- To save this word, you'll need to log in. Log In

cost analysis

Definition of cost analysis

Love words.

You must — there are over 200,000 words in our free online dictionary, but you are looking for one that’s only in the Merriam-Webster Unabridged Dictionary.

Start your free trial today and get unlimited access to America's largest dictionary, with:

- More than 250,000 words that aren't in our free dictionary

- Expanded definitions, etymologies, and usage notes

- Advanced search features

Dictionary Entries Near cost analysis

cost an arm and a leg

Cite this Entry

“Cost analysis.” Merriam-Webster.com Dictionary , Merriam-Webster, https://www.merriam-webster.com/dictionary/cost%20analysis. Accessed 7 Apr. 2024.

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

Can you solve 4 words at once?

Word of the day.

See Definitions and Examples »

Get Word of the Day daily email!

Popular in Grammar & Usage

The tangled history of 'it's' and 'its', more commonly misspelled words, why does english have so many silent letters, your vs. you're: how to use them correctly, every letter is silent, sometimes: a-z list of examples, popular in wordplay, the words of the week - apr. 5, 12 bird names that sound like compliments, 10 scrabble words without any vowels, 12 more bird names that sound like insults (and sometimes are), 8 uncommon words related to love, games & quizzes.

Cost Analysis: What Is It and Why Is It Used?

Rebeca Bichachi , Product Marketing Specialist

September 8, 2022

Clean data and quality reports are traditionally the result of painstaking efforts to gather the required information and organize it meaningfully quickly enough to ensure relevance. Companies can do better.

To deliver valuable business insights and rich comparative reports, any kind of business analysis needs to follow an organized approach, beginning with gathering and sorting data. Cost analysis follows much of the same methodical process but maintains a narrow focus on the total costs for a company’s goods and services. That close tracking and examination of cost patterns enables organizations to identify what may be driving spending higher, determine if they are getting enough value for their money and understand if there are alternative materials, suppliers or processes worth exploring.

This systematic review categorizes expenditures by their direct and indirect effects on goods and services produced. Once you have this data, you can review costs, revenues and profit margins and compare and analyze spending by product, location and across different levels of the business.

Understanding how your organization generates costs, spends money and where improvements may be found can make all the difference when margins are tight and competition is fierce.

For business leaders determined to make informed decisions, the first step is to ensure the information at hand reflects an accurate business position. Confidence in data inputs and understanding of informational outputs help finance leaders create more accurate budgets, plan better and control cost drivers. But manual processes for gathering data, calculating variances and analyzing comparisons consume a substantial amount of time and effort that companies can scarcely afford — not to mention often delivering incomplete or error-filled results.

Challenge: Unorganized, Inconsistent Data

Faced with the challenge of obtaining and aligning data from multiple sources, most companies try their best to piece it all together. But a constant need for ever-more accurate and timely information clashes with complex and manual cost accounting processes, where methods of allocations, analysis and comparisons typically involve manual and repetitive entries, multiple tabs and dozens of summary spreadsheets.

Without timely and automated coverage and analysis of each angle and level of the business, the risk of errors and omissions increases exponentially. Missed opportunities for expansion, course correction and savings can prove costly. Like an arrow launched from a bow slightly off course, imperfect and stale data used in cost budgets and forecasts can yield wildly off target results or worse — provide an advantage for competitors.

The answer: A solid foundation on which to analyze reports and accurate, timely information to form assumptions. Both are critical in cost analysis.

Automate Cost Analysis with Oracle NetSuite

Automating repetitive tasks like data collection and reporting ensures uniformity and consistent application of rules. Accounting databases primed with this normalized data can then retrieve critical information in an organized, timely manner. That supports better decisions and frees up time for value-added activities and analysis.

NetSuite, an accounting software suite dedicated to automation, instantly captures, categorizes, calculates and analyzes transactions with synced data, automated allocations and journal entries and live dashboards and KPIs. Saved searches and configurable reports simplify analysis, ensuring that current information is automatically displayed in an organized fashion by location, product line and customizable classifications.

Forget the struggle of sorting data, updating spreadsheets and racing against time. NetSuite provides the precise data capabilities companies need for comprehensive cost analysis and automates these procedures, ensuring better control over your decisions — and your business.

Learn more about the cost analysis capabilities in NetSuite by joining our upcoming webinar, Automating Cost Analysis (opens in new tab) .

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there's continuity from sales to services to support.

- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- This Or That Game New

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Finance and Business

- Running a Business

- Business Finances

How to Do a Cost Analysis

Last Updated: October 8, 2023 Approved

This article was co-authored by Dave Labowitz and by wikiHow staff writer, Jennifer Mueller, JD . Dave Labowitz is a Business Coach who helps pre-entrepreneurs, solopreneurs/entrepreneurs, and team leaders start, scale, and lead their businesses and teams. Before beginning his coaching career, Dave was a startup executive who spent over a decade building high-growth companies. Dave’s “path less traveled” life includes adventures such as dropping out of high school, co-authoring a book in the Smithsonian Institute, and getting his MBA at Pepperdine’s Graziadio Business School. There are 9 references cited in this article, which can be found at the bottom of the page. wikiHow marks an article as reader-approved once it receives enough positive feedback. This article has 22 testimonials from our readers, earning it our reader-approved status. This article has been viewed 743,193 times.

Cost analysis is one of four types of economic evaluation (the other three being cost-benefit analysis, cost-effectiveness analysis, and cost-utility analysis). Conducting a cost analysis, as the name implies, focuses on the costs of implementing a program without regard to the ultimate outcome. A cost analysis is an important first step before you engage in other types of economic evaluation to determine the suitability or feasibility of a potential project. [1] X Trustworthy Source Centers for Disease Control and Prevention Main public health institute for the US, run by the Dept. of Health and Human Services Go to source

Defining Your Purpose and Scope

- Programs that overlap to a significant degree may be lumped together, rather than evaluated separately. Go with what makes the most sense for the operations of your organization, avoiding duplication of efforts wherever possible.

- To determine whether programs should be separated, look at the services offered by each program, the resources needed to provide those services, and who those services are provided to. If two programs are the same in 2 out of 3 of those dimensions, they probably should be treated as one for the purposes of cost analysis.

- For example, if you're trying to decide whether to charge for a specific service, you would first determine how much that service costs you to provide. You would then do a longer term cost analysis to determine whether your organization can sustain a loss for providing that service.

- It's generally best to choose a time period for which you can acquire accurate revenue data, rather than estimates. This will help if you plan to use your cost analysis as a basis for further economic evaluation. [4] X Research source

- If you are conducting a cost analysis merely to set a budget or plan strategically for the future, you would typically conduct a cost analysis that extended organization-wide.

- On the other hand, a narrower or more specific purpose, such as determining whether to bill for a particular service (and how much), might require a narrower cost analysis that only addressed the costs of that particular service.

- For example, you may be interested in the cost to your clients of offering a particular service. You would look at costs from their perspective, taking into account the amount you bill (or plan to bill) for the service, transportation to your location, and other costs.

- If you're simply looking at the cost of the program to your organization, you'll look at your organizational expenses generally. You might also look at opportunity costs, such as whether offering one program means you will be unable to offer other programs.

Categorizing Costs

- You might also look at cost analyses conducted by similar organizations implementing similar programs or providing similar services.

- Direct costs are specific to the program or service you're evaluating in your cost analysis – they are not shared with any other programs.

- Overhead costs, such as utilities or rent, may be a direct cost if the program or service has its own location.

- Ultimately, when you calculate the costs of an individual program or service, you'll need to allocate these indirect costs

- Standard categories may include personnel costs, operational costs, and start-up costs. Within each category, identify which costs are direct and which are indirect.

Calculating Costs

- Use actual cost information as much as possible. It will increase the utility and reliability of your ultimate cost analysis. [11] X Trustworthy Source Centers for Disease Control and Prevention Main public health institute for the US, run by the Dept. of Health and Human Services Go to source

- For estimates, seek out reliable sources that can be applied as narrowly as possible. For example, if you need to estimate pay, use average rates for employees locally, not nationally.

- If you're doing a longer term cost analysis, compute direct costs first on a weekly or monthly basis, and then extend them out.

- When computing personnel costs, be sure to include the cost (or value) of any benefits offered to employees working on the program.

- For example, suppose you're allocating the salary of the director of human resources. Since they are responsible for personnel, it makes sense to divide their salary by the number of people on staff. If you have 10 employees total, 2 of whom are dedicated to the program or service you're evaluating, you can allocate 20 percent of the director's salary to the program for the purposes of your cost analysis.

- Calculating depreciation can be a complicated endeavor. If you don't have experience doing it, consider hiring an accountant. [14] X Research source

- For example, if you're doing the cost analysis of a program for a non-profit, hidden costs might include the estimated value of volunteer hours, donated materials, or donated space.

- Hidden costs might also include opportunity costs. For example, launching one program may affect your organization's ability to offer other programs.

- At a minimum, your cost analysis should provide your organization with the true cost of running a program or providing a particular service.

- Your cost analysis may also raise additional questions, indicating further analysis is necessary before an ultimate decision can be made.

Community Q&A

You Might Also Like

- ↑ https://www.cdc.gov/dhdsp/pubs/docs/CB_January_2013.pdf

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction

- ↑ https://www.universalclass.com/articles/business/basic-methods-and-calculations-of-financial-and-cost-analysis.htm

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-3-allocate-indirect-costs

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-4-allocate-indirect-costs

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-2-gather-financial-data

- ↑ https://2012-2017.usaid.gov/sites/default/files/documents/1868/300mad.pdf

- ↑ https://www.investopedia.com/ask/answers/021815/what-are-different-ways-calculate-depreciation.asp

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-6-apply-this-knowledge

About This Article

To do a cost analysis, start by calculating the direct costs for your program, which include things like salaries, supplies, and materials. If you're doing a long-term cost analysis, break the costs up into weeks or months. Next, calculate the indirect costs, which are costs that are shared across multiple programs or services. You'll also want to include the depreciation of your company's assets that will be used, as well as any hidden costs that may appear. To learn how to calculate direct and indirect costs, keep reading! Did this summary help you? Yes No

- Send fan mail to authors

Reader Success Stories

Rashid kawawa A.

Jul 18, 2023

Did this article help you?

Jul 2, 2019

Monica Grigor

Sep 19, 2016

Sam McElroy

Jun 6, 2016

Michelle Stone

Aug 31, 2016

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

wikiHow Tech Help Pro:

Develop the tech skills you need for work and life

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Do a Cost-Benefit Analysis & Why It’s Important

- 05 Sep 2019

Are you unsure whether a particular decision is the best one for your business? Are you questioning whether a proposed project will be worth the effort and resources that will go into making it a success? Are you considering making a change to your business, marketing, or sales strategy, knowing that it might have repercussions throughout your organization?

The way that many businesses, organizations, and entrepreneurs answer these, and other, questions is through business analytics —specifically, by conducting a cost-benefit analysis.

Access your free e-book today.

What Is A Cost-Benefit Analysis?

A cost-benefit analysis is the process of comparing the projected or estimated costs and benefits (or opportunities) associated with a project decision to determine whether it makes sense from a business perspective.

Generally speaking, cost-benefit analysis involves tallying up all costs of a project or decision and subtracting that amount from the total projected benefits of the project or decision. (Sometimes, this value is represented as a ratio.)

If the projected benefits outweigh the costs, you could argue that the decision is a good one to make. If, on the other hand, the costs outweigh the benefits, then a company may want to rethink the decision or project.

There are enormous economic benefits to running these kinds of analyses before making significant organizational decisions. By doing analyses, you can parse out critical information, such as your organization’s value chain or a project’s ROI .

Cost-benefit analysis is a form of data-driven decision-making most often utilized in business, both at established companies and startups . The basic principles and framework can be applied to virtually any decision-making process, whether business-related or otherwise.

Related: 5 Business Analytics Skills for Professionals

Steps of a Cost-Benefit Analysis

1. establish a framework for your analysis.

For your analysis to be as accurate as possible, you must first establish the framework within which you’re conducting it. What, exactly, this framework looks like will depend on the specifics of your organization.

Identify the goals and objectives you’re trying to address with the proposal. What do you need to accomplish to consider the endeavor a success? This can help you identify and understand your costs and benefits, and will be critical in interpreting the results of your analysis.

Similarly, decide what metric you’ll be using to measure and compare the benefits and costs. To accurately compare the two, both your costs and benefits should be measured in the same “common currency.” This doesn’t need to be an actual currency, but it does frequently involve assigning a dollar amount to each potential cost and benefit.

2. Identify Your Costs and Benefits

Your next step is to sit down and compile two separate lists: One of all of the projected costs, and the other of the expected benefits of the proposed project or action.

When tallying costs, you’ll likely begin with direct costs , which include expenses directly related to the production or development of a product or service (or the implementation of a project or business decision). Labor costs, manufacturing costs, materials costs, and inventory costs are all examples of direct costs.

But it’s also important to go beyond the obvious. There are a few additional costs you must account for:

- Indirect costs: These are typically fixed expenses, such as utilities and rent, that contribute to the overhead of conducting business.

- Intangible costs: These are any current and future costs that are difficult to measure and quantify. Examples may include decreases in productivity levels while a new business process is rolled out, or reduced customer satisfaction after a change in customer service processes that leads to fewer repeat buys.

- Opportunity costs: This refers to lost benefits, or opportunities, that arise when a business pursues one product or strategy over another.

Once those individual costs are identified, it’s equally important to understand the possible benefits of the proposed decision or project. Some of those benefits include:

- Direct: Increased revenue and sales generated from a new product

- Indirect: Increased customer interest in your business or brand

- Intangible: Improved employee morale

- Competitive: Being a first-mover within an industry or vertical

3. Assign a Dollar Amount or Value to Each Cost and Benefit

Once you’ve compiled exhaustive lists of all costs and benefits, you must establish the appropriate monetary units by assigning a dollar amount to each one. If you don’t give all the costs and benefits a value, then it will be difficult to compare them accurately.

Direct costs and benefits will be the easiest to assign a dollar amount to. Indirect and intangible costs and benefits, on the other hand, can be challenging to quantify. That does not mean you shouldn’t try, though; there are many software options and methodologies available for assigning these less-than-obvious values.

4. Tally the Total Value of Benefits and Costs and Compare

Once every cost and benefit has a dollar amount next to it, you can tally up each list and compare the two.

If total benefits outnumber total costs, then there is a business case for you to proceed with the project or decision. If total costs outnumber total benefits, then you may want to reconsider the proposal.

Beyond simply looking at how the total costs and benefits compare, you should also return to the framework established in step one. Does the analysis show you reaching the goals you’ve identified as markers for success, or does it show you falling short?

If the costs outweigh the benefits, ask yourself if there are alternatives to the proposal you haven’t considered. Additionally, you may be able to identify cost reductions that will allow you to reach your goals more affordably while still being effective.

Related: Finance vs. Accounting: What's the Difference?

Pros and Cons of Cost-Benefit Analysis

There are many positive reasons a business or organization might choose to leverage cost-benefit analysis as a part of their decision-making process. There are also several potential disadvantages and limitations that should be considered before relying entirely on a cost-benefit analysis.

Advantages of Cost-Benefit Analysis

A data-driven approach.

Cost-benefit analysis allows an individual or organization to evaluate a decision or potential project free of biases. As such, it offers an agnostic and evidence-based evaluation of your options, which can help your business become more data-driven and logical.

Makes Decisions Simpler

Business decisions are often complex by nature. By reducing a decision to costs versus benefits, the cost-benefit analysis can make this dilemma less complex.

Uncovers Hidden Costs and Benefits

Cost-benefit analysis forces you to outline every potential cost and benefit associated with a project, which can uncover less-than-obvious factors like indirect or intangible costs.

Limitations of Cost-Benefit Analysis

Difficult to predict all variables.

While cost-benefit analysis can help you outline the projected costs and benefits associated with a business decision, it’s challenging to predict all the factors that may impact the outcome. Changes in market demand, material costs, and the global business environment are unpredictable—especially in the long term.

Incorrect Data Can Skew Results

If you’re relying on incomplete or inaccurate data to finish your cost-benefit analysis, the results of the analysis will follow suit.

Better Suited to Short- and Mid-Length Projects

For projects or business decisions that involve longer timeframes, cost-benefit analysis has a greater potential of missing the mark for several reasons. For one, it’s typically more difficult to make accurate predictions the further into the future you go. It’s also possible that long-term forecasts won’t accurately account for variables such as inflation, which can impact the overall accuracy of the analysis.

Removes the Human Element

While a desire to make a profit drives most companies, there are other, non-monetary reasons an organization might decide to pursue a project or decision. In these cases, it can be difficult to reconcile moral or “human” perspectives with the business case.

In the end, cost-benefit analysis shouldn't be the only business analytics tool or strategy you use in determining how to move your organization into the future. Cost-benefit analysis isn’t the only type of economic analysis you can do to assess your business’s economic state, but a single option at your disposal.

Do you want to take your career to the next level? Download our free Guide to Advancing Your Career with Essential Business Skills to learn how enhancing your business knowledge can help you make an impact on your organization and be competitive in the job market.

This post was updated on July 12, 2022. It was originally published on September 5, 2019.

About the Author

- Skip to main content

- Skip to primary sidebar

Business Jargons

A Business Encyclopedia

Cost Analysis

Definition: In economics, the Cost Analysis refers to the measure of the cost – output relationship, i.e. the economists are concerned with determining the cost incurred in hiring the inputs and how well these can be re-arranged to increase the productivity (output) of the firm.

In other words, the cost analysis is concerned with determining money value of inputs (labor, raw material), called as the overall cost of production which helps in deciding the optimum level of production.

There are several cost concepts relevant to the business operations and decisions and for the convenience of understanding these can be grouped under two overlapping categories:

- Cost Concepts Used for Accounting Purposes: Generally, the accountants use these cost concepts to study the financial position of the firm. They are concerned with arranging the finances of the firm and therefore keep a track of the assets and liabilities of the firm. The accounting costs are used for taxation purposes and calculating the profit and loss of the firm. These are:

- Opportunity Cost

- Business Cost

- Explicit Cost

- Implicit Cost

- Out-of-Pocket Cost

- Analytical Cost Concepts Used for Economic Analysis of Business Activities: These cost concepts are used by the economists to analyze the likely cost of production in the future. They are concerned with how the cost of production can be managed or how the input and output can be re-arranged such that the overall profitability of the firm gets improved. These costs are:

- Variable Cost

- Average Cost

- Marginal Cost

- Short-run Cost

- Long-Run Cost

- Incremental Cost

- Historical Cost

- Replacement Cost

- Private Cost

- Social Cost

In business, the manager must have a clear understanding of the cost-output relation as it helps in cost control, marketing, pricing, profit, production, etc. The cost-output relation can be expressed as:

C = f (S, O, P, T) Where, C =cost, S = Size of the firm, O = output, P = Price and T = Technology.

With the increase in the size of the firm, the economies of scale also increase and as a result the cost of per unit production comes down. There is a positive relation between the cost and the output, as the output increases the cost also increases and vice-versa. Likewise, the price of inputs is directly related to the price, as the input price increases the cost of production also increases. But however, the technology is inversely related to the cost, i.e. with an improved technology the cost of production decreases.

Thus, the cost analysis is pivotal in business decision-making as the cost incurred in the input and output is to be carefully understood before planning the production capacity of the firm.

Related terms:

- Cost-push Inflation

- Constant Elasticity of Substitution Production Function

Reader Interactions

ANKUSH says

February 12, 2021 at 12:31 pm

very helpful information

June 5, 2021 at 12:18 pm

Very educating.

Soita Gift says

January 12, 2022 at 3:12 pm

Very helpful

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Cambridge Dictionary +Plus

Meaning of cost analysis in English

Your browser doesn't support HTML5 audio

Examples of cost analysis

Word of the Day

bits and bobs

small things or jobs of different types

Shoots, blooms and blossom: talking about plants

Learn more with +Plus

- Recent and Recommended {{#preferredDictionaries}} {{name}} {{/preferredDictionaries}}

- Definitions Clear explanations of natural written and spoken English English Learner’s Dictionary Essential British English Essential American English

- Grammar and thesaurus Usage explanations of natural written and spoken English Grammar Thesaurus

- Pronunciation British and American pronunciations with audio English Pronunciation

- English–Chinese (Simplified) Chinese (Simplified)–English

- English–Chinese (Traditional) Chinese (Traditional)–English

- English–Dutch Dutch–English

- English–French French–English

- English–German German–English

- English–Indonesian Indonesian–English

- English–Italian Italian–English

- English–Japanese Japanese–English

- English–Norwegian Norwegian–English

- English–Polish Polish–English

- English–Portuguese Portuguese–English

- English–Spanish Spanish–English

- English–Swedish Swedish–English

- Dictionary +Plus Word Lists

- Business Noun

- All translations

Add cost analysis to one of your lists below, or create a new one.

{{message}}

Something went wrong.

There was a problem sending your report.

An Expert Guide to Cost Benefit Analysis

By Joe Weller | December 8, 2016

- Share on Facebook

- Share on LinkedIn

Link copied

In business today, it’s essential to get the most out of every idea, option, and investment. To accomplish this, many organizations - from large enterprises to startups and small businesses - use cost benefit analyses to help make important decisions. Using a cost benefit analysis can help teams identify the highest and best return on an investment based on the cost, resources, and risk involved. In this article, we’ll walk you through the process of cost benefit analysis, and offer insight and tips from industry experts. They’ll shine a light on the risks and uncertainties you should be aware of as you work, and provide real-world examples to show cost benefit analysis in action.

Cost benefit analysis: What is it?

A cost benefit analysis (also known as a benefit cost analysis) is a process by which organizations can analyze decisions, systems or projects, or determine a value for intangibles. The model is built by identifying the benefits of an action as well as the associated costs, and subtracting the costs from benefits. When completed, a cost benefit analysis will yield concrete results that can be used to develop reasonable conclusions around the feasibility and/or advisability of a decision or situation. Why Use Cost Benefit Analysis? Organizations rely on cost benefit analysis to support decision making because it provides an agnostic, evidence-based view of the issue being evaluated—without the influences of opinion, politics, or bias. By providing an unclouded view of the consequences of a decision, cost benefit analysis is an invaluable tool in developing business strategy, evaluating a new hire, or making resource allocation or purchase decisions. Origins of Cost Benefit Analysis The earliest evidence of the use of cost benefit analysis in business is associated with a French engineer, Jules Dupuit, who was also a self-taught economist. In the mid-19th century, Dupuit used basic concepts of what later became known as cost benefit analysis in determining tolls for a bridge project on which he was working. Dupuit outlined the principles of his evaluation process in an article written in 1848, and the process was further refined and popularized in the late 1800s by British economist Alfred Marshall, author of the landmark text, Principles of Economics (1890).

Scenarios Utilizing Cost Benefit Analysis

As mentioned previously, cost benefit analysis is the foundation of the decision-making process across a wide variety of disciplines. In business, government, finance, and even the nonprofit world, cost benefit analysis offers unique and valuable insight when:

- Developing benchmarks for comparing projects

- Deciding whether to pursue a proposed project

- Evaluating new hires

- Weighing investment opportunities

- Measuring social benefits

- Appraising the desirability of suggested policies

- Assessing change initiatives

- Quantifying effects on stakeholders and participants

How to Do a Cost Benefit Analysis

While there is no “standard” format for performing a cost benefit analysis, there are certain core elements that will be present across almost all analyses. Use the structure that works best for your situation or industry, or try one of the resources and tools listed at the end of this article. We’ll go through the five basic steps to performing a cost benefit analysis in the sections below, but first, here’s a high-level of overview:

- Establish a framework to outline the parameters of the analysis

- Identify costs and benefits so they can be categorized by type, and intent

- Calculate costs and benefits across the assumed life of a project or initiative

- Compare cost and benefits using aggregate information

- Analyze results and make an informed, final recommendation

As with any process, it’s important to work through all the steps thoroughly and not give in to the temptation to cut corners or base assumptions on opinion or “best guesses.” According to a paper from Dr. Josiah Kaplan, former Research Associate at the University of Oxford, it’s important to ensure that your analysis is as comprehensive as possible: “The best cost-benefit analyses take a broad view of costs and benefits, including indirect and longer-term effects, reflecting the interests of all stakeholders who will be affected by the program.”

How to Establish a Framework

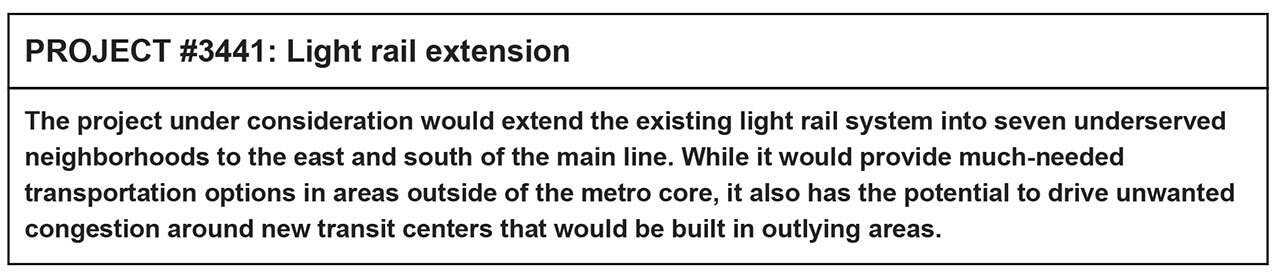

In establishing the framework of your cost benefit analysis, first outline the proposed program or policy change in detail. Look carefully at how you position what exactly is being evaluated in relationship to the problem being solved. For example, the analysis associated with the question, “should we add a new professor to our staff?” will be much more straightforward than a broader programmatic question, such as, “how should we resolve the gaps in our educational offering?” Example:

Once your program or policy change is clearly outlined, you’ll need to build out a situational overview to examine the existing state of affairs including background, current performance, any opportunities it has brought to the table, and its projected performance in the future. Also make sure to factor in an objective look at any risks involved in maintaining the status quo moving forward. Now decide on how you will approach cost benefits. Which cost benefits should be included in your analysis? Include the basics, but also do a bit of thinking outside the box to come up with any unforeseen costs that could impact the initiative in both the short and long term. In some cases geography could play a role in determining feasibility of a project or initiative. If geographically dispersed stakeholders or groups will be affected by the decision being analyzed, make sure to build that into the framework upfront, to avoid surprises down the road. Conversely, if the scope of the project or initiative may scale beyond the intended geographic parameters, that should be taken into consideration as well.

Identify and Categorize Costs and Benefits

Now that your framework is in place, it’s time to sort your costs and benefits into buckets by type. The primary categories that costs and benefits fall into are direct/indirect , tangible/intangible , and real :

- Direct costs are often associated with production of a cost object (product, service, customer, project, or activity)

- Indirect costs are usually fixed in nature, and may come from overhead of a department or cost center

- Tangible costs are easy to measure and quantify, and are usually related to an identifiable source or asset, like payroll, rent, and purchasing tools

- Intangible cost s are difficult to identify and measure, like shifts in customer satisfaction, and productivity levels

- Real costs are expenses associated with producing an offering, such as labor costs and raw materials

Now that you’ve developed the categories into which you’ll sort your costs and benefits, it’s time to start crunching numbers.

How to Calculate Costs and Benefits

With the framework and categories in place, you can start outlining overall costs and benefits. As mentioned earlier, it’s important to take both the short and long term into consideration, so ensure that you make your projections based on the life of the program or initiative, and look at how both costs and benefits will evolve over time.

TIP: People often make the mistake of monetizing incorrectly when projecting costs and benefits, and therefore end up with flawed results. When factoring in future costs and benefits, always be sure to adjust the figures and convert them into present value.

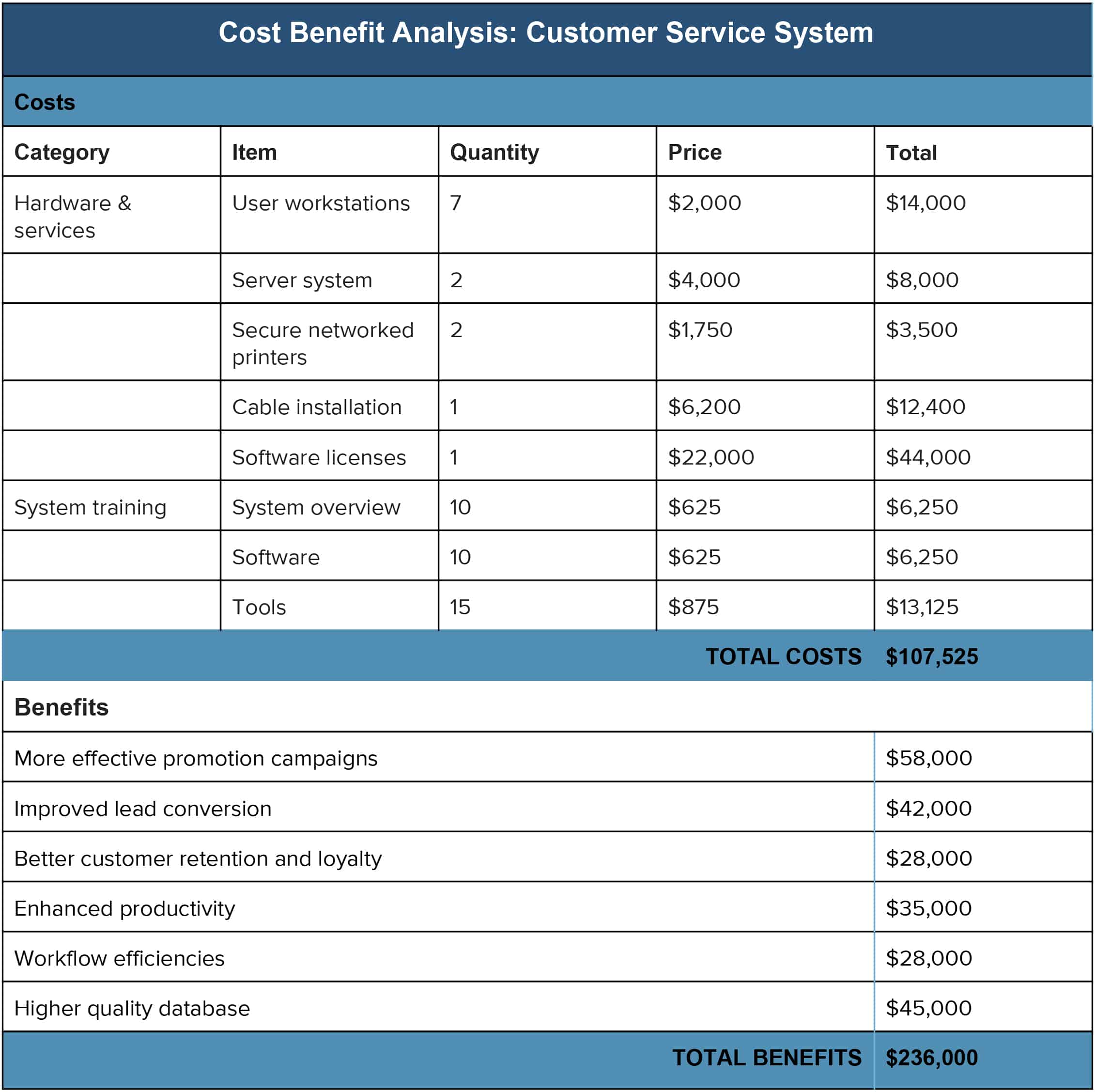

Compare Aggregate Costs and Benefits

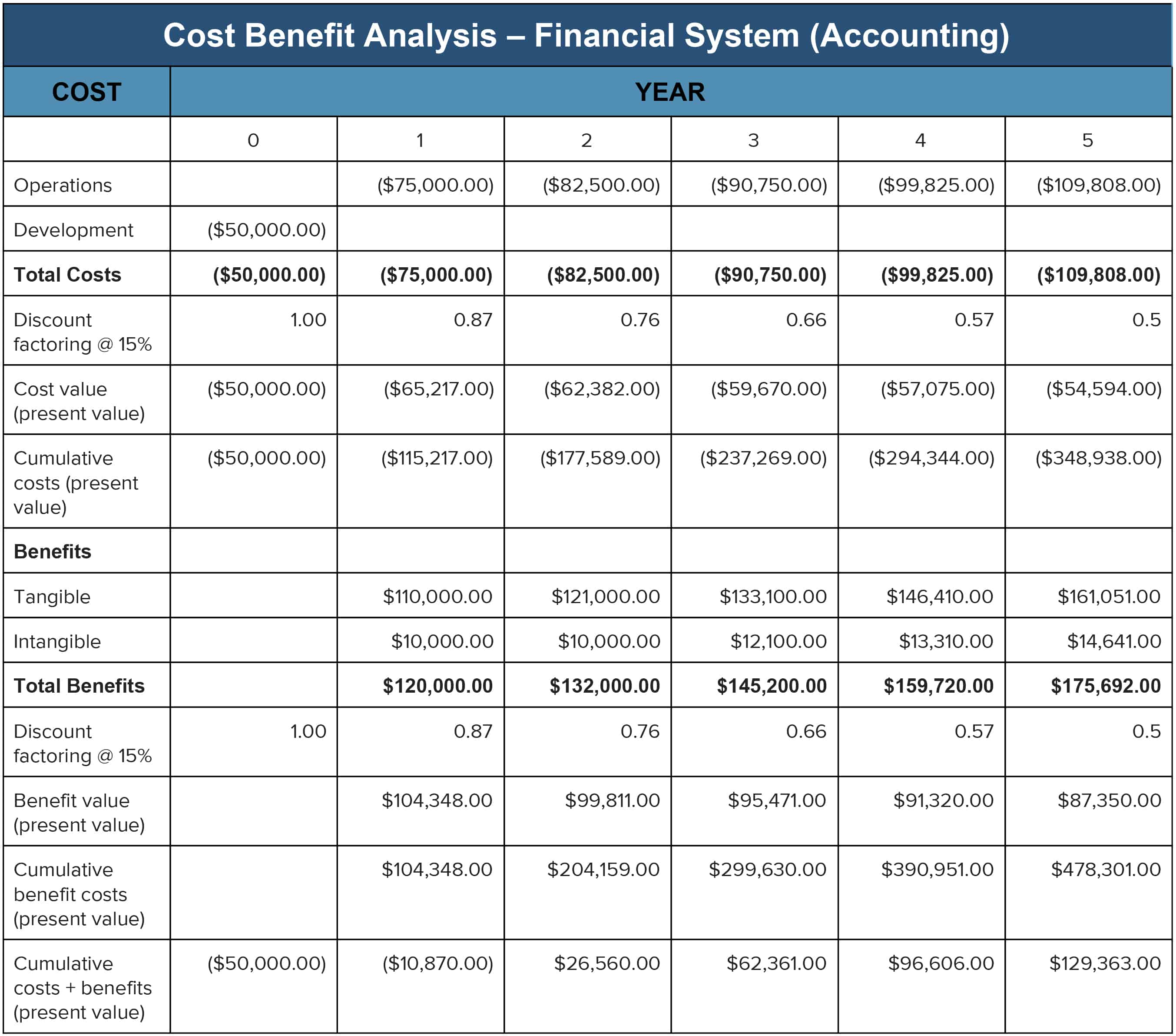

Here we’ll determine net present values by subtracting costs from benefits, and project the timeframe required for benefits to repay costs, also known as return on investment (ROI). Example:

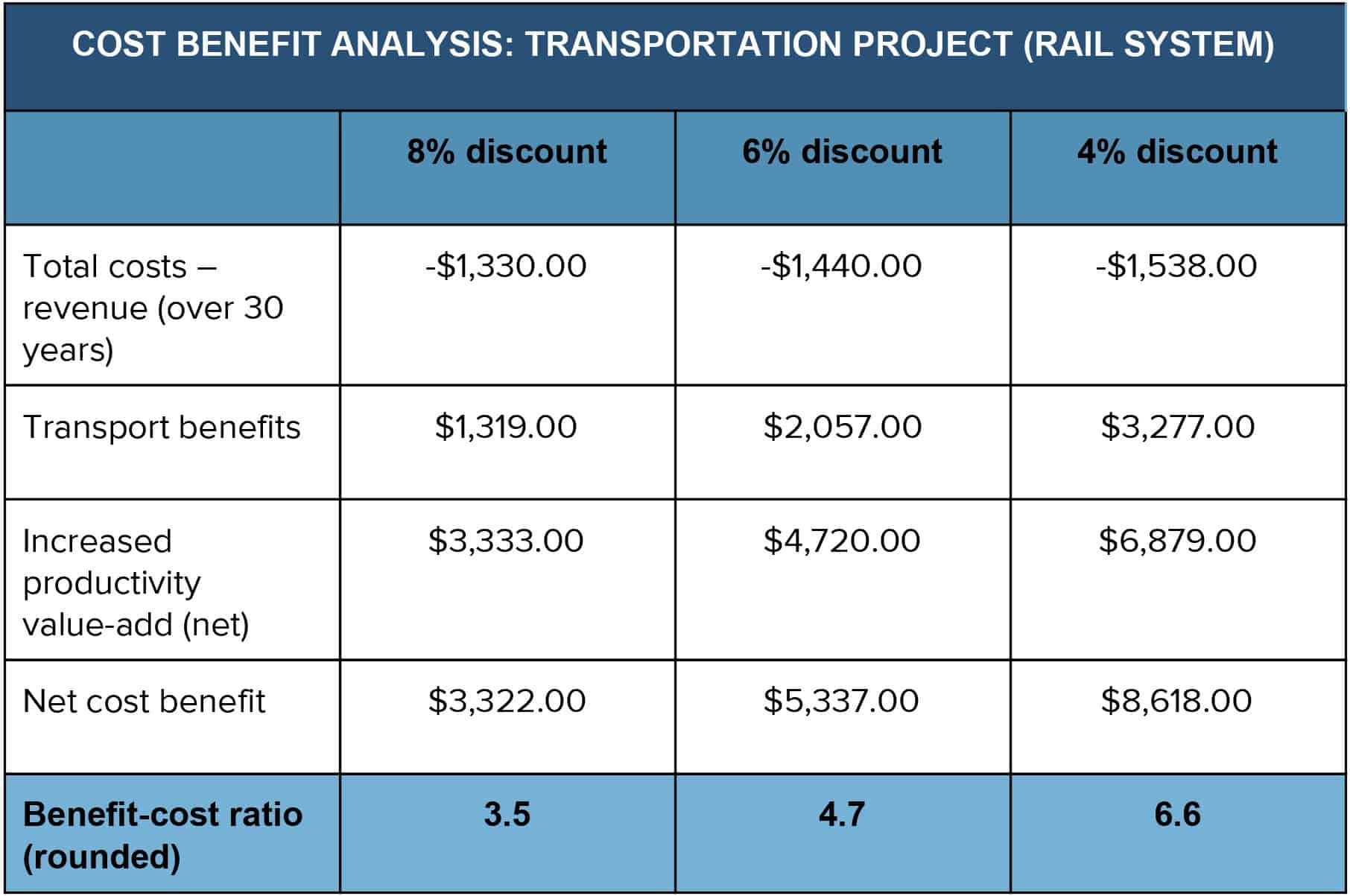

The process doesn’t end there. In certain situations, it’s important to address any serious concerns that could impact feasibility from a legal or social justice standpoint. In cases like these, it can be helpful to incorporate a “with/without” comparison to identify areas of potential concern. With/Without Comparison The impact of an initiative can be brought into sharp focus through a basic “with/without” comparison. In other words, this is where we look at what the impact would be—on organizations, stakeholders, or users—both with, and without, this initiative. Thayer Watkins, who taught a course on cost benefit analysis during his 30-year career as a professor in the San Jose State University Department of Economics, offers this example of a “with/without” comparison: “The impact of a project is the difference between what the situation in the study area would be with and without the project. So that when a project is being evaluated the analysis must estimate not only what the situation would be with the project but also what it would be without the project. For example, in determining the impact of a fixed guideway rapid transit system such as the Bay Area Rapid Transit (BART) in the San Francisco Bay Area the number of rides that would have been taken on an expansion of the bus system should be deducted from the rides provided by BART and likewise the additional costs of such an expanded bus system would be deducted from the costs of BART. In other words, the alternative to the project must be explicitly specified and considered in the evaluation of the project.” TIP: Never confuse with/without with a before-and-after comparison.

3 Steps for Analyzing the Results and Make a Recommendation

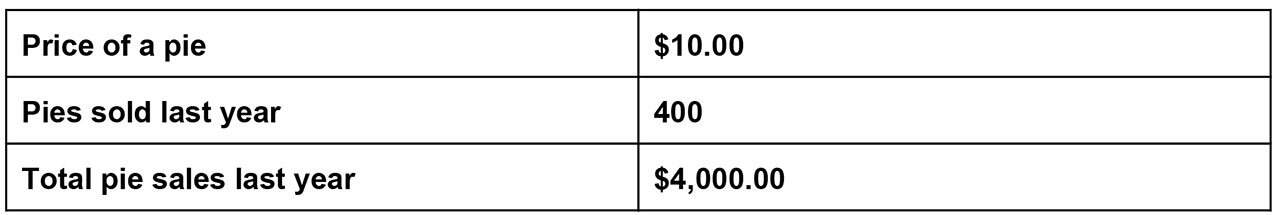

In the home stretch of the cost benefit analysis, you’ll be looking at the results of your work and forming the basis to make your decision. 1. Perform Sensitivity Analysis Dr. Kaplan recommends performing a sensitivity analysis (also known as a “what-if”) to predict outcomes and check accuracy in the face of a collection of variables. “Information on costs, benefits, and risks is rarely known with certainty, especially when one looks to the future,” Dr. Kaplan says. “This makes it essential that sensitivity analysis is carried out, testing the robustness of the CBA result to changes in some of the key numbers.” EXAMPLE of Sensitivity Analysis In trying to understand how customer traffic impacts sales in Bob’s Pie Shop, in which sales are a function of both price and volume of transactions, let’s look at some sales figures:

Bob has determined that a 10% increase in store traffic will boost his pie sales by 5%. This allows Bob to build the following sensitivity analysis, based upon his sales of 400 pies last year, that demonstrates that his pie sales are significantly impacted by fluctuations or growth in store traffic:

2. Consider Discount Rates When evaluating your findings, it’s important to take discount rates into consideration when determining project feasibility.

- Social discount rates – Used to determine the value to funds spent on government projects (education, transportation, etc.)

- Hurdle rates – The minimum return on investment required by investors or stakeholders

- Annual effective discount rates – Based on a percentage of the end-of-year balance, the amount of interest paid or earned

Here is a template where you can make your Cost Benefit Analysis

Download Simple Cost Benefit Analysis Template

Microsoft Excel | Smartsheet

3. Use Discount Rates to Determine Course of Action After determining the appropriate discount rate, look at the change in results as you both increase and decrease the rate:

- Positive - If both increasing and decreasing the rate yields a positive result, the policy or initiative is financially viable.

- Negative - If both increasing and decreasing the rate yields a negative result, revisit your calculations based upon adjusting to a zero-balance point, and evaluate using the new findings.

Based upon these results, you will now be able to make a clear recommendation, grounded in realistic data projections.

The Risks and Uncertainties of Cost Benefit Analysis

Despite its usefulness, cost benefit analysis has several associated risks and uncertainties that are important to note. These risks and uncertainties can result from human agendas, inaccuracies around data utilized, and the use of heuristics to reach conclusions. Know the Risks Much of the risk involved with cost benefit analysis can be correlated to the human elements involved. Stakeholders or interested parties may try to influence results by over- or understating costs. In some cases, supporters of a project may insert a personal or organizational bias into the analysis. On the data side, there can be a tendency to rely too much on data compiled from previous projects. This may inadvertently yield results that don’t directly apply to the situation being considered. Since data leveraged from an earlier analysis may not directly apply to the circumstances at hand, this may yield results that are not consistent with the requirements of the situation being considered. Using heuristics to assess the dollar value of intangibles may provide quick, “ballpark-type” information, but it can also result in errors that produce an inaccurate picture of costs that can invalidate findings. In addressing risk, it’s sometimes helpful to utilize probability theory to identify and examine key patterns that can influence the outcome. Uncertainties There are several “wild-card” issues that can influence the results of any cost benefit analysis, and while they won’t apply in every situation, it’s important to keep them in mind as you work:

- Accuracy affects value – Inaccurate cost and benefit information can diminish findings around value.

- Don’t rely on intuition – Always research benefits and costs thoroughly to gather concrete data—regardless of your level of expertise with the subject at hand.

- Cash is unpredictable – Revenue and cash flow are moving targets, experiencing peaks and valleys, and translating them into meaningful data for analysis can be challenging.

- Income influences decisions – Income level can drive a customer’s ability or willingness to make purchases.

- Money isn’t everything – Some benefits cannot be directly reflected in dollar amounts.

- Value is subjective – The value of intangibles can always be subject to interpretation.

- Don’t automatically double up – When measuring a project in multiple ways, be mindful that doubling benefits or costs can results in inconsistent results.

Controversial Aspects When thinking about the most controversial aspects of cost benefit analysis, all paths seem to lead to intangibles. Concepts and things that are difficult to quantify, such as human life, brand equity, the environment, and customer loyalty can be difficult to map directly to costs or value. With respect to intangibles, Dr. Kaplan suggests that using the cost benefit analysis process to drive more critical thinking around all aspects of value—perceived and concrete—can be beneficial outcomes. “[Cost benefit analysis] assumes that a monetary value can be placed on all the costs and benefits of a program, including tangible and intangible returns. ...As such, a major advantage of cost-benefit analysis lies in forcing people to explicitly and systematically consider the various factors which should influence strategic choice,” he says.

Cost Benefit Analysis in the Real World

Extending Transport Options in Seattle

Originally built for the 1962 World’s Fair, the Seattle monorail runs between the Seattle Center and the city’s downtown area. Several times over the past 50+ years, the city has considered extending monorail service to key areas in order to provide more transport options for residents. The following is an excerpt from a cost benefit analysis performed by DJM Consulting and ECONorthwest on behalf of the Elevated Transportation Company to assess an expansion project. Costs The estimated costs for constructing and operating the monorail are $1.68 billion (in 2002 dollars). This includes a total capital cost of $1.26 billion and a total discounted stream of operating costs of $420 million (at approximately $29 million a year), using the same discount rate (7.95%). Operating costs were discounted over a span of 22 years, from 2008 through 2029. Benefits

Benefit type Benefit value (millions, 2002$) Value of travel time savings $77.1 Parking savings 28.7 Reduced auto operating/ownership costs 11.2 Reliability 7.7 Road capacity for drivers 4.6 Reduction in bus-related accidents 3.7 Reduction in auto-related accidents 2.6 2020 Benefits $135.6

Benefits accrue for 23 years from 2007 through 2029. A discount rate of 7.95% was used to estimate the total benefits, in 2002 dollars. The net benefits were evaluated to be $2,067,263,000. Analysis

- Net present value B-C = $390,164,000

- Benefit-cost ratio B/C = 1.23

- Nominal rate of return = 7.95%

Sensitivity Analysis A team of outside engineers and contractors determined that there is a 60% chance the monorail project would come in at or under budget and a 90% chance the project will come in under 1.15 times the budget. The travel demand forecasters included a 10% range around their estimate of future monorail ridership. For the case where the costs are low and the benefits are high, a 9.9% return is expected. For the case where the costs are higher than expected and the benefits are lower, a 5.2% return is expected. Read the full analysis here . Solid Waste Reduction in California California's Department of Resources Recycling and Recovery’s mission is to help state residents achieve the highest waste reduction, recycling and reuse goals in the U.S. The following is an excerpt from a cost benefit analysis performed in 1997 to compare the costs of Cardiovascular Group’s (CVG) solid waste reduction program to its economic benefits. Costs According to the Environmental Manager, one employee spends eight hours per day on recycling duties. This employee is paid an average of $5.50 per hour. The Environmental Manager spends an estimated 5% of his time ($100,000/per year compensation) directing the solid waste reduction program. Utilizing this cost data, the calculations below demonstrate that CVG spent an estimated $16,440 in 1997 on its solid waste reduction program: (1 Employee) X ($5.50/hr.) X (8 hrs./day) X (260 work days/year) = $11,440 per year + 5%(100,000) = $16,440 per year Benefits 1995 Disposal cost reductions (1989 Baseline disposal costs – 1995 disposal costs) = $99,190 - $26,800 = $72,390 1996 Disposal cost reductions (1989 Baseline disposal costs – 1996 disposal costs) = $99,190 - $33,850 = $65,340 Average Annual Disposal Cost Reduction (DCR) (1995 DCR + 1996 DCR)/ 2 = ($72,390 + $65,340)/2 = $68,865 Analysis

- Nominal Rate of Return = 7.95%

From these data, it is clear that CVG has benefited economically from its solid waste reduction programs. Average annual costs amounted to $16,440 per year, while benefits equaled $1,308,865 per year. Therefore, net savings from CVG’s solid waste reduction program amounted to $1,292,425 per year.

Discover a Better Way to Manage Your Finance Operations

Befähigen Sie Ihr Team, über sich selbst hinauszuwachsen – mit einer flexiblen Plattform, die auf seine Bedürfnisse zugeschnitten ist und sich anpasst, wenn sich die Bedürfnisse ändern. Mit der Plattform von Smartsheet ist es einfach, Arbeiten von überall zu planen, zu erfassen, zu verwalten und darüber zu berichten. So helfen Sie Ihrem Team, effektiver zu sein und mehr zu schaffen. Sie können über die Schlüsselmetriken Bericht erstatten und erhalten Echtzeit-Einblicke in laufende Arbeiten durch Rollup-Berichte, Dashboards und automatisierte Workflows, mit denen Ihr Team stets miteinander verbunden und informiert ist. Es ist erstaunlich, wie viel mehr Teams in der gleichen Zeit erledigen können, wenn sie ein klares Bild von der geleisteten Arbeit haben. Testen Sie Smartsheet gleich heute kostenlos.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Privacy Policy

- Terms & Conditions

Home » Finance » Financial Management » What is Cost Analysis | Types | Methods | Importance | Steps | Challenges

What is Cost Analysis | Types | Methods | Importance | Steps | Challenges

Cost analysis is the bedrock of informed decision-making in the business world. It provides the vital insights needed to manage resources efficiently, set prices, and strategically plan for the future.

Here below we will discuss what is cost analysis, exploring its various facets, methodologies, and real-world applications.

Table of Contents

What is Cost Analysis | Different Definitions

Cost analysis refers to the process of examining and evaluating the various costs associated with a particular project, business operation, or product. It involves the systematic breakdown and assessment of all costs incurred to understand the financial implications of a decision or investment.

Cost analysis is a crucial tool in business management, financial planning, and decision-making. Below are different definitions of cost analysis:

- Cost analysis is a financial management process that involves the identification, classification, and evaluation of all expenses incurred by an organization, project, or product. It aims to determine the total cost of production, operation, or a specific activity.

- Cost analysis is a systematic examination of direct and indirect costs associated with a particular business process or investment. It helps organizations make informed decisions, set pricing strategies, and allocate resources efficiently.

- Cost analysis refers to the comprehensive study of expenses, including fixed and variable costs, overheads, and other financial outlays, to assess their impact on profitability and to identify areas for cost reduction or optimization.

- Cost analysis is the process of breaking down and studying all components of a cost structure, such as materials, labor, overhead, and administrative expenses, to determine the total cost of producing goods or delivering services.

- Cost analysis is an essential tool for businesses to evaluate the financial feasibility of projects, measure the cost-effectiveness of products or services, and analyze the impact of cost drivers on overall expenses.

These definitions highlight the importance of cost analysis in helping businesses and organizations manage their finances, control expenses, and make strategic decisions. It involves a detailed examination of various cost elements to ensure efficient resource allocation and maximize profitability.

Types of Cost Analysis

Let’s see the various types of cost analysis in detail.

1 . Fixed Cost Analysis:

Fixed cost analysis focuses on examining and understanding expenses that remain constant regardless of the level of production or output.

Characteristics:

- Constant: Fixed costs do not change with fluctuations in production or sales volume.

- Time-Based: These costs occur regularly, typically on a monthly or annual basis.

- Examples: Rent or lease payments, insurance premiums, salaries of permanent staff, depreciation of fixed assets.

Fixed cost analysis helps businesses in budgeting, as these costs need to be covered regardless of operational levels. It allows organizations to plan for stable and consistent expenses.

Variable Cost Analysis:

Variable cost analysis concentrates on costs that fluctuate in direct proportion to changes in production or output.

- Proportional: Variable costs increase or decrease in line with changes in production or sales volume.

- Direct Relationship: There is a direct cause-and-effect relationship between variable costs and production.

- Examples: Cost of raw materials, direct labor costs (hourly wages), sales commissions.

Variable cost analysis is crucial for determining the cost of producing each additional unit of a product or service. It aids in pricing strategies and assessing the profitability of different production levels.

Direct Cost Analysis:

Direct cost analysis focuses on expenses directly attributable to a specific product, project, or department.

- Attributable: Direct costs can be traced and linked directly to a particular output or project.

- Tangible: These costs are often physical and easily identifiable.

- Examples: Cost of raw materials used in manufacturing a specific product, labor costs of employees working solely on one project.

Direct cost analysis is instrumental in determining the precise cost of producing a specific item or delivering a particular service. It helps in pricing, budgeting, and evaluating the profitability of individual products or projects.

Indirect Cost Analysis:

Indirect cost analysis deals with expenses that are essential for overall operations but cannot be directly attributed to a specific product or project.

- Shared: Indirect costs are incurred across the organization and are not tied to a single output.

- Allocated: These costs are often allocated to various departments or activities based on predetermined methods.

- Examples: Utilities (electricity, water), administrative salaries, office supplies.

Indirect cost analysis is crucial for determining the overhead costs associated with running the organization as a whole. It helps in pricing strategies, cost allocation, and assessing the efficiency of support functions.

Opportunity Cost Analysis:

Opportunity cost analysis delves into the concept of the next best alternative foregone when a particular decision is made.

- Not Tangible: Opportunity costs are not monetary; they represent the value of the alternative choice.

- Immaterial: These costs are intangible and often subjective.

- Examples: Choosing to invest in Project A instead of Project B, which had the potential for higher returns.

Opportunity cost analysis helps decision-makers assess the potential benefits they may lose when making a specific choice. It aids in evaluating trade-offs and making decisions that maximize overall value.

Sunk Cost Analysis:

Sunk cost analysis involves examining costs that have already been incurred and cannot be recovered.

- Irrecoverable: Sunk costs are expenditures that cannot be retrieved or reversed.

- Not Relevant: In decision-making, sunk costs should not influence future choices.

- Examples: Money spent on failed research and development projects, advertising costs for a product that has been discontinued.

Sunk cost analysis is essential for preventing the consideration of past expenses when making current decisions. It encourages organizations to focus on future costs and benefits.

Each type of cost analysis serves a specific purpose in helping organizations manage their financial resources effectively, make informed decisions, and achieve their objectives. By understanding these cost categories, businesses can tailor their analysis approaches to suit their unique needs and challenges.

Importance of Costs Analysis

Cost analysis holds immense importance in the realm of business and decision-making. Let’s explore its significance in detail:

Informed Decision-Making:

Strategic Planning: Cost analysis provides data that guides strategic planning. It helps businesses assess the financial implications of various strategies, such as expansion, diversification, or market entry.

Investment Decisions: When considering new investments or projects, cost analysis clarifies potential returns and risks, aiding in investment decisions.

Pricing Strategies:

Competitive Pricing: Understanding cost structures allows businesses to set competitive prices in the market while ensuring profitability.

Optimized Margins: Cost analysis helps in identifying the cost components of products or services, enabling better margin management.

Budgeting and Resource Allocation:

Effective Budgets: Cost analysis forms the foundation for creating realistic budgets, ensuring that resources are allocated efficiently.

Resource Optimization: It helps organizations allocate resources where they are needed most, reducing waste and improving overall efficiency.

Performance Evaluation:

Departmental Efficiency: By analyzing costs, organizations can assess the efficiency and effectiveness of different departments or projects within the company.

Benchmarking: Cost analysis allows for benchmarking against industry standards and competitors, helping companies identify areas for improvement.

Cost Reduction:

Identifying Inefficiencies: Through cost analysis, organizations can identify areas of inefficiency or excessive spending, enabling targeted cost reductions.

Continuous Improvement: It promotes a culture of continuous improvement, where cost-saving measures are implemented systematically.

Risk Management:

Financial Risk Mitigation: Cost analysis assists in identifying and mitigating financial risks, ensuring that organizations can weather economic uncertainties.

Contingency Planning: Understanding cost structures aids in contingency planning for unforeseen events or economic downturns.

Pricing Transparency:

Customer Trust: Transparent pricing, backed by cost analysis, fosters customer trust and confidence.

Fairness: It ensures that customers perceive prices as fair, enhancing brand reputation.

Product and Service Enhancement:

Quality Improvement: Cost analysis helps in assessing the cost implications of improving product or service quality.

Innovation: It guides decisions related to product innovation and development, ensuring cost-effectiveness.

Resource Efficiency:

Environmental Impact: Cost analysis can include evaluating the environmental costs of business operations, encouraging sustainable practices.

Resource Conservation: It promotes the efficient use of resources, reducing waste and minimizing ecological footprint.

Compliance and Reporting:

Financial Reporting: Cost analysis is essential for financial reporting and compliance with accounting standards.

Taxation: Accurate cost analysis helps in tax reporting and compliance with tax regulations.

Business Survival and Growth:

Sustainability: By optimizing costs, businesses can improve their financial stability and long-term sustainability.

Competitive Edge: Cost-efficient operations provide a competitive edge, allowing businesses to thrive in challenging markets.

Cost analysis is the compass that guides organizations through the complexities of modern business. It empowers businesses to make data-driven decisions, allocate resources efficiently, enhance profitability, and drive sustainable growth. Whether it’s pricing strategies, budgeting, or strategic planning, cost analysis is the key to achieving financial success and operational excellence.

Methods of Cost Analysis

Cost analysis involves several methods to examine and assess costs in different contexts. Let’s explore these methods in detail:

Historical Cost Analysis:

Historical cost analysis involves examining past cost data to understand how expenses have evolved over time.

- Use Cases: It is often used for budgeting, forecasting, and identifying cost trends.

- Advantages: Provides a historical perspective, allowing for trend analysis and informed decision-making.

- Limitations: Historical data may not accurately reflect future cost dynamics.

Marginal Cost Analysis:

Marginal cost analysis assesses the cost of producing one additional unit or providing one more service.

- Use Cases: Commonly used in pricing decisions and determining optimal production levels.

- Advantages: Helps in evaluating the cost-effectiveness of incremental changes in production.

- Limitations: Assumes that variable costs remain constant with small changes in output.

Standard Cost Analysis:

Standard cost analysis involves comparing actual costs to predefined standards or benchmarks.

- Use Cases: Used for performance evaluation, identifying cost variances, and improving cost control.

- Advantages: Enables organizations to detect and address deviations from planned costs.

- Limitations: May not consider changes in external factors or market conditions.

Activity-Based Costing (ABC):

ABC assigns costs to specific activities within an organization and then allocates those costs to products or services based on their consumption of these activities.

- Use Cases: Valuable for understanding the true cost drivers in complex operations and for pricing decisions.

- Advantages: Provides a more accurate allocation of costs, particularly in businesses with diverse product lines.

- Limitations: Requires detailed data and can be resource-intensive to implement.

Life Cycle Cost Analysis (LCCA):

LCCA evaluates the total costs associated with a product or asset over its entire lifecycle, from acquisition to disposal.

- Use Cases: Often used for capital investment decisions, such as equipment purchases.

- Advantages: Offers a holistic view of costs, including maintenance, operational, and disposal expenses.

- Limitations: Requires long-term forecasting and may involve uncertainties.

Break-Even Analysis:

Break-even analysis determines the level of sales or production at which total revenue equals total costs, resulting in zero profit or loss.

- Use Cases: Helps identify the point at which a business becomes profitable and the level of output required to cover costs.

- Advantages: Simple and useful for setting sales targets and pricing strategies.

- Limitations: Assumes constant variable and fixed costs, which may not hold true in real-world scenarios.

Cost-Volume-Profit (CVP) Analysis:

CVP analysis evaluates the relationship between costs, volume of production or sales, and profits.

- Use Cases: Assists in determining the sales volume required to achieve desired profit levels.

- Advantages: Helps in pricing strategies, break-even analysis, and profit planning.

- Limitations: Assumes linear relationships and constant costs, which may not always apply.

Cost-Benefit Analysis (CBA):

CBA assesses the costs and benefits associated with a project, policy, or investment to determine its economic feasibility.

- Use Cases: Widely used in public policy, environmental assessments, and project evaluations.

- Advantages: Provides a framework for evaluating the economic impact of decisions.

- Limitations: Requires assigning monetary values to intangible factors and may not capture all social or environmental impacts.

Variable vs. Fixed Cost Analysis:

This analysis categorizes costs into variable (changing with production) and fixed (constant regardless of production) to understand cost structures.

- Use Cases: Essential for pricing decisions, budgeting, and cost control.

- Advantages: Helps differentiate costs that can be controlled from those that cannot.

- Limitations: May oversimplify complex cost structures.

These methods of cost analysis provide businesses and organizations with valuable tools to evaluate and manage costs effectively. The choice of method depends on the specific goals, context, and complexities of the cost analysis required. By employing these methods, businesses can make informed decisions, enhance profitability, and achieve better financial control.

Steps in Conducting Cost Analysis

Conducting a cost analysis involves a systematic approach to evaluating and understanding the costs associated with a particular project, process, or decision. Here are the steps in conducting a cost analysis:

Define the Purpose and Scope:

Clearly articulate the reason for conducting the cost analysis and define its scope. Determine what specific aspect of costs you want to analyze.

Identify Costs:

Gather and identify all relevant costs associated with the project or decision.

- Direct Costs: Costs directly attributable to the project or product (e.g., materials, labor).

- Indirect Costs: Costs that support the project but are not directly attributable (e.g., overhead, administrative costs).

Gather Data:

Collect accurate and up-to-date data on each cost element. This may involve reviewing financial records, invoices, bills, and other relevant documents.

Classify Costs:

Further classify costs based on their behavior:

- Variable Costs: Costs that change in direct proportion to the level of production or activity.

- Fixed Costs: Costs that remain constant regardless of the level of production or activity.

- Semi-Variable Costs: Costs that have both fixed and variable components.

Calculate Total Costs:

Calculate the total cost of the project by summing up all the identified costs, both direct and indirect.

- Break Costs Down:

Break down the total costs into relevant cost components or cost categories. This helps in understanding where the major expenses lie.

Choose a Cost Analysis Method:

Select the appropriate cost analysis method(s) based on your objectives and the nature of costs. Common methods include historical cost analysis, marginal cost analysis, or activity-based costing.

Analyze Cost Behavior:

Analyze how costs behave under different conditions or production levels. This may involve plotting cost data on graphs to visualize cost behavior.

Evaluate Cost Drivers:

Identify the factors or activities that drive changes in costs. Understanding cost drivers helps in cost control and management.

Determine Cost Variability:

Assess the variability of costs. Some costs may be highly variable, while others remain stable. This information is crucial for budgeting and decision-making.

Consider Time Horizon:

Determine the time period over which you’ll conduct the cost analysis. Some costs may be one-time, while others are recurring.

Sensitivity Analysis:

Perform sensitivity analysis to assess how changes in assumptions or variables affect the cost estimates. This helps in understanding potential risks and uncertainties.

Compare Alternatives:

If applicable, compare the costs of different alternatives or scenarios. This is especially important for decision-making processes.

Interpret Results:

Interpret the findings of the cost analysis. What do the numbers mean in the context of your objectives? Are there any cost-saving opportunities or areas for improvement?

Report and Communicate:

Present the results of the cost analysis in a clear and concise manner. Use tables, charts, and narratives to communicate the findings effectively.

Make Informed Decisions:

Use the insights gained from the cost analysis to make informed decisions. Consider the financial implications and risks associated with each option.

Monitor and Review:

Continuously monitor and review costs during the project or decision implementation. Compare actual costs to the estimates and adjust strategies as needed.

Document Findings:

Keep detailed records of the cost analysis process, including data sources, assumptions, and calculations. This documentation is essential for future reference and audits.

Seek Expert Advice:

In complex cost analyses, consider seeking advice from financial experts or consultants who specialize in cost analysis.

Continuous Improvement:

Incorporate lessons learned from the cost analysis into future projects or decisions to improve cost estimation and control.

By following these steps, organizations can conduct comprehensive and effective cost analyses that provide valuable insights for better financial management, budgeting, and informed decision-making.

Challenges in Cost Analysis

Cost analysis, while essential for informed decision-making and financial management, comes with its own set of challenges and complexities. Here are some of the common challenges in cost analysis:

Data Accuracy and Availability:

Gathering accurate and complete data can be challenging, especially when dealing with historical records or complex cost structures. Missing or unreliable data can lead to inaccurate cost estimates.

Cost Classification:

Properly classifying costs as direct, indirect, fixed, variable, or semi-variable is crucial. However, determining the appropriate classification for certain costs can be ambiguous.

Allocation of Indirect Costs:

Allocating indirect costs to specific projects or products can be challenging. Different allocation methods can yield different results, leading to potential biases.

Overhead Allocation:

Determining how to allocate overhead costs (e.g., rent, utilities, administrative salaries) to specific cost centers or activities can be complex and subjective.

Cost Behavior Assumptions:

Assuming that costs behave consistently under varying conditions may not always hold true. Real-world cost behavior can be dynamic and nonlinear.

Time Horizons:

Deciding on the appropriate time period for a cost analysis can be tricky. Short-term and long-term costs may differ significantly.

Intangible Costs and Benefits:

Evaluating and quantifying intangible factors, such as brand reputation or employee morale, can be challenging. These factors often play a vital role in decision-making.

Sensitivity to Assumptions:

Many cost analysis models rely on assumptions about future variables like inflation rates or market demand. Small changes in these assumptions can lead to significantly different outcomes.

Scalability:

As organizations grow or undertake larger projects, the complexity of cost analysis can increase exponentially. Managing and analyzing extensive data sets can become overwhelming.

Technological Challenges:

Keeping up with evolving technologies for data collection and analysis can be demanding. Integrating data from various sources and software platforms can be a technical challenge.

Regulatory Compliance:

In some industries, strict regulations govern how costs should be reported and analyzed. Non-compliance can result in legal and financial repercussions.

Complex Cost Structures:

Industries with intricate cost structures, such as healthcare or manufacturing, may require advanced cost allocation methods and specialized knowledge.

Subjectivity and Bias:

Cost analysis often involves subjective judgments, especially when estimating future costs or assigning values to intangible factors. Bias can affect the analysis.

Communication and Interpretation:

Presenting complex cost analysis results to non-financial stakeholders can be challenging. Ensuring that decision-makers understand the implications of the analysis is crucial.

Continuous Monitoring:

Ongoing monitoring of actual costs versus estimated costs is essential for cost control. However, maintaining this vigilance can be resource-intensive.

Economic Uncertainty:

Economic conditions can change rapidly, affecting cost structures, pricing, and demand. Cost analysis may need to adapt to uncertain economic environments.

Navigating these challenges requires a combination of expertise, robust data management systems, and a commitment to transparency and accuracy in cost analysis processes. Organizations must continuously refine their cost analysis methodologies to address these challenges effectively and make informed decisions.

How Cost Analysis Influence Decision-Making

Cost analysis plays a pivotal role in the decision-making process for individuals, businesses, and organizations. It involves evaluating the costs associated with different options or courses of action to make informed choices. Here we will discuss how cost analysis influences decision-making:

Cost Identification:

The first step in cost analysis is identifying and categorizing all relevant costs associated with a decision. This includes direct costs (e.g., materials, labor) and indirect costs (e.g., overhead, administrative expenses).

Cost Quantification:

Once costs are identified, they need to be quantified. This involves assigning specific monetary values to each cost component. Accurate cost quantification is essential for meaningful analysis.

Cost Comparison:

Cost analysis allows for a systematic comparison of costs between different alternatives. Decision-makers can assess the financial implications of each option by comparing the total costs involved.

Cost-Benefit Analysis:

Beyond just identifying costs, decision-makers also consider the benefits or outcomes associated with each option. A cost-benefit analysis weighs the costs against the expected benefits to determine whether a decision is financially viable.

Cost-Effectiveness Analysis:

In some cases, the focus is on achieving specific outcomes efficiently. Cost-effectiveness analysis compares the costs of achieving similar outcomes across different options. It helps choose the most efficient approach.

Cost analysis is crucial in budgeting and resource allocation decisions. Organizations use it to allocate financial resources, manpower, and materials efficiently.

For businesses, pricing decisions are heavily influenced by cost analysis. Understanding production costs helps in setting competitive prices while maintaining profitability.

Investment Decisions:

When considering investments in new projects, products, or assets, cost analysis helps assess the potential return on investment (ROI) and the payback period.

Risk Assessment:

Cost analysis can reveal the potential risks associated with each option. For example, some options may have higher variable costs, making them more sensitive to market fluctuations.

Quality Control:

In manufacturing and service industries, cost analysis is used to ensure that quality standards are maintained while minimizing production costs.

Strategic Planning:

Organizations use cost analysis to develop long-term strategies. It helps in making decisions related to expansion, diversification, and resource allocation over time.

Cost Reduction Initiatives:

Cost analysis identifies areas of inefficiency and waste within an organization. This information is critical for implementing cost reduction measures.