An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- v.9(8); 2023 Aug

- PMC10457530

Effects of automated teller machine service quality on customer satisfaction: Evidence from commercial bank of Ethiopia

Abibual getachew nigatu.

a Department of Accounting and Finance, Samara University, Semera, Ethiopia

Atinkugn Assefa Belete

b Department of Economics, Samara University, Semera, Ethiopia

Getnet Mamo Habtie

c Department of Statistics, Samara University, Semera, Ethiopia

Associated Data

Data will be made available on request.

The banking industry has seen the emergence of numerous service delivery channels, automated teller machines (ATMs), telephone banking, and online banking. Global financial systems and mature competition have been compelled to research the importance of consumer satisfaction. Thus, this study aimed to examine the effects of automated teller machine service quality on customer satisfaction in commercial banks of Ethiopia in the Afar regional state, Northeast Ethiopia. To this end, cross-sectional data were collected through a questionnaire from a sample of three hundred forty-six (346) ATM users selected from Semera-logia City, Asyaita, and Awash Town. To identify the dimensions of automated teller machine service quality and their relationship with customer satisfaction, confirmatory factor analysis and structural equation modeling (SEM)) through SPSS and AMOS 23.0 data analysis software were used. The findings indicate that convenience, reliability, ease of use, fulfillment, and security/privacy of ATM service quality dimensions are positively and significantly associated with customer satisfaction. The results of this study can help banks' management improve the quality of their ATM services to increase overall customer satisfaction. To ensure continued customer satisfaction, banks are encouraged to make the ATM service more convenient, reliable, user-friendly, secure, and fulfilling. They should also constantly update and differentiate their ATM service quality aspects to build a competitive advantage and boost their profitability.

1. Introduction

Effective and cost-effective methods are needed to survive and generate profits in today's fast-paced, fiercely competitive global market. These revenues can then be used to fuel the organization's expansion. It is evident that customers are more significant stakeholders in many firms, and marketing management places a high focus on ensuring their pleasure. In many service sectors, technology is one of the most important forces behind increased client attraction, improved service delivery, and improved transaction execution [ 1 ]. The banking industry is regarded as the heart of global business in the era of advanced technologies. To expand the competitive market share, technological innovation improves the efficiency of banking operations and systems. The use of technology is helping the banking sector expand quickly. Information technology has revolutionized the banking sector over the past few decades and given banks a way to serve their consumers with products and services of high quality [ 2 ].

A banking company can only set itself apart from rivals by offering top-notch services. As a result of technological advancements, businesses may now offer improved services that satisfy clients [ 3 ]. Conventional banking systems are being replaced by electronic-based business models, and most banks are reevaluating their business process designs and customer relationship management strategies. Due to the low cost of comparing options in online contexts, researchers have suggested that electronic service quality is a major factor in differentiating service offers and creating a competitive advantage [ 4 ].

To be competitive, banks are expanding their electronic service options, such as SMS, mobile banking, internet banking, and ATMs. The trend in the banking industry changed from a cash economy to a cheque economy, which then shifted to a plastic card economy [ 5 ]. Clients primarily used automated teller machines out of all of these, which are self-service technology devices, and are the most commonly used electronic banking product. Using their cards in public places, customers of banks can access financial transactions like cash withdrawals, prepaid mobile phone credits, fund transfers between accounts, and checking account balances without the assistance of a bank teller [ 6 ].

The Ethiopian banking sector is also adopting this ICT-based service to clients to improve operational efficiency by lowering operating costs, which would ultimately boost client satisfaction and profitability. The state-owned Commercial Bank of Ethiopia (CBE) is the first bank in Ethiopia to introduce ATM service for a long time ago as part of ensuring service excellence by reducing waiting time, errors, and costs, thereby improving client satisfaction. Even though ATM service has a great significance in improving customer satisfaction, the services in Ethiopia are challenged by inappropriate infrastructure, unavailability of competent and skilled employees in the banks, and related problems. To encourage further ATM service expansion in the country, a better understanding of ATM service quality dimensions and client satisfaction is critical [ 7 ]. Customer impressions of ATM service quality are gauged by the ATM's ability to perform these tasks to their satisfaction. Researchers and corporations have been interested in the relationship between customer satisfaction and service quality because certain studies have shown that it exists [ 8 ].

Researchers such as [ [9] , [10] , [11] , [12] , [13] , [14] , [15] , [16] ] conducted on ATM service quality in different parts of the world. In Ethiopia, previously scant research has been done on ATM service quality and its effects on customer satisfaction in Ethiopia, such as Embiale [ 17 ] conducted a study on the effect of automatic teller machine service quality on customer satisfaction: the case of the Commercial Bank of Ethiopia in Hawassa city, and conclude that aspects of ATM service quality, such as reliability, convenience, user-friendliness, security, and responsiveness, positively and significantly affect customers' satisfaction. Tewodros and Debela [ 18 ] studied Factors affecting customers' satisfaction towards the use of automated teller machines (ATMs): A case in a commercial bank of Ethiopia, Chiro town, responsiveness, efficiency, appearance, reliability, and convenience of ATMs have a significant and positive influence on customers’ satisfaction. Tadesse and Bakala [ 19 ] also conducted a study on the effects of automated teller machine service on client satisfaction in the Commercial Bank of Ethiopia and found a positive relationship between tangibles, reliability, responsiveness, empathy and assurance, and client satisfaction.

However, those studies were complicated by some issues. The selection of quality dimensions in previous studies often lacked a strong theoretical foundation. As a result, the dimensions for Automated Teller Machine (ATM) quality were chosen from existing literature on electronic quality without considering the unique attributes and aspects of ATM service quality. The studies have also neglected a crucial aspect of ATM quality such as fulfillment which has been suggested as a major ATM service quality dimension [ 9 , 20 ]. Also, the convenience sampling methodology adopted in prior studies and the limited geographic scope of those studies could affect the generalizability of the results which requires the need for a more comprehensive study. Overall, the existing literature falls short of providing a comprehensive understanding of the effect of ATM service quality on customer satisfaction, as it fails to consider the unique attributes of ATM services, and explores the holistic nature of ATM services.

An investigation into the dimensions of ATM service quality and their relationship with customer satisfaction is crucial due to the rising popularity of ATMs in retail banking, and this study is intended to address the identified gaps and enhance understanding of the unique characteristics of ATM services, shed light on the dimensions of service quality that customers value, and provide valuable insights for banks to improve customer satisfaction in the specific context of banking through ATM. The survey will give bank management a thorough understanding of how to manage client expectations and raise ATM user satisfaction. The objectives of this study are therefore to examine the dimensions of perceived ATM service quality evaluate the relative importance of these dimensions in predicting customer satisfaction based on the perceptions of customers and provide insight into ATM service quality in a region often understudied in academic discourse and inquiry.

2. Literature review

2.1. atm service quality and customer satisfaction.

ATMs are technological tools that enable users to deposit, withdraw, and transfer money, pay bills, and carry out other financial activities without a branch employee or teller's assistance [ 13 ]. From the aforementioned, it is claimed that an ATM is the electronic equivalent of a traditional banking hall. Customers visit an ATM to conduct financial transactions, such as withdrawals, deposits, or balance checks, just as they would have done in a traditional banking hall.

Service quality is an important factor that influences how attractive a service provider is to customers [ 21 ]. If a company provides high-quality products that fulfill customer needs, it initially ensures customer satisfaction. Therefore, to enhance customer satisfaction, service providers should enhance the quality of their services. In simpler terms, service quality and customer satisfaction have a positive relationship, where the quality of service is the primary factor that determines customer satisfaction [ [22] , [23] , [24] ]. Providing high-quality customer service is crucial for establishing and maintaining a positive rapport with customers in the traditional banking industry [ 22 ]. In this sector, delivering exceptional customer service plays a vital role in fostering positive relationships with clients [ 25 ]. Specifically, concerning ATM services, service quality refers to the customer's general evaluation and judgment of the quality of services received through the ATM channel [ 26 ].

Customer satisfaction is of utmost importance for both customers and banks. It pertains to evaluating how well a bank's products and services meet or exceed customer expectations [ 27 ]. Customer satisfaction refers to the state in which customers feel adequately rewarded or compensated in a buying situation in exchange for a particular cost [ 28 ]. Farris, Bendle [ 29 ] also described that customer satisfaction refers to the extent to which customers are happy with the products and/or services provided by a business. According to Habte and Mesfin [ 30 ], customer satisfaction refers to a response that is specific to a particular focus and time. It is closely associated with meeting the needs of clients and is recognized as a significant factor in influencing their future purchasing decisions [ 31 ]. When discussing client satisfaction, it can be described as an individual's level of pleasure or discontentment derived from comparing the perceived performance of a product with their expectations [ 32 ]. Customer perceptions of ATM service quality are determined by how effectively the ATM meets its expectations and fulfills its desired tasks.

According to the literature, ATM service quality dimensions are multidimensional [ 15 , [33] , [34] , [35] ]. Several aspects of ATM service quality, including reliability, convenience, security and privacy, ease of use, and fulfillment, were recognized by Ref. [ 33 ]. This study tried to examine the ATM's service quality dimensions such as reliability, convenience, security and privacy, ease of use, and fulfillment. A review of these dimensions and their alleged connection to customer satisfaction is given in the next section.

Convenience is the state of having work simple and hassle-free [ 36 ]. Narteh [ 33 ] described convenience as the location of the ATM and involves the availability of services to clients around the clock. ATMs are conveniently positioned at bank branches and other locations, like malls and colleges. Customers can withdraw money from other ATMs for a minimal price because the bank's ATM card is compatible with systems used by other banks. It reduces the hassle of utilizing ATMs and has been found to positively correlate with client satisfaction. It is less inconvenient to conduct financial transactions when ATMs are nearby, as this eliminates the need to travel far [ 12 ]. According to Olusanya and Fadiya [ 11 ], customer satisfaction has been found to positively correlate with convenience, which is the most frequently used factor of ATM service quality.

Convenience of ATM service has a significant positive relationship with customer satisfaction.

Reliability is the ability to perform the desired service exactly and dependably [ 37 ]. Wolfinbarger and Gilly [ 38 ] claimed that reliability is a good predictor of client satisfaction in electronic channels. According to Ennew, Waite [ 39 ], reliability can be viewed as the degree to which customers can rely on the service that the company has promised. The reliability dimension is essential because it incorporates the active competency to carry out all the contracted services consistently and precisely. Reliability in the context of an ATM setting refers to the capacity of the device to operate continuously and deliver services that are constant and error-free. According to Ogbeide [ 10 ], reliability is a crucial ATM service quality dimension that affects client satisfaction. The literature that is currently available has also demonstrated that in the banking industry, reliability and customer satisfaction are positively correlated [ [40] , [41] , [42] , [43] ].

Reliability of ATM service has a significant positive relationship with customer satisfaction.

Ease of Use: Since some customers may feel threatened by technology, one would anticipate that ATMs would be designed to speed up the transactional process for users [ 44 ]. Ease of use is the extent to which the prospective user anticipates the target system to be free of effort, according to Davis, Bagozzi [ 44 ]. Chong, Ooi [ 45 ] argued that people are more inclined to use an electronic banking system if they think it's easy and stress-free. The term "concept" in this study refers to the extent to which an ATM service provides a hassle-free transaction for the user. An important factor in determining the acceptance and utilization of different corporate information technologies, such as online banking, is the ease of use [ 46 ]. The ease of use was identified by Refs. [ 9 , 47 , 48 ] as an essential ATM quality dimension.

Easy use of ATM service has a significant positive relationship with customer satisfaction.

Fulfillment: The extent to which the website's guarantees about order delivery and item readiness are upheld is what matters [ 20 ]. Wolfinbarger and Gilly [ 38 ] stated that the fulfillment of websites has a significant effect on overall quality, satisfaction, and loyalty goals. In the ATM context, the study employed fulfillment quality to gauge how well the ATM delivers results that live up to client expectations One could also indicate the amount given to clients per transaction, the transactional fees charged by the ATM, and the validity of the notes handed by the ATM (to eliminate counterfeits). Fulfillment was found to be the primary determinant of customer satisfaction for ATM service quality [ 13 ].

Fulfillment of ATM service has a significant positive relationship with customer satisfaction.

Security and Privacy: Customers should receive protection and privacy from an ATM. While privacy is the defense of personal information, security includes protecting clients against fraud and financial loss [ 49 ]. Security was described by Casaló, Flavián [ 50 ] as the technical guarantee that the legal requirement and practices protecting privacy will be properly met. The adoption of Internet banking in Vietnam was found to be influenced by security and privacy [ 45 ]. Every client expects their banks to protect their personal information and money. Khan [ 15 ] concluded that security and privacy were important aspects of the ATM service quality.

Security and privacy of ATM service have a significant negative relationship with customer satisfaction.

Based on the previously studied literature that is already in existence, the current study predicts that the key aspects of ATM service quality that will affect customer satisfaction are reliability, convenience, security and privacy, ease of use, and fulfillment. Based on the previous discussions, the study suggests a framework that directs the ongoing research, as shown in Fig. 1 .

Conceptual model of ATM service quality and customer satisfaction.

3. Research methods

3.1. study area.

This study was conducted in Samara-Logia city, Asayita, and Awash town located in Afar regional state, eastern Ethiopia. Currently, the region is growing into a place of considerable social, economic, and political activities with the establishment of colleges, a lot of commercial banks, a university, factories, modern shops, investment projects, and other significant financial institutions.

3.2. Research design

A research design is an overall strategy for the study that outlines the precise steps a researcher should take to answer the study's questions and accomplish its objective [ 51 ]. The study's research design strategy is designed based on the objectives of the study. To achieve the objectives of the study, both descriptive and explanatory research methods are employed to describe and evaluate how automated teller machine service quality affects customer satisfaction. In addition, this study collected data over a specific period to look into the effect of ATM service quality on customer satisfaction in addition to its descriptive and explanatory nature. As a result, our study used the cross-sectional data type for this investigation based on the time horizon dimension of research design classification.

3.3. Sampling techniques and sampling size

A multi-stage sampling technique was used in this study. In the first stage, from the regional state of Afar, two towns (Awash and Asayita) and one city administration (Samara-logia) were selected purposively because there are large numbers of ATM users in those areas. In the Second stage, the sample size from each selected area was determined proportionally to the number of registered ATM users in the Commercial Bank of Ethiopia operated in each town and city. Finally, 386 ATM users were selected based on the simple random sampling method. To derive the sample size, the study used a [ 52 ] simplified formula by considering a sample error of 5%.

3.4. Data source and collection procedure

The sources of data for this study are both primary and secondary data sources for the achievement of the objectives. The primary data were obtained from ATM users of commercial banks of Ethiopia (CBE) in selected towns and a city through structured questionnaires. The data were collected from October 2022 to December 2022. The secondary sources were obtained from published and unpublished materials and annual reports of the bank.

3.5. Measurement of instruments

The survey questionnaire for the study consists of demographic variables and five constructs in the research model. Demographic variables for acquiring information about participants consisted of gender, age, marital status, educational background, and occupation. Other than that, to identify respondents who have experience in using conventional banking services and ATMs a screening question was included in demographic questions. The survey items were assessed based on a five-point Likert-type scale, where 1 indicates strongly disagree and 5 indicates strongly agree. The construct, reliability, convenience, security and privacy, ease of use, and fulfillment were assessed by 3 items, and lastly, customer satisfaction was assessed by 4 items, adopted from Refs. [ 13 , 15 , 34 , 53 ] with some modification.

3.6. Statistical technique

The structural equation modeling (SEM) approach using Amos was employed for data analysis. This study consists of 15 latent variables, which can be deemed complex; therefore, SEM is considered appropriate for dealing with complex research models with larger numbers of latent variables [ 54 ]. The reliability, convenience, security and privacy, ease of use, and fulfillment of ATM service quality were the exogenous variables, and customer satisfaction was the endogenous variable.

3.7. Normality test

After gathering data, the participants' answers were organized, stored, and examined using SPSS, the statistical software. To determine whether the data followed a normal distribution, the kurtosis and skewness were assessed using two tests called the Shapiro-Wilk and Kolmogorov-Smirnov tests. The findings of the normality tests showed that they were not significant, meaning that the p-values obtained were greater than 0.05. This suggests that the distribution of the data was indeed normal. Given that our null hypothesis assumes a normal distribution, we do not reject the hypothesis when the p-value is greater than 0.05.

3.8. Common method variance

According to Aslam, Arif [ 36 ], common method variance (CMV) presence in the study has to be detected first before examining the measurement model to prevent any bias. To detect any bias, this study used Harman's single factor test, which stated that if the variance is less than 50%, then it indicated no CMV issue. In this study, it is indicated that the percentage of variance is 45.39%, which indicates no presence of data bias in this study.

3.9. Ethical consideration and consent to participate

The College of Business and Economics at Samara University provided ethical clearance. The confidentiality of the data was protected by removing respondents' identifiers, such as names, from the data collection format.

Finally, those who were willing to engage in the study and were in the sampled city and towns provided verbal informed consent. Moreover, the results were recommended to be disseminated by the responsible bodies who were involved in the Commercial Bank of Ethiopia.

Out of the 386 questionnaires distributed to selected ATM users, 26 questionnaires were not returned for various reasons. In addition, 14 questionnaires were not appropriately completed by the respondents. Therefore, 346 questionnaires were analyzed, which accounted for a response rate of 89.6%.

4.1. Demographic profile of respondents

Table 1 presents the background profile of the users of ATM services provided by the Commercial Bank of Ethiopia in Awash and Asayita Towns and Samara-logia city administration. Out of the total completed ATM user survey in the study area, about 73.4% were male and the remaining 26.5% were female customers. Among the total samples, the majority age group of ATM users (50.3%) was 27–35 years, 19.9% were 36–50 years age group, whereas, 10.1% were 18–26 and 19.7% of them were over 51 years. Concerning marital status, the dominant 70.8% of samples are single, followed by married 19.7%, divorced 6.9%, and widowed 2.6% ( Table 1 ).

Background of Respondents (ATM users).

Regarding their levels of education, the majority of the total sample respondents 72.6% of them had completed a diploma and above or higher qualifications, with 26.9% having secondary education, and 0.6% of them were illiterate. Of the total sample respondents, 39.6% were salaried individuals, 28% were unemployed individuals, and 17.9% and 14.5% of the sample of ATM users were businessmen and students respectively ( Table 1 ).

Regarding customer's experience in using the conventional banking service, from the total ATM users, 41.6% of them have 5–6 years of experience, 27.7% of them have over 6 years of experience, 12.4% of them have 1–2 years of experience, 9.8% of them have an experience of below one year, and 8.4% of them have 3–4 years of experience in the bank. Concerning using ATM service, out of the total sample respondents, about 37% of them have 5–6 years of experience, 32.7 of them have over 6 years of experience, 14.5% of them have 3–4 years of experience, 13.3% of them have 1–2 years of experience, and 3.7% of them have an experience of below one year in using ATM service from the bank according to Table 1 . This indicates that, on average, most of the ATM banking users in the study area have an experience of more than three years. The longer period of the users of the ATM service served contributes to evaluating better how the ATM service of the bank is effective and efficient. Besides that, it helps the researcher to gain responses, which are most likely expected to be reliable information as a customer rating their level of satisfaction or dissatisfaction concerning services received from the bank in the study area.

4.2. Customer satisfaction with ATM banking services

Table 2 shows the status of customer satisfaction with using ATM banking services within the Commercial Bank of Ethiopia. The table shows that the highest mean score of all the customer satisfaction items is obtained and ranges from 3.83 to 4.11. According to Alhakimi and Alhariryb [ 55 ], the interpretations of the Likert scale results are: the mean score value of 1–2.32 indicates a low level, scores of 2.33–3.65 indicate a medium level, and scores of 3.66–5 indicate high level. In addition, the higher mean values (>3) refer to the customers are agreed on the item, and vice-versa. So, this result revealed that ATM users are more delighted with the ATM services they receive from the bank.

Client Satisfaction with the ATM service quality of commercial bank of Ethiopia.

This signifies that the users of ATMs concur that ATM banking services offer higher satisfaction than conventional banking systems, have met customer expectations, offer adequate guidance on how to use and secure the ATM banking service, and, as a whole, have a more positive effect on banking practices than ordinary banking services. Overall, the grand mean for the overall satisfaction level is (3.9913) implying their satisfaction has reached a high level implying that the majority of users are satisfied with the provided ATM service of the Commercial Bank of Ethiopia in the study area and is evaluated as very good, though it needs an improvement on the different dimensions.

4.3. Effects of ATM service quality on customer satisfaction

The perception of the customer was analyzed based on the convenience, reliability, ease of use, fulfillment, and security dimension of ATM service quality offered by the Commercial Bank of Ethiopia. Table 3 , shows the summary of customer perception of ATM services quality and the overall mean for the dimension of convenience, reliability, easiness, fulfillment, and security. As a result, the mean values of all dimensions vary from 2.37 to 4.18, showing that customers perceived that the ATM service is moderately convenient that there are enough ATMs, that offer 24/7 service, and that ATM waiting time for a given transaction is acceptable; reliable service that performs the service exactly as promised and completes the service correctly the first time; easy to use service that the ATM service is user friendly and uses simple and clear language; fulfillment that the service contains full banking service, provides information that exactly fits needs and the daily cash withdrawal limit of ATM is adequate; and finally, making transactions through ATM is safe, protects users privacy and transaction information and also has clear transaction safety policies regarding ATM followed by the bank. Moreover, the result established that the overall mean of all the ATM service quality dimensions from 2.41 to 3.98 referring that the ATM service their bank provides is convenient, reliable, easy to use, fulfilled, and secured in Commercial Bank of Ethiopia operated in the regional state of Afar.

Customer perception of ATM service.

4.4. Measurement model assessment

Each latent construct was measured with multiple indicators to reach a high level of validity. The psychometric properties of the survey instrument were tested using CFA employing structural equation modeling (SEM) analysis with SPSS Amos version 23 to assess the quality of the measures. The measurement scales are provided in Table 4 .

Confirmatory factor analysis (CFA) and Convergent validity.

Tests of sampling adequacy were initially carried out before the analysis. Kaiser-Meyer-Olkin (KMO) statistic is 0.84, which is appropriately higher than the suggested cut cut-off of 0.60 [ 56 ]. Additionally, the Bartlett test of Sphericity (approximately: χ2 = 5264.913, df = 171, significance 0.000) was significant, at the 1% level.

Confirmatory factor analysis (CFA) was used to evaluate the measurement model. Based on the criteria of Cronbach's alpha and factor loading, the reliability of each construct was tested. For reliability to be considered acceptable, the Cronbach alpha and factor loading must surpass 0.70 and 0.50, respectively [ 57 ]. Table 4 presents the findings of the assessment of the measurement model and demonstrates that each variable's factor loading is greater than 0.6, and Cronbach alpha is greater than 0.70. Reliability has been determined to be at an acceptable level in this study. Opponents of Cronbach's α argue that while it is a straightforward reliability indicator based on internal consistency, it is ineffective for estimating mistakes brought on by variables outside of an instrument, such as variations in testing conditions or respondent characteristics over time [ 56 ]. Because they are more parsimonious than Cronbach's, composite reliability (CR) and average variance extracted (AVE) are suitable options for SEM [ 58 ]. As a result, a validity test consisting of convergent and discriminant validity was conducted to assess the reliability of the constructs and the items . Hair, Ringle [ 59 ] noted that the index of composite reliability (CR) should exceed 0.70 whereas the index of average variance extracted (AVE) should exceed 0.50 while examining convergent validity. According to Table 4 , which lists the results for convergent validity, the values of CR, which range from 0.863 to 0.978, are greater than the 0.70 suggested threshold value. The findings based on factor loadings, Cronbach's alpha, and CR confirmed the five-factor structure as the dimensions of ATM service quality.

Convergent and discriminant validity were used to evaluate the measuring scale's validity. The degree to which latent variables have a significant amount of variance in common is measured by convergent validity [ 60 ]. The AVE in items by their respective constructs must be bigger than the variance unexplained for convergence validity to be attained (i.e. AVE >0.50). The findings in Table 4 showed that the constructs match the standards outlined by Ref. [ 57 ], with an AVE between 0.551 and 0.722 (>0.50). The study's convergent validity is therefore verified.

4.5. Structural model estimation

In this model, there were five exogenous variables (convenience, reliability, ease of use, fulfillment, and security/privacy), and one endogenous variable (satisfaction with service quality). The model was tested for good fit using various model fit indices and it was determined that the fit was adequate by the following standards: Chi-square (CMIN/DF) = 1.68; Goodness-of-Fit Index (GFI) = 0.90; Adjusted Goodness-of-Fit Index (AGFI) = 0.88; Incremental fit index (IFI) = 0.94; Tucker-Lewis Index (TLI) = 0.93; Comparative Fit Index (CFI) = 0.94; and Root Mean Square Error of Approximation (RMSEA) = 0.04. The findings of all goodness of fit indices met the specified levels from the literature (See Table 5 ), indicating that our data matched our model quite well.

Model fit indices.

The relation was developed and examined by the suggested model after the SEM model fit was determined . Fig. 2 depicts the predicted association. Out of the five ATM service quality aspects, all were found to be statistically significant, supporting four out of the five relationship hypotheses. The findings show that reliability, ease of use, fulfillment convenience, and security/privacy are the main predictors of customer satisfaction with ATM service quality. According to the path coefficients of the SEM results shown in Table 6 , the reliability of the ATM service is the most predictor of customers' satisfaction (standardized beta = 0.636), followed by ease of use (standardized beta = 0.44), fulfillment (standardized beta = 0.40), convenience (standardized beta = 0.25), and security/privacy (standardized beta = 0.14), the factor that has the least contribution to the service quality of the ATM and customer satisfaction.

Path diagram of structural model.

Hypothesis testing.

5. Discussions

The purpose of the study was to identify the dimensions of ATM service quality and investigate the relationship between customer satisfaction and ATM service quality constructs. In this study, a five-factor structure was developed and tested, and the results showed that ATM quality is multidimensional, in line with recently published literature on ATM service quality [ 13 , 15 , 34 ]. The SEM approach discovered that reliability, ease of use, fulfillment, convenience, and security/privacy predicted customer satisfaction.

The study has confirmed that reliability is the major determinant of customer satisfaction with ATMs. The result of this study indicates that the dimension of reliability has a positive and significant association with customer satisfaction. This implies that ATM services are reliable enough that users don't need to carry cash wherever they go, deliver the service exactly as promised, and complete the service right the first time client will be more satisfied with ATM banking services. This finding is in line with the findings [ 3 , 10 , 17 , 19 ], which suggested that ATM service quality is an antecedent of customer satisfaction with a significant and positive influence on it.

The finding of this study also shows that the ease of use of ATM service quality dimension is an important contributor to customer satisfaction. Clients expect the ATM to be straightforward because even the most tech-savvy customers occasionally find technologies to be a little daunting. Easy-to-understand language, services adapted to the needs of people with disabilities, and user-friendly instructions were all deemed essential for enhancing the customer experience with ATMs. These results are consistent with the findings of other empirical studies such as [ 17 , 47 , 48 , 63 ].

In addition, this study further indicates that fulfillment of the ATM service is a good predictor of customer satisfaction. The outcome also implies that, if the ATM banking service daily cash withdrawal limit of ATM is adequate provides information that exactly fits needs, and contains full banking service the level of customer satisfaction could be improved. This finding is in tandem with the finding of [ 13 , 33 ].

Similarly, the convenience of ATM service quality is another significant dimension of ATM service quality in predicting customer satisfaction. This denoted that if the banks install other ATMs at different locations like shopping areas, hotels, hospitals, college campuses, etc., enabling customers can carry out their banking activities whenever they want in a 24/7 h service, ATM banking service would be more convenient, and higher the customer satisfaction is likely to be. This finding is concurrent with the findings of [ 10 , 17 , 47 , 63 ].

Finally, the finding of this study indicates that the security or privacy of the ATM banking service to the customer has a positive and significant influence on customer satisfaction. This suggested that as the service secures the privacy of the customer, protects the customer's banking information, and has clear transaction safety policies will significantly improve customer satisfaction with the bank service. The result of the study is consistent with the works of [ 10 , 63 , 64 ]. Thus, to summarize the findings of the study reveal that convenience, reliability, ease of use, fulfillment, and security dimensions of ATM service, have a positive and significant effect on overall ATM service quality in Commercial Bank of Ethiopia in the Afar regional state.

6. Conclusion, theoretical and practical implications of the study

The purpose of the study was to examine the effect of ATM service quality on customer satisfaction in the case of the Commercial Bank of Ethiopia. The study used primary data for analysis, which were obtained from 346 ATM users in the region selected area, to achieve this purpose. The required data are collected in person through a structured questionnaire. After data collection, the study employed descriptive and econometric data analysis methods. The findings of this study obtained from the descriptive analysis showed that the majority of current ATM users are youth between the ages of 18–35, gender-wise the males are the dominant users, occupationally salaried and unemployed are the majority users, and businessmen/women and students are not an active participant in using the service, educational level diploma and first-degree holders are the majority users, as indicated by the overall mean of all ATM service quality dimensions, which runs from 3.21 to 3.63 that the customers agreed that the ATM service is more reliable, easy to use, fulfilled, convenient, and secured provided by the bank in the study area.

Moreover, the results obtained from the SEM revealed that reliability, ease of use, fulfillment, convenience, and security of ATM service quality dimensions have a positive and significant contribution to customer satisfaction. Out of this reliability has been identified as the key factor in predicting customer satisfaction.

6.1. Theoretical implication

The study contributes to the existing literature by identifying five dimensions of ATM service quality (reliability, ease of use, fulfillment, convenience, and security/privacy). This helps researchers and practitioners to have a comprehensive understanding of the key factors that influence customers' perception of ATM services. The research findings in the study contribute to the current understanding of the topic by establishing the connection between the quality of ATM services and customer satisfaction. The study emphasizes the importance of these aspects in determining overall customer satisfaction. It presents arguments on why and how the quality of ATM services influences customer satisfaction, thereby adding to the existing literature on this relationship. Through the use of structural equation modeling (SEM), the study ensures the reliability and validity of the developed five-factor structure. This finding contributes to the methodological aspect of assessing service quality dimensions.

6.2. Practical implications

The findings of this study provide valuable insights for ATM service providers and managers in identifying areas that need improvement. By focusing on improving the identified dimensions of ATM service quality (reliability, convenience, ease of use, fulfillment, and security/privacy), ATM service providers can enhance customer satisfaction. This may involve enhancing system reliability, simplifying the user interface, ensuring prompt transaction processing, increasing convenience through additional functionalities, and prioritizing security and privacy measures. Implementing findings from this study enables organizations to align their strategies with customer expectations and requirements. Understanding the dimensions that drive customer satisfaction empowers service providers to develop targeted initiatives, such as training programs for employees, technological advancements, and personalized customer experiences, to improve overall service quality. Differentiating ATM services based on the identified dimensions can provide a competitive advantage for banks. By excelling in reliability, ease of use, fulfillment, convenience, and security/privacy of ATM services, institutions can attract and retain satisfied customers who perceive their ATM services as superior to competitors'. This can ultimately lead to increased market share and customer satisfaction.

Overall, this study provides theoretical insights into the dimensions of ATM service quality and its relationship with customer satisfaction. It also offers practical implications for banks, financial institutions, and ATM manufacturers to enhance service quality, and improve customer satisfaction in the ATM domain.

6.3. Limitations and future research directions

Although the research paper has greatly enhanced our comprehension and assessment of ATM service quality, it is crucial to recognize its inherent limitations. One major limitation is that the study was conducted specifically in one city and two towns of the Afar region, focusing on ATM users of the Commercial Bank of Ethiopia. The attitudes and experiences of customers from different provinces or banks may vary, and therefore, the results may only provide limited insights into customer attitudes toward ATM service quality and its impact on customer satisfaction. To address this limitation, additional research should be conducted to investigate the behavior of customers located in different regions.

Furthermore, since this study solely relied on quantitative methods for data collection through surveys, it is important to acknowledge the limitations associated with this approach. Future research should consider employing mixed methodology and qualitative approaches to gain a more comprehensive understanding of the topic. Additionally, it is recommended that future studies explore the relationship between other dimensions of service quality and customer satisfaction, loyalty, and retention in various other self-service technologies such as Internet banking and mobile banking. Comparing the cross-cultural service quality of conventional commercial banks would also be of interest in future research.

Author contribution statement

Abibual Getachew Nigatu; Atinkugn Assefa Belete; Getnet Mamo Habtie: Conceived and designed the experiments; Performed the experiments; Analyzed and interpreted the data; Contributed reagents, materials, analysis tools or data; Wrote the paper.

Funding statement

During this investigation, there was no financial support.

Data availability statement

Declaration of interest's statement.

The authors declare no conflict of interest.

Declaration of competing interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Appendix A Supplementary data to this article can be found online at https://doi.org/10.1016/j.heliyon.2023.e19132 .

Appendix A. Supplementary data

The following is the Supplementary data to this article:

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

The impact of ATM services on customer satisfaction in Indian banks

Related Papers

Management Research and Practice

Dr. Vijay M. Kumbhar

kanika verma

Now a time, in Indian banking industry, E- Banking is at its revolutionary stage and provides various electronic service like Mobile Banking, Internet Banking, ATM services, Electronic Fund Transfer (EFT), Credit Cards and Electronic Clearing Services etc. Among all of these, ATM is the widely used and popular E-Banking services. This study aims at analyzing the satisfaction level of customers of Union Bank of India and Yes Bank based on various aspects related to ATMs. In this study, data will be collect from the way of survey from bank customers and later on will be analyze by statistical technique and tools like Descriptive Statistics, Percentage Method, and Ranking Method. The conclusion would be interpreted accordingly. Keywords: E-Banking, ATM, Customer Satisfaction.

The Automated Teller Machine has a tremendous rise in past few years in India with a convenient access to cash. Advanced technology and customer acceptance have made ATM's more potential in banking sector. The aim of this paper is to provide a preliminary comparative investigation of the customer's satisfaction towards ATM service of SBI and ICICI banks. The respondents selected for this study were the account holders and ATM users of SBI and ICICI banks of Warangal City, Telangana State. For the purpose of knowing the customers satisfaction and to analyze the data survey method was adopted. The Paper has explored the factors that drive customers to use ATM and highlights the problems customers face during the use of ATM and provides recommendations to manage the problems.

Journal of Emerging Technologies and Innovative Research (JETIR)

Prof. G.P. Dang

The study seeks to analyse the inconveniences faced by the public while using ATMs and to compare the ATM services rendered by private and public sector banks. Cash is an important medium of exchange in India and thus, requirement of ATMs become indispensable. The study therefore evaluates the performance of ATMs in Dehradun City along with a comparative study of private and public bank ATMs. The study is based on quantitative research design, where primary data is collected and analysed. For the purpose of the study, convenience sampling technique was used. The sample was composed of two categories of banks: private and public sector banks and included a total of 412 respondents. The data was collected by direct interview method using structured questionnaire based on five point likert scale. The study reveals that there is still a persistent requirement of cash and ATMs can provide 'Any Time Money' facility to the public. The study highlights the inconveniences faced by the public when using ATMs along with below the mark delivery of ATM service by the public sector banks. A prominent finding that came up is that people have started keeping more cash reserves at home due to a feeling of uncertainty about getting the cash when required. The study highlights present reality of ATMs from which almost everyone is affected. The study takes into account the inconveniences faced by the public with a view to bring the matter to the notice of the concerned authorities. The comparative study between private and public bank ATM performance throws light on the low quality of public sector banks when it comes to delivering ATM services.

International Journal of Engineering Technologies ManagementResearch, July, 2020, Vol, 7(07)97-101

Balathandayutham P , DR. SRITHARAN RAJENDRAN

The study presented here is an attempt to draw the attention of bankers towards the factors that has an influence over the satisfaction of customers regarding the ATM services provided to them. The study made use of primary data which was collected through a questionnaire. The sample size of the study was 100 and the respondents were selected randomly from Chennai. Findings of the analysis show that most of the service quality have positive gap only eight service quality attributes have high expectation in retail bank service but the perception of service quality is very less. Hence it is concluded from the study that only eight attributes exhibit negative gab.

Ramakrishna Mishra

Aminul Haque Russel

This is an age of technology. Now, all types of organizations are adopting the modern technology for providing efficient services to the customers. This study is an attempt to find out the significant factors that affecting the customer " s satisfaction in ATM (Automated Teller Machine) service in Dhaka city. The results of reliability test, factor analysis, and regression analysis focuses that cost of services of ATM, ATM network, security in transactions of ATM, location of ATM Centers, and maximum withdrawal limit per day are the most vital factors in customers satisfaction of ATM services. Finally , it is evident from the study; overall 62% of the customers are satisfied by using ATM services in Dhaka city.

Tabara Rahman

ATM banking acceptance among people is growing every day and this growth has been accompanied by an increased business interest in measuring and managing ATM banking service quality. This interest is also reflected in a large number of academic studies pertaining to measuring ATM banking service quality. With time various scales and dimensions of ATM banking service quality have been proposed by various researchers. Bank Asia has introduced the ATM facility since its foundation. Currently, the bank has the largest number of ATMs in the country. A number of studies have been conducted by the internal management of this bank to have an idea about customer satisfaction regarding its various products. The use of ATMs is increasing day by day, so it is important to study the perception about the level of customer satisfaction with respect to various aspects of ATM banking of Bank Asia and to detect the problem areas and proposed recommendations leading to improvement.

European Journal of Business and Management Research

Alexis NSHIMIYIMANA

The current competition from both national and international markets has created a new assignment for companies to give serious consideration to providing a high quality of service to satisfy and maintain customers. This paper aimed to analyze the effects of ATM service quality on customer satisfaction and customer loyalty. The Bank of Kigali has been chosen as a case in this research. For this investigation, primary data was collected from 284 respondents from Bank of Kigali through a structured questionnaire. Collected data were analyzed with SPSS (Statistical Package for the Social Sciences, 23.0) according to the objectives of the present research. Results of the statistical analysis indicate that the age group of 26-35 dominates with 59.2% of total respondents, with males showing dominance in terms of gender with 75% and 54.2% of respondents being graduates. The study reveals that there is a significant relationship observed between service quality and customer satisfaction, an...

RELATED PAPERS

physica status solidi (a)

Udo Bakowsky

WSEAS Transactions on Mathematics

Muhammad Akram

komang adi Suwirya

Sandesh Kumar

Colette Bodelot

Single‐Use Technology in Biopharmaceutical Manufacture

Miriam Monge , Gerben Zijlstra

Journal of Medical Microbiology

Ashraf Ahmed

David Cilia

Ore Geology Reviews

William Delorraine , Peter Matt

BMC Geriatrics

Cyrus Leung

Biomaterials

Marco Cecchini

Meera Krishna

Micromachines

Callum Nash

Journal of Ardabil University of Medical Sciences

Enayatollah Seydi

Journal of Contextual Behavioral Science

Nikos Evangelou

Iranian Journal of Science and Technology Transaction A-science

Debashis Sitikantha

Arte y Transdisciplina en Mexico Cap 2

Myriam Beutelspacher Alcántar

Darren Hick

Culture and Arts in the Modern World

Liliia Syrota

Dian Novita Antro19

See More Documents Like This

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Table of contents

2. i. introduction, 3. ii. literature review, 4. iii. methodology, 5. a) research design, 6. b) data collection, sampling procedure and data analysis i. data collection, 7. ii. sampling procedure and population, 8. iii. data analysis, 9. c) model development, 10. ii. model verification and validation, 11. d) number of replication estimation, 12. iv. result and discussion, 13. v. conclusion and recommendation.

Analysis of ATM Service Performance by using ARENA Simulation: The Case of Commercial Bank of Ethiopia, Sabyan Branch Dinku Manaye ? & Amare Worku ? Abstract-ATMs are among the most important service facilities in the banking industry. The main objective of ATM for bank is to keep away the customers from coming to bank and make the process easy for them to avoid the basic procedure they have to do in the bank. But ATMs themselves have as a result become subjects of large service demands which directly translate to queues for services when these demands cannot be quickly satisfied specially during weekend periods and month endings (salary times) where the demand for cash is high. In this study Arena simulation model was developed for the ATM service found in the commercial bank of Ethiopia, Sabyan branch to analyse its service performance. In the ATM center the customer inter arrival time of the customers followed the exponential distribution with a mean of 29 seconds and the service time is a Poisson distribution with a mean of 44.3 seconds. From the Arena simulation run results, we can conclude that the service is not efficient in the ATM Centre as there is excessive waste of time in the ATM center (71.3 seconds) and higher number of customers waiting in the queue (4 customers). To improve the ATM service efficiency of the case company and to keep satisfaction of the customers, we recommend the company to follow the following ways. To improve the ATM service efficiency of the case company and to keep satisfaction of the customers, we recommend the company the following ways. One way can be increasing the ATM facility number from two to three and another way can be increasing the service time of the available ATM services by improving the speed of the system. Both ways can be taken as good options since the operating cost of the new mechanisms is minimal compared with cost of losing customers due to low quality of service.

mproving the performance of service industries when arrival and service time are random and performed by human employee is a complex decision environment [1, 2] . This scenario was best expressed in the banking industry. The development of information technology in bank sectors is Automatic Teller Machine (ATM). ATMs are among the most important service facilities in the banking industry [3] . The main objective of ATM for bank is to keep away the customers from coming to bank and make the process easy for them to avoid the basic procedure they have to do in the bank. ATMs themselves have as a result become subjects of large service demands which directly translate to queues for services when these demands cannot be quickly satisfied. This situation becomes more evident during weekend periods and month endings (salary times) where the demand for cash is high. Simulation has become one of the most widely used tool in such system analysis due to availability of the many software's having large computing capabilities [2] . The simulation model is developed and run with particular inputs and model characteristics. In this study, two ATM services found in the commercial bank of Ethiopia, Sabyan branch has been considered. Simulation software ARENA is used to develop a simulation model and Performance analysis will be carried out.

Simulation modeling is fast becoming an important aid in achieving higher levels of efficiency and productivity. Historically, the most frequent uses of simulation modeling have been directed to the improvement of manufacturing operations. More recently, simulation has come into its own as a powerful tool for improvement of operations within the services sector [4] . Simulation is one of the most powerful tools available to decision-makers responsible for the design and operation of complex processes and systems. It makes possible the study, analysis and evaluation of situations that would not be otherwise possible. In an increasingly competitive world, simulation has become an indispensable problem solving methodology for engineers, designers and managers [5] .

Simulation can be defined as "the imitation of the operation of a real-world process or system over time" [6] . The process of interest is usually called a system. When building a simulation model of a real-life system under investigation, one does not simulate the whole system. Rather, one simulates those sub-systems which are related to the problems at hand. This involves modeling parts of the system at various levels of detail. In order to study the system, we make a set of assumptions about it. These assumptions constitute a model. Assumptions are expressed in mathematical or logical relationship. If the model is simple enough, it may be solved by mathematical methods such as calculus, algebra or probability theory. However, many real world problems are too complex. Models of these systems are almost impossible to solve analytically. In a simulation, we use a computer to evaluate a model numerically and data are gathered in order to estimate the desired characteristics of the model [7] .

A simulation model is a representation that incorporates time and the changes that occur over time. Simulation models can be classified by many ways, but one useful way is along these dimensions [8] :

(1) Continuous vs. Discrete: It is convenient to distinguish between continuous and discrete simulations. In a continuous simulation the underlying space-time structure as well as the set of possible states of the system is assumed to be continuous [7] , thus the state of the system can change continuously over time; an example would be the level of water flows in a tank. In discrete simulations, changes can occur only at separated points in time such as customer arrivals to a bank.

( Simulation has a number of advantages that allow the identification of problems, bottlenecks and design shortfalls before building or modifying a system. It allows comparison of many alternative designs [9] and let us experiment with new and unfamiliar situations as to answer "what if" questions [5] . Evaluation and comparisons can take place before committing resources and investment to a project. Simulation allows study of the dynamics of a system, how it changes over time and how subsystems and components interact [9] . On the other hand, often simulations are time consuming, data is not available or costly to obtain, and the time available before decisions must be made is not sufficient for a reliable study [9] .

Simulation modeling is an art that requires specialized training and therefore high skills of the modelers [5] . If two models of the same system are constructed by two competent individuals, they may have similarities, but it is highly unlikely that they will be the same. Despite its tremendous benefits, simulation is not a perfect technology. It is a decision support tool that may help in simplifying the decision making process. As such, simulation output must be carefully analyzed. Most simulation models have random inputs such as equipment reliability, variable demand or loss, which cause the simulation output to be random too [8] . Therefore, running a simulation once is like performing a random physical experiment once and the results will probably be different each time. So it is highly recommended to run simulation models many times before concluding results. Simulation modeling is used in a multitude of applications. Many researchers attempted to classify and categorize the simulation applications. Simulation modeling is often used for modeling and designing many applications including hospitals, military operations, traffic, airports, services industries, computer systems, telecommunication networks and manufacturing systems like factories, flexible manufacturing systems, assembly lines, warehouses, and supply chains [8] .

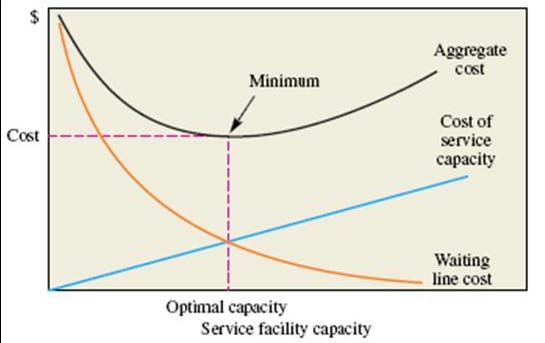

Service industry has been developing rapidly and receiving more attention in the recent years by system modelers. Customer satisfaction is a growing concern in service industry settings such as banks, hospitals, and call centers. High variability in demand is prevalent in the service industry, and customers still expect to be served promptly when they arrive [10] . Therefore, there is a need for efficient staff utilization with minimal possible cost, taking into account varying demand levels for the day of the week, or even for the time of the day. Improving customer satisfaction and service levels usually requires extra investments. To decide whether or not to invest, it is important to know the effect of the investment on the waiting time, and service cost. Usually managers and decision makers seek to balance between the service and waiting time cost to offer the best service with minimal cost [11] . Figure (1) shows the relation between these costs and how to obtain the minimum aggregate cost and optimal capacity. Source: (Chase, 2007) Figure 1 : Waiting line versus service capacity level trade-off

The service system is characterized by the number of waiting lines, the number of servers, the arrangement of the servers, the arrival and service patterns, and the service priority rules [12] . Some waiting line and service problems that seem simple on first impression turn out to be extremely difficult or maybe impossible to solve. Waiting lines that occur in series and parallel (such as in assembly lines and job shops) usually cannot be solved mathematically [9] . Therefore, simulation modeling is necessary to explore and analyze alternative designs to obtain the optimal solution.

Commercial simulation modeling packages enable modelers to develop simulation models and also provide facilities to carry out simulation optimization as to help modelers optimize performance parameters that are of critical importance in the design of the systems under study. Most simulation modeling packages provide statistical reports (mean, minimum value, maximum value) to simplify analysis for performance measures (e.g., wait times, inventory on hand, utilization ? etc.). There are many different simulation modeling packages in the market and each has its strengths and weaknesses. The best packages allow the user to combine easy-to-use constructs with more flexibility [13] . Some of the most popular simulation modeling packages include Arena, Auto Mod, Pro Model, Simul8, and Witness.

Arena is a simulation software developed by Rockwell Automation. It uses the SIMAN simulation language. Arena is extensively used to simulate a company's process or system to analyze its current performance as well as possible changes that could be made. By accurately simulating a process or system, a company can see the outcomes of changes without implementing them in real-time, thus saving valuable time and resources.

In Arena, the user builds an experiment model by placing modules (boxes of different shapes) that represent processes or logic. Connector lines are used to join these modules together and specify the flow of entities. While modules have specific actions relative to entities, flow, and timing, the precise representation of each module and entity relative to real-life objects is subject to the modeler. When planning a new system or making significant changes to an existing one, simulation modeling is a key tool for predicting and validating system performance. Simulation modeling is not a perfect technology. It is a decision support tool that aids in decision making process and it is not a decision-maker. Simulation software tools like Arena are used to describe and analyze the behavior of a system, answer questions about proposed changes to the system, and help designing new systems. Statistical data, such as waiting time and resource utilization, can be recorded and outputted to reports as to simplify analysis. So in this study we have used the Arena simulation software to model and analyze the performance of the ATM service system.

Various scholars have studied ATM service performance by using queuing theory [14, 15, 16] . But in this study we want to use computer simulation of ARENA instead of queuing theory to study the case ATM service system with ease. So different materials and methods are used to achieve the goal of this study as shown below in detail.

Depending on research questions and orientation of the researcher, a choice is made in setting out the research plan. There is experimental design, longitudinal design, cross-sectional design and case study design. These designs are divided into fixed and flexible research designs [17] . Others have referred to this distinction as quantitative research designs and qualitative research designs respectively.

The case study design is applied appropriately in this paper. Case study as an empirical inquiry is chosen because it allows focus to be placed on the queue phenomenon within its real-life context. A case study design was chosen also because the topical issue was customer queuing at ATMs; this could not be considered more perceptively without the context, the banking environment and more specifically the settings created by the ATM-customer interaction. It was in these settings that data was gathered and utilized. Moreover, it allowed us to cover contextual conditions relevant to the phenomenon under study. The design here is particularly a single case where we considered the two ATMs of the commercial bank of Ethiopia, Sabyan branch. This appropriately provides us the needed environment to collect required data for analysis.

The researchers have provided the example of the application of discrete event simulation in evaluating performance of service line in the case company. A simulation model provides a visual animation of the service delivery process. The data was collected from the two ATM facilities of the commercial bank of Ethiopia, Sabyan branch so that modeling and simulation will be done by using arena software. An ARENA® simulation model was developed, verified, and validated to determine the performance of the ATM services.

In this paper, two types of data were collected and used. These are primary data and secondary data. Secondary data was obtained through an intensive review of relevant literature on the ARENA simulation from journal articles, textbooks and many usable electronic sources and review of the ATMs transaction history. Primary data was collected in two weeks period via observation which involves recording of the three key required quantities (customer arrival time, customer service start time and customer service end time) as customers reach at and leave the ATM terminal.

Participants for the time studies were ATM users who arrived at the ATM terminal between the hours of 7:00 AM and 7:00 PM. In each of the study period several repeat customers might have been captured in the time studies, but we didn't believe this will affect the analysis.

To simplify the study, the study period was divided into two groups that means peak hours of a day where there are more customers coming to the ATM terminal and normal hours of a day where there are less customers coming to the ATM terminal. Peak hours of a day includes early morning (7:00 AM to 9:30 AM) and late afternoon (4:30 PM to 7:00 PM) whereas the normal hours includes the hours which are not included in the peak hours of the day. But in the normal hours there are minimum number of customers coming to the ATM service. So we can represent a particular day customer arrival rate and service rate by the peak hour range.

Then by taking a one hour interval observation we can obtain customer arrival rate and service rate.

The collected data through direct observation was analyzed. Fitting input distribution through the input analyzer of Arena is used to identify fitted statistical distribution. It is used to evaluate the distribution's parameter and calculates a number of measures of the data. To select which type of distribution to use, we have compared the square error of each distribution. Larger square error value means the further away of the fitted distribution is from the actual data [18] . So we have selected the distribution with the smallest square error value. The data was analyzed by using real recorded time from the case ATM system. These data supported the analysis of validation of the model [19] .

The other thing we will analyze was the customer waiting time. There are two types of customer waiting times; the time a customer spends in the queue and the total time a customer spends in the system. Since we are dealing with human beings, we are specifically concerned with customer waiting time in queue. It is waiting in queue that is dissatisfactory to customers and affects greatly their service experience. The following performance measures of the system would be generated from the simulation model: Based on the values of this measures, we can give the analysis of the performance of the case ATM service system.

The conceptual model for the ATM service can be represented as shown below. Customers arrive at the service system at random points in time to seek service also in a random manner. The service system operates in such a manner that for each arrival, if both ATMs are busy then the customer enters a queue; else the arriving customer immediately enters service. As customers depart, one or both ATMs becomes idle, else a customer is selected from the queue to enter service. This will be modelled by using computer simulation of Arena. the time customer takes to do transaction in ATM, is also random.

To verify the model, the Arena developed model should run in different running conditions to know whether the outputs are logical or not.

Validation activities are necessary to the construction of reliable models. Validation means to check whether the real world model and model made in simulated world is the same. The standard approach is to collect data (parameter values, performance metrics, etc.) from the system under study, and compare them to their model counter parts. These will prove the validity of the data and simulation.

In particular, minimizing the number of replications and their length is necessary to obtain reliable statistics. In order to decide the number of replication the model must run some initial set of replication so that sample average, standard deviation and confidence interval are computed.

Based on recorded arrival times, the inter arrival time and service time are found out. Using the input analyzer module of the software, the probability distribution for inter-arrival time and service time are found out. The inter arrival time of the customers followed the exponentially distribution (Square Error: 0.009100 and corresponding p-value = 0.329) with a mean of 29 seconds. The service time is a Poisson distribution (Square Error: 0.049503 and corresponding p-value = 0.263) with a mean of 44.3 seconds. To verify the model, the Arena developed model was tested in different running conditions to know whether the outputs are logical and consistent or not. Through this mechanism the model was verified.

Validation of the model was performed by comparing the actual customers being served by the ATM service in a day which is 1000 in average (found from the bank personnel's data) and the Arena simulation run result (number out) which is 986. The data comparison shows that the difference is minimal which shows the developed model is valid. The above Arena simulation model run results indicate that:

? The average utilization of ATM service one and ATM service two was found 75.53% and 76.16% respectively.

? The average number of customers coming to the ATM service were 990 and out of which 986 were served. ? The average number of customers waiting in the queue was 4.

? The average waiting time for a customer in the queue was whereas the service time was 44.3 seconds. ? The total waiting time for a customer in the ATM service was 115.6 seconds.

From these it was clear that the waiting time of a customer in the queue (71.3 seconds) is higher amount even as we can compare it with the service time (44.3 seconds) and higher number of customers waiting in the queue (4 customers) which indicates inefficient system.

The main purpose of this study is analysis of the performance of the ATM service found in the commercial bank of Ethiopia, Sabyan branch by developing Arena simulation model for the ATM service center. That means the simulation run was used to collect the service performance measures like the number of customers waiting in the queue and the waiting time in the queue. With all the above results, we can conclude that the service is not efficient in the ATM Centre as there is excessive waste of time in the ATM center (71.3 seconds) and higher number of customers waiting in the queue (4 customers). So efforts has to be taken to reduce the waiting line even though it cannot be totally eliminated as going for total elimination would lead to excessive service cost.

To improve the ATM service efficiency of the case company and to keep satisfaction of the customers, we recommend the company the following ways. One way can be increasing the ATM facility number from two to three (it can be increased further up to optimum service cost). Another way can be increasing the service time of the available ATM services by improving the speed of the system (for example by increasing the internet speed and removing fluctuation of electric power). Both ways can be taken as good options since the operating cost of the new mechanisms is minimal compared with cost of losing customers due to low quality of service.

- A Ullah , I Khalid , Z Xiao-Dong , A Muhammad . 978-1-4799-3134-7/14/$31.00©2014 IEEE. Sub-optimization of Bank Queuing System by Qualitative and Quantitative Analysis , 2014.

- A Guide to Simulation , B Paul , L F Bennett , E S Linus . 1986. New York, Berlin, Heidelberg, London, Paris, Tokyo : Springer-Verlag . (nd edn)

- Real-world research: A resource for social scientists and practitioner-researchers , C Robson . 1993. Malden : Blackwell Publishing .

- Simulation with Arena , D Kelton , R Sadowski , D Sturrock . 2004. New York : McGraw Hill Inc . (Third Edition)

- D T Phillips , J S James . Operations Research: Principles and Practice , 1987. John Wiley & Sons . (nd edn)

- Introduction into Modeling and Simulation . I I Carson , J . Proceedings of the 2005 Winter Simulation Conference , (the 2005 Winter Simulation Conference USA ) 2005.

- Introduction to Simulation . J Banks . Proceedings of the 2000 Winter Simulation Conference , (the 2000 Winter Simulation Conference USA ) 2000.

- Location of banking automatic teller machines based on convolution . M A Aldajani , Alfares , HK . Systems Engineering Department 2009. p. 31261. King Fahd University of Petroleum and Minerals

- Simulation Implements Demand-Driven Workforce Scheduler for Service Industry . M Zottolo , E Williams , O Ülgen . Proceedings of the 2007 Winter Simulation Conference , (the 2007 Winter Simulation Conference USA ) 2007.

- Queuing Theory and its Application: Analysis of the Sales Checkout Operation in ICA Supermarket , N Azmat . 2007. University of Dalarna, Department of Economics & Society

- , P Bhavin , P Bhathawala . 2013.

- Queuing Model for Bank ATM System . Mathematical Sciences International Research Journal 2 (2) p. .

- Operations Management , R Chase . 2007. McGraw Hill Inc . (Second Edition)

- Operations Management , R Reid , N Sanders . 2005. Wiley Publishers . (Third Edition)

- Introduction to the Art and Science of Simulation . R Shannon . Proceedings of the 1998 Winter Simulation Conference , (the 1998 Winter Simulation Conference USA ) 1998.

- Case Study for Bank ATM Queuing Model . S Dhar , T Rahman . IOSR Journal of Mathematics (IOSR-JM) May. -Jun. 2013. 7 (1) p. .

- The World as a Process: Simulations in the Natural and Social Sciences', PhilSci Archive , S Hartmann . http://philsci-archive.pitt.edu/archive/00002412/01/Simulations.pdf 2005. April 2008. University of Pittsburgh

- Introduction to Manufacturing Simulation . S Miller , D Pegden . Proceedings of the 2000 Winter Simulation Conference , (the 2000 Winter Simulation Conference USA ) 2000.

- Analysis of M/M/I Queueing Model for ATM Facility . S Srinivasan , M S Sundari . Global Journal of Theoretical and Applied Mathematics Sciences 2012. 2 (1) p. .

- Determining Bank Teller Scheduling using Simulation with Changing Arrival Rates , W Chandra , W Conner . http://www.personal.psu.edu/wxc202/cv/Determining%20Bank%20Teller%20Scheduling_Wenny%20Chandra_Whitney%20Conner.pdf 2006. 13 November 2007. USA . College of engineering, Pennsylvania State University (Research project)

IMAGES

VIDEO

COMMENTS

Founded on the aforementioned literature review, the study proposes a framework which guides the current research. Analysis Demographic Profile. ... 2008) that responsiveness is not significantly associated with satisfaction in ATM services. Another reason for this insignificant result might be that if the ATM card gets trapped or damaged in ...

Table 1 presents the background profile of the users of ATM services provided by the Commercial Bank of Ethiopia in Awash and Asayita Towns and Samara-logia city administration. Out of the total completed ATM user survey in the study area, about 73.4% were male and the remaining 26.5% were female customers. Among the total samples, the majority age group of ATM users (50.3%) was 27-35 years ...

ATM Ease to use EOU 1: In the bank, ATM services are user-friendly .862 EOU 2: In the bank, ATMs provide tailored services for disabled persons. .826 .932 .698 .874