Buyside Hustle

Investment Banking, Private Equity, Hedge Fund Career Advice

Don’t Get Left Behind

Stay up to date with real advice and have new posts emailed to you. Promise we will never send spam.

By Buyside Hustle Leave a Comment

Best Private Equity Case Study Guide + Excel Model + Example

The most important part of the private equity interview is the case study round. After meeting a few people and going through a number of interviews, you will most likely get hit with a case study where you have to analyze whether a company is a good leveraged buyout target or not.

Your performance during the private equity case study round will determine whether or not you will get an offer. It is the most important part of the interview process, so you need to make sure you are well prepared and create a work product that sets you apart from the other candidates you are competing against.

Private Equity Case Study Example + Full LBO Excel Model

Private Equity Case Study Example + Model

It’s hard to know how to complete a full private equity case study if you don’t actually have experience working in private equity. With just an investment banking background or someone who is straight out of undergrad, you just don’t have the experience to understand how to structure and write a good case study.

Make sure you get access to a full private equity case study that was used in a real interview. You can use this as a reference on how to write your response and build the LBO model with all the key outputs.

Get access here before reading on. It becomes much easier to build a proper LBO model and complete a case study when you can refer to one that is already fully completed.

The case study was written by a private equity professional and includes a:

- Real Private Equity Case Study Example and Response

- Full Detailed LBO Excel Model

How is a Private Equity Case Study Structured

The private equity interview process is a lot more structured relative to hedge fund interviews. Most interviews happen during “on-cycle” recruiting your first six months in investment banking right out of undergrad. This is the best time to land an offer as you have dozens upon dozens of firms that are fighting to get the top talent to work at their firms. People will land offers after a matter of days after answering the basic private equity interview questions because of all this competition.

Unlike hedge fund case studies , private equity case studies are a bit different as it depends on if you are interviewing during the rush of on-cycle recruiting where firms fight for talent. You can expect the case study to be structured in either three ways:

- LBO Modeling Test

If you are going through the crazy all-out blitz of private equity interviews during on-cycle recruiting, you will like get either of the first two types of case studies, the modeling test and/or the paper LBO.

For an interview that is done outside of this period and at most of the smaller middle-market funds, you may get a longer take-home case study that is more comprehensive. It really just depends on the firm and how they conduct interviews.

1. LBO Modeling Test

The LBO modeling test is used in person during on-cycle recruiting very frequently. Usually when on-cycle interviews start, you’ll get invited along with other candidates to do a modeling test over the course of a few hours, then proceed with the usual interviews either before or after.

There is no reason why anyone can’t pass the modeling test. All it takes is practice after practice, just like how you’d get good at anything else. Back when I was an investment banking analyst, the only way I would learn how to do anything was by looking at previous models done by prior analysts saved on the shared drive and recreating those models from scratch over and over again. It’s the best way to learn how to get good at any type of Excel model – looking at precedent then recreating from scratch.

Wall Street Prep was another tool I used back during my investment banking analyst days. There is a course that was specifically created for Private Equity interviews and LBO modeling that teaches you everything you need to know. It was the best resource I was able to find to get prepared for private equity interviews and teaches you how to complete a full LBO model step-by-step from start to finish.

Start preparing today and sign up for the course below if you really want to break into private equity. I promise you will have a very low chance of landing a private equity offer if you do not know the basics of how to build an LBO.

Get 15% off if you use the coupon code in the link below:

Private Equity Masterclass: Step-By-Step Online Course

A Complete LBO and PE Training Program. Whether you’re preparing for an LBO Modeling test or you want to learn to build an LBO model and become a better PE professional, this course has you covered.

Special Offer: Get 15% Off On Wall Street Prep’s Private Equity Course

2. Paper LBO

The paper LBO is used during interviews to make sure you have spent the time to learn the basics of how an LBO works. Usually, you are given a set of assumptions, a pen/paper and asked to work through a paper LBO live during the interview without the help of a computer or calculator.

You need to be able to walk through how to:

- Calculate the purchase price

- Calculate sources and uses

- Build a simple income statement and projections

- Build to levered free cash flow

- Calculate the exit value, IRR and multiple on invested capital

The Wall Street Prep course above walks through how to do all this in detail and provides a few paper LBOs that you can use for practice.

3. Private Equity Take-Home Case Study + Written Memo

Now the full-blown take-home case study is the hardest and most in-depth analysis a private equity firm can ask of you during interviews. Outside of on-cycle recruiting, this is the most common type of case study that is given. Most firms will give you a week to work on it independently at home.

This case study round is the most important part of the interview. If you do not have a well-written case study with a good backup model that you can present to the interviewer, you will not get an offer.

The majority of case studies will ask either two questions:

- Look into XYZ company and tell us whether it’s a good LBO target

- Find an attractive LBO target and give us your thoughts

To answer the first question, you need to screen a universe of public companies and find one that could be an attractive target. You need to find a business that has the following characteristics:

- Growing market dynamics – markets that have structural tailwinds is a good place to start

- Strong competitive advantages – study Porter’s Five Forces if you haven’t already

- Stable recurring cash flows – business is going to be levered up in a buyout so it needs to have positive EBITDA and stable cash flows to pay off interest payments

- Low working capital / capex needs

Quickly eliminate all companies in your screen that have:

- Negative EBITDA

- High capex needs (capex is >75% of EBITDA)

- High valuation (EV/EBITDA is > 15x)

You can quickly eliminate companies in your screen that have negative EBITDA or high capex needs. Once you’ve found your target company (or if already given one), then you can start working on the actual meat of the case study.

Steps to Finish a Private Equity Case Study

This guide will walk you through all the steps required to complete a case study, from start to finish. You will learn everything from what documents you need to download, to how to build the LBO/model with all the key outputs, to how to actual write a good memorandum/presentation, to all the common mistakes to avoid.

- Download and organize all documents in one folder

- Research the industry to understand trends and key metrics

- Read the filings and take notes

- Input financials in Excel and build the LBO model

- Work on the presentation / memo

1. Download and organize all documents in one folder

You want to have everything in one folder that you can quickly access. Key websites to use for company filings are:

- www.sec.gov/edgar/searchedgar/companysearch.html – for direct access to filings

- www.Bamsec.com – access to filings in an organized fashion

- You want to save down (at the very least) the latest 10K and the prior four 10Qs, last four transcripts, earnings releases, investor presentations and supplements

- Other sources if you have access to them: Bloomberg, CapIQ, FactSet

- Sell-side research – sell-side research is how you gauge market expectations and quickly understand the business. Most initiating coverage reports will give a good overview of the company, its strengths, weaknesses and competitive landscape. Ask around for others to send you research if you don’t have direct access

- Other write-ups online – read all of the articles on Seeking Alpha and look at ValueInvestorsClub.com. Research on Seeking Alpha is usually very bad, but there may be articles that do a good job summarizing any fundamental pressures / tailwinds

2. Research the industry to understand trends and key metrics

If you have access to sell-side research, then go through the latest industry analysis for your target company or initiating coverage reports. When a sellside research firm initiates coverage, they write up a very in-depth review of the company. These reports provide a very good summary of a company and the industry it’s in with all relevant metrics.

If you don’t have access to sell-side research, then go through prior investor presentations of the company or any of its peers. There should be an industry/market overview and benchmarking metrics vs. peers in these presentations.

If you do not understand what is happening in the industry that the company is in, you will not know if there are any big headwinds or tailwinds that are directly impacting the company. A lot of private equity LBOs focus on growth and consolidation within an industry, so you need a good understanding of the market and what the growth opportunities are.

3. Read the filings and take notes

Create a new word document to copy and paste anything notable that you read. You can create sections in your notes for company overview, revenue / cost drivers, fixed versus variable costs, industry tailwinds/headwinds, key questions for items you don’t understand or need to follow-up with management on, etc.

The most important part of every 10K/10Q is the management’s discussion and analysis section (MD&A). This is where the company talks in detail about how the business has performed over the quarter/year relative to prior year’s performance. You should focus on the sections of the MD&A that talk about the revenue and cost drivers. Make a table in Excel and copy and paste commentary every quarter on what impacted revenue growth and margins (COGS and SG&A). Once you lay it all out in Excel, the fundamental picture of the Company becomes clearer and you can see what has had a major impact on recent results.

The most important thing you should read are the transcripts and investor presentations. Management usually gets into more detail on the overall strategy and key tailwinds / headwinds of the business. Additionally, you can gauge what the sell-side is most focused on in the Q&A section at the end of every transcript.

Lastly, read the risk section of the latest 10K to note what the Company finds to be the biggest risks to its overall performance. Pay close attention to the top few items listed here as you want to see what the structural/secular challenges are to the business.

4. Input financials in Excel and build the LBO model

Since private equity interviews can start very quickly after you start your first job in investment banking, most do not know how to properly build an LBO model. Every single private equity firm builds an LBO when looking at any investment. If you want to work in private equity, you need to make sure you spend time understanding an LBO, how it works and how to build one in your sleep.

Like I mentioned before, sign up for Wall Street Prep if you don’t know how to build an LBO. It’s the best resource available to learn how to build a LBO model and provides step-by-step instructions using a real public company example.

5. Work on a presentation or write a memo

Once you have done all the research and finished the modeling, you need to create outputs in a presentation or word doc format. The interviewer may specify what kind of output they prefer, but if not than do what you most comfortable with.

This presentation/memo will be what your interviewer will focus on, so the outputs need to be nicely formatted just like how you create outputs in investment banking. Formatting may not seem that important to you, but showing that you can present analysis in a clean, formatted manner without errors is what will set you apart from your peers.

Continue reading below to learn everything you need to know on what to include in this presentation or memo.

Private Equity Case Study Presentation / Memo

Background and company overview.

If you had to screen to find a company, briefly summarize the criteria you used to choose your company. List the financial metrics and any other factors you used when making the decision.

Then you need to summarize what that company does in around five sentences. If you were provided the company to analyze, the interviewer already knows what the company does so no need to go that much in depth as you can describe more in person if asked. Make sure to describe how the company makes money (a revenue breakdown), where they make money (what markets drive the most revenue), who their customers are (customer concentration), etc.

This is the easiest section as you can open up the latest 10K and within the first few pages there is a business description section that outlines what the company does. You should also check the latest investor presentations (if available) and sell-side research initiating coverage reports as they usually give good overviews of the company.

You need to make sure you yourself understands what the company does and what the revenue and cost drivers are. Anybody can copy the business descriptions written by the Company and sell-side research. You should make sure you know the company well enough to be able to talk about it without looking at your notes.

Investment Thesis/Highlights

Here you list out the top reasons why a company is a good leverage buyout target or not. The most common investment highlights discussed in a potential target can be:

- Attractive market dynamics due to XYZ reasons – could be due to fragmented market / consolidation opportunities, growing market dynamics, geographic expansion lack of competition, etc.

- Multiple ways to win – private equity firms love businesses that don’t just rely on one avenue of growth, so point out all the different ways value can be created either through revenue growth, expense rationalization, multiple expansion, etc.

- Recurring revenues – leverage buyout targets need to have steady cash flows since the business is going to be levered up in an acquisition and so cash flows need to be steady to support high recurring interest payments on the debt. Revenues need to be stable, recurring and non-cyclical in nature.

- Asset-light business – Also, PE firms like businesses that are asset-light (low capital expenditures or working capital requirements) and have low variable costs (little need to increase the expense base to grow revenues, also known as operating leverage).

- Valuation – if a company is underappreciated in the public markets and trades at a low valuation relative to peers, then returns can be very high if you can somehow grow/fix the business and make it more attractive at exit in the future. High LBO returns come from both growing cash flows and multiple expansion. Usually, you want to assume the same exit multiple (the multiple you sell the business for) in your model compared to your entry multiple (the multiple you purchased the business for). Purchasing a business at a high multiple and selling it at a lower multiple in the future will lead to significantly lower returns and can be a big risky.

Like I mentioned earlier, make sure you understand Porter’s Five Forces to understand the main competitive advantages/disadvantages a business can have.

Recommendation to Investment Committee

Summarize whether or not you think the company you chose to analyze (or were provided) is a good LBO target or not. Everything depends on the purchase price, so if you mention that it is not a good LBO target then make sure to describe why and at what price do you think makes the deal attractive.

Financials/Return Summary

Your LBO model should have summary outputs that describe how attractive the deal looks from a financial perspective. At minimum, you need to show:

- Returns at various prices

- Sources and uses

- Pro forma capitalization

- Sensitivity table on returns, showing IRR/MOIC at various premiums and exit multiples

- 5-year levered free cash flow bridge

- Main model assumptions

The private equity case study example shows you all of these outputs and more, which you can replicate for your model.

Here you talk about the main risk factors and any potential unexpected events that would cause the firm to lose money on its investment. Look in the Risk Factors section of the 10K or sellide research to understand what the main risks are to the business. Analyze the most important risk factors to see if they have any merit and the potential implications to your analysis if the risk factor is realized. Examples of risks include technology disruption, realization of synergies / other cost savings initiatives, commodity price changes, wage or cost inflation in general, cyclicality/seasonality, changes to regulations, etc.

Outstanding Diligence Questions

Depending on the company, there may or may not be very detailed information on the company in public filings. Usually the bigger the market capitalization, the better the disclosures are.

You want to show the interviewer a list of diligence items you would still want to ask from the company to better understand the business. These questions should be around unit economics, profitability by segment/region, strategic plan over the next five years, cost structure plans/initiatives, etc.

Model Output/Exhibits

Either in a separate PDF or in the exhibits, you want to have a full output of the entire LBO model. At most private equity firms, associates print out the full model to discuss key assumptions with others on the deal team and to make sure everything is working properly. Make sure your Excel is nicely formatted and is already in print format.

The model should have all the outputs described above as well as full detailed 3-statement financials, revenue build and the levered free cash flow waterfall.I know this seems like a lot of work, but it’s the minimum that you need to do for a take home private equity case study.

General Tips and Common Mistakes to Avoid

Get Access to a Real Private Equity Case Study Example + Excel Model

If you need an example case study used in an real interview, then get instant access to one in the link below. You can use this as a reference as you complete a case study to make sure you are building the LBO model correctly, having all the key outputs, and learning how to put it all together in a written memo.

Check your model for errors

One of the worst things you can do is send a model that has a huge bust that changes all the outputs and return metrics. It’s the quickest way to get axed during the interview process, so make sure you spend time going through each cell of your model after completion to make sure there are no errors.

Spend time properly formatting the case study

Being able to cleanly present your analysis is a very important skill in private equity. Most firms create decks and go to investment committee to present a deal, so you need to show that you can format properly and present financials in a clean manner.

There are a ton of people applying for the same job as you are, so you need to figure out a way to differentiate yourself. If you were previously or currently an investment banker, then you should have no problem properly formatting the Excel model and the memorandum.

Understand the firm’s investment style

Every private equity firm has their own approach to making investments. Make sure that you understand the types of investments the firm likes to make and the key qualities to look for.

Then if given a case study, point out these key qualities. It’s good to show that you can analyze investments in a similar manner as the private equity firm you are interviewing at if possible.

Prepare for the most common private equity interview questions

Private equity is one of the most sought career paths and one of the Best Paying Jobs in Finance and Wall Street . There are so many young, smart, Ivy League educated investment bankers trying to break into private equity, so you must make sure you stand apart from the crowd in both your case study and when answering the most common private equity interview questions .

Don’t lie or try to bullshit if asked a question you do not know the answer to

The problem with a lot of smart people in this industry is that they are reluctant to say “I don’t know” and tend to talk as if they know what they are talking about. Interviewers will easily see through the bull shit as they likely know the company well and have heard others talk about the company.

Be a “straight shooter.” Be honest if you do not know the answer to a question and say you will follow-up with the interviewer. That said, you should know the company and industry inside out before presenting the case study and be confident when you speak about facts that you know are true.

Memorize key metrics

When discussing the case study in person with the interviewer, make sure you are an expert in the company and can answer questions on the spot without having to reference your written case study. Key metrics you should know off the top of your head include EBITDA, capex, interest, margins, market cap, total enterprise value, leverage, valuation metrics, valuation metrics versus peers, IRR/MOIC, etc.

Recent Posts

- Will Home Prices Go Down? Get Ready for a Downturn

- Complete List Of Finance Firms In Miami Florida

- Reality Of Working At A Hedge Fund – An Insider’s Guide

- Safest Cash Investments Ranked – Maximize Returns Today

- Work-Life Balance In Finance Ranked – Best to Worst

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- Video Tutorials

- Knowledge Base

- Group Licenses

- Why Choose Us?

- Certificates

- Leveraged Buyouts and LBO Model Tutorials

Paper LBO Example: Full Tutorial for Private Equity Interviews

In this tutorial, you’ll learn how to complete a “paper LBO” test in a private equity interview and how to approximate the IRR in a leveraged buyout using pencil and paper.

- Tutorial Summary

- Files & Resources

- Premium Course

Paper LBO Definition: In a “paper LBO” test, a private equity firm describes the leveraged buyout of a company and asks you to approximate the IRR or money-on-money multiple in the deal without using Excel or a calculator .

Key Tips for Paper LBO Tests

Paper LBOs are not true “financial modeling tests” in the same way that other Excel-based exercises are; they’re more like extended mental math questions.

To succeed with paper LBO tests, you must round and simplify the numbers as much as possible so you can finish the calculations within the time limit (often 30 minutes or less).

It’s also important to start with the end in mind so you can check yourself along the way.

For example, if the PE firm is targeting a 25% IRR over 5 years, you should know that it corresponds to a 3x multiple of the initial Investor Equity (see: our tutorial on how to calculate IRR manually ).

If you finish most of the exercise and you can tell that the deal will generate nothing close to a 3x multiple, you can immediately reject it.

It’s best to simplify the transaction assumptions as well, which means “ignore the transaction and financing fees” and “assume all deals are cash-free, debt-free” (i.e., that the target company’s Cash and Debt immediately go to 0 after the deal closes).

Finally, you may assume that the Debt issued to fund the leveraged buyout stays the same or that 100% of the company’s Free Cash Flow is used to repay the Debt principal.

More complicated assumptions, such as “cash flow sweeps,” make it too difficult to track the numbers and calculate everything with pencil and paper.

Paper LBO Example: Real Case Study

Click here to get the case study prompt for this exercise .

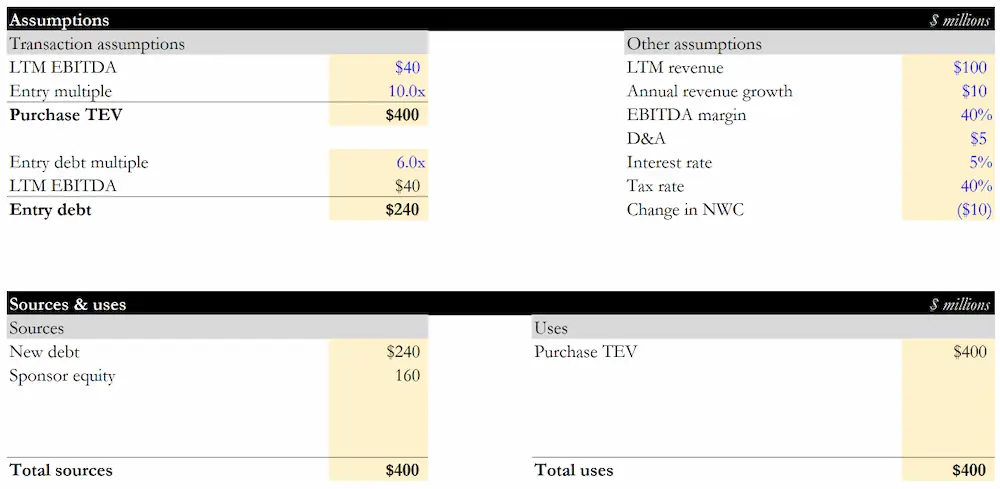

In short, the PE firm is acquiring a company for 10x EBITDA and using 6x Debt to fund the deal.

They provide numbers for the company’s revenue, EBITDA, cash flow line items, and the details of the Debt funding, such as the interest rates and principal repayments.

The PE firm is targeting a 20% IRR over 5 years, so we have to complete this paper LBO and recommend or reject the deal based on this target.

You can click here to get the full solutions to this exercise , but we’ll present the highlights below:

Paper LBO, Step 1 – Determine the End Goal

You should know that a 20% IRR over 5 years is approximately a 2.5x multiple of invested capital because a 2x multiple is a ~15% IRR over 5 years, and a 3x multiple is a ~25% IRR.

The case document gives us the company’s initial EBITDA of $250 million.

Since the company spends 60% of Revenue on COGS and 15% on SG&A, its EBITDA Margin equals 1 – 60% – 15% = 25%.

So, the company’s Revenue is $250 / 25% = $1,000.

A 10x purchase multiple means a Purchase Enterprise Value of $2,500, and the deal is funded with 6x Debt and 4x Equity, so the Investor Equity is $2,500 * 40% = $1,000.

Therefore, this deal must generate $1,000 * 2.5x = $2,500 in Equity Proceeds to be viable.

We need to determine the Year 5 EBITDA and the Year 5 Debt to see if that happens.

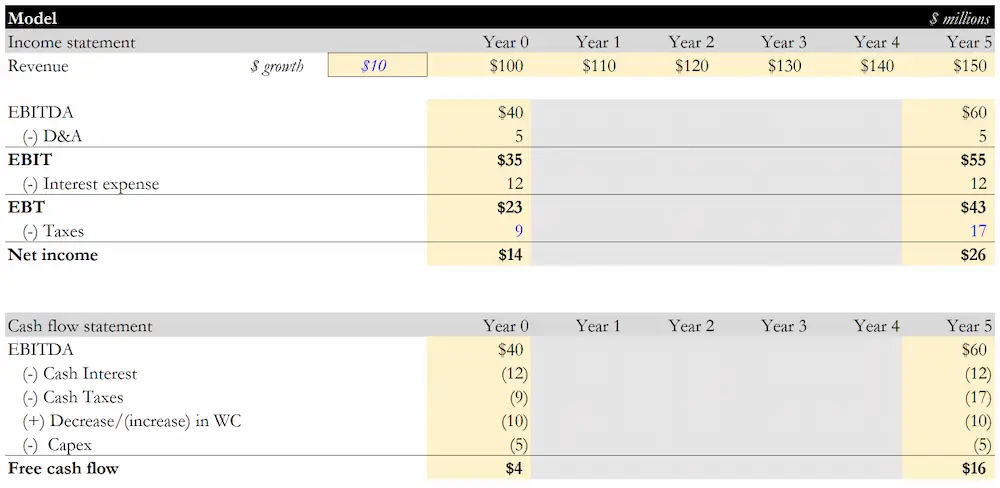

Paper LBO, Step 2 – Project Revenue and EBITDA

The case document gives us the initial numbers:

To project the Revenue figures, we can use approximations. For example:

- $1,000 * 5% –> This is easy; it’s an increase of $50.

- $1,050 * 7.5% –> This is halfway between $52.5 and $105, so we can round it to $80.

Once we have all the Revenue figures, we can use a similar strategy for EBITDA.

For example, if we know the Year 1 Revenue is $1,050 and the EBITDA Margin is 24%, we can approximate the Year 1 EBITDA like this:

$1,050 * 24% –> $1,050 is a bit higher than $1,000, and 24% is a bit lower than 25%, so we can say the EBITDA is still $250.

After completing these steps, we arrive at these estimates for Revenue and EBITDA:

Paper LBO, Step 3 – Calculate the Annual Free Cash Flow

In the context of this simplified “model,” we can define Free Cash Flow like this:

Free Cash Flow = EBITDA – Interest – Taxes +/– Change in Working Capital – CapEx – Purchases of Intangibles.

CapEx, Purchases of Intangibles, and the Change in Working Capital are all simple percentages of Revenue, so we can group them together:

FCF = EBITDA – Interest – Taxes – “Other Items.”

CapEx = –8% of Revenue, Intangible Purchases = –4%, and Change in WC = +2%.

The first two are negative, and the Change in WC is positive, so “Other Items” represents negative 10% of Revenue.

To calculate the Taxes and Interest, we need the Taxable Income first.

Taxable Income = EBIT – Interest, and EBIT = EBITDA – D&A.

The D&A is simple, but the Interest changes each year as the company repays Debt.

So, let’s start with the D&A: it’s 5% of Revenue, so we can multiply each of the “Other Items” above by 50% to estimate it.

The Interest Expense is the toughest part because the company repays its Term Loan balance over time, and many of the numbers are interdependent:

Interest: Depends on the Debt balance, but the Debt balance depends on FCF.

FCF: Depends on the Interest and Taxes.

Taxes: Depends on the Interest.

We have to complete this process iteratively , starting with the Interest in Year 1.

The initial Term Loan is $1,000, or $250 * 4, and the initial Senior Notes are $500, or $250 * 2, so the initial Interest Expense is $1,000 * 5% + $500 * 10% = $100:

The Term Loans have 2% annual principal repayments, which might seem complicated at first.

But since the company’s FCF is higher than 2% * $1000 = $20 per year, we can combine the mandatory and optional repayments and assume that 100% of the company’s FCF is used to repay Debt principal.

The Senior Notes stay the same at $500 per year, so only the Term Loan balance changes.

Once we have the Year 1 numbers, we can continue to Year 2, where Interest = 5% * $975 + 10% * $500.

We round all the Interest numbers to units of 5 or 10 to simplify the math.

The company’s FCF never changes by a huge amount, so we use figures such as $25, $30, and $35 in each period.

We also round all the Tax numbers to ones that end in 5 or 0, as shown below:

Once we have the numbers for Years 1 and 2, we go through the same process for each of the following years.

It’s impossible to track all these numbers in your head, so it’s essential to write down the whole schedule on paper.

The finished “ Debt Schedule ” looks like this:

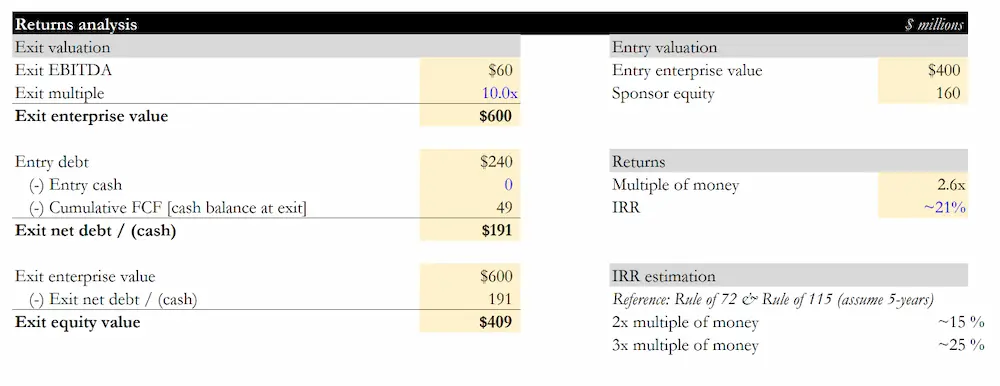

Paper LBO, Step 4 – Calculate the Exit Proceeds

To finish, we need to calculate the Exit Enterprise Value, Exit Equity Value, money-on-money multiple, and IRR.

We know the Year 5 EBITDA is approximately $300 and the Year 5 Exit Multiple is 12x (from the case document):

$300 * 12 = $300 * 10 + $300 * 2 = $3,600 for the Exit Enterprise Value ($3.6 billion).

We have no information on the Cash balance, but we know it has NOT changed because all the company’s FCF was used to repay the Term Loan .

Since the remaining Debt in Year 5 is $1,360, the Exit Equity Value = $3,600 – $1,360 = $2,240; we can round this to $2,200 or $2,300.

This range produces a multiple of 2.2x to 2.3x because $2,200 / $1,000 = 2.2x and $2,300 / $1,000 = 2.3x.

To get a 20% IRR over 5 years, we need a 2.5x multiple on the $1,000 of Investor Equity.

Therefore, this deal is not viable .

The exact IRR here is probably between 15% and 20%, so it’s not a bad outcome – but it’s also below what the PE firm was targeting.

The “Paper LBO” in Excel Format

If you want to “see” this paper LBO in Excel format, click here to download the Excel recreation , which has the exact numbers rather than approximations.

Note that it’s completely pointless to build this model in Excel because the purpose of a paper LBO test is to finish it using pencil and paper and mental math.

If you use Excel, you might as well try a full-blown LBO modeling test that takes 2-3 hours to complete.

How Important is the Paper LBO in Private Equity Interviews?

Some private equity firms like to administer paper LBO tests, but you’re more likely to get real Excel-based modeling tests and case studies.

So, if you’re going through the private equity interview process , it’s worth practicing a few paper LBO tests, but don’t go through dozens of exercises or spend days on them.

You should spend that time improving your story, reviewing and discussing your deal experience, and practicing real LBO modeling tests.

Paper LBOs, when they do come up, tend to occur in earlier rounds of interviews and are mostly used to eliminate candidates.

You’re never going to win a private equity job offer because you ace a paper LBO test.

But if you perform poorly, you could easily lose a job offer.

About Brian DeChesare

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Files And Resources

Premium Courses

Other biws courses include:.

Got an Investment Banking Interview?

The BIWS Interview Guide has 578+ pages of technical and fit questions & answers, personal pitch templates, 17 practice case studies, and more.

S T R E E T OF W A L L S

Lbo modeling test example.

When interviewing for a junior private equity position, a candidate must prepare for in-office modeling tests on potential private equity investment opportunities—especially LBO scenarios. In this module, we will walk through an example of an in-office LBO modeling test. In-office case studies and modeling tests can occur at various stages of an interview process, and additional interviews with other members of the private equity team could occur on the same day. Therefore, you should strive to be able to do these studies effectively and efficiently without draining yourself so much that you can’t quickly rebound and move on to the next interview. Make sure to take your time and build every formula correctly, since this process is not a race. There are many complex formulas in this test, so make sure you understand every calculation.

This type of LBO test will not be mastered in a day or even a week. You must therefore begin practicing this technique in advance of meeting with headhunters. Repeated practice, checking for errors and difficulties and learning how to correct them, all the while enhancing your understanding of how an LBO works, is the key to success.

- Investment Scenario Overview

Given Information (Parameters and Assumptions)

Step 1: income statement projections, step 2: transaction summary, step 3: pro forma balance sheet.

- Step 4: Full Income Statement Projections

Step 5: Balance Sheet Projections

Step 6: cash flow statement projections, step 7: depreciation schedule, step 8: debt schedule, step 9: returns calculations.

Below we provide the given information from a real-life LBO test that was given to a pre-MBA associate candidate at a large PE firm. We will use it as an example of how to build an LBO model from scratch during the interview. Remember that candidates will receive a laptop and a printout with key information regarding the transaction to complete this assignment.

ABC Company, Inc.

Scenario Overview and Revenue Assumptions:

ABC Company, Inc. is a developer of software applications for smartphone devices. The company sells two products for the various smartphones. The first is a software application called Cloud that tracks weather data. The second application, Time, acts as a calendar that keeps track of a user’s schedule. ABC Company prices Cloud at $16.00 and Time at $36.00 per software license. ABC Company sold 1.5 million copies of Cloud and 3 million copies of Time in 2010. That was the first year ABC Company generated any revenue.

Each software application requires the payment of a $5.00 renewal fee every year. ABC Company renews approximately 25% of the licenses it sold in the prior year; this renewal fee acts as a source of recurring revenue. To simplify, assume that renewals happen for only one additional year and that the recurring revenue stream is based on the prior year’s new licenses. Note that ABC Company does not incur any additional costs for renewals.

COGS assumptions (assume constant throughout the projection period):

- Packaging costs = $1.50 per unit

- Royalties to technology patent owners = $3.00 per unit

- Marketing expense = $3.00 per unit

- Fulfillment expense = $4.00 per unit

- Fees to smartphone companies = 15% of sale price (does not include renewal fees)

- ABC Company incurs a 15% bad debt allowance on total revenues (consider this as part of cost of sales, wherein ABC Company is unable to collect from customers’ credit card companies).

G&A and other assumptions (assume constant throughout the projection period):

- Rent of development property and warehouse facilities = $350,000 annually

- License fee to telecom internet providers = $1.5 million annually

- Salaries and benefits = $1.75 million annually

- Sales commissions = 5% of all sales including renewals

- Offices and other administrative costs = $750,000 annually

- CEO salary and bonus = $1.25 million annually + 3% of all sales including renewals

- Federal tax rate = 35% and state tax rate = 5% on EBT

Starting Balance Sheet:

Investment Assumptions:

Due to the depressed macroeconomic and investing environment, the PE fund is able to acquire ABC Company for the inexpensive purchase price of 5.0x 2011 EBITDA (assuming a cash-free debt-free deal), which will be paid in cash. The transaction is expected to close at the end of 2011.

- Senior Revolving Credit Facility: 3.0x (2.0x funded at close) 2011 EBITDA, LIBOR + 400bps, 2017 maturity, commitment fee of 0.50% for any available revolver capacity. RCF is available to help fund operating cash requirements of the business (only as needed).

- Subordinated Debt: 1.5x 2011 EBITDA, 12% annual interest (8% cash, 4% PIK interest), 2017 maturity, $1 million required amortization per year. (Hint: add the PIK interest once you have a fully functioning model that balances.)

- Assume that existing management expects to roll-over 50% of its pre-tax exit proceeds from the transaction. Existing management’s ownership pre-LBO is 10%.

- Assume a minimum cash balance (Day 1 Cash) of $5 million (this needs to be funded by the financial sponsor as the transaction is a cash-free / debt-free deal).

- Assume that all remaining funding comes from the financial sponsor.

- Assume that all cash beyond the minimum cash balance of $5 million and the required amortization of each tranche is swept by creditors in order of priority (i.e. 100% cash flow sweep).

- Assume that LIBOR for 2012 is 3.00% and is expected to increase by 25bps each year.

- The M&A fee for the transaction is $1.5 million. Assume that the M&A fee cannot be expensed (amortized) by ABC and will be paid out of the sponsor equity contribution upon close.

- In addition, there is a financing syndication fee of 1% on all debt instruments used. This fee will be amortized on a five-year, straight-line schedule.

- Assume New Goodwill equals Purchase Equity Value less Book Value of Equity.

- Assume Interest Income on average cash balances is 1%.

Hint: The first forecast year for the model will be 2012. However, you will need to build out the income statement for 2010 and 2011 to forecast the financial statements for years 2012 through 2016.

- Build an integrated three-statement LBO model including all necessary schedules (see below).

- Build a Sources and Uses table.

- Make adjustments to the closing balance sheet of ABC Company post-acquisition.

- Build an annual operating forecast for ABC Company with the following scenarios (using 2010 as the first year for the revenue forecast; note that 2010 EBITDA should be approximately $25 million). Assume that in 2011 there is 5% growth in units sold (both Cloud and Time units).

- Upside Case: 5% annual growth in units sold (both Cloud and Time units)

- Conservative Case: 0% annual growth in units sold (both Cloud and Time units)

- Downside Case: 5% annual decline in units sold (both Cloud and Time units)

- Build a Working Capital schedule using Accounts Receivable Days, Accounts Payable Days, Inventory Days, and other assets and liabilities as a percentage of Revenue. Assume working capital metrics stay constant throughout the projection period and assume 365 days per year.

- Build a Depreciation Schedule that assumes that existing PP&E depreciates by $1 million per year, and that new capital expenditures of $1.5 million per year depreciate on a five-year, straight-line basis.

- Build a Debt schedule showing the capital structure described earlier. Use average balances for calculating Interest Expense (except for PIK interest—assume that PIK interest is calculated based on the beginning year Subordinated Debt balance and not the average over the year).

- Create an Exit Returns schedule (including both cash-on-cash and IRR) showing the returns to the PE firm equity based on all possible year-end exit points from 2012 to 2016, with exit EBITDA multiples ranging from 4.0x to 7.0x.

- Display the results of all of these calculations using the “Upside Case.”

Note that the above description incorporates all of the information, assumptions and assignments that were given in this LBO in-person test example.

As part of the first step, build out the core operating Income Statement line items for years 2010 through 2016.

- Make a distinction between 2011 assumptions and 2012-2016 assumptions

- Take the provided assumptions and make the revenue and cost build based upon them.

- OFFSET is a simple Excel formula that is used commonly to interchange scenarios, especially if the model becomes very complex. It simply reads the value in a cell that is located an appropriate number of rows/columns away, based on the parameters given to the function. Thus, for example, =OFFSET(A1, 3, 1) will read the value in cell B4 (3 rows and 1 column after A1).

Next, build the costs related to Revenue based upon the information given in the case.

Then, build the G&A expenses from the given information.

Finally, build a simple summary schedule for the above projections.

As part of the second step, build out the transaction summary section which will consist of the Purchase Price Calculation, Sources and Uses, and the Goodwill calculation.

- This model assumes a debt-free/cash-free balance sheet pre-transaction for simplification. Without debt or cash, the transaction value is simply equal to the offer price for the equity (before fees and minimum cash—discussed below).

- The funding for this model is fairly simple: the funded credit facility is 2.0x 2011E EBITDA, the subordinated debt is 1.5x, and the remaining portion is the equity funding, which is a combination of management rollover equity and sponsor (PE firm) equity. (Note that the 5.0x 2011E EBITDA is the offer value for the equity before the M&A and financing fees and the minimum cash balance, not after. After fees/cash, it ends up being 5.25x.)

- The management rollover is simply half of the management team’s proceeds from selling the company. Since management owned 10% of the company before the transaction, it constitutes 5% of the offer price for the original equity.

- The sponsor equity is the “plug” in this calculation. In other words, it is the amount that is solved for once all other amounts are known (offer price + minimum cash + fees – debt instruments – management rollover equity).

- The total equity (including management rollover) represents about 30-35% of the funding for the deal, which is about right for a typical LBO transaction.

- Goodwill is simply the excess paid for the original equity (offer price – book value of equity).

As a next step, build out the Pro Forma Balance Sheet using the given 2011 balance sheet. To do this, you need to incorporate all the transaction and financing-related adjustments needed to produce the Pro Forma Balance Sheet. Each adjustment is discussed in detail below.

- Since this is a cash-free and debt-free deal to start, there are no Pro Forma adjustments for the cancelling or refinancing of debt.

- Cash increases by $5 million upon close because the sponsor is funding the minimum cash balance (minimum cash that is assumed to be needed to run the business).

- The New Goodwill is simply the purchase value of the equity (not including fees) less the original book value of the equity.

- The adjustment for Debt Financing Fees reflects the cost of issuing the new debt instruments to buy the company. This fee is considered an asset, and is capitalized and amortized over 5 years.

- The Debt-related adjustments reflect the new debt instruments for the new capital structure.

- The Equity adjustment reflects the fact that the original equity is effectively wiped out in the transaction—the “adjustment” amount shown here is simply the difference between the new equity value and the old one. The new equity value will equal the amount of the total equity funding for the transaction (sponsor plus management’s rollover) less the M&A fee, which is accounted for as an off balance-sheet cost.

- VERY IMPORTANT: This stage of the LBO model development (once Pro Forma adjustments have been made to reflect the impact of the transaction on the balance sheet) is a very good time to check to make sure that everything in the model so far balances and reflects the given assumptions. This includes old and new assets equaling old and new liabilities plus equity; new sources of capital equaling the transaction value, which equals the offer price for the original equity (adjusting for cash, old debt and fees), etc.

Step 4: Full Income Statement

Next, build the full Income Statement projections all the way down to Net Income. Note that a few line items (especially Interest Expense!) will be calculated in later steps. Once the Cash Flow section and other schedules are built, link all the final line items to complete the integrated financials.

- You can link the Revenue, COGS and SG&A calculations to the operating model (built in Step 1) to get to EBITDA.

- D&A will be linked to the Depreciation Schedule that you will need to build (schedule of the Depreciation of the existing PP&E and new Capital Expenditures made over the projection period).

- Interest Expense and Interest Income will be linked to the Debt Schedule that you will need to build. There will be a natural circular reference because of the cash flow sweep feature of the LBO model, combined with the fact that Interest Expense is dependent upon Cash balances. This is usually one of the last things you should build in an LBO model.

- The amortization of Deferred Financing Fees is fairly straightforward: it uses a straight-line, 5 year amortization of the fees described in the case write-up and computed in Step 2.

- The tax rates apply to EBT after all of these expenses have been subtracted out. They are given in the case write-up.

Next, forecast the Balance Sheet from 2011 to 2016. Note that we start with the 2011 Pro Forma Balance Sheet from Step 3 , not the original Balance Sheet.

- Laying out the Balance Sheet is similar to laying out the Income Statement—you’ll have to set up the framework for some line items and leave the formulas blank at first, as they will be calculated in the other schedules you will create.

- Cash remains at $5 million throughout the life of the model, as we’re assuming a 100% cash flow sweep and that the minimum cash balance is $5 million. (Cash would only start to increase if we project out long enough that all outstanding Debt is paid off.)

- Accounts Receivable (AR): Calculate AR days (AR ÷ Total Revenue × 365) for 2011 and keep it constant throughout the projection period.

- Inventory: Calculate Inventory days (Inventory ÷ COGS × 365) for 2011 and keep it constant throughout the projection period.

- Other Current Assets: Keep this line item as a constant percentage of revenue throughout the projection period.

- Accounts Payable (AP): Calculate AP days (AP ÷ COGS × 365) for 2011 and keep it constant throughout the projection period.

- Other Current Liabilities: Keep this line item as a constant percentage of revenue throughout the projection period.

- Total Deferred Financing Fees are computed based upon the Debt balances and percentage assumptions given in the model. Deferred financing fees are then amortized, straight-line, over 5 years.

- The Credit Facility and Subordinated Debt line items will link to your Debt schedule. Their balances will decrease over time as a function of the cash available for Debt paydown (since the case write-up specifies a 100% cash sweep function).

- Equity (specifically Retained Earnings) will increase each year by the same amount as Net Income, because there are no dividends being declared. If dividends were to be added into the model, you would calculate ending Retained Earnings as Beginning Retained Earnings + Net Income – Dividends Declared.

- As discussed earlier, the balance sheet has the pleasing feature that if it balances, the model is probably operating correctly! Now is another good time to make sure everything balances before proceeding.

Next, forecast the Cash Flow Statement as requested in the Exercises section.

- Start with Net Income and add back non-cash expenses from the Income Statement, such as D&A, Non-Cash Interest (PIK), and Deferred Financing Fees.

- Next, subtract uses of Cash that are not reflected in the Income Statement. These include the increase in Operating Working Capital (which you calculated using your balance sheet) and Capital Expenditures (which is calculated here or, alternatively, could be calculated in the Depreciation Schedule to be built shortly).

- Next, calculate the change in cash, which will be interconnected with the Debt schedule. In this case, the model is assuming a 100% cash flow sweep (after mandatory debt amortization payments), so cash should not change after the 2011PF Balance Sheet amount of $5 million.

- Even though the amount is not changing, the Cash line item should link back to the Balance Sheet. This is because the model could later be used to relax the assumption that 100% of excess cash is swept to pay down Debt. If it’s less than 100%, Cash would accumulate, and that would need to tie in to the other financial statements.

Next, forecast the Depreciation schedule as requested in the Exercises section.

- The original PP&E is depreciated $1 million annually, as stated in the assumptions.

- New Depreciation is calculated based on the annual investment in Capital Expenditures over the projection period. This new Depreciation is created using a waterfall (see above): each year new Capital Expenditures occur and need to be depreciated; each year, Capital Expenditures from previous projection years in the model may have to be partially depreciated in that year. The sum of all of the component Depreciation line items (one row for each year, plus the Depreciation on the original PP&E) gives the total Depreciation Expense for the year.

Note that this model is less complex than it could be. Given that Capital Expenditures do not change each year, and that each new Capital Expenditure is depreciated according to the same simple schedule, the numbers and calculations are fairly straightforward. Here, we’re simply assuming that new Capital Expenditures are expensed evenly over a 5 year period (using straight-line depreciation), as specified in the case write-up.

Next, forecast the Debt Paydown and Interest Expenses for each year via the Debt Schedule, as requested in the Exercises section.

- WARNING: Be very careful about changing formulas once you have built the iterative calculation. If you do so and introduce an error, it could bust your entire model if you’re not careful. This is because the error will travel all the way through the iterative calculations and end up everywhere! If you run into this problem, break the circular reference entirely (by deleting it), reconstruct the calculations for the first forecast year (2012), and then copy and paste them across the columns, one year at a time (2013, then 2014, etc.). Many PE professionals have spent late nights in the office trying to recover from an accidental error introduced into a circular LBO model formula!

- The non-discretionary portion is the required amortization payments made on debt (in this case, there is only required pay-down for subordinated debt).

- The discretionary portion is the sweep portion of the remaining LFCF less required amortization. Since we’re assuming a 100% cash flow sweep, all of the LFCF is used to pay down debt—first the Senior Credit Facility, then the Subordinated Debt. The cash flow sweep and required payments will help you calculate the beginning and ending balances of both of the debt tranches.

- Also note that we need to include a fee for the availability of the unused portion of the RCF, even if the business never uses it—this is a typical, annual commitment fee arrangement for revolving credit facilities.

- The interest rate on the debt is a floating rate (this means an interest rate that is dependent on LIBOR, according to the assumptions provided). We need to calculate interest based on this rate times the average S/RCF balance over the year.

- The 8% cash interest is calculated based upon the average of the debt balance, just like with the S/RCF.

- However, the 4% PIK (non-cash) interest will accrue based upon the beginning debt balance, not the average.

- Because of this difference (and the fact that one source of interest uses cash and the other does not), we need to make sure we’re using separate line items for the two types of Interest Expense.

- We also need to be aware of the mandatory amortization payment of $1 million per year, provided in the assumptions. This amount will get paid down out of LFCF no matter what.

- Interest Income on Cash is fairly easy to calculate—it is the Cash interest rate (1%) times the average balance throughout the year. This amount will increase Cash.

- Total Interest needs to be linked to the Income Statement.

- Non-Cash Interest needs to be added back to Net Income in the Statement of Cash Flows to assist in deriving LFCF (it’s a non-cash expense).

- Any LFCF that is not used to pay down Debt needs to link to the Cash line item of the Balance Sheet. (In this model none will, but you should include this measure in case the model is later used to either relax the 100% cash sweep assumption, or to project financials beyond the point at which all debt has been paid off).

- All Debt balances paid down by LFCF need to link to the Debt line items on the Balance Sheet.

In the final step of the LBO test, build out the Returns calculation required in the Exercises section.

- For each year, we simply take EBITDA multiplied by a range of purchase multiples to get to a total Exit Value for the company (Transaction Enterprise Value, or TEV).

- Next, we subtract out Net Debt (which is dependent on the 3-statement model you just created) to get to Equity Value.

- Next, we calculate the portion of the Equity Value that belongs to the management and the sponsor by using the initial equity breakdown for each party.

LBO Case Study: Conclusion and Final Comments

We hope that this case study provides some insight into all of the considerations that need to be made in building a realistic LBO model based on a case study in a Private Equity interview, and that the 9-step breakdown helps you simplify the task into easy-to-replicate and easy-to-execute steps.

No one becomes an expert LBO modeler overnight, so the key to doing well in this portion of the process is practice, practice, and more practice. With enough sample LBO cases, you should be able to master the steps needed to confidently build a fully functioning, professional LBO model on interview day.

Good luck with the modeling case and with the interviews!

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

The Timed LBO Modeling Test: Full Tutorial for a 60-Minute Case Study

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

But it’s a bit misleading to call it a “modeling test.”

Given the time constraints – often between 1 and 3 hours – it’s more of an Excel speed test .

If you know the shortcuts and formulas like the back of your hand, and you can enter data quickly, you should do quite well.

And if not, you better start learning and practicing ASAP.

We’ll go through a full practice run in this tutorial for a 60-minute test starting from a blank sheet:

Types of LBO Modeling Tests

As discussed in the PE case study article , there are different types of “modeling tests” and “case studies”: simple paper LBOs, 1-3-hour timed tests, and open-ended take-home case studies.

The 1-3-hour timed tests are most common in the on-cycle recruiting process at large firms in the U.S.

However, they could come up in any recruiting process; for example, some firms in London start with a simple, timed test to screen candidates before advancing them to the next rounds.

The good news is that these timed tests require far less critical thinking, creativity, and research than the open-ended case studies.

The bad news is that if you want to get good at them, you’ll need to “put in the reps” by completing many practice exercises.

What to Expect in a Timed LBO Modeling Test

The two main categories are tests that give you an Excel template and tests in which you start from a blank sheet .

The ones with templates tend to have more complex formulas, and the ones where you start from scratch have simpler formulas but are more challenging to finish under time pressure.

Here’s a summary of the likely differences based on the type and allotted time:

The 60-Minute LBO Modeling Test from a Blank Sheet

You can find examples of tests with provided templates fairly easily, so I thought it would be more interesting to look at an example without a template here.

You can get the case study prompt, the answers, and the completed Excel file below:

- 60-Minute LBO Modeling Test – Case Study Prompt (PDF)

- 60-Minute LBO Modeling Test – Completed Excel File (XL)

- Answers to Case Study Questions (PDF)

- Overview of Main Points in 60-Minute LBO Modeling Test – Slides (PDF)

There is no “blank” or “beginning” file because we create a new sheet in Excel and enter everything from scratch in this tutorial.

You can get the video version of this entire tutorial below:

Table of Contents:

- 2:24: Part 1: Likely Requirements in Modeling Tests

- 7:43: Part 2: Transaction Assumptions and Sources & Uses

- 17:24: Part 3: Model Drivers and Income Statement

- 32:14: Part 4: Free Cash Flow and Debt Schedule

- 46:04: Part 5: Returns and Sensitivities

- 56:22: Part 6: Answers to the Case Study Questions

- 1:03:12: Recap and Summary

This example is not taken from our courses – it’s new for this article – but it is similar to one of the many case studies in our Core Financial Modeling course :

Core Financial Modeling

Learn accounting, 3-statement modeling, valuation/DCF analysis, M&A and merger models, and LBOs and leveraged buyout models with 10+ global case studies.

The full course has a different 60-minute example and a 90-minute test as well. And if you want more complex LBO models and a “take-home” example, check out the Advanced Financial Modeling course :

Advanced Financial Modeling

Learn more complex "on the job" investment banking models and complete private equity, hedge fund, and credit case studies to win buy-side job offers.

Part 1: Likely Requirements in an LBO Modeling Test

The chart above sums up the likely requirements for tests of different lengths. To be more specific, you can expect the following in a 60-minute test starting from a blank sheet:

- Assumptions: Purchase Enterprise Value or Equity Value and a simple Sources & Uses schedule . There may be a working capital adjustment as well, but it’s fairly simple and makes a low impact on the model.

- Debt Schedule : Perhaps 2-3 tranches of Debt with slightly different interest rates and repayment terms (e.g., fixed vs. floating interest, cash vs. PIK, and mandatory and optional repayments for one tranche). A Revolver is possible but unlikely.

- Revenue, Expenses, and Cash Flow: These will often be simple percentage assumptions, but they could be a bit more complicated, such as Units Sold * Average Unit Price or Market Share * Market Size.

- Financial Statements: A simple Income Statement and partial Cash Flow Statement; you just need enough to calculate Free Cash Flow and Cash Flow Available for Debt Repayment.

- Returns Calculations: These will be fairly simple, but there could be a small twist, such as an earn-out, options pool, or management rollover.

- Sensitivity Analysis : You might create 1-2 tables if the returns calculations were simple, but you might skip these if they were more complex. The case study questions determine whether or not you “need” these tables.

- Total # of Rows: Probably ~100 or less (including blank rows), but you could go up to ~130 if there are sensitivities.

Unless they specifically ask you to do so, you should NOT build a full 3-statement model .

It’s a waste of time when you have only 60 minutes and adds nothing over the cash flow projections.

You should also skip other bells and whistles such as purchase price allocation , scenarios, complex Debt schedules, etc.

And do not include anything beyond bare-bones formatting, or you’ll never finish on time – number formats are OK, but forget about colors and borders for headers, input boxes, etc.

Part 2: Transaction Assumptions and Sources & Uses

The first part of this exercise is simple: we enter the assumptions provided in the case study document, focusing on ones that stay the same each year :

Since this is a cash-free, debt-free deal , we use Purchase Enterprise Value on the Uses side of the Sources & Uses schedule.

One slightly tricky part is the $25 million “Cash Injection” when the deal closes; the case document strongly hints that we need to include this:

“Cash-free, debt-free” means the company has 0 Cash and 0 Debt immediately after the deal closes – but that changes a second later due to the new Debt used to fund the deal.

There isn’t always a “Cash injection” right after the deal closes, but in this case, there is.

The rest is straightforward, and the Investor Equity is a standard “plug,” as shown above (Total Uses – Sources So Far).

Part 3: Model Drivers and Income Statement

It helps to start by setting up a sketch of the Income Statement, so we know what we’re building up to:

Then, we can go back and fill in some of the drivers, starting with widget unit sales and the average price per widget:

The document gives us information about the factories, including Maintenance CapEx and Growth CapEx, but it’s vague about the Depreciation.

You might be tempted to do something complicated, such as a detailed Depreciation schedule based on annual CapEx spending.

Or you might want to use functions like ROUNDUP to ensure that the factory count can only be in whole units rather than decimals (“8.5 factories” doesn’t make logical sense).

I recommend avoiding all of this and keeping the drivers as simple as possible because these details do not matter in a time-pressured test.

We drive the # of factories with the Widget Unit Sales and the Widgets per Factory, which is 500,000 based on the initial year (4 million widgets / 8 factories).

Depreciation is a simple % of sales, set to percentages slightly below the CapEx ones:

The COGS and Operating Expenses ( “Fixed Expenses” here) are simple; COGS is based on the Gross Margin % , and Fixed Expenses = (Sales – EBITDA) – COGS.

They grow at the same rate as average widget pricing:

We can then put together all the pieces to build the Income Statement down to Net Income, skipping the Interest deduction for now:

Part 4: Free Cash Flow and Debt Schedule

Free Cash Flow , at least under U.S. GAAP, is defined as Cash Flow from Operations minus CapEx (roughly).

“Cash Flow from Operations” is simple because this company is simple: start with Net Income, add Depreciation and Non-Cash Interest, and add/subtract the Change in Working Capital .

And then subtract Total CapEx from the model drivers to calculate FCF:

To complete the blank lines here, we need the Interest numbers – but to get the Interest expense, we need the Debt balances first.

But before we can project the Debt balances, we need to think about optional repayments , otherwise known as “cash flow sweeps.”

In other words, if the company generates positive cash flow available for Debt repayment in one year, how much of that cash flow could it use to repay the Term Loans optionally?

The case document explicitly tells us the answer is “50%”:

However, it’s NOT as simple as using 50% of the “Free Cash Flow” to repay these Term Loans.

“Cash Flow Available for Debt Repayment” is different from “Free Cash Flow” because more line items factor into it:

- FCF Generated in the Year: This increases the cash the company could potentially use to repay the Term Loans.

- Beginning Cash: The higher the company’s initial Cash balance, the more it can potentially use to repay Debt.

- Mandatory Repayments: If the company must repay 5%, 10%, or 15% of the Term Loans, these payments reduce how much it can pay optionally.

- Minimum Cash: Finally, Widget Co. must maintain 5% of its previous year’s sales as a minimum Cash balance at all times, which reduces the amount it can use to repay Debt.

Putting these pieces together, we get this sketch:

At this stage, we should move to the Debt balances below and link the Term Loans to the mandatory and optional repayments and the Senior and Subordinated Notes to PIK Interest :

And then, we can go back and calculate the Cash Flow Used for Debt Repayment and the Ending Cash each year:

NOTE: In the video, the Ending Cash calculation is incorrect at first. We go back and fix it a few minutes later. The screenshot above reflects the correct numbers at this stage of the model.

The Cash Flow Used for Debt Repayment is the minimum between the Cash Flow Available * Sweep % and the remaining Term Loan balance after the mandatory repayment.

This formula ensures that if, for example, $50 of the Term Loan remains, but we have $200 * 50% = $100 in available cash flow, only the remaining $50 is repaid.

The Ending Cash is based on the Beginning Cash minus Mandatory Debt Repayments plus Free Cash Flow minus Optional Repayments (“CF Used for Debt Repayment”).

The final step is to calculate the interest for each tranche of Debt, which we split into Cash and PIK to make it easier to link the statements later:

We then go back and link the total Interest Expense into the Income Statement and add back the Paid-in-Kind portions to calculate Free Cash Flow:

As a result of these Interest links, the company’s Cash balance grows to a lower level, and it repays the Term Loans more slowly.

To avoid circular references, we can use the beginning Debt balance as well (for more, see our tutorial on how to remove circular references in Excel ).

Part 5: Returns and Sensitivities

The basic returns calculations here are simple: we apply an Exit Multiple to the EBITDA in Year 4 or 5 to calculate the Exit Enterprise Value, subtract the remaining Debt, and add the remaining Cash:

The 5% management options pool makes things trickier, as we need to factor in the Cash the management team pays to exercise their options and the Equity they receive.

By paying to exercise their options, the management team increases the total Equity, which means they no longer own exactly 5% of the total Equity .

Management owns 5% / (1 + 5%) = ~4.8% of this expanded pool, so the Equity to Management Option Holders is based on that percentage times the expanded total Equity:

If you get this slightly wrong, it’s not the end of the world; this point barely affects the returns.

You just need to show some small outflow of proceeds, assuming the Exit Equity Value is higher than the initial Investor Equity (meaning the options are exercisable).

We can then calculate the IRR and multiple of invested capital and create a few simple sensitivity tables:

If you’re wondering about the exit multiple range of 9-13x, the purchase multiple was 12x, and the company is growing more slowly by the end of the holding period (~9% vs. ~16%), so we assumed modestly lower multiples.

Ideally, we’d look at the ROIC and comparable companies to estimate the exit multiple, but we do not have the time or information for those.

With that, we’re done with the Excel portion of this modeling test.

Part 6: Answers to the Case Study Questions

You can read the answers yourself , but in short, we recommend doing this deal because the likely IRRs are between 20% and 30%, with MOICs between 2x and 3x.

The company’s financial projections may be slightly aggressive in terms of margin expansion (with EBITDA margins increasing from 20% to 25%), but growth is also slowing, so they’re not crazy.

If the PE firm wants to boost its returns, the easiest solution is to use more Debt .

The company can support more than 5x Debt / EBITDA because it pays off the Term Loans by Year 5, with Total Debt falling by over $200 million in that period.

So, the PE firm could increase the initial Debt to 6x or do a Dividend Recap midway through the holding period (or even a simple cash dividend).

How to Master the LBO Modeling Test

Overall, this is a fairly challenging LBO modeling test .

I intentionally inserted multiple ways to make mistakes and waste time on marginally useful tasks.

That said, you do not need to score 100% to “pass” – the median score on these tests is often below 50%.

So, if you can finish the model and get most of it correct, you should be in good shape, even with some mistakes here and there.

But the key part of that sentence is “finish the model.”

If you don’t know Excel quite well, you will struggle to finish in 60 minutes.

If it takes you 2-3 hours to finish, that’s a fine result for your first try.

At that level, you could reduce your time to the 60-minute range with repeated practice.

Similar to standardized tests like the SAT and GMAT, there are only so many features they could throw at you in an LBO modeling test.

Once you’ve done 5-10 practice tests, you’ll be ready for ~90% of future tests.

And if the average person suddenly learned the truth about what it takes to get into private equity , they might start wondering what explains those sky-high salaries …

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

Paper LBO: A Step-By-Step Guide with Interview Examples

Preparing for private equity or growth equity interviews is quite an undertaking. Whether it’s your first interview or your tenth, there’s a lot you need to prepare.

Preparing for that first one is especially tricky, though, because you’re facing your first paper LBO exercise.

The paper LBO requires knowledge of the ins-and-outs of a leveraged buyout model, as well as strong analytical skills, knowledge of the deal, and a quick mind for mental math.

Once you know how to do it, be sure to practice – you don’t want to have the additional challenge of feeling pressured while you think.

In this article, we’ll cover what a Paper LBO model is, how to prepare, and example prompts so you can go into it feeling extremely confident.

What is a paper LBO?

At its most basic level, a paper LBO highly is a simplified LBO model that uses certain simplifying assumptions that allow you to either calculate using pen and paper (or verbally). It allows you to estimate returns for a deal quickly without a full model.

The paper LBO is not actually used much “on the job” but it is often asked for during private equity interviews (and even growth equity interviews).

In an interview situation, the interviewer will commonly ask the candidate to pencil out a paper LBO for a company or deal they’ve worked on in their previous job. In other cases, the interviewer might present a new company and supply the candidate with assumptions and financial metrics to use.

Because the paper LBO simplifies the math, usually you can complete a paper LBO using paper & pen, or verbally in an interview. Sometimes interviewers will lead you along with questions, as you complete the Paper LBO live on the fly.

Usually the paper LBO exercise will last 5-20 minutes during an interview.

Paper LBO in Interviews

Paper LBO calculations are mostly for private equity interviews , although they can show up in growth equity interviews as well.

The Paper LBO assesses many key skills for private equity and growth equity jobs and internships :

First, it’s an excellent way to quickly assess your knowledge of the mechanics of LBO modeling.

It’s also a great way for an interviewer to assess your communication and quantitative skills. Can you make quick calculations on the fly? Can you sift through financial metrics in your head and calculate orally with confidence?

Additionally, the Paper LBO allows the interviewer to dig into a deal on your resume by asking you to sketch out a Paper LBO for the deal. This allows in-depth follow up questions.

Finally, because usually the Paper LBO is requested for a company/deal you’ve worked on, it tests your level of preparation for the interviews, because in order to complete it successfully you need to remember or memorize key financial metrics for the company and deal.

Paper LBO vs full LBO model

The paper LBO you might encounter in an interview is a highly simplified version of a full leveraged buyout model.

Here are a couple key ways that paper LBO models differ from full LBO models:

- Instead of building a full 3-statement model, simply focus on projecting Revenue, EBITDA, and free cash flow every year (memorize these for the entire projection period for all your deals!)

- Since you are memorizing financial numbers for Revenue, EBITDA, and FCF, it’s OK to use figures that are rounded to the nearest $5 million

- Often, you’ll assume growth in metrics over the projection period is linear, allowing you to memorize the year 0 and year 5 metric values (and assume linear growth between them)

- No need to build out balance sheet or debt schedule; you’ll capture their impact by simply projecting FCF

Sometimes interviewers will throw in a complicating factor or two, but the calculations are all designed to be completed without a computer in less than ~20 minutes.

Step-by-step process for Paper LBO

In many ways, completing a paper LBO is the same as completing any other financial model.

For any model, you can remember the ASBICIR process. This stands for the following steps:

- A ssumptions – gather all your operating and entry assumptions (incl. pro forma valuation and debt figures); start with the purchase price and debt/equity financing split.

- S ources and uses – using the assumptions, fill out your sources and uses, which shows where the cash flows to and from in the acquisition transaction. Ultimately, this will get you to your “Sponsor Equity” which is the investment amount upon which you should base your IRR

- (Pro forma) B alance sheet – With your Sources & Uses done, you can now complete your pro forma balance sheet, and start laying the foundations for projecting it forward until the exit year. This includes setting up your debt schedule, if your modeling an LBO

- I ncome statement – next, you can start projecting forward your income statement, all the way down to net income; notably, do not yet integrate interest expense; leave this blank for now

- C ash flow – with your income statement and balance sheet up, you can project forward your cash flows. This and the prior two steps will be iterative as you set up schedules and make calculations that are interdependent on multiple statements (e.g. D&A)

- I nterest – finally, once your 3-statements are connected and projected forward, always the last step is to calculate interest expense and connect it to the income statement; turn on model iterations

- R eturns – the last step is to make an assumption about your exit, and to calculate your returns by comparing the entry investment amount to the exit investment amount

For the paper LBO, the only differences are:

- No need for B alance Sheet and I nterest Expense steps; these are both excluded; given this, you’re left with the Paper LBO short version: ASICR

- Instead of building a full 5-year projection, instead build up the model for Year 0 and Year 5 (from memory). To estimate the intervening years, you can either assume linear growth or you can use the “average” method