Quarterly and Annual Business Reviews: Why They Can Make or Break Your Success

The business review is one of the most underrated tools in a services company's arsenal. Quarterly business reviews highlight new ways to help clients achieve their goals, uncover risks and opportunities you're equipped to address and ensure customer leadership sees you as a critical piece of their growth strategies.

If you already do regular annual or quarterly business reviews with clients, you know how valuable they are. If not, you're about to learn what you're missing.

What Is a QBR?

A quarterly business review, or QBR, is when you sit down with customers on a quarterly basis to review how well you're contributing to their success. They ensure customer satisfaction and keep engagements on schedule, at or under budget and on track to meet agreed-on KPIs.

Here, we'll discuss the elements of both annual and quarterly business reviews, sometimes called "executive business reviews" or "health checks."

You can mix and match elements from each category, but in any case, these should be topics of regular conversation with your clients — because you don't want to be just a service provider. You want to be a partner in your customers' businesses such that they see you as intrinsic to their success. That increases client stickiness and opens the door to expanding the relationship.

Get a quick overview of quarterly business reviews and how to use them to solidify client relationships:

Is a QBR really needed?

Not all services businesses need to conduct frequent or in-depth business reviews. If you supply coffee to the breakroom, you can probably get away with a monthly email check-in. But if you provide a business-critical service, like technology, accounting, legal or marketing, you need to understand how your service plugs into the customer's business strategy.

Key Takeaways

- The real work is done at the annual review; QBRs are quick checks of KPIs and the relationship overall.

- Remember the old adage to keep goals S.M.A.R.T.

- Want to reduce churn? An agreed-on, documented set of goals is key.

What Are the Benefits of a QBR?

There are three main benefits of a quarterly business review.

They provide a measuring stick.

A well-defined performance-to-plan analysis gives customers a solid understanding of where they are on their journeys to new revenue opportunities , lowered risk or both — and how your services helped get them there. It also makes the customer equally invested in and accountable for certain shared metrics, such as profit margin. Yes, your service should aid them in achieving goals, but the real work is up to them. Business reviews allow you to track mutual KPIs so both you and the client have skin in the game. On that note ...

They track overall success metrics.

Business reviews should include KPIs with realistic timelines, budget allocations and responsible parties. A "scorecard" reflecting this ensures everyone is clear on expectations and that your services are steadily moving the client toward goals. For example, if you're a digital marketing agency tasked with recruiting new prospects, confirm there's a sales strategy to close the leads you bring in. That way, the blame for a lack of new customers isn't laid completely at your feet.

In that example, a relevant sales KPI is conversion rate, or the percentage of qualified leads that become paying customers. If the goal is, say, a 10% conversion rate and you're sending along plenty of prospects but your client's sales team isn't closing deals, then maybe you can help with sales coaching.

They solidify customer commitment and engagement.

A business review should highlight successes to date and map improvements that can lead to greater growth. This shows the customer that you understand how your individual contributions support its business strategy and that you're looking for new opportunities to engage, which can increase loyalty and minimize your own churn.

How Do You Prepare for a QBR?

The most important step in conducting a quarterly business review is preparation, which starts when the engagement begins. Service providers should gather a ton of critical information in the customer discovery process, but many skip that step.

Gather this data at the start of the relationship to make conducting annual or quarterly business reviews a smoother process.

Gather contacts and an org chart

Identify the people you'll interact with directly and the influencers who will play a part in executing and evaluating the strategy you propose. If you deal day-to-day with an operations manager who doesn't have a finger on the pulse of the company's overall strategy, ask for an introduction to the COO or whomever can define KPIs that tie directly to business objectives. In our previous digital marketing example, a conversation with the VP of sales will reveal how you can better assist in closing deals.

Set business plan objectives

Understand how your customer's goals align with your own capabilities and business objectives. If you're a managed service provider with an SLA for regular data backups, you should know exactly which types of data you're backing up, compliance regulations to which that backup should adhere, how quickly your customer needs to get back online after a cybersecurity incident to meet its own SLAs and more. Be very clear on how your services and success metrics align with customer needs.

Share success stories

Understand what success looks like for your customer. Where have they had wins? Where have previous service providers fallen short and lost credibility? What could they have done differently, and/or what did they do correctly that the customer expects you to repeat?

Learn about unresolved issues you're expected to handle or that your service will touch

Clearly it's important to identify outstanding issues that your team will pick up and run with, but successful firms go beyond that. If you provide digital marketing services to support sales, it's important to know whether the company has a CRM integration underway or if it's revamping its sales training, for example.

Set solid timelines for success

Make a template to assess early wins that looks something like this:

Customer pain point: How we will address it: How we will define success: Timeline for results:

In subsequent business reviews, assess whether the problem is resolved. Demonstrably removing pain points wins trust for upsells.

Know which KPIs will prove wins

Relatedly, and particularly in smaller shops, clients often want to hand over a general bucket of responsibilities without taking time to nail down exact metrics to track over the course of the engagement. Don't ever skip this step. It's vital to both business reviews and the relationship overall. You can't meet a client's needs if you don't know exactly what you're aiming for.

After you've collected the above information in your customer discovery, digest it and create a broad plan for how you'll steadily help the customer achieve the goals you've outlined. Then, turn those findings into an annual plan that you will track against on a quarterly basis. Don't make the plan super prescriptive — you and the customer will review and refine it together as you talk about business goals and conditions change.

Finally, sit down with your customer and conduct the actual QBR.

Annual business reviews vs. quarterly business reviews (QBRs)

The annual review, done at the beginning of the engagement and repeated yearly, can be an onerous process, and it will outline what success looks like. Quarterly business reviews (QBRs) should be much quicker and more to-the-point. Our main advice for both: Come prepared so you can make the most of every minute spent with the customer. Your contacts likely have many service providers demanding their time. Respect that, and you'll stand out.

What Is an Annual Business Review?

An annual business review is where you really get to know your customer's business. Note: The past 18 months showed that goals and tactics can change quickly in a weird and unpredictable business environment, so you may need to perform in-depth reviews more often if conditions change dramatically.

At least annually, sit down with your client for ideally two hours — and no less than one hour. Steps in an annual business review include:

Discuss business objectives.

We can't say this enough: Continually align the goals for your engagement with the customer's business strategy. As clients grow, you want to go along for the ride. If you don't know what "good" and "better" look like, then you don't know where to plug in. Don't be satisfied with what's working today. To capture a recurring customer for the long haul, look for areas in which you can contribute in the future.

Review past business goals.

Look at the previous year's goals, whether this is your first business review with this client or not. If it's your first rodeo, look at the top goals your client set with your predecessor so you know what you're getting into. And if you've done an annual business review with this client before, discuss whether the goals outlined last year have been achieved and why or why not.

Set Top 3 business goals for the coming year.

Focus this discussion on overall business strategy, not just the part your service will play. That breadth allows you to identify opportunities to provide additional services.

Identify opportunities for the coming year.

Which customer segments or sales channels is your customer targeting? Which new verticals or geographic markets are they expanding into? Which new products or services are they announcing? Internally, do they have future products on the drawing board? Challenges with suppliers? Which new systems are they implementing? Again, these insights help you employ your services to drive everyone forward.

Tease out barriers to success.

You never know where you'll uncover a need for additional services or ways to use your expertise to overcome a business challenge. Maybe clients are having trouble supporting new customers or scaling a service. Maybe it's staffing or supply chain visibility or margin pressure — issues that are pressing now and likely will be for the next year or so. Maybe the client's org structure is out of whack and needs fine-tuning. Getting a peek under the hood at what isn't working is just as important as understanding what is — maybe more so, because it presents problems you can potentially solve.

What Should the Content of a QBR Include?

As discussed, you need a mutual understanding of what "good" looks like so your offerings are aligned with the customer's needs. This piece shouldn't take long, because ideally, you came prepared with an understanding of how the partnership will work.

The content of a QBR should include an outline of three areas:

The customer's strategic goals and where they expect your help. In our digital marketing example, the customer's goal might be to get 300 new customers this year from a specific vertical that will help them expand into new markets.

Your own strategic goals and how they align with what's outlined in your SLA or service contract. Say your digital marketing agency is implementing a new marketing automation software or integrating multiple systems into a more comprehensive solution that will serve your clients better. How does that goal tie in to what your customer is expecting?

Joint strategic goals that you and the customer outline together. Perhaps the client's team has determined that to get those 300 new customers, it needs 2,000 marketing qualified leads. Now you know their overall strategic goals and how they expect you to contribute, before discussion in your quarterly business review.

What are SMART Goals?

Here's where you take the knowledge accumulated so far and lay out the areas in which planning, accountability and investments of money and time will drive the engagement.

Outline three to five strategic initiatives that will grow various parts of the business via your direct touch. Typically, these items require action in the short-term but may not show immediate ROI.

If your assignment is to drive new-customer acquisition with your digital marketing services, then you probably shouldn't expect to help the sales team deliver 100 new customers in the first couple of months. What's the goal for the year, and how can you work toward it?

Remember the old adage and keep goals S.M.A.R.T.: S pecific, M easureable, A ctionable, R elevant and T ime-bound.

Maybe your customer wants to double down on cross-selling to existing customers. You can glean KPIs specific to the client with questions like: How much revenue does the team expect from this initiative? How many customers are they targeting? By when do they expect to achieve this goal? Your shared metrics come from questions like: Which specific actions are marketers taking to move that initiative forward? Finally, where do you plug in? Only after outlining these with the customer can you define an SLA, commit to a certain benchmark and gain a solid understanding of how the engagement should proceed over the next year.

Concluding items

This is where you plot a plan of attack. Outline open items that will drive the business toward its goal — there are probably several of these, as the annual review is a kickoff for the coming year. Note any follow-up items that arise from the business review. Maybe you need to look into a new platform or research new technologies. Write those items down to hold everyone accountable.

Then, you and your customer need to literally sign off on the plan. Legally binding in court? Probably not. But the action alone solidifies a joint commitment to the objectives, KPIs and strategies outlined in the review. Plus, it makes it harder for customers to come back during a QBR with new goals you've never heard of and say you've known about them all along. If they try to throw a curveball, you have a mutually agreed-on strategy to point back to.

How Do You Conduct a QBR?

You do the heavy lifting in the annual business review. It isn't a light load, but it makes quarterly check-ins with the client quicker because you've already identified objectives, initiatives and KPIs. QBRs allow you to confirm that you and the customer are tracking toward those items. Unless your customer has a major strategic shift to fill you in on, the review's purpose is simply to keep you on track and help you identify wins, talk about KPIs, review open projects and get set for the next quarter.

Where can I find a QBR template?

We'll detail the elements of a QBR below. We've also distilled them into a handy template:

Get the QBR Template

Wow your clients and cement long-term relationships with our template for a quick yet thorough quarterly business review.

Download Now

Lay out the agenda.

Recap wins and misses..

Take a minute or two to talk about wins or success stories, as well as anywhere you or the client might have fallen down on the goals that you put your John Hancocks next to at the end of the annual review.

Discuss rearview-mirror metrics.

Glance at previous quarters to make sure you're tracking toward goals. If you've promised a certain number of MQLs for the year, calculate how many you've delivered, how many you have to go and your momentum. If you're an IT service provider, did you meet or exceed SLAs? How many tickets did you close? How long did it take, on average, to close them? CPAs will want to know whether quarterly taxes have been filed, the accuracy of forecasts and how fast their team responded to inquiries, for instance. Confirm you're tracking metrics that matter.

Review open projects.

Again, this shouldn't take long. Ideally, your project managers are having quick check-ins with customers at least monthly, making the QBR a time to wrap up results and progress with a tidy bow. Show how you're achieving mutually-agreed-on goals.

Then, review areas of improvement you and your team have identified while working through the engagement. After all, it isn't the client's job to identify other areas in which you can help them. Maybe they're done with their CRM integration; now you have a new marketing technology platform to suggest. Moving into a new vertical? Perhaps you have an idea for sales team training or events they should attend to learn more.

If you've identified or hope to identify opportunities for an upsell or cross-sell, bring in the account's sales rep — if the timing is right. The presence of sales can pressure a client into stubbornness.

Talk about unresolved issues.

Some items slowing progress may be on the client side, and some might be in your court. Regarding the latter: Has a hiccup on your end slowed progress? Clients are generally far more forgiving of delayed initiatives when those delays are addressed regularly vs. sprung upon them at the last minute.

Don't assume responsibility for issues on the customer's side that you can't fix. That trap is difficult to escape once you land in it. Are you waiting on the client to complete an integration? Is their HR team taking longer than anticipated to hire for a key role? Address any items that are outstanding, above budget or beyond deadline to avoid surprises. Identify ways you can help, but don't fall on your sword for issues that aren't in your control. Who within the organization is ultimately responsible for the client's initiatives? Who influences decisions that may be holding them up? Refer to the org chart if needed.

Unresolved issues may come up when discussing rearview-mirror metrics and open projects . If so, make a note and come back to them in this section. This advice applies to all sections of the QBR: If changes in business objectives come up in earlier sections of the review, make a note of it, and then touch on/clarify those changes in the appropriate section to ensure everyone is on the same page. There's no such thing as too many notes on your part.

Cover changes in business objectives.

Prepare for your client's business objectives to shift as the year progresses. It might frustrate you, but it will undoubtedly happen. Stay flexible, and talk about objectives on a regular basis so you can prepare for a shifted set of goals in the coming quarter.

Evaluate progress on last quarter's goals.

Map the objectives laid out in your annual business review to a KPI scorecard that holds everyone accountable to moving the engagement forward.

Should you collect customer feedback in QBR?

Essential to the QBR is a quick-and-dirty scorecard that lists objectives and how you’re meeting them. Keep the scorecard short and simple, using an “ABC;” “red, yellow, green;” or “percent complete” scoring system to indicate the initiative’s relation to the goal. The format should be easy to understand at-a-glance.

Again, your contacts have enough service providers to deal with. So don’t waste their time, and come with the scorecard mostly filled out with goals and metrics that you’ve continually tracked throughout the quarter.

See an example of a QBR scorecard in our QBR template .

Discuss pain points in the relationship.

Ask your client: Does your team respond to emails quickly? Are service issues resolved fast enough? Are there any complaints? Where can processes or communication be improved? Have you proven your value this quarter?

Touch on the future state.

Do this, but do it very quickly. You've already talked about changing business objectives and how you can help, so this is just a recap to cement yourself in the client's mind when they're creating a strategy for future endeavors. Do you see additional places you can plug into the customer's business in the future? This could look like expanding the number of departments you touch or appropriate additional services you might be able to provide. You're just planting the idea in the client's head, not making a sales pitch.

Sign the scorecard, and close it out.

At the close of the QBR, sign off on the completed scorecard to hold everyone accountable to the metrics, strategies and goals you're working toward. This level of accountability is invaluable in keeping the relationship even-keeled and on track. Review your call cadence with the client and ask if they have any questions.

How long should a QBR take?

A QBR should take 30 minutes at most. The above may seem like quite a bit to run through in half an hour, but a few elements make it possible: First, you've been updating this information and thinking through each of the points throughout the quarter. Second, you've been keeping track of KPIs in your scorecard and have come prepared to breeze through that piece — if your client is strapped for time, the scorecard is where you should focus your efforts. Third, the more you do QBRs, the better you'll get at them and the faster they'll go.

#1 Cloud Accounting Software

The Bottom Line

As a services company, keeping customers satisfied is pivotal in reducing churn. And it's difficult to know whether you're meeting expectations if you don't regularly check in with customers. Without the business review process, you're floating in space without any sense of True North, just guessing about the right actions to take.

You might think that you know your stuff, but there are always accounts that will say they're dissatisfied one day out of the blue, and you'll wonder where you went wrong. Avoid that by checking in with your clients regularly and using customer relationship management (CRM) software to keep an eye on satisfaction. Plus, doing so ensures you're aligned with customers' overall business objectives so that you can continue to provide value and more deeply enmesh yourself into said strategies. Who doesn't love being needed?

Accounts Receivable Turnover Ratio: Definition, Formula & Examples

The accounts receivable turnover ratio is one metric to watch closely as it measures how effectively a company is handling collections. If money is not coming in from customers…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

Sep 7, 2023

Blog » Engagement

• Read Time 9 min

How to lead quarterly business reviews (QBRs) customers want to attend

by Darien Aasen

If you were your own customer, would you want to sit through your quarterly business review (QBR)? If you hesitated before answering, then it’s time to rethink your approach. The QBR has become an industry staple—and polarizing topic—in customer success. Many of its critics complain it inflicts death by PowerPoint. Fans of the meeting espouse its bottom-line benefits. In a sense, both sides are right. QBRs, when designed with respect to customer needs, are an effective tool to gain strategic alignment between a vendor and an account. However, many customer success teams squander this opportunity by making it about themselves and not thinking outside the box. And while there isn’t one right way to lead a QBR, there are certainly plenty of wrong ways to go about it. In my years as a customer success manager, I’ve seen what makes a standout QBR and what makes a bad one. Often, it’s the small details that make all the difference.

What is a quarterly business review?

A quarterly business review (QBR), also known as an executive business review (EBR), is a customer meeting typically held every three to six months where vendors assess a customer’s goals, performance, and strategies. Typically, vendors present an analysis of agreed-upon KPIs and business trends to measure the company’s progress against its objectives. The generally acknowledged purpose of a QBR is for the vendor and customer to align on the value the customer has received to date and the potential value they stand to gain in the future. The QBRs I’ve seen and done that really stood out and were most successful had the subtle message of “Customer, be confident in us and what we can do for you.” The meeting should include past, present, and future initiatives while mentioning notable challenges, learnings, benefits, and tangible wins for your customer. If my vendor never spoke about anything negative, I wouldn’t trust them to surface when things went wrong. It’s rare that things to go perfectly, so apply ownership of any problems and focus on the lessons learned and resolutions. The clearer you can be in defining the solution and learnings, the more confidence you inspire as a business partner.

Are quarterly business reviews right for your business?

QBRs are an effective tool for managing customers with annual or multi-year contracts—regardless of auto-renewal agreements. Basically, you need to spend a long enough period of time with the customer to form a substantive relationship. The meeting’s frequency can be correlated with customer segmentation for your business. For example, strategic customers might get a business review every quarter and smaller customers get a review once or twice a year. If your business runs on monthly contracts or individual orders, there is commonly less value in trying to force-fit a scheduled QBR because the customer could leave in 30 days or never order again. You’re not doing yourself or the customer any favors by forcing them into a QBR cadence that is not aligned with their obligation to you or appetite for you. That is not to say they cannot be valuable; relationships can supersede standard obligations. Consider your own business dynamics before rolling out a process.

Who should attend quarterly business reviews?

From the customer side, QBR attendees ideally include executive sponsors and relevant points of contact. While optional, it can be valuable to invite other departmental leaders who interact with your product or its output in some capacity. Even if they’re not your direct customers, these impacted teams can have a strong influence over business decisions, such as renewing, adding licenses, and integrating the product into other areas of the business. A quick aside on roles: In customer success, there are different terms for the same role. There is a buying committee with different requirements and goals and the more you can relevantly include them in these QBRs, the better. You want to have the executive who is accountable for your performance, the people you work with regularly, and others who have significant influence over decisions present during these calls. From the vendor side, QBR attendees should include the CSM as the one responsible for leading the meeting. If you’re conducting a QBR for a high-value customer, you may want to invite someone from your leadership team as a sign of commitment and respect. CSMs in tech-heavy roles may also choose to include a technical resource from both their side and the customer’s side to help facilitate questions and explain the rationale behind specific decisions. A technical resource can be someone from the operations, product or development team. These roles tend to become more involved when discussing future projects or technical issues.

How to run an effective quarterly business review (QBR)

If you’ve never led a quarterly business review before, or you’re looking to revamp your QBR’s format and script, I’ll walk you through my QBR process from preparation and kickoff to conclusion and follow-up. Use these tips to encourage active participation, clear communication, and accountability among QBR attendees.

Quarterly business review preparation: Get the most out of your meeting

To prepare for the QBR, start by getting your hands on every scrap of data you can, even if you’re not going to present it. Why? Because it makes you more holistically ready for the meeting. When I conduct QBRs, I almost always get questions about things that are not directly shown in the slides. If you don’t do the prep work to thoroughly understand everything, then you’re more likely to run into situations where you have to tell the customer “I don’t know. I’ll have to get back to you.” And while it’s not a mark against you, it is a missed opportunity to demonstrate preparedness to the customer. You build your customer’s confidence when you’re able to consistently prove your knowledge of their business. Most of the data you gather should be ready at your disposal, not prepared for display. The difference in these approaches is often an indication of a CSM’s skill level. More experienced CSMs use slides to complement their presentation, not to drive it. As mentioned, I prefer to structure the meeting around past, present, and future initiatives:

- What has happened so far, what have we learned, and how has the customer benefited?

- What is in progress? What’s on hold? How will it help the customer?

- What is planned? What are the areas of opportunity?

There should always be an element of personalization when deciding what information goes into the presentation. Know your customers and what they look for. Be selective. Additionally, don’t shy away from covering service or product problems. Customers will notice and be more irritated by the omission. Instead, when faced with a negative situation, try to present a positive outcome whenever possible. To give you an example, in a prior role, I once had to tell a global head of engineering that we couldn’t meet our deployment deadline for two of their sites. The reason was that we encountered unforeseen workflow challenges because the teams had non-standard processes. As a result, the teams identified multiple other use cases they wanted to pursue beyond the plan. Within two months, these sites were leading the company in terms of adoption and the number of use cases in deployment. After your prep work is complete, build a clear meeting agenda. Share the agenda in advance to let participants know what to expect. This helps set expectations and protects the QBR’s purpose. If the slides complement the meeting, then it will be inherently more interesting and decrease the chance of people skipping.

Quarterly business review kickoff: Keep it short and sweet

While introductions are essential in QBRs, they can derail and delay your meeting when left unchecked. For example, if you have four people from the customer’s side attending plus three people from your side, introductions can take 10 minutes. If any conversations spin off from that, you lose another 10. Now you’re 20 minutes behind and rushing through the presentation you diligently prepared for. One time-saving tactic is to assign a person from each side to handle the task. At the start of the meeting, have your main point of contact introduce their entire team. Coordinate this with them ahead of time to get their agreement. As the CSM, introduce the team members from your side who are attending. This way, everyone gets to know who’s who within a few minutes, and you can move on.

Quarterly business review engagement: Encourage participation during the meeting

Too often, QBRs devolve into a one-sided conversation where the CSM reads off data from the slides. This will all but guarantee a meeting decline the next time around. Get customers to open up and engage during QBRs by following these strategies.

- Use a narrative format. Paint a picture of what’s happened, the current state, and what’s to come. Draw out emotion by contrasting the old way of working with this new, better way. Illustrate how the customer’s hard work and strategies, along with your product—as the supporting role, of course—helped them make that transition.

- Build in opportunities for engagement. Take intentional breaks and frequent pauses. Give customers the space to ask questions. Prepare a list of questions ahead of time to spark conversation when the line goes silent, which inevitably happens to us all.

- Practice the communication imperatives of alignment, control, and affection. Alignment is understanding why the customer cares. Do you have a shared interest and objective? Are you working toward the same goal? Control is offering them a choice. People hate not having options. Invite customers to influence the conversation. Build in areas they can control and comment on. Affection is affirming them through edification and encouragement. If people are sticklers, thank them for being detail oriented. You can convince customers to show up by bringing these needs to the forefront.

- Put customers on the spot. If I’m part of the way through a QBR and no one is engaging, I use a line that gets customers to speak up. It works 100% of the time. It’s super simple. I did not invent it, but I’ve used it ever since I first learned it. After I finish speaking, I’ll say, “I’m going to pause here. I just gabbed at you a whole lot. I take silence to mean either I’m doing an amazing job so there are no questions and we’re all perfectly aligned, or I’m doing an absolutely terrible job. Someone give me something.” If it goes another few seconds and no one says anything, I follow up by saying, “I will wait.” That always gets them. Someone jumps in. I’ve never had it not work. If no one’s participating, consider using that call-out or a similar one to help lighten the mood.

- Ask questions. When you ask the customer questions, it allows them to provide insight and guidance. An example of this would be “Are there things we didn’t cover that you want to discuss?” or “Am I understanding your ideal outcomes or initiatives correctly?” You can also ask them questions about business challenges or areas of opportunity. However, this should not be an interrogation. It’s about showing curiosity, a desire to understand, and a sincere interest in the customer’s success. These insights will change the way you support them and provide value.

- Ask pointed yes-no questions. While you typically want to use open-ended questions as conversation starters, if you find yourself in a meeting with unresponsive attendees, try to elicit a reply using yes-no questions. The idea is that easy answers will act as a springboard to a more engaging dialogue. For example, if you’re presenting recent learnings to a customer, you could pause to ask, “Do you have any questions about how we set up this project?” If they say “no,” then you could follow up by asking, “Do you feel confident that you’d be able to replicate this process in other areas?” It’s harder for them to say yes or no to that. Getting a reply, even if it’s a one-word answer, makes it easier to ask follow-on questions that eventually get the ball rolling.

Quarterly business review conclusion and follow-up: Close out on a positive note

At the end of your QBR, start by taking a minute to recap the positives. Reiterate one or two of the customer’s notable accomplishments. These points should support the foundation of future goals and initiatives. Keep talking points high-level. Don’t summarize everything you’ve just talked about. Save the detailed summary for the follow-up email you’ll send after the meeting. Include in your follow-up email any notable discussion points, questions, and action items. Capturing this information in writing demonstrates accountability. It shows the meeting was productive and makes the customer feel confident that you were listening, that their contributions were valued, and that action will be taken quickly. Attach a PDF of the QBR deck to your email so the customer can refer back if needed. Thank everyone for their time. Give personal shout-outs when suitable. For example, if someone asks a good question or surfaced a concern you were able to address. This helps build the relationship, and again, shows you were engaged in the discussion. It can be as simple as saying: “Matt, I really liked your question and your consideration of [past issue]. It’s resolved now, but I appreciate you making sure we think through these details and take the best approach possible.” Don’t dig too hard though. Only include these types of personal touches when natural. Otherwise, your praise will come off as disingenuous and do more harm than good.

Breaking the traditional mold

While QBRs are a tool that can absolutely provide value, customer success teams tend to get hung up on trying to fit the traditional mold of what a QBR should be. They conduct QBRs because they think that’s what they’re supposed to do, and what the customer expects. Instead of following the status quo, I encourage CS teams to consider if QBRs are the best use of their resources and time or if there are alternative ways to achieve the same alignment. Bottom line: QBRs are what you make them. If you use them to talk about all the work you have done for the customer and the data you want to present and the upsell opportunity you want to promote, then yeah, they will be an hour-long drag. But if you design the QBR to make the customer confident in their decision to partner with you, they can be a huge relational and financial asset to your customer success team.

The hidden impact of investing in customers

This is a guest post by Todd Busler, CEO of Champify. When companies think about investing in their customer base, they are usually thinking about driving product adoption, reducing churn, or even delivering expansion revenue. Rarely are teams thinking about the...

Three effective strategies for improving customer onboarding with AI

AI is changing just about everything within the SaaS and technology space. What was once time-consuming and tedious is becoming streamlined and automated, with customer success teams better able to manage their customers proactively. It’s easier than ever before to...

Handling conflict in customer success: nine tips for mastering tough talks.

Every CSM has faced a day or two that felt like a minefield of tough conversations and tricky interpersonal situations. From tense renewal negotiations to rivalry with other departments to frustrated customers, there’s no shortage of conflict in customer success. It...

How To Run Effective Quarterly Business Reviews

Quarterly business reviews aren’t just routine meetings; they’re strategic checkpoints that help organizations chart the optimal route toward success. Unlike the once-a-year pit stop of annual reviews, quarterly business reviews (QBRs) offer a more dynamic assessment that allows businesses to fine-tune their strategy, recalibrate roadmaps, or even set new goals.

Previously, we discussed the importance of a strategy review . Now, we’ll delve deeper into why a quarterly review is an integral part of strategy governance.

We’ll cover what you should do before, during, and after a quarterly business review to ensure it’s impactful.

What Should A Quarterly Business Review Cover?

QBR, essential for strategic alignment and internal information sharing, is a quarterly meeting bringing together department heads, executives, and other business leaders. It involves assessing the business's overall performance, adapting existing initiatives , or developing new strategies as a part of a bigger strategy governance process.

Attendees aim to identify roadblocks, risks, or challenges encountered during the quarter, and to map out strategic initiatives for both short-term and long-term growth.

QBRs should also focus on gathering insights and key takeaways, not just showcasing results.

Here are some high-level questions that must be asked and discussed during the meeting:

- Financial performance: What were last quarter's results? Are we on budget, and what are next quarter's financial projections?

- Resource utilization and operational efficiency : How effectively are resources used? Are there inefficiencies or opportunities for optimization?

- Operational KPIs and alignment: How are operational key performance indicators (KPIs) performing and are they aligned with strategic goals?

- Customer relationships: How did customer success teams perform in the past quarter? Based on customer feedback, have we met customer needs? If not, how can we improve customer experiences and forge stronger relationships?

- Market and competitive analysis: What are the key market trends and competitive challenges? How do these impact our business and strategies? Do we need to adapt existing strategies to attract new customers?

Along with the quarterly reports from department heads, discussions that arise from answering these questions enable businesses to make better decisions and strategies.

How To Prepare For A Quarterly Business Review?

The success of a quarterly strategy review hinges on meticulous preparation. Here’s how to do it:

1. Craft a focused QBR agenda

Begin the preparation process by creating a well-structured QBR agenda. Ensure it’s focused and aligned with the strategic goals and objectives outlined in the previous quarter.

A clear plan sets expectations and allows attendees to prepare relevant questions, discussion points, data, and reports ahead of time.

💡Tip : Distribute this agenda well ahead of the meeting to give participants sufficient time to prepare.

2. Collect data needed for the review

Collect data demonstrating the results delivered within the specified period, including benchmarking against crucial business metrics and competitor comparisons. This not only validates achievements but also provides a broader industry context.

Business leaders or department heads must provide detailed reports in their areas, essential for a comprehensive business performance overview.

Some reports to prepare for the QBR include:

- Financial reports with revenue and expenditure forecasts

- Budgets vs. Actuals reports to assess financial performance against planned budgets

- Customer Satisfaction (CSAT), churn, and retention reports

- Competitive and market analysis reports for an external perspective

- Operational KPIs reports highlighting key performance metrics

Beyond gathering data, analyze it to prepare actionable plans for the QBR. For example, if your data shows a drop in sales, you shouldn’t merely present the related numbers.

You must identify what factors led to the poor performance and have a clear action plan to reverse it in the next quarter. This ensures that QBR meetings are focused and effective without exposing decision-makers to indecision due to a lack of information.

👉 How to easily prepare reports with Cascade:

If you find that too much of your time is spent gathering data and creating reports, consider using strategy execution platforms like Cascade , which simplifies the data collection process using integrations across multiple business tools .

Whatever accounting, CRM, or business intelligence tool your team uses, you can integrate them all within Cascade, creating a single powerful source of truth.

Updates from various data sources are fed automatically to Cascade so you can gather accurate information and create beautiful visual reports using the relevant data.

You can also send automatic notifications to team members using email, Microsoft Teams, or Slack to remind them to update various elements they’re accountable for.

How To Run A Quarterly Business Review?

The quarterly strategy review meeting can be divided into three key steps:

%20(1).jpg)

Step 1: Review past performance and goals

Begin with a quantitative analysis of key metrics, such as financial indicators , operational KPIs, and other performance benchmarks. Compare these against targets and previous results to gauge progress towards strategic objectives and assess overall operational efficiency .

Additionally, review any ongoing strategic projects to monitor their status and identify any impediments to success.

Participants of QBR should also revisit any commitments or action items discussed in the last quarter’s QBR. If there was a strategic focus defined or an improvement identified, they should evaluate the progress made from the past review to the current one.

Let’s say you implemented a new sales intelligence tool so the sales team and account managers wouldn’t have to rely on intuition-based approaches. Consider how it affected revenue, the percentage increase in sales, and if this increase offset the tool's cost.

This approach to discussing the impact of previous initiatives ensures there is accountability and follow-through.

Step 2: Open the floor for a strategic discussion

The QoQ performance review helps you identify the gaps between actual performance and targets. This exercise paves the way for the critical next step—strategizing to bridge these gaps.

Focus on the 'WHY' behind the numbers. Analyze reasons for successes and failures, challenging assumptions to uncover true causes.

Next, explore new strategies. For example, if market share loss is linked to a competitor's new product, discuss initiating projects or adjusting strategies to counter competitive threats.

Finish with proactive risk management discussions to identify potential obstacles and challenges that may affect future performance.

Step 3: Prioritize and document decisions

Turn insights from the quarterly review into concrete actions . Leaders must collaboratively determine which initiatives to begin, cease, or maintain, aligning these choices with the company's strategic vision and long-term objectives.

For initiatives involving cross-functional teams , assign timelines and key roles to department heads or business leaders. Make sure it’s clear who owns which initiative for clarity and accountability across departments.

Document every decision, including the underlying reasons, action plans, timelines, and assigned responsibilities. This documentation provides a future reference, fostering transparency and trust among stakeholders.

What To Do After The Quarterly Business Review Meeting?

The true impact of quarterly business review is realized in the actions taken after the meeting. This section outlines crucial steps to maintain momentum and effectively implement decisions made during the QBR.

Relay decisions and develop action plans

Post-QBR, department heads need to communicate the meeting's decisions to their teams clearly and transparently.

Highlight how these decisions are in line with the company's broader strategy. This approach not only builds trust but also gives team members a clear sense of direction.

Next, collaborate with team members and leaders of shared projects to create detailed action plans.

Clearly outline roles and set expectations to ensure everyone understands their part in executing the strategy. Emphasize the significance of each individual's contributions to the broader strategic objectives, fostering accountability and engagement for effective results.

👉 Do it in Cascade:

With Cascade, you can build an action plan that aligns with strategic objectives and key business metrics, while ensuring every project or KPI has its owner.

%20(1).png)

Teams can also clearly visualize the dependencies of their plans with other teams using the Alignment Map . This visual representation provides a holistic view of an organization’s performance.

Set up processes and tools for progress updates

Without regular monitoring and follow-up, it's easy for initiatives to go off track. Consistent tracking helps identify and rectify issues promptly.

Strategy execution tools like Cascade make this easier by streamlining communication and collaboration to facilitate a smooth flow of information and efficient check-ins between different teams and leaders.

Real-time insights and structured team updates ensure that any roadblocks or risks can be addressed proactively to prevent potential deviations from the strategic course.

The post-QBR phase is instrumental in translating decisions into actionable results. Effective communication, strategic alignment, well-defined roles, and the right tools, such as Cascade, collectively contribute to successfully executing strategies devised during the QBR. This sustains the momentum generated during the meeting and leads the company toward its long-term goals.

Quarterly Business Review (QBR) Template

Cascade makes it easy for you to build custom reports for various use cases within your organization. This means you can stop using clumsy spreadsheets and automate time-consuming tasks like data consolidation and report updating.

With Cascade’s intuitive interface, you can tailor your reports to highlight essential metrics and progress in a clear, concise format.

👉Here’s how:

- Add an executive summary at the top of your quarterly performance report.

- Add headlines and notes to your data to provide additional context.

- Organize a certain set of data with a table format which helps to display more details or drill deeper to get more information.

- Present larger amounts of data with charts.

Additionally, reports in Cascade have a built-in presentation mode that will let you interact with your reports live in meetings.

If you want to reuse the same report for the next QBR, you can simply duplicate it and select the data you wish to include. This will help you maintain consistency and save time.

Using these templates from Cascade not only streamlines the QBR process but also enhances the clarity and impact of the presentations.

💡 Sign up for Cascade free and build your first QBR report today. Or get in touch with our strategy execution experts to learn more about Cascade.

💜You can also watch this free on-demand webinar that walks you through reporting in Cascade. No signup required.

Simplify Your Quarterly Business Reviews With Cascade 🚀

When you use Cascade to centralize visibility over your organization’s performance, you gain valuable insights and the ability to proactively address potential challenges that could steer you in the wrong direction.

You can gauge an accurate picture of your strategic performance, which means you can make better business decisions and deliver on the promised results.

Simplify your QBR process with:

- Robust reports for data-driven decisions

- Update templates for real-time insights

- Strategy planner to formulate your strategies and action plans

- Alignment map to visualize how different plans work together

- Over 1,000 integrations to consolidate your existing business tools underneath a unified roof

Ready to improve your QBR? Get a live demo today.

Popular articles

Viva Goals Vs. Cascade: Goal Management Vs. Strategy Execution

What Is A Maturity Model? Overview, Examples + Free Assessment

How To Implement The Balanced Scorecard Framework (With Examples)

The Best Management Reporting Software For Strategy Officers (2024 Guide)

Your toolkit for strategy success.

Quarterly Business Reviews (QBRs): A Quick-Fire Guide

This article will walk you through everything you need to know about Quarterly Business Reviews (QBR): what exactly a QBR is, why they’re essential for success, key stakeholders of a QBR, and provide you with a QBR template.

Let’s get started!

What is a quarterly business review?

A quarterly business review (QBR) is a quarterly meeting held with your clients and customers to analyze what’s working, what needs work, current results, and action items.

A QBR is a process by many names. It can also be called an Executive Business Review or a Business Review, but in practice, they're all the same thing.

These reviews are conducted by client or customer success teams to review the previous quarter and set goals for the quarter up ahead, with actions in place to achieve your new goals.

These check-ins help foster customer relationships, reduce client churn, and help both you and your client achieve the results you're looking for.

Why is a quarterly business review important?

Quarterly business reviews help set your internal team and your clients up for success on a quarterly basis with an emphasis on ROI for the client and customer retention for your internal team.

According to Gainsight , there are five main benefits of QBRs:

- First, they foster relationships between your executives and your customer’s executives.

- They allow you the opportunity to highlight the ROI of your product, thus reinforcing your value to the customer.

- QBRs open up honest discussions around your customers’ overall health and what you can do to maintain and improve that status.

- They eliminate the question of whether your customer will renew once the contract or subscription expires.

- They demonstrate to your customer that you’re serious about providing ROI, and that you expect to do so within a 90-day period.

Which customers get a Quarterly Business Review?

In an ideal world, all of your customers and clients would be receiving quarterly business reviews from your client success team. But, since time and resources are valuable, you should, at least, conduct quarterly business reviews for all of your top accounts.

A great way to determine who your top customers are is by measuring your CHI. CHI stands for Customer Health Index , which is a way to measure how healthy your accounts are, which in turn helps you retain customers and prevent churn. So, to ensure you retain accounts with high CHI, you should be performing QBRs.

Now, let’s take a look at who should be included in your QBR meetings.

Key stakeholders of a quarterly business review

We’ve already touched on many of the key stakeholders of a quarterly business review. Mainly, it’s important to ensure you’re including key stakeholders from both your side and the client side.

From your team, your CSM (client success manager/customer success manager) should be leading the meeting, sales executives should be included (depending on the importance/CHI of the customer), and anyone else who is dedicated to the client.

From the client side, you should have your main point of contact, any executives from their side, and any other key decision-makers with who you’ve been working.

Ensuring that you have every key stakeholder present for your QBR ensures that nothing gets overlooked and everyone is on the same page as you get ready for the next quarter.

What to include in a quarterly business review

When you kick off your QBR, you should have a visual deliverable available for your clients—whether it be a presentation, pdf, or a fully built-out client portal (like the one from Dock, below). Provide your clients with something that tells them exactly what they should expect from your team this quarter.

First and foremost, tell your client what you’re meeting about in the form of an Executive Summary. That summary should include what’s going well and which areas could be improved.

Then as you get into the details of your QBR, you’ll be able to dig into why something went well and how you’ll improve upon the rest in the months ahead.

A big piece of a QBR is whether or not you’ve hit the KPIs you and your client set for the previous quarter. When you’re bringing up what went well and what didn’t go according to plan, ensure that you’re backing it up with data examples, and putting an action plan in place for how you expect to hit your goals next quarter so that it doesn’t feel like anything is being overlooked.

Did you know that you can get your QBR template from Dock?

With Dock’s QBR template, you just have to plug your data into the dashboard. There are pre-built fields for all of the most important areas of a QBR, including:

- Analysis of the client's business alongside core KPIs from the previous quarter

- Quarterly business review presentations that you can embed in multiple formats, including PowerPoint templates, google slides, pdfs, and more

- Product roadmaps

- Case studies that go over how the client can improve next quarter and beyond

- Onboarding action plans that will drive customer engagement

- Answers to FAQs that you were preemptively expecting to get from your clients

- Links to upcoming webinars, pricing for new products, essential workflows, and automation

The Dock template includes everything in a traditional QBR all in one place so that you and your client can follow along, look back at the results, and see progress quarter after quarter.

How Dock can help with your quarterly business review

When your CSM team conducts a quarterly business review, you want to ensure that they’re not missing any details. Dock can set your team up for success with a QBR template and an easy to execute, repeatable process. With Dock, you can build custom quarterly business reviews for each of your clients and continue to crush your QBRs, quarter after quarter.

Related Revenue Lab Articles

Templates for Sales, Onboarding, Projects and Portals

Customize and share with clients

- Client-Facing Workspaces Sales Proposal & Order Form Software

- Sales Content Management Software

- Client Project Management Software

- Digital Sales Room Software

- Customer Onboarding Software

- Client Portal Software Mutual Action Plan Software Sales Proof of Concept Software Sales Portal Software

- About Us Careers Request Demo

- LinkedIn Twitter

Legal & Support

- Help Center

- [email protected]

- Privacy Request

- Privacy Policy

- Terms of Service

Quarterly Business Review: How to extract benefits beyond transparency

Leads our agile work in Central Europe and our Enterprise Agility Center in Budapest and helps institutions across industries to shape growth strategy and transform themselves in the digital age

October 5, 2020 In previous research, our colleagues have outlined the importance for agile organizations to create both stable and dynamic practices . A periodic business review, prioritization of different activities, and alignment across organizational units (frequently called tribes) are often together referred to as Quarterly Business Reviews (QBRs). QBRs can be the cornerstone of an effective agile organization, linking overall strategic direction to agile organizational units and team-level backlogs.

When done well, QBRs can bring immense value to an organization by creating vertical and horizontal alignment. However, inefficiencies often occur due to limitations in the ecosystem around the QBR—even if the narrowly defined process is done well. There are five reasons behind these suboptimal operations:

- QBR ownership: The QBR and the broader ecosystem surrounding it are at the heart of an agile organization and must have a proper owner. This role spans three main activities: managing the QBR process, ensuring proper content quality, and continuously improving the QBR. A dedicated squad is required during QBR cycles, combining agile, IT, finance/budgeting and strategy expertise, and a strong and respected leader.

Broad dependency alignment: During the QBR process, these units set Objectives and Key Results (OKRs) and plan what they will deliver to achieve them. Ideally, a substantial portion of the unit backlog can be delivered autonomously by the owner of the group, while a smaller fraction requires broader alignment. The QBR should serve as a forum to understand those dependencies and resolve them while not making the process highly technical and administrative.

For instance, one LATAM company organizes a quarterly fair where each unit leader presents its initiatives and all other leaders are responsible to challenge them and understand potential dependencies.

Traditional budgeting: Agility brings a paradigm shift in the logic of budgeting. Instead of projects, agile organizations use cross-functional teams as budgeting units. Agile organizational unit leads must assume resources are relatively fixed, and their job is maximizing impact, generated via prioritization. This is important, because if agile organizational units are subject to traditional project and business case-based budgeting logic, then QBRs cannot function properly. If fully agile budgeting is not realistic in the short term, companies can opt for a hybrid approach.

For example, a leading bank uses QBRs to review budget status against delivered business results—and potentially make adjustments in a transparent and fast way during the QBR meeting, if circumstances require.

KPI and OKR misalignment: OKRs are among the most fundamental elements of QBR logic, used by many organizations to set aspirational targets with motivating narratives to rally people behind a common vision. In the QBR, these units must define OKRs from strategic company aspirations. Yet, organizations often struggle to draw a connector line between the newly introduced OKR concept and end-of-year key performance indicators (KPIs).

A Western European bank defined the value driver KPIs for each agile organizational unit and derived OKRs that helped to achieve these relatively fixed end-of-year KPIs.

Disconnect from IT processes: In an ideal agile environment, agile organizational units can release standards and an IT architecture vision. This is rarely the case in large corporations due to legacy architectures and monolithic systems. Given that planning for major monolith IT systems often requires 12+ months, QBRs often need to co-exist with IT release planning.

One European telco solved this by synchronizing the timing of IT release planning with QBRs, and then used them as a complementor forum—refining and breaking down the upcoming portion of the high-level IT roadmap.

Building proper QBR practices and enabling the ecosystem takes time and effort. However, once these pain points are addressed, the QBR can truly act as the nerve center of the organization, transmitting key impulses and strategic signals.

The authors would like to thank Gabor Takacs for his valuable contribution to this blog post.

Learn more about our People & Organizational Performance Practice

Quick Guide to Doing a Strategic Business Review

Chris Leadley

[email protected]

A Strategic Business Review is an audit, or health check, of a company’s current financial and operational position.

The aim of a business review is to find areas in the business that need to be corrected and then work out ways to do it.

By carrying out your own business review you can look into areas that are concerning you and develop real, workable solutions to the problems before it’s too late.

It is part of working on your business rather than in it.

Gain valuable insight into your business with a business review

Identifying, understanding, and solving problems in your business is critical in delivering sustained growth and profitability.

A systematic analysis of the key areas of your business can help to highlight performance issues, helping you to understand what your problems are and why it is important to fix them in order to drive the success of your business.

What areas need to be covered by a business review?

A thorough analysis of the following key aspects of your business should be undertaken:

The review should also examine other critical issues that may affect your business, including:

- Competition

- Market dynamics

- Creditor and stakeholder expectations and objectives

- Legislation affecting the business and industry in general

- Lender considerations

Identifying and understanding the issues in your business is the first step in its transformation. The next step is creating the step-by-step plan, process and action solution needed to solve those issues.

The business review plan

Once you have completed the business review you need to create the plan on how you intend to address and fix the issues found in each of the key areas.

Fixes may include updating your marketing plan, developing a cashflow forecast, or applying for finance to invest in new equipment.

The plan should detail how the fixes will be applied, who will manage them, the resources required, and when they will be done by.

Need help to review your business?

If you want some help to carry out a business review get in touch today. Email [email protected] or call us on 0800 975 0380

Make a strategic change in your business

Whether your business is treading water or advancing but without direction, our free Business Analysis will help you take stock, diagnose issues, and identify a strategy for the future.

Quickly examine the 4 core pillars of your business and identify the areas that are holding your business back.

- It takes just 5 minutes

- It’s completely free and no obligation

- Receive a bespoke report from our consultants

Find out more about the Find out more about our Free Online Business Analysis →

Free Confidential Advice And Help For Company Directors

Need some advice get in touch using the form below or by calling us on 0800 975 0380, trustpilot reviews, related articles.

Why You Need a Strategic Business Plan And How to Actually Write One

How to Prepare a Business Survival Plan

We're here for you.

As a dedicated team of Advisers and Consultants our aim is to help you fix the issues and solve the problems within your business.

How to: Monthly Business Review

A monthly business review is one of the best ways to make sure your strategic plans stay on track. But how do you avoid getting stuck spending too much time preparing and a too much time in a meeting that may or may not be adding value? This post will give you a roadmap to follow.

What is a Monthly Business Review?

A Monthly Business Review (MBR) is a meeting where you come together to review actual performance against your strategic plan. The primary purpose of this meeting is to provide an opportunity to reflect on the previous period and see if you are still on track to achieve the targets and if necessary, implement corrective actions before it is too late.

Monthly Business Reviews are one of the critical rituals of a company that wants to be excellent at execution.

Why is a Monthly Business Review important?

- Focus: A monthly review of the business will ensure you stay focused on the established vital few priorities.

- Ownership: By encouraging individuals to take ownership of the metrics that are part of the MBR and to commit to corrective actions when required, the level of individual ownership and commitment will increase.

- Reflection: A scheduled period of reflection is critical for learning. A monthly cadence insures you have 12 periods of reflection in a calendar year.

Focus: Improves communication

Engaging people across your business and providing a specific format where individual KEY metrics are reviewed and discussed will reinforce the focus that those metrics represent. The purpose of any goal or target is to focus the energy and attention of the goal seekers. The monthly cadence is a good interval to provide this strategic reminder.

Ownership: Engage individuals to take responsibility

A monthly business review has the potential to pull in greater insight from across your business. Whether you’re sharing information company-wide or sticking with select leaders from each department, it immediately expands the scope of expertise.

The more that every leader and employee knows what’s going on with everyone else, the better you can align and produce effective goals. It also provides the opportunity to identify potential solutions or issues from outside your core team’s responsibilities.

Reflection: A scheduled time to learn and react

It’s easy to let operations and processes become stagnant and standard. Without a regular performance review, any potential problems may remain to fester well beyond when they’re first identified. You don’t want to waste company time and resources on things that are ineffective, but it’s difficult to change course without first processing it.

By setting aside the monthly time for a monthly business review, it provides the opportunity to commit to learning and adjusting anything and everything. This isn’t based on off-hand information but on solid information and data that helps you identify and evaluate what’s most important for your business.

How to conduct your Monthly Business Review

Agenda for a monthly business review.

The Agenda for a Monthly Business Review should include Goals, Metrics, and Projects, but your primary focus should be on the Metrics. Specifically you should be reviewing each metric and its Target vs. Actual performance. If the actual performance is not where it should be, you should be looking to ensure that there is a plan to fix it in the next period.

A simple formula to follow for a successful Monthly Business Review:

- State the Strategic Goal or perspective

- Identify the Key Metrics

- Identify the Target Value and the Actual Value

- Express the status as a color: Red/ Yellow/Green

- Add a brief comment for each metric explaining the reason for the color code.

Questions to ask in a Business Review

The following questions are appropriate for a Monthly Business Review:

- Is the strategy or goal still important and relevant?

- Is the chosen metric still the best way to measure our progress?

- What is our progress toward the established target? (Indicated with color Red, Yellow, Green).

If target is Green , ask:

- Is there anyone who performed exceptionally that should be recognized? (This is a great opportunity to provide kudos)

If the Target is Yellow , ask:

- Do we know why we missed the target?

- Is a corrective action required?

If the Target is Red , ask:

- What is being done to bring this metric back to green?

Best Tools & Resources to Conduct a Monthly Business Review

Download this Business_Review_Template PDF to help you more easily and efficiently manage your Monthly Business Review with metrics and targets in place.

Moreover, you are prompted to use these resources from KPI Fire to conduct better business reviews and maintain your CI projects:

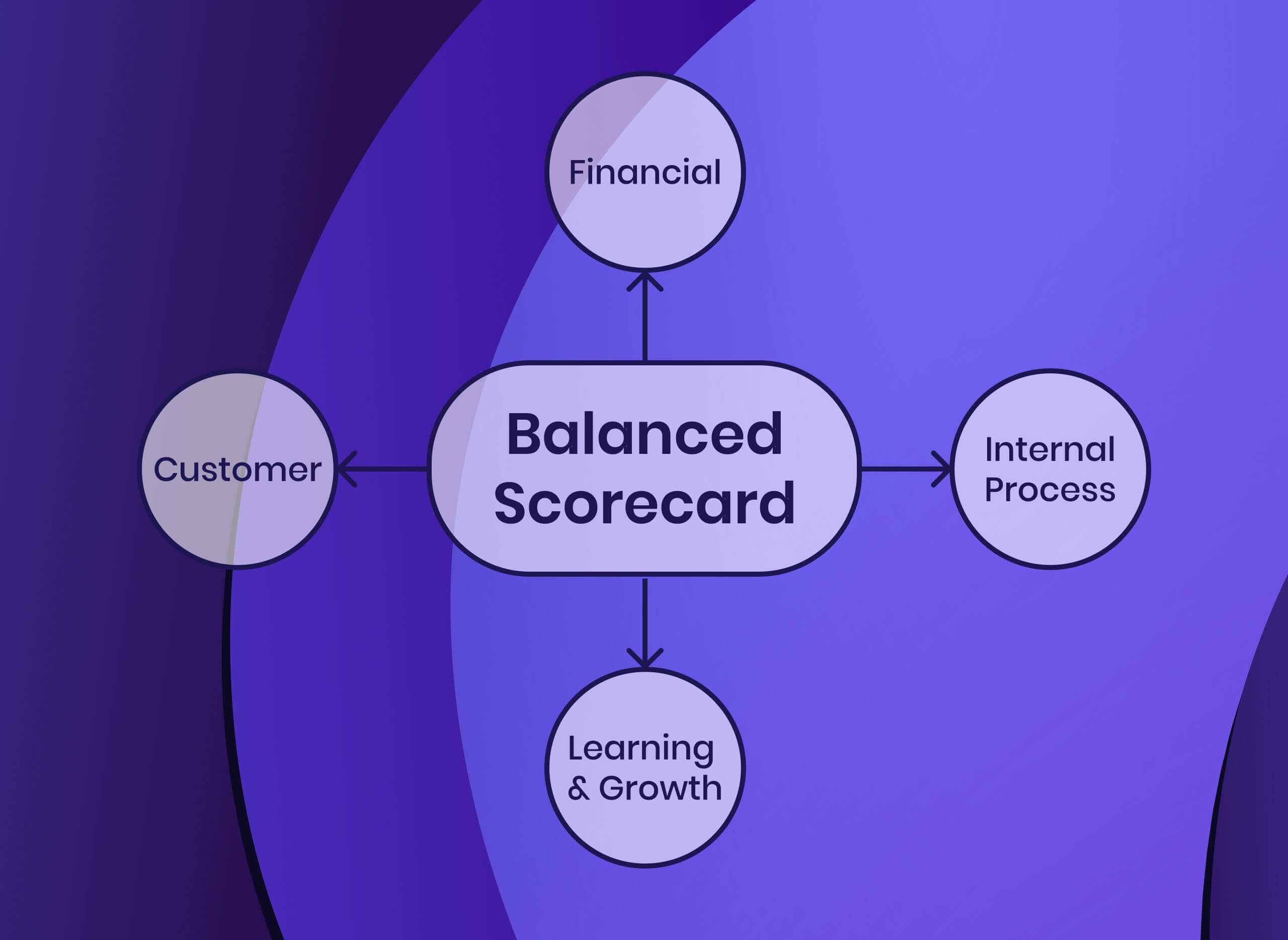

- Balanced Scorecard Examples

- Should you be using a Balanced Scorecard?

- Using the Balanced Scorecard Feature in KPI Fire

If you haven’t done so yet, now is the time to download your free DEMO version of KPI Fire to easily and efficiently plan, execute and manage your Monthly Business Review.

Watch as Keith Norris, CEO of KPI Fire takes you step-by-step on how to use KPI Fire to make your Monthly Business Review the most important meeting of the month…

Share This Story, Choose Your Platform!

About the author: keith norris.

Related Posts

Product enhancements – release notes april 2024.

How-to Take and Use Screenshots

Lean Thought Leaders and Consultants: The Ultimate Collection

Product enhancements – release notes march 2024.

What is the best way to train a team on Lean Six Sigma?

What Is a Quarterly Business Review and Why You Should Do One

A quarterly business review, or QBR for short, is a meeting between a business and its key stakeholders and customers. It assesses the company’s performance over the past quarter and plans for the next one.

This meeting can be beneficial for businesses of all sizes, as it allows them to track their progress and make changes. In this article, we will discuss the advantages of quarterly business reviews and how they can help your business grow.

Quarterly Business Review (QBR) Definition

A quarterly business review (QBR) is a formal meeting between a company and its key customers. The purpose of a QBR is to review the health of the business relationship and identify any areas of improvement.

QBRs cover the previous quarter’s performance, goals for the current quarter, and any challenges or opportunities that have arisen.

During a QBR, both parties should share feedback and suggestions to maintain a strong relationship.

By setting aside time to review the state of the relationship, companies can ensure that their vendors or customers are satisfied. And that any potential problems are quickly resolved.

Why is QBR is important?

A Quarterly Business Review is an important part of customer success. It’s an opportunity for customer success managers to review the business and identify areas for improvement.

QBRs also help to build relationships between customer success managers and their customers. By reviewing the customer’s business and identifying areas of improvement, companies show their commitment to the customer’s success.

QBRs give customer success managers a chance to share best practices with their customers and learn about new technologies and approaches that can help their customers succeed. As a result, QBRs are an essential part of customer success.

When are quarterly business reviews needed?

As a business begins to scale, it can become increasingly difficult to keep track of all customers and their specific needs.

In these cases, quarterly business reviews (QBRs) can be an essential way to check in with customers and ensure that their needs are being met.

QBRs provide an opportunity for businesses to ask for feedback, identify potential areas of improvement, and nurture relationships with key customers.

They can also be used to troubleshoot problems, set goals for the future, and review progress made over the previous quarter. As a result, QBRs can be extremely valuable for both the customer and you.

How to conduct a QBR

At the QBR, you will review your goals and performance for the quarter. Discuss any challenges or changes in strategy, and set an agenda for the next quarter. The QBR is an opportunity to course-correct and make sure that your business is on track to meet its objectives.

To prepare for the QBR, start by reviewing your goals and performance. Take a close look at your numbers and identify any areas where you fell short. Then, take some time to reflect on your strategy. Are there any changes you need to make?

Then, set an agenda for the next quarter. What do you want to achieve? What are your priorities? By preparing for the QBR, you can ensure that it is a productive and valuable exercise for your business.

QBR presentation tips

When it comes to giving a quarterly business review presentation , there are a few key things to keep in mind to make the meeting engaging.

Be sure to prepare your slides and deck in advance, including all relevant KPIs. This will ensure that the presentation runs smoothly and that attendees have all the information they need.

Make an effort to keep the meeting engaging by incorporating interactive elements such as polls or Q&A sessions.

Respect attendees’ time by keeping the presentation concise and to the point.

The benefits of conducting a QBR

A quarterly business review is an opportunity for a company to take stock of its progress and relationships with customers and stakeholders.

By bringing everyone together to discuss recent successes and challenges, a QBR can help to build stronger relationships and create a more united team . You get to properly understand what’s in it for the customer .

Additionally, a QBR can help to set the future direction for a company by identifying areas of opportunity and outlining a plan for how to capitalize on them. It gives you goals to discuss in the next quarterly business review.

The QBR also gives a chance to collect customer feedback that the customer success team and sales team can use to improve products. The quarterly business review session gives a chance to existing customers to have their voices heard.

These business reviews also help avoid marketing myopia as you get to see the market from the eyes of a customer.

Finally, conducting a QBR can build more trust with customers by demonstrating that the company is committed to its success.

By reviewing the past quarter and planning for the next one, companies can ensure that they are making the most of this valuable opportunity.

QBR vs. EBR

Though both Quarterly Business Review (QBR) and Executive Business Review (EBR) involve presentation and discussion of a company’s performance with executives, there are key differences between the two.

The quarterly business review presentation takes place on a quarterly basis. While EBRs occur less frequently, usually only once or twice a year.

QBRs usually involve a wider range of departments and team members, while EBRs are more focused, with only key decision-makers in attendance.

Additionally, QBRs are generally shorter in duration than EBRs. Because they occur less often, EBRs tend to be more comprehensive in nature, with greater opportunity for strategy development and long-term planning.

Both QBRs and EBRs serve as important forums for communication and review. But the frequency and focus of each type of meeting differ according to the needs of the business.

Quarterly Business Review: Summary

The Quarterly Business Review, or QBR, is a meeting that takes place between a company and its customers to review the progress made over the past quarter. It is an opportunity for both parties to identify any areas of improvement and to set goals for the next quarter.

QBRs can be beneficial for businesses of all sizes, as they provide a structured forum for feedback and collaboration. QBRs can help build strong relationships between companies and their clients. QBRs can be an invaluable tool for ensuring continuous improvement and success.