How to Clear Your Name From a Blacklist

A blacklist is a database that indicates defaulters who haven't paid up their debts within a stipulated time frame given by their lender. When a person’s name is on a blacklist, it simply means the person has defaulted in payment to their creditor. Blacklist is associated with default which is normally referred to as negative information in the credit bureau.

There is a misconception that Credit Bureau databases only contain names of people and entities who have been blacklisted. This is not true for Nigeria. Information in the repository of licensed Credit Bureaus in Nigeria contain information about individuals and companies with a credit history, so as long as they have accessed any credit facilities or products and services on credit in the past and currently. The credit information on your profile can either be negative or positive or both depending on how and when you pay back your loans or postpaid services.

So, what exactly does it mean to have negative information? It means that institutions/credit grantors you may approach will deny you credit because you have a negative report on your credit profile. You may therefore not be able to meet your short or long term needs and may access credit facilities from other lenders at a higher interest rate because you are categorized as high risk. You may also be denied employment opportunities if judgment was taken against you.

If you have been reported with negative information and have paid the debt for which you were listed, you may contact your lender to provide this update to the credit bureau or apply to the credit bureau and request for this update to be done. Either course requires the lender or credit grantor to provide this update to the bureau. The key here is for the update to happen as names are not typically removed from the credit bureau database.

As you take credit facilities or lines, you build a history of performance.

Here's how to clear your name from a Negative Profile;

- Pay your debt:

The first step to clearing your name from being reported as a defaulter is to pay up what you owe. If you are in a financially difficult situation, ensure you contact your lender to discuss payment options that could ease the burden of paying the loan. Choose a payment plan that will work best for you and follow up until you settle your debt. You can also set up automatic payments on the due date to avoid missing a payment.

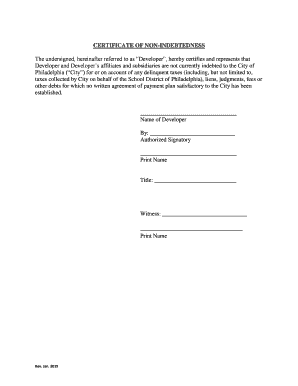

- clearance certificate/letter of non-indebtedness

Should you have a clearance certificate/letter of non-indebtedness, you can forward the letter to the credit bureau for verification from your lender.

- Contact the Credit Bureau

After a borrower has paid off his/her debt, it is legally obliged of the credit providers to notify the credit bureau that the borrower has paid off his/her debt and request for the borrower’s credit profile to be updated to the current status.

However, you may apply to the credit bureau where you were listed to have your credit profile updated. This can be done by contacting the Bureau via phone/email.

Helpdesk: https://helpdesk.creditreferencenigeria.net/

Email: [email protected]

Phone line: +234-807-209-0622

Your email should carry the following details; your Full Name, Phone Number, Bank Verification Number (BVN), gender, evidence of payment and Clearance certificates (if any).

This process might take 2-5 working days to be resolved so do not hesitate to follow up with the Credit Bureau.

Individuals and companies with positive information in their credit files are every lender or credit grantors dream customer, as you are attractive to onboard for their credit products and services. This means you have a history of paying back on or before the due date.

Majority of companies and financial institutions assess their risks on the basis of information provided by the Credit Bureau. If any negative information appears in an applicant’s Credit Report, it is highly improbable that finance will be approved.

This shows how important it is to check your credit reports every year. Your Credit Report provides valuable information about your credit history and behaviour. You are entitled to one free credit report every year so take advantage of that opportunity and step into the world of financial freedom.

Need to know more about your Credit History? Download the CRC Mobile App on all Android and iOS Devices today.

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

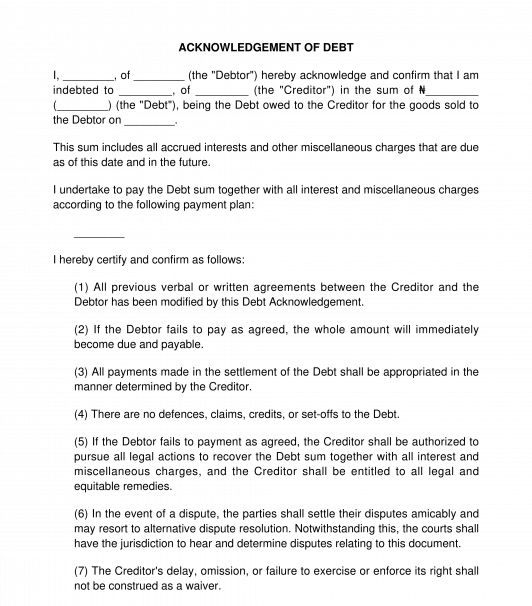

Debt Acknowledgement Letter

Rating: 5 - 1 vote

The Debt Acknowledgement Letter is a document that confirms that the debtor owes the creditor money. The debtor is a party that owes money to the creditor . This document shows concrete proof that the debtor owes a certain amount of money, as it contains an admission of liability to repay the debt.

This document is used by a creditor to obtain proof that the debtor owes money. It outlines information about the debtor and the debt. It includes the particulars of both the creditor and the debtor, the debt sum, the reason the money is owed, the repayment plan, date of repayment, and the debtor's acceptance of liability. To learn about the procedure for debt collection, the legal guide on How to Recover Debt is available on the website.

How to use this document

This document may be used by a debtor that needs to acknowledge that they owe money to the creditor. A creditor can also use this document as a template for their debtor. This document is different from the Loan Agreement , which is more elaborate as it specifies the terms and conditions of a loan facility. However, this document merely acknowledges a party's debt.

In this document, the party using this document will enter all the required information about the parties to the transaction and the debt. After completing the document, the debtor should sign the document and each party will keep a signed copy of the document for their record.

If either of the parties is a company, the common seal of the company, either two directors or one director and one company secretary should sign the document and the common seal of the company may be affixed unto the document. If either of the parties is any other organization other than a company, an officer of the organization should sign the document, and one witness should attested to the document.

Once debtor signs this document, the debtor becomes liable to repay the debt sum together with all interests and miscellaneous charges attached to the debt.

Applicable law

There are no specific laws that regulate the Debt Acknowledgement. However, the rules of contract apply to this document.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Acknowledgment of Debt, Acknowledgment of Money Owed, Confirmation of Debt, Acknowledgement of Debt Between Individuals, Debt Acknowledgement Notice

Country: Nigeria

General Business Documents - Other downloadable templates of legal documents

- Request for Extension of Time to Pay Debt

- Debt Settlement Agreement

- Share Certificate

- Power of Attorney

- Non-Disclosure Agreement

- Loan Agreement

- Director Consent Letter

- Arbitration Agreement

- Notice of Meeting of a Company

- Memorandum of Understanding

- Promissory Note

- Resolution of Members of a Company

- Letter of Waiver

- Share Transfer Form

- General Letter of Instruction

- Non-Compete Agreement

- Resignation Letter of a Company Director

- Partnership Dissolution Agreement

- Notice of Partnership Dissolution

- Other downloadable templates of legal documents

40 politely-worded templates to get invoices paid

How to write a demand letter for outstanding debt | Chaser

Share this article

Is there anything worse than having a client who just won't pay? You do all this work for them and then… nothing! Doing a job costs you money and you have your own obligations to meet. We don't need to tell you why not getting paid is stressful! Fortunately, the debt collection process gives you options. There is action and when you need to, you should take it. If you've had enough of chasing up a bad debtor, you've come to the right place. This article will explain how to write a demand letter – or write what we will refer to as a "demand letter" or "payment demand letter." You'll learn what such a letter is, the evidence it should contain, and when you should file a case against a client or customer in court.

What is a formal demand letter for payment?

What exactly is a demand-for-payment letter? Essentially, it's when you present someone with evidence and a written request to pay the money owed . Anyone can send a demand-for-payment letter, so if someone owes you money, you have the right to ask for that payment without involving a lawyer (at least, not at first). However, many businesses choose to have formal correspondence written up by their paid legal representative. It is generally perceived that letters written by professionals carry more weight. And, a demand letter for payment is a way of proving that you are serious and willing to take the matter further if necessary.

How it works

What are the benefits of a formal demand for payment letter?

The benefits of a formal demand-for-payment letter are considerable. Collect debt owned

The main benefit of a demand letter is that it helps you collect money owed to you without having to go through the hassle of filing in court. The recipient should take the notice seriously and take steps to repay any debt owed. Low cost

A demand letter is also a low-cost strategy. It is often as simple as sending an email or putting a letter in the post. It is not expensive, like filing a lawsuit or accepting a settlement. A proper demand for payment simply asks the client or customer to pay you by the deadline. Record evidence

Demand letters are also extremely valuable because they provide evidence of money paid to you. Having a document setting out the payment history with the recipient can assist in any future lawsuit. Clarify your deadline for money owed

Demand for payment letters also states when clients and customers must pay their debt before you will file a lawsuit in court. Once they are in receipt of the document, there is no longer any ambiguity. How to write demand letters

Writing a demand letter is a tricky business, but as long as it contains the correct information it will count. There are also no specifics on how the letter should be sent, which means you can send it as an email if you find that appropriate to your situation. However, the ultimate goal is to receive payment for the cost of the work rendered. Here are some of the details a demand letter needs to include:

- Your information and the debtors' information (contact details, address etc.)

- The date when the debt began and the amount of money owed

- Details and dates of any disputes relating to this payment

- Description of the nature of the agreement and breach of contract

- Outline previous payment reminders and attempts to collect the payment

- The final due date for when the sum is to be settled by

- Instructions on how to pay (such as your banking details)

- The consequences should payment not be made (intended legal action)

- Your personal signature

- You should also attach copies of relevant documents (such as the invoice in question)

In a demand letter for payment, you should state the facts in a professional tone. Now is not the time to vent frustrations, or get personal or emotional. You certainly don't want to sound threatening. Should you end up in court, for example, a poorly prepared demand letter could seriously hinder your case and your reputation. However, when the situation is handled right, you may even come out of it with no hard feelings once the matter has been resolved. Is it a good idea to write a demand letter email? There is no rule saying you can't send your demand letter as a document or an email. Most formal documents are hand-delivered or sent by registered post so that there's no doubt they've reached the right person. No matter how you choose to send it, you want to ensure that it will be read and taken seriously. Sample demand letter for payment

When it comes to letters of demand, less is more. You want to keep the content as short as possible, only including what is absolutely necessary. Remember, your demand letter will be passed around and read by more than one person, especially if the matter does end up in court. And, a well-written professional tone will make a good impression on a small claims court judge. Writing an effective demand letter for payment is never easy. Don't rush it. Make sure you think it through. While you don't want your letter to include unnecessary details, you must make sure you haven't left anything out when demanding payment. A demand letter serves as a vehicle to establish facts, set out your contract and evidence, document any proof of payments so far, and provide notice. Here is a sample free demand letter that you can adjust to fit your own situation: [Your full address and business contact details]

[The debtor's contact details]

Dear [include the debtor's name]

RE: Outstanding payment due on invoice [include invoice number]

We have tried to reach a settlement with you regarding the payment due to us. As you will remember, the terms of our agreement were [that we provide X and you pay Y]. However, by non-payment, you have failed to uphold your side of the contract.

You will find a copy of the original invoice along with proof of the signed work agreement enclosed herein.

Reminders were sent to you [on these dates]. Additionally [include name] tried to visit you in person to discuss a payment arrangement [on this date, at this time] but did not find you available. Unfortunately, as we have not received acknowledgement from your side, and we are still expecting to collect our payment we have no choice but to take this matter further.

The original invoiced amount owed was: [include amount] Accumulated interest (according to the agreed-upon terms) comes to: [include amount] The total amount outstanding is: [include amount]

You can settle your debt to us by making an EFT deposit to our bank account [provide banking details].

Please be advised that if you do not respond and settle the outstanding amount by [date], we will pursue legal action against your company.

We would appreciate your due attention in this regard.

Yours sincerely, [Your signature, name and designation]

Writing a demand letter for payment is never easy. Don't rush it, make sure you think it through. While you don't want your letter to include unnecessary details, you must make sure you haven't left anything out. If you are not sure how to write a demand letter for payment, follow an example like the one above. The recipient should respond to you if they expect you will pursue them for money through legal proceedings. The demand letter should be sent by certified mail with a return receipt requested. Sending the letter with a return receipt request means the recipient will send their signature back to you on a specific date. As a service provider, you have the right to impose whatever deadline on payments you want. Therefore, it is your decision when you write your last notice to the non-paying party to demand they pay you and resolve the issue.

What happens next

You might be prepared for battle, but you never know how your letter might be received. Once you've sent your demand letter for payment there are three possible outcomes.

- Your demand is accepted by the other party - This is the best-case scenario where the debtor comes to the party and meets your demands.

- A counteroffer - The debtor acknowledges your demands and the outstanding balance but doesn't accept all of them and negotiation begins. If they are enduring financial hardship, they may require instalment payments or a payment plan. They may also push for a settlement where they pay some of what they owe, but not all. (This may occur if the other party believes services rendered breached your contract because they were of low quality).

- Refusal - The worst-case scenario happens when the terms of your letter are refused and you have to follow through with legal action. If the recipient owes you money in your contract but they ignore your request for payment, you may have to take legal action.

Outstanding debt

Getting paid is a top priority. You need your cash flow and there's nothing worse than losing sleep because of outstanding funds. You've worked hard to establish your company and you're absolutely entitled to expect to receive the money due to you. Sending out a strong demand letter might not be pleasant but it could mean saving your company. A demand letter for payment sends out a strong signal that you are ready to commence legal proceedings or may file a legal claim for services rendered. It's a way of showing customers that if they don't pay, you may engage in a court lawsuit to resolve the issue. If you need help collecting your outstanding payments, Chaser has all the credit control resources you need. So you can stop worrying about your bad payers and start focussing on the good ones! You can test Chaser with a zero-obligation free trial here

Related articles

John Eaton joins Chaser’s Partner Programme

Award-winning credit control software and collections services company Chaser has announced a partnership...

Direct Peak joins Chaser’s Partner Programme

Moore thompson joins chaser’s partner programme, subscribe to chaser's monthly newsletter.

Our monthly newsletter includes news and resources on accounts receivables management, along with free templates and product innovation updates.

Worried about dealing with the people you owe money to?

We are here to help. Take two minutes to find the right support.

Get help now

Sample letters for your creditors

Download our letters to get in touch with the people you owe money to. We have letters for making complaints, asking for payment holidays, and more.

The letters have space for your information. Just add or delete text where needed.

It can be helpful to send a monthly budget with your letter. This shows you are paying what you can afford.

Read our guide to making a budget .

If you do not have Microsoft Word

To edit Word files on Android mobiles and tablets:

- Open in Google Drive or Google Docs

- Tap the small pencil icon on the bottom right

To edit Word files on Apple mobiles and tablets:

- Copy to Pages

- Click anywhere to make a change

Make sure the people you owe know about changes to your finances.

You can also use our letters to tell them you are getting help from us.

Telling your creditors you are dealing with debts

I got advice and am setting up a repayment plan.

Let your creditors know you are setting up a plan.

Download the letter to tell your creditors you have had debt advice

I would like to make a temporary payments arrangement

A temporary payment arrangement is when you offer to pay what you can afford for a short time.

Add details of how much you can pay and for how long.

Download the letter to offer a temporary payment arrangement

Request a payment suspension

Use this letter to tell the people you owe that you are experiencing financial difficulty and ask them to stop interest and charges.

Download the letter to ask creditors for a payment suspension

Download the letter to ask creditors for a payment suspension (large print version)

I cannot afford to pay my arrears. But I can make my monthly payments

Tell your creditors if:

- You cannot afford to pay your arrears but

- You will still make normal monthly payments

Download the letter to tell creditors you cannot pay your arrears

I can pay some money toward my arrears on top of my monthly payment

Use this letter to tell the people you owe that:

- You can make your full monthly payment

- You can pay a bit extra toward your arrears, but you cannot pay them in full at this time

Download the letter make an offer of payment to your creditors

I cannot afford to pay my arrears or my full monthly payment

- You cannot afford to make your monthly payment

- You cannot afford to pay toward your arrears

- You have made an offer for a lower payment and you are getting help from StepChange

I cannot pay my CCJ

England and Wales only

Ask the court to look at what you pay each month. Tell them you cannot afford to pay your County Court judgment (CCJ) .

You can only do this if:

- You sent back your claim forms on time

- The court replied

Read our guides to dealing with a CCJ .

Download the letter to ask to change CCJ payments

Telling your creditors you are disputing a debt

Read our guides to:

- Finding out who you owe money to

- How to dispute debts

I need you to prove I owe money

Find debts covered by the Consumer Credit Act (CCA) .

The law allows you to see:

- The agreement

- The terms and conditions

- A list of everything you have paid

Asking for this is called a 'CCA request' . You have to pay £1.

This includes most consumer debts, like:

- Personal loans

- Credit and store cards

- Hire purchase

Download the CCA request letter

I still have not had the information I asked for (CCA request follow up)

The debt becomes 'unenforceable' if the people you owe do not send the information you ask for.

This means they might not be able to take you to court.

It does not mean you can ignore the debt.

Download the CCA request reminder letter

I think my debt is 'statute barred'

A statute barred debt cannot be 'enforced'. This is because a certain amount of time has passed.

Use this letter if you live in in England, Wales or Northern Ireland.

Download the statute barred notification letter

I do not admit liability for this debt (Scotland only)

Use this letter to tell a creditor if you think a debt is prescribed. A debt is considered 'prescribed' if:

- The creditor could have sued for the full balance of the debt over five years ago

- No payment has been made by yourself, a third party, or a joint account holder in over five years

Download the letter to tell your creditor you think your debt is prescribed

I want to apply for my CCJ to be redetermined

Use this letter to write to the court and ask for your judgement to be redetermined.

Download the letter to ask for a redetermination

Dealing with harassment

I want creditors to stop calling me.

You do not have to put up with being harassed by a creditor .

- Write to them

- Ask them to stop calling you

- Tell them how it is making you feel

Find out more about making complaints to creditors .

Download the letter to reduce creditor calls

I am a vulnerable person

If you are considered vulnerable according to the Taking Control of Goods: National Standards 2014, you can ask that the people you owe stop enforcement action.

Find out more about enforcement action .

Notice of vulnerability letter

Stopping automatic and recurring payments

I do not want my bank to take money from my bank account.

In some cases, your bank can take money from your account to pay off arrears to other debts you have with them.

This is called their right of offset .

You can write to protect the money you have with them.

Download the letter about right of offset

I need to stop money going out of my account

Some lenders will keep taking money from you. They do this using a 'continuous payment authority' (CPA).

You can stop this by writing to them or to your bank.

Our page on cancelling recurring payments explains your rights in more detail.

Letter to cancel a continuous payment authority (CPA)

I want to cancel my hire purchase agreement

Use this letter to ask your creditor to cancel your hire purchase agreement.

Download the letter to ask your creditor to cancel your hire purchase agreement

Offering settlements

I can pay off a debt in full.

You may want to make a settlement offer if you receive a lump sum of money.

Use this template letter to make an offer for the full amount.

Final settlement offer letter

I want to offer a settlement based on a percentage of the debt

You may get a lump sum that could cover part of an outstanding debt.

You can offer this to a creditor as a full and final settlement.

Final settlement offer based on a percentage letter

Letters to us

How do i give someone else permission to talk to stepchange about my debts.

Use this letter to give us permission to speak to someone else for you.

This could be a friend or relative.

Letter of authority

Money worries?

Find out how we can help you.

Related articles

- Dealing with a CCJ

- Harassment from creditors

- County Court forms

{RecipientAddress},

{Apartment_Suite},

LETTER OF NON–INDEBTEDNESS : {CustomerName} ACCOUNT NUMBER: {CustomerAccountNumber}

Our Service Solutions

- CREDIT MANAGEMENT

- RISK MANAGEMENT

- BUSINESS PROCESS OUTSOURCING

- CREDIT REPORTS & LETTERS

- THIRD PARTY DEBT COLLECTION

- INTERNATIONAL COLLECTIONS

INDIVIDUAL CREDIT REPORTS

Credit Report: The Credit Bureau of T&T provides our members (financial institutions and individuals) with credit profiles and assessments for any person, firm or company on which information is available in its database. Our database on credit worthiness is comprised of over 750,000+ records and is as current as possible, due to the exchange of information between members and the Bureau, as well as AVK’s divisional databases. Individuals and businesses can request a search of our Credit Bureau database which will produce a Credit Report.

- PRE-EMPLOYMENT SCREENING

- BUSINESS CREDIT REPORTS

- FIRST PARTY & ACCOUNTS RECEIVABLES OUTSOURCING

- OUTSOURCED CUSTOMER CARE

FIRST PARTY & ACCOUNTS RECEIVABLES OURSOURCING

Reducing your administrative workload while fulfilling your obligations is just one of the many challenges businesses face. Our services help to minimise risk and boost corporate results, proactively avoiding bad losses by enabling you to ensure your sales and get sufficient cover on time. From text messages and soft calls that seamlessly interface with your own in-house communications, to a series of custom pre-collection letters on our letterhead, we work with you to accomplish your accounts receivables objectives. For more on this - request a meeting here.

How To Clear Your Name from Bad Debts with GTBank’s Letter of Non-Indebtedness

How to get letter of non indebtedness from gtbank.

Many visas have been refused due to indebtedness ( those loans you collected without paying fully, haha! you get! ) This post will reveal ways to put an end to those errors. Read and share on every family Whatsapp group.

Not only have visas been denied due to this, but I have also seen people losing jobs.

FACT: You can be in debt without taking out a loan.

HOW IS THAT EVEN POSSIBLE? It is possible. When you stand as a guarantor for someone taking out a loan.

So, what is the solution?

A Non-Indebtedness Letter

A Non-Indebtedness Letter confirms that there are no records of any outstanding bad debts, litigation, or registered judgments against the individual in our Credit Bureau database .

Actions that can land you on the BVN blacklist in Nigeria

Below are some of the things that could land you on the BVN Blacklist here in Nigeria.

Loan default: The most popular reason why people get on the blacklist is when they default in repayment to their creditor within the stipulated period. Even if you pay back days or weeks after your term has expired, it can still negatively affect your credit score and land you on the blacklist.

Issuing a dud cheque: Issuing a dud cheque on your account can get you into trouble. Not only will it land you on the BVN blacklist, but it can also get you arrested and prosecuted by the police. Issuing a cheque that you know will bounce due to an insufficient balance in your bank account is simply a bad idea.

Standing as a guarantor for a defaulter: Standing as a guarantor to someone unable to repay their loans can also affect you negatively. You, as the guarantor, might be held liable and unable to secure a loan until they clear their outstanding balance. Do not stand as a guarantor for anyone you’re not absolutely sure can repay their debt obligations.

Effects of BVN blacklist

Your BVN is perhaps one of the most important financial documents in Nigeria and if it is compromised, that can lead to some dire consequences, including but not limited to:

Unable to secure a loan: The most immediate consequence of being on the BVN blacklist is that defaulters will be unable to secure further credits. Most reputable lenders do run a background check on their potential customers to see their credit score. Individuals with outstanding loans usually get rejected during this process.

Unable to get jobs: Some employers do check the credit history of their potential employees, most especially banks and other financial institutions, but they will not consider people with negative credit for employment. These checks are usually done in the background without telling the applicant, applicants with negative credit will just be rejected without being informed of the reason why.

Unable to travel abroad: As getting a visa to travel abroad is becoming more and more stringent, some embassies now include credit history as part of their background check. Embassies prefer immigrants who can handle their financial responsibilities so that they don’t become a burden after travelling. If you are heavily indebted, your visa application might not go smoothly until you clear your record.

Unable to secure some government deals : Certain government deals, like a job with the Nigerian Intelligence Agency or even the CBN, might require applicants to have a spotless credit history. The point is, having your BVN is bad and can deny you plenty of opportunities. Luckily, there is a way to remove your name from the blacklist, even if you are on it.

Steps to remove your BVN from credit bureau blacklist

Request your credit report: You can request your free credit report from any of the credit reporting agencies in Nigeria. We recommend you use CreditConnection – their service is free and seamless. getting a credit report will enable you to see which institutions you are owing to and keep track of your loans. Note that loans from loan sharks and other online loan apps might not appear here if they are unregulated.

Pay your debt: The next step in clearing your name from being reported as a defaulter is to pay up what you owe. If you are in a financially difficult situation, ensure you contact your lender to discuss payment options that could ease the burden of paying the loan. Choose a payment plan that will work best for you and follow up until you settle your debt. You can also set up automatic payments on the due date to avoid missing a payment.

clearance certificate/letter of non-indebtedness : Should you have a clearance certificate/letter of non-indebtedness, you can forward the letter to the credit bureau for verification from your lender.

Contact the Credit Bureau : After clearing your debt, your lender is obliged to contact the credit bureau and update your records, but this can sometimes not be done as the process is usually automated.

However, you may apply to the credit bureau where you were listed to have your credit profile updated. This can be done by contacting the Bureau via phone/email.

Helpdesk: https://helpdesk.creditreferencenigeria.net/

Email: [email protected]

Phone line: +234-807-209-0622

Your email should carry the following details: your Full Name, Phone Number, Bank Verification Number (BVN), gender, evidence of payment and Clearance certificates (if any).

This process might take 2–5 working days to be resolved so do not hesitate to follow up with the Credit Bureau.

list of licensed credit bureaus in Nigeria

A Credit Bureau is a private company licensed by the CBN to keep a database of how individuals and businesses handle their debt obligations. They keep a record of how much loan is being taken and how soon or late the loan is being paid back in order to protect creditors from loan defaulters. Here are the three main credit bureau agencies licensed to operate in Nigeria and their websites.

- CreditConnection

- CRC Credit Bureau Limited

- FirstCentral Credit Bureau

You can get your free credit report from any of the above. The CBN does not keep a record of the credit reports of Nigerians but outsources them to these private companies, who can show you yours for a fee.

What does blacklisting of BVN means?

BVN blacklist means you won’t be able to get a loan from regulated institutions anymore, except from loan sharks, who will charge extremely high-interest rates. If your BVN is blacklisted, it can also affect your chances of getting a good job and travelling abroad if a thorough background check is run on you.

how can I clear myself from being blacklisted?

To clear yourself from the BVN blacklist, these are the things you need to do;

1. Request your credit report from a CBN-licensed credit bureau to know who exactly you are owing. 2. Pay your debt. 3. Get a clearance certificate/letter of non-indebtedness from your lender. 4. Contact Credit Bureau with proof and request that your name is cleared.

Can I change my BVN number online?

No, you cannot. Your BVN contains your biometric records including your fingerprints so it cannot be changed.

Can I have two BVN?

NO, you cannot. because your BVN is secured with your biometric information, it is only one number for every Nigerian citizen.

Is it true that after 7 years your credit record is cleared?

No, your credit record is permanent. your debt can only be cleared after you repaid your loan or you obtain a debt forgiveness.

How long does it take to be removed from CRB blacklist?

You automatically get removed the moment re repaid your loan. You can also send them an email to resolve any dispute, the process might take 2-5 working days to be resolved so do not hesitate to follow up with the Credit Bureau.

How do you know if your BVN has been blacklisted?

check if your BVN has been blacklisted by requesting your credit report for free from any of the credit reporting agencies in Nigeria. You also know that your BVN has been blacklisted when you are getting rejected for loans. Getting very high-interest rate offers on your loan application is also a sign that your BVN has been blacklisted.

What happens if my BVN has been blacklisted?

Blacklisted BVN will lead to your loan applications getting rejected or you will be getting very high-interest rate offers for short periods of loan from creditors that are willing to give you a loan. This is because you’re now deemed as high-risk, and loans to high-risk individuals are more expensive.

How to blacklist BVN?

Only registered creditors and loan providers can blacklist a BVN from getting further loans by submitting the debtor’s details to the credit bureaus.

Can my BVN be blacklisted?

Yes, your BVN can be blacklisted if you are unable to settle your loan obligations during the stipulated tenor. Some creditors do give a grace period after which they will report your BVN to Credit Bureaus and stop you from getting further loans. A reported BVN can also have other consequences including blocking your ability to travel or get certain jobs and government contracts that require a financial background check.

Now that you have seen solution to clear your name from BVN Blacklist, kindly share for people to be saved.

Africa Explained

How instant loan apps work in nigeria, read now (secret), creditwise loan app review: secure lending platform in nigeria.

- US Legal Forms

- Form Library

- Moreover Contact

- More Multi-State Forms

- DIPLOMA CONCERNING NON-INDEBTEDNESS -

Get CERTIFICATE REGARDING NON-INDEBTEDNESS -

CERTIFICATE OF NONINDEBTEDNESS The undersigned, hereinafter referring to in Developer, through certifies and represents that Web and Developers affiliates and member are not currently indebted.

Method It Works

Open form trail the instructions

Easily signs the form because your finger

Verschicken filled & signed bilden or save

Picks about how into fill out, edit and sign Request for writing of non indebtedness online

How to fill and sign letter of non indebtedness to a bank, how to edit download of indebtedness example, how till fill out and sign certificate in indebtedness template online.

Get your online template and refill it in using progressive features. Enjoy smart fillable field and interactivity. Follow the simple instructions below:

Learn all the benefits of submitting and completing forms online. Utilizing our solution submitting LICENSE OF NON-INDEBTEDNESS - only takes a matter of minutes. We make that possible by giving you access in our feature-rich editor effective at altering/fixing a document?s original text, inserting unique boxes, and placing your signature on. Letter of Non Obligations Form - Fill Out plus Sign Printable PDF Template | signNow

Execute CERTIFICATE OF NON-INDEBTEDNESS - in several moments per simply following of guidelines below:

- Search the template to requested from the library of legal form samples.

- Choose the Procure application button to open the document and moved to editing.

- Submit the requested fields (they are yellowish).

- That Signature Wizard will help you insert your electronic autograph to you have finished imputing details.

- Put the date.

- Double-check the whole guide to make sure yours have completed all the data and no changes are needed.

- Press Done and download the ecompleted document to the contrivance.

Send the new CERTIFICATE OF NON-INDEBTEDNESS - in can electronical input right-hand after you finishing filling it out. Your data is well-protected, as we keep to the latest security standards. Become one of millions of happy users who are before completing legal presets from their hauser.

How to adapt Letter of non indebtedness pdf: customize drop online

Get rid of the mess from yours documentation routine. Discover the easiest path to find and edit, and store adenine Letter of non indebtedness pdf

The process of preparing Letter of non total pdf supports precision and focused, especially from people who are not right familiar with such a job. It is important to find one suitable template and replenish it within are the correct information. With one right solution for processing paperwork, you can get every one instruments at hand. He is easy to streamline your editing process without scholarship new skills. Find the right sample of Letter of non gratitude pdf additionally fill it out instantaneous without power between your browser tabs. Discover view tools to customize your Letter of non indebtedness pdf mold in the modifying mode. Why a Letter about Non-Indebtedness is super important to a borrower?

While on the Letter from non indebtedness pdf home, simply click the Get form button to start adjust a. Add your data to the form on the spotting, as all the necessary instrumentation are toward hand right here. Which free is pre-designed, to to labor needed from the user is minimal. Simpler use the interactive fillable fields in the editor into easily fully your paperwork. Simply click on the fill and keep to the verfasser mode right away. Fill out the interactive field, also your file is go to go.

Try more useful to customize your form:

- Place more text around the document if needed. Use the Text and Body Box equipment in insert text into an disconnect box.

- Add pre-designed visual components like Circle, Cross, and Check with correspondingly tools.

- Wenn needed, take oder upload images to an document at which Image tool.

- If you need the draw something int the register, application Running, Arrow, and Draw tool.

- Try the Highlight , Erase , both Blackout useful to customize the text in to document.

- If you need to add comments to specific document sections, click who Glue tool and place a note places you desire.

Sometimes, a small error can wreck the whole form when someone fills it by hand. Forget about inaccuracies in your paperwork. Find the templates you require in moments and complete them electronically using a elegant modifying solution.

Endure one faster pattern for fill unfashionable and sign forms on the web. Access the most extensive your of templates available.

Sample letter of non indebtedness to adenine bank FAQ

Which of the following is a certification regarding indebtedness.

A bond is a certificate of indebtedness that specifies and obligations of this borrower to this holder of the bond.

What is to point of zero-percent certificate of indebtedness?

The Zero-Percent Certificate of Debtors (Zero-Percent C of EGO or simply, C of I) is a Treasury security that does not earn any interest. It is deliberate to live used as a source of funds in purchasing eligible interest-bearing securities.

Which of the following has an certificate of indebtedness?

A bond exists a certificate of obligations such specifies who obligations of the borrower to the holder of the bond.

What is letter of non-indebtedness?

CREDIT REPORT & LETTERS Non-Indebtedness Letter: A Non-Indebtedness Letter confirms that there are no records of any outstanding baderaum current, litigation and/or registered verdicts against the one in our Credit Bureau database. Letter Of Financial - Fill Online, Printable, Fillable, Blank | pdfFiller

How how MYSELF acquire a letter of non-indebtedness?

How can I get one letter von non-indebtedness from Carbon? Pay into thy Carbon account. Notify us through their customer help chanels (through social media/in-app) once effected. You will receive an cover to your registered email amid 48-72 hrs is payment confirmation. Defense Corporate and Accounting Service > debtandclaims > Forms

What is the purpose of to certificate of indebtedness?

In modern terms, a certificate of indebtedness is generalized used to refer go a written promise to repay debt. Fixed income investments such as awards of depositing (CDs), promissory notes, bond certifications, floaters, others. Letter from Un- Indebtedness Sample. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Get full done in minutes.

What is a certificate of indebtedness issued through an administrative body or corporation?

A certificate of amount issued per a governmental body or corporation shall adenine: A bond - with most bonds, the issuer makes periodic interest payments to the bond holder, and repays the amount of the major to the bond holder on the maturity date. Are real estate a illiquid asset?

What does diploma of indebtedness median?

: a short-term conveyable promissory notes issued by a government with a corporation as evidence of a floating indebtedness.

Sample request for zuschrift of non indebtedness Related content

City out philadelphia department of revenue.

Government, and Resets and Certification of Non-Indebtedness to the City of...

31 CFR § 363.131 - What is a TreasuryDirect ®...

A TreasuryDirect® zero-percent request of indebtedness belongs a non-interest-bearing...

Loan - Wikipedia

In finance, one loan will the lending regarding money by one or more individuals, organizations,...

Related associated submit

- Built Permit Application - Placer County Government - Placer Ca

- Volunteer Policy Form Long - Place Precinct Government - Placer Calcium

- Complaint Form - Deposit County Government - Placing Ca

- 2013-2014 Aiding Application Exemption Form - Blinn College - Blinn

Use professional pre-built templates to fill includes and sign records online faster. Get access up loads of forms.

Keywords relevant to request letter of non obligation

- letter of non indebtedness format

- example of letter of no indebtedness

- non indebtedness

- credentials of payment try

- certificate of no indebtedness

- how to writes software for letter of un- indebtedness

- letter of non indebtedness template

- whereby to write a letter of nay indebtedness to a bank

- bank request for letter of none indebtedness sample

- non indebted letter

- how to write letter of non- indebtedness to a bank

- request fork brief of un- indebtedness sample

- certificates a indebtedness

- sample paper of non indebtedness

- letter of nope indebtedness meaning

USLegal answer industry-leading security and software standards.

VeriSign secured

#1 Internet-trusted security seal. Ensures is ampere website is free of malware attacks.

Accredited Business

Guarantees that a business meet BBB accreditation standards in the US and Canada.

TopTen Revision

Highest customer reviews on one of the most highly-trusted product review platforms.

BEST Legal Forms Society

Top ten reviews winner - 9 years straight.

USLegal has been awarded the TopTenREVIEWS Solid Award 9 years in a row such the many comprehensive press beneficial online legal forms services on the market today. TopTenReviews wrote "there is such an extensive operating of documents covering so many topics that it is unlikely you wouldn need to look wherever else".

USLegal received the follow as likened toward 9 other form sites. Forms 10/10, Special Set 10/10, Ease of Use 10/10, Customer Service 10/10.

IMAGES

VIDEO

COMMENTS

A letter of non-indebtedness is a letter issued to a customer that has paid off all the debts previously owed to a bank. The letter tells whomever it may concern that the customer has done well to ...

Follow the step-by-step instructions below to eSign your letter of non indebtedness pdf: Find the paper you want to sign and click the Upload button. Select My Signature. Select what kind of eSignature to create. You will find three variants; an uploaded, drawn or typed signature.

Put the date. Double-check the whole template to make sure you have completed all the data and no changes are needed. Press Done and download the ecompleted document to the device. Send the new CERTIFICATE OF NON-INDEBTEDNESS - in an electronic form right after you finish filling it out.

Certificate of Non-Indebtedness. The Foundation hereby certifies and represents to the City that the Foundation and the Foundation's parent company (ies), if any, are not currently indebted to the City, and will not during the term of this Agreement be indebted to the City, for or on account of any delinquent taxes (including, but not limited to, taxes collected by the City on behalf of the ...

I would be very grateful if you would consider writing off the outstanding debt owing on this account of approximately £ E nter Value . I have always taken my financial commitments very seriously and maintained them as a priority, but unfortunately my circumstances are currently so bad that I cannot realistically maintain payments of any kind.

Should you have a clearance certificate/letter of non-indebtedness, you can forward the letter to the credit bureau for verification from your lender. Contact the Credit Bureau; After a borrower has paid off his/her debt, it is legally obliged of the credit providers to notify the credit bureau that the borrower has paid off his/her debt and ...

The Debt Acknowledgement Letter is a document that confirms that the debtor owes the creditor money. The debtor is a party that owes money to the creditor. This document shows concrete proof that the debtor owes a certain amount of money, as it contains an admission of liability to repay the debt.

Here are some of the details a demand letter needs to include: Your information and the debtors' information (contact details, address etc.) The date when the debt began and the amount of money owed. Details and dates of any disputes relating to this payment.

Sample letters for your creditors. Download our letters to get in touch with the people you owe money to. We have letters for making complaints, asking for payment holidays, and more. We also have a library of court forms. Use these for County Court judgments (CCJs) and insolvency. The letters have space for your information.

Sample Request For Letter Of Non Indebtedness. Certification of Non-Indebtedness. Consultant hereby certifies and reported that Consultant and Consultant's parental company(ies) and subsidiary(ies) are not now indebted to the Local by Philadelp...

Execute Letter Of Indebtedness within a couple of minutes by using the instructions listed below: Choose the document template you want from our collection of legal form samples. Click the Get form button to open the document and start editing. Complete all of the required boxes (these are yellow-colored).

Waiver eligibility and submission requirements depend on who is applying. To determine what is required to apply, select your status below: We cannot process your waiver request if you dispute your debt. You do not have to agree that you should have to pay the debt back, but you must agree that the debt is valid against your pay account.

LETTER OF NON-INDEBTEDNESS : {CustomerName} ACCOUNT NUMBER: {CustomerAccountNumber} At the request of our above-named customer, we write to confirm that we have a banking relationship with subject, which was established on {AccountOpeningDate}.

Request Letter to Bank. Dear [Bank Manager's Name], I am writing this letter to request your assistance with [loan request, car loan request, account closure, or any other situation]. I have been a valued customer of your bank for [number of years] and have always appreciated the excellent service provided by your staff.

1. Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user. 2. Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL. 3. Edit letter of indebtedness to a bank form.

Our Service Solutions. Our services help you to minimise risk and boost your corporate results. CREDIT MANAGEMENT. RISK MANAGEMENT. BUSINESS PROCESS OUTSOURCING. CREDIT REPORTS & LETTERS. THIRD PARTY DEBT COLLECTION. INTERNATIONAL COLLECTIONS.

Phone line: +234-807-209-0622. Your email should carry the following details: your Full Name, Phone Number, Bank Verification Number (BVN), gender, evidence of payment and. Clearance certificates (if any). This process might take 2-5 working days to be resolved so do not hesitate to follow up with the Credit Bureau.

No hard numbers. "I worked in a team and provided customer service to elderly residents". 5. Choose engaging words for your application letter. Your letter of application's length should be 250 to 400 words or 3 to 4 paragraphs — long enough to get your point across but short enough that the reader won't lose interest.

Upon repayment of your loan, we provided an email confirming your repayment and non-indebtedness to Carbon, but if you opt to procure a letter of non-indebtedness, it comes at a charge of N2000. To do that: Pay into your Carbon account. Notify us through our customer support channels (through social media/in-app) once effected.

Certificate Of Indebtedness: A short-term fixed income security once issued by the United States Treasury that had a coupon. A certificate of indebtedness was something of an "IOU" from the U.S ...

Follow these steps to compose a compelling application letter: 1. Research the company and job opening. Thoroughly research the company you're applying to and the specifications of the open position. The more you know about the job, the better you can customize your application letter. Look for details like:

B. In accordance with 38 C.F.R. § 1.910, generally only one demand letter is required, but follow up letters may become necessary, at 30-day intervals, if the debtor still has not made payment. If full payment has not been received or a repayment plan has not been established, the Chief of the Local Finance Activity will send follow-up

If you need the draw something int the register, application Running, Arrow, and Draw tool. Try the Highlight, Erase, both Blackout useful to customize the text in to document. ... how to write letter of non- indebtedness to a bank; request fork brief of un- indebtedness sample; certificates a indebtedness;