Core systems strategy for banks

Serves financial institutions, helping them get their legacy technologies ready for the digital age

Specializes in getting legacy systems “digital ready”

May 4, 2020 Core transaction processing engines for banks—or “core banking systems”—have been making news in the world of banking technology of late. Some of the major global banks have announced partnerships with new cloud-based core banking systems providers. There have been a few instances in the US of these partnerships as well. Many small and midcap banks in the US and Latin America are known to be shopping around for new cores. This topic seems to have suddenly gained visibility in the US and the rest of the world

In this article we look at the forces that are raising the core banking profile, and at the alternatives available to banking leaders as they consider their technology roadmap.

Banks all over the world spend millions of dollars each on maintaining their core banking systems, which usually interface with tens or hundreds of systems. Core banking systems handle a high volume of transactions and are expected to function without interruption—prolonged outages can invite regulatory scrutiny, customer opprobrium, and significant loss of revenue.

Legacy core banking systems have traditionally succeeded in terms of reliability. Failures are rare, with some banks going without an outage for months, if not years. However, with the advent of digital banking, cloud, and APIs, banks have seen a significant shift in the way banking products and partnerships are constructed. Banks are now expected to process transactions in real time, be able to stitch together partnerships with fintech companies in a matter of weeks, release new features frequently, be able to scale (up and down) their infrastructure needs at will, and even execute on M&A quickly. Older core banking systems— usually designed for reliability rather than open architecture—may need to respond to this new requirement, which, to their credit, many are doing with alacrity.

In addition to the existential issues listed above, banks endure some tactical day-to-day pain points with legacy core banking systems. These problems vary from bank to bank, but include a dwindling engineering talent pool, excessive undocumented customization leading to a complex code base that can be difficult and risky to change, and various vendor-support issues.

In response to these issues, a new breed of core banking systems has emerged in the last few years. They are, or will be, cloud-ready and open-banking compliant, and, in some cases, have very advanced architectures that make frequent feature releases easier. Some of these systems are also pushing the envelope in customer experience and offering innovative and reasonable pricing schemes for core banking replacements. More importantly, they claim not to compromise on the core tenet of faultless transaction processing.

Most banking leaders are aware of the significance of their core banking system, but many do not have explicit strategies tied to the core. And as banking continues to be disrupted, the traditional core architecture may not be able to deliver for incumbent banks; and given the long lead times required for transitioning to a new core, they need to set their strategies in motion now.

The best place to begin this effort is by answering five questions:

Does our legacy core banking system require intervention?

What interventions are possible to stave off a full transformation, if a core banking replacement is needed, what are the options.

- What are the core elements of a good business case for such a transformation ?

What does a bank do next?

Another set of simple questions can give decision-makers a sense of the urgency of their core system problem (Exhibit 1). Affirmative answers to more than two of the questions indicate a potential problem and merit further intervention.

It is important to carry out this exercise dispassionately and in a business-risk focused manner. This does not mean taking a myopic view of the problem. If a bank believes that there are no problems now, but there could be in the future, then preparing for an intervention now may make sense. It is common for core banking projects to take two to three years to complete, so the assessment should be made considering a medium-term horizon.

Contrary to popular opinion, a “rip-and-replace” is not the only possible intervention—and often it is often actually not the right choice. Depending on the urgency, several responses are possible, ranging from small tactical changes to large-scale re-architecture. Measures like this can extend the life of a core banking system by as long as five to ten years, which is especially valuable for banks that lack the capital to install a new core banking system, have other near-term priorities, or want to wait until more advanced offerings come to market.

Many banks have used these measures (popularly known as “hollowing out”) to extend the service life of their core banking system by many years, with a lot of success, and more importantly without slowing down their “digital” journeys.

Exhibit 2 shows a (non-exhaustive) range of options available for extending the effective life of a core banking system. It is important to remember that these are at best medium-term measures.

There are two main options (with a few variations) for banks that conclude that they need to replace their core banking system: a traditional enterprise core banking system (self-hosted or as a utility) and a next-generation cloud-based core banking system .

Most current implementations are still of the traditional variety. But we are seeing an increase in banks of all sizes putting off traditional core implementations with the aim of experimenting with next-gen systems.

There is some evidence to suggest that banks will try and shift en masse to a cloud-based microservice architecture in the next few years. The core method of communication between machines will be APIs. Armed with a micro-service based architecture, the new core banking applications will become core enablers of the shift to this architecture. Traditional core banking providers have become aware of the need and potential inherent in a cloud-based microservice architecture; banking leaders should keep a close watch on developments here. We also expect to see some M&A activity between traditional and next-gen core banking system providers.

For now, there are four primary issues that prevent banks from replacing their core applications with next-generation core banking applications.

- The “at-scale” problem: Banks are very risk averse when it comes to core replacement, and rightfully so. Given how embedded these core applications are, banks tend to prefer a tried and tested system to replace them. It is likely that once the first bank successfully implements a large, “at-scale” next-gen core system, the floodgates of demand will open. We increasingly see banks willing to experiment with these players and put their own engineering resources to work to accelerate this trend.

- The “functionality” problem: Traditional core banking systems come with a range of product and process functionality and are made for heavy customization to meet the individual needs of the bank. Next-generation core banking systems are designed to support a slightly more limited set of products and processes, but with a versatile toolkit (a software development kit, or a repository of APIs), and fulfill additional needs using an ecosystem of fintech or traditional partners. This is the right architectural answer, as it ensures loose coupling and fewer customization problems down the line, but will take some getting used to for traditional banks. We see this as an opportunity for banks to start building their ecosystem muscle

- The “integration” problem: This problem is proving to be a little more intractable. Banks expect new core banking systems to integrate with their existing stack of channels, customer-relationship-management systems, data architecture, risk systems, and middleware—all of which are very difficult to replace and represent hundreds of millions of dollars of investment over the years, meaning they cannot be written off without causing significant disruption and losses. The problem is that this integration entails high risk and high cost. The incumbent core banking system has usually undergone significant customization and development, reflecting changes in business logic over decades. Untangling the integration from the old system and re-integrating the new core banking system is an extremely difficult exercise—the banking equivalent of a high-risk brain surgery. For a medium-size bank, the cost of this integration could exceed $50 million depending upon its complexity; for larger banks, $300 million to $400 million is not unheard of (based on estimates for traditional implementations). Most banks understandably have very little appetite for this sort of expense. Banks expect to avoid this problem by installing next-generation core banking systems separate from the current stack, migrating customers gradually into the new stack over time and executing a “reverse-takeover” of the old stack. We believe there is a significant opportunity for banks to use this as a forcing mechanism to decommission their redundant systems, simplify their product set, and improve their technology skills, specifically in the areas of cloud, API based ecosystems, and automation in general.

- The public cloud problem: There are a few other issues related to core banking systems on the public cloud. Most banks are just finding their feet in this arena and starting to come to grips with the security implications of the cloud. It will take some time for banks to start storing public data on the cloud without any fear. We see a lot of positive momentum in this area, with “neo banks” leading the way. We also see very sophisticated; and constructive engagement by regulators as far as cloud hosting is concerned. We anticipate that as banks start honing their cloud operating models, this will soon become a non-issue.

What are the elements of a good core banking business case?

Whatever option is chosen, an initiative like core banking transformation requires a solid business case. This is not a trivial exercise: a core banking transformation is akin to replacing the foundation of a building, and is therefore not always amenable to a straightforward revenue-based business case. Traditional core banking replacements have tried to make their case by adding in cost-saving elements through process automation and clean-ups, but it has proven very difficult to pay for a core banking transformation purely through efficiencies.

Next-generation core banking systems may present some additional advantages in making a business case because of their architecture and business model. Some examples:

- Faster time to market for new products if they are truly API driven

- Faster set up of ecosystems

- Reduced cost of change if testing is truly automated and if core banking vendors follow a “train the trainer” model and not a “consulting plus model”

- Reduced upfront costs if the core banking vendor charges fees based on revenue-like events such as customer uptake or profits

The next steps for any bank depend, naturally, upon the context. For some banks, the core system is an urgent priority; for others less so. Some banks have an appetite for experimentation, while others prefer to be followers and wait for other incumbents to pioneer a new core banking system. In general, we expect that core banking implementations will become cheaper and their architecture will become more and more open. Irrespective of appetite for change, there are several no-regret moves banks can make now:

- Make a list of tactical modernization needs for the current core banking system, but invest only if there is a burning need. Minimize any strategic non-reusable investment on the current core banking system, unless it is expected to be the bank’s core system for the next decade.

- Maintain general preparedness for a migration. This includes maintaining a clean Chart of Accounts and a clean set of customer accounts. Ensure that duplicate, unpopular, or redundant products are minimized, and dormant accounts or inactive accounts are reduced where regulation allows it.

- If you can experiment with a new application, do so. If an affordable opportunity arises to set up a new stack using a next-gen core banking system, a bank should grab the chance to get learn about managing a core system in the cloud.

- Build up core talent. Start building up a core team made up of cloud specialists, data engineers, and core banking subject matter experts in product, finance, and operations. This core team does not need to be more than six to seven people.

Even if the core banking system is not an immediate issue for a bank, it is very likely to reach the C-suite agenda at some point. Next-gen cloud-based core banking systems are gaining more and more traction, and they will rapidly try to become natural alternatives to traditional core banking systems. Banks should start laying the no-regret groundwork and do all they can now to prepare for a migration to a newer system in the medium-term without neglecting tactical modernization of the existing core.

- Ad Creative Eye-catching designs that perform

- Social Media Creative Engaging assets for all platforms

- Email Design Templates & designs to grab attention

- Web Design Growth-driving designs for web

- Presentation Design Custom slide decks that stand out

- Packaging & Merch Design Head-turning apparel & merch

- eBook & Digital Report Design Your digital content supercharged

- Print Design Beautiful designs for all things printed

- Illustration Design Visual storytelling for your brand

- Brand Identity Design Expertise & custom design services

- Concept Creation Ideas that will captivate your audience

- Video Production Effortless video production at scale

- AR/3D Design New creative dimensions that perform

- AI-Enhanced Creative Human expertise at AI scale

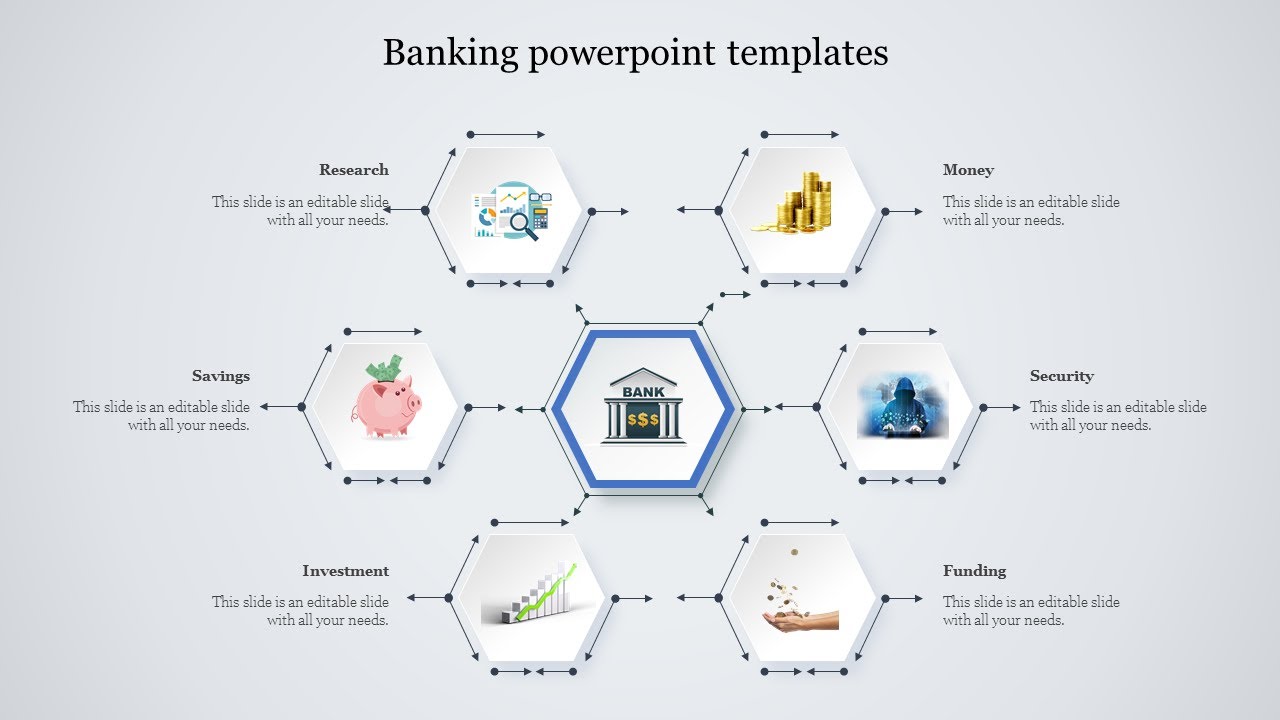

Create a striking yet easy to follow banking presentation using the Banking PowerPoint Template . This design incorporates relevant banking aspects through familiar icons such the currency signs, dollar bills, vault, time and other useful icons significant to the banking industry. This PowerPoint template is completely editable. Its background can be set to plain colors or to an image such as the world map. It has several clipart that accentuate the banking idea in each slide. The template also has PowerPoint clipart that are scalable depending on the user’s preference. It could be used as a small icon or as the main illustration in the slide. The presenter can use this banking template and its banking icons set as it is or with other PowerPoint Diagrams in our gallery.

A bank’s main business transactions concern money or cash and other monetary instruments. Banking institutions starts making money by earning the trust people whom eventually make deposits to the bank. The bank safe keeps the depositors’ money while making them earn a nominal interest. However, banks don’t just keep the money as an actual physical deposit stored in their vault. Banks lend these “deposits” to businesses and individuals and place significant amount of interest on those barrowed money. Through time, the banking industry has developed several other products that work similarly as money. One of which is the credit card. A credit card is a popular term used for a credit account in a banking institution. It is commonly utilized by an electronically capable plastic card. These cards store the owner’s credit and personal information. This information has also become accessible through the online banking system, enabling the user to use the account in online transactions without the actual plastic card. This transaction set-up has now evolved to a different type accessibility known as mobile banking. It is the ability of the user to make online transactions using a mobile phone equipped with the bank’s mobile application.

You must be logged in to download this file.

Favorite Add to Collection

Details (13 slides)

Supported Versions:

Subscribe today and get immediate access to download our PowerPoint templates.

Related PowerPoint Templates

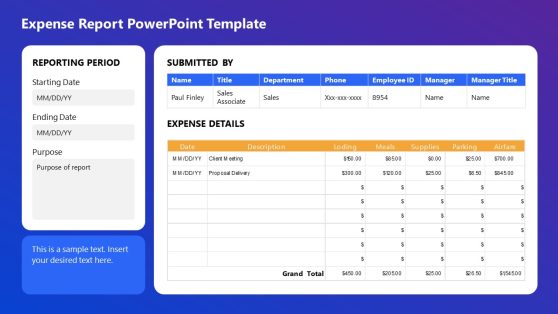

Expense Report PowerPoint Template

Financial Cash Flow KPI PowerPoint Template

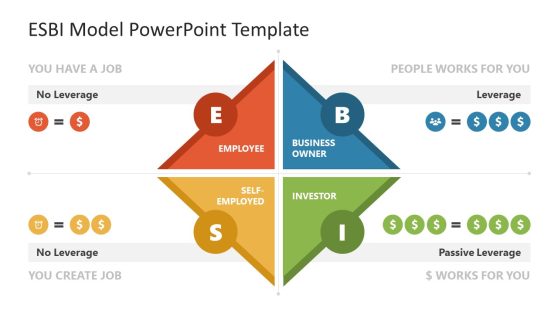

ESBI Model PowerPoint Template

Buy Now Pay Later PowerPoint Template

Got any suggestions?

We want to hear from you! Send us a message and help improve Slidesgo

Top searches

Trending searches

solar eclipse

25 templates

145 templates

biochemistry

37 templates

12 templates

sunday school

65 templates

education technology

181 templates

Banking Services Project Proposal

Banking services project proposal presentation, free google slides theme and powerpoint template.

Whenever something affects our finances, it becomes something that requires our interest. Of course! But how about new banking services that are becoming a novelty in today's world? People are afraid of changes, but you can overcome that perception. With this new template and its modern design, you can present your project proposal and be sure to be heard. Explain what your project is about as you let the gradients, the shapes and the linear icons (and some photos) do some magic, which is catch the attention of your intended audience!

Features of this template

- 100% editable and easy to modify

- 33 different slides to impress your audience

- Contains easy-to-edit graphics such as graphs, maps, tables, timelines and mockups

- Includes 500+ icons and Flaticon’s extension for customizing your slides

- Designed to be used in Google Slides and Microsoft PowerPoint

- 16:9 widescreen format suitable for all types of screens

- Includes information about fonts, colors, and credits of the free resources used

How can I use the template?

Am I free to use the templates?

How to attribute?

Attribution required If you are a free user, you must attribute Slidesgo by keeping the slide where the credits appear. How to attribute?

Related posts on our blog.

How to Add, Duplicate, Move, Delete or Hide Slides in Google Slides

How to Change Layouts in PowerPoint

How to Change the Slide Size in Google Slides

Related presentations.

Premium template

Unlock this template and gain unlimited access

Home Collections Financials Banking

Free Banking Presentation Templates

Tired of boring bank presentations try free banking powerpoint templates and google slides from slide egg we've slides for every banking topic, from investment strategies to mobile apps, designed to make your presentation shine. easy to edit, royalty-free, and available in multiple formats. so, skip the stress and download your free templates today.

- Diverse themes: A wide range of banking topics, from mobile banking apps and online banking systems to commercial loan processes and digital banking security tips are available here. We even have special slides dedicated to International Banking Day!

- Creative and engaging: Forget boring bullet points and usual layouts. Our banking slides are bursting with vibrant colors, captivating infographics, and dynamic layouts that keep your audience glued to the screen.

- Flexibility at your fingertips: Whether you prefer PowerPoint or Google Slides, portrait or landscape, 4:3 or 16:9 aspect ratio, we've slides here! Choose the format that best suits your needs and platform.

Become an expert with SlideEgg

How to make a banking PowerPoint presentation

We're here to help you, what kind of banking presentation templates do you have.

We have a wide variety of templates for all your banking needs, including slides on investment banking, mobile banking, commercial loans, online banking, E-wallets, and more. We even have special slides for International Banking Day!

Are your templates free?

Yes, we offer a selection of free banking templates to get you started. You can also upgrade to a premium plan for access to even more templates and features.

Can I edit the templates?

Absolutely! All our templates are 100% editable, so you can customize them to match your brand and message. Change colors, fonts, layouts – the possibilities are endless!

Can I use your templates for commercial purposes?

Yes, our templates are royalty-free, so you can use them for both personal and commercial presentations.

How can I download the templates?

Simply browse our "Banking Presentation Templates" category page and click on the template you want to download. You'll be able to download it as a PowerPoint file or a Google Slides file.

I need help using the templates. What can I do?

We're happy to help! Contact our support team for assistance.

What are some tips for creating a great banking presentation?

Use clear and concise language. Keep your slides visually appealing. Use data and charts to support your points. Practice your presentation beforehand.

- Infographic

Banking Technology Vision 2021

Research report.

- The past year has poked holes in long-standing norms about how banks operate.

- 99% of banking executives agree that the COVID-19 pandemic created an unprecedented stress test for their organization.

- While it will be tempting for banks to retreat to what they know, 2020 emphasized the need for a different path.

- Those that continue to have a clear-eyed perspective on digital transformation will emerge as the leaders of the future.

Masters of change at a moment of truth

The COVID-19 pandemic was a stress test of unprecedented proportions for banks, putting their technology architecture, strategy and workforces under immense pressure. For most, the crisis was a sobering experience that dispelled any illusions about how far they had progressed with their cloud migrations and digital transformation.

Yet amid the many challenges of the pandemic, silver linings could be found in how quickly banks were able to adapt to a new reality. Most worked fast to rebuild their business with a digital core that could support a more flexible workforce, a more agile operating model and a range of emerging customer needs.

Banks worldwide have generally weathered the crisis well, playing a key role in channeling unprecedented public-sector stimulus, displaying flexibility on payments holidays and short-term credit, and rapidly deploying remote interaction solutions to make up for the lack of face-to-face engagement.

Their next challenge, after making technology and business model changes in a matter of months, will be to sustain the agility and innovation beyond the pandemic. The leading banks understand that the pace of change isn’t likely to slow down anytime soon—and they also know that COVID-19 has accelerated changes that would otherwise have taken years to materialize.

The Banking Technology Vision for 2021 identifies the emerging technology trends that hold the greatest potential to disrupt the industry beyond the pandemic. The cross-industry survey sample includes some 700 banking IT and business executives from around the world to get their perspectives on the technology trends shaping the world of finance.

of banking executives say the pace of digital transformation for their organization is accelerating

agree that organizations are operating with a renewed sense of purpose

2021 tech trends

In this report, we identify five Technology Vision trends that resonate for banks.

Stack strategically

In the years ahead, banks will compete on their architecture. The winners will be those that build and wield the most competitive technology stack.

Mirrored world

Banks will be able to create living models of product lifecycles, customer behaviors and journeys, market scenarios and more.

I, technologist

Natural language processing, low-code platforms, robotic process automation and more put capabilities in the hands of those closest to the business.

Anywhere, everywhere

Beyond the pandemic, leading banks are considering how to transform remote work from an accommodation to an advantage.

From me to we

Banks are rethinking how they operate in the context of multiparty systems, Open Banking regulation and open data.

The ultimate guide to banking in the metaverse

Leaders will set themselves apart from the laggards in the banking industry by using the COVID pandemic as a springboard—with the winners embracing leading-edge technology to evolve and transform their business.

Accelerating transformation

COVID-19 catalyzed the biggest reinvention of banking since the global financial crisis. Now, senior leaders at banks are focusing on compressing what had been decade-long transformation agendas into two-to-three-year sprints. They know they cannot fall back on old practices if they are to get on the right side of the digital achievement gap.

Banks with a clear-eyed perspective are continuing to expedite their digital transformations, reimagining everything from their people and their data to their architectures and ecosystems. A new age of banking competition is dawning—one where architecture matters, and leaders will be decided not just on the success of their business plans, but on the ingenuity of their technology choices.

Banking Top 10 Trends for 2022

Michael Abbott

Senior Managing Director – Global Banking Lead

Fabrice Asvazadourian

Senior Managing Director – Banking, Europe

DANIEL LANIADO

Managing Director – Banking, Latin America

Purpose: Driving powerful transformation for banks

Banking Cloud Altimeter

Frequently asked questions, what is new in banking technology.

Tomorrow’s leaders are looking at how they can build technology architectures that they can wield as a competitive weapon. The Tech Vision research for 2021 shows that 89% of banking executives agree that their organization’s ability to generate business value will increasingly be based on the limitations and opportunities of their technology architecture.

Amid the growing diversity of technology capabilities across the stack, banks are determining which combinations of technologies enable them to develop one-of-a-kind offerings for their markets. Cloud strategies and microservices are playing a key role as banks look to create an adaptive technology foundation and avoid being weighed down by their legacy systems.

What technology is used in banking?

Most banks have moved some enterprise applications, data & analytics and surrounding architecture to the cloud. However, many still rely on the same core banking systems that have powered their operations for decades. These legacy platforms are constraining banks’ agility in keeping up with the speed at which digital innovations, new regulations and rising customer expectations are reshaping the market.

Forward-thinking banks are thus evaluating how they can hasten the pace and mitigate the risks of migrating to the cloud and including their core systems. The rewards for those that succeed are significant. They will be able to drive down costs, achieve greater speed and agility, and create platforms that can support their innovation efforts.

Why is banking going more digital?

The COVID-19 pandemic prompted accelerated adoption of digital banking and payments tools and platforms among banking customers. A sharp rise in demand for remote services, frictionless payments, and new ways of building trust exposed what had been left undone with banks’ existing digital transformations. Leading banks are moving fast to close this digital gap.

What is next in digital banking?

Digital payments, mobile banking apps, and online banking experiences meet consumers‘ functional needs, yet the customer experience across most is broadly similiar and, often, emotionally void. The challenge leading banks are working on solving is how to create a differentiated experience, innovative propositions and a human connection when banking is in danger of becoming a faceless, price-sensitive commodity.

To set themselves apart, customer-facing banks need to be able to inject humanity at scale into their digital experiences. They need the capabilities to leverage internal and external data, and to engage digitally with clients in an empathetic way across multiple channels. An alternative approach is to become a utility that provides banking products and services that are embedded into other companies’ digital customer experiences.

Related capabilities

- Bank Management

- Popular Categories

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Powerpoint Templates and Google slides for Bank Management

Save your time and attract your audience with our fully editable ppt templates and slides..

Item 1 to 60 of 665 total items

- You're currently reading page 1

This complete deck covers various topics and highlights important concepts. It has PPT slides which cater to your business needs. This complete deck presentation emphasizes Electronic Banking Management To Enhance Transaction Transparency Complete Deck and has templates with professional background images and relevant content. This deck consists of total of Seventy Nine slides. Our designers have created customizable templates, keeping your convenience in mind. You can edit the color, text and font size with ease. Not just this, you can also add or delete the content if needed. Get access to this fully editable complete presentation by clicking the download button below.

Deliver an informational PPT on various topics by using this Online Banking Management For Operational Efficiency Powerpoint Presentation Slides. This deck focuses and implements best industry practices, thus providing a birds-eye view of the topic. Encompassed with Seventy Seven slides, designed using high-quality visuals and graphics, this deck is a complete package to use and download. All the slides offered in this deck are subjective to innumerable alterations, thus making you a pro at delivering and educating. You can modify the color of the graphics, background, or anything else as per your needs and requirements. It suits every business vertical because of its adaptable layout.

This complete deck covers various topics and highlights important concepts. It has PPT slides which cater to your business needs. This complete deck presentation emphasizes E Banking Management And Services Powerpoint Presentation Slides and has templates with professional background images and relevant content. This deck consists of total of seventy five slides. Our designers have created customizable templates, keeping your convenience in mind. You can edit the color, text and font size with ease. Not just this, you can also add or delete the content if needed. Get access to this fully editable complete presentation by clicking the download button below.

This complete presentation has PPT slides on wide range of topics highlighting the core areas of your business needs. It has professionally designed templates with relevant visuals and subject driven content. This presentation deck has total of fifty two slides. Get access to the customizable templates. Our designers have created editable templates for your convenience. You can edit the color, text and font size as per your need. You can add or delete the content if required. You are just a click to away to have this ready-made presentation. Click the download button now.

Deliver this complete deck to your team members and other collaborators. Encompassed with stylized slides presenting various concepts, this Bank Risk Management Tools And Techniques Powerpoint Presentation Slides is the best tool you can utilize. Personalize its content and graphics to make it unique and thought-provoking. All the forty five slides are editable and modifiable, so feel free to adjust them to your business setting. The font, color, and other components also come in an editable format making this PPT design the best choice for your next presentation. So, download now.

Presenting Introducing Operational Risk Management Framework In Banks Complete Deck. Our slideshow is easy to download and can be presented in standard screen(14:6) and widescreen (16:9) ratios. You can alter the font style, font color, and other components. This presentation is compatible with Google slides. This PPT can be transformed into numerous documents or image formats like PDF or JPEG. High-quality graphics ensure that the picture quality is maintained.

Deliver this complete deck to your team members and other collaborators. Encompassed with stylized slides presenting various concepts, this Credit Risk Management Frameworks For Banks Powerpoint Presentation Slides is the best tool you can utilize. Personalize its content and graphics to make it unique and thought-provoking. All the fourty three slides are editable and modifiable, so feel free to adjust them to your business setting. The font, color, and other components also come in an editable format making this PPT design the best choice for your next presentation. So, download now.

If you require a professional template with great design, then this Bank Data Management Powerpoint Ppt Template Bundles is an ideal fit for you. Deploy it to enthrall your audience and increase your presentation threshold with the right graphics, images, and structure. Portray your ideas and vision using twenty slides included in this complete deck. This template is suitable for expert discussion meetings presenting your views on the topic. With a variety of slides having the same thematic representation, this template can be regarded as a complete package. It employs some of the best design practices, so everything is well-structured. Not only this, it responds to all your needs and requirements by quickly adapting itself to the changes you make. This PPT slideshow is available for immediate download in PNG, JPG, and PDF formats, further enhancing its usability. Grab it by clicking the download button.

If you require a professional template with great design, then this Bank Management System Powerpoint Ppt Template Bundles is an ideal fit for you. Deploy it to enthrall your audience and increase your presentation threshold with the right graphics, images, and structure. Portray your ideas and vision using fifteen slides included in this complete deck. This template is suitable for expert discussion meetings presenting your views on the topic. With a variety of slides having the same thematic representation, this template can be regarded as a complete package. It employs some of the best design practices, so everything is well-structured. Not only this, it responds to all your needs and requirements by quickly adapting itself to the changes you make. This PPT slideshow is available for immediate download in PNG, JPG, and PDF formats, further enhancing its usability. Grab it by clicking the download button.

Presenting Implementing Big Data for Employee Performance and Management in the Banking Industry. Our PowerPoint experts have included all the necessary templates, designs, icons, graphs, and other essential material. This deck is well crafted by extensive research. Slides consist of amazing visuals and appropriate content. These PPT slides can be instantly downloaded with just a click. Compatible with all screen types and monitors. Supports Google Slides. Premium Customer Support is available. Suitable for use by managers, employees, and organizations. These slides are easily customizable. You can edit the color, text, icon, and font size to suit your requirements.

If you require a professional template with great design, then this Bank Manager Powerpoint PPT Template Bundles is an ideal fit for you. Deploy it to enthrall your audience and increase your presentation threshold with the right graphics, images, and structure. Portray your ideas and vision using eight slides included in this complete deck. This template is suitable for expert discussion meetings presenting your views on the topic. With a variety of slides having the same thematic representation, this template can be regarded as a complete package. It employs some of the best design practices, so everything is well-structured. Not only this, it responds to all your needs and requirements by quickly adapting itself to the changes you make. This PPT slideshow is available for immediate download in PNG, JPG, and PDF formats, further enhancing its usability. Grab it by clicking the download button.

It covers all the important concepts and has relevant templates which cater to your business needs. This complete deck has PPT slides on E Banking Management Process Solutions Resource Dollar Icon with well suited graphics and subject driven content. This deck consists of total of twelve slides. All templates are completely editable for your convenience. You can change the colour, text and font size of these slides. You can add or delete the content as per your requirement. Get access to this professionally designed complete deck presentation by clicking the download button below.

Deliver a credible and compelling presentation by deploying this Bank Loan Process Documents Management Corporate Management Service Business. Intensify your message with the right graphics, images, icons, etc. presented in this complete deck. This PPT template is a great starting point to convey your messages and build a good collaboration. The twelve slides added to this PowerPoint slideshow helps you present a thorough explanation of the topic. You can use it to study and present various kinds of information in the form of stats, figures, data charts, and many more. This Bank Loan Process Documents Management Corporate Management Service Business PPT slideshow is available for use in standard and widescreen aspects ratios. So, you can use it as per your convenience. Apart from this, it can be downloaded in PNG, JPG, and PDF formats, all completely editable and modifiable. The most profound feature of this PPT design is that it is fully compatible with Google Slides making it suitable for every industry and business domain.

If you require a professional template with great design, then this Bank Automation Implementation Gear Management Investment Strategy is an ideal fit for you. Deploy it to enthrall your audience and increase your presentation threshold with the right graphics, images, and structure. Portray your ideas and vision using twelve slides included in this complete deck. This template is suitable for expert discussion meetings presenting your views on the topic. With a variety of slides having the same thematic representation, this template can be regarded as a complete package. It employs some of the best design practices, so everything is well-structured. Not only this, it responds to all your needs and requirements by quickly adapting itself to the changes you make. This PPT slideshow is available for immediate download in PNG, JPG, and PDF formats, further enhancing its usability. Grab it by clicking the download button.

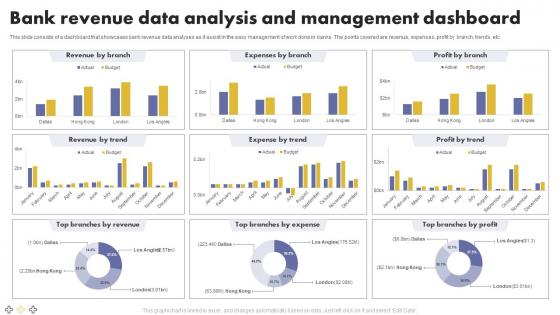

This slide consists of a dashboard that showcases bank revenue data analyses as it assist in the easy management of work done in banks. The points covered are revenue, expenses, profit by branch, trends, etc. Introducing our Bank Revenue Data Analysis And Management Dashboard set of slides. The topics discussed in these slides are Revenue By Branch, Expenses By Branch, Profit By Branch. This is an immediately available PowerPoint presentation that can be conveniently customized. Download it and convince your audience.

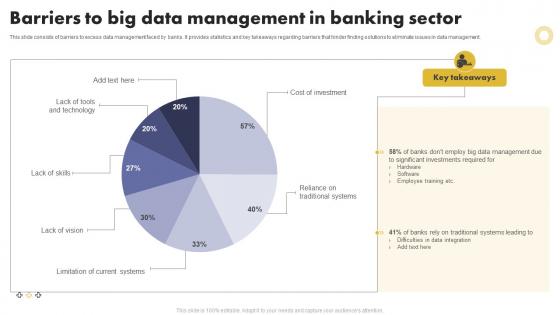

This slide consists of barriers to excess data management faced by banks. It provides statistics and key takeaways regarding barriers that hinder finding solutions to eliminate issues in data management. Presenting our well structured Barriers To Big Data Management In Banking Sector. The topics discussed in this slide are Tools And Technology, Traditional Systems, Lack Of Vision. This is an instantly available PowerPoint presentation that can be edited conveniently. Download it right away and captivate your audience.

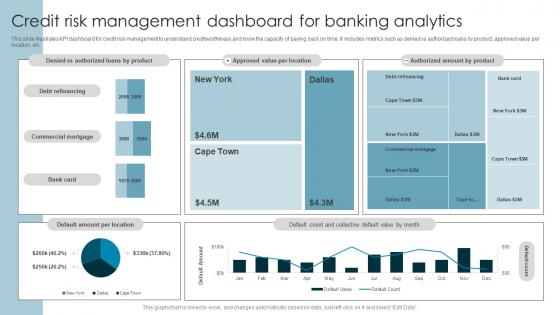

This slide illustrates KPI dashboard for credit risk management to understand creditworthiness and know the capacity of paying back on time. It includes metrics such as denied vs authorized loans by product, approved value per location, etc. Introducing our Credit Risk Management Dashboard For Banking Analytics set of slides. The topics discussed in these slides are Management, Dashboard, Analytics. This is an immediately available PowerPoint presentation that can be conveniently customized. Download it and convince your audience.

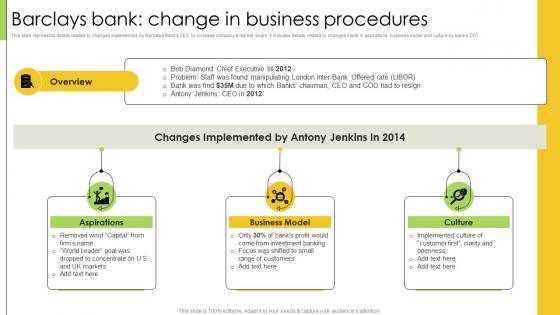

This slide represents details related to changes implemented by Barclays Banks CEO to increase companys market share. It includes details related to changes made in aspirations, business model and culture by banks CEO. Increase audience engagement and knowledge by dispensing information using Change Management Case Studies Barclays Bank Change In Business Procedures CM SS. This template helps you present information on three stages. You can also present information on Aspirations, Investment Banking, Barclays Bank, Clarity And Openness using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

This complete deck can be used to present to your team. It has PPT slides on various topics highlighting all the core areas of your business needs. This complete deck focuses on Banking Value Chain Infrastructure Management Development Procurement Marketing Services and has professionally designed templates with suitable visuals and appropriate content. This deck consists of total of ten slides. All the slides are completely customizable for your convenience. You can change the colour, text and font size of these templates. You can add or delete the content if needed. Get access to this professionally designed complete presentation by clicking the download button below.

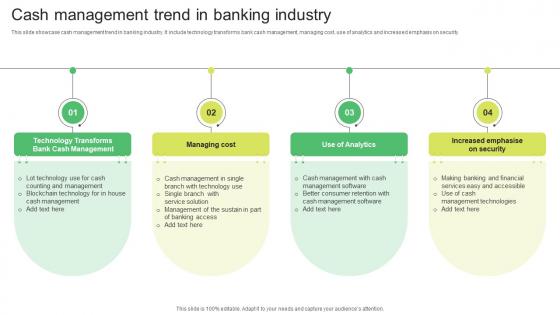

This slide showcase cash management trend in banking industry. It include technology transforms bank cash management, managing cost, use of analytics and increased emphasis on security. Introducing our premium set of slides with Cash Management Trend In Banking Industry. Ellicudate the four stages and present information using this PPT slide. This is a completely adaptable PowerPoint template design that can be used to interpret topics like Technology, Managing, Analytics. So download instantly and tailor it with your information.

Following slide showcases process of patch management to ensure security of banking systems. The purpose of this slide is to outline a series of steps to align with industry regulations while maintaining the security and stability of financial operations. It includes steps such as regulatory framework, etc.Presenting our set of slides with Ensuring Security Compliance For Banking Systems With Patch Management Process. This exhibits information on seven stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Vulnerability Management, Compliance Validation, Documentation Improvement

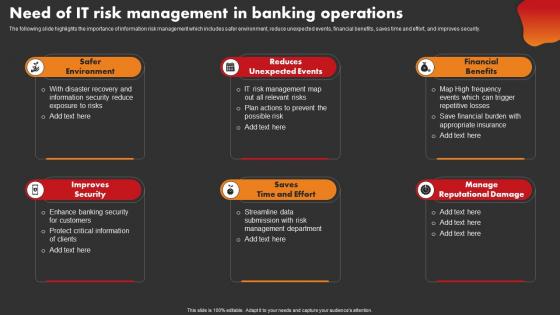

The following slide highlights the importance of information risk management which includes safer environment, reduce unexpected events, financial benefits, saves time and effort, and improves security. Increase audience engagement and knowledge by dispensing information using Need Of It Risk Management In Banking Operations Strategic Improvement In Banking Operations. This template helps you present information on six stages. You can also present information on Safer Environment, Reduces Unexpected Events, Financial Benefits using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

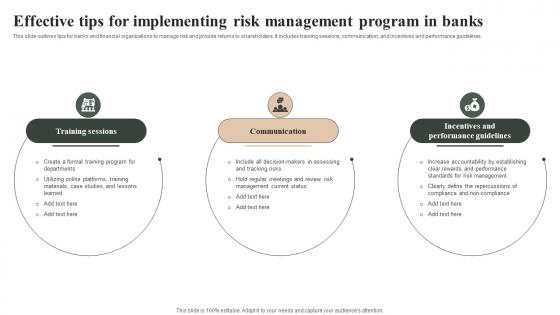

This slide outlines tips for banks and financial organizations to manage risk and provide returns to shareholders. It includes training sessions, communication, and incentives and performance guidelines. Presenting our set of slides with Effective Tips For Implementing Risk Management Program In Banks. This exhibits information on three stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Training Sessions, Communication, Incentives And Performance Guidelines.

Presenting our Bank Assets Under Management In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Bank Assets Under Management. This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Presenting Bank Operations Manager Jobs In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase four stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like Bank Operations Manager Jobs. This well-structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

This slide shows the benefits of deploying a risk management strategy for the bank. It includes financial stability, regulatory compliance, cost reduction, and competitive advantage Introducing Benefits Of Risk Management Plan For Banks Strategic Improvement In Banking Operations to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Financial Stability, Regulatory Compliance, Competitive Advantage , using this template. Grab it now to reap its full benefits.

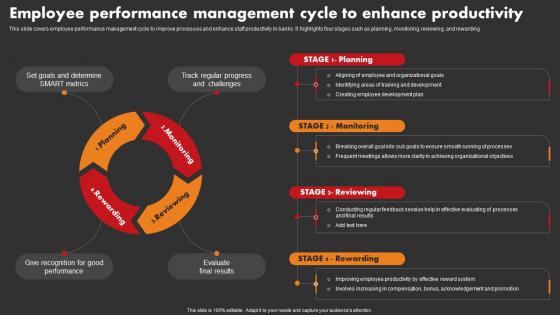

This slide covers employee performance management cycle to improve processes and enhance staff productivity in banks. It highlights four stages such as planning, monitoring, reviewing, and rewarding Introducing Employee Performance Management Cycle To Enhance Strategic Improvement In Banking Operations to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Planning, Monitoring, Reviewing, using this template. Grab it now to reap its full benefits.

Presenting our Bank Wealth Management Salary In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases three stages. It is useful to share insightful information on Bank Wealth Management Salary This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Presenting our Management Liquidity Risk Banks In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Management Liquidity Risk Banks This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Presenting Disaster Management Banking Sector In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase four stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like Disaster Management Banking Sector. This well structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

Presenting our set of slides with Bank Data Management And Reporting Tool Icon. This exhibits information on three stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Bank Data Management, Reporting Tool Icon.

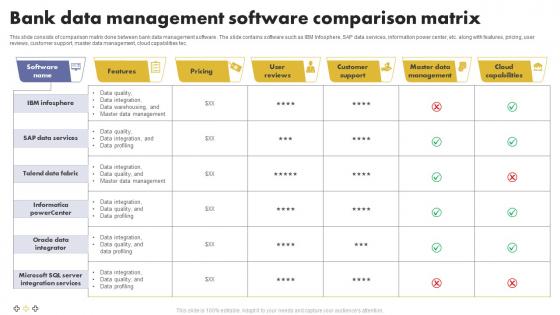

This slide consists of comparison matrix done between bank data management software. The slide contains software such as IBM Infosphere, SAP data services, information power center, etc. along with features, pricing, user reviews, customer support, master data management, cloud capabilities tec. Introducing our Bank Data Management Software Comparison Matrix set of slides. The topics discussed in these slides are Data Services, Talend Data Fabric, Customer Support. This is an immediately available PowerPoint presentation that can be conveniently customized. Download it and convince your audience.

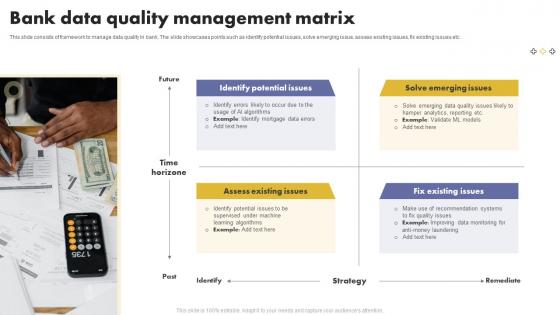

This slide consists of framework to manage data quality in bank. The slide showcases points such as identify potential issues, solve emerging issue, assess existing issues, fix existing issues etc. Presenting our set of slides with Bank Data Quality Management Matrix. This exhibits information on four stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Identify Potential Issues, Solve Emerging Issues, Assess Existing Issues.

This slide consists of benefits initiated on data management in the bank after a thorough evaluation and governance of the work done. It highlights points such as improved data quality, data security, regulatory compliance, operational efficiency, stakeholder confidence, etc. Presenting our set of slides with Benefits Of Governance In Bank Data Management. This exhibits information on five stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Regulatory Compliance, Operational Efficiency, Stakeholder Confidence.

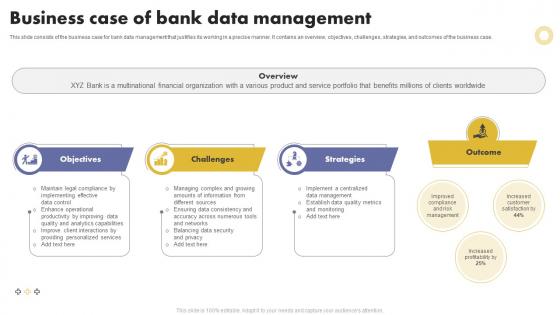

This slide consists of the business case for bank data management that justifies its working in a precise manner. It contains an overview, objectives, challenges, strategies, and outcomes of the business case. Introducing our premium set of slides with Business Case Of Bank Data Management. Ellicudate the four stages and present information using this PPT slide. This is a completely adaptable PowerPoint template design that can be used to interpret topics like Objectives, Challenges, Strategies, Overview. So download instantly and tailor it with your information.

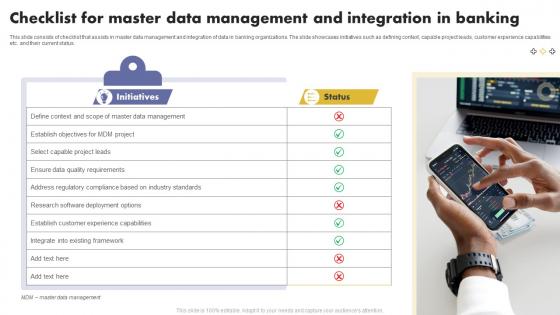

This slide consists of checklist that assists in master data management and integration of data in banking organizations. The slide showcases initiatives such as defining context, capable project leads, customer experience capabilities etc. and their current status. Presenting our set of slides with Checklist For Master Data Management And Integration In Banking. This exhibits information on one stage of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Data Management, Project Leads, Existing Framework.

Introducing our premium set of slides with Cloud Integration Icon For Bank Data Management. Ellicudate the three stages and present information using this PPT slide. This is a completely adaptable PowerPoint template design that can be used to interpret topics like Cloud Integration, Icon For Bank Data Management. So download instantly and tailor it with your information.

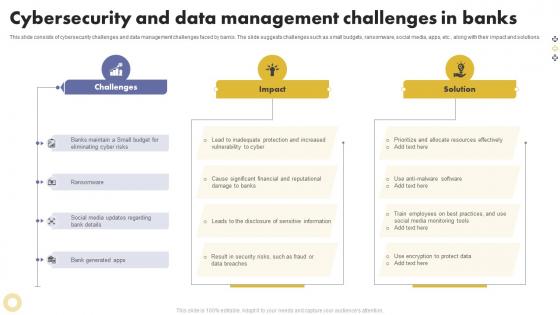

This slide consists of cybersecurity challenges and data management challenges faced by banks. The slide suggests challenges such as small budgets, ransomware, social media, apps, etc. along with their impact and solutions. Introducing our Cybersecurity And Data Management Challenges In Banks set of slides. The topics discussed in these slides are Ransomware, Social Media, Bank Generated Apps. This is an immediately available PowerPoint presentation that can be conveniently customized. Download it and convince your audience.

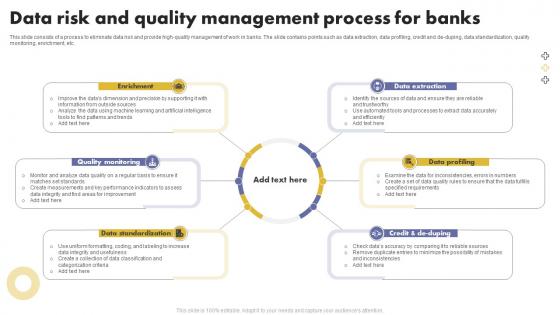

This slide consists of a process to eliminate data risk and provide high quality management of work in banks. The slide contains points such as data extraction, data profiling, credit and de duping, data standardization, quality monitoring, enrichment, etc. Presenting our set of slides with Data Risk And Quality Management Process For Banks. This exhibits information on six stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Enrichment, Data Extraction, Data Profiling, Quality Monitoring.

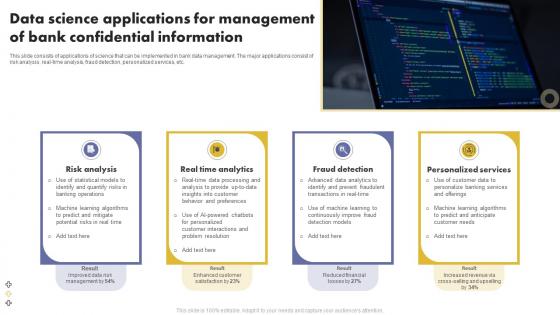

This slide consists of applications of science that can be implemented in bank data management. The major applications consist of risk analysis, real time analysis, fraud detection, personalized services, etc. Introducing our premium set of slides with Data Science Applications For Management Of Bank Confidential Information. Ellicudate the four stages and present information using this PPT slide. This is a completely adaptable PowerPoint template design that can be used to interpret topics like Risk Analysis, Real Time Analytics, Fraud Detection. So download instantly and tailor it with your information.

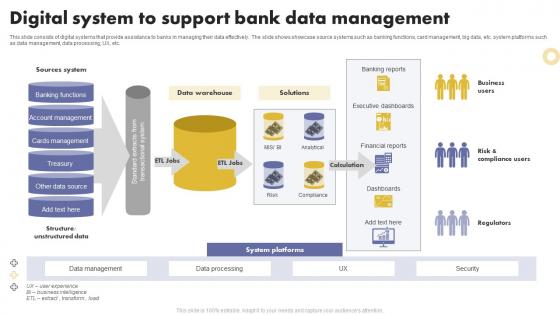

This slide consists of digital systems that provide assistance to banks in managing their data effectively. The slide shows showcase source systems such as banking functions, card management, big data, etc. system platforms such as data management, data processing, UX, etc. Introducing our Digital System To Support Bank Data Management set of slides. The topics discussed in these slides are Sources System, Data Warehouse, Solutions, Calculation. This is an immediately available PowerPoint presentation that can be conveniently customized. Download it and convince your audience.

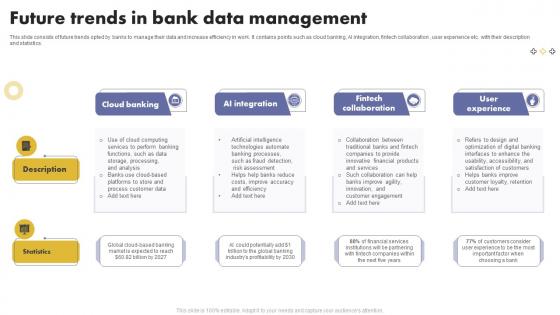

This slide consists of future trends opted by banks to manage their data and increase efficiency in work. It contains points such as cloud banking, AI integration, fintech collaboration, user experience etc. with their description and statistics. Presenting our set of slides with Future Trends In Bank Data Management. This exhibits information on four stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Cloud Banking, Fintech Collaboration, User Experience.

Introducing our premium set of slides with Icon For Issues Identified In Bank Data Management. Ellicudate the three stages and present information using this PPT slide. This is a completely adaptable PowerPoint template design that can be used to interpret topics like Icon For Issues Identified, Bank Data Management. So download instantly and tailor it with your information.

This slide consists of statistics that are the result of a survey conducted in relation to bank data management. It assist in creating reports that assure bank data management with ease. Presenting our set of slides with Statistics Related To Bank Data Management. This exhibits information on six stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Portfolio Optimization, Data Security, Customer Satisfaction.

This slide consists of strategies that assist banks to maintain operational efficiency and regulatory compliance. It shows strategies such as data auditing, locating missing information, validating data, providing feedback, etc., along with descriptions and benefits. Introducing our Strategies For Bank Data Quality Management set of slides. The topics discussed in these slides are Data Auditing, Locating Missing Information, Validating Data. This is an immediately available PowerPoint presentation that can be conveniently customized. Download it and convince your audience.

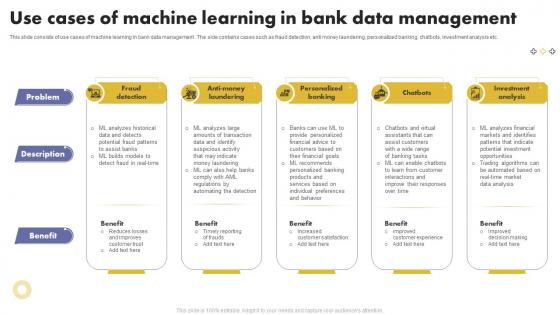

This slide consists of use cases of machine learning in bank data management. The side contains cases such as fraud detection, anti money laundering, personalized banking, chatbots, investment analysis etc. Presenting our set of slides with Use Cases Of Machine Learning In Bank Data Management. This exhibits information on five stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Fraud Detection, Personalized Banking, Investment Analysis.

Presenting our Investment Bank Risk Management In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Investment Bank Risk Management This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Presenting our Vendor Management Training Banks In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases five stages. It is useful to share insightful information on Vendor Management Training Banks. This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

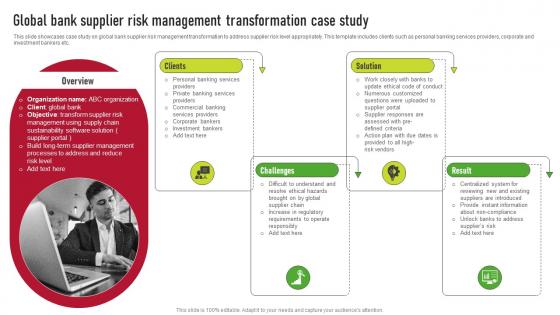

This slide showcases case study on global bank supplier risk management transformation to address supplier risk level appropriately. This template includes clients such as personal banking services providers, corporate and investment bankers etc. Introducing Global Bank Supplier Risk Management Transformation Case Study Supplier Risk Management to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Overview, Clients, Challenges, Solution, using this template. Grab it now to reap its full benefits.

This slide shows various tasks or activities which can be conducted via mobile banking without visiting physical bank branch. It includes tasks such as check account regularly, set up alerts, review transaction history, etc. Deliver an outstanding presentation on the topic using this Account Management Checklist For Mobile Banking E Wallets As Emerging Payment Method Fin SS V. Dispense information and present a thorough explanation of Management, Transaction, Physical using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

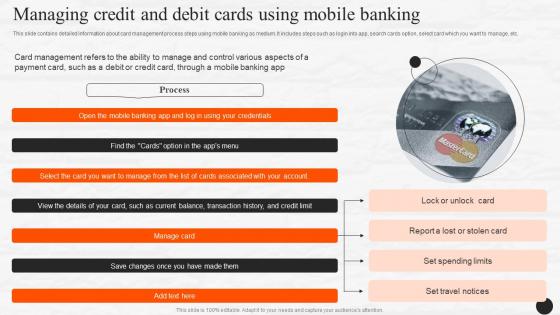

This slide contains detailed information about card management process steps using mobile banking as medium. It includes steps such as login into app, search cards option, select card which you want to manage, etc. Deliver an outstanding presentation on the topic using this Managing Credit And Debit Cards Using Mobile Banking E Wallets As Emerging Payment Method Fin SS V. Dispense information and present a thorough explanation of Management, Credentials, Transaction using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

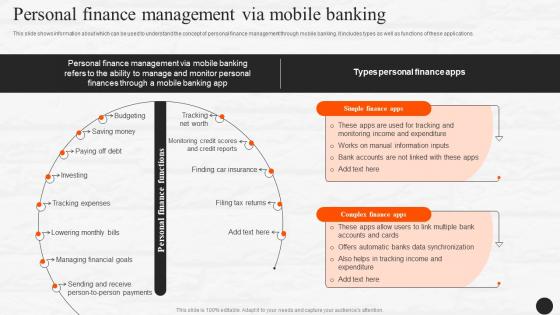

This slide shows information about which can be used to understand the concept of personal finance management through mobile banking. It includes types as well as functions of these applications. Deliver an outstanding presentation on the topic using this Personal Finance Management Via Mobile Banking E Wallets As Emerging Payment Method Fin SS V. Dispense information and present a thorough explanation of Finance, Management, Synchronization using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

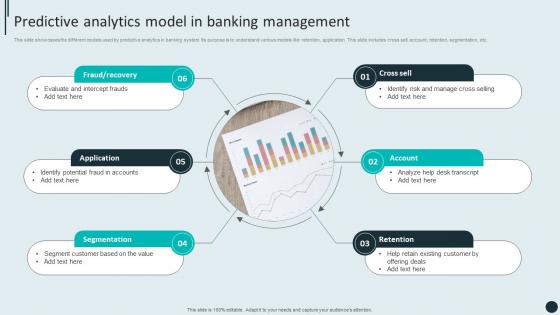

Presenting our set of slides with Predictive Analytics Model In Banking Management. This exhibits information on Six stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Cross Sell, Account, Retention.

This slide provides information regarding customer feedback management with sentiment analysis by gaining deeper insights from customer feedback across various feedback channels. It enables bank to capture positive or negative sentiments along with enhancing overall bank experience. Present the topic in a bit more detail with this Ai Powered Sentiment Analysis Case Study Atom Bank Customer Feedback Management AI SS. Use it as a tool for discussion and navigation on Sentiment, Analysis, Management. This template is free to edit as deemed fit for your organization. Therefore download it now.

Presenting our Bank Strategy Management In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Bank Strategy Management This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

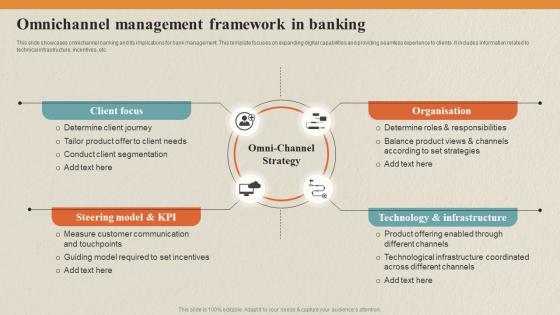

This slide showcases omnichannel banking and its implications for bank management. This template focuses on expanding digital capabilities and providing seamless experience to clients. It includes information related to technical infrastructure, incentives, etc.Increase audience engagement and knowledge by dispensing information using Omnichannel Management Framework In Banking Data Collection Process For Omnichannel. This template helps you present information on four stages. You can also present information on Determine Client Journey, Measure Customer, Required Incentives using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

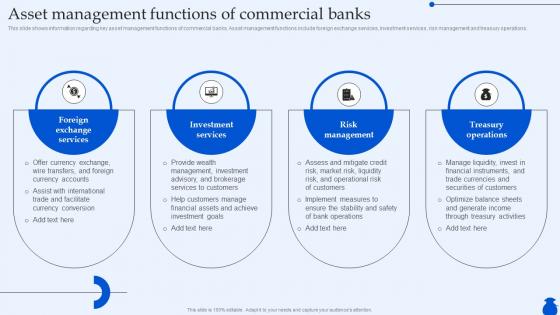

This slide shows information regarding key asset management functions of commercial banks. Asset management functions include foreign exchange services, investment services, risk management and treasury operations. Increase audience engagement and knowledge by dispensing information using Asset Management Functions Of Commercial Banks Ultimate Guide To Commercial Fin SS. This template helps you present information on four stages. You can also present information on Foreign Exchange Services, Investment Services using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

Presenting our Best Banks Wealth Management In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases three stages. It is useful to share insightful information on Best Banks Wealth Management. This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Presenting our Best Wealth Management Banks Examples In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases three stages. It is useful to share insightful information on Best Wealth Management Banks Examples. This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

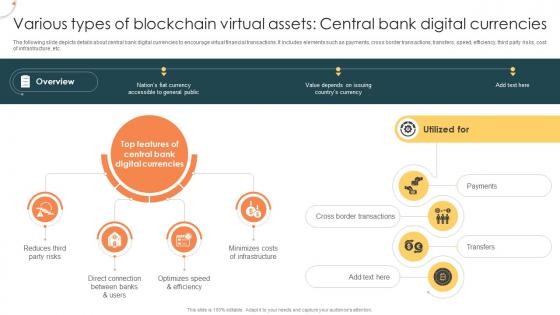

The following slide depicts details about central bank digital currencies to encourage virtual financial transactions. It includes elements such as payments, cross border transactions, transfers, speed, efficiency, third party risks, cost of infrastructure, etc. Introducing Various Types Of Blockchain Virtual Assets Central Bank Digital Managing Digital Wealth BCT SS to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on Payments, Cross Border Transactions, Transfers using this template. Grab it now to reap its full benefits.

Banking System in India

Oct 11, 2014

3.3k likes | 9.32k Views

Banking System in India. Indigenous bankers. Individual bankers like Shroffs, Seths, Sahukars, Mahajans, etc. combine trading and other business with money lending. Vary in size from petty lenders to substantial shroffs

Share Presentation

- sector banks

- branch expansion

- narasimham committee

- 3 years npa

- nationalised banks 1969 1980

Presentation Transcript

Banking Systemin India

Indigenous bankers • Individual bankers like Shroffs, Seths, Sahukars, Mahajans, etc. combine trading and other business with money lending. • Vary in size from petty lenders to substantial shroffs • Act as money changers and finance internal trade through hundis (internal bills of exchange) • Indigenous banking is usually family owned business employing own working capital • At one point it was estimated that IBs met about 90% of the financial requirements of rural India

RBI and indigenous bankers • IB should have their accounts audited by certified chartered accountants • Submit their accounts to RBI periodically • As against these obligations the RBI promised to provide them with privileges offered to commercial banks including • Being entitled to borrow from and rediscount bills with RBI • The IBs declined to accept the restrictions as well as compensation from the RBI • Therefore, the IBs remain out of RBI’s purview

BANKING SYSTEM IN INDIA

SCHEDULED BANK: • which is registered in Second Schedule of the RBI • Must be carrying on a business of banking in India • Must have paid-up capital and reserve of an aggregate value of not less than Rs.5 lakh(100cr.-for New) • It must satisfy RBI- not in a manner detrimental to the interest of depositor • NON SCHEDULED BANK: • Which is not included in Second Schedule of RBI • Not entitled to facility of borrowing & rediscounting

Co-operative Banks

SCHEDULED COMMERCIAL BANKS • PUBLIC SECTOR BANKS • SBI & Associates (SBI Act, 1955) • Nationalised Banks (1969-1980) • PRIVATE SECTOR BANKS: • Post Reform Period 24 banks in pvt. Sector Banks • Initial minimum paid up capital from Rs.100 to Rs.200 crore.

REGIONAL RURAL BANKS • Bank with local knowledge and familiarity • Organisation ability to mobilize deposits, access to money market and modernized outlook • ORGANISATION- Separate body corporate with perpetual succession and common seal- may establish its branches • CAPITAL- Authorised-1 cr.- paid up-50laks- -50% subscribed by Central Govt.-15%State Govt. – 35% by Sponsor Bank

FOREIGN BANKS: Registered outside India- to operate in India the minimum capital requirement of US $25 million, spread over 3 branches, that is, US$ 10million for the 1st and 2nd bank respectively and US$5million for the 3rd branch • The no. of licences fixed is 12 per year both for new and expansion by existing banks

Development Oriented Banking • Historically, close association between banks and some traditional industries- cotton textiles in the west, jute textiles in the east • Banking has not been mere acceptance of deposits and lending money; included development banking • Lead Bank Scheme- opening bank offices in all important localities • Providing credit for development of the district • Mobilising savings in the district. ‘Service area approach’

Progress of banking in India (1) • Nationalisation of banks in 1969: 14 banks were nationalised • Branch expansion: Increased from 8260 in 1969 to 71177 in 2006 • Population served per branch has come down from 64000 to 16000 • A rural branch office serves 15 to 25 villages within a radius of 16 kms • However, at present only 32,180 villages out of 5 lakh have been covered

Progress of banking in India (2) • Deposit mobilisation: • 1951-1971 (20 years)- 700% or 7 times • 1971-1991 (20 years)- 3260% or 32.6 times • 1991- 2006 (11 years)- 1100% or 11 times • Expansion of bank credit: Growing at 20-30% p.a. thanks to rapid growth in industrial and agricultural output • Development oriented banking: priority sector lending

Progress of banking in India (3) • Diversification in banking: Banking has moved from deposit and lending to • Merchant banking and underwriting • Mutual funds • Retail banking • ATMs • Internet banking • Venture capital funds • Factoring

Profitability of Banks(1) • Reforms have shifted the focus of banks from being development oriented to being commercially viable • Prior to reforms banks were not profitable and in fact made losses for the following reasons: • Declining interest income • Increasing cost of operations

Profitability of banks (2) • Declining interest income was for the following reasons: • High proportion of deposits impounded for CRR and SLR, earning relatively low interest rates • System of directed lending • Political interference- leading to huge NPAs • Rising costs of operations for banks was because of several reasons: economic and political

Profitability of Banks (3) • As per the Narasimham Committee (1991) the reasons for rising costs of banks were: • Uneconomic branch expansion • Heavy recruitment of employees • Growing indiscipline and inefficiency of staff due to trade union activities • Low productivity • Declining interest income and rising cost of operations of banks led to low profitability in the 90s

Bank profitability: Suggestions • Some suggestions made by Narasimham Committee are: • Set up an Asset Reconstruction Fund to take over doubtful debts • SLR to be reduced to 25% of total deposits • CRR to be reduced to 3 to 5% of total deposits • Banks to get more freedom to set minimum lending rates • Share of priority sector credit be reduced to 10% from 40%

Suggestions (cont’d) • All concessional rates of interest should be removed • Branch expansion should be carried out strictly on commercial principles • Diversification of banking activities • Almost all suggestions of the Narasimham Committee have been accepted and implemented in a phased manner since the onset of Reforms

Income Recognition • Incomes from NPAs not recognised on accruals basis but on receipt basis • If interest debited not recovered within 180 days(2 quarters) then the same shall not be recognised as income

Non Performing Asset(NPA)For Cash Credit & OD • Where the outstanding balance remains continuously in excess of the sanctioned limit/Drawing power OR • Where the outstanding balance is less than the sanctioned limit/Drawing power, but there is no credits continuously for 6 months OR • Where the credits are not enough to cover the interest debited during the 6 months as on the date of the Balance Sheet

Non Performing Asset(NPA)(For Loans & Advances) • Standard Assets: are those which are not NPA as they are regular and performing and there are no adverse features • Sub-Standard Assets: are those which are NPAs for a period Not exceeding Two Years • Doubtful Assets: are those non-performing assets which remain as such for a period, Exceeding 2 years • Loss Assets: are those NPAs where 100% loss has been identified but not yet written off in the books of accounts

Name of Asset Standard Asset Substandard Asset Doubtful Assets Doubtful upto 1 year (NPA more than 2 years but upto 3years) Doubtful for more than 1 year but upto 3 years (NPA more than 3yrs but upto 5 years) Doubtful for more than 3 years(NPA for more than 5 yrs) Loss Assets Provisioning Requirement No provision is required General prov.10% of outstanding 100% to the extent of deficit (deficit=advance –security) Plus 20% of Tangible Security 30% of Tangible Security 50% of Tangible Security 100% of the outstanding Provisioning for Loans & Advances

Capital Adequacy Norms (9%) • Tier I Capital: • Paidup Capital • Statutary and other disclosed free reserves including share premium • General Reserve less • Investment in subsidiaries • Intangible assets • Brought forward and current losses

Capital Adequacy Norms Tier II capital consists: • Undisclosed reserves & cumulative perpetual preference shares • Revaluation Reserves at a discount of 25% • Surplus provisions/loss reserves subject to a maximum of 1.25% weighted Risk Assets • Hybrid Debt Capital instrument • Subordinated Debt

Capital Adequacy Formula Capital Adequacy=Capital Funds * 100 Weighted Risk Assets

Other Important Terms • On Balance Sheet Items: Those Items which appear on the Balance Sheet of a Bank & for which RBI has given percentage weights to various types of assets • Off Balance Sheet Items: Those items which do not appear on the face of the Balance Sheet like Guarantees, Letter of Credit etc. • Dividend Payout Ratio: Banks should have a Capital Adequacy Ratio of atleast 9 for the a/c yr. for which it proposes to declare dividend subject to a ceiling on DP ratio 40%

NPA Management • The Narasimham Committee recommendations were made, among other things, to reduce the Non-Performing Assets (NPAs) of banks • To tackle this the government enacted the Securitization and Reconstruction of Financial Assets and Enforcement of Security Act (SARFAESI) Act, 2002 • Enabled banks to realise their dues without intervention of courts

SARFAESI Act • Enables setting up of Asset Management Companies to acquire NPAs of any bank or FI (SASF, ARCIL are examples) • NPAs are acquired by issuing debentures, bonds or any other security • As a second creditor can serve notice to the defaulting borrower to discharge his/her liabilities in 60 days • Failing which the company can take possession of assets, takeover the management of assets and appoint any person to manage the secured assets • Borrowers have the right to appeal to the Debts Tribunal after depositing 75% of the amount claimed by the second creditor

- More by User

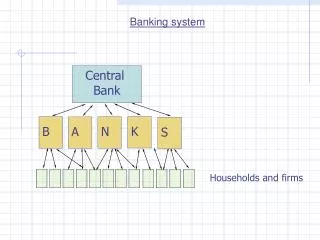

Banking system

Banking system. Central Bank. K. B. N. A. S. Households and firms. The role of commercial banks is to Serve as a financial intermediary between savings and investments; Assist the process of money circulation, connect lenders to borrowers, in other words, “create money”.

678 views • 44 slides

The Banking System

The Banking System. What is a Bank?. What is a Bank?. A FINANCIAL INTERMEDIARY —connects money from savers to people who need to borrow it. Financial intermediaries include many types of institutions—some are banks, some are not

472 views • 18 slides

CO-OPERATIVE BANKING IN INDIA

CO-OPERATIVE BANKING IN INDIA. Introduction of co-operative banks Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world.

1.54k views • 7 slides

Indian Banking System

Status of integration with global Banking system. Indian Banking System. A few India Banks have presence overseas Stringent RBI restriction on opening office overseas Indian Banks overseas mainly provide trade finance with host country

611 views • 12 slides

CONSUMER BANKING SYSTEM

CONSUMER BANKING SYSTEM. PURPOSE STATEMENT . The purpose of our project is to provide fast and safe analysis of sales data of banks by the state bank and also to create a platform where the state bank can communicate and monitor the commercial banks. PROBLEM DESCRIPTION.

380 views • 24 slides

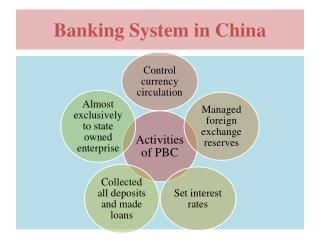

Banking System in China

Banking System in China. Three specialized Banks -. Chinese Bank reforms : 1979-92. Two stages of reform have been undertaken , from 1979 to 1992 and 1993 to present . Stage one began with the creation of a ‘two-tier’ banking system.

485 views • 8 slides

Banking system in turkey

Banking system in turkey. PROF. Yaprak Gülcan. Main Objective of the Central Bank of The Republic of turkey (CBRT). Price Stability Article 4- (As amended by Law No. 4651 of April 25, 2001) "The primary objective of the Bank shall be to achieve and maintain price stability.

283 views • 11 slides