TESCO – British Retailer that redefined Grocery Shopping

The first time I visited a ‘Tesco Extra’ store was at midnight, making an emergency run for next morning’s breakfast. The store seemed to occupy the area of an entire football field in Ashby-De-La-Zouch, UK. Even at an ungodly hour, Tesco was well-lit with visiting customers.

Inside, there were never-ending aisles lined up with groceries, food items, clothing, electronics, and whatnot. It was easy to lose way and lose track of time in the colossal supermarket.

I thought to myself that this would be the only store of its kind in the county, but I was wrong.

Tesco has 4008 stores across the UK and Republic of Ireland , with 7005+ stores and franchises across the world. In Europe, Tesco has established itself in Hungary, Slovakia, Czech Republic, Poland and Turkey. In Asia it has stores in Thailand, South Korea, Malaysia, Japan and China.

TESCO is much more than a chain of supermarkets selling a million products. It’s a giant conglomerate, spanning across so many verticals. It’s the equivalent of one of the FAANG companies but in the Grocery & Retail sector. It becomes imperative for business enthusiasts like you and me to understand the business model of this retail giant called Tesco.

It’s considered a part of the ‘Big Four’ supermarkets alongside ASDA, Sainsbury’s, and Morrison’s in Europe.

The Birth of Supermarkets in Britain

Founded in 1919 by a war veteran – Jack Cohen , Tesco began as a grocery stall in the East End of London, making a profit of £1 on sales of £4 on day one. Tesco’s first store was launched in 1929, selling dry goods & its own brand of Tesco Tea. A hundred more Tesco stores were opened in the next 10 years.

With 100+ mom-and-pop stores in Britain, Jack wanted to expand his product range. He traveled to the US in 1946 and noticed the self-service system, where customers would select different products on the shop floor and finally checkout at a counter. Jack brought this concept back to Britain, giving birth to Tesco Supermarkets and changing the face of British Shopping. His motto was to “stack ‘em high, and sell ‘em low (cheap).”

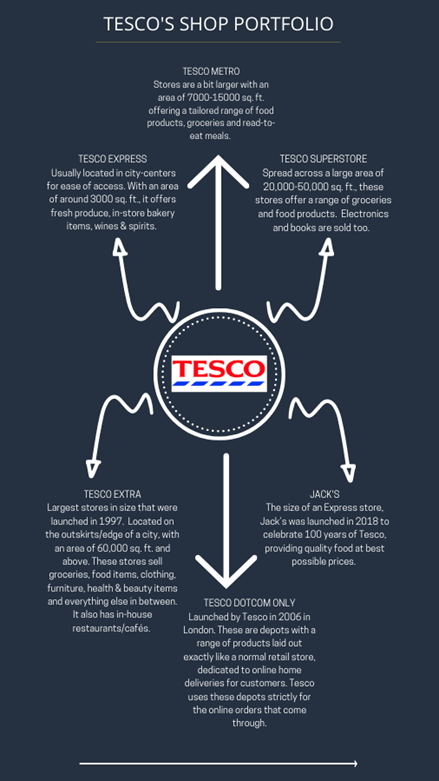

Tesco has a wide range of supermarkets depending upon their size, range of products, and location. This also helps regulate their Supply Chain to reduce wastage.

Tesco Business Model is based on various verticals

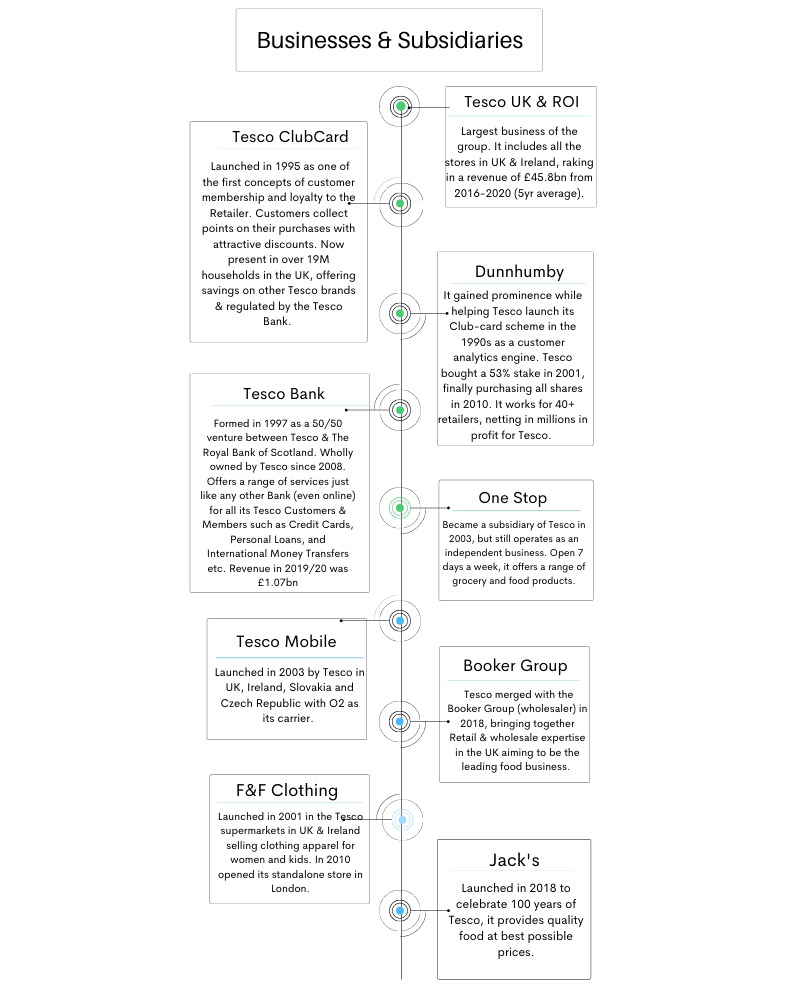

Tesco has deep-rooted its businesses in the European market so well, it’s difficult to miss out on the Tesco hoarding anywhere. Its Businesses and subsidiaries are:

A glimpse into the Complex Supply Chain

A supply chain is one of the critical aspects of the business model of a giant retailer like Tesco. Tesco has its priorities set when it comes to procuring products from different parts of the world:

- Use expertise to offer a better range of products at reasonable prices

- Use economies of scale to buy more for less

- Leverage and maintain relations with global branded suppliers

- Grow the brand

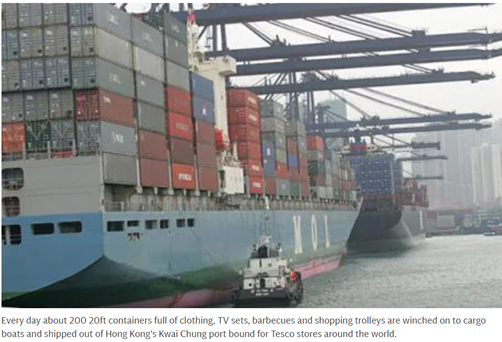

It procures goods from over 44 countries, majorly China. A stock of up to 90,000 different products (30% are food & beverages) is transferred via the global sourcing office located in Hong Kong. Keeping wholesalers out of the loop, Tesco procures directly from suppliers. The conglomerate has developed and maintained long-lasting relations with suppliers’ world over—the main ones being General Mills, Kellogg, Mars, and Princes.

Tesco has set up a separate division to regulate its supply chain, “the machine behind the machine” – Tesco International Sourcing (TIS). It can be compared to the East India Company of the 18 th -19 th Century, catering to only one customer – Tesco.

TIS is connected to over 1000+ suppliers across 1200+ factories . It’s responsible for over 50,000 Tesco product lines in terms of quality control, sourcing, production, designing, timely delivery, and sorting trading/customs documentation.

All activities are coordinated centrally at TIS, with just 533 staff members. These staff members undergo rigorous training to detect & analyze Supplier-violations and conduct Auditing.

Tesco coordinates with TIS on a daily basis to procure products in the following ways:

- The local team uses customer insights to create a Product Brief (new or modified) specified for each region.

- TIS analyzes the product brief and develops a Product Sourcing Plan depending upon – stores that need this product and figuring out minimum transport time and cost, as per the region.

- The Plan is executed, and specific demands are handed out to Suppliers all over the world. Expert TIS Buyers make sure the best deal is made.

- Inbound logistics are consolidated at specific Tesco Depot to receive the product efficiently from Suppliers.

- Local teams then make sure the product is distributed to different Tesco stores from the Depots.

Tesco adding eCommerce to the mainstream business model

Being in the Top 50 retailers globally as of 2021 , Tesco’s annual revenue worldwide in 2020 was £58.09B , a 9.1% decline from 2019 (due to the Pandemic & disposing of its Asia operations , to focus on the core business in Europe).

It shifted from Brick & Mortar to Brick & Click stores. The Click+Collect functionality on its website accounts for 43% of E-grocery sales in the UK. The Click+Collect concept enables customers to place their orders online and collect their orders a few hours later at the nearest Tesco Depot. Tesco created these specialized Depots for online orders only.

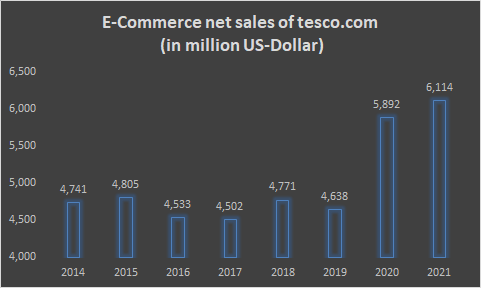

Despite shutting down most its mall operations, Tesco survived 2020 through its online retail store Tesco.com , with double the orders. Its E-commerce net sales had shot up by 31% from 2019-2021.

A Global Operations & Technology Center in Bengaluru was also set up in 2004. This center serves as the backbone of distribution operations for Tesco worldwide. Its business functions are- Finance, Property, Distribution Operations, Customers & Product. The employees at this Center are Engineers, Analysts, Designers, and Architects.

Tesco’s Marketing Strategy

Tesco has always believed in acquiring loyal customers and regaining stakeholders’ trust. It aims to reach customers from all financial backgrounds. So it launched 2 of its own sub-brands – Tesco finest for the affluent customers and Tesco Everyday Value for the rest of the crowd.

Tesco also launched the Club Card in 1995 as a Membership card, to maintain customer loyalty and keep them coming back. The Card operates on a point-based system with discounts on products, & other subsidiaries like double data on Tesco Mobile. With 5 Million subscribers in the first year , Tesco finally overtook its competitor – Sainsbury’s to become No.1 in the UK.

The Club-card strategy was used to obtain customer data and observe buying habits. This data was analyzed, allowing Tesco to put the right products on shelves while eliminating unpopular ones. Tesco realized that the Club Card isn’t just a quick fix & temporary promotional tool; it’s a promotion in itself. This made the Tesco Club Card unique and long-lasting.

Tesco also realized that spending Billions on traditional marketing efforts and maintaining a ‘one-size-fits-all’ brand image wouldn’t work. It decided to hyper-target specific customers and to earn their trust. For starters, thousands of head-office staff and senior executives were sent to work in stores – to demonstrate how Tesco values its customer. Customization became key for its new marketing strategy; sending out discounts on birthdays via Emails and campaigning from door-to-door.

Tesco also made a partial shift to Digital Marketing which costs much lesser and has a wider outreach. It created well-tailored profiles on all social media platforms. On Twitter, it has more than 15 accounts, separate for each of its business units. The online customer care account on Twitter is active 24-7.

All supermarkets commonly advertised themselves to have quality products at a reasonable cost; Tesco wanted to differentiate itself as a unique brand. It introduced step-by-step Recipes prepared from ingredients available at any Tesco store, with Chef Jamie Oliver as its Health Ambassador . Tesco Food and its variety of recipes were a massive hit. Later on, the monthly Tesco Magazine as a food & lifestyle magazine was also launched, with 4.65Million readers worldwide.

The beginning of the pandemic in March 2020 left people apprehensive about visiting a physical store to buy groceries. To deal with customers’ concerns, Tesco came up with an instructional advertisement in April ‘20. With crisp instructions similar to that of an in-flight safety video, this ad showed customers how to physically shop and behave at Tesco stores. It was considered to be the most effective advertising and communications campaign of 2020 as per YouGov BrandIndex .

Competition

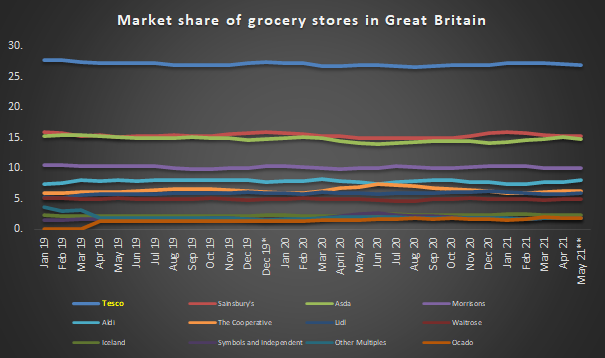

Tesco’s earliest competitor has been Sainsbury’s since the 70s. The Tesco Club Card strategy in 1995 helped it overtake Sainsbury’s to become the No.1 Retailer in the UK, but not for long. The ‘Big Four’ supermarkets in Europe have been in close competition throughout the years. Tesco has acquired a 28% majority stake in the UK market.

The horse meat and accounting scandals were a real setback for Tesco, letting competitors take over the European market. The newest German entrants – Aldi and Lidl had caught customers’ attention and market share in a short span of time.

With a combined market share of 12%, these German retailers posed a threat to Tesco. So much so that Tesco began the ‘ Aldi Price Match ’ campaign to curb the growth of the German discounter and win back customers. Tesco started price-matching thousands of its products with that of Aldi, offering better quality and branded products at Aldi’s prices.

Tesco has a majority market share in Britain, with Sainsbury’s and ASDA in tow:

Tesco Adding Sustainability to its business model – The Little Helps Plan

It’s a well-known fact that giant conglomerate retailers are one of the major causes of rapid climate change and increasing carbon footprints. Tesco realized its impact on the planet and launched the Little Helps Plan as a core part of business in 2017. This plan serves as a framework to attain long-term sustainability. Its four Pillars – People, Products, Planet, and Places are aligned with the UN’s Sustainable Development Goals.

Until now, the Plan has enabled Tesco to:

- Permanently remove 1 Billion pieces of plastic from its packaging

- Redistribute 82% of unsold food, safe for human consumption

- Remove 52Billion unnecessary calories from foods sold

Apart from this, it also aims to increase sales of Plant-Based Meat alternatives by 300% by 2025. At present, it has 350 plant-based meat alternatives on the shelf.

Apart from partnering with various other organizations, Tesco entered a 4-year partnership with World Wide Fund for Nature (WWF) to address one of the biggest causes of wildlife loss – the global food system. It aims to eliminate deforestation from products, promote recyclable/compostable packaging and minimize food waste.

Tesco is one of the few successful retailers in the world, with a compelling history. Tesco has overcome numerous issues across its supply chain, faced global criticism, and still stands undeterred in the European market with its rock-solid business model. It has always adapted to its unpredictable consumers and continues to do so while caring for the planet.

The business is healthy. We said we would rebuild the relationship with the brand and consumers; you will see that in every measure of customer satisfaction we do that. The business is healthy, vibrant and there is a lot of optimism of what we can do going forward. CEO Dave Lewis, who took over Tesco in 2014 (during the struggle years) & stepped down in September 2020

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Johnnie Walker – The legend that keeps walking!

Johnnie Walker is a 200 years old brand but it is still going strong with its marketing strategies and bold attitude to challenge the conventional norms.

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

BlackRock, the story of the world’s largest shadow bank

BlackRock has $7.9 trillion worth of Asset Under Management which is equal to 91 sovereign wealth funds managed. What made it unknown but a massive banker?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

The Nokia Saga – Rise, Fall and Return

Nokia is a perfect case study of a business that once invincible but failed to maintain leadership as it did not innovate as fast as its competitors did!

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-

An Engineering grad, currently working in the fields of Big Data & Business Intelligence. Apart from being immersed in Tech, I love writing and exploring the business world with a focus on Strategy Consulting. An ardent reader of Sci-Fi, Mystery, and thriller novels. On my days off, I would spend time swimming, sketching, or planning my next trip to an unexplored location!

Related Posts

How does Instacart work and make money: Business Model

What does Zscaler do | How does Zscaler work | Business Model

What does Chegg do | How does Chegg work | Business Model

What does Bill.com do | How does Bill.com work | Business Model

What does Cricut do | How does Cricut work | Business Model

What does DexCom do? How does DexCom business work?

What does CarMax do? How does CarMax business work?

What does Paycom do? How does Paycom work?

What does FedEx do | How does FedEx work | Business Model

How does Rumble work and make money: Business Model

Dollar General Business Model & Supply Chain Explained

What does C3 AI do | Business Model Explained

What does Aflac do| How does Aflac work| Business Model

How does Booking.com work and make money: Business Model

What does Okta do | How does Okta work | Business Model

What does Alteryx do | How does Alteryx work | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Section Navigation

9. Learning from Others 9.1 Introduction: Grouping by Business Models :Cautionary Tales 9.2 A Start 9.3 Coins International 9.4 Fine Art Ceramics 9.5 Halberd Engineering 9.6 Ipswich Seeds 9.7 Seascape e-Art 9.8 Whisky Galore :Case Studies 9.9 Amazon 9.10 Andhra Pradesh 9.11 Apple iPod 9.12 Aurora Health Care 9.13 Cisco 9.14 Commerce Bancorp 9.15 Craigslist 9.16 Dell 9.17 Early Dotcom Failures 9.18 Easy Diagnosis 9.19 eBay 9.20 Eneco 9.21 Fiat 9.22 GlaxoSmithKline 9.23 Google ads 9.24 Google services 9.25 Intel 9.26 Liquidation 9.27 Lotus 9.28 Lulu 9.29 Netflix 9.30 Nespresso 9.31 Netscape 9.32 Nitendo wii 9.33 Open Table 9.34 PayPal 9.35 Procter & Gamble 9.36 SIS Datenverarbeitung 9.37 Skype 9.38 Tesco 9.39 Twitter 9.40 Wal-mart 9.41 Zappos 9.42 Zipcar

Control Panel

9.38 tesco plc.

Though still still essentially UK-based, Tesco has diversified geographically and into widely-separated market sectors: retailing books, clothing, electronics, furniture, petrol and software, financial services, telecom and Internet services, DVD rental, and music downloads.{10}

Competition

Tesco is an aggressive company benefiting from Internet technologies, as indeed are its main UK rivals. {9} Sainsbury's and Morrisons cater for more affluent customers, and Asda focuses on the more cost-conscious. Market share as of 2008 was: Tesco 30.5%, Asda 16.9%, Sainsbury's 16.3, and Morrisons 12.3%.{10} A cost breakdown is given below. {9}

Tesco has built its fortune on two business elements: an unrelenting drive to provide value to customers, and continued investment in the latest technologies — today customer relationship management, Internet and mobile phone shopping, and supply chain management (probably a private industrial network, though details are not available).

Back in 1995, however, Tesco was losing market share, causing Terry Leahy, the new CMO, to reexamine its market position and propose a three-pronged solution: {11}

1. Stop copying Sainsbury's and develop its own strategy. 2. Listen to customers throughout the company, at every level. 3. Offer goods and services as the customer valued, not what Tesco could do (i.e. adopt an outside-in strategy).

Customer Relationship Management

Tesco went to extraordinary lengths to understand its customers and add value to their lives.

1. Marketing was aimed at sensible, middle-class families, from its slogan 'Every little helps' to its no-frills website. {11} {14} 2. A loyalty card ('Clubcard') was introduced in 1995, and data subsequently fed into Customer Management Systems. {10} 3. American preferences were studied by embedding staff with US families prior to launching its USA operation in 2007. {11}

Internet Technology

Tesco has been particularly forward-looking. It was one of the first to: {10}

Outlook: Pestel Analysis

A Pestel analysis identifies the forces with most impact on Tesco performance.{9}

Tesco benefited from access to the world's most profitable market of 1.3 billion people, notably by:

1. Britains' joining the European Union, and the inclusion of 10 more countries in 2004. 2. China's entry into the WTO.

The continuing recession has made supermarket customers:

1. More cautious and cost-conscious. 2. More inclined to eat in that go out to restaurants.

As the UK's population changes (especially ages), customers:

1. Tend to eat (and therefore buy) less food. 2. Have become more health conscious, met by Tesco's increased stocking of organic foods. 3. Have been retained by Tesco loyalty programs.

Technological

Tesco were early leaders in Internet shopping, supply chain management and customer relationship management. These continue to be vital today with:

1. Customer loyalty cards and Internet shopping records providing CRM information. 2. Growth of Internet use and broadband access fueling growth in Tesco online shopping. 3. Mobile phone shopping, introduced with Cortexica Vision Systems for Tesco Wines, etc. 4. Supply chain management: rumored to be the world's best, still being extended. {4}

Environmental

Tesco has responded to Government environmental initiatives by:

1. Encouraging reuse of plastic bags. 2. Rewarding bagless deliveries with Tesco's green Clubcard points. 3. Providing practical advice of environmental issues. 4. Adding carbon footprint data to its products.

1. European VAT increases will affect nonfood sectors like clothing. 2. Increase in the UK's minimum wage will increase Tesco operating costs.

Outlook: Swot Analysis

The SWOT {9} analysis regards the UK concentration of business as a weakness, though this is a market Tesco knows well, and which saw further expansion in 2011. {13}

Outlook: Value Chain Analysis

As defined by Lynch (2006), {19} the value chain is the value added at each link in a company's key activities. For Tesco, the values are: {9}

1. Use of leading market position and economies of scale to achieve low costs from its suppliers. 2. Constant upgrading of their ordering system, approved vendor lists, and in-store processes.

Operations Management: 30%

Sources and Further Reading

Lotus's

The lines between physical and digital worlds are blurring — shoppers will use whatever format best suits their needs for convenience, choice and value. Thailand’s most dynamic hypermarket chain, Lotus's, steps up its retail omnichannel distribution to bridge the gaps between channels and create a better shopping experience for customers.

Revolutionizing Customer-Centric Supply Chain for E-Commerce

To better align the experience across multiple platforms, Lotus's has made simplifying the order fulfillment processes possible through supply chain reinvention and optimization. On behalf of Lotus's, SSI SCHAEFER created a recipe for a flexible logistics concept: from the order handling to picking and shipping sortation.

While inbound pallets can be loaded directly into the Pallet Racks , the pick module system integrates various storage solutions inside the Mezzanine work platform system to provide efficient storage, retrieval and fast delivery the customer expects. The pick module system is multi-level, combining the elements of shelving system and Carton flow racks into one high-density footprint. Integrated with the design structure, the Carton and bin conveying system reduces wasted walk time for the pickers so that they can better focus on order picking tasks.

The bin Destacking machines enhance the order start process with constant automatic destacking and order sorting in one work step. Coupled with management technology has meant that error-free and traceable picking is now a possibility. While it only takes one misstep in the supply chain to cause a bottleneck and holds up the preceding departments, the WAMAS® logistics system plays a critical role in managing all the orders in the pipeline.

Today the solutions in Lotus’s facility strike the right balance for an omnichannel supply chain — the efficiency to optimize fulfillment operations and the agility to match customer’s needs throughout the Kingdom of Thailand.

The Partnership Between Lotus's and SSI SCHAEFER

Tech transforming e-commerce hypermarket strategy.

E-commerce is faster than ever as customers can shop at the click of a button. It’s no surprise that hypermarket giant, Lotus's, is turning to technology to speed up delivery of goods to doorsteps. There were several goals outlined for Lotus’s biggest piece-picking facility. While Lotus's wanted to retrofit the existing facility for improved fulfillment operations, the main goal is to ensure a reliable logistics warehouse system software to automate manual processes and save time. The integration of WAMAS® logistics software into the existing Oracle environment was a crucial success factor for Lotus's.

A Deeper Dive: Optimizing Order Picking Operations

From order start to shipping, the combination of the conveyor and WAMAS® logistics system synchronizes the order picking processes and personnel for optimal throughput and productivity. Lotus's relies on the automated function to manage the routing for workload balancing and preventing bottlenecks. Another key feature is the ability to re-route incomplete or incorrect picking jobs to an error station for rectification.

Perfect Blend: Automation and Workers Augmentation

As the business expands, so will the volume of stock-keeping units (SKUs) and the speed items need to be shipped. Lotus's is prepared to meet this heightened demand over the next six years by taking an incremental approach to modernizing their warehouse operations. The solutions developed for Lotus's improves not only the space utilization of the warehouse. It also balances labor and automation in the warehouse, ultimately empowering their employees with a performance edge.

Impressions of the partnership with Lotus's

“SSI SCHAEFER more than exceeded our expectations. They have allowed us to execute fast response to our customer demands. Effortlessly in picking processes — this, in turn, enables us to offer more SKUs and achieve error-free delivery for our customers.”

Bridging the gaps between channels with increased capacity and fulfillment

Lotus's wanted to develop a more cost-effective solution and introduce partial automation to handle in-store and online orders more efficiently. By retrofitting the existing facility, Lotus's can optimize material flow, improve efficiency and better utilize the available space without having to uproot their business.

The Solution

From initial planning and design construction, the solutions from SSI SCHAEFER include:

Pallet Racks

Carton flow racks

Carton and bin conveying system

Destacking machines

WAMAS® logistics system

Lotus's distribution center

Innovative material flow design with semi-automation in Lotus’s biggest piece-picking distribution center. The solutions developed for Lotus's improves space utilization and performance edge with automation. Leverage on technology and ramp-up the hypermarket distribution Lotus's wanted to retrofit the existing warehouse to maximize pick density and space utilization. Combining both automation and work augmentation solutions, Lotus's and SSI SCHAEFER created the recipe of flexible logistics concept: from the order start to picking stations and shipping sortation. The system delivers capabilities to meet the end-customer satisfaction levels by optimizing order processing speed and accuracy.

Case Study Lotus's, Thailand

Innovative material flow design with semi-automation in Lotus’s biggest piece-picking distribution center

Download our Best Practice Guides here!

Determine what automated solution is best for your application.

A Best Practice Guide to getting started with automation

Which E-commerce Fulfillment Solution is Best for Your Business?

Click here to download a Best Practice Guide to getting started or retrofitting your fulfillment solution.

How to Leverage and Retrofit Existing Operations for Retail Omnichannel Distribution

Learn how to retrofit your fulfillment solution to support E-Commerce volume

Do You Have Questions or Remarks?

China’s Retailing Graveyard: A Case Study of TESCO

- First Online: 15 May 2016

Cite this chapter

- Pauline Cosijn 2

Part of the book series: Management for Professionals ((MANAGPROF))

6456 Accesses

Many foreign firms have entered the Chinese retail market, lured by the prospect of a rapidly growing middle class. However, difficulties arise due to the inability of retailers to truly understand the country. In 2013, Tesco announced it would partner up with China Resource Enterprise (CRE), after the retailer had tried to crack the Chinese retail market for 9 consecutive years. The case follows a series of events that led to Tesco’s eventual withdrawal from the Chinese retail market.

- Retail industry

- Brand awareness

- Brand changes

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Bibliography

AtKearney. (2004). Emerging market priorities for Global Retailers . Chicago: AtKearney.

Google Scholar

BBC. (2006, October 3). Tesco makes £1.1bn in six months . Retrieved March 5, 2015, from http://news.bbc.co.uk/2/hi/business/5401494.stm

BBC. (2014, May 29). Tesco and China resources enterprise reach retail deal . Retrieved March 5, 2015, from http://www.bbc.co.uk/news/business-27615404

CBR. (2013, October 2). Tesco to abondon its solo approach to supermarkets in China . Retrieved March 5, 2015, from http://www.chinabusinessreview.com/tesco-to-abandon-its-solo-approach-to-supermarkets-in-china/

Chin, H. (2012). The case for China retail: Issues and opportunities . New York: Prudential Real Estate Investors.

Clark, T. (2014, October 4). A history of Tesco: The rise of Britain’s biggest supermarket . Retrieved March 5, 2015, from http://www.telegraph.co.uk/finance/markets/2788089/A-history-of-Tesco-The-rise-of-Britains-biggest-supermarket.html

Lin, L. (2014, November 14). China resources enterprise turns to loss as Tesco Drags . Retrieved March 5, 2015, from http://www.bloomberg.com/news/articles/2014-11-14/china-resources-enterprise-profit-plunges-as-tesco-drags

Neville, S. (2013, September 29). Tesco end nine-year solo career in China . Retrieved March 5, 2015, from http://www.independent.co.uk/news/business/news/tesco-ends-nineyear-solo-career-in-china-8846322.html

Parry, C. (2013, January 18). Analysis: Challenges faced by UK retailers in the Chinese market . Retrieved March 5, 2015, from http://www.retail-week.com/analysis-challenges-faced-by-uk-retailers-in-the-chinese-market/5044801.article

Rudarakanchana, N. (2013, October 3). Tesco’s struggles in the US, China and Europe . Retrieved March 5, 2015, from Tesco’s struggles in the US, China and Europe.

Tesco. (2004). Tesco enters China through a joint venture with Ting Hsin . London: Tesco Press Office.

Tesco Annual Report. (2012). Accessed February 1, 2013, from www.tesco.com

The Economist. (2014). The rural-urban divide ending apartheid. Accessed October 15, 2015, from http://www.economist.com/news/special-report/21600798-chinas-reforms-work-its-citizens-have-be-made-more-equal-ending-apartheid

The Guardian. (2013, October 2). Tesco’s profits crash: The global picture. The Guardian , 1.

Thomas, D. (2013, August 9). After nine years, Tesco gives up on cracking China alone . Retrieved March 5, 2015, from http://www.reuters.com/article/2013/08/09/us-chinaresources-tesco-idUSBRE97806F20130809

Walsh, F. (2006, December 12). The Guardian . Retrieved March 5, 2015, from http://www.theguardian.com/business/2006/dec/12/supermarkets.tesco.org

Download references

Author information

Authors and affiliations.

TIAS School for Business and Society, Utrecht, The Netherlands

Pauline Cosijn

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Pauline Cosijn .

Editor information

Editors and affiliations.

School of Economics and Management, Tongji University, Shanghai, China

Christiane Prange

Rights and permissions

Reprints and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this chapter

Cosijn, P. (2016). China’s Retailing Graveyard: A Case Study of TESCO. In: Prange, C. (eds) Market Entry in China. Management for Professionals. Springer, Cham. https://doi.org/10.1007/978-3-319-29139-0_9

Download citation

DOI : https://doi.org/10.1007/978-3-319-29139-0_9

Published : 15 May 2016

Publisher Name : Springer, Cham

Print ISBN : 978-3-319-29138-3

Online ISBN : 978-3-319-29139-0

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Case study of Tesco plc: Future international expansion strategy into New Markets

Related Papers

Adam Lindgreen

Social, Humanities, and Educational Studies (SHEs): Conference Series

Sri Aminatun ST., MT.

Located on a hilly topography with a steep slope, highlighted the importance of settlement arrangement based on a landslide risk assessment in Girirejo village, Imogiri, Bantul, Yogyakarta. This study aims to map landslides risk, identify houses in the landslide risk zone, and provide recommendations for settlement arrangements. The research begins with observation, interviews, and focus group discussion. Disaster risk mapping and analysis were carried out through weighting method based on Perka BNPB No.2 of 2012 concerning General Guidelines for Disaster Risk Assessment and a formula with parameters of hazard, vulnerability, and capacity. Results showed the medium to a high-level of landslide risk was dominated by northern and eastern parts of Girirejo (21 families in red-zone, 23 families in yellow-zone), while western and southern regions had a low landslide risk level. This research also provided a formulation of settlements concept for medium and high-risk areas by considering ...

Graciela Pavon-djavid

Astaxanthin is a xanthophyll carotenoid showing efficient scavenging ability and represents an interesting candidate in the development of new therapies for preventing and treating oxidative stress-related pathologies. However, its high lipophilicity and thermolability often limits its antioxidant efficacy in human applications. Here, we developed a formulation of lipid carriers to protect astaxanthin’s antioxidant activity. The synthesis of natural astaxanthin-loaded nanostructured lipid carriers using a green process with sunflower oil as liquid lipid is presented. Their antioxidant activity was measured by α-Tocopherol Equivalent Antioxidant Capacity assay and was compared to those of both natural astaxanthin and α-tocopherol. Characterizations by dynamic light scattering, atomic force microscopy, and scattering electron microscopy techniques were carried out and showed spherical and surface negative charged particles with z-average and polydispersity values of ~60 nm and ~0.3, r...

Ecological Modelling

jeroen steenbeek

International Journal of Academic Research in Business and Social Sciences

Serkan Kunu

Jordan Lucas

Sarmishtha Palit

Real-time condition monitoring of critical engineering components used in industries finds significant importance nowadays. The hostile operating environment of the components such as high temperatures, contraction/expansion, vibrations etc, may lead them to suffer from creep, thermo-mechanical fatigue, environmental attack (oxidation and hot corrosion) etc. Non-existence of sensors applicable to high temperature (~ 400°C) make us handicapped for real time health monitoring of such components. The present work aims to bridge the gap by developing application specific high-temperature sensors for assessing and monitoring the health during operation. Sensors using microfabricated sensing element are the promising, non-contact technology that have significant potential in structural health monitoring of critical engineering components operating at elevated temperatures. Presently, spiral coils/probe has been designed on glass epoxy substrate through chemical etching. Characterizations ...

Autentik : Jurnal Pengembangan Pendidikan Dasar

Barokah Widuroyekti

This study aims to: (1) obtain an overview of the effectiveness of the formation of independent learning through Independent Learning Activity Training in improving the ability of Scientific Writing at the PGSD-UT S1 Pokjar Pamekasan 2017-2018.2; (2) obtain an overview of the effectiveness of the formation of independent learning through designing tutorials in improving the ability of Scientific Writing at S1 PGSD-UT Pokjar Pamekasan 2017-2018.2. Based on these objectives, this research was carried out using a descriptive-qualitative research approach. The process of data analysis begins with examining all data, reducing data, arranging it in units, and analyzing it with percentages. The data analysis of the research was carried out by quantitative and qualitative analysis techniques. Quantitative data were analyzed using percentage calculations. This step is the first step towards the whole process of qualitative descriptive analysis. Quantitative descriptive data analysis in the f...

Periódico Eletrônico Fórum Ambiental da Alta Paulista

Antonio Carlos De-Barros-Corrêa

RELATED PAPERS

Clinical Nuclear Medicine

RAVI RAJ KASHYAP

E3S Web of Conferences

Piotr Rybarczyk

Medical Image Understanding and Analysis

Pankaj Pandey

European Journal of Medicinal Chemistry

Simranjeet Kaur

Parasitology Research

Microbiological Research

Gamal Abdel-Fattah

Biochemical and Biophysical Research Communications

Stephanie Vougier

Journal of Applied Polymer Science

Gajender Saini

African Entomology

Robin Crewe

Salvador Martín M Torres

European Journal of Cardio-Thoracic Surgery

Arshad Quadri

Wael El-Matary

Peggy Levitt

IEEE Transactions on Wireless Communications

mohsen rezaee

giuseppe camodeca

Otieno Otieno

See More Documents Like This

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Tesco Case Study: How an Online Grocery Goliath Was Born

Tesco boasts an impressive history in the UK and abroad. Over the years, the grocery goliath has achieved continued success by remaining at the forefront of retail trends, including everything from self-service shopping to international expansion. More recently, Tesco has made its mark with a sophisticated online grocery strategy that enables seamless digital shopping. There’s a lot that can be gleaned from Tesco’s eCommerce efforts. In this Tesco case study, we highlight the retailer’s long-term emphasis on customer service, which can be seen not only in its physical locations but also in its eCommerce strategy.

Table of Contents – Summary

A Brief History of Tesco

Tesco’s and world’s first virtual store, tesco and scandals, how tesco became a retail case study favorite, tesco’s ecommerce website, interesting technologies that tesco’s uk site uses, impressive tesco stats you may not know, faq on tesco.

- The Tesco Success

To understand current growth and successes and why they warrant a Tesco case study, it helps to understand the retailer’s history. Founded in 1919, the company initially consisted of a group of high-performing market stalls. Founder Jack Cohen conceived the idea shortly after leaving the Royal Flying Corps as World War I drew to a close. He used demobilization funds known as “demob money” to purchase surpluses of fish paste and golden syrup.

Tesco’s initial success could largely be attributed to Cohen’s understanding of mass-market sales. In a time of strict austerity, he employed a rigid business model of “stack ’em high, sell ’em low.” The brand also set itself apart by embracing a self-service approach, which, at the time, was rare in the UK. Following the introduction of its first supermarket in 1956, the retailer entered an era of rapid growth.

After emerging as the UK’s preeminent grocery chain, Tesco released the revolutionary Clubcard. During the 1990s, the chain expanded to include thousands of international locations. This was quickly followed by investments in internet retailing, which led to the chain’s current status as a top eCommerce grocer, netting £1.3 billion in pre-tax profits for the year ending in February 2018.

In 2011 Tesco was the first-ever retailer building the world’s 1st virtual grocery store in South Korea. The experiment took place in a subway station and the results were tremendous: the number of new registered members rose by +76%, online sales increased by +130% and Tesco became South Korea’s no1 online grocery retailer, outranking its rivals e-mart, so this experiment was one of the first key steps towards Tesco’s digital transformation.. After this phenomenal success, Tesco opened its first European virtual grocery shop in Gatwick Airport, UK. See how they did it in this brilliant video:

Tesco has occasionally suffered controversy in the last several decades, with 2 shocking moments that everyone remembers:

- The Horse Meat Scandal: Back in February 2013, several products believed to consist entirely of beef were found to contain horse meat. The Food Safety Authority of Ireland tested a range of cheap frozen beefburgers and it found that Tesco’s sample contained 29% horse instead of beef . The retailer made every effort to appease concerned customers. One of which included a notable promise to tighten up its supply chain and purchase a more significant share of its meat from the UK. Such efforts have likely played into the grocery chain’s recent logistics successes.

- The Accounting scandal: It was 2014 when the news dropped like a bomb: an FTSE 100 firm could get away with “cooking the books”. The company admitted submitting overstated profits by £250 million . The results? £2 billion off the supermarket’s share price in one day.

How Tesco thrived in the COVID-19 area

During Q1 2021, Tesco reported that the sales from its online store were “remarkably higher” than before the Covid-19 crisis. As Internet Retailing mentions , Tesco’s sales increased by +22% in 2020, even though the physical stores and hospitality re-opened at some point. It is believed that this success was a result of Tesco’s recent delivery enhancements and doers mentality, implemented during the first lockdown.

It’s revenue analysis shows that 1.3m online orders were conducted only in spring 2021. This means that the total number of transactions was 81.6% higher than the same period in 2019 (a before Covid-19 year), proving that Tesco actually turned COVID-19 into an opportunity for its business, achieving memorable results by quickly adjusting its business model to the pandemic’s needs.

Despite the horsemeat scandal, Tesco remains a customer favorite throughout the United Kingdom. The Tesco case study has become a common phenomenon, as the chain boasts several unique strengths worth emulating on a broad scale.

Over the years, the retailer has shifted its original “stack ’em high, sell ’em low” approach. While affordability remains a priority, Tesco did not pursue it to the detriment of quality. Instead, it combines reasonable prices with exceptional convenience and customer service. This can be seen in physical stores and eCommerce alike.

Excellent Customer Service

Strong customer service lies at the heart of Tesco’s sustained success. The retailer employs a variety of initiatives to keep consumers happy. Customer-oriented product development, for example, ensures that all stores are stocked with the items visitors actually want. This development process includes rigorous consumer testing to ensure that new products and services are well-received. Customized stores lend further appeal; each is designed based on carefully analyzed demographics.

Quality customer service means making accommodations for all consumers—including those with special needs. Tesco accomplishes this through the use of sunflower lanyards, which allow customers with hidden disabilities to secure additional assistance discreetly. The chain also provides induction loops for hard-of-hearing customers, as well as helpful visual guides for consumers with autism.

Ultimately, Tesco’s impressive customer service derives from its top-down approach, in which a commitment to customer satisfaction permeates every element of the company’s culture. Insight Traction’s Jeremy Garlick tells The Grocer that the key to large-scale retail success lies in “ understanding your customers, anticipating their needs, and giving them what they will value.” Tesco checks off all these boxes. This is true both in stores and with its website, which uses an intuitive layout to ensure that customers can quickly access the products and services they desire.

Product Diversification

Tesco may be best known as a grocery chain, but the retailer provides a surprising array of products and services. It aims to serve as the ultimate one-stop-shop for those who prioritize convenience and quality above all else. Customers can expect to find a collection of produce, dry goods, frozen products, and more. Toiletries, household products, pet food, and even apparel can also be located within Tesco stores and on the retailer’s eCommerce website.

Beyond its many product offerings, Tesco also provides a few key services to enhance customer convenience. Tesco Bank, for example, offers everything from credit cards to pet insurance. These digital offerings play largely into Tesco’s eCommerce strategy, with banking customers capable of accessing their account information online.

Fine-Tuned Logistics

Quality customer service is not possible without an effective logistics and supply chain strategy. Strong relationships with suppliers are essential, especially as Tesco seeks to diversify its already vast product collection further. Efficient routes ensure that produce and other time-sensitive products arrive promptly in stores—and are quickly distributed to customers taking advantage of the chain’s affordable home delivery program.

Ongoing investments in telematics promise to further improve Tesco’s already fine-tuned supply chain. New monitoring tools offer greater insight into the trip status and real-time decision-making—and how these elements play into both profit margins and long-term customer satisfaction.

Digital customers, in particular, appreciate Tesco’s tight supply chain. When they order items online, they can rest assured, knowing that their favorite products will consistently be in stock. What’s more, online customers feel confident that delivered items will be fresh and of exceptional quality.

Insane International Expansion

Tesco may currently dominate the UK grocery market, but it’s also an international force. While the retailer pulled out of the United States in 2014, it has enjoyed sustained growth in Eastern Europe and Thailand.

Just as Tesco targets its international in-store efforts to reflect local populations, it designs its global eCommerce strategy around a diverse consumer base. Different websites are offered in each target country, with text provided in both English and the respective region’s primary language.

Customer Loyalty

Brands such as Costco and Amazon prove that customer loyalty can pay dividends for a company’s bottom line. Tesco demonstrated this long ago with the Clubcard, which encourages customers to prioritize the chain over competitors.

Today, the Clubcard continues to play a crucial role in Tesco’s success. Further transformation is in store, as Tesco recently unveiled a £7.99 per month subscription service called Clubcard Plus . Subscribers will receive significant discounts above and beyond those offered through the traditional Clubcard, including a permanent 10 percent off many of the store’s most beloved brands. Given the current popularity of subscription services, this could prove an excellent opportunity to get existing customers even more enmeshed in the Tesco ecosystem and more responsive to eCommerce marketing automation efforts.

Tesco’s eCommerce strategy reflects the brand’s commitment to value and convenience. These priorities are evident in everything from the logo to the images and even the general layout. Website visits are just as efficient and orderly as in-person purchases at Tesco’s physical locations. Tesco’s website, like its stores, may not be fancy—but it gets the job done. In this Tesco case study, we’ve analyzed several of the key eCommerce strategies that help Tesco’s page stand out in a competitive digital marketplace, as well as a few areas that warrant improvement.

Analyzing Tesco’s Homepage

What We Liked

- Easy to navigate . Today’s impatient customers demand easy-to-navigate websites that almost instantly get them from point A to point B. Tesco’s homepage appeals greatly to convenience-oriented online shoppers, who can quickly find desired products via a simple search tool. Headings highlight main categories, including groceries, clothing, banking, and even recipes.

- Visually-appealing fullscreen displays . Rather than distract website visitors with several separate visuals, Tesco’s website maintains a single, but decidedly bold display. This impactful background stretches across the entire screen and is layered behind text and customer prompts. The homepage, featuring fresh produce, has eye-catching graphics that reflect the commitment to quality that emerges in every Tesco case study

- Minimalist, but not dull . Minimalist displays dominate modern web design. Sometimes, however, white space feels excessive. Tesco strikes an ideal balance by keeping clutter to a minimum without relying on a bare-bones approach.

- Easy logo identification . Customers can always spot the Tesco logo in the upper left-hand corner, surrounded by just enough white space to ensure that it stands out.

What We Didn’t Like

- Customer testimonials . Reviews from happy customers may prove desirable in some contexts, but there is a time and a place. These particular testimonials take up the page’s most prominent space, which could be better served by showcasing exciting deals or products.

- Tabs that open into new pages . Ideally, when clicking on a link that appears to be a tab (such as the Delivery Saver tab), the new content should open in the same page, instead of loading an entirely new page.

Analyzing Tesco’s Category Page

- Sticky cart functionality . As shoppers browse the website and add items to their carts, they can keep track of these intended purchases on the right side of the screen. This intuitive design allows for a seamless Tesco checkout process , thereby increasing the likelihood of conversion.

- Variety of filters . A wide array of filters are provided to allow customers to browse through products based on brands and categories. Furthermore, customers can customize their browsing according to specific dietary filters such as vegan or Halal. This plays into Tesco’s overarching emphasis on personalized shopping.

- Usually bought next . Situated at the bottom of each category page, this helpful section makes it easy to pair similar grocery items. This increases customer convenience while also helping to improve sales and final revenue on Tesco’s end.

What We Didn’t

- Difficult filter navigation . There’s a lot to be said for the variety of filters at customers’ disposal, but the actual process of navigating them can prove complicated, particularly compared to competitor websites.

- Navigating to different items within categories . Navigation can prove surprisingly difficult for those browsing various items within categories. The constant need to return to the homepage could quickly grate on otherwise amenable customers.

- Lack of search functionality within categories . Items cannot be sought via keywords within specific category pages. All searches must be completed using the main search bar on the top of each page. For many users, this may represent the website’s greatest weakness, as keyword category searches are an expected feature among competitors.

Analyzing Tesco’s Product Page

- Time-limited delivery notice . Produce delivery is inherently time-sensitive, as are several other services that Tesco provides via its website. The retailer harnesses the power of time-limited delivery notices to ensure that consumers use products when they’re freshest and most appealing.

- A wealth of product information . Product pages contain a wealth of relevant information, including everything consumers could possibly want to know about each item’s nutritional content, country of origin, and even preparation instructions.

- Customer reviews . Shoppers on the fence about a particular product can read customer reviews to get a better idea of whether they actually want to invest in said item. With a wealth of alternatives available, they can take solace in knowing that other options are always on hand.

- Nondescript Add to Cart button . Tesco’s approach for adding options to its carts may get the job done, but this could be an excellent opportunity for adding a bit of visual flair without detracting from the website’s minimalist approach.

- Too much text combined with too small product images . Many shoppers regularly purchase items without actually knowing their names. Rather, they focus on packaging. Tesco’s small pictures make it difficult for these shoppers to identify the elusive products they want. Some may end up with unexpected and unwelcome surprises upon delivery.

- Too much information . While it’s useful to know the origin of each item, including the exact address may seem like overkill to some users. This detailed information detracts from Tesco’s otherwise streamlined product pages.

Analyzing Tesco’s Checkout Process

- Numerous delivery slots are available . A variety of helpful slots for receiving grocery deliveries are provided on an hourly basis throughout the day. This dramatically improves customer convenience, particularly for those who work long hours and might not be available for the limited delivery times provided by some of Tesco’s key competitors.

- Automatic Click+Collect locations . Those who opt to collect deliveries at Tesco stores can look to this feature to automatically display a variety of nearby locations. This makes in-person delivery collection nearly as convenient as Tesco’s impressive delivery setup.

- Several Delivery plans are available . Shoppers who aren’t in a big hurry can elect to have their orders delivered mid-week for a reduced charge. Meanwhile, demanding customers are asked to pay extra for same-day delivery. Customers love options, particularly when they believe those options prompt significant savings.

- Oddly unavailable Click+Collect hours . Shoppers who plan their grocery pickup several days out will be surprised to find that some collection times up to a week out are unavailable. Hence, while Click+Collect provides exceptional functionality for last-minute pickups, it’s not always ideal for those who prefer to schedule in advance.

Eager to learn more about Tesco’s strategy and the technologic functionalities that make Tesco’s website so easy to use, we harnessed the power of BuiltWith to scan the website. A few of the notable technologies we spotted include:

- Omniture SiteCatalyst . Tesco’s web analytics are provided by Adobe’s Omniture SiteCatalyst — an expensive, complex system when compared to its main competition (Google Analytics). If set up correctly, however, Omniture SiteCatalyst provides excellent customer support.

- Hotjar . One of the world’s most famous screen recording and heatmaps tools, Hotjar offers a range of behavior analytic services ideal for businesses such as Tesco, which aim for a targeted approach based on actual customer behavior.

- Optimizely . This top experimentation platform plays significantly into modern web innovation. Despite its name, however, Optimizely may increase page load times throughout the Tesco site.

- OpinionLab . OpinionLab does an admirable job of collecting customer feedback on every aspect of Tesco’s webpage. This allows Tesco to customize better its web offerings based on actual customer opinions

- SendinBlue . User experience is a huge point of contention for SaaS provider Sendinblue. Clients regularly struggle with forms, automation, and APIs. ContactPigeon may prove a more customer-oriented alternative.

Some of these eCommerce tools are also used by John Lewis, UK’s homeware giant , so we do realize that these technologies play also an important part in a retailer’s business model and online success.

- As of 2019, Tesco boasted over 6,800 shops worldwide.

- Tesco currently employs over 450,000 employees around the world.

- Tesco had a 26.9 percent market share in the UK in 2019.

- Of the UK shoppers who primarily visit Aldi, 45 percent highlight Tesco as their main secondary store.

Breaking Tesco News:

- Tesco changes bonus rules after Ocado success hits pay – Read more here

- Coronavirus: The weekly shop is back in fashion, says Tesco boss – Read more here

- Tesco launches half price clothing sale – but some slam the company as ‘irresponsible’ – Read more here

- Tesco, Sainsbury’s, Asda and Aldi put restrictions on items amid stockpiling – Read more here

- Tesco sells its Thai and Malaysian operations to CP Group. Learn more here

- In September 2021 Tesco launched a zero-waste shopping service, providing customers with containers. – Learn more here.

When did Tesco begin?

Tesco technically began in 1919 but did not receive its current name until 1924. The company originally consisted of market stalls, with the first shop that might be recognizable to modern consumers not opening until 1931.

What made Tesco successful?

Tesco is popular in the UK and abroad due to its combined emphasis on quality, convenience, and affordability. The Clubcard plays a huge role in the retail chain’s continued popularity, as it keeps customers coming back for deals. So why is Tesco so successful? It is because of its customer-centric approach, that it gradually helped Tesco to develop a very loyal customer base and equity and a very powerful multinational brand.

Who is Tesco’s owner?

Tesco is currently experiencing a shakeup in leadership. After serving as CEO for several years, Dave Lewis announced his resignation in 2019. He will be replaced by Ken Murphy in 2020. John Allan currently serves as the chain’s non-executive chairman.

What is Tesco industry sector?

Tesco PLC is a retail company. Its core business is grocery retail but they also are in retail banking and assurance industries as well, as part of their product diversification strategy.

How many stores Tesco has?

Tesco has 6993 stores in 12 countries

How profitable is Tesco?

Tesco’s revenue grew by +12% YoY in 2019 hitting £63.91 billion.

Is Tesco in the public or private sector?

While Tesco was initially a privately-held company, it became a public limited company (PLC) in 1947 and has continued to operate under this approach. However, despite Tesco’s status as a PLC, it remains firmly part of the private sector.

Discover more resources about FMCG retailers

- Sainsbury’s Marketing Strategy: Becoming the Second-Largest Supermarket Chain in the UK

- ASDA’s marketing strategy: How the British supermarket chain reached the top

- The Marks and Spencer eCommerce Case Study: 3 Growth Lessons for Retailers

- The Ocado marketing strategy: How it reached the UK TOP50 retailers list

- ALDI’s marketing strategy: The key growth ingredients of the FMCG titan

- Walmart Marketing Strategy: Decoding the Success of the US Multinational Retailer

- Analyzing Lidl’s Marketing Strategy: How the Discount Supermarket Leader Scaled

- FMCG Marketing Strategies to Increase YOY Revenue

The Tesco Case Study: An overnight Success?

As our analysis showed, a variety of factors play into Tesco’s success. The retailer has a long history of using cutting-edge practices (like the virtual store mentioned above) to set itself apart from the competition. Much of its current success, however, relies on its perception as a convenient and affordable chain.

Tesco’s success is not a matter of luck. On its website and in its stores, the retailer emphasizes customer-oriented practices designed to make every shopping experience as seamless and as enjoyable as possible. This simple yet effective approach promises to keep the retailer at the forefront of the grocery industry in years to come.

If you’re looking to emulate the qualities evident in this Tesco case study, don’t hesitate to get in touch. Contact us today to book a free marketing automation consultation.

Let’s Help You Scale Up

Spending time on Linkedin? Follow us and get notified of our thought-leadership content:

Loved this article? We also suggest:

Sofia Spanou

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Sign up for a Demo

- Join Our Team

- News & Events

- Set a target

Case Study - Tesco

Tesco is one of the world’s largest retailers, with more than 6,000 outlets across Europe and Asia serving millions of customers every week. Here you can read more about Tesco's science-based targets.

Why did you set a Science-Based Target?

Tesco has a long-standing ambition to become a net-zero carbon company by 2050. It has been over ten years since we set our first business-wide carbon reduction targets in 2006. Following the Paris Agreement, we conducted a review of our short- and medium-term plans to ensure that our efforts were aligned with what the science tells us is required to help keep global temperature rise below 2°C. This review showed that although our long-term, zero-carbon ambition (2050) is aligned with this global aim, we needed to set steeper absolute targets over the short- and medium-terms. These targets have informed our revised climate change strategy, comprising energy and refrigerant efficiency, renewables deployment and policy engagement.

What was the process of setting your target?

In order to set our science-based targets we needed to answer three questions:

- What are credible climate change targets for Tesco?

- How can we realistically achieve these targets?

- What would it cost to implement the solutions?

To answer the questions we plotted the 1.5°C and 2°C warming trajectories and found that our long-term, zero-carbon ambition aligns with 1.5°C. We then modelled what it would take to realistically achieve this ambition. While our existing climate change strategy was already focused on efficiency improvements, 60% of our operational footprint comes from our electricity use so it was clear to us that we would need to switch to renewable electricity. We created a costed renewable electricity roadmap which, along with our efficiency projects, gave senior leadership confidence that the new interim targets were achievable.

In terms of scope 3 emissions, we conducted a full supply-chain footprint survey of our product portfolio to identify the hotspots that should be targeted for GHG emission reductions. Through this process we learned that we needed to set different targets for agricultural emissions and emissions from food manufacturing. This reflects the contribution of these life cycle stages to our overall supply-chain footprint and provides the best route to working with our suppliers to keep the global temperature rise below 2°C.

What are you achievements so far?

Efficiency improvements: Since 2006 we have invested over £700 million in energy and refrigeration efficiency improvements. This has reduced emissions from our stores and distribution centres by 41% per square foot and delivered absolute reductions against our 2006 baseline despite significant floor area growth. We will continue to invest in efficiency improvements to meet our targets.

Renewables: We have switched to 100% renewable electricity in the UK and the Republic of Ireland. In Asia, we invested £8 million in onsite generation in 2016, with a plan to expand renewable onsite generation further. We have successfully developed a cost-neutral renewable electricity plan to 2030 for the whole company. This includes a commitment to ensuring that the majority of our renewable electricity comes from renewable onsite generation and PPAs (i.e. less than 50% from certificates).

What the benefits of having a science-based target?

Climate change mitigation: The science-based target illustrates our commitment to the Paris Climate Agreement and quantifies Tesco’s rightful contribution to achieve the goals set out under it.

Motivation: Our target has also been a source of motivation and pride for colleagues.

Supply chain engagement: Our targets act as an example and offer us the opportunity to cooperate with our suppliers to address climate change impacts and risks.

Reputation: The targets demonstrate our seriousness in tackling climate change, both to our investors and our other stakeholders. It is also part of meeting our business purpose to serve our shoppers and our communities.

Did you encounter any problems?

We successfully addressed a number of potential obstacles to ensure our science-based targets were approved.

Awareness and education: Outside of the sustainability and climate change team, the idea of science-based targets was new and we needed to raise awareness of the concept before securing buy-in from others in the business.

Coordination: As a food retailer, our science-based targets touch on various functions from property to procurement. This required active engagement and coordination across many internal teams to ensure their support and input.

Agricultural emissions: Emissions from agriculture represents around 70% of our supply chain emissions, while the world is also expected to produce more food to feed our growing world population. We incorporated these projections into our model to set a separate reduction target for agricultural emissions from other scope 3 contributors to recognise its unique challenge.

Implementation strategy: In order to secure executive approval for our science-based targets we developed a costed strategy with the Energy, Property, and Treasury functions of our business, demonstrating that the targets could be realistically delivered in the timescales proposed.

What is the wider impact of companies making such commitments?

Science-based targets have helped us, for the first time, to align our efforts to act on climate change with those of the global community. This alignment signals the direction of travel in the fight against climate change to all of our stakeholders – including our investors, suppliers and customers. With more and more businesses setting science-based targets we also have the opportunity to encourage policymakers to raise their national ambitions, which will be vitally important as they look to increase the levels of their Nationally Determined Contributions (NDCs) every five years.

Join the companies taking action

Case studies, latest news.

We use cookies to improve your experience on our site. By continuing to use our site you accept our use of cookies. Please see our cookie policy and privacy policies for details.

IMAGES

VIDEO

COMMENTS

Case study: How Tesco Lotus's "point-of-sale" turned into "point-of-satisfaction". Tesco Lotus is a leading retailer in Thailand, which over an 18 year period of development has grown to more than 1,500 stores and 45,000 employees across the country. As a retailer committed to meeting the evolving needs of its customers and wider ...

In this case study, we shall discuss how Tesco achieved this feat by looking at its latest news, competitors, marketing strategies, and online retail presence. ... Tesco Lotus, Tesco Kipa, F&F Clothing, Tesco Value, etc. Tesco's wide range of products and own brands are supported by a strong digital marketing strategy. By using digital ...

Tesco adding eCommerce to the mainstream business model. Being in the Top 50 retailers globally as of 2021, Tesco's annual revenue worldwide in 2020 was £58.09B, a 9.1% decline from 2019 (due to the Pandemic & disposing of its Asia operations, to focus on the core business in Europe). It shifted from Brick & Mortar to Brick & Click stores.

Big data and real time analytics are helping to transform the performance of UK retail giant Tesco. This use case outlines how Tesco is applying the latest data science tools to deliver real world ...

Lotus's is the leading hypermarket in Thailand, which over the 26 years of development has grown more than 2,000 stores, spanning a total retail floor space of over 1.4 million square meters. Lotus's serves more than 15 million customers every week throughboth physical stores and an online platform.

Tesco was founded in 1919 and launched its first store in Edgware, London, UK in 1929. Today, Tesco is the world's third-largest retailer (after Wal-mart and Carrefour) {10} with 2012 figures as follows: revenues £72.0 billion, of which £3.8 billion was trading profit. Revenues were 66% UK, 15% Europe, 17% Asia & USA, and 2% Tesco Bank.

The company. manages a portfolio of more than 290 journals and over 2,350 books and book series volumes, as well as. providing an extensive range of online products and additional customer ...

Lotus's wanted to retrofit the existing warehouse to maximize pick density and space utilization. Combining both automation and work augmentation solutions, Lotus's and SSI SCHAEFER created the recipe of flexible logistics concept: from the order start to picking stations and shipping sortation. The system delivers capabilities to meet the end ...

In 2013, Tesco Lotus introduced an online platform for shopping. In 2017, ... (BCG) study, the average household income was expected to increase from £4,528 in 2010 to £13,067 in 2020. During the period under consideration, urbanization improved to 40%, and over 200 million households to be nuclear. ... Case . Competing With Giants: Aldiâ s ...

CASE STUDY How Tesco's Obsession with Customer Stories Engages Employees, Drives Change, and Impacts the Bottom Line Customer Viewpoint Early in its Voice of Customer journey, Tesco used a mystery shopper programme— one person's opinion, one day a month, using a list of predetermined and predictable

By June 2013 sales in China fell 4.9 % in the first quarter of Tesco's new financial year. Tesco said the whole sector had been affected by the bird flu outbreak and a food safety scare involving pork. "China is a business we said we are going to focus much more on profitable sustainable growth," Clarke says.

Tesco - Full Case Study. Thủy Tiên Nguyễn. ... In 1998 it found a local partner in Thailand and established Tesco-Lotus. An innovative partnership in 1999 with Sam- sung in South Korea formed Homeplus, thereby creating the bedrock for a sustained Asian presence. Tesco initially entered most of its foreign markets ethnocentrically by ...

This thematic paper will be focused by choosing Tesco Lotus as a case study. The main reason I chose this company is because Tesco Lotus claims to be an innovative company and its business strategy is "to develop new innovation to be the best in our business and for our customers". Tesco Lotus has constantly invested in

This case Tesco, UK's Largest Supermarket Group, International Expansion Strategies focus on Tesco, UK's largest and world's third largest retailer, to expand into foreign markets for sustaining its future growth in the global retail industry. The company initiated its international expansion strategy by venturing into Central Europe, Asia and the US.

CASE STUDY - Tesco: Tesco is a major UK-based retailer, and used to be found within the UK only. However it has rapidly expanded and become the world's third largest retailer behind Walmart and Carrefour. It currently employs. around 500,000 people and operates in more than 14 countries around the world.

Tesco Lotus' outsourcing to Linfox (Thailand) Case Study Write-Up for Strategic Management I. Tesco Lotus background relevant to the subject According to the British Chamber of Commerce Thailand, Ek-Chai Distribution System Co., Ltd, known as Tesco Lotus, was formed in 1998 with only 14 "Supercenters" in key regional locations[i].

Business district of Carrefour overlap with Tesco. • Tesco handed over six loss-making stores and two development sites in Taiwan worth £90m to Carrefour. Carrefour gave Tesco 11 stores in the Czech Republic and four in Slovakia, worth £129m. • Tesco's 2,200 Taiwan employees were transferred to Carrefour.

Industry Analysis: Brazil 4 3.1 Competitive Rivalry in the industry 5 3.2 Bargaining Power of Suppliers 5 3.3 Bargaining Power of Customers 5 3.4 Threat of New Entrants 5 3.5 Threat of Substitutes 6 4 Company Analysis: Tesco 6 4.1 Resource Based View: Tesco 6 4.2 SWOT Analysis: Tesco 8 5.

Tesco is one of the world's leading multinational grocery and general merchandise retailers that was founded in 1919. Tesco opened its first hypermarket in Burnt Oak, England in 1931. Tesco has expanded rapidly in different countries such as Malaysia, Hungary, and Thailand. For decades, it has been the people' go-to hypermarket.

In 2011 Tesco was the first-ever retailer building the world's 1st virtual grocery store in South Korea. The experiment took place in a subway station and the results were tremendous: the number of new registered members rose by +76%, online sales increased by +130% and Tesco became South Korea's no1 online grocery retailer, outranking its ...

Case Study - Tesco Tesco is one of the world's largest retailers, with more than 6,000 outlets across Europe and Asia serving millions of customers every week. ... Case Studies Supplier Engagement Case Study - Salesforce Salesforce creates cloud-based Customer Relationship Management (CRM) software to enable businesses to manage customer data ...