- Search for:

Home Resources Case studies Procter & Gamble

Procter & Gamble

Download PDF

Procter & Gamble was founded in the US in 1837, by William Procter from England and James Gamble from Ireland. Both men were travelling through the Unites States when they met by chance in Cincinnati.

What were the original business drivers for your SRM programme?

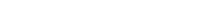

How have these business drivers changed and how has srm adjusted to remain aligned, what were the major barriers and how were they overcome (internally and with suppliers), p&g's five core strength focus.

P&G is a pioneer of open innovation – how does this apply to suppliers?

Given your reputation for innovation, is there a risk that you are overrun with innovation ideas that turn out to be little more than a sales pitch, how important is risk management in your srm approach, how do you measure the eff ectiveness of your srm approach.

- We create joint business plans with our most strategic business partners to identify two-three year goals for the relationship and key action plans which will deliver those goals.

- Quarterly scorecard metrics are used to measure performance, and are typically a mix of predictive, outcome, quantitative and qualitative measures.

- We also use a very comprehensive supplier performance management system, which uses multi-functional assessments to evaluate and reward supplier performance against four key areas: commercial, operational, innovation and relationship.

What do you think is the most successful aspect of your SRM? What makes you proud?

When you talk about leadership involvement, what does this mean in a practical sense for p&g, where next for p&g srm what are the next challenges, what advice would you give to organisations just starting out on their srm journey.

- Focus – Not all relationships are created equal and you have to be strategic about where value is created.

- Resource – Effective SRM work takes time and resources, and leaders must be involved and role model the effort.

- Measure and reward – Find a clear, simple way to know that you are making a difference, and make sure your business partners feel valued for the contributions they make to your business.

Reports and Publications

Case studies, newsletter sign-up, stay connected on linkedin, lang: en_us, enjoy customer of choice benefits.

Find out what your key suppliers really think of you and how to become their customer of choice.

Find out more

Stay in touch

2020 global srm research report - supplier management at speed..

Now in its 12th year, this year we have seen an increase of 29% in the number of companies responding compared to 2019. In addition, the proportion of respondents at CPO/EVP level or equivalent has increased to over 50%. Learn how now, more than ever before, procurement has the opportunity to make the case for SRM to ensure organisations don’t just survive but thrive.

Sign up below to get our insight emails direct to your inbox.

- +91-987-956-4584

- [email protected]

Cost Optimization Services

Process optimization services, transformation services.

- Dashboard & Tools

- Procurement Reports

- Success Stories

- Our Approach

- May 8, 2023

- By: EmpoweringCPO Insights Team

Procter & Gamble’s Supplier Relationship Management: A Model for Collaborative Success

Introduction, a. brief overview of procter & gamble (p&g).

Procter & Gamble, commonly known as P&G, is a multinational consumer goods corporation founded in 1837. With its headquarters in Cincinnati, Ohio, P&G has grown to become one of the world’s leading companies in the fast-moving consumer goods sector. The company’s diverse portfolio includes well-known brands in categories such as personal care, home care, health care, and baby care. With a strong commitment to innovation and sustainability, P&G continues to make a significant impact on consumers’ lives worldwide.

B. Importance of supplier relationship management in today’s competitive market

In the increasingly competitive global market, companies are constantly seeking ways to improve efficiency, reduce costs, and drive innovation. One key aspect that plays a significant role in achieving these goals is supplier relationship management (SRM). Effective SRM enables organizations to create mutually beneficial relationships with their suppliers, leading to better collaboration, increased value, and streamlined processes. By fostering strong supplier partnerships, businesses can enhance their product offerings, adapt to changing market conditions, and maintain a competitive edge.

C. Overview of P&G’s supplier relationship management program

Recognizing the immense potential of SRM, Procter & Gamble implemented a comprehensive program to strengthen its relationships with suppliers. This program focuses on identifying and nurturing strategic partnerships, streamlining the supplier base, and promoting collaboration and innovation. As a result, P&G has been able to improve efficiency, reduce costs, and bring more innovative products to market faster. The success of P&G’s supplier relationship management program serves as an inspiring example for other companies looking to optimize their supply chains and foster a collaborative environment with their suppliers.

Streamlining P&G’s Supplier Base

A. identifying strategic partners.

- Criteria for selection – Procter & Gamble recognizes the importance of carefully selected strategic partners to optimize its supply chain. Key criteria for selecting suppliers include their ability to deliver high-quality products, cost competitiveness, expertise in the relevant industry, commitment to sustainability, and capacity for innovation. Additionally, P&G values suppliers that demonstrate a strong cultural fit, aligning with the company’s values and vision for the future.

- Benefits of strategic partnerships – Strategic partnerships with suppliers offer numerous benefits for P&G. These partnerships enable the company to leverage the expertise, resources, and innovation capabilities of its suppliers to drive growth and create value. By working closely with strategic partners, P&G can improve its responsiveness to market changes, reduce lead times, and capitalize on opportunities more effectively. Additionally, strategic partnerships foster a collaborative environment that can lead to joint problem-solving, shared risk management, and continuous improvement.

B. Reducing the number of suppliers

- The rationale behind consolidation – P&G’s decision to consolidate its supplier base stems from the understanding that managing a large number of suppliers can be complex and resource-intensive. By reducing the number of suppliers, the company can focus its resources on nurturing meaningful relationships with strategic partners, leading to better alignment, more effective communication, and improved collaboration. This consolidation also simplifies the supply chain, making it easier to monitor supplier performance and ensure consistent quality across all product categories.

- Impact on efficiency and cost savings – The reduction of P&G’s supplier base has had a significant impact on efficiency and cost savings. With a streamlined supplier base, the company can negotiate better terms, reduce transaction costs, and optimize procurement processes. Additionally, a consolidated supplier base allows for improved visibility into the supply chain, enabling P&G to identify bottlenecks, redundancies, and opportunities for further improvement. Ultimately, this approach to supplier management has led to lower costs, enhanced operational efficiency, and a more agile supply chain that supports P&G’s growth and innovation objectives.

Fostering Collaboration and Innovation

A. joint business planning with suppliers.

- The process of developing shared goals – Procter & Gamble places great importance on developing shared goals with its strategic suppliers. This process begins with understanding each other’s objectives, priorities, and capabilities. P&G and its suppliers then collaborate to create a joint business plan that outlines mutual goals, identifies opportunities for growth and innovation, and establishes performance metrics. This collaborative approach ensures that both parties are working towards common objectives and helps to build a strong foundation for a long-term partnership.

- Aligning strategies and resources – Once shared goals have been established, P&G and its suppliers work together to align their strategies and resources to achieve these objectives. This includes aligning procurement, product development, and manufacturing processes, as well as sharing knowledge, expertise, and best practices. By working together and leveraging each other’s strengths, P&G and its suppliers can drive innovation, improve efficiency, and create value for both parties.

B. Open communication channels

- Regular meetings and information sharing – Open communication is vital for fostering collaboration and innovation between P&G and its suppliers. To facilitate this, regular meetings are held to review progress, share updates, and discuss challenges and opportunities. These meetings provide a platform for both parties to share information, gain insights, and collaborate on solutions. By maintaining open lines of communication, P&G and its suppliers can work together more effectively and adapt to changes in the market.

- Addressing challenges and opportunities – In addition to regular meetings, P&G encourages its suppliers to proactively communicate any challenges, risks, or opportunities that arise. By addressing these issues together, P&G and its suppliers can jointly develop solutions, mitigate risks, and capitalize on new opportunities. This collaborative approach helps to strengthen the relationship between P&G and its suppliers while driving continuous improvement and innovation.

C. Incentivizing supplier innovation

- Rewarding suppliers for new ideas – Procter & Gamble understands the value of supplier innovation and encourages its suppliers to contribute new ideas and solutions. To incentivize this, P&G recognizes and rewards suppliers for their innovative contributions. This can include public recognition, financial incentives, or opportunities for increased business. By rewarding innovation, P&G fosters a culture of continuous improvement and encourages its suppliers to think creatively and take calculated risks.

- Collaborative product development – P&G actively engages its suppliers in the product development process, leveraging their expertise and capabilities to create innovative products that meet customer needs. By involving suppliers from the early stages of product development, P&G can access new technologies, materials, and ideas, leading to more innovative and competitive product offerings. This collaborative approach to product development strengthens the relationship between P&G and its suppliers while driving growth and value creation for both parties.

Enhancing Product Offerings and Reducing Time to Market

A. leveraging supplier expertise.

- Utilizing supplier knowledge in product development – Procter & Gamble recognizes the immense value of its suppliers’ knowledge and expertise in product development. By actively involving suppliers in the development process, P&G can tap into their specialized skills, industry insights, and innovative ideas. This collaboration allows P&G to create products that are better tailored to consumer needs, while also incorporating the latest advancements in materials and technology.

- Access to new technologies and materials – Suppliers often have access to new technologies, materials, and manufacturing techniques that can help improve product quality and performance. By working closely with its suppliers, P&G can gain insights into these innovations and incorporate them into its product offerings. This not only enhances P&G’s products but also helps the company stay ahead of its competitors and maintain its reputation for innovation.

B. Accelerating product launch timelines

- Streamlined supply chain processes – A key benefit of P&G’s strong supplier relationships is the ability to streamline supply chain processes. By working closely with suppliers, P&G can identify and eliminate inefficiencies, optimize inventory levels, and reduce lead times. These improvements help accelerate product launch timelines, ensuring that P&G’s innovative products reach consumers as quickly as possible.

- Improved coordination between P&G and suppliers – Effective coordination between P&G and its suppliers is crucial for reducing time to market. Open communication channels, joint business planning, and shared goals all contribute to improved coordination and alignment. This close collaboration enables P&G and its suppliers to work together more effectively, respond to changes in the market more rapidly, and bring innovative products to consumers faster.

Measuring the Success of P&G’s Supplier Relationship Management Program

A. key performance indicators (kpis).

- Cost savings – One of the primary objectives of P&G’s supplier relationship management program is to reduce costs. By streamlining the supplier base, improving collaboration, and optimizing procurement processes, P&G can achieve significant cost savings. Monitoring cost reductions over time is a crucial KPI for measuring the success of the program and ensuring that these savings are sustained.

- Efficiency improvements – Efficiency improvements are another key metric for evaluating the success of P&G’s supplier relationship management program. These improvements can be measured by assessing factors such as lead times, inventory levels, and production throughput. By tracking these metrics, P&G can gauge the effectiveness of its supplier relationships and identify areas for further optimization.

- Innovation rates – The rate of innovation is an essential KPI for P&G, as it indicates the company’s ability to maintain its competitive edge and meet evolving consumer needs. This can be measured by tracking the number of new products launched, the speed of product development, and the adoption of new technologies and materials. By monitoring innovation rates, P&G can ensure that its supplier relationships are contributing to the company’s growth and success.

B. Long-term benefits

- Strengthened brand reputation – P&G’s supplier relationship management program contributes to the company’s strong brand reputation. By collaborating with suppliers to develop innovative, high-quality products, P&G demonstrates its commitment to meeting customer needs and staying at the forefront of industry trends. This, in turn, enhances the company’s brand image and increases consumer trust and loyalty.

- Increased market share – A successful supplier relationship management program can also help P&G increase its market share. By accelerating product launch timelines, improving efficiency, and reducing costs, P&G can bring innovative products to market more quickly and at a competitive price. This enables the company to capture a larger share of the market and expand its presence in existing and new product categories.

Lessons Learned and Best Practices

A. the importance of trust and transparency in supplier relationships.

One of the key lessons from P&G’s supplier relationship management program is the critical role of trust and transparency in building strong supplier relationships. By maintaining open communication channels, sharing information, and jointly addressing challenges, P&G and its suppliers can build a foundation of trust that enables them to work together effectively and achieve mutual benefits. Companies looking to improve their supplier relationships should prioritize trust and transparency as cornerstones of their approach.

B. Adapting supplier relationship management strategies for different industries

P&G’s success demonstrates that supplier relationship management strategies must be tailored to the unique characteristics of each industry. By understanding the specific needs, challenges, and opportunities within their industry, companies can develop a more targeted approach to managing supplier relationships. This involves identifying the most relevant criteria for selecting suppliers, aligning strategies and resources, and adapting communication and collaboration methods accordingly.

C. Fostering a culture of continuous improvement

Another important lesson from P&G’s supplier relationship management program is the value of fostering a culture of continuous improvement. This involves encouraging suppliers to contribute new ideas, learn from each other, and seek out opportunities for optimization. By creating an environment in which both the company and its suppliers are committed to ongoing improvement, businesses can drive innovation, enhance efficiency, and strengthen their competitive advantage. To achieve this, companies should incentivize supplier innovation, collaborate on problem-solving, and regularly review performance metrics to identify areas for further improvement.

A. Recap of P&G’s supplier relationship management program’s impact on collaboration, innovation, and product offerings

Procter & Gamble’s supplier relationship management program has had a significant impact on the company’s collaboration, innovation, and product offerings. By streamlining its supplier base, fostering trust and transparency, and promoting a culture of continuous improvement, P&G has built strong relationships with its strategic partners. These relationships have enabled P&G to leverage the expertise and resources of its suppliers, accelerate product launch timelines, and bring more innovative products to market. As a result, the company has experienced cost savings, efficiency improvements, and increased market share.

B. The potential for other companies to adopt similar approaches to strengthen their supplier relationships and achieve greater success

P&G’s success demonstrates the potential benefits of implementing a robust supplier relationship management program. By adopting similar approaches, other companies can strengthen their supplier relationships, improve collaboration, and drive innovation. This, in turn, can lead to greater operational efficiency, cost savings, and a more competitive product portfolio. The key to achieving these benefits lies in prioritizing trust and transparency, tailoring strategies to the unique needs of each industry, and fostering a culture of continuous improvement. By following P&G’s example, companies across various industries can unlock the full potential of their supplier relationships and achieve greater success.

Infographics Posts

Unlock Immediate Cost Savings: Strategize Legal Spend Analysis for Optimal Efficiency and Reduced Expenditure

Unlocking Healthcare Financial Potential

The Power of Spend Analysis with EmpoweringCPO

The Role of Spend Analysis in Strategic Sourcing: A complete Guide

Get a call back.

If you need to speak to us about a general query fill in the form below and we will call you back within the same working day.

Recent Blogs

Savings Realization Cycle; Bridging the Gap: From Projected Savings to Realized Savings

Explore the Savings Realization Cycle in healthcare procurement: from projected savings to tangible results. Unlock strategies for success!

AI Revolutionizing Procurement: A Strategic Shift

Introduction In the dynamic world of procurement, artificial intelligence (AI) is rapidly reshaping the sourcing landscape. As businesses seek agility, cost optimization, and data-driven decision-making,

How to Choose the Right Procurement Service and Dashboard Tool for Your Business?

Introduction In the ever-evolving realm of modern business, where procurement plays a pivotal role in shaping success, the choice of the right procurement service and

CONSULTING CAREERS WITH A DIFFERENCE

Hear from our people about why they enjoy life at empoweringcpo..

Terms & Conditions

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Share Podcast

Procter & Gamble’s Lean Innovation Transformation

Can a new leader guide an established company, like P&G, through disruptive transformation from within?

- Apple Podcasts

- Google Podcasts

When Kathy Fish became Procter & Gamble’s Chief Research, Development & Innovation Officer in 2014, she was concerned that the world’s leading consumer packaged goods company had lost its capability to produce a steady stream of disruptive innovations. In addition, intensifying competition from direct-to-consumer companies convinced Fish that P&G needed to renew its value proposition to make all aspects of the consumer experience “irresistibly superior.” But making this change would require wholesale transformation from within. Can Fish bring lean innovation to scale at Procter & Gamble?

Harvard Business School assistant professor Emily Truelove discusses the challenges of bringing this established company back to an innovative mindset in her case, “ Kathy Fish at Procter & Gamble: Navigating Industry Disruption by Disrupting from Within. ”

HBR Presents is a network of podcasts curated by HBR editors, bringing you the best business ideas from the leading minds in management. The views and opinions expressed are solely those of the authors and do not necessarily reflect the official policy or position of Harvard Business Review or its affiliates.

BRIAN KENNY: Always, Ariel, Bounty, Charmin, Crest, Dawn, Downy, Fairy, Febreeze, Gain, Gillette, Head & Shoulders, Olay, Oral-B, Pampers, Pantene, SK-II, Tide and Vicks. What is this, you might ask? This is a list of the brands in the Procter and Gamble family that generated over a billion dollars in revenue in 2019. They are the superstars of a portfolio that includes 66 active brands in the home goods and personal hygiene categories. Founded by brothers-in-law David Procter and William Gamble in 1837, P&G has been a dominant force in consumer brands since landing its first contract to provide soap and candles to the union forces in the civil war. Along the way, they shaped the fields of consumer marketing and brand building through advertising and mass media. Simply put, P&G is the firm to beat. And that’s what worries them. Today on Cold Call , we welcome professor Emily Truelove to discuss her case entitled, “Kathy Fish at Proctor & Gamble, Navigating Industry Disruption By Disrupting From Within.” I’m your host, Brian Kenny, and you’re listening to Cold Call on the HBR Presents Network.

Emily Truelove studies the changing nature of work inside established organizations, experiencing the digital transformation of their industries. A very timely topic. Emily, thanks for joining me today.

EMILY TRUELOVE: Thanks so much for having me, Brian.

BRIAN KENNY: It’s great to have you here. You and I are in the studio together in Klarman Hall. I don’t get to say that very often. It’s been a long time since we’ve been able to be in the studio together, but I see this as clear signs of progress of a post pandemic world.

EMILY TRUELOVE: Very exciting.

BRIAN KENNY: Very exciting, and we are fully protected and socially distanced and all those other caveats. This is a great case to talk about. P&G has reached into our homes and our hearts and our wallets so much. I think people will really like to hear about this mature established firm that is still sweating the details and trying to find ways to innovate and remain competitive in their space. Let me ask you to start just by telling us how you would start this class, what’s the cold call?

EMILY TRUELOVE: I open the class with the question, why is it so hard for P&G to innovate? And I point out to students that they have this incredible R and D budget, as you’ve pointed out, Brian, there’s this massive track record of success in terms of breakthrough innovations and defining whole new categories. And yet, as we see in the case, when Kathy Fish is entering her role, there are really big challenges related to innovation, particularly breakthrough innovations. And what I find is that students pretty quickly can generate a long list. So there are cultural factors. People are afraid of taking risks. There are issues related to systems and processes like funding and performance management and how these don’t necessarily incentivize breakthrough innovation. And students also often point out shifting competition. There are new direct to consumer competitors that are much savvier with digital technologies. And so what we quickly see in discussing this case is that there’s a long list of issues that they interrelate with one another. And it’s really hard to figure out what is the root cause of why innovation is tough for P&G today. And I think that’s a great way to open for students because that’s often the place that leaders find themselves in. Kathy Fish, the case protagonist, she said to us, “Everybody was convinced that the innovation machine was broken at P&G, but it was not so clear what the real problem was or how to fix it.” And I think that’s a common challenge leaders face.

BRIAN KENNY: Yeah. And I’ll bet people who are listening to the show today who work in large organizations, probably bump up against this a lot, this feeling that we’re stuck in our ways and we can’t change. And so the case really dives into that. So I’m looking forward to talking about some of those issues that surface in the case. I mentioned in introducing you, that you study organizational behavior and organizations that are going through transformations, and that’s a very sort of a buzz word we hear these days, the digital transformation. I’m wondering how did you choose this case to write about and how does it relate to the kinds of things that you think about as a scholar?

EMILY TRUELOVE: I was immediately attracted to the opportunity to write a case at P&G, particularly after meeting Kathy Fish. And we’ll go much more into her background. I know later in the podcast, but to the extent that this is this iconic American company, over a hundred years of history, this incredible history of innovation, and yet they were finding themselves in a position where historic strengths were actually liabilities. Was very fascinating to me. And I think is completely common for incumbent firms to experience when their industry is being transformed, particularly by digital technologies. And so my interest in understanding how leaders can lead change in this situation, and also how work changes for employees on the ground in terms of new mindsets they need, new capabilities they need. The minute I learned about this case opportunity, I knew I wanted to go to Cincinnati and visit to understand what was happening and to capture because I think there’s a lot to learn.

BRIAN KENNY: Yeah, there sure is. And a lot of those issues surface in the case. Maybe you can just start for people who aren’t familiar with P&G. I had some fun with that intro. I just barely scratched the surface of their product portfolio. Tell us a little bit about P&G and their history of innovation.

EMILY TRUELOVE: You covered a lot of the big brands and I think one of the incredible things about P&G is that there’s just a parade of brand names that you can cycle through.

BRIAN KENNY: It’s crazy.

EMILY TRUELOVE: When talking about the innovations of this company, it’s quite a formidable history. And as people have pointed out when I’ve taught this case, students who are 50 years old in executive education will say, “Oh, my grandmother used this brand. I remember when I was young.” And so just the history of the company is really pretty incredible. I think though, one of the challenges for P&G particularly what we capture when the case opens, is just the shifting environment. And again, as I said earlier, how these strengths were becoming liabilities. P&G has this massive R and D budget. It has this incredible scale. It’s clearly excelled at mass media advertising and has these incredible relationships with retailers like Target and Walmart. And internally the innovation processes were actually quite slow, which was okay back in the day, but not so much anymore. So the processes were very much about, “Okay, R and D is going to cook something in the lab.” That’s their language. “We’re going to cook this idea in the lab. Maybe we’ll rely on consumer focus groups, but pretty much it’s us in our lab. And then we’re going to hand something over a couple of years later, to people in marketing who are going to hand it over to sales.” And you can get this impression of it’s very sequential. It’s very siloed and it’s really quite slow, which again was okay back in the day. What they started to really struggle with though, is that the industry was changing much faster. They were facing newer competitors where that approach to innovation simply couldn’t cut it.

BRIAN KENNY: So who are those competitors? Who are they worried about?

EMILY TRUELOVE: One of the interesting things happening in this industry is that really the notion of value starts to shift, pretty much at the time of when we’re starting the case. And it shifts from a focus on competing on products to competing on experiences. And I think giving an example from the razor business, which is one that P&G gave us when we were writing the case, helps to really crystallize this. So for many decades, P&G had dominated in the razor business by having basically a technically superior razor. And they would change it in incremental ways, but it basically worked and people would buy it again and again. And that business was really rocked by Dollar Shave Club, one of these direct to consumer companies that came on the scene. And ultimately, I think in 2016 was purchased by Unilever, one of P&G’s competitors, for a billion dollars. What was interesting about what Dollar Shave Club did though, is that they had this subscription model where they said, one of the big pain points of razors is that you run out and you have to run to the store then at night or in the morning when you don’t want to have to. And so we’re going to have a subscription model such that the purchase experience is really frictionless, and we’re going to collect data on people so that we can give them personalized products. So you have kind of pre-shave and aftershave products related to your razor, which is also customized for you. They were also really great at using social media to advertise their brand again, to collect more data from consumers. And so fundamentally P&G had this industry where they had really kind of dominated, and yet they’re facing this competitor that’s playing a different game. Again, they’re competing more on the experience. And that is broadly the big shift that P&G was grappling with when we were writing the case. Competitors being these direct to consumer companies, which were much smaller, much more focused, very agile, very adept at using social media adept to doing small batches, at creating holistic experiences, et cetera. And that marked a huge change because historically P&G was really competing with other big CPG companies like themselves. So this was a whole new game for them.

BRIAN KENNY: Yeah. We’ve done a couple of episodes on direct to consumer companies. They are in sort of a very interesting phenomenon that we’re seeing quite a bit more of these days. The protagonist in the case you mentioned before, is Kathy Fish. Tell us a little bit about Kathy, what’s her background and what is she being asked to do here?

EMILY TRUELOVE: Kathy Fish joined Proctor and Gamble way back in 1979. And she joined as a chemical engineer and made her way through the ranks, basically over the course of four decades, she visited one of our executive education classes here at HBS last week and mentioned that she almost came to HBS, but decided not to. She was going to stay in R and D, but keep a business focus as much as she could. And she really rose up the ranks working in many of the different business units, which are category based at P&G. Ultimately, she made it into the role, in 2014, of being Chief Technology Officer at the company and her final role then, which we see in the case in 2017, she becomes the Chief Research Development and Innovation Officer at P&G.

BRIAN KENNY: Okay. Well, I guess she did all right, even though she didn’t come to HBS.

EMILY TRUELOVE: She did okay.

BRIAN KENNY: So tell us a little bit about the company itself. You mentioned its size. I mean, how big is it and what’s it like to be part of the P&G community? What’s the culture like?

EMILY TRUELOVE: P&G has something like a hundred thousand employees. It’s a relatively large organization. It’s Cincinnati based. Some people come and go, but many stay for years as Kathy, and many of her peers on the leadership team, had. And in a lot of ways, it’s quite a healthy culture and people have a lot of pride in all of these amazing brands they’ve produced and tended over time. I do think though, when it came to fostering a culture of innovation, there were some challenges that P&G was facing. One of these was just a basic fear of failure, and this is something that came up again and again, from people inside the company we talked to, and this largely sprang from the fact that the people who would get promoted were typically those who are really great at execution and operating. Therefore it was really scary to be somebody who is trying out something really new. And if you can picture that there is this very heavyweight approach to innovation. If that’s your process where you have many years riding behind a product launch, millions and millions of dollars, it’s very scary if you fail and it’s very public. And so there was kind of a general sense of, I don’t want to fail, which was a huge impediment to innovation at the company. A couple other things that I think are relevant to the case, around the time of the recession, they struggled financially and also had an activist investor. And so there were a number of things happening in the environment for P&G that created quite a short-term focus and people became really heads down, therefore, not so much thinking about the future and where are our categories heading? What are new categories we could be inventing? The final thing I’ll mention about the culture of P&G that I think is relevant for this case is that it’s very much a decentralized organization where power is with the BU leaderships. And there’s a number of different BUs based on categories-

BRIAN KENNY: Business units there.

EMILY TRUELOVE: Business units, yes, Fabric care, haircare, feminine care. And as a result, Kathy Fish being in this very senior role, she was actually the most senior woman at Procter and Gamble. But even as somebody on the leadership team, she was not in a position to really tell BU leaders what to do, which is an important piece of this case.

BRIAN KENNY: And probably, similar to the experience that a lot of people have had if they’ve worked in large companies, there are these solitary business units, and they’ve got presidents in charge of them and they kind of run those in a siloed fashion. So I think we see that play out a lot. Interesting. And presents huge challenges in terms of how you break those silos down and get them thinking about an enterprise wide solution to something. So, Kathy has this notion of “irresistible superiority,” which I just like the sound of that.

EMILY TRUELOVE: Why do you laugh?

BRIAN KENNY: What does that mean? What does that mean?

EMILY TRUELOVE: So, Kathy developed this notion of “irresistible superiority” and what it means is creating a product experience that is so good, people find it so good that they find it really difficult to switch to a competitor. And she talks about how this is not just about again, having a technically superior product, it’s really about the whole experience. The packaging, the purchase experience, the marketing, how all of these things integrate together. And Kathy developed the notion, early on into her role as the Chief Technology Officer where she wanted to figure out what is behind our billion-dollar brands. Like what are these brands doing where people have found them to be irresistibly superior? And that’s where she was kind of looking at these factors of, it’s not just the product, it’s this emotional connection. And she strove to figure out how can we actually make sure that maybe not all of our innovations, but that most of our innovations are brought up to that bar.

BRIAN KENNY: And that probably makes them think very differently about their process from concept to delivery of a product. How does that affect the way that they come at their science and their packaging and all those other things?

EMILY TRUELOVE: Yeah, exactly. So once Kathy started socializing this idea with others on the senior team, everyone was like, “Great. We would love to do irresistibly superior innovations and products.” But people also quickly realized we’re not really set up to do this because to the extent that a huge piece of it is having this holistic, personalized experience, that’s not something we’re going to do when we have people inside the organization, working in silos. And when we have them working in a slow way that’s behind the times. And in particularly, we’re not going to have it by cooking things in a lab. We actually need to have much more engagement with consumers and adapt our products accordingly.

BRIAN KENNY: So this concept of GrowthWorks then is one of the central themes in the case. Can you talk like, what is growth works and how did they start to operationalize that within the firm itself?

EMILY TRUELOVE: The big philosophy behind it, or I should say the underlying philosophy is one quite similar to lean innovation or lean startup. And the basic idea with lean is you want constant, rapid, cheap experimentation, and you want to make sure that people are kind of falling in love with problems as opposed to solutions. That’s something that the philosophy talks about. Having people constantly test their assumptions, transact with real customers, having a metered approach to funding where you’re not putting huge amounts of money behind something before if it’s going to work, but distributing it over time. And so the general idea is we want experimentation to be happening all the time and for it to be de-risked. And for it to be something that the culture embraces, therefore, it’s clear to see why this would be appealing to the leadership of P&G. This is kind of where they needed to go. However, as I also mentioned, Kathy was coming from a place where she couldn’t mandate that those in the business units start working in a new way, given the nature of her position. So the idea with growth works was we’re going to try to create this enabling capability where we help people to work in a new way, but they can basically volunteer to take part in it or not. We’re not going to force it on them. And so from the get-go Kathy, I should say, she worked very closely with the CMO of P&G, Mark Pritchard. And from the start they had this idea of, we want GrowthWorks to be business unit led, but corporately supported. And they developed an 18-person team of volunteers from across the company who said, “Okay, we’re going to try to help people in the business units start working in these new ways.” And to your question of how they really operationalized it, what did this look like on the ground? One of the cornerstones was to have multifunctional teams that were very small and that were completely dedicated to a particular problem. So these were limited to three people. They called the members of these teams, founders. They would sic themselves on a particular problem that they knew consumers wanted to have solved, and they would run experiments and really just completely own this space. So the multifunctional dedicated team was a really important piece and was quite different from how people had actually been working before. Another piece of it was to have growth boards. So within each of the business units basically have a set of leaders from the business unit who would help to coach these teams along, who would give them funding in this metered way. And then throughout, there were a lot of different sponsors in the organization, including the CEO, David Taylor, who was very supportive throughout.

BRIAN KENNY: It all sounds really good. It all sounds really scary. And I’m wondering a couple of things. One is, how committed was the organization really to this it’s great that the CEO is putting a shoulder behind it, but how does the CFO feel about it? And are they creating the space that these teams would need to actually achieve something? And at the same time who within the organization would have the nerve, I guess, to sort of take this risk in a risk averse culture and say, “Yeah, I’m going to be one of these founders and I’m going to try and make this thing happen at the risk potentially of losing whatever stature I might’ve had within the firm to begin with.”

EMILY TRUELOVE: Right. A couple answers to that. One thing is in the summer of 2016, right around when GrowthWorks was launched, the CEO had taken the senior team on an innovation tourism trip to Silicon Valley. Those in the senior team had actually gotten really energized around the idea of, “Okay, we can really work in these much leaner ways and it’s going to really improve our innovation capability.” And so I do think the groundwork in some ways had been laid for people to understand there is a case for change here. The other thing is it’s true, it was a big risk to ask people to take on these new ways of working. And indeed, along the way as GrowthWorks started launching pilots, they started to learn some of the challenges that were arising that they hadn’t even anticipated. So I can give you a couple of examples of it, because I think that the way that the GrowthWorks team handled these challenges is really pretty interesting. So to give an example, even among people who were pretty excited about, “Okay, I’d like to be one of these founders, I’d like to do this newer kind of work. I’d like to work in a new way.” They struggled because they were concerned about their careers. I think to the point you were making, Brian, this seemed like a risk. Why would you want to be on one of these teams when this has been a place where innovation is kind of seen as a risky area. One of the things that the GrowthWorks team did was say, “Okay, look, why don’t we start a whole new career track where it’s going to be just as prestigious as other ones, except you’re going to have a different set of metrics that you’re dealing with. So for example, instead of rewarding you on short-term performance, we’re actually going to measure how much have you learned by conducting an experiment. And if you’ve learned a lot, even if it failed, we’re going to see that as positive performance.” And so like all these different problems kept coming up as they were trying to actually have teams pilot this new way of working, and they would try to throw solutions at those problems. Another one that came up is even after people’s career concerns were somewhat assuaged, they realized that people down below in the organization were pretty much loving working in new ways, and yet the leadership of business units actually didn’t really have the… even if they had the willingness, they didn’t necessarily have the capability to coach these teams. So, one of the things that they did was bring in a consulting firm called Bionic, who they helped to use to really coach business leaders and get them into a place where they could actually serve as helpful sponsors for projects.

BRIAN KENNY: The idea of killing projects surfaces here. And we know that people who create projects get vested in them and they feel passionate about them and it’s hard to kill something, but it was pretty important to the overall success of what P&G was trying to do.

EMILY TRUELOVE: Absolutely. So a lot of talk there during our visits about the importance of killing projects. And historically, that was just something that wasn’t done again, part of this because there’s a sense of, “Well, it’s going to be horrible for this person’s career if we kill this project.” And what they came to realize over time is, first of all, if you don’t kill projects, you have a problem in that you’re spending your money and your time and attention in places where they could be much better spent elsewhere making progress on something. And again, the other thing is, what kind of culture does it create? It creates one where a project that is killed is seen as this career ending thing. And so part of the idea with GrowthWorks with this whole notion of we need to embrace experimentation and do it rapidly and do it cheaply is, we’re going to de-risk this enough that if something is killed, it’s not a big deal, you just move on to the next thing. I think another piece that was really interesting is they very much emphasized, we want these founder teams to fall in love with problems, not solutions, such that if your particular solution you developed to a problem doesn’t work, you just go back to that problem that you think is great and try to develop another solution. And so it very much helped with this issue of killing projects and making it feel… Of course, the idea isn’t that you want to be killing projects, you want them to be successful. But the idea is let’s try to actually normalize having projects not work out and just quickly move on to the next one.

BRIAN KENNY: So it’s not the project, it’s the problem that you’re really focused on.

EMILY TRUELOVE: Yeah, trying to keep people focused on the problem not their solutions. Yeah.

BRIAN KENNY: So what were some of the pilots that came out of this? Describe a couple of them.

EMILY TRUELOVE: In terms of some of the projects that came out of growth works, it’s interesting because some were, quite low tech and others were quite high tech. In terms of a low tech one, there was a team that did something called forever roll, where they developed a roll of toilet paper that was so big that you basically never needed to buy another one, or you didn’t have to buy one very frequently, which it’s interesting because this was happening pretty much in the months before the pandemic started. It turns out that’s actually a useful innovation. So that’s one kind of thing that came out of this. And again, from really looking at consumer insights. Some really interesting other higher tech products, too, there are some skincare products that use AI technology. You can take a selfie of yourself and get your skin age in case you want to know that I think there’s questions about it, people want to know that, but you got your skin age and it customizes for you, here’s different products you might use. You can imagine their social media integrations with this, product recommendations. A real robust set of projects came out of this and pretty quickly there were 130 different projects in the GrowthWorks portfolio. And these are across a range of business units and they were at different stages of development, some in validation, some were actually incubating in testing in the market.

BRIAN KENNY: The case talks about some key questions that business unit leaders need to be asking or thinking about when they’re looking at these opportunities. Can you describe what those are?

EMILY TRUELOVE: Yeah. So in concert with Bionic those on the GrowthWorks team, were really working towards coaching leaders. How can we actually help them to really coach these teams with their innovations? And there were four questions that they were really instructed to ask. So the first is, what did you learn in conducting an experiment? Second of all, how do you know? Third, what do you need to learn next? And finally, how can I help? And I think what’s really interesting about these questions is shifting it from a performance focus to much more of a learning and development focus, and very much positioning the leaders in a place not of, “I’m going to tell you what to do because I’m not the one who’s talking to consumers and who’s actually running the experiments, but I’m just going to figure out how can I enable you to actually get this work done.”

BRIAN KENNY: Yeah. And I think those questions actually could be used in a much broader way. I think managers just generally speaking, those are great questions to ask anybody who’s working on any kind of a project.

EMILY TRUELOVE: Absolutely. And I think one of the things that was really smart about how P&G utilized outside consulting help is that they very much had an approach of, “We want you to help us to build the capability internally.” So things like, what are the questions we need to ask, as opposed to just tell us what to do.” I think went a long way and helped to really embed this into the organization in a real way.

BRIAN KENNY: And the case also describes as these pilots are moving to different phases, the teams start to encounter things that they probably had never had to think about before. And I saw this a little bit as an ode to central services everywhere because I think in a lot of places where you’ve got either scientists or you’ve got sort of thought leaders who are focusing on the solution, and then you’ve got other teams that are stepping in to support in different ways, that realization became really clear to these folks. Can you just describe that a little bit, too?

EMILY TRUELOVE: As teams started to move into the incubate phase, this is when they’re transacting with real customers, there were a whole new host of challenges that they encountered. So one of them is that P&G, I think we have a quote like this in the case, it is good at doing say 50,000 units of something and can do five units, but 5,000 is really tough. So one of the things they struggled with is, even if we now have the product, we have the experience, figuring out things like new supply chains, new ways of dealing with transactional marketing. This was very new for them. And interestingly at P&G, because it’s this massive company, for a lot of employees inside they just weren’t used to having to do a lot of little pieces of essentially starting up a business, which is what they were doing. And so many teams became very overwhelmed with, gosh, there’s so much stuff we took for granted. We now have to do. One of the things that the GrowthWorks team did that I think was very smart is they developed this centralized capability called The Garage. And the idea of The Garage was it’s this one-stop shop for capabilities that teams are going to use, regardless of which kind of business unit they’re in. Again, things like leaner supply chain, new ways of doing marketing. And Kathy Fish and Mark Pritchard funded this with their own budgets. And they said, “We’re going to pay for this capability. And if you’re running these experiments and you run into roadblocks, come to us, we’ll send over XYZ talent that you need or whatever capabilities. And if you really like it, you can keep those people. If you try it and like it, you can buy it.

BRIAN KENNY: This has been awesome conversation. I have two more questions for you before we wrap it up, the first would be, now that they’ve created this movement, people are getting excited about it. It’s a huge firm with a long history. How do you embed this in some ways? And how does this become the way that Proctor and Gamble operates on a going forward basis?

EMILY TRUELOVE: Kathy convinced the CEO and then the board of directors, to have innovation metrics really put on the scorecards of the business unit leaders in a way that they had never been before. And what’s really interesting about what they did is they didn’t just add innovation metrics that were more medium and long term. They also added a set of more qualitative questions that Kathy said really yielded completely different conversations with these leaders. So some of the questions were things like, how are you doing on irresistible superiority? Were you worried you might be disrupted? What experiments are you running against those areas? And how do you think about yourself as a leader of innovation? In what ways do you need to improve? What are your strengths? And it really just kind of shifted their focus into a very different space. Clearly they’re still very focused on the short-term objectives that they need to meet as they should be, but this really kind of complemented their evaluation in a way that really has them thinking much more broadly and much more aligned with doing disruptive innovation.

BRIAN KENNY: Yeah. It makes great sense. So Emily, I guess my last question then would be, as you know, as our listeners are sort of taking all this in, what’s one thing that you would really like to have them take away from the case?

EMILY TRUELOVE: I think something really important to take away is this basic approach to leading change, and even just to leadership that Kathy Fish exhibited and her team too I should say, because she really was working with a team. But it’s very much this approach of, as a leader, my job is to enable others to do great work. And I think whether it is in this constant, “Okay, here’s a problem that comes up, how can I remove that barrier from someone that we see throughout the case?” Or even Kathy’s general approach of, “I’m not going to force people to do something, I’m going to try to actually pull them in this direction as opposed to push them.”

BRIAN KENNY: It’s a great case, Emily, thank you for joining us to discuss it.

EMILY TRUELOVE: Thank you.

BRIAN KENNY: If you enjoy Cold Call , you should check out our other podcast from Harvard Business School, including After Hours , Skydeck , and Managing the Future of Work . Find them on Apple Podcasts or wherever you listen. Thanks again for joining us. I’m your host, Brian Kenny, and you’ve been listening to Cold Call , an official podcast of Harvard Business School, brought to you by the HBR Presents network.

- Subscribe On:

Latest in this series

This article is about disruptive innovation.

- Experimentation

- Product development

Partner Center

Supply-Chain Partnership between P&G and Wal-Mart

Cite this chapter.

- Michael Grean &

- Michael J. Shaw

Part of the book series: Integrated Series in Information Systems ((ISIS,volume 1))

1926 Accesses

16 Citations

This paper describes the development of channel partnership between a manufacturer (Procter and Gamble, or P&G) and a retailer (Wal-Mart). Both major players in their industries, P&G and Wal-Mart found a way to leverage on information technology by sharing data across their mutual supply chains. The resulting channel has become more efficient because channel activities are better coordinated. There are reduced needs for inventories but greater returns by focusing on selling what the customers want. All in all, the supply chain between P&G and Wal-Mart has adopted a much better customer focus through the channel partnership. And it is mutually beneficial. This integration of the supply-chain information systems will become increasingly important both for enhancing business-to-business electronic commerce and for supporting the increasing volume and customization in business-to-consumer electronic commerce.

- Integrated Supply Chains

- Information Sharing

- Channel Partnership

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Unable to display preview. Download preview PDF.

Cachon, G., and Fisher, M., “Cambell Soup’s Continuous Replenishment Program: Evaluation and Enhanced Inventory Decision Rules,” Production and Operation Management , Vol. 6, No. 3, Fall, 1997, pp. 266–276.

Google Scholar

Clark, T. H. and Lee, H. G., “Performance, Interdependence, and Coordination in Business-to-Business Electronic Commerce and Supply-Chain Management,” Information Technology and Management , Vol. 1, 2000, pp.85–105.

Article Google Scholar

Clark, T. H. and McKenny, J. L., “Procter&Gamble: Improving Consumer Value through Process Redesign”, HBS Case #9-195-126, Harvard Business School, Boston, MA, 1995.

Lee, H., Padmanabhan, P., and Whang, S., “Information Distortion in a Supply Chain: The Bull Whip Effect.” Management Science . Vol. 43, 1997b, pp.546–58.

ISI Google Scholar

Seidmann, A. and Sundararajan, A., “Sharing Logistics Information Across Organizations: Technology, Competition, and Contracting,” Information Technology and Industrial Competitiveness . C. Kemerer (Ed.), Kluwer Academic Publishers, 1998.

Download references

You can also search for this author in PubMed Google Scholar

Editor information

Rights and permissions.

Reprints and permissions

Copyright information

© 2002 Kluwer Academic Publishers

About this chapter

Grean, M., Shaw, M.J. (2002). Supply-Chain Partnership between P&G and Wal-Mart. In: Shaw, M.J. (eds) E-Business Management. Integrated Series in Information Systems, vol 1. Springer, Boston, MA. https://doi.org/10.1007/0-306-47548-0_8

Download citation

DOI : https://doi.org/10.1007/0-306-47548-0_8

Publisher Name : Springer, Boston, MA

Print ISBN : 978-1-4020-7178-2

Online ISBN : 978-0-306-47548-1

eBook Packages : Springer Book Archive

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Complimentary Case Study

P&g case study creating a sustainable supply chain through innovative partnerships.

The overarching goal of the partnership between Procter & Gamble and Domtar was clear: developing an increased supply of FSC-certified wood pulp fiber in the southeast U.S. to create sustainable consumer products. Domtar and P&G formed a unique, corporate-to-corporate partnership based on a common objective — developing a strategy to create their own supply of FSC-certified fiber when there was not enough supply. Domtar and P&G created their own supply by seeking out individual landowners in the southern United States and convincing them to seek FSC certification for their lands. This case study will explore the nature of the partnership, the relationships with the landowners and the incentives to certify their land, as well as challenges, successes, and lessons learned from this successful and on-going program.

What You Will Learn:

- How did a unique corporate partnership help increase the supply of Forest Stewardship Council® certified wood fiber in a mutually beneficial way?

- How did two organizations collaborate to engage landowners and build trust?

- How did two organizations connect all elements of the supply chain?

- Three key lessons to create effective and efficient ongoing partnerships

Share this with your network:

Fill out the form below to download:

Experience in Sustainability: Select Less than 2 years 2 - 6 years 7 - 10 years More than 10 years

*What does your role fit best? Sustainability/CSR Marketing Communications & PR Design & Innovation Finance & Investment Supply Chain Management Human Resources Education (educator, administrator, other) NGO/Non-Profit Student Consultant Business/Brand Strategy President/CEO Legal Other

What organizational level does your role fit in?

Company Size

Phone Number

Send me updates about events near me

- Predictive Analytics Workshops

- Corporate Strategy Workshops

- Advanced Excel for MBA

- Powerpoint Workshops

- Digital Transformation

- Competing on Business Analytics

- Aligning Analytics with Strategy

- Building & Sustaining Competitive Advantages

- Corporate Strategy

- Aligning Strategy & Sales

- Digital Marketing

- Hypothesis Testing

- Time Series Analysis

- Regression Analysis

- Machine Learning

- Marketing Strategy

- Branding & Advertising

- Risk Management

- Hedging Strategies

- Network Plotting

- Bar Charts & Time Series

- Technical Analysis of Stocks MACD

- NPV Worksheet

- ABC Analysis Worksheet

- WACC Worksheet

- Porter 5 Forces

- Porter Value Chain

- Amazing Charts

- Garnett Chart

- HBR Case Solution

- 4P Analysis

- 5C Analysis

- NPV Analysis

- SWOT Analysis

- PESTEL Analysis

- Cost Optimization

Supply Chain Finance at Procter & Gamble

- Finance & Accounting / MBA EMBA Resources

Next Case Study Solutions

- Cargill: Keeping the Family Business Private Case Study Solution

- Red, White & Hoos: A New A Cappella Group at the University of Virginia Case Study Solution

- The Role of Real Estate in Endowment Portfolios: The Case of Christ Church College Case Study Solution

- Wonder Kidz Franchise Case Study Solution

- Textbooks for Change Case Study Solution

Previous Case Solutions

- Olam: Accounting for Biological Assets Case Study Solution

- Tiger Airways: Buyout Offer from Singapore International Airlines Case Study Solution

- GMR Airport Concession: Mumbai Versus Delhi Case Study Solution

- RegionFly: Cutting Costs in the Airline Industry Case Study Solution

- Turnaround at Norsk Gjenvinning Case Study Solution

Predictive Analytics

April 6, 2024

Popular Tags

Case study solutions.

Case Study Solution | Assignment Help | Case Help

Supply chain finance at procter & gamble description.

In April 2013, Procter & Gamble (P&G), the world's largest consumer packaged goods (CPG) company, announced that it would extend its payment terms to suppliers by 30 days. At the same time, P&G announced a new supply chain financing (SCF) program giving suppliers the ability to receive discounted payments for their P&G receivables. Fibria Celulose, a Brazilian supplier of kraft pulp, joined the program in 2013, but was re-evaluating the costs and benefits of participating in the SCF program in the summer of 2015. The firm's treasury group and its US country manager must decide whether to keep using the program and, if so, whether to keep their existing SCF banking relationship or start a new relationship with another global SCF bank.

Case Description Supply Chain Finance at Procter & Gamble

Strategic managment tools used in case study analysis of supply chain finance at procter & gamble, step 1. problem identification in supply chain finance at procter & gamble case study, step 2. external environment analysis - pestel / pest / step analysis of supply chain finance at procter & gamble case study, step 3. industry specific / porter five forces analysis of supply chain finance at procter & gamble case study, step 4. evaluating alternatives / swot analysis of supply chain finance at procter & gamble case study, step 5. porter value chain analysis / vrio / vrin analysis supply chain finance at procter & gamble case study, step 6. recommendations supply chain finance at procter & gamble case study, step 7. basis of recommendations for supply chain finance at procter & gamble case study, quality & on time delivery.

100% money back guarantee if the quality doesn't match the promise

100% Plagiarism Free

If the work we produce contain plagiarism then we payback 1000 USD

Paypal Secure

All your payments are secure with Paypal security.

300 Words per Page

We provide 300 words per page unlike competitors' 250 or 275

Free Title Page, Citation Page, References, Exhibits, Revision, Charts

Case study solutions are career defining. Order your custom solution now.

Case Analysis of Supply Chain Finance at Procter & Gamble

Supply Chain Finance at Procter & Gamble is a Harvard Business (HBR) Case Study on Finance & Accounting , Texas Business School provides HBR case study assignment help for just $9. Texas Business School(TBS) case study solution is based on HBR Case Study Method framework, TBS expertise & global insights. Supply Chain Finance at Procter & Gamble is designed and drafted in a manner to allow the HBR case study reader to analyze a real-world problem by putting reader into the position of the decision maker. Supply Chain Finance at Procter & Gamble case study will help professionals, MBA, EMBA, and leaders to develop a broad and clear understanding of casecategory challenges. Supply Chain Finance at Procter & Gamble will also provide insight into areas such as – wordlist , strategy, leadership, sales and marketing, and negotiations.

Case Study Solutions Background Work

Supply Chain Finance at Procter & Gamble case study solution is focused on solving the strategic and operational challenges the protagonist of the case is facing. The challenges involve – evaluation of strategic options, key role of Finance & Accounting, leadership qualities of the protagonist, and dynamics of the external environment. The challenge in front of the protagonist, of Supply Chain Finance at Procter & Gamble, is to not only build a competitive position of the organization but also to sustain it over a period of time.

Strategic Management Tools Used in Case Study Solution

The Supply Chain Finance at Procter & Gamble case study solution requires the MBA, EMBA, executive, professional to have a deep understanding of various strategic management tools such as SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis.

Texas Business School Approach to Finance & Accounting Solutions

In the Texas Business School, Supply Chain Finance at Procter & Gamble case study solution – following strategic tools are used - SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis. We have additionally used the concept of supply chain management and leadership framework to build a comprehensive case study solution for the case – Supply Chain Finance at Procter & Gamble

Step 1 – Problem Identification of Supply Chain Finance at Procter & Gamble - Harvard Business School Case Study

The first step to solve HBR Supply Chain Finance at Procter & Gamble case study solution is to identify the problem present in the case. The problem statement of the case is provided in the beginning of the case where the protagonist is contemplating various options in the face of numerous challenges that Scf Program is facing right now. Even though the problem statement is essentially – “Finance & Accounting” challenge but it has impacted by others factors such as communication in the organization, uncertainty in the external environment, leadership in Scf Program, style of leadership and organization structure, marketing and sales, organizational behavior, strategy, internal politics, stakeholders priorities and more.

Step 2 – External Environment Analysis

Texas Business School approach of case study analysis – Conclusion, Reasons, Evidences - provides a framework to analyze every HBR case study. It requires conducting robust external environmental analysis to decipher evidences for the reasons presented in the Supply Chain Finance at Procter & Gamble. The external environment analysis of Supply Chain Finance at Procter & Gamble will ensure that we are keeping a tab on the macro-environment factors that are directly and indirectly impacting the business of the firm.

What is PESTEL Analysis? Briefly Explained

PESTEL stands for political, economic, social, technological, environmental and legal factors that impact the external environment of firm in Supply Chain Finance at Procter & Gamble case study. PESTEL analysis of " Supply Chain Finance at Procter & Gamble" can help us understand why the organization is performing badly, what are the factors in the external environment that are impacting the performance of the organization, and how the organization can either manage or mitigate the impact of these external factors.

How to do PESTEL / PEST / STEP Analysis? What are the components of PESTEL Analysis?

As mentioned above PESTEL Analysis has six elements – political, economic, social, technological, environmental, and legal. All the six elements are explained in context with Supply Chain Finance at Procter & Gamble macro-environment and how it impacts the businesses of the firm.

How to do PESTEL Analysis for Supply Chain Finance at Procter & Gamble

To do comprehensive PESTEL analysis of case study – Supply Chain Finance at Procter & Gamble , we have researched numerous components under the six factors of PESTEL analysis.

Political Factors that Impact Supply Chain Finance at Procter & Gamble

Political factors impact seven key decision making areas – economic environment, socio-cultural environment, rate of innovation & investment in research & development, environmental laws, legal requirements, and acceptance of new technologies.

Government policies have significant impact on the business environment of any country. The firm in “ Supply Chain Finance at Procter & Gamble ” needs to navigate these policy decisions to create either an edge for itself or reduce the negative impact of the policy as far as possible.

Data safety laws – The countries in which Scf Program is operating, firms are required to store customer data within the premises of the country. Scf Program needs to restructure its IT policies to accommodate these changes. In the EU countries, firms are required to make special provision for privacy issues and other laws.

Competition Regulations – Numerous countries have strong competition laws both regarding the monopoly conditions and day to day fair business practices. Supply Chain Finance at Procter & Gamble has numerous instances where the competition regulations aspects can be scrutinized.

Import restrictions on products – Before entering the new market, Scf Program in case study Supply Chain Finance at Procter & Gamble" should look into the import restrictions that may be present in the prospective market.

Export restrictions on products – Apart from direct product export restrictions in field of technology and agriculture, a number of countries also have capital controls. Scf Program in case study “ Supply Chain Finance at Procter & Gamble ” should look into these export restrictions policies.

Foreign Direct Investment Policies – Government policies favors local companies over international policies, Scf Program in case study “ Supply Chain Finance at Procter & Gamble ” should understand in minute details regarding the Foreign Direct Investment policies of the prospective market.

Corporate Taxes – The rate of taxes is often used by governments to lure foreign direct investments or increase domestic investment in a certain sector. Corporate taxation can be divided into two categories – taxes on profits and taxes on operations. Taxes on profits number is important for companies that already have a sustainable business model, while taxes on operations is far more significant for companies that are looking to set up new plants or operations.

Tariffs – Chekout how much tariffs the firm needs to pay in the “ Supply Chain Finance at Procter & Gamble ” case study. The level of tariffs will determine the viability of the business model that the firm is contemplating. If the tariffs are high then it will be extremely difficult to compete with the local competitors. But if the tariffs are between 5-10% then Scf Program can compete against other competitors.

Research and Development Subsidies and Policies – Governments often provide tax breaks and other incentives for companies to innovate in various sectors of priority. Managers at Supply Chain Finance at Procter & Gamble case study have to assess whether their business can benefit from such government assistance and subsidies.

Consumer protection – Different countries have different consumer protection laws. Managers need to clarify not only the consumer protection laws in advance but also legal implications if the firm fails to meet any of them.

Political System and Its Implications – Different political systems have different approach to free market and entrepreneurship. Managers need to assess these factors even before entering the market.

Freedom of Press is critical for fair trade and transparency. Countries where freedom of press is not prevalent there are high chances of both political and commercial corruption.

Corruption level – Scf Program needs to assess the level of corruptions both at the official level and at the market level, even before entering a new market. To tackle the menace of corruption – a firm should have a clear SOP that provides managers at each level what to do when they encounter instances of either systematic corruption or bureaucrats looking to take bribes from the firm.

Independence of judiciary – It is critical for fair business practices. If a country doesn’t have independent judiciary then there is no point entry into such a country for business.

Government attitude towards trade unions – Different political systems and government have different attitude towards trade unions and collective bargaining. The firm needs to assess – its comfort dealing with the unions and regulations regarding unions in a given market or industry. If both are on the same page then it makes sense to enter, otherwise it doesn’t.

Economic Factors that Impact Supply Chain Finance at Procter & Gamble

Social factors that impact supply chain finance at procter & gamble, technological factors that impact supply chain finance at procter & gamble, environmental factors that impact supply chain finance at procter & gamble, legal factors that impact supply chain finance at procter & gamble, step 3 – industry specific analysis, what is porter five forces analysis, step 4 – swot analysis / internal environment analysis, step 5 – porter value chain / vrio / vrin analysis, step 6 – evaluating alternatives & recommendations, step 7 – basis for recommendations, references :: supply chain finance at procter & gamble case study solution.

- sales & marketing ,

- leadership ,

- corporate governance ,

- Advertising & Branding ,

- Corporate Social Responsibility (CSR) ,

Amanda Watson

Leave your thought here

© 2019 Texas Business School. All Rights Reserved

USEFUL LINKS

Follow us on.

Subscribe to our newsletter to receive news on update.

Dark Brown Leather Watch

$200.00 $180.00

Dining Chair

$300.00 $220.00

Creative Wooden Stand

$100.00 $80.00

2 x $180.00

2 x $220.00

Subtotal: $200.00

Free Shipping on All Orders Over $100!

Wooden round table

$360.00 $300.00

Hurley Dry-Fit Chino Short. Men's chino short. Outseam Length: 19 Dri-FIT Technology helps keep you dry and comfortable. Made with sweat-wicking fabric. Fitted waist with belt loops. Button waist with zip fly provides a classic look and feel .

Doing the Right Thing with Our Supply Chain

Over the last four years of doing our annual Supplier Citizenship Survey, we have grown the response rate tremendously. In 2020, we had more than 760 suppliers provide data and information on all Citizenship areas, which represents approximately 50% of P&G's global supplier spending. We have seen more suppliers improve in the areas of Environmental, Social and Governance (ESG), with 72% indicating they publish a sustainability or Citizenship report. And we continue to drive inspiration and action across the Citizenship areas. In April 2021, we had our first Global Virtual Supplier Summit which was viewed by more the 1,500 external participants and internal stakeholders. Through this two-hour event, we heard from P&G leaders, including Ana Elena Marziano – Chief Purchasing Officer, Shelly McNamara – Chief Equality & Inclusion Officer and Virginie Helias – Chief Sustainability Officer, about P&G's response to the pandemic and our focus areas going forward. The Summit was followed by a series of 11 workshops through which P&G and our partners shared tools and ideas on how our suppliers can join the journey on Equality & Inclusion, Sustainability and Supplier Diversity. We continue to believe in the importance of sharing P&G strategies and action plans with our key partners, so together we can have significant positive impact on the people in our supply chains, communities and planet.

Supplier Diversity

When our supplier ecosystem reflects the diversity of our consumers, our business grows and the communities in which we live and operate thrive. P&G’s Supplier Diversity program in the U.S. aims to spend with businesses owned by minorities, women, LGBTQ+, people with disabilities and U.S. veterans. Now with the expansion of Supplier Diversity, we are tracking spend with women-owned and women-led suppliers globally, too. We are proud to have spent almost $3 billion with this group of diverse suppliers in fiscal year 20/21, across first and second tiers. Supplier diversity is a competitive advantage for us, and we are committed to drive economic empowerment across our end-to-end supply chain. Therefore, it is important that we recognize and highlight the valuable diverse owned suppliers currently adding value every day to P&G’s business. We share some of their success stories and videos here .

Supplier Diversity Success Story: DSI Mask Distribution