- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Is Bookkeeping? Definition, Tasks, Terms to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

The evolution of bookkeeping

What is a bookkeeper’s job, what is the difference between bookkeeping and accounting, common bookkeeping terms.

Bookkeeping is broadly defined as the recording of financial transactions for a business. It’s a key component of the accounting process and can be done as frequently as daily, weekly or monthly. Accurate bookkeeping is vital to filing tax returns and having the financial insights to make sound business decisions.

QuickBooks Online

Modern bookkeeping was formally established in the late 15th century when Italian mathematician and Franciscan monk Luca Pacioli described double-entry bookkeeping in his book, “Summary of Arithmetic, Geometry, Proportions and Proportionality.”

While the basics of accounting haven’t changed in over 500 years, the practice of bookkeeping has. Bookkeeping was once done manually using actual books called journals and ledgers. Because bookkeeping is based on double-entry accounting , each transaction affects two accounts — one gets debited and the other is credited. These debits and credits had to be manually recorded and balanced.

The advent of accounting software significantly lessened the tediousness of bookkeeping by handling debits and credits for you in the background. And technologies like optical character recognition (OCR) and bank feeds have come just short of fully automating the traditional bookkeeping process. Data entry can now happen as soon as you snap a photo of a receipt with your smartphone. And reconciliations happen almost in real time through daily bank feed maintenance, making the end-of-month closing process a snap. Now one bookkeeper can manage the bookkeeping for several businesses in fewer than eight hours a day.

» MORE: Bookkeeping 101: A crash course in small-business bookkeeping

Bookkeeping means different things to different people. Some bookkeepers focus solely on “write up” work, which basically consists of compiling the books quickly, usually for tax preparation purposes. Other bookkeepers provide “full-charge” services and can even serve as a financial controller for your company.

Full-charge bookkeeping tasks can be broken down into four broad categories.

1. Data entry

Data entry involves entering your business’s transactions into your bookkeeping system. As mentioned above, a lot of the data entry now happens automatically, either through OCR or bank feeds.

There's more to data entry than just putting the numbers into your software, though. Proper data entry includes:

Source document verification: This step usually gets skipped when doing your bookkeeping solely from bank feeds. Ideally, you want to make sure your data entry comes not from the bank feed, but from source documents like receipts or bills. This ensures that only valid business transactions are being entered into your books. Today’s bookkeeping software allows you to snap a photo of or scan in your source documents, and then OCR technology will extract the pertinent information and do much of the data entry for you. This means you can maintain source document verification while still taking advantage of the time-saving technology of your accounting software.

Accurate classification of transactions: Each entry into your bookkeeping system impacts at least two accounts in your business’s chart of accounts . Proper data entry — or data management if you rely on automation for your data entry — ensures that transactions are being posted to the correct accounts. Accurate classification of transactions enables you to produce financial management reports that can be used to make strategic business decisions.

Accurate identification of transactions: One downfall of some bookkeeping software is that the artificial intelligence behind it can make mistakes a human wouldn’t make while entering the data. The most common of these mistakes is assigning the wrong payee name to a transaction. You must make sure your transactions are being identified correctly. This is especially important for payments you make to vendors who will need a 1099 form at the end of the tax year.

2. Office management

Often, office management tasks like customer billing, paying vendors and payroll are considered to be bookkeeping tasks. Although accounts receivable, accounts payable and payroll do impact your books, some of these tasks can be managed by a person in your company other than your bookkeeper. Others, like payroll, can be outsourced to independent companies that specialize in the task.

If your bookkeeper bills your customers or pays your vendors and employees, make sure you have proper checks and balances in place to mitigate the possibility of fraud.

3. End-of-period closing

Your books should be closed at the end of each accounting period. End-of-period closing includes:

Reconciling all bank, credit card and loan accounts.

Reconciling accounts payable and accounts receivable.

Making any adjusting journal entries for prepaid revenue or expenses, depreciation or other unusual transactions.

Reviewing the financial statements for accuracy and completeness.

Locking the books so they can’t be changed after the end-of-period closing has been completed (optional, but highly recommended).

4. Internal management reports

Only an accountant licensed to do so can prepare certified financial statements for lenders, buyers and investors. However, your bookkeeper can generate internal management reports for your business.

There are three common reports your bookkeeper can prepare:

Your balance sheet is a snapshot of your assets, liabilities and equity as of a certain date.

Your income statement (also known as a profit and loss statement) details your business’s income and expenses for a period of time (a month, quarter, year, etc.). It shows whether your business has earned a profit or experienced a loss.

Your cash flow statement reconciles the income statement to the balance sheet and answers the question, “Where did the cash go?” for accrual-basis businesses.

Your bookkeeper might also prepare other auxiliary reports for your business, like accounts payable and accounts receivable aging reports . You can use these to make business decisions, but they should not be presented as audited, certified or official financial statements.

It’s important to note that not all lenders and investors require certified or audited financial statements. However, it’s still a good idea to ask an accountant to review your bookkeeper’s financial statements for accuracy and completeness prior to submitting them to a third party for consideration. And even if you’re not looking for funding, consider asking an accountant to review your financial statements at least once a year.

» MORE: Best online bookkeeping services

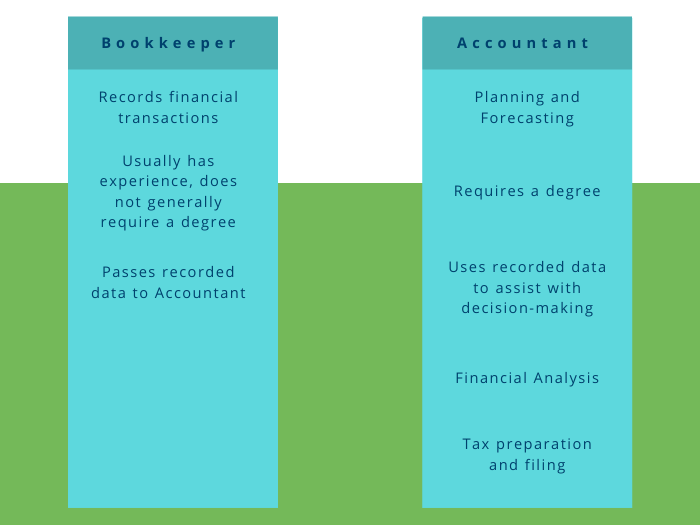

Bookkeeping is largely concerned with recordkeeping and data management. Bookkeepers make sure the information in the books is accurate and that the books are reconciled each month. In essence, they complete the first step in the accounting process.

Accountants, on the other hand, use the information provided by bookkeepers to summarize a business’s financial position and render financial advice to the business owner. Many accountants also prepare tax returns, independent audits and certified financial statements for lenders, potential buyers and investors.

Accountants typically have at least a bachelor’s degree in accounting, and many go on to become certified public accountants (CPAs) or certified management accountants (CMAs). Bookkeepers might also have degrees in accounting, but most have either technical certifications or on-the-job experience.

» MORE: Does your business need a bookkeeper or an accountant?

Bookkeeping has its own language, and bookkeepers and accountants sometimes forget business owners might not be fluent in it. Here are some common bookkeeping terms:

The accounting equation: The accounting equation is the key formula that keeps your books in balance. That equation is Assets = Liabilities + Equity. You can see the accounting equation in action in your business’s balance sheet.

Assets: What your business owns. Assets include cash, buildings, vehicles, patents and open invoices due from customers (accounts receivable), just to name a few.

Liabilities: What your business owes. Liabilities include credit card balances, amounts due to vendors (accounts payable), loan balances and tax liabilities that haven't yet been paid.

Equity: What is owed to the owner or shareholders of the business. Equity includes money paid in by the owner (contributions), money the owner has earned but not taken from the business (retained earnings) and other types of contributions like stock issued.

General ledger: The general ledger is where financial transactions are recorded and is made up of assets, liabilities, equity, income and expenses. These five types of accounts comprise the books for your business.

Chart of accounts: The list of categories you use to classify your business’s transactions. Think of the chart of accounts as a sort of filing system for your business’s transactions.

Debits and credits: Each bookkeeping transaction has two sides (remember, it’s called double-entry accounting). One side of the transaction is the debit side, and the other side is the credit side. Assets and expenses are increased by debits and reduced by credits. Income, equity and liabilities are increased by credits and reduced by debits.

Accrual basis and cash basis: Accrual-basis accounting recognizes income and expenses when they are incurred. Cash-basis accounting recognizes income when payment is received and expenses when payment is made. Check out NerdWallet’s accrual vs. cash basis accounting guide for more details.

Reconciliation: The process of verifying the balance of certain accounts (checking, credit cards, loans, etc.) against statements from an outside source, usually a bank.

Income: Money your business earns through sales.

Expenses: Money your business spends on operations and overhead.

Cost of goods: Money your business spends to produce income. Read NerdWallet’s cost of goods sold explainer to learn more.

Profit: What your business has earned after cost of goods and expenses are subtracted from income. Profit is not the same as cash on hand.

» MORE: NerdWallet’s top picks for accounting and bookkeeping apps

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

On a similar note...

Bookkeeping – Definition, Importance, Types & Methods

What is bookkeeping and why is it important?

Bookkeeping is the process of recording your company’s financial transactions into organized accounts on a daily basis. It can also refer to the different recording techniques businesses can use. Bookkeeping is an essential part of your accounting process for a few reasons. When you keep transaction records updated, you can generate accurate financial reports that help measure business performance. Detailed records will also be handy in the event of a tax audit.

This guide will walk you through the different methods of bookkeeping, how entries are recorded, and the major financial statements involved.

Methods of bookkeeping

Before you begin bookkeeping, your business must decide what method you are going to follow. When choosing, consider the volume of daily transactions your business has and the amount of revenue you earn. If you are a small business, a complex bookkeeping method designed for enterprises may cause unnecessary complications. Conversely, less robust methods of bookkeeping will not suffice for large corporations.

With this in mind, let’s break these methods down so you can find the right one for your business.

Single-entry bookkeeping

Single-entry bookkeeping is a straightforward method where one entry is made for each transaction in your books. These transactions are usually maintained in a cash book to track incoming revenue and outgoing expenses. You do not need formal accounting training for the single-entry system. The single-entry method will suit small private companies and sole proprietorships that do not buy or sell on credit, own little to no physical assets, and hold small amounts of inventory.

Double-entry bookkeeping

Double-entry bookkeeping is more robust. It follows the principle that every transaction affects at least two accounts, and they are recorded as debits and credits . For example, if you make a sale for $10, your cash account will be debited for $10 and your sales account will be credited by the same amount. In the double-entry system, the total credits must always equal the total debits. When this happens, your books are “balanced.”

Using the double-entry method for bookkeeping makes more sense if your business is large, public, or buys and sells on credit. Enterprises often choose the double-entry system because it leaves less room for error. In a way, it ‘double-checks’ your books because each transaction is recorded as two matching but offsetting accounts.

Cash-based or accrual-based

The next step is choosing between a cash or accrual basis for your bookkeeping. This decision will depend on when your business recognizes its revenue and expenses.

In cash-based, you recognize revenue when you receive cash into your business. Expenses are recognized when they are paid for. In other words, any time cash enters or exits your accounts, they are recognized in the books. This means that purchases or sales made on credit will not go into your books until the cash exchanges.

In the accrual method, revenue is recognized when it is earned. Similarly, expenses are recorded when they are incurred, usually along with corresponding revenues. The actual cash does not have to enter or exit for the transaction to be recorded. You can mark your sales and purchases made on credit right away.

Both a cash and accrual basis can work with single- or double-entry bookkeeping . In general however, the single-entry method is the foundation for cash-based bookkeeping. Transactions are recorded as single entries which are either cash coming in or going out. The accrual basis works better with the double-entry system.

How to record entries in bookkeeping

Generating financial statements like balance sheets, income statements, and cash flow statements helps you understand where your business stands and gauge its performance. For these reports to portray your business accurately, you must have properly documented records of your transactions. Keeping these records as current as possible is also helpful when reconciling your accounts.

Recording transactions begins with source documents like purchase and sales orders, bills, invoices, and cash register tapes. Once you gather these documents, you can record the transactions using journals, ledgers, and the trial balance . If you are a very small company, you may only need a cash register. The information can then be consolidated and turned into financial statements.

C ash registers

A cash register is an electronic machine that is used to calculate and register transactions. Usually, cash registers are used to record cash flow in stores. The cashier collects the cash for a sale and returns a balance amount to the customer. Both the collected cash and balance returned are recorded in the register as single-entry cash accounts. Cash registers also store transaction receipts, so you can easily record them in your sales journal.

Cash registers are commonly found in businesses of all sizes. However, they aren’t usually the primary method of recording transactions because they use the single-entry, cash-based system of bookkeeping. This makes them convenient for very small businesses but too simplistic for enterprises.

The journal

The journal is called the book of original entry. It is the place where a business chronologically records its transactions for the first time. A journal can be either physical (in the form of a book or diary), or digital (stored as spreadsheets, or data in accounting software). It specifies the date of each transaction, the accounts credited or debited, and the amount involved. While the journal is not usually checked for balance at the end of the fiscal year, each journal entry affects the ledger. As we’ll learn, it is imperative that the ledger is balanced, so keeping an accurate journal is a good habit to keep. This form is useful for double-entry bookkeeping.

A ledger is a book or a compilation of accounts. It is also called the book of second entry. After you enter transactions in a journal, they are classified into separate accounts and then transferred into the ledger. These records are transcribed by accounts in the order: assets, liabilities, equity, income, and expenses. Like the journal, the ledger can also be physical or electronic spreadsheets.

A ledger contains a chart of accounts, which is a list of all the names and number of accounts in the ledger. The chart usually occurs in the same order of accounts as the transcribed records.

Unlike the journal, ledgers are investigated by auditors, so they must always be balanced at the end of the fiscal year. If the total debits are more than the total credits, it’s called a debit balance. If the total credits outweigh the total debits, there is a credit balance. The ledger is important in double-entry bookkeeping where each transaction changes at least two sub-ledger accounts.

Trial balance

The trial balance is produced from the compiled and summarized ledger entries. The trial balance is like a test to see if your books are balanced. It lists the accounts exactly in the following order: assets, liabilities, equity, income, and expenses with the ending account balance.

An accountant usually generates the trial balance to see where your business stands and how well your books are balanced. This can then be cross-checked against ledgers and journals. Imbalances between debits and credits are easy to spot on the trial balance. It is not always error-free, though. Any miscalculated or wrongly-transcribed journal entry in the ledger can cause an incorrect trial balance. It is best to look out for errors early, and correct them on the ledger instead of waiting for the trial balance at the end of the fiscal year.

Financial statements

The next, and probably the most important, step in bookkeeping is to generate financial statements. These statements are prepared by consolidating information from the entries you have recorded on a day-to-day basis. They provide insight into your company’s performance over time, revealing the areas you need to improve on. The three major financial reports that every business must know and understand are the cash flow statement, balance sheet, and income statement.

The cash flow statement

The cash flow statement is exactly what its name suggests. It is a financial report that tracks incoming and outgoing cash in your business. It allows you (and investors) to understand how well your company handles debt and expenses. By summarizing this data, you can see if you are making enough cash to run a sustainable, profitable business.

The balance sheet

The balance sheet reports a business’ assets, liabilities, and shareholder’s equity at a given point in time. In simple words, it tells you what your business owns, owes, and the amount invested by shareholders. However, the balance sheet is only a snapshot of a business’ financial position for a particular date. It must be compared with balance sheets of other periods as well. The balance sheet allows you to understand the liquidity and financial structure of your business through analytics like current ratio, asset turnover ratio, inventory turnover ratio, and debt-to-equity ratio.

The income statement

The income statement , also called the profit and loss statement, focuses on the revenue gained and expenses incurred by a business over time. There are two parts in a typical income statement. The upper half lists operating income while the lower half lists expenditures. The statement tracks these over a period, such as the last quarter of the fiscal year. It shows how the net revenue of your business is converted into net earnings which result in either profit or loss. The income statement does not focus on receipts or cash details.

Bank reconciliation

Bank reconciliation is the process of finding congruence between the transactions in your bank account and the transactions in your bookkeeping records. Reconciling your bank accounts is an imperative step in bookkeeping because, after everything else is logged, it is the last step to finding discrepancies in your books. Bank reconciliation helps you ensure that there is nothing amiss when it comes to your money.

Why is it mandatory?

Bank reconciliation is a must because it:

- Provides the exact financial situation of your company

- Tracks cash flow accurately

- Helps detect fraud or bank errors

Stay on top of your bookkeeping

Proper bookkeeping drives your company to success. It is a foundational accounting process, and developing strategies to improve core areas of your business would be nearly impossible without it. Yet as important as bookkeeping is, implementing the wrong system for your company can cause challenges. Some companies can still use manual methods with physical diaries and paper journals. However, as technology gets more and more advanced, even smaller companies could get benefits from going digital. This is where a cloud bookkeeping solution like Zoho Books comes in. Zoho Books helps you keep accurate records of your business finances. It provides quicker and easier solutions for cash management, accounts payable/receivable, bank reconciliation, and generating financial statements. Further, its built-in automation takes care of mundane accounting tasks and helps you focus more on your business. Try our bookkeeping software for free and see how it can help your business maintain perfect bookkeeping records.

Related Posts

- 'It's a match!': A simple guide on how to do bank reconciliation

- Difference between single entry and double entry bookkeeping

- What Are the Different Accounting Methods?

- What is Journal & Ledger in Accounting and Bookkeeping?

Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

ooh what a nice article.. Bravo!!!

This is an awesome and quite empowering article in the world of accounts,kudos

I really love this

I like the way it is explained and need practical examples

Very insightful. Thank you for the lecture.

great, we are really surprised to read your article.

I had a confusion regarding bookkeeper and accountant, this article helped me understand the difference between them. Thanks for the article really appreciate it.

This is so impressive and very understanding, thanks you for Impacting more knowledge to me, God bless you.

This is very great 👍 I really appreciate this ❤️

Wow, it’s so awesome I’ve been getting trouble In understanding the entry system in bookkeeping , thanks for the knowledge

Nice explanation. Keep sharing valuable content to create awareness.

Good and well explained notes,I like them

this will be of great help

You might also like

Switch to smart accounting. try zoho books today.

- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

The Beginner's Guide to Bookkeeping

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-1d1189bf85d0470eb415291cb149a744.jpg)

What Is Bookkeeping?

- Bookkeeping vs. Accounting

- Bookkeeping for Business

- Balancing the Books

- The Income Statement

Image by Daniel Fishel é The Balance 2019

Bookkeeping is the process of recording all financial transactions made by a business. Bookkeepers are responsible for recording, classifying, and organizing every financial transaction that is made through the course of business operations. Bookkeeping differs from accounting. The accounting process uses the books kept by the bookkeeper to prepare the end of the year accounting statements and accounts.

Very small businesses may choose a simple bookkeeping system that records each financial transaction in much the same manner as a checkbook. Businesses that have more complex financial transactions usually choose to use the double-entry accounting process.

Bookkeeping is the process of keeping track of every financial transaction made by a business firm from the opening of the firm to the closing of the firm. Depending on the type of accounting system used by the business, each financial transaction is recorded based on supporting documentation. That documentation may be a receipt, an invoice, a purchase order, or some similar type of financial record showing that the transaction took place.

The bookkeeping transactions can be recorded by hand in a journal or using a spreadsheet program like Microsoft Excel. Most businesses now use specialized bookkeeping computer programs to keep books that show their financial transactions. Bookkeepers can use either single-entry or double-entry bookkeeping to record financial transactions. Bookkeepers have to understand the firm's chart of accounts and how to use debits and credits to balance the books.

The bookkeeping process should allow for communication of the financial results of the firm at the end of the year for income tax purposes and the preparation of financial statements by the firm's accountant.

How Does Bookkeeping Differ From Accounting?

Bookkeeping in a business firm is an important, but preliminary, function to the actual accounting function . A bookkeeper collects the documentation for each financial transaction, records the transactions in the accounting journal, classifies each transaction as one or more debits and one or more credits, and organizes the transactions according to the firm's chart of account.

The financial transactions are all recorded, but they have to be summarized at the end of specific time periods. Some firms require quarterly reports. Other smaller firms may require reports only at the end of the year in preparation for doing taxes.

At the end of the appropriate time period, the accountant takes over and analyzes, reviews, interprets and reports financial information for the business firm. The accountant also prepares year-end financial statements and the proper accounts for the firm. The year-end reports prepared by the accountant have to adhere to the standards established by the Financial Accounting Standards Board (FASB). These rules are called Generally Accepted Accounting Principles (GAAP).

What Do You Need to Set Up Bookkeeping for Your Business?

One of the first decisions you have to make when setting up your bookkeeping system is whether or not to use a cash or accrual accounting system . If you are operating a small, one-person business from home or even a larger consulting practice from a one-person office, you might want to stick with cash accounting.

If you use cash accounting, you record your transaction when cash changes hands. Using accrual accounting, you record purchases or sales immediately, even if the cash doesn't change hands until a later time, Sometimes firms start their business using cash accounting and switch to accrual accounting as they grow.

If you are going to offer your customers credit or if you are going to request credit from your suppliers, then you have to use an accrual accounting system.

You also have to decide, as a new business owner, if you are going to use single-entry or double-entry bookkeeping. Single-entry bookkeeping is much like keeping your check register. You record transactions as you pay bills and make deposits into your company account. It only works if your company is relatively small with a low volume of transactions.

If your company is larger and more complex, you need to set up a double-entry bookkeeping system. Two entries, at least, are made for each transaction. At least one debit is made to one account, and at least one credit is made to another account. That is the key to double-entry accounting .

Companies also have to set up their computerized accounting systems when they set up bookkeeping for their businesses. Most companies use computer software to keep track of their accounting journal with their bookkeeping entries. Very small firms may use a basic spreadsheet, like Microsoft Excel. Larger businesses adopt more sophisticated software to keep track of their accounting journals.

Lastly, the business must set up its chart of accounts. The chart of accounts may change over time as the business grows and changes.

The chart of accounts lists every account the business needs and should have. Each account has a number and a name. Subaccounts are also listed.

Understanding Assets, Liabilities, and Equity When Balancing the Books

Effective bookkeeping requires an understanding of the firm's basic accounts. These accounts and their sub-accounts make up the company's chart of accounts. Assets , liabilities , and equity make up the accounts that compose the company's balance sheet.

Assets are what the company owns such as its inventory and accounts receivables. Assets also include fixed assets which are generally the plant, equipment, and land. If you look you look at the format of a balance sheet , you will see the asset accounts listed in the order of their liquidity. Asset accounts start with the cash account since cash is perfectly liquid. After the cash account, there is the inventory, receivables, and fixed assets accounts. Those are tangible assets. You can touch them. Firms also have intangible assets such as customer goodwill that may be listed on the balance sheet.

Liabilities are what the company owes like what they owe to their suppliers, bank and business loans, mortgages, and any other debt on the books. The liability accounts on a balance sheet include both current and long-term liabilities. Current liabilities are usually accounts payable and accruals. Accounts payable are usually what the business owes to its suppliers, credit cards, and bank loans. Accruals will consist of taxes owed including sales tax owed and federal, state, social security, and Medicare tax on the employees which are generally paid quarterly. Long-term liabilities have a maturity of greater than one year and include items like mortgage loans.

Equity is the investment a business owner, and any other investors, have in the firm. The equity accounts include all the claims the owners have against the company. The business owner has an investment, and it may be the only investment in the firm. If the firm has taken on other investors, that is reflected here.

In bookkeeping, you have to balance your books at the end of the year. The bookkeeper has to keep careful track of these items and be sure the transactions that deal with assets, liabilities, and equity are recorded correctly and in the right place. There is a key formula you can use to make sure your books always balance. That formula is called the accounting equation:

Assets = Liabilities + Equity

The accounting equation means that everything the business owns (assets) is balanced against claims against the business (liabilities and equity). Liabilities are claims based on what you owe vendors and lenders. Owners of the business have claims against the remaining assets (equity).

Income Statement and Bookkeeping: Revenue, Expenses, and Costs

The income statement is developed by using revenue from sales and other sources, expenses, and costs . In bookkeeping, you have to record each financial transaction in the accounting journal that falls into one of these three categories.

The information from a company's balance sheet and income statement gives the accountant, at the end of the year, a full financial picture of the firm's bookkeeping transactions in the accounting journal.

Revenue is all the income a business receives in selling its products or services. Costs, also known as the cost of goods sold, is all the money a business spends to buy or manufacture the goods or services it sells to its customers. The Purchases account on the chart of accounts tracks goods purchased.

Expenses are all the money that is spent to run the company that is not specifically related to a product or service sold. An example of an expense account is Salaries and Wages or Selling and Administrative expenses.

A bookkeeper is responsible for identifying the accounts in which transactions should be recorded. For example, if the business makes a cash sale to a customer and your business uses double-entry bookkeeping, you would record the cash received in the asset account called Cash and the sale would be recorded in the revenue account called Sales.

Key Takeaways

- Bookkeeping is the process of keeping track of every financial transaction made by a business firm from the opening of the firm to the closing of the firm.

- Accounting analyzes, reviews, interprets, and reports financial information for the business firm. The accountant also prepares year-end financial statements and the proper accounts for the firm.

- In cash accounting, you record your transaction when cash changes hands. Using accrual accounting, you record purchases or sales immediately, even if the cash doesn't change hands until a later time,

- Effective bookkeeping requires an understanding of the firm's basic accounts. These accounts and their sub-accounts make up the company's chart of accounts.

- A business's six basic accounts are Assets, Liabilities, Equity, Revenue, Expenses, and Costs.

SCORE. " 10 Bookkeeping Basics You Can't Afford to Ignore ."

Bench Co. " Accounting 101: 8 Steps to Set Your Business Up for Success ," Page 8.

Bench Co. " Accounting 101: 8 Steps to Set Your Business Up For Success ," Pages 5-7.

Save up to 500 Hours on Paperwork 🙌 50% Off for 3 Months. BUY NOW & SAVE

50% Off for 3 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

- Online Accountants

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Track project status and collaborate with clients and team members

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Businesses With Employees

- Businesses With Contractors

- Self-Employed

- Freelancers

- Marketing & Agencies

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- A Beginner’s Guide to MTD

- Reports Library

- FreshBooks vs Quickbooks

- FreshBooks vs Xero

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Help Center

- Business Loan Calculator

- Markup Calculator

- VAT Calculator

Call Sales: +44 (800) 047 8164

- All Articles

- Productivity

- Project Management

- Making Tax Digital

Resources for Your Growing Business

What is bookkeeping definition, types & importance.

What is bookkeeping? Is it the same as accounting? People are often confused and think the terms are interchangeable. They aren’t! In this article, you’ll learn all about bookkeeping. It will discuss what bookkeeping means, types of bookkeeping and why it matters for your business. Here’s everything you need to know!

Here’s What We’ll Cover:

What Is Financial Bookkeeping?

Why is bookkeeping important for a business, how do you record financial transactions, top 5 bookkeeping apps for business owners, what is the difference between bookkeeping and accounting, the different types of bookkeeping, what is petty cash bookkeeping, is it hard to be a bookkeeper, key takeaways.

Financial bookkeeping is the record-keeping aspect of accounting . It includes recording all daily transactions. These are individual entries in journals or ledgers that summarize each business transaction. Accountants use these journals to prepare your financial statements. These are reports containing a summary of the business’s income and expenses for a specific timeframe. This accounting period could be weeks, months or years. It will reflect in your accounts receivable and accounts payable.

Bookkeeping isn’t just an inconvenience. It’s crucial to the success of your business! Bookkeeping is important because it documents every transaction that occurs within your company. This information allows you to make smart decisions for future growth and planning. It could result in improving processes or making purchasing decisions.

Good bookkeeping can reveal issues with your business. These issues might be preventing you from climbing the ladder to success! For example, let’s say that your business is losing money each month or that your overhead costs are too high. You can make changes by improving processes or evaluating purchases. However, you also need the right type of bookkeeping software to evaluate this information correctly.

There are different bookkeeping methods. Each one of these is designed to track specific types of business transactions. For example, there’s cash basis accounting and accrual basis accounting. You need to decide which accounting method you will use for your company. The most commonly used accounting method is the accrual method. Either way, it’s critical to have an accurate balance sheet and income statements.

If you’re unsure about this, consult a professional. A financial advisor or accountant can provide you with some guidance on the best type of bookkeeping software for your business.

Now that you know what bookkeeping is and why it’s important, let’s talk about what software you should be using. There are lots of great choices for bookkeeping software depending on your business’s needs. Here are five of the best:

FreshBooks is another great bookkeeping app for small businesses that need time-tracking capabilities. It’s an easy-to-use program that will let you set up recurring invoices for repeat clients. It’s a great choice if you need to save time by making your invoices as automatic as possible!

- QuickBooks Self-Employed

This is the perfect choice for people who work as freelancers or run a one-person shop. This is because QuickBooks Self-Employed offers 100% coverage for your tax prep so you won’t have to spend extra time filing taxes! It’s a great choice for anyone who needs a simple bookkeeping solution that will allow them to manage their expenses and income quickly.

TSheets is another great choice for businesses that work with employees and need to track their time. It’s an easy-to-use solution that makes it quick and simple to manage employees’ hours.

Xero is a great option if you deal with any international transactions or have multiple currencies. It offers real-time cloud bookkeeping, and also gives you access to certified accountants. It’s a great choice for any business that needs financial support and advice from its bookkeeping app. You can also quickly compare Xero with FreshBooks to make better business choice.

Wave provides a cloud-based solution for businesses looking to do their bookkeeping themselves. They’ll handle its complicated tax prep services for you, too! It’s a great choice if you’d like to manage your finances from anywhere and won’t require additional assistance.

Financial bookkeeping and accounting both record financial transactions. They’re not the same thing though! Financial bookusing software will help you track your business’s income and expenses. Accounting software is what you’ll use to prepare your financial statements. These statements show your company’s profit and loss over a specific period of time. Accounting software also makes it easier to forecast future growth and plan for the coming months or years!

Here are some other differences between bookkeeping and accounting:

- Accounting creates financial reports

- Bookkeeping records transactions

- Accounting is for your internal use only

- Bookkeeping can be completed by an accountant or yourself

Now that you know what bookkeeping is, let’s talk about the different types of bookkeeping. There are two main types: single-entry and double-entry .

Single-entry systems only record one side of a transaction. For example, if you paid $100 for supplies this month using your credit card, your expenses account would increase by $100.

Double-entry systems record both sides of a transaction. If you used your credit card to purchase supplies, then your cash account would decrease by $100 and your expenses account would increase by $100.

Petty cash is a small amount of money that your business uses for different purposes throughout the day. This could be as simple as buying doughnuts for your office or grabbing lunch during an impromptu meeting. To keep track of these expenses, you’ll need to use the petty cash bookkeeping method.

Petty cash bookkeeping is a single-entry system that simply records the total amount of money you have in your petty cash drawer. If you’re using an actual cash box for this, it’s best to keep track of each entry. This way, you can determine how much change remains at the end of the day.

Much of the work that goes into bookkeeping is more administrative than anything else. For example, your bookkeeper will need to make sure that every transaction in your business’s financial records has an entry. This could range from paying employees or purchasing supplies for your office.

It can be difficult to get used to doing this on a daily basis. It’s easy to make small mistakes and forget a few transactions every once in a while. This is why it’s important to choose the right bookkeeping software for your business. These types of programs will do all of this work automatically, so you won’t have to keep track of everything!

All in all, bookkeeping simply means tracking your business’s expenses and income. There are a variety of methods for this, including single-entry and double-entry systems.

Today’s better bookkeeping software makes it easier to prepare financial reports for your accountant or tax professional. You can use these reports to help you make informed decisions about the future of your company.

Hopefully this article provides some insights in bookkeeping. It should give you a great starting point for perfecting your bookkeeping strategy.

Did you enjoy reading this guide? Head over to our resource hub for more great content!

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

What is Bookkeeping?

- What Is Bookkeeping in Accounting?

- What Is the Difference Between Bookkeeping and Accounting?

- What Are the Objectives of Bookkeeping?

- What Is the Importance of Bookkeeping?

- What Are the Types of Bookkeeping?

- What Does a Bookkeeper Do?

- Can You Automate Bookkeeping?

- How Can You Learn Bookkeeping?

What Is Bookkeeping? | 8 Bookkeeping Basics

1. what is bookkeeping in accounting, 2. what is the difference between bookkeeping and accounting, 3. what are the objectives of bookkeeping.

- Objective 1 – Accurately record the financial transactions that result from business activities in accordance to best practices.

- Objective 2 – Communicate the financial results the business activities yielded.

4. What Is the Importance of Bookkeeping?

- Records of their financial transactions

- Financial statements

- Tax compliance

- Proper cash flow management

- It’s required by the government ― The government, specifically the IRS, requires businesses to keep track of their financial records . Bookkeeping is the answer to this need.

- It improves cash flow ― The financial statements the bookkeeper produces help the business manage and improve their cash flow. They can also strategically plan based on financial data and make informed decisions that’ll benefit the business.

- It provides the data that investors look for ― Investors want to know how a business is faring to determine their investment’s value. When the business is able to project how much money enters and leaves at a given time, it can increase and maintain its pool of investors.

- Makes tax filing easier ― Having organized and accurate books can cut back the time and effort your client spends on tax filing. The accountant can focus on finding opportunities for tax deductions, which can save both money and time.

- It helps the auditing process go smoothly ― At some point, businesses go through internal or external auditing. If they practice good bookkeeping, their financial information will be readily available for checking and they can avoid penalties.

- It gives the business owner peace of mind ― When the finances are well-taken care of, business owners can focus on other aspects of their work that’ll allow them to grow. Plus, they no longer need to be anxious when auditing season comes.

5. What Are the Types of Bookkeeping?

- Cash sales journal ― This is where you enter the revenue the business receives.

- Cash disbursements journal ― This is where you enter the expenses paid.

- Bank statements ― The journal entries should align with the bank statements.

What is an accrued expense? This refers to an expense entered into the bookkeeping system at the purchase date, not on the payment date.

- Accounts payable and receivable

- Loan tracking

- Journal entries

- Manual ― This is the traditional way that’s paper-based.

- Computerized ― This is done through the use of accounting and bookkeeping software.

6. What Does a Bookkeeper Do?

- Computation

- Maintaining accurate financial records

- Communicating financial issues

- Overseeing the inventory and cash flow

- Managing the budget

- Paying suppliers, customers, and loans

- Generating financial reports

- Excellent data entry skills

- Good communication skills

- Bookkeeping know-how

- Attention to detail and organization

- Good understanding of the micro and macro perspectives in a business

- Discipline and commitment

- Willingness to learn

7. Can You Automate Bookkeeping?

8. how can you learn bookkeeping.

- Frequently Asked Questions

- How To Make Clients Line Up And Beg You To Serve Them

Related Articles

How to Start a Bookkeeping Business in…

Bookkeeping Advice for Small Businesses

Coming soon.

Get Instant Access To

- Toll Free 1800 309 8859 / +91 80 25638240

Home Accounting Bookkeeping: Definition, Importance, Types and Tasks

Bookkeeping: Definition, Importance, Types and Tasks

Tally Solutions | Updated on: February 14, 2023

--> published date: | updated on: --> <--, what is bookkeeping, why bookkeeping is important for all business, tasks and examples of the bookkeeping system.

- Accounting period

Types of Bookkeeping

Method of bookkeeping, principles of bookkeeping.

- How to record entries in bookkeeping

Posting entries and documentation

Influence of bookkeeping on the chart of accounts, frequently asked questions.

Bookkeeping is a process of recording and organizing all the business transactions that have occurred in the course of the business. Bookkeeping is an integral part of accounting and largely focuses on recording day-to-day financial transaction of the business.

All the financial transactions such as sales earned revenue, payment of taxes, earned interest, payroll and other operational expenses, loans investments etc. are recorded in books of accounts.

The way the bookkeeping is managed determines the accuracy of the overall accounting process that is been followed by the business. Thus, bookkeeping ensures that the record of financial transactions are up-to-date and more importantly, accurate

Just like to prepare a report, you need a source of data, bookkeeping is a source that gets summarized into the financial statements or any other accounting report that you see. With bookkeeping tracks and records all the financial transactions, it becomes the starting point of accounting. No bookkeeping = No accounting.

Thus, it becomes important for businesses, small or big to have bookkeeping in place.

The following are the importance of bookkeeping:

- Bookkeeping helps to keep track of receipts, payments. Sales, purchases and record of every other transaction made from the business.

- It helps to summarize the income, expenditure and other ledger records periodically.

- It provides information to create financial reports which tells us specific information about the business as how much profits the business has made or how much the business is worth at a specific point of time.

With the definition of bookkeeping, it’s clear that the bookkeeping task involves all that is required to track, record and organize all the financial transaction that has occurred in the business.

The person is responsible for managing bookkeeping usually entrusted with the responsibility of tracking all the transaction related to business. The following are the bookkeeping tasks examples:

- Billing for goods sold or services provided to clients.

- Recording receipts from customers.

- Verifying and recording invoices from suppliers.

- Recording payment made to suppliers and so on…

Are accounting and bookkeeping different? Read ‘ Bookkeeping and Accounting’

Bookkeeping period

The accounting period that a business entity chooses for its business becomes part of its bookkeeping system and is used to open and close the financial books. The accounting period affects all aspects of the company’s finances, including taxes and analysis of your financial history.

In most of the countries, the accounting period is the financial year which starts from 1st April and ends on 31st March of every year. In some countries like the Middle East (UAE, Saudi, Bahrain etc) the calendar year is used as an accounting period i.e. 1st January to 31st December.

Business entities choose from two types of bookkeeping systems, although some entities use a combination of both.

The single-entry system of bookkeeping requires recording one entry for each financial activity or transaction. The single-entry bookkeeping system is a basic system that a company might use to record daily receipts or generate a daily or weekly report of cash flow.

The double-entry system of bookkeeping requires a double entry for each financial transaction. The double entry system provides checks and balances by recording corresponding credit entry for each debit entry. The double-entry system of bookkeeping is not cash-based. Transactions are entered when a debt is incurred or revenue is earned.

Read ' Types and Methods of Bookkeeping System' to know more.

The cash-based system of accounting records financial transactions when payment is made or received. This system recognizes revenue or income in the accounting period in which it is received and expenses in the period in which they are paid.

The accrual basis method, which is favoured under the generally accepted principals of accounting, record income in the accounting period in which it is earned and records expenses in the period incurred.

To ensure the all the transactions are recorded and organized systematically, bookkeeping principles are applied. The following are the bookkeeping principle

- Revenue principle

- Expense principle

- Matching principle

- Cost principle

- Objectivity principle

Read ' Principles of Bookkeeping' to know more.

How to record entries in Bookkeeping

Entries in bookkeeping are recorded in the archaic method of journal entry . Here, the respective individual or accountant manually enters the account numbers and performs individual action of debits and credits for each transaction. This approach is time-consuming and subject to error, and so is usually reserved for adjustments and special entries.

All Financial transactions undertaken by a business entity are posted in ledgers using the information from receipts and other documentation. Ledgers summarize the transactions recorded. Most bookkeeping software automates the posting of transaction details to respective ledgers and reports.

Most entities post financial transactions daily, while others post in batches or outsource the posting activity to accounting professionals. Posting entries regularly helps in generating on-time financial statements or reports.

Financial transactions documentation is an important element of a company’s bookkeeping system. It requires maintaining files of receipts and other documents. The duration period for maintaining documentation records depends on your company policy and legal or tax requirements.

A business entity can create more comprehensive bookkeeping system when it includes accounts for each area of financial transactions. Financial accounts are grouped or categorized based on the nature of accounts or impact on the financial statements. This usually includes balance sheet accounts and income statement accounts.

Balance sheet accounts are assets, liabilities, and stockholder or owner equity. Income statement accounts are operating and non - operating revenues, expenses, gains and losses.

What exactly does a bookkeeper do?

A bookkeeper is primarily responsible to record and track a company's financial transactions which include, purchases, sales and expenses. These transactions are first recorded as general ledger, which are later used while preparing a balance sheet.

What is the difference between Accounting and Bookkeeping?

Accounting is a broad subject. It calls for a greater understanding of records obtained from bookkeeping and an ability to analyze and interpret the information provided by bookkeeping records.

Bookkeeping is the recording phase while accounting is concerned with the summarizing phase of an accounting system . Bookkeeping provides necessary data for accounting and accounting starts where bookkeeping ends.

Take a look at the difference between Bookkeeping and Accounting

Is it hard to be a Bookkeeper?

No. Bookkeeping is a rather simple and straight forward process which can be easily learnt while you're on-the-job.

What are the 2 kinds of Bookkeeping?

The single-entry and double-entry bookkeeping systems are the two methods commonly used. While each has its own advantage and disadvantage, the business has to choose the one which is most suitable for their business.

More on types of Bookkeeping system

Read More on Bookkeeping

Bookkeeping Principles , Types of Bookkeeping System , Elements of Bookkeeping , Bookkeeping Vs. Accounting , Difference between Accountant & Bookkeeper , Basic Accounting Assumptions Basis Bookkeeping

Tally Solutions | Nov-28-2019

- Business Guides

- ERP Software

Latest Blogs

Moving to New Financial Year

How to Create and Use Barcodes for Inventory Management with TallyPrime

5 Inventory Management Best Practices

Warehouse Inventory Management – A Complete Guide

Multi-Location Inventory Management – A Definitive Guide

Saved Report Views: Enhancing Efficiency and Delight in TallyPrime Reports

Accelerate your profitability & business growth with TallyPrime!

Thanks for Applying

We will be in touch with you shortly.

What Is Bookkeeping? A Small-Business Guide

No matter the industry or size, all businesses need to track and manage their financial operations. Bookkeeping is integral to that mission, ensuring that a company’s transactions — everything from paying suppliers to receiving payments from customers — are properly recorded every day. Small businesses typically have less of a financial cushion and are more easily affected by dips in cash flow than their larger counterparts. Effective bookkeeping helps small businesses stay on top of their spending, keeps financial records organized and improves decision-making, among many other benefits that lead to a financially healthy outcome.

Put simply, bookkeeping brings structure and transparency to a business’s financial operations and is part of the overall accounting function. This article explains how, including an overview of the bookkeeping process, the advantages of effective bookkeeping and how automated accounting software helps companies simplify and speed up their bookkeeping tasks.

What Is Bookkeeping?

Bookkeeping is the process of recording, organizing and maintaining a company’s financial records. This can be performed manually by recording transactions in a written journal or spreadsheet or using accounting software — an approach that is increasingly popular among small businesses because it gives them more time to concentrate on growth. The bookkeeper’s job is broad, with daily duties ranging from paying suppliers, to delivering financial reports, to billing clients, to recording receipts and tracking accounts receivable.

Key Takeaways

- Bookkeepers are responsible for recording their business’s daily financial transactions, for use by accountants for higher-level financial operations.

- The benefits of effective bookkeeping include detailed financial records, improved reporting and simplified regulatory compliance.

- Accounting software cuts time and cost from the bookkeeping process while reducing the risk of human error.

Bookkeeping Explained

Bookkeeping handles the daily maintenance of a business’s books and records, with every financial transaction diligently recorded by one or more bookkeepers. Unlike accountants, who analyze their company’s financial data from the highest level, bookkeepers are historians of transactions. They build, maintain, organize, sort, store and ensure the completeness of a business’s financial records. Recorded transactions cover every payment, sale and loan that a business takes on, and can be easily retrieved for use in the preparation of taxes, financial statements and other reports.

Bookkeeping tasks vary based on a company’s needs and accounting processes. For instance, a small, privately owned business may focus on maintaining simple financial records, like invoices, payroll, bank statements and tax returns, whereas a larger company may have more complex bookkeeping records as it grows and takes on additional lines of business with different delivery models. In a public company, bookkeepers must follow more specific guidelines as set forth by the U.S. Generally Accepted Accounting Principles (GAAP) , especially when it comes to financial reporting and governance.

That said, some bookkeeping tasks are common to all sizes of businesses. Here are a few examples:

Record payables and receivables:

Recording accounts payables (AP) and receivables (AR) , along with processing related invoices, is a core bookkeeping function. Every business should record its sales, purchases, expenses and cash transactions in a general ledger.

Reconcile accounts:

Bookkeepers make sure that the financial accounts in their spreadsheets or accounting software are accurate and up to date. That requires regular reconciliation of financial accounts against third-party documents, such as a company’s credit card statements and bank statements.

Determine unadjusted trial balance:

At the end of an accounting period, a bookkeeper closes the account balances and adds up credits and debits. If the dollar amounts don’t balance, the bookkeeper will have to track down the errors and offset them with adjusting entries.

Bookkeeping Process

The bookkeeper’s mandate is to record all daily financial transactions and make it easy for accountants and other business stakeholders to find the information they need. Generally speaking, the bookkeeping process follows these steps:

When a financial transaction is completed, a bookkeeper assesses and assigns it to the right accounts in the company’s journal using debits and credits.

The bookkeeper then transfers transaction details to the general ledger, which tracks every transaction completed by the business over a given accounting period.

At the end of the accounting period, the bookkeeper closes the financial books and makes sure every debit transaction has an equal credit transaction before the data can be used in financial statements.

There are two primary bookkeeping methods: single-entry and double-entry .

Single-entry bookkeeping

As the name implies, single-entry bookkeeping involves one account entry for each transaction recorded in a business’s financial books. It is used by businesses that do their accounting on a cash basis — reflecting when cash actually changes hands — as opposed to an accrual basis (more on this distinction soon).

Double-entry bookkeeping

Most companies use the double-entry accounting method, whereby every transaction affects at least two accounts in their financial records – a debit account and a credit account. Bookkeepers must preserve a balance between debits and credits. Public organizations in the U.S. are required to use double-entry accounting in compliance with GAAP.

Components of the Bookkeeping Process

The bookkeeping process involves a half-dozen moving pieces and ensuing financial documents. Ensuring accuracy, timeliness and consistency in every place a transaction must be recorded is essential to a successful bookkeeping operation.

Chart of accounts

A chart of accounts lists every account in the business’s general ledger. An account is a financial record that tracks the activity of an individual asset, liability, equity, revenue and expense. Accounts are categorized based on a coding system that makes it easy to identify them.

Journal entries

The goal of bookkeeping is to present an accurate, real-time view of a business’s financial standing. Journal entries are used to record the details of each financial transaction, including how much was credited or debited to a particular account. Entries are eventually posted to the business’s general ledger.

General ledger

The general ledger is a numbered record of a company’s financial transactions and is used for tracking purposes and preparing three core financial statements, listed below. Under the double-entry bookkeeping system, a debit to one general ledger account must be balanced with an equal and opposite credit in another account.

Cash flow statement

A cash flow statement documents the cash (and cash equivalents) moving into and out of a business over a given time period. Cash flow statements help companies assess their liquidity.

Income statement

An income statement reports a business’s revenue, expenses, gains, losses and earnings for a specific accounting period. Some companies refer to their income statement as an earnings statement or a profit and loss statement , P&L for short.

Balance sheet

A company’s balance sheet provides a full picture of its financial position at a given moment in time. It tracks every asset, liability and equity.

Cash Basis vs. Accrual Basis

Which accounting method is best? The answer depends on how a business wants to time its revenue and expenses. Cash basis accounting — the simpler of the two methods — records transactions when money changes hands on a given account, such as when the business pays a supplier for service rendered. This approach is attractive to small businesses because it ensures that their financial statements closely reflect their current cash position.

Accrual-based accounting records expenses when they are incurred and sales when they are earned, regardless of when payment is exchanged. This is useful for businesses that extend credit to their customers or use credit to purchase goods and services from suppliers, as well as for companies that hold large volumes of inventory. In these cases, there is a time gap between when a sale or purchase is made and when subsequent payment occurs, making the cash-basis method of bookkeeping less accurate and thus less useful.

The accrual-based method is considered the gold standard because it more accurately reflects a business’s financial position. What’s more, public companies are obligated to use this approach, as is any business that must produce GAAP-compliant financial reports.

Bookkeeping vs. Accounting

Bookkeeping lays the groundwork for accounting . The main difference between the two is their focus. Bookkeepers are tasked with day-to-day tactical responsibilities. They log and track a business’s financial transactions — ensuring that records are accurate and organized — reconcile accounts and close the books at the end of an accounting period. Meanwhile, accountants have a strategic, big-picture role and typically oversee bookkeepers. Accountants analyze and interpret the information prepared by bookkeepers to generate the business’s financial statements, tax returns and other high-level financial reports. The insight they communicate to business stakeholders about the company’s financial health is used to inform decision-making.

Another difference is the required level of education. Bookkeepers don’t necessarily need to possess a college degree or certification to gain employment, though one or both can certainly help them stand out when applying for jobs. Accountants, however, need a bachelor’s degree in accounting, finance, business or another mathematics-related field. Many go on to become licensed certified public accountants (CPAs), which requires passing a rigorous, four-part exam .

Why Businesses Need Bookkeeping

Bookkeeping oversees the daily documentation of a business’s financial activities as journal entries, which are then posted to the general ledger. This complete view of every business account is used by stakeholders to understand the company’s financial position and, in turn, make strategic business decisions regarding cash flow, budgeting and more.

In addition, up-to-date books are helpful when a business is applying for loans or building a business case for potential investors. They’re also integral to the creation of time-sensitive financial statements and reports, and to ensure compliance with specific tax codes and/or the U.S. Securities and Exchange Commission (SEC) requirements.

In the event of an audit, bookkeeping helps businesses back up their expense claims and applications for tax deductions with granular financial records.

Balancing the Books: Assets, Liabilities and Equity

Bookkeepers are responsible for closing a company’s books. To do so, total assets must balance the sum of its liabilities and shareholders’ equity. This is known as the accounting equation, and the information appears on the company’s balance sheet.

- Assets: Assets refer to anything a business owns. They include current assets, like cash or a retailer’s inventory, that are typically used within a year’s time; and fixed assets , including tangible assets, like an office building or machinery, and intangible assets, like patents or trademarks acquired from a third party. Fixed assets are also known as long-term assets because they generally have a useful life of more than one year.

- Liabilities: Liabilities refer to financial obligations a business must pay. Common liabilities include bank loans, money owed to suppliers and unpaid rent for office space or storage facilities. Short-term liabilities are financial obligations that must be paid within 12 months, like employee wages. Long-term liabilities, such as a mortgage, have a maturity of more than one year.

- Equity: Also known as shareholders’ equity (SE) or net worth, reflects the value of a company that remains after subtracting liabilities from assets.

Advantages of Bookkeeping

Not only is bookkeeping crucial to support core financial processes, but it also serves to make accountants’ lives a little easier. Among its advantages:

- Detailed records: Detailed, centralized financial records make it easier to oversee and track business accounts, which ultimately speeds reporting. Comprehensive records also simplify financial or tax audits because relevant information can be located more quickly and at lower cost.

- Improved compliance: Competent bookkeepers make sure their work complies with the latest legal and accounting requirements applicable to their business and industry, thereby avoiding fees or penalties for being out of compliance. That means all accounts, ledgers and financial statements adhere to the latest tax codes, SEC provisions and any accounting regulation specific to a business’s industry.

- Better planning: Solid bookkeeping data leads to better accounting and business decisions based on a complete understanding of the company’s performance. With a detailed record of their business’s accounts, finance teams can be confident in the data used to inform their reporting and future planning.

- Transparent reporting: Bookkeepers keep their business’s general ledger updated at all times. For their part, accountants can present that data to business stakeholders when creating financial reports, be it for a monthly close or ad-hoc information requests.

- Faster analyses: Accurate, up-to-date records help accountants do their job more quickly, whether they are creating financial statements or helping to develop a budget for a future project.

Challenges of Bookkeeping

As with all financial processes, bookkeeping comes with its challenges. This is especially true in resource-constrained small businesses. Below are three of the most common challenges associated with bookkeeping.

- Making time: Small companies don’t necessarily have dedicated bookkeepers on their payrolls, which means owners or other employees must take time away from other core business functions to handle bookkeeping tasks. Alternatively, they can use accounting software or hire an external consultant to take bookkeeping tasks off their plates. Bookkeeping consultants are also less expensive than accountants, in most cases.

- Using records passively: Many businesses view bookkeeping as a tick-box exercise that keeps them compliant and helps them to file accurate tax returns. But that’s only half the story. Up-to-date financial records help key stakeholders make informed business decisions based on a better understanding of their organization’s financial health.

- Getting bogged down in manual processes: Manual processes are the enemy of accurate bookkeeping for a growing business. With an ever-expanding list of transactions to record, companies can get only so far with paper records and spreadsheets. Software-based bookkeeping cuts significant time and effort from the bookkeeping process while reducing the risk of human error.

Common Bookkeeping Abbreviations

Financial documents are full of abbreviations. Below are some of the most common abbreviations used in bookkeeping and accounting records, in alphabetical order:

- AE: Accrued expenses

- AP: Accounts payable

- AR: Accounts receivable

- ATB: Adjusted trial balance

- BS: Balance sheet

- CA: Current assets

- CAP: Capital

- CF: Cash flow

- CL: Current liabilities

- COA: Chart of accounts

- COGS: Cost of goods sold

- CR: Credits

- FA: Fixed assets

- FE: Fixed expenses

- GL: General ledger

- LTL: Long-term liabilities

- NI: Net income

- OE: Operating expenses or owner’s equity

- P&L: Profit and loss statement (also known as the income statement )

- PPE: Property, plant and equipment

- TB: Trial balance

- VE: Variable expenses

History of Bookkeeping

Bookkeeping has been around for thousands of years. Archeological records reveal ancient civilizations used some form of bookkeeping as early as 6000 B.C. Modern bookkeeping can be traced back to the 15th century, when Italian mathematician Friar Luca Pacioli developed the first double-entry system.

No surprise, bookkeeping has evolved tremendously since that time, especially with the invention of computers in the 20th century and the more recent uptake of automated, cloud-based accounting software. Companies have also changed the media they use to keep records, in line with the shift from a cash-based economy to one built on credit and digital transactions.

Petty cash books

Petty cash is a small amount of cash that companies keep on hand to pay for incidental or emergency expenses. A traditional petty cash book is a physical ledger that records all a business’s cash expenditures. Modern petty cash accounting uses spreadsheets or accounting software. The need for petty cash is becoming a thing of the past, as most businesses make their purchases with a credit card or via bank transfer.

Before the age of software, businesses would record financial transactions chronologically in a handwritten journal. It was common to use different journals for different transactions, i.e., one for purchases, another for sales and another for cash payments and receipts. Then the entries would be added to the organization’s general ledger. These days, much of the process is digital.

Daybooks are a remnant from the days of physical journals. To avoid recording every single financial transaction in a single journal, businesses staged the process by recording the day’s credits and debits in a smaller daybook before transcribing them in an overarching bookkeeping journal.

Bookkeeping Examples

At its core, bookkeeping offers businesses a way to track their credits and debits. Bookkeepers document financial transactions, recording each credit or debit in the relevant account and posting those entries in the business’s general ledger. At the end of an accounting period, they ensure that all accounts are balanced — i.e., that every debit has an equal and opposite credit.

One simple way to log these activities is with T-charts, also known as T-accounts. Each chart represents a specific account, named at the top. Below the account’s name are two columns, one for debits and one for credits, with space for bookkeepers to log the date of each transaction during the accounting period.

Consider a wholesale distributor that orders $50,000 of inventory on Jan. 1, 2023. The order is logged as a $50,000 debit in the T-chart for “Inventory.” Meanwhile, a $50,000 credit is added to the “Accounts Payable” T-chart, representing the liability taken on by the business until the inventory is paid for. The “Accounts Payable” chart gets a second entry for a $50,000 debit, bringing the overall balance to $0. Finally, once the vendor bill is paid, it gets logged in the company’s “Cash” T-chart as a $50,000 credit entry.

Automate Bookkeeping With NetSuite

Bookkeepers increasingly use accounting software to perform their jobs. The accounting workflows in NetSuite’s cloud accounting software automate many bookkeeping tasks, making it easier to close the company’s books and wrap up the accounting cycle. These tasks include recording financial transactions, preparing customer invoices, processing vendor bills and reconciling bank and credit card statements — all of which are time-consuming and prone to error when handled manually. GL entries and account balances are updated in real time, rather than in batches, which improves financial visibility, helps accelerate the financial close process, and improves the accuracy of financial statements.

Is QuickBooks the right bookkeeping solution for you?