You are using an outdated browser. Please upgrade your browser to improve your experience and security.

Robert T. Kiyosaki

After growing up watching the financial lives of his "two dads" (his own father and his best friend's) unfold, Robert T. Kiyosaki turned the lessons he learned into the bestselling Rich Dad, Poor Dad line of personal finance guides. No doubt both dads are proud.

- Books By Robert T. Kiyosaki

#1 in Textbooks

#2 in Business & Investing

#2 in Parenting & Relationships

#2 in Accounting & Finance

#16 in Schools & Teaching

Rich Dad, Poor Dad

- Cashflow Quadrant: Rich Dad's Guide to Financial Freedom

- Rich Dad's Guide to Investing

Rich Kid Smart Kid

- Own Your Own Corporation: Why the Rich Own Their Own Companies and Everyone Else Works for Them (Rich Dad's Advisors (Paperback))

- Sharon L. Lechter

- T. Harv Eker

- Donald J. Trump

- Robert G. Allen

- Garrett Sutton

- Meredith McIver

- Robert G. Hagstrom

- Dolf de Roos

- Bill Miller

- Ken McElroy

- Michael Corbett

- Diane Kennedy

- Andrew James McLean

- Blair Singer

- Hal Zina Bennett

- Joel S. Moskowitz

- Kim Kiyosaki

- Michael A. Lechter

Books by Robert T. Kiyosaki

$ 3.99 - $ 19.59

Cashflow Quadrant: Rich Dad's Guide to Financial Freedom

$ 3.99 - $ 15.10

Rich Dad's Guide to Investing

$ 3.99 - $ 41.89

$ 7.89 - $ 218.19

Own Your Own Corporation: Why the Rich Own Their Own Companies and Everyone Else Works for Them (Rich Dad's Advisors (Paperback))

$ 12.79 - $ 90.09

Rich Dad's Increase Your Financial IQ: It's Time to Get Smarter with Your Money

$ 4.29 - $ 45.09

Why We Want You to Be Rich

$ 4.39 - $ 15.73

Rich Dad's Retire Young, Retire Rich: How to Get Rich Quickly and Stay Rich Forever!

$ 4.19 - $ 15.10

Rich Dad Poor Dad for Teens

$ 6.19 - $ 13.22

Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar Business (Rich Dad's (Paperback))

$ 4.19 - $ 14.58

Rich Dad: The Business of the 21st Century

$ 4.29 - $ 15.89

Rich Dad's Guide to Becoming Rich...Without Cutting Up Your Credit Cards

$ 4.69 - $ 9.95

The Real Book of Real Estate

$ 12.69 - $ 37.29

Rich Dad's Prophecy

$ 4.19 - $ 13.76

Rich Dad's Who Took My Money?: Why Slow Investors Lose and Fast Money Wins! (Rich Dad's (Paperback))

$ 4.19 - $ 14.43

Midas Touch: Why Some Entrepreneurs Get Rich-And Why Most Don't

$ 7.29 - $ 19.98

Unfair Advantage: The Power of Financial Education

$ 4.29 - $ 14.37

Faux: Comment des mensonges appauvrissent les pauvres et la classe moyenne

$ 6.69 - $ 16.85

Rich Dad's Conspiracy of the Rich: The 8 New Rules of Money

$ 4.19 - $ 12.01

The Business School for People Who Like Helping People

$ 7.39 - $ 11.09

Seconda chance. Per il tuo denaro, la tua vita e il nostro mondo

$ 6.29 - $ 18.19

Rich Dad's Plan for Financial Success

Despierta El Genio Financiero De Tus Hij

$ 6.59 - $ 14.83

Rich Dad's Success Stories: Real Life Success Stories from Real Life People Who Followed the Rich Dad Lessons

$ 4.29 - $ 10.89

Why the Rich Are Getting Richer

$ 10.49 - $ 15.29

Capitalist Manifesto: How Entrepreneurs Can Save Capitalism

Rich Dad's Escape from the Rat Race: How to Become a Rich Kid by Following Rich Dad's Advice

$ 5.49 - $ 12.05

If You Want to Be Rich & Happy: Don't Go to School? : Ensuring Lifetime Security for Yourself and Your Children

$ 5.49 - $ 18.95

Covered Calls and LEAPS--A Wealth Option + DVD: A Guide for Generating Extraordinary Monthly Income (Wiley Trading)

More Important Than Money: An Entrepreneur's Team

Popular Categories

- Teen and Young Adult

- Literature & Fiction

- Mystery & Thriller

- Sci-fi & Fantasy

- Large Print Books

- Rare & Collectible Books

- ShareBookLove

- Educator Benefits

- Librarian Benefits

- e-Gift Cards

- View Mobile Site

- Shopping Cart

- Order History

Partnerships

- Library Program

- Help & Support

- Shipping Costs

- Return Policy

- Website Suggestions

- Our Purpose

- Social Responsibility

- Testimonials

- Best selling

- Alphabetically, A-Z

- Alphabetically, Z-A

- Price, low to high

- Price, high to low

- Date, old to new

- Date, new to old

Recently Viewed Products

- Cart 0 0 items

- Choosing a selection results in a full page refresh.

Thanks for subscribing!

This email has been registered!

Shop the look

Choose options, back in stock notification.

- Robert Kiyosaki

- Kim Kiyosaki

- Rich Dad Events

- Physical Books, games, and more

- Digital Courses, memberships, and more

- Investing classes

- Clases de Español

- Rich Dad Coaching

- Coaching Español

- Rich Dad Shows

- FREE Online Event The Great Wealth Rush Opportunity of a Lifetime! →

- Rich Dad Radio Show

- Millennial Money

- Classic Rich Dad

- CryptoVerse

- Trusted Services →

Close the book on how you read one.

Enhance your reading with rich dad's ebooks.

Choose from our catalog of best-selling books in multiple eReader formats.

Rich Dad Poor Dad

What the rich teach their kids about money - that the poor and middle-class do not.

Author: Robert Kiyosaki

Personal-finance author and lecturer Robert Kiyosaki shares his unique economic perspective gained from two disparate influences: his own highly educated but fiscally unstable father, and the multimillionaire eighth-grade dropout father of his closest friend. The lifelong monetary problems of his "poor dad" pounded home the counterpoint communicated by his "rich dad", that "the poor and the middle class work for money," but "the rich have money work for them."

Rich Dad's CASHFLOW® Quadrant

Guide to financial freedom.

This work will reveal why some people work less, earn more, pay less in taxes, and feel more financially secure than others.

Are you tired of living paycheck to paycheck?

In the world of money there are two mindsets, those that see scarcity and need security, and those who see abundance and thrive on financial adventure – the mindset of the employee or self-employed, and the mindset of the business owner or professional investor.

Rich Dad's Guide to Investing

Become the ultimate investor. End those fears that keep you up at night regarding the financial choices you make. By reading Rich Dad's basic rules of investing, you can reduce your investment risk and convert your earned income into passive and portfolio income. That means you keep more of your income-not the government. " Rich Dad's Guide to Investing" is just that - a guide. It offers no guarantees, just as Robert Kiyosaki's rich dad offered him no guarantees, only guidance. But if you're interested in the inside look at an entrepreneur's financial plan to be rich, this is the book for you.

Rich Kid Smart Kid

Start your child off on the right financial footing..

Do you value your child’s education? Do you want your children to have a financial head start in life? Are you willing to take an active role to make that happen?

At school, your children learn many valuable concepts, yet they are rarely taught anything about finances. Imagine if you had been taught about money and, more specifically, about what the rich know about money - that the way to wealth is through cash flowing assets.

For a kid, these financial lessons, and others, are vital to their future financial well-being. Robert Kiyosaki’s Rich Dad’s Rich Kid Smart Kid is an introduction to the financial world specifically written for children. But more than that, it gives your child the right context in which to view money from a very early age, and places them on the right financial footing for a secure future.

Take the first step in ensuring your child has a secure financial future with Rich Dad’s Rich Kid Smart Kid .

Unfair Advantage

The power of financial education.

Why do the rich get richer even in a financial crisis? In his new book the bestselling author of " Rich Dad Poor Dad " confirms his message and challenges readers to change their context and act in a new way. In this timely new book, Robert Kiyosaki takes a new and hard-hitting look at the factors that impact people from all walks of life as they struggle to cope with change and challenges that impact their financial world. In " An Unfair Advantage: The Power of Financial Education ", Robert underscores his messages and challenges readers to change their context and act in a new way. Readers are advised to stop blindly accepting that they are "disadvantaged" people with limited options and challenge the preconception that they will struggle financially all of their lives. Robert's fresh approach to his time-tested messages includes clear, actionable steps that any individual or family can take, starting with education. Education becomes applied knowledge, a powerful tactic with measurable results. In true "Rich Dad" style, readers will be challenged to understand two points of view, and experience how financial knowledge is their unfair advantage.

Midas Touch

Why some entrepreneurs get rich - and why most don't.

Author: Robert Kiyosaki and Donald J. Trump

In a world of high unemployment with an economy that needs new jobs to recover, who isn’t hungry for a solution, something that brings about recovery fast? Many look to government, but it’s becoming obvious that governments can’t create real jobs. The little-known truth is that only one group can bring our world back to prosperity: It’s entrepreneurs and particularly entrepreneurs with the Midas Touch.

It's Rising Time

What it really takes to reach your financial dreams.

Author: Kim Kiyosaki

Question: What’s an entrepreneur’s most important job?

For women who have a vision for what they want in life and are willing to do what it takes to turn that vision into a reality.

Kim's own unique style has won over friends and fans all over the world. In her new book, she explains what it really takes to go from wherever you are financially today to where you want to be. It’s a book of courage and creativeness, time-tested principles and real-life stories of success, setbacks and comebacks… with a few surprises along the way. Kim will share candid stories from women and men who have been through the good, the bad, and the ridiculous—and the lessons they learned.

Why a new book from Kim in these unsettling economic times? Because it’s time for women’s true strength and determination to surface. Because it’s time for new answers and new ideas… and because It’s Rising Time! for women everywhere.

Rich Dad's Retire Young Retire Rich

How to get rich quickly and stay rich forever.

Are your financial plans on the fast track or the slow track? If you are like most, retiring early sounds great; more time to do what really interests you. To get on the fast track, you need to leverage your mind, your plan and your actions. In "Retire Young Retire Rich" , Kiyosaki details how he and his wife Kim achieved financial freedom in less than ten years. More importantly, he shows how a context shift in your mind allows you to create a plan that formulates the actions necessary for your financial freedom.

Rich Dad's Conspiracy of The Rich

The 8 new rules of money.

In late January, 2009, Robert Kiyosaki launched "Conspiracy of The Rich: The 8 New Rules of Money" - a free online book which was written in serial basis to help people understand how the current recession came about, and what they need to learn on how to survive through the coming rough years.

Rich Dad's Increase Your Financial IQ

For years, Robert Kiyosaki has firmly believed that the best investment one can ever make is in taking the time to truly understand how one's finances work. Too many people are much more interested in the quick-hitting scheme, or trying to find a short-cut to real wealth. As Kiyosaki has preached over and over again, one has to truly understand the process of how money works before one can start out on trying to escape the daily financial Rat Race.

Padre Rico Padre Pobre

Este libro le ayudará a... ? Derribar el mito de que usted necesita tener ingresos elevados para hacerse rico. ? Cuestionar la creencia de que su casa es una inversión. ? Demostrar a los padres por qué no deben confiar en el sistema escolar para que sus hijos aprendan a manejar dinero. ? Definir de una vez y para siempre qué es una inversión y qué es una obligación. ? Aprender qué debe enseñar a sus hijos acerca del dinero para su futuro éxito financiero.

Bring Out the Rich Woman In You

For women who have a vision for what they want in life and are willing to do what it takes to turn that vision into a reality

Let’s face it. When it comes to money, men and women are different. While the how-to’s of investing, how to buy and sell a stock or how to find a profitable rental property, are the same, there are the unique issues that women face when it comes to money and investing.

Here are some eye-opening statistics:

- 47% of women over the age of 50 are single.

- 50% of marriages end in divorce (The #1 thing couples fight about is money).

- In the first year after a divorce, a woman’s standard of living drops an average of 73%.

- 90% of all women will be solely responsible for their financial well-being within their lifetime.

Empowerment and freedom through entrepreneurship

Kim Kiyosaki has just released her latest book, Happiness: Empowerment and Freedom through Entrepreneurship. Thousands of books have been written on the topic of happiness – some providing useful points but most providing quick, hollow platitudes. Kim Kiyosaki, author of Rich Woman and It’s Rising Time!, takes a unique approach providing her key insights to empower women to become financially independent to have the freedom to pursue what truly makes them happy.

Through pointed questions and personal stories, Kim pushes her readers to define Happiness and to use it as their “why,” or purpose. She shapes the context that financial independence allows people to freely enjoy what truly makes them happy. Kim describes the specific steps women can take for personal fulfillment and financial independence.

Written with stark candor and firsthand wisdom, Kim’s book is a call to action to enjoy what makes you happy on a scale most have never imagined.

Meet Your Own Rich Dad

Do you need help with your personal finances maybe investing or retirement planning perhaps you want to create or grow your business, don't do anything until you take my free quiz for your next step toward financial freedom..

- Terms & Conditions

- Privacy Policy

Robert T. Kiyosaki Books In Order

Publication order of rich dad books, publication order of non-fiction books, publication order of anthologies.

Robert T. Kiyosaki Robert T. Kiyosaki is a best-selling author best known for his self-help book Rich Dad, Poor Dad. Kiyosaki writes from his own experiences, growing up poor, and observing how the poor and rich made and invested their money. He also borrows from others’ experiences and makes readers see the numerous mistakes they make where money is concerned. Some of his other notable books include Rich Dad’s Guide to Investing and Rich Dad’s CASHFLOW Quadrant, to mention but a few.

Rich Dad, Poor Dad Rich Dad, Poor Dad, is a financial book that expounds on the difference between assets and liabilities. Drawing from his own experiences, Kiyosaki shows how the rich invest their money to continue getting richer while the poor invest in liabilities that take more money than they can make. Kiyosaki’s birth father was poor, yet he worked hard every day of his life. His friend’s dad, who the author refers to as his rich dad, had a different way of doing things. He saved up a portion of his income and invested in other income-generating projects. Over time, the rich dad could make more money than his family could live on and make his money work for him.

This book is not just about money. It expounds on the way most of us are socialized. The way schools program students to study hard so they can join the workforce. While many skills are taught from a young age, there is little information where money, creating wealth, and becoming financially independent is concerned. Kiyosaki also tries to reprogram our minds and behavior around money. Instead of using all your money on clothes, designer shoes, jewelry, and cars, you should keep a percentage on your income and continue reinvesting it until you can make enough money to sustain you as you sleep. Friends and family may mean well when they influence you to spend more, but this only keeps you in the poverty cycle.

This book’s message is pretty simple, and Kiyosaki delivers it in an understandable way to anyone who can read. Some images are included, which works great for those who think in pictures. The author shows you how money flows from your pockets to the different avenues you choose to spend it on. While most financial books tell you what to correct to be better financially, this one guides you on practical steps you can take towards financial freedom. The author also touches on why economic stability is essential, not just for you but also for your future generations.

Rich Dad, Poor Dad, is a perfect choice if you are looking for an easy to understand book on finances. The book will not only change the way you look at money but also equip you with a few life skills. Kiyosaki includes his life story as well as stories about other people who used some of his teachings to change their lives. The good thing about this book is that it doesn’t focus only on the learned. Even if you never had an opportunity to go to school, you could make good use of the money that passes through your hands. While this book is about serious money issues, the anecdotes make it interesting. It is also quite short, and you can choose to read it all in one sitting or enjoy it in bits.

Rich Dad’s Cashflow Quadrant Rich Dad’s Cashflow Quadrant follows Robert Kiyosaki’s Rich Dad Poor Dad book. In this story, the author reveals strategies for wealth creation and financial stability that goes beyond job security. The author concentrates on four ways of generating wealth that include employment, self-employment, business, and investments. For anyone in any form of employment, the goal should be to own a business or become an investor. These two quadrants work for those looking to create great wealth to pass down to the next generation. This is not to say that people should look down on employment, far from it. As long as someone works intending to save enough to start a business and later invest, they are moving in the right financial direction.

Besides teaching you how you can work towards a more financially secure future, this book reveals how you can work less. It is also possible to pay fewer taxes and earn more while becoming more financially secure than your peers. While some of the teachings may seem obvious to some, many think that the career path is the only way towards a promising future. It is okay to climb up the corporate ladder, but there are many more options available for those who choose to plan beyond retirement. This book will open your eyes to more exciting roads you can take towards success if you are already in employment.

Kiyosaki makes an interesting point about the education system. The current system is geared towards creating employees who do as they are told and rarely think out of the box. All is not gloom as we have seen a rise in home-based businesses in the past few years. People who are employed are establishing businesses that generate some extra income. These businesses also provide something to fall back on if their terms are terminated. The beauty of this book is that it is written in a simple language that the average person will understand. Kiyosaki even uses diagrams to explain the four quadrants and enough descriptions of what to expect in each of them.

Rich Dad’s Cashflow Quadrant is ideal if you are looking for a financially helpful and thought-provoking book. If you want to retire early or never have to struggle after your workdays are over, this book will teach you how this can be achieved. It will also offer insights on how you can get yourself out of debt and prevent this from happening in the future. By teaching readers how the rich ascend to financial freedom, Kiyosaki hopes that the poor and middle class can start making changes that will guarantee a more comfortable life in the future.

2 Responses to “Robert T. Kiyosaki”

The books are so inspirational and enables one to think Outside the box. Kindly can I be notified just Incase he Publishes he’s new other book

my role model

Leave a Reply

The links beside each book title will take you to Amazon where you can read more about the book, check availability, or purchase it. As an Amazon Associate, I earn money from qualifying purchases. If you would like to link to us, Get the Code Here .

I often get asked by readers if they can donate to the site as a thank you for all the hard work. While I appreciate the offer – please support one of these great causes instead (list rotates monthly): Your local humane society Ronald McDonald House Camfed The Life You Can Save

Are you a fan of psychological thrillers? A big fan of authors such as Gillian Flynn? These are our most recommended authors in the thriller genre, which is my personal favourite genre:

- Freida McFadden

- Linwood Barclay

- Megan Goldin

- Peter Swanson

- Sarah Aldersom

- Shari Lapena

- Jack Reacher

- Court Gentry / Gray Man

I just want to thank everyone for visiting the site. Any issues at all don’t hesitate to use the contact form. To read more about the site or if you want a graphic to link to us, see the about page for more details.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

A Complete List of Books by Robert Kiyosaki

If you have been seeking financial advice that can take you miles, it is time that you get the right advice from the right person. Robert Kiyosaki, the father of the Rich Dad Poor Dad series, has written amply on this subject. Read this Buzzle article to find out more about his books that come with more advice.

Learn to Become Rich!

Rich Dad Education is the brainchild of Robert Kiyosaki. It aims to provide education to people of all strata for financial upliftment.

Born in Hawaii, in the year 1947, Robert Toru Kiyosaki has curved a niche for himself as the creator of the bestseller―the Rich Dad Poor Dad Series . His first book, published in the year 1992, has set a benchmark. Following this, there were numerous others in the line, which addressed numerous issues pertaining to finance, business, investment, and entrepreneurship. He completed his education from Merchant Marine Academy, USA, and fought in the Vietnam War. He is known worldwide as the business ‘guru’, given to the vast knowledge he possesses in the field. He is a motivational speaker, and his advice on finance and business has fetched him global attention and acclaim. Through the Rich Dad, Poor Dad series, Kiyosaki has shared the advice regarding the risk-taking techniques, which one should employ in order to be rich and successful, rather than work as employees and retire as poor. This article provides a list of Robert Kiyosaki books in order of their release.

If You Want to Be Rich & Happy, Don’t Go to School? (1992) In this book, Kiyosaki negates the conventional idea of schooling. It is an accepted norm that studying and learning can actually bring out the best of our abilities, and help us to become knowledgeable, thereby, helping to earn a living along with a good standard of lifestyle. But in his book, he defies this ideology and says that the conventional ways of learning only limits an individual’s vision and problem-solving capacities, restricting him to think within the box. He disbelieved in the stigma that education is complete once the degree is attained.

Rich Dad, Poor Dad (1997)

In this book, the author opines that going to school, learning the lessons well, and fetching a job do not guarantee one of wealth. It is rather the application of knowledge in the field that does the trick. He has jotted down the differences between the rich and the poor by citing examples of his biological father and the father of his school friend. His biological father was a well-educated man, working as a high-ranking official, but was still struggling to make ends’ meet and afford a luxurious life. Contradicting this was the father of his friend, who with his limited education was a successful entrepreneur.

Cashflow Quadrant (May 2000) Kiyosaki, in this book, has laid down four quadrants of workers, namely the employees, the self-employed, the business owners, and the investors. He further says that in most cases, the employees are the workers who work very hard, give their best, but make money for their owners. The self-employed are the ones who work very hard, make profit for their own, but also have to do the formalities of paperwork, taxes, and the like. So, in most cases, he will discontinue the work somewhere down the line. The business owner also runs his own business, but hires a manager to do the work for him. He is in a better position. The investors are the ones who earn money with money. They invest a sum of money in a particular business, and the profit earned is several times the investment. In a nutshell, Kiyosaki concluded that the worst positions are those of the employee and the self-employed. Time and freedom are best enjoyed by the remaining two types of workers.

Rich Dad’s Guide to Investing (June 2000)

The author has clearly divided the types of investors into three. They are the sophisticated investors, the inside investors, and the ultimate investors. He further says that a change in the way of how we look into the concept of investment makes all the difference. This makes the rich, the middle class, and the poor. The rich, according to Kiyosaki, invest in three different E’s; Education, Experience, and Excessive Cash.

The Business School For People Who Like Helping People ( March 2001, 2 nd Edition, 2003)

This book focuses on the importance of building a network in the business. He supports the concept of Network Marketing, and endorses the philosophy that successful businessmen build their own network. Through this book, he lays eight different values that he considers good, along with making money, which support the very concept of Network Marketing Business.

Rich Dad’s Rich Kid Smart Kid (2001)

Robert Kiyosaki has been highly influenced by his ‘rich dad’, the father of his school friend. He was taught several things pertaining to managing finance. This book of his puts up the insight that he had gathered over time from his ‘rich dad’. This book is a guide for those parents who want their children to excel in life, thereby attaining success. He is of the opinion that the schooling system, nowadays, doesn’t suffice the purpose of providing adequate knowledge to the students. Rich Kid Smart Kid intends to teach what the school fails to teach. It is sure to instill the love for learning amongst the young minds so that they are always receptive to know new things, at all times possible. And all of this would be spearheaded by the parents, who want their kids to be self-sufficient in today’s competitive world.

Rich Dad’s Retire Young, Retire Rich (2002)

The theme of this book is that how a person can earn more with less time and effort. It highlights the techniques that young entrepreneurs should follow in order to be able to amass so much wealth in less time such that they are able to retire early, without even having afterthoughts of post-retirement life. The techniques that he prescribes in the book are the ones that can be put to use by anyone in the real estate or stock market business. These are highly valued techniques that he has compiled in his book. He was taught about these techniques by his ‘rich dad’, and undoubtedly, were highly beneficial, which explains why Kiyosaki himself had retired at a very early age.

Rich Dad’s Prophecy (2002) This book talks at length about a probability that Kiyosaki has predicted, and the process of changing the probability into a beneficial one. In the first part of the book, which is entitled as, ‘Is the Fairy Tale Over?’, he predicts that there will come the crash of the financial market, which will lead to nowhere but the doom. Having said this, he also consoles by stating that the rich and smart people are those who can curve out opportunities from the worst of the situations. The crisis perhaps always turns out to be opportunities for the rich. In the next section of the book, ‘Building the Ark’, he further opines that the bad days can be turned into the best of the days with a little technique, knowledge, and foresight. It promotes the fact that every individual must develop his own survival strategy.

Rich Dad’s Success Stories (2003) This book is dedicated to those who are scared to take that first plunge. It is a motivation for those who are scared to make that first investment. It is a compilation of the experiences and success stories of those people who didn’t have much in life. But by applying the theories laid down by Kiyosaki in his ‘Rich Dad’ series, they have all tasted success. In his own words, “The future will be very bright for those who prepare today.”

You Can Choose to be Rich (2003)

This book was also published as an audio series with three books. It sets the idea that it depends on an individual whether he wants to be rich or not. It also gives the much-needed financial education about how to change the approach towards money and life, and how this change of approach will reap benefits for an individual. He says that drafting a financial plan is of importance as that will take an individual towards success. He also emphasizes the importance of financial knowledge, financial literacy, and self-confidence as the factors that will take one closer to success.

Rich Dad’s Who Took My Money? (2004)

This book narrates how the return on investment can be maximized in a short duration of time, enabling one to be financially independent. He counts on the advice given to him by his ‘rich dad’, which enabled him to get the maximum profit in less time. The idea he sets is to maximize the leverage and protect the cash flow. The book is divided into two parts: (i) pointing out the ideas and experiences of the small-time investors and entrepreneurs like insurance agents, dairy owners, etc.; (ii) a section that underlines the goodness of power investment.

Rich Dad, Poor Dad for Teens (2004)

This book is for all the young minds, who want to make it big in life. It summarizes the counter philosophies, which are contrary to the perceived convention. Through his advice, he suggests that anybody can survive in this extremely challenging situation and gain financial independence. He advises not to work for earning; rather to work in order to learn. The following of his philosophies have been mentioned in the book such as never work for money, make the money do the work, and not to let go of something because it is not affordable; rather, make yourself able enough to afford it. This book is appealing both to the adults and the teens.

Rich Dad’s Before You Quit Your Job (2005)

This book provides the experiences he gained while setting up his own business ventures. He narrates the lessons that he learned from his encounters of success and failure. It also states the dos and don’ts one needs to adhere to, in order to start a business venture independently. This book, like the others in the series, is a source of motivation for those who want to work independently as entrepreneurs, rather than limiting themselves in the employee status. It demands much more knowledge, effort, planning, money, and patience on the part of entrepreneurs. It clearly tells one to understand whether the business plan designed is feasible or not, and whether it has the potential to be financed by the investors.

Rich Dad’s Escape from the Rat Race (2005)

The basic outline and the core message of all the books of the ‘Rich Dad’ series is that everyone should undergo the basic schooling, get degrees, fetch a good job, and then invest in self-business goals. This book too echoes the same message. The title is suggestive enough to say that everyone should explore for himself a niche of his own, and establish something unique, which no one else does, in order to ‘escape from the rat race’, thereby achieving success. This will, for sure, help him to make him strive hard to earn money, and help him to have sufficient wealth for a lifetime. With very innovative examples of the mouse and the turtle, Kiyosaki has penned down the complex elements of entrepreneurship.

Why We Want You to Be Rich: Two Men, One Message (2006) jointly written by Donald Trump

The two legendary rich men vouch on the same advice for the ever-struggling middle class. The message is loud and clear, i.e., to tread a path of one’s own by attaining workable knowledge in finance. The idea is to gather wealth in the best possible way, at a fast pace. This book brings to light the fast-approaching American economy, where the middle class will be totally absent. There shall prevail only two classes in the society: the, ‘rich’ and the ‘poor’.

Rich Dad’s Increase Your Financial IQ: Get Smarter with Your Money (2008)

The touchstone for financial independence and stability is to increase the financial IQ. This book is a guide for thinking just like the ‘rich’, in order to be rich. Kiyosaki has time and again preached about the necessity to earn a lot of money, in a short duration, by eliminating oneself from the rat race. But in parallel, he has also highlighted the drawbacks of trying to adhere to shortcuts in order to achieve goals. He is rather of the opinion that people should increase their knowledge and IQ of finance. Planning, leverage, techniques, knowledge, and good budgeting will lead a person closer to long-term wealth.

Rich Dad’s Conspiracy of the Rich: The 8 New Rules of Money (2009)

The USP of this book is the solution it has sought to live through the global recession that had hit all and sundry, at some level, at some point of time. He has also engineered a new approach to connect to the readers by extending to them the platform of interaction, instead of passive reading. He, therefore, encouraged feedback and comments from his much-valued readers. He carefully laid down eight new rules of money. He has elaborated on the causes of recession that posed such devastating consequences to millions.

Rich Brother Rich Sister (2009) jointly written by Emi Kiyosaki

This book deserves a special mention, not just because of the fact that Robert is not the lone writer of this book, but also because it projects the diverse ideologies of both the siblings on life and survival. They have both fought against the odds in life, but in two different paths. While Robert, in his early life, fought the war, his sister chose to walk on the path of non-violence. However, both of them resulted to get the maximum in life, and also secured the future by having saved sufficient wealth. The book touches upon the serious, yet inevitable aspects of life, such as life itself, the antonym of it, that is death, religion, philosophy, fear of the unknown, and perhaps, above all, spirituality. The book is an inspirational quotation of both of them.

The Real Book of Real Estate: Real Experts, Real Stories, Real Life (2010)

Perhaps, one of the toughest ventures that exist for entrepreneurship is the business of real estate. Like others, it too has a lot of uncertainties, but perhaps the degrees are a little more heightened. But the opportunities are also ample. This book is a well-researched compilation from the top tycoons of the real estate world who, through this book, have laid down their valuable insight with the common mission to enable the commoner to become ‘rich’ in the real estate business, in the truest sense possible. This book is of help for the experienced players, like it is helpful even for the amateur ones. The bottom line is to overpower one’s fears related to finance, and encash on self-reliance.

An Unfair Advantage: The Power of Financial Education (2011)

Through this book, Kiyosaki talks at length about the multidimensional hurdles that a modern man in modern times has to undergo, and also how he marches ahead in search of a befitting solution to those problems. As it is rightly proclaimed, ‘change is the only constant’, but the irony is that change may not always be desirable, and not always accompanied by advantages. Therefore, his advice to the victims of such undesirable changes is to alter the way to deal with problems, and to manifest newer ways to deal with newer problems. The answer to the problem is to move out of the conventional framework that has been inculcated in our minds throughout the growing and learning years. Unlearning the old will, in the long run, make us suitable to adopt and learn newer things in life, thus serving the purpose. And to do this, everybody has to start with education. On the whole, this book is the perfect teacher of financial education.

Midas Touch: Why Some Entrepreneurs Get Rich And Why Most Don’t (2011) jointly written by Donald Trump

Like their earlier joint venture, this book too advocates how the education system, these days, fails the purpose of education. How it trains an individual to become only employees and not the entrepreneurs, themselves. This book provides the ‘midas touch’ by developing a ‘five-point’ guide to successful entrepreneurship. Thus, this book reveals the secrets of great business techniques that are required to become successful businessmen. Through a mixed bag of success experiences and failure stories, this book is a thorough inspiration. They have meticulously assembled the secret into five points―these being a strong character, focus, branding, network, and other little things that contribute greatly.

Why “A” Students Work for “C” Students and “B” Students Work for the Government: Rich Dad’s Guide to Financial Education for Parents (2013)

This book is intended for the parents so that they don’t force their children to fetch good grades, restrict them to dream big, and envision a life of their own with their own dreams, rather than living by conventions. He has carefully segregated the student fraternity into three broad categories: ‘A’, ‘B’, and ‘C’. A’s are the ones, who learn by conventions and land up being employed by the C’s who never followed conventions, but sought ways to be successful. The average ones are the B’s who somehow manage to get hired by the government.

Riches are not the most important thing in life, but are not the least important either. Therefore, in a world of stiff competition, like the present times, it is essential to secure financial background so that the present and future are secure. For this to happen, knowing about finance and business is mandatory. May the advice from veterans in the field, like Kiyosaki, continue to come in handy.

Like it? Share it!

Get Updates Right to Your Inbox

Further insights.

Privacy Overview

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

Robert Kiyosaki’s Best Basic Money Advice To Get You Started

April 06, 2024 — 11:01 am EDT

Written by Cynthia Measom for GOBankingRates ->

Entrepreneur, educator and investor, Robert Kiyosaki , received his claim to fame through the success of his No. 1 personal finance book “Rich Dad Poor Dad.” Decades later, Kiyosaki is still explaining how money works — and how to get rich — with the goal of helping people become more financially literate .

Learn More: I’m a Self-Made Millionaire: What Being Broke Taught Me About Keeping Wealth Try This: One Smart Way To Grow Your Retirement Savings in 2024

To get you started, here’s Kiyosaki’s best basic money advice from his book , “The Beginner’s Guide to Personal Finance.” Also, for more great advice, check out our list of the Top 100 Money Experts .

Pay Yourself First

Kiyosaki wrote that he and his wife, Kim, achieved financial success by using a method called “Pay Yourself First.” He wrote, “Essentially, this is a way of prioritizing your financial saving and investing, making it an expense item on your budget … the most important one.”

Kiyosaki explained that for every $1 of income, he and his wife placed 30% into three separate accounts:

- 10% to Savings — used as a cushion for emergencies

- 10% to Investing — allocated for investment opportunities that arise

- 10% to Charity — Kiyosaki believes charity is a powerful tool that yields many benefits.

Kiyosaki wrote that the reason he and Kim paid themselves first was because they needed the money to purchase assets that provided more and more passive income each month. “We then used that income to purchase our liabilities — not our earned income from salaries,” he wrote. “That is the simple way we budgeted to get rich, and it is a very different approach than other financial advice.”

Read Next: Warren Buffett: 6 Best Pieces of Money Advice for the Middle Class

Know the Difference Between Assets and Liabilities

Kiyosaki believes that if it puts money in your pocket, it’s an asset, and if it takes money out of your pocket, it’s a liability. Unlike many other personal finance experts, Kiyosaki views your home as a liability because it takes money from your pocket. It only becomes an asset, he wrote, when you sell it for a profit.

He also believes in finding ways to turn liabilities into assets when possible. Kiyosaki said that when his wife wanted a 60-foot sailboat, they didn’t have the money to purchase it. So, instead of saving up for it and buying it later on, the couple found a more creative and financially beneficial option to afford it.

“So, Kim did some research, found out how to contract the boat with a charter company, and the income from the charters covered our liability in the boat,” explained Kiyosaki. “We got to own a luxury liability, and it also became an asset for us. That is winning at money. Saving and then buying is not.”

Know the Difference Between Good Debt and Bad Debt

Kiyosaki believes there are two kinds of debt: good and bad. He explained that bad debt is used to buy liabilities that don’t provide any cash flow, such as cars, vacations and homes for personal use. Good debt is used to buy assets that add more money to your bank account each month than the cost of the debt. Examples are investment properties and capital investments in your business.

Kiyosaki urges you to pay bad debt off as soon as possible and embrace good debt.

“The reason for this is simple,” wrote Kiyosaki. “You can accelerate your return on investment (ROI) by using debt, aka Other People’s Money (OPM), to purchase assets. This is because you have less of your own money in an investment, but you still enjoy the cash flow from that asset.”

Understand How To Improve Your Credit Score

Kiyosaki wrote that the path to getting rich using “good” debt is to have good credit. Additionally, he wrote that a credit score of 700 is considered good, and above 800 is excellent.

“Simply put,” explained Kiyosaki, “the higher your credit score, the easier it is to get debt, better terms on that debt, and insurance to protect your investments.”

For example, lenders often use FICO scores to determine whether someone is a good lending risk. FICO scores are made up of the following categories:

- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- New credit accounts: 10%

- Types of credit used: 10%

And what’s the easiest way to improve your credit score, according to Kiyosaki?

“The easiest way to improve your credit score is to reduce your bad debt and to pay your creditors on time (or negotiate with them for extensions as you pay yourself first),” he wrote.

More From GOBankingRates

- Suze Orman: 5 Social Security Facts Every Soon-To-Be Retiree Must Know

- 4 Sneaky Car Dealership Scams That Will Be Illegal in 2024

- These 10 Aldi Brand Products Are Worth Every Penny

- The Biggest Mistake People Make With Their Tax Refund -- And How to Avoid It

This article originally appeared on GOBankingRates.com : Robert Kiyosaki’s Best Basic Money Advice To Get You Started

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

More Related Articles

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

Robert Kiyosaki's Track Record on Predicting Stock Market Crashes

The "Rich Dad Poor Dad" author has an abysmal record when it comes to stocks.

Kiyosaki's Record Predicting Crashes

Patrick McMullan via Getty Image

A self-proclaimed financial guru, Kiyosaki had a lackluster financial track record prior to publishing his book.

Robert Kiyosaki is a popular figure in the world of personal finance. Kiyosaki is the author of "Rich Dad Poor Dad," a book he self-published back in 1997 that went on to spend more than six years on the New York Times bestseller list. In the book, Kiyosaki argues that it's extremely difficult to build wealth from a paycheck, and the best way to become rich is by owning real estate and other assets that generate passive income.

Some of Kiyosaki's practical personal finance advice is sound, if not particularly original. For example, he argues that building wealth is more about how much money you spend than how much money you earn.

Kiyosaki is a self-proclaimed finance guru, but his financial track record prior to "Rich Dad Poor Dad" isn't particularly impressive. The Hawaii native has a Bachelor of Science degree from the United States Merchant Marine Academy but failed to complete an MBA program at the University of Hawaii at Hilo. Several companies he founded have gone bankrupt, and Kiyosaki was reportedly living out of his car during the worst of his financial struggles.

Beyond his questionable resume, some critics have also blasted Kiyosaki for dangerous and illegal advice he has given during speaking appearances, including advocating for insider stock trading, recommending investors buy stocks on margin in unfunded brokerage accounts and advising people to buy multiple real estate properties with little or no money down.

Over the years, Kiyosaki has not been shy on weighing in on the stock market, typically making doom and gloom predictions about the economy and advising followers to sell stocks and buy assets like gold and real estate. While some of Kiyosaki's basic personal finance philosophy is solid, any followers who took his advice and avoided the stock market for the past couple of decades have missed out on tremendous wealth-building opportunities.

Here's a look back at several stock market recommendations the author has made over the years and how well his predictions played out in the market.

Robert Kiyosaki's Stock Market Predictions

April 7, 2011 (tweet): "For the educated, an economic crash is the best time to get rich. Guess what? The crashing is not over."

Kiyosaki was presumably talking about the 2008 stock market crash at the time of this prediction. While the S&P 500 did drop from a 2011 high of around 1,370 to a low of around 1,074, it came nowhere close to its 2009 lows of around 666. In the year following his April 7 tweet, the S&P 500 generated a total positive return of 3.7%.

Sept. 1, 2015 (tweet): "I've been predicting since '02 that we would see a stock market crash in '16."

Kiyosaki's followers might argue that the early 2016 market volatility that dropped the S&P 500 from around 2,050 to as low as 1,810 is the "crash" he was predicting, but a less than 15% pullback from recent highs is a fairly typical example of a healthy market correction. And by the end of 2016, the S&P 500 had generated a 9.5% gain on the year.

July 30, 2017 (tweet): "Another sign a real estate crash is coming....."

This time, Kiyosaki's prediction of a repeat of the 2008 housing market collapse completely missed the mark. The tweet, which retweeted a zerohedge tweet from the day before that read "Southern California Median Home Price Doubles In Five Years", could not have been more wrong. In the 12 months following this prediction, the Real Estate Select Sector SPDR Fund (ticker: XLRE ) gained 4.9%, the national Case-Shiller Home Price Index gained 5.7% and the S&P 500 climbed 14%.

In fact, despite the rapid run-up in SoCal home prices at the time of the tweet, prices in the region would never go lower than they were at the time of Kiyosaki's tweet. A St. Louis Federal Reserve index measuring housing prices in the Los Angeles - Long Beach - Glendale area sat at 329.29 in the second quarter of 2017, a level it's exceeded in every quarter since. The index last clocked in at 521.66 in the fourth quarter of 2023.

Aug. 7, 2018 (article): "Unfortunately we had a big crash in 2000, they called it the dotcom crash, then in 2008 it was the subprime real estate crash. The next is going to be the biggest of all. When it's coming I don't really know, but the foreshocks are sounding right now."

In this article , which was published in August 2018 and updated four months later, Kiyosaki specifically recommended investors buy gold. It turns out gold has been a fairly good investment in recent years, but investors who followed this advice at the time didn't gain very much. Since the article was published in 2018, SPDR Gold Shares ( GLD ) is up 84%, and the S&P 500 is up 82%.

The biggest crash of all that Kiyosaki predicted has yet to occur.

April 17, 2020 (tweet): "CRASH ONLY BEGINNING: Buffet says 'When tide goes out you see who's been swimming NAKED.' Billions of naked swimmers. SAD."

This time, Kiyosaki warned investors that the stock market crash tied to the COVID-19 pandemic was only beginning. The only problem was he posted this warning on Twitter just after the S&P 500 reached its 2020 lows. In the year following this warning, the S&P 500 gained a staggering 53.4%.

The tweet also misspells the last name of Warren Buffett , the Berkshire Hathaway Inc. ( BRK.A , BRK.B ) CEO who is widely considered the greatest investor of all time.

Oct. 28, 2020 (tweet): "The EVERYTHING CRASH is coming. Since 1987 world has been in EVERYTHING BUBBLE. Now all crashing. Prices of gold silver Bitcoin will crash too. US dollar to rise. Be patient."

This time, Kiyosaki was very specific with his recommendations: Buy gold, silver, U.S. dollar. Kiyosaki's predictions were a complete dud. In the 12 months following these recommendations, the GLD ETF declined 4.6%. The Invesco DB US Dollar Index Bullish Fund ( UUP ) was down 0.7%, the iShares Silver Trust ( SLV ) was up 2.2%, the S&P 500 was up 40.5% and the price of Bitcoin skyrocketed 356.8%.

Sept. 26, 2021 (tweet): "Giant stock market crash coming October. Why? Treasury and Fed short of T-bills. Gold, silver, Bitcoin may crash too."

Almost a year after his previous economic doomsday prediction, Kiyosaki went back to the well with nearly identical recommendations. This time, his recommendations worked out a bit better for his followers ... but the economic collapse never materialized. In the 12 months following this message, the S&P 500 dropped 17.7%, the GLD fund dropped 7.6%, the SLV fund dropped 19.2% and Bitcoin prices tumbled 55.5%.

That said, Kiyosaki makes a specific claim here (an October 2021 crash) that did not materialize. It's another objectively incorrect prediction.

Sept. 26, 2022 (tweet): "EVERYTHING BUBBLE into EVERYTHING CRASH. I warned in my books, the biggest crash has been building since 1990s. Rather than fix problems FED printed FAKE $. In Everything Crash everything crashes even gold, silver, BC."

In the 2022 edition of his annual fall doom and gloom proclamation, Kiyosaki played his greatest hits. One year later, the S&P 500 was up 16.9%, the GLD fund was up 16.6%, the SLV fund was up 23.9% and Bitcoin was up 36.4%.

Kiyosaki's assertion that an "everything crash" was coming ended up being a great buy signal, as markets would soon begin a roaring year-plus rally that continues to this day.

July 17, 2023 (tweet): "I do not play the stock or bond markets. As an entrepreneur I like my hands on control too much. Yet too many signs point to a severe stock market crash."

In Kiyosaki's defense, many economists were calling for a recession throughout 2023. However, that recession never materialized and the S&P 500 has instead surged to new all-time highs. Specifically, the S&P 500 is up 15.1% since this warning.

Dec. 10, 2023 (tweet): "Get some cash out of banks as you need cash. This may be the start of the biggest crash in history."

It's only been a few months since Kiyosaki made his latest economic collapse prediction , but he's off to a rough start with this one. The S&P 500 is up 12.6% since this warning.

For some people, Robert Kiyosaki's bestselling book "Rich Dad Poor Dad" has been an excellent resource for learning about the basics of personal finance, including topics like budgeting, saving and investing. However, Kiyosaki seems to have found an audience more as a stock market and economic permabear than a personal finance expert in recent years.

Timing bull and bear markets is extremely difficult even for professional traders, but the S&P 500 has proven to be extremely resilient over the decades for investors who buy and hold index funds for the long term. Kiyosaki has repeatedly warned investors about a catastrophic stock market crash for at least 13 years now. Yet since his initial warning in April 2011, the S&P 500 has generated an overall total return of 290%.

Given his atrocious track record, Kiyosaki's morbid predictions on financial assets and the economy should not be taken seriously, and certainly shouldn't cause you to make changes to your portfolio. The investor who bought a low-cost stock market index every time the author predicted a crash has built a dramatically better financial life than the investor who sold in fear each time Kiyosaki cried "wolf."

Berkshire Hathaway's Portfolio

John Divine and Wayne Duggan Feb. 22, 2024

Tags: money , investing , stock market , wealth , Berkshire Hathaway , Warren Buffett , financial literacy

The Best Financial Tools for You

Credit Cards

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

See a newsletter example .

You May Also Like

Fidelity mutual funds to buy and hold.

Tony Dong April 10, 2024

Dividend Stocks to Buy and Hold

Wayne Duggan April 9, 2024

What Is a Stock Market Correction?

Marc Guberti April 9, 2024

If You Invested $10,000 in SMCI IPO

6 of the Best AI ETFs to Buy Now

Tony Dong April 9, 2024

7 Best Cybersecurity Stocks to Buy

Glenn Fydenkevez April 8, 2024

How Bitcoin Mining Is Evolving

Matt Whittaker April 8, 2024

9 of the Best Bond ETFs to Buy Now

Tony Dong April 8, 2024

10 Best Tech Stocks to Buy for 2024

Wayne Duggan April 8, 2024

About the Methodology

U.S. News Staff April 8, 2024

9 Growth Stocks That Also Pay Dividends

Jeff Reeves April 5, 2024

Effects of the Bitcoin Halving Event

Dmytro Spilka April 5, 2024

9 Best Cheap Stocks to Buy Under $5

Ian Bezek April 5, 2024

5 Best Charles Schwab Money Market Funds

Tony Dong April 5, 2024

How Stocks Perform in Election Years

Wayne Duggan April 4, 2024

10 Best AI Stocks to Buy

Natural Gas ETFs and Funds

Matt Whittaker April 4, 2024

Fidelity Bond Funds for Steady Income

Tony Dong April 4, 2024

Lithium Stocks to Buy Now

Brian O'Connell April 3, 2024

7 Best Vanguard Funds to Buy and Hold

Tony Dong April 3, 2024

Robert Kiyosaki predicts decade of market downturns

Robert Kiyosaki , the famed American author of best-selling books on personal finance and the author of ‘Rich Dad, Poor Dad,’ has donned a weary look and uttered a message of dire warning: “The Robots are coming!” He argues that stocks, bonds, and real estate in U.S. are on an “everything bubble”, and they were only good for the last 10 years, and the next 10 years would be negative. Kiyosaki is of the opinion that investors ought to hedge the risk that an economic downturn might cause by buying gold, silver, and Bitcoin (BTC).

Robert Kiyosaki warns of potential market downturn

While Robert Kiyosaki signaled the carpet beneath the investor’s feet, Reuters historical data proffered that the possibilities of the stock market bubble may be exaggerated. Only during the post-World War II period, before the start of the new millennium, can one find the only significant bubble burst, which was the famous dot-com crash.

In the 2000s, this situation was witnessed in the internet boom, the implosion of which brought severe panic. Business media maintains that current corporate balance sheets are strong for now, and foreign markets especially clearly demonstrate this through their positive view of the stocks. Nevertheless, SocGen’s Albert Edwards has been pointing to the so-called AI stock valuations, especially the case with those driven by the so-called AI hysteria, which, according to him, might be a potential risk.

Bitcoin move in opposite direction with the S&P 500 index

In the second quarter of the year 2022, the Fed began hiking interest rates to try to curb inflation. Following the move by the Fed, Bitcoin’s price and that of US stocks dropped, leaving people wondering if it could actually be a good hedge.

Jurrien Timmer, an associate director of global macro at Fidelity Investments, indicated that Bitcoin now manifests a negative correlation with the S&P 500, which suggests its possible role in the spectrum of more promising instruments for portfolio diversification in the year 2024.

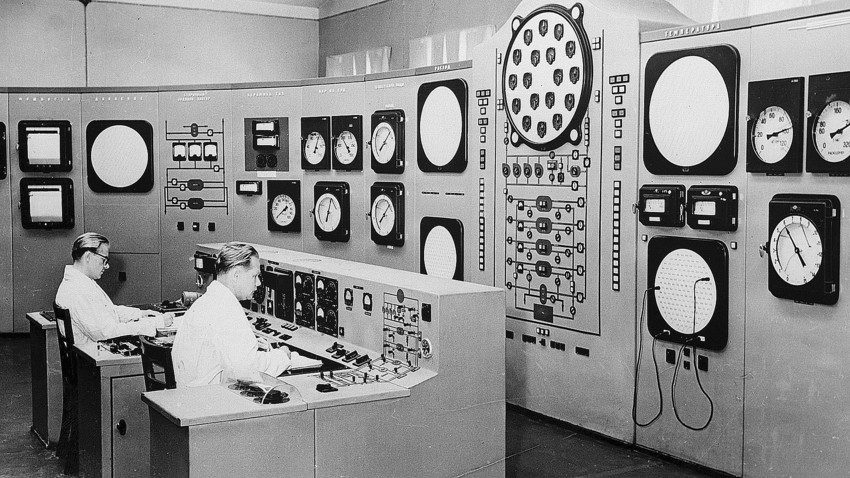

First refuelling for Russia’s Akademik Lomonosov floating NPP

!{Model.Description}

The FNPP includes two KLT-40S reactor units. In such reactors, nuclear fuel is not replaced in the same way as in standard NPPs – partial replacement of fuel once every 12-18 months. Instead, once every few years the entire reactor core is replaced with and a full load of fresh fuel.

The KLT-40S reactor cores have a number of advantages compared with standard NPPs. For the first time, a cassette core was used, which made it possible to increase the fuel cycle to 3-3.5 years before refuelling, and also reduce by one and a half times the fuel component in the cost of the electricity produced. The operating experience of the FNPP provided the basis for the design of the new series of nuclear icebreaker reactors (series 22220). Currently, three such icebreakers have been launched.

The Akademik Lomonosov was connected to the power grid in December 2019, and put into commercial operation in May 2020.

Electricity generation from the FNPP at the end of 2023 amounted to 194 GWh. The population of Pevek is just over 4,000 people. However, the plant can potentially provide electricity to a city with a population of up to 100,000. The FNPP solved two problems. Firstly, it replaced the retiring capacities of the Bilibino Nuclear Power Plant, which has been operating since 1974, as well as the Chaunskaya Thermal Power Plant, which is more than 70 years old. It also supplies power to the main mining enterprises located in western Chukotka. In September, a 490 km 110 kilovolt power transmission line was put into operation connecting Pevek and Bilibino.

Image courtesy of TVEL

- Terms and conditions

- Privacy Policy

- Newsletter sign up

- Digital Edition

- Editorial Standards

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

From Hitler to Stalin: The secret story how German scientists helped built the Soviet A-bomb

In the late 1940s, Soviet scientists worked hard on their own atomic project, and the help of captured (or invited) German colleagues was of great help.

Soviet soldiers might have been quite surprised when in 1945 they approached Baron Manfred von Ardenne’s home near Berlin. As described by an eyewitness, the “half-mansion, half-castle” was decorated with a sign in Russian saying, “ Dobro pojalovat ! ” (‘Welcome’). “Ardenne well understood how the wind was now blowing,” the officers joked.

Indeed, Ardenne, a scientist who developed the first broadband amplifier, contributed to establishing a stable radio system in Hitler’s Germany, and he also worked on the Nazi’s nuclear project. Caught in the Soviet zone of occupation, he knew that he now had to work for Moscow. And so did many of his colleagues.

Brains as trophies

The first Soviet atomic bomb test.

In spring 1945 it was clear that World War II was coming to a close, and both the West and the USSR were already preparing for the coming Cold War, with each side planning to develop incredible new weapons. Both sides wanted to use scientists from Nazi Germany to further their own new technologies.

The U.S. forced Wernher von Braun and Werner Heisenberg, two key scientists in the German nuclear project, to collaborate. But Moscow also captured some prominent specialists. As Vladimir Gubarev, a journalist who wrote a book on the Soviet nuclear program, emphasized, “One shouldn’t underestimate the German contribution to the development of the Soviet nuclear industry; it was significant.”

The Baron and the Communists

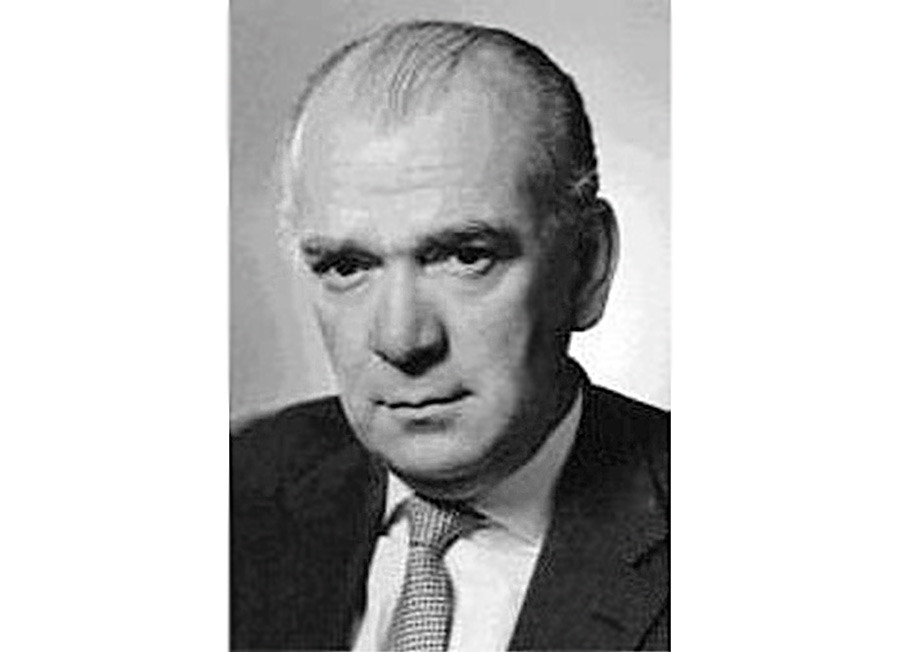

Baron Manfred von Ardenne in his younger years.

One of those German scientists, Manfred von Ardenne, had an outstanding life. Born into a noble family but then a high school dropout, the Baron went on to become an extremely successful inventor with around a total of 600 patents, including the first high-resolution scanning electron microscope. Ardenne, however, was doomed to work with three totalitarian leaders: Adolf Hitler, Joseph Stalin and Erich Honecker.

After the Soviets arrived in Berlin, Stalin’s official in charge of the Soviet atomic program, Lavrenty Beria, made Ardenne an offer that he couldn’t refuse: drop the electronics and work on the Soviet A-bomb.

From Berlin to Sukhumi

Ardenne asked to be allowed to concentrate on the development of the isotope separation process for obtaining nuclear explosives, such as uranium-235 (and not on the bomb itself). Beria agreed. Later the scientist called his role in the Soviet nuclear program, “the most important deed that fortune and post-war events led me to.”

Ardenne, working in his laboratory.

Not that Ardenne wasn’t familiar with uranium. As Vadim Gorelik put it in an article for Neue Zeiten , “During World War II, prisoners built for Ardenne a cyclotron and a uranium centrifuge that would have created material for the Fuhrer’s nuclear bomb.” But Germany lost the war, and now Ardenne, with his laboratory evacuated, worked in Sukhumi (now Abkhazia) on splitting isotopes and was in charge of more than 100 people.

Ardenne’s work was successful, and he was decorated with the Stalin Prize in 1947, and then again in 1953 with a Stalin Prize first class. In 1955, he returned to East Germany. Talented and unsinkable, Ardenne lived for 42 more years, doing important research in physics and medicine.

Hero of Socialist Labor

Physicist Nikolas Riehl - perhaps not as sharp-dressed as Baron von Ardenne yet even more important for the Soviet nuclear program.

Ardenne wasn’t the only prominent German scientist ‘invited’ to work on the Soviet nuclear program. There was also physicist Gustav Hertz who won the Nobel Prize; physical chemist Max Volmer, who later headed East Germany’s Academy of Science; Max Steenbeck, who pioneered the development of supercritical centrifuges; and many others (about 300 in total).

Nikolaus Riehl possibly had the most interesting fate of them all. This physicist was born in tsarist St. Petersburg in 1901, moved to Germany in the 1920s, and 20 years later was forced to return. His Soviet colleagues called him “Nikolai Vasilyevich,” because of his Russian roots.

Vladimir Gubarev recalls: “Both the American and the Soviet secret services pursued Riehl after the war… we were lucky enough – and he worked in the USSR.” In the Elektrostal factory (Moscow Region) Riehl, along with other scientists, managed to create metal uranium necessary for making a bomb. For that he was awarded the title of “Hero of Socialist Labor” – the only German scientist to achieve such an honor.

“Nikolas Riehl loved to wear his medal and demonstrated it anytime he could,” Gubarev wrote. “All the money he received he gave to the German POWs working in Elektrostal, and they remembered that even decades later, as their memoirs attest.”

In 1949 the USSR had its own nuclear bomb, and in the 1950s, after the work of the German scientists was completed, most left for East Germany. Some, such as Riehl, even managed to defect to West Germany, leaving behind the socialist chapter in their lives.

With the Cold War unfolding, rivaling nuclear projects were not the only case of the USSR and the U.S. challenging each other: read our text on how the global superpowers faced each other in the Korean peninsula.

If using any of Russia Beyond's content, partly or in full, always provide an active hyperlink to the original material.

to our newsletter!

Get the week's best stories straight to your inbox

- How a German soldier became a Hero of the Soviet Union

- Andrei Sakharov: 'Nuclear war might come from an ordinary one'

- Why didn’t Soviet airships bomb German cities during WWII?

This website uses cookies. Click here to find out more.

A Chronicle of Current Events

For human rights & freedom of expression in the ussr, the podrabinek case, dec 1977 to feb 1978 (48.7).

<<No 48 : 14 March 1978>>

On 1 December 1977, the brothers Alexander and Kirill PODRABINEK (CCE 47) and their father Pinkhos Abramovich PODRABINEK were summoned for a chat by Yu.S. Belov, chief of a department at the Moscow City and Regional KGB. Alexander refused to appear.

“On behalf of the Committee for State Security ” (Belov told Kirill and his father Pinkhos Podrabinek)

“I suggest that you and your families leave the Soviet Union and go abroad via Israel within 20 days. There is enough material against you, Kirill Pinkhosovich, to institute criminal proceedings. You, Pinkhos Abramovich, are also known to us for your anti-social activities. An act of humanity is being offered to you both. I advise you to make use of it.”

Alexander (b. 1953) and Kirill Podrabinek (b. 1952)

The same evening Alexander Podrabinek was arrested on the street and taken to the KGB. Belov presented him, too, with an ultimatum: all three must leave the country, otherwise criminal proceedings would be instituted against both brothers.

Belov let it be understood that the absence of an invitation and difficulties with money would not be obstacles. Belov stressed that they could only leave all together.

HOSTAGE-TAKING

Many painful disputes have sprung up around the moral problems arising from KGB’s ultimatums and blackmail. The Chronicle cannot present the arguments but at least it can accurately convey the stance of participants in such events by reproducing all their statements in sufficient detail.

On 6 December 1977, there was a press conference at Andrei Sakharov ’s flat. Pinkhos PODRABINEK read out a “Statement for the Belgrade Conference [note 1] and the Press”:

“A distinctive feature of this case is the KGB’s use of the hostage system. Not one of us can determine his own fate independently, and a decision about the fate of three people has been placed by the KGB on Alexander Podrabinek alone, in whose departure the authorities are most of all interested. “We categorically refuse to accept such conditions and insist on our right to make our choices independently…”

Then Alexander PODRABINEK read out his “Reply” to the KGB’s proposal:

“I would like to draw the attention of the world public to my brother’s painful position and to the dirty tactics of the KGB — tactics of intimidation and terror. The whole world condemns the hijacking of aeroplanes and the taking of passengers as hostages, yet the KGB is using the very same method with regard to my brother, a method commonly used by terrorists. In the situation that has arisen the most painful thing for me is my brother’s fate. “At the KGB they insistently advised me to take advantage of this ‘humane act of the Soviet government’, as they expressed it. I regard this proposal as unconcealed blackmail by the KGB. “They have given me four days to reflect. On 5 December I have to give my reply. A reply that means a great deal to me. “This is my reply.

“I do not wish to go to prison. I value even the semblance of freedom which I possess now. I know that I would be able to live freely in the West and at last receive a real education. I know that there I would not have four agents at my heels, threatening to beat me up or push me under a train.

“Over there, I know, they will not put me in a concentration camp or a psychiatric hospital for attempting to defend people who are denied their rights and oppressed. Over there, I know, one breathes easily. While here one does so with difficulty, and they stop your mouth and stifle you if you speak too loudly. I know that our country is unhappy and doomed to suffering.

“And that is why I am staying.

“I do not want to go to prison, but neither do I fear a camp. I value my own freedom as I value my brother’s, but I am not bargaining for it. I will not give in to any blackmail.

“A clear conscience is dearer to me than material well-being. I was born in Russia. This is my country, and I must remain here, however hard it may be and however easy in the West. As far as I am able, I will go on defending those whose rights are being so brazenly trampled on in our country.

“That is my reply. I am staying.”

After this Alexander Podrabinek added that he would agree to leave the country only if Kirill were to ask him to do so.

On 7 December 1977, Kirill PODRABINEK made a statement:

KGB Blackmail

1. The KGB is using the hostage-taking method. They are basically blackmailing my brother Alexander, while I am the hostage. 2. The very formulation of the question: ‘leave or we will put you in prison’, is contrary to the law. If a man has committed a crime he must be prosecuted. However, in this case the KGB does not want to stage a new political trial but prefers to dispatch us abroad. The KGB has employed a well-calculated device — to exploit the insolubility of a situation with a hostage. All this blackmail is patently a consequence of the public stand taken by our family … “If any one of the three of us is arrested and any charge whatsoever brought against him, it can only be viewed as an act of revenge by the KGB and not as a requirement of justice.”

On 12 December 1977, Kirill Podrabinek informed Belov that he had decided to leave. Belov replied that Kirill could hand in his emigration documents, and on the same day Kirill did so. On 14 December Kirill Podrabinek made an addition to his previous statement:

“On 12 December, I telephoned investigator Belov at the KGB. Permission to go abroad has been granted; there was no mention of my only being able to leave only with my brother. Does this mean that the KGB has given up its hostage-taking and will really allow me to leave? In the very near future this will become clear … In view of all the circumstances, and fearing for my life” (see CCE 47) “I have taken the decision to leave.” *

KIRILL PODRABINEK (b. 1952)

On 27 December 1977, the police in Elektrostal (Moscow Region) brought charges against Kirill Podrabinek under Article 215 (RSFSR Criminal Code: “Illegal possession of arms, ammunition” etc). Kirill refused to sign the record of this charge. Investigator Radygin obtained his written undertaking not to leave town but said he would not need Kirill before the middle of January and, if need be, he could go to Moscow.

When Kirill Podrabinek came out of the Elektrostal police station he was met at the door by KGB Investigator Belov, who had arrived from Moscow. The condition of Kirill’s departure remained unchanged, Belov said, and gave him three days in which to persuade his brother to agree to leave.

From that day onwards, KGB employees began trailing Kirill Podrabinek . (His brother Alexander had been under a similar “escort” since 10 October 1977, see below). The same day 22 Muscovites issued a statement:

“Wishing to force Alexander Podrabinek to leave the country, the KGB is openly blackmailing him with his brother’s fate. A method of hostage-taking used thus far only by irresponsible criminal-terrorists is in the present case being adopted as a weapon by the official representatives of a powerful State. This blackmail clearly demonstrates the value of the charges brought against Kirill Podrabinek. “We call upon our fellow countrymen and world public opinion to protest against the use of hostage-taking, unprecedented in the practice of civilized states. We call upon our fellow countrymen and world public opinion to follow attentively the fate of the Podrabinek family.”

On 28 December Kirill Podrabinek made a statement:

State Terrorism

“… The KGB has resorted to hostage-taking. My brother Alexander has made a statement for the press saying that he does not wish to leave, but he will leave if I so demand. “Under no circumstances will I make this demand of Alexander. In the first place, that would mean becoming a blind instrument of blackmail in the hands of the KGB, exploiting a situation created by them for my own sake. In the second place, it is impossible for me to even ask, let alone demand such a thing. “However, I have resolved to pursue my chosen line of action and try to obtain permission to leave.”

On the evening of 29 December 1977, Kirill Podrabinek was arrested.

On the day of his arrest, he declared a hunger strike. After a few days he was transferred from Elektrostal to Moscow, to the MVD’s detention centre on Matrosskaya Tishina Street.

The first response to Kirill’s arrest was “The Christmas ‘Feat’ of the KGB”, a short article by Victor Nekipelov [note 2]:

“… The arrest of Kirill Podrabinek is an act of deliberate, demonstrative revenge. The authorities know full well that they are thereby dealing the severest blow to both Alexander Podrabinek – Take that for not accepting our offer! – and to his father — While you didn’t steer your sons to a compromise!”

On 1 January 1978, Yevgeny Nikolayev (see “In the Psychiatric Hospitals”, CCE 48.12 ) sent a letter to the RSFSR Procurator’s Office, protesting against the arrest of Kirill Podrabinek.

On 4 January 1978, Alexander and Pinkhos Podrabinek asked Belov for a meeting with Kirill.

Belov refused but promised to pass Kirill a note from them, “if there are no objections on the part of the investigator”. In the note Alexander and his father asked Kirill: “Do you agree to leave if there is no need to ask Alexander to do the same?”

On the same day, at 11.30 pm, Belov came to Elektrostal to see Pinkhos Podrabinek . He informed him that the investigator “had not allowed” the note to be passed to Kirill. If Alexander handed in his application to emigrate within three days, however, all three could leave the USSR. Otherwise, Alexander would also be arrested. Belov suggested that P.A. Podrabinek go at once to Moscow and persuade Alexander to change his mind: he even gave Pinkhos Abramovich a lift back to Moscow in his car.

On 5 January 1978, Alexander Podrabinek appealed in an open letter to Amnesty International, calling on the organisation to speak out in Kirill’s defence.

On 9 January Alexander Podrabinek telephoned Belov at the KGB. When Belov asked if he intended to leave, Alexander replied that he could only decide this matter together with his brother.

On 15 January 1978, the Christian Committee for the Defence of Believers’ Rights in the USSR called upon “world public opinion” to speak out in defence of Kirill Podrabinek and condemn the policy of hostage-taking.