowledge of trust operations preferred

- Strong credit background with solid understanding of fundamental credit research and a generalist background

- Strong quantitative background and experience

- Exceptional work ethic and commitment to excellence

- Basic understanding of capital markets, investment asset classes, and retirement plans

- Experience reviewing Building Condition Reports, Environmental Site Assessments (ESAs) and Surveys practical experience leading and arranging for building upgrades and environmental and remediation

- An understanding of basic utility accounting, finance, and regulatory principles

Thank you for considering me to become a member of your team.

Shae Durgan

In my previous role, I was responsible for life Company technical statutory accounting research and support to NM Controller constituencies and all investment management constituencies in MSA and NM Investment Management Company.

- Facility with common corporate technology platforms and applications including MS Excel, Word, Outlook, SharePoint, and Adobe Acrobat Pro

- Leading the manager due diligence meetings, calls, onsite visits and prepare summary internal communication, as appropriate

- Developing best-class model to enhance oversight on the delegated function of portfolio activities and reporting tools

- Being the point of escalation and solving issues with regards to the investment management of the funds

- A thorough understanding of the investment management industry

- A working knowledge of investment operations related to security, market, and valuation data

- Treasury experience preferable, but not essential

- Students of Economics/Engineering or related

Thank you in advance for taking the time to read my cover letter and to review my resume.

Brooklyn Haley

I am excited to be applying for the position of investment management. Please accept this letter and the attached resume as my interest in this position.

Previously, I was responsible for market risk update/view slides for various decks/presentations such as the bi-weekly Capital Markets Update, Investment Portfolio Report, Senior ALCO, and Investment Committee.

I reviewed the requirements of the job opening and I believe my candidacy is an excellent fit for this position. Some of the key requirements that I have extensive experience with include:

- Solid PC skills including MS Excel, Word, and PowerPoint

- Experience using investment research systems, including Morningstar Direct, FactSet, Bloomberg, and Advent Tamale is preferred

- Knowledge of fundamental equity and fixed income research methodologies

- Strong financial acumen and risk analysis skills

- Knowledgeable of leasing and property management business activities and processes and of leasing and investment market activities and dynamics for office, retail, industrial and multi-family property types

- Self-confident, outgoing and enthusiastic person, who has good people skills, works well under pressure and who is comfortable dealing with multiple tasks and "bosses"

- Proficient with Microsoft Office (Excel, Word & PowerPoint) and Argus

- Analyst, Asset Management should have post-secondary education in Finance, Economics or Business

I really appreciate you taking the time to review my application for the position of investment management.

Avery Hyatt

Previously, I was responsible for support to investment company board of directors and coordination with investment company service providers.

- Expert in Microsoft Office applications (e.g., Excel data manipulation, advanced formulas, pivot tables

- Strong knowledge of investment management compensation processes

- Results-focused, with strong project management skills

- Strong decision making, strategic influencing and leadership skills

- Familiarity with the business planning process

- Detail oriented with a commitment to high quality work

- Market due diligence and research

- Drafting investment memorandums

Sawyer Hoeger

Previously, I was responsible for insight to business on the catalyst for investment accounting results and how investment data has developed over time and can be interpreted.

Please consider my qualifications and experience:

- Knowledge on Financial Math

- Interest on macroeconomics, corporate finance and accounting

- Proficiency in MS Word and MS Excel , Experience with Morningstar, Morningstar Direct, eVestment, Lipper and Zephyr preferred

- Proven history of managing teams through influence at all levels and across functions within a financial institution

- Excellent written and verbal communication with strong attention to detail and accuracy

- Advanced computer skills, including demonstrated knowledge of Excel and Power Point

- Prior investment experience working for an endowment, foundation, family office, fund of funds or outsourced CIO preferred

- Pursuit of the Chartered Financial Analyst® (CFA®) designation is strongly encouraged

Thank you in advance for reviewing my candidacy for this position.

Briar Hudson

Related Cover Letters

Create a Resume in Minutes with Professional Resume Templates

Create a Cover Letter and Resume in Minutes with Professional Templates

Create a resume and cover letter in minutes cover letter copied to your clipboard.

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

The Investment Banking Cover Letter Template You’ve Been Waiting For

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

A long time ago I said that we would never post a cover letter template here :

“I was tempted to post a Word template, but I don’t want 5,000 daily visitors to copy it and to start using the same exact cover letter.”

But hey, we already have resume templates that everyone is using, so why not go a step further and give you a cover letter template as well?

Plus, “investment banking cover letter” is one of the top 10 search terms visitors use to find this site – so you must be looking for a template.

The Template & Tutorial

Let’s jump right in:

Investment Banking Cover Letter Template [Download]

Download Template – Word

Download Template – PDF

And here’s the video that explains everything:

(For more free training and financial modeling videos, subscribe to our YouTube channel .)

And if you’d rather read, here’s the text version:

Do Cover Letters Actually Matter?

At bulge bracket banks, people barely read cover letters.

Cover letters matter 10x less than resumes and 100x less than networking.

But there are a few special cases where they’re more important:

- Boutiques and Local Banks – Sometimes they actually read cover letters.

- Unusual Backgrounds – If you’re NOT in university or business school at the moment, you may need to explain yourself in more detail.

- Outside the US – In Europe, for example, some banks pay more attention to cover letters, online applications, and so on.

Similar to grades and test scores, a great cover letter won’t set you apart but a poor one will hurt you – so let’s find out how to avoid that.

Keep your cover letter compact and avoid 0.1″ margins and size 8 font.

With resumes you can get away with shrinking the font sizes and margins if you really need to fit in extra information, but this is questionable with cover letters.

Go for 0.75″ or 1″ margins and at least size 10 font.

With resumes there were a couple different templates depending on your level – but with cover letters that’s not necessary and you can use the same template no matter your background.

1 Page Only

Ok, maybe they do things differently in Australia (just like with resumes) but aside from that there is no reason to write a multi-page cover letter.

If you actually have enough experience to warrant multiple pages, do it on your resume instead and keep the cover letter brief.

Contact Information

List your own information – name, address, phone number, and email address – right-aligned up at the top.

Then, below that you list the date and the name and contact information for the person you’re writing to, left-aligned on the page.

If you don’t have this information you can just list the company name and address and use a “Dear Sir or Madam” greeting.

That’s not ideal – especially if you’re applying to smaller firms where cover letters actually get read – but it’s all you can do if you can’t find a person’s name.

If you’re sending the cover letter via email as the body of the email, you can omit all this information and just include the greeting at the top.

Paragraph 1: Introduction

This is where you explain who you are, where you’re currently working or studying, and how you found the bank that you’re applying to.

Name-drop as much as possible:

- Impressive-sounding university or business school ? Mention it. Even if it’s not well-known, you still need to mention it here.

- Your company name , especially if it’s recognizable, and the group you’re working in, especially if it’s something relevant to finance like business development.

- How you found them – specific peoples’ names , specific presentations or information sessions where you met them, and so on.

- The position you’re applying for (Analyst? Associate?) – especially for smaller places that are not well-organized.

This first paragraph is all about grabbing their attention.

Example 1st Paragraph:

“My name is John Smith and I am currently a 3rd year economics major at UCLA. I recently met Fred Jackson from the M&A group at Goldman Stanley during a presentation at our school last week, and was impressed with what I learned of your culture and recent deal flow. I am interested in pursuing an investment banking summer analyst position at your firm, and have enclosed my resume and background information below.”

Paragraph 2: Your Background

You go through your most relevant experience and how the skills you gained will make you a good banker right here.

Do not list all 12 internships or all 5 full-time jobs you’ve had – focus on the most relevant 1-2, once again name-dropping where appropriate (bulge bracket banks / large PE firms / Fortune 500 companies).

Highlight the usual skills that bankers want to see – teamwork, leadership, analytical ability, financial modeling and so on.

If you worked on a high-impact project / deal / client, you can point that out and list the results as well.

This may be your longest paragraph, but you still don’t want to write War and Peace – keep it to 3-4 sentences.

Example 2nd Paragraph:

“I have previously completed internships in accounting at PricewaterhouseCoopers and in wealth management at UBS. Through this experience working directly with clients, analyzing financial statements, and making investment recommendations, I have developed leadership and analytical skills and honed my knowledge of accounting and finance. I also had the opportunity to work with a $20M net-worth client at UBS and completely revamped his portfolio, resulting in a 20% return last year.”

Paragraph 3: Why You’re a Good Fit

Now you turn around and link your experience and skills to the position more directly and explain that leadership + quantitative skills + accounting/finance knowledge = success.

There is not much to this part – just copy the template and fill in the blanks.

Example 3rd Paragraph:

“Given my background in accounting and wealth management and my leadership and analytical skills, I am a particularly good fit for the investment banking summer analyst position at your firm. I am impressed by your track record of clients and transactions at Goldman Stanley and the significant responsibilities given to analysts, and I look forward to joining and contributing to your firm.”

Paragraph 4: Conclusion

This part’s even easier: remind them that your resume is enclosed (or attached if sent via email), thank them for their time, and give your contact information once again so they don’t have to scroll to the top to get it.

Example 4th Paragraph:

“A copy of my resume is enclosed for your reference. I would welcome an opportunity to discuss my qualifications with you and learn more about Goldman Stanley at your earliest convenience. I can be reached at 310-555-1234 or via email at [email protected]. Thank you very much for your time and consideration.”

Unusual Backgrounds

These examples cover how to apply to a bank if you’re in university, business school, or you’ve been working for several years.

If you have a more unusual background (e.g. you went to med school, graduated, started your residency, but then decided you wanted to be an investment banker), then you might need to add a few sentences to paragraph #2 or #3 explaining yourself.

Resist the urge to write your life story because no one will read it – interviews are a much better venue to prove how committed you are.

Email vs. Attachments

If you’re emailing your cover letter and resume, do you create a separate cover letter attachment?

Or do you make the body of your email the cover letter?

I think it’s redundant to create a separate cover letter and attach it, so don’t bother unless they ask specifically for a separate cover letter.

If you’re making the body of your email the cover letter, make it even shorter (4-5 sentences total) and cut out the address bits at the top.

Optional Cover Letters?

If you’re applying online and it says “Optional Cover Letter” should you still upload one?

You might as well because it takes 2 minutes once you have a good template – it’s not the end of the world if you don’t include one, but you never know what everyone else is doing and it’s not terribly time-consuming.

Cover Letter Mistakes

Remember the role of cover letters: great ones don’t help much, but poor ones get you dinged.

The biggest mistakes with cover letters:

- Making outrageous claims (“I’m a math genius!”) or trying to be “creative” with colors, pictures, fonts, and so on.

- Going on for too long – 10 paragraphs or multiple pages.

- Listing irrelevant information like your favorite ice cream, your favorite quotes from Wall Street or Boiler Room , and so on.

If you think this sounds ridiculous, remember the golden rule: do not overestimate the competition .

For every person reading this site, there are dozens more asking, “What it’s like to be an investment banker?” at information sessions.

Sometimes you hear stories of people who write “impassioned” cover letters, win the attention of a boutique, and get in like that …

…And I’m sure that happens, but you do not want to do that at large banks.

If you do, your cover letter will be forwarded to the entire world and your “career” will be destroyed in 5 minutes .

More Examples

As with resumes, there are hardly any good examples of investment banking cover letters online.

Most of the templates are horribly formatted and are more appropriate for equities in Dallas than real investment banking.

Here’s a slightly different but also good templates you could use:

- Best Cover Letters – MBA Template

More questions? Ask away.

Still Need More Help?

Introducing: premium investment banking-specific resume/cv and cover letter editing services.

We will take your existing resume and transform it into a resume that grabs the attention of finance industry professionals and presents you and your experience in the best possible light.

When we’re done, your resume will grab bankers by the lapels and not let them go until they’ve given you an interview.

Specifically, here’s what you’ll get:

- Detailed, line-by-line editing of your resume/CV – Everything that needs to be changed will be changed. No detail is ignored.

- Your experience will be “bankified” regardless of whether you’ve been a student, a researcher, a marketer, a financier, a lawyer, an accountant, or anything else.

- Optimal structuring – You’ll learn where everything from Education to Work Experience to Activities should go. Regional badminton champion? Stamp collector? You’ll find out where those should go, too.

- The 3-point structure to use for all your “Work Experience” entries: simple, but highly effective at getting the attention of bankers.

- How to spin non-finance experience into sounding like you’ve been investing your own portfolio since age 12.

- How to make business-related experience, such as consulting, law, and accounting, sounds like “deal work.”

- How to avoid the fatal resume mistake that gets you automatically rejected . Nothing hurts more than making a simple oversight that gets you an immediate “ding”.

- We only work with a limited number of clients each month. In fact, we purposely turn down potential clients in cases where we cannot add much value. We prefer quality over quantity, and we always want to ensure that we can work well together first.

FIND OUT MORE

Other Options for Personalized Help: Wall Street Mastermind

Finally, if you want to go beyond your cover letter and also get help with your resume, work experience, networking, and interview prep, check out Wall Street Mastermind .

They’ve worked with over 1,000 students to help them secure high-paying investment banking jobs out of school (and internships while in school), and their coaches include a former Global Head of Recruiting at three different large banks.

They provide personalized, hands-on guidance through the entire networking and interview process – and they have a great track record of results for their clients.

It could be a great fit for you if you’re looking for comprehensive coaching through the entire process rather than just a new version of your resume or cover letter.

You can book a free consultation with them to learn more .

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

279 thoughts on “ The Investment Banking Cover Letter Template You’ve Been Waiting For ”

I love how hand downs and direct this page is. Trying to break into IB come from a (semi-)target school but very bad GPA, love how you are always motivating, but realistic. Keep it up!

I am a sophomore and have a low gpa (2.5) should I include this on my cover letter? how do I stand out and not get dinged, low gpa because had to work full time freshman year because my dad lost his job, and my family had health issues. Am an only child.

All you can really do about a low GPA is network extensively so that people who know you can recommend you, and so you can avoid being filtered out by screening tools. See: https://mergersandinquisitions.com/low-gpa-investment-banking/

Maybe include a brief mention of why your GPA is lower in your cover letter, but focus on how you’ve improved since your first year (mention the higher GPA since then).

Thanks for the write up!

If i am writing my cover letter in the body of the email, Do i write the name of the recipient instead of dear Madam ?

I like it not bad