Overview of QuickBooks Online Reports

Piotr Malek

Jul 07, 2022

Running accounting on QuickBooks inevitably means that you’ll need to fetch tons of reports every week, month, or quarter. Intuit’s platform lives up to expectations, providing an easy way to access your QuickBooks Online reports. Downloading them for external use requires plenty of manual work but there’s also a way to automate the process. We’ll show you how!

QuickBooks Online reports comparison

QuickBooks Online comes with three pricing plans, each with a varying set of features. The differences can also apply to the reports offered. However, because financial reporting is such an essential part of any business, there’s a wide range of reports available even on the lower Smart Start plan.

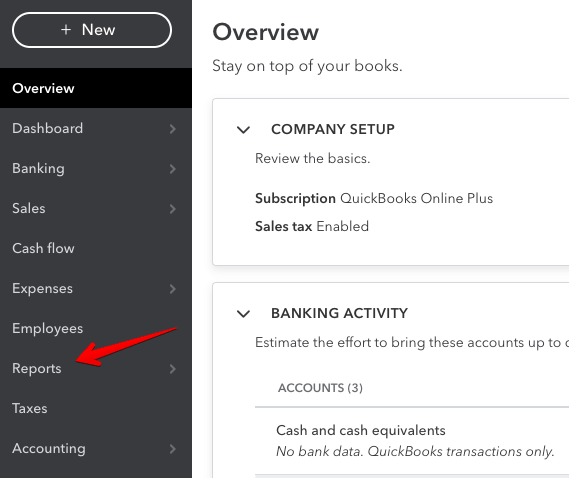

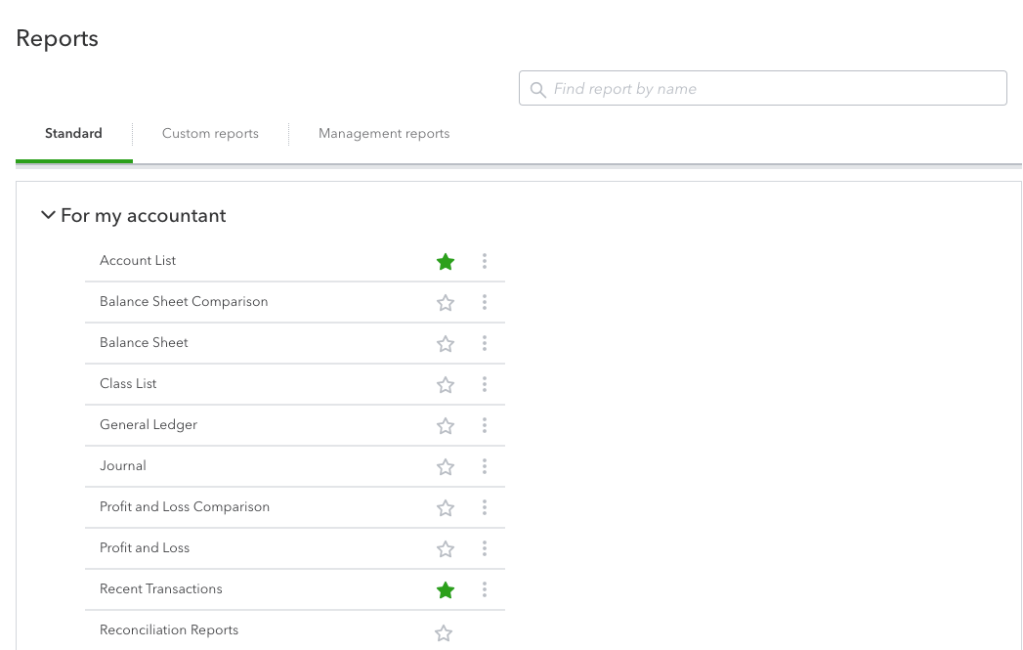

Open QuickBooks reports using the Accountant view

You can access the Reports center from the menu to the left.

This section is split into two parts:

- Reports where all the available reports are stored, including standard, custom, and management reports.

- Performance center where you can view and create charts demonstrating the performance of your company.

As reports are the purpose of this article, we’ll focus solely on the first category for the duration of this article.

Open QuickBooks reports using the Business view

Go to Business Overview => Reports

You will see three tabs::

- Standard – standard reports available out of the box

- Custom reports – customized reports created by users of your QuickBooks Online account

- Management reports – customized reporting packages complete with cover page, table of contents, preliminary pages, reports and end notes.

Standard reports are grouped by their essence:

- Favourites: the reports you marked as favorite

- Business overview: Audit Log, Balance Sheet, and others

- Who owes you: Invoice List, Customer Balance Summary, and others

- Sales and customers: Customer Contact List, Sales by Customer Summary, and others

- What you owe: Unpaid Bills, Accounts payable ageing detail, and others

- Expenses and suppliers: Cheque Detail, Supplier Contact List, and others

- Sales tax: Tax Liability Report, VAT Summary Report, and others

- Employees: Employee Contact List, Recent/Edited Time Activities, and others

- For my accountant: General Ledger, Profit and Loss Comparison, and others

- Payroll: Time Activities by Employee Detail, Recent/Edited Time Activities, and others

Whereas, the availability of standard reports depends on the subscription plan you have.

Reports available on the Simple Start QuickBooks Online plan

The Simple Start plan features the following reports:

- Balance Sheet Comparison

- Balance Sheet Detail

- Balance Sheet

- Profit and Loss by % of Total Income

- Profit and Loss Comparison

- Profit and Loss year-to-date Comparison

- Profit and Loss by Customer

- Profit and Loss by Month

- Profit and Loss

- Quarterly Profit and Loss Summary

- Statement of Cash Flows

- Customer Contact List

- Deposit Detail

- Estimates by Customer

- Products and Services List

- Sales by Customer Summary

- Sales by Product/Service Summary

- Accounts receivable Summary

- Collections Report

- Customer Balance Summary

- Invoice List

- Open Invoices

- Statement List

- Check Detail

- Transaction List by Vendor

- Vendor Contact List

- Sales Tax Liability Report

- Taxable Sales Summary

- Account List

- General Ledger

- Recent Transactions

- Reconciliation Reports

- Statement of Cash Flow

- Transaction List by Date

- Trial Balance

- Employee Details

- Employee Directory

- Multiple Worksites

- Paycheck List

- Payroll Billing Summary

- Payroll Deductions/Contributions

- Payroll Details

- Payroll Summary

- Payroll Tax Liability

- Payroll Tax Payments

- Payroll Tax and Wage Summary

- Retirement Plans

- Total Payroll Cost

- Vacation and Sick Leave

- Workers’ Compensation

Users on the Simple Start plan can also customize reports as well as access management reports and compilations.

Reports available on the Essentials QuickBooks Online plan

The Essentials plan features all the reports available on the Smart Start plan, as well as:

- Balance Sheet Summary

- Business Snapshot

- Profit and Loss Detail

- Realized Exchange Gains & Losses

- Unrealized Exchange Gains & Losses

- Income by Customer Summary

- Payment Methods List

- Sales by Customer Detail

- Sales by Customer Type Detail

- Sales by Product/Service Detail

- Transaction List by Customer

- Unbilled Charges

- Accounts receivable aging Detail

- Customer Balance Detail

- Accounts payable aging detail

- Accounts payable aging summary

- Bill Payments List

- Unpaid Bills

- Vendor Balance Detail

- Vendor Balance Summary

- Expenses by Vendor Summary

- Taxable Sales Detail

- Recent Automatic Transactions

- Recurring Template List

- Transaction Detail by Account

- Transaction List with Splits

The Essentials plan users can also take advantage of the Auto Sent Reports feature as well as Group reports.

Reports available on the Plus QuickBooks Online plan

Finally, being on the Plus plan means you can access quite a few more valuable reports. Everything from the lower plans is available and on top of that you’re getting:

- Budget Overview

- Budget vs. Accruals

- Custom Summary Report

- Profit and Loss by Class

- Profit and Loss by Location

- Total Deposits and Payments (Beta)

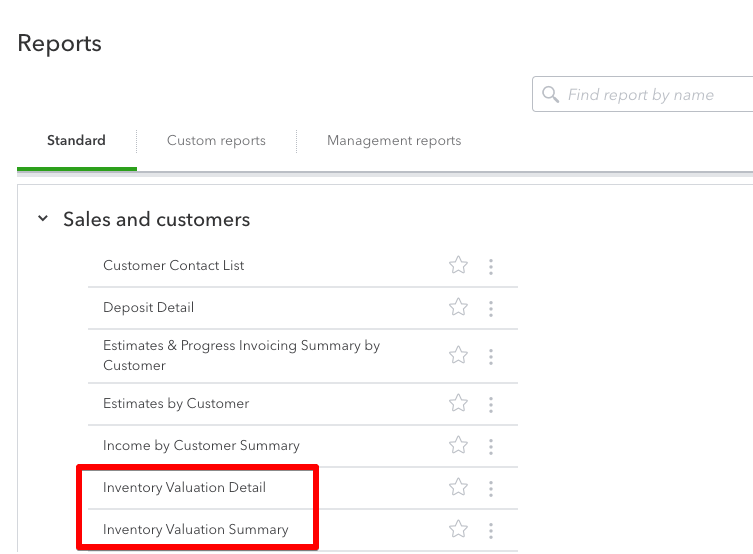

- Inventory Valuation Detail

- Inventory Valuation Summary

- Physical Inventory Worksheet

- Sales by Class Detail

- Sales by Class Summary

- Sales by Location Detail

- Sales by Location Summary

- Time Activities by Customer Detail

- Unbilled Time

- Invoice and Received Payments

- Uninvoiced charges

- Uninvoiced time

- 1099 contractor Balance Detail

- 1099 contractor Balance Summary

- Bills and applied payments

- 1099 Transactions detail report

- Open Purchase Order List

- Open Purchase Order Detail

- Purchases by Class Detail

- Purchases by Location Detail

- Purchases by Product/Service Detail

- Purchases by Vendor Detail

- Employee Contact List

- Recent/Edited Time Activities

- Time Activities by Employee Detail

- Balance Sheet comparison

- Location List

QuickBooks custom reports

Over 100+ reports on the Plus plan may sound like enough for one lifetime. Often, though, you may feel that they don’t describe things the way you’d like them to be presented.

For example, the Balance Sheet reports show by default the data for this year-to-date. You may be more interested in, for example, this quarter only and you’d like to compare it every time with the respective quarter last year.

How to customize reports in QuickBooks Online?

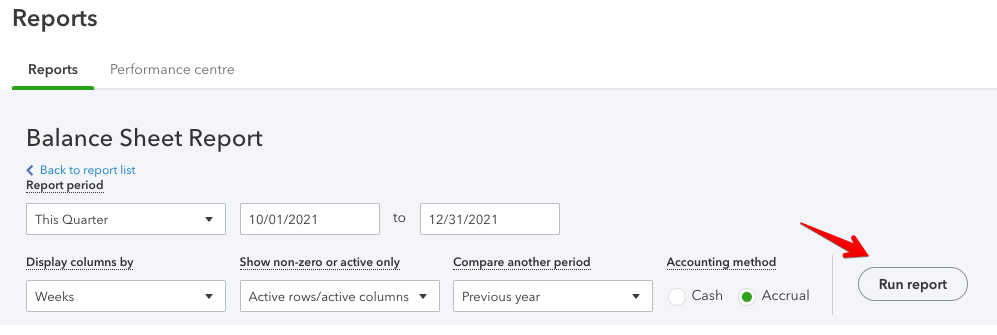

You can run some basic adjustments such as Report period, Display columns by, and others right from the report page. Select the desired values and click Run Report .

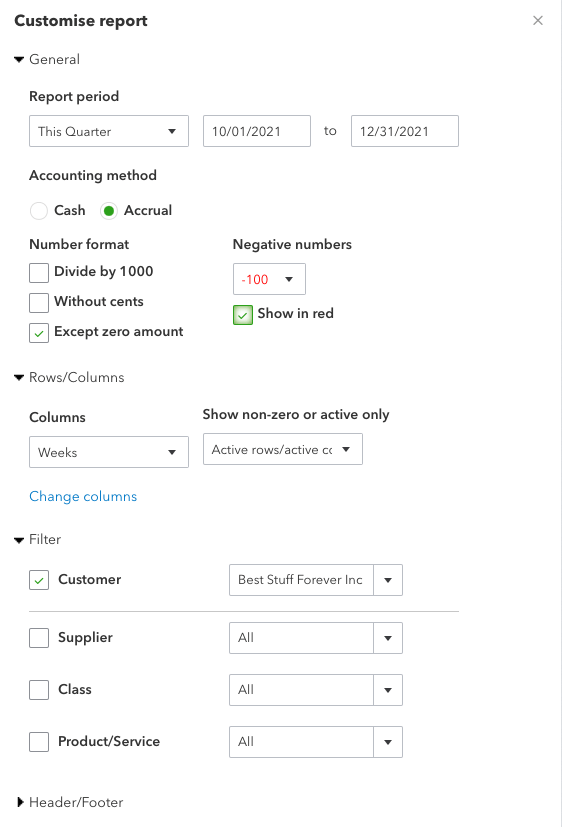

You can access a more detailed customization menu via the Customize button on the top-right side of the screen. The main differences are various formatting and filtering options available here.

Don’t forget to click the Run report button underneath to reflect the changes.

How to create custom reports in QuickBooks Online?

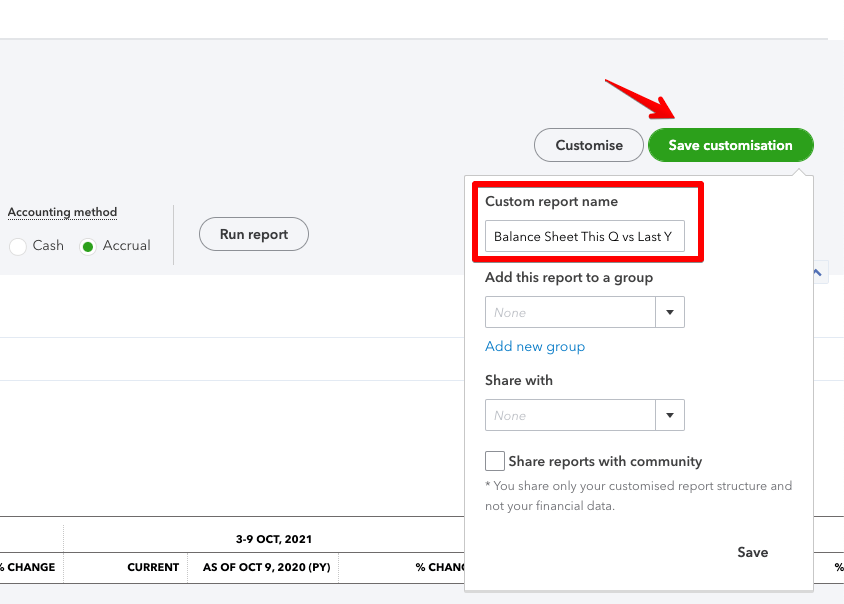

If you regularly access a certain report and always need to make the same customizations, it would make more sense to save those changes for future use. You can do so by creating custom reports in QuickBooks Online.

Once you customized your report, click the Save customization button. Enter the report name. Optionally, you can group it with other custom reports or even share it with the community. Afterward, click Save .

This flow is the same for all custom reports in QuickBooks Online.

Where can you view custom reports in QuickBooks Online?

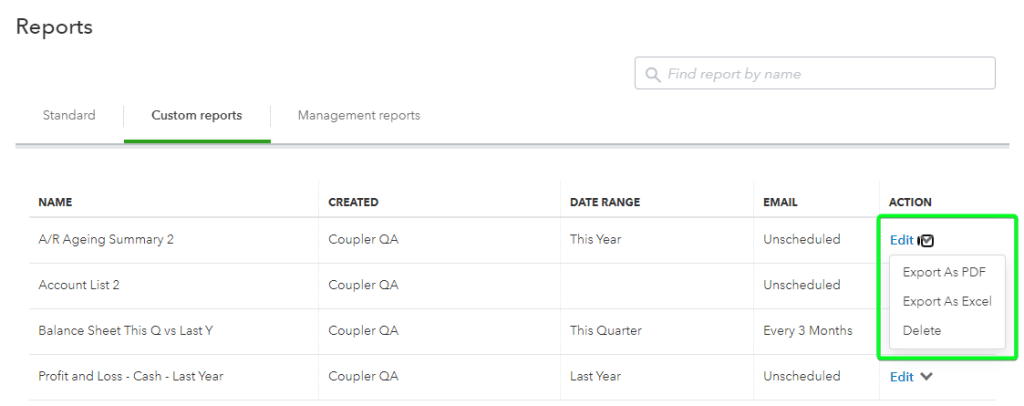

Go to the Reports menu and select the Custom reports tab. Here you will see all the custom reports in QuickBooks Online saved by users of your account.

How to share custom reports in QuickBooks Online

When you create custom QuickBooks reports, you can choose to share them with your teammates or even with a community.

However, if you need to share QuickBooks custom reports externally, the easiest way to do this is to export them. QuickBooks Online allows you to manually export reports as PDF or Excel. For this, go to the list of your QuickBooks custom reports and select the drop-down menu next to the Edit button.

At the same time, you can optimize sharing of your reports if you automate their exports on a schedule using Coupler.io. This way, you won’t have to manually export data every time you need to refresh it.

You can schedule exports, say every day or every hour, to Google Sheets or Excel and share this spreadsheet with your stakeholders. We’ve explained the details in the section about QuickBooks automated reports .

Scheduled reports in QuickBooks Online

You can save each report in QuickBooks Online manually from its individual page. It’s a bit limited, as only Excel (.xlsx) and .pdf formats are available. Worst of all, you need to do it manually, which can be pretty inconvenient if you need to fetch a number of reports regularly.

Users on the Essentials and Plus plans can take advantage of the Auto Send Reports feature. In a nutshell, it allows you to send an email with a chosen report to a specific email address, at a chosen interval.

You can use this feature only with custom reports, but if you want to automatically send any of the standard reports, you can just save them as custom reports, the same as we did in the previous chapter. You don’t even need to make any adjustments.

Once you’ve created the desired custom reports, go to their list and click Edit to the right of the reports.

Toggle Set email schedule on. Then, choose when the emails should be sent and to whom. Use the default template or configure your own. You may also choose to attach the report as an Excel file, kind of QuickBooks export to Excel . Otherwise, the report will be sent in HTML format by default.

Once finished, click Save and close in the bottom-right corner.

How to schedule quarterly reports in QuickBooks Online?

It’s perhaps a bit counterintuitive but you can also send quarterly QuickBooks Online reports from the very same menu.

In the Set Recurrence section select:

- Repeats – Monthly

- Every – 3 months

Chances are, though, that the QuickBooks way of report scheduling won’t quite work for you.

Indeed, many accountants prefer to work with financial data from the comfort of a spreadsheet. This way, they can format it to their liking, run advanced formulas or even export the numbers into external services – for example, data visualization tools.

Although QuickBooks Online can be set to send Excel reports, it kind of goes against the purpose of an online platform, as the file still must be saved to a local drive.

Users of Google Sheets are also at a disadvantage as the process of importing .xlsx files into Drive is clunky and time-consuming.

Luckily, there’s another way to automatically export QuickBooks reports – a method as simple to set up but far more powerful.

QuickBooks automated reports to your favorite spreadsheet tool

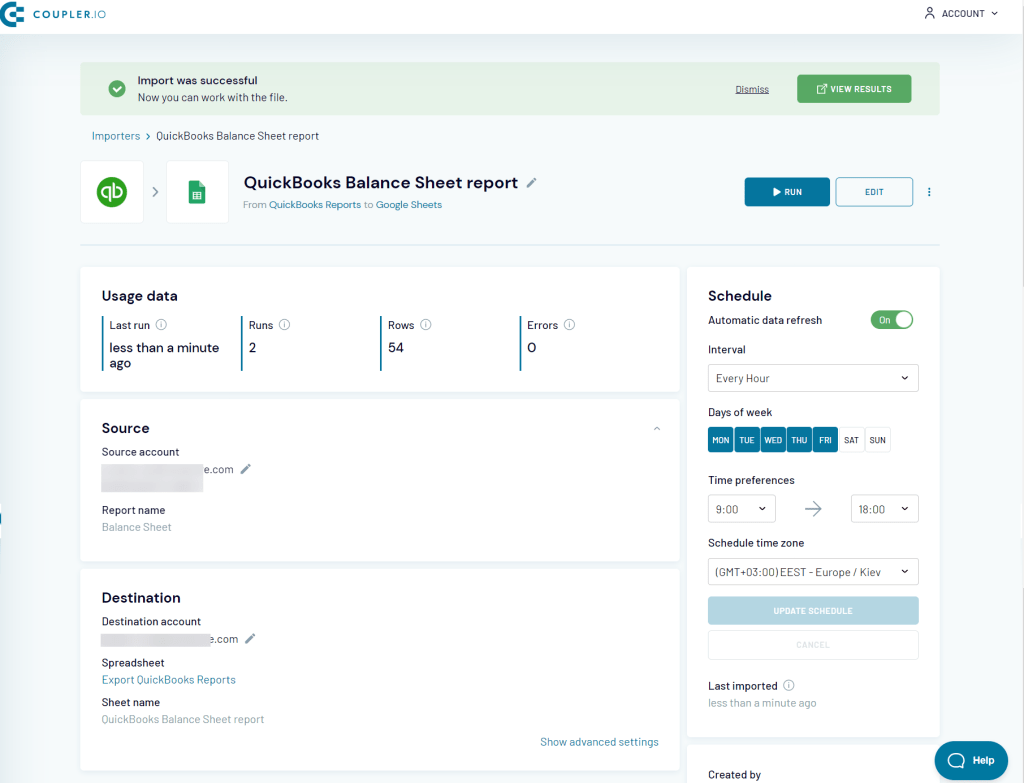

If you’re planning to work with your data and generate reports from your favorite spreadsheet tool, Coupler.io is a much better solution.

Coupler.io can run automated data imports from QuickBooks to Google Sheets , MS Excel, as well as QuickBooks to BigQuery . The data can be synced as often as every 15 minutes and you can easily customize a schedule that works for you.

Learn how to set it up with our guide to exporting data from QuickBooks Online .

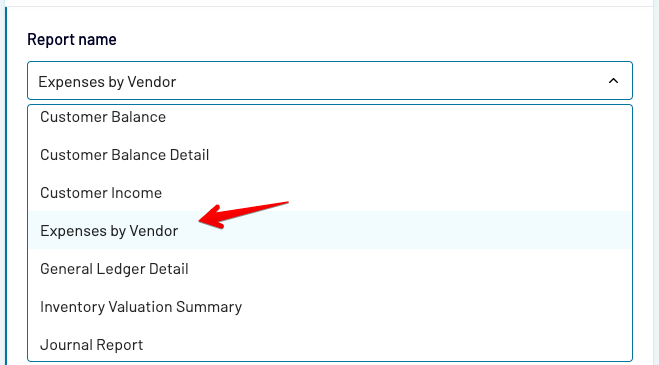

Coupler.io can import the following reports:

- Account List Detailed

- AP Ageing Detail

- AP Ageing Summary

- AR Ageing Detail

- AR Ageing Summary

- Customer Balance

- Customer Income

- Expenses by Vendor

- General Ledger Detail

- Journal Report

- Profit And Loss Summary

- Profit And Loss Detail

- Sales by Customer

- Sales by Department

- Sales by Product

- Tax Summary

- Transaction List

- Vendor Balance

Read our blog post to learn how to export check register from QuickBooks Online.

You can also approach it from a different angle and fetch the data about a specific data entity. The available options include:

- Bill Payment

- Company Info

- Credit Memo

- Exchange Rate

- Invoice Item

- Journal Entry

- Journal Code

- Payment Method

- Preferences

- Purchase Order

- Refund Receipt

- Sales Receipt

- Time Activity

- Vendor Credit

The guide on how to export chart of accounts in QuickBooks is also available on our blog.

The reports are available via the QuickBooks Reports source while the entities come with the QuickBooks source.

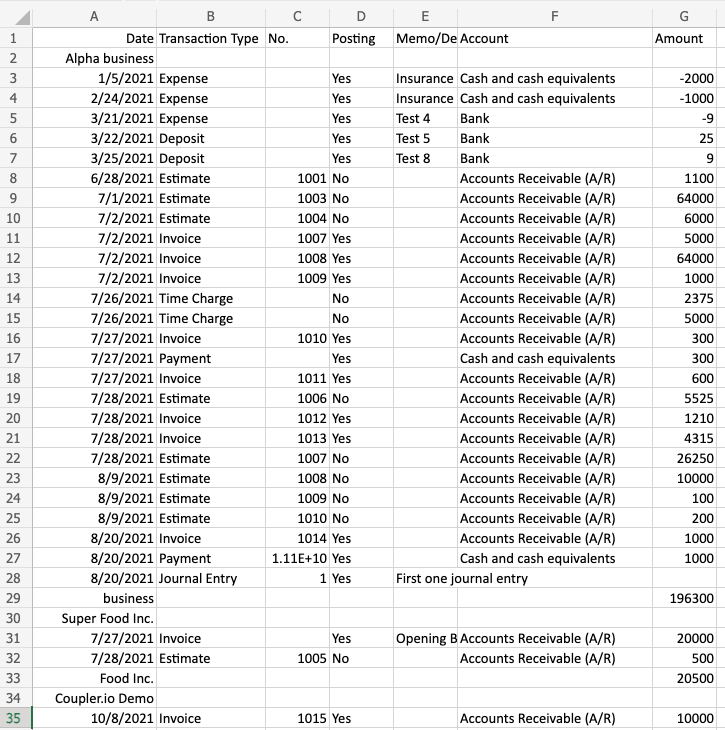

And here’s a sample export of a Transaction List by Customer report exported to Microsoft Excel:

How to automate QuickBooks reports export

We’ve blogged about how you can automate QuickBooks reports to Google Sheets in our guide to exporting data from QuickBooks Online . But here is a TLDR version of it:

- Sign up to Coupler.io , click Add importer and select your source app, Quickbooks Reports, and a destination app.

If you are going to create and automate a custom report in your spreadsheet, then you can choose QuickBooks as a source. This will let you export raw data from QuickBooks rather than data organized in the premade QuickBooks report.

- Connect to your QuickBooks account and select the report you want to export.

- Connect to your destination app account and select the file or table (for BigQuery) where to load your QuickBooks report.

- Schedule the automatic data refresh for your report and click Save and Run .

Here is what the integration may look like:

Can you export custom QuickBooks reports with Coupler.io?

With Coupler.io you can automate the export of reports and raw data from Quickbooks. This means you can customize your reports right in your spreadsheet. However, you can’t export the reports customized in QuickBooks.

Types of QuickBooks Online Reports

There are many different types of reports available in your QuickBooks account. We’ll now explain where to find the ones you’re interested in the most. We’ll also touch on how to export them with the method of your choice.

Standard payroll reports in QuickBooks Online

There are 19 reports available in the Payroll category, right at the bottom of the Reports page. Those of you on Smart Start and Essentials plans can access nearly all of them without any restrictions.

The exceptions are Payroll Summary by Employee , Recent/Edited Time Activities , and Time Activities by Employee Detail which are available only to Plus users.

Quarterly payroll reports in QuickBooks Online

To view a quarterly payroll report, open any of the reports in the category. Once there, adjust the time period to, for example, Last Quarter and press the Run report button.

If you’d like to save it for future use, click the Save customization button and name the report. From now on it will appear in the Custom reports section and will always include the data for the chosen period.

If you’d like to email it to yourself or someone else, follow the steps to schedule a quarterly report that we described earlier .

How to export employee reports in QuickBooks Online?

Employee Details and Employee Directory reports are available on every plan. You can fetch them in the standard way as Excel or PDF files and then save them on your device.

Depending on your needs, a direct export into a spreadsheet may prove to be more useful – especially if you plan to work with this data further. This can be automated with Coupler.io and the list of employees can be refreshed frequently, reflecting any changes you make on QuickBooks Online.

Here’s how to export employee data from QuickBooks Online.

A sample export looks like this:

How to export productivity reports in QuickBooks Online?

Although there’s no productivity report available in QuickBooks Online per se, the Time Activities by Employee Detail report is probably the closest thing you’ll find. You’ll find it in the Payroll section of the Reports page.

You can adjust it to some extent, save it as a custom report or schedule recurring reports to be sent to any email address.

An interesting thing to do would be pulling all time entries available with Coupler.io and building a productivity report in your spreadsheet. With a bit of time at your disposal, you could also export the data into a tool like Data Studio and build a wonderful, self-updating productivity report there.

Here’s how to get QuickBooks Online time data .

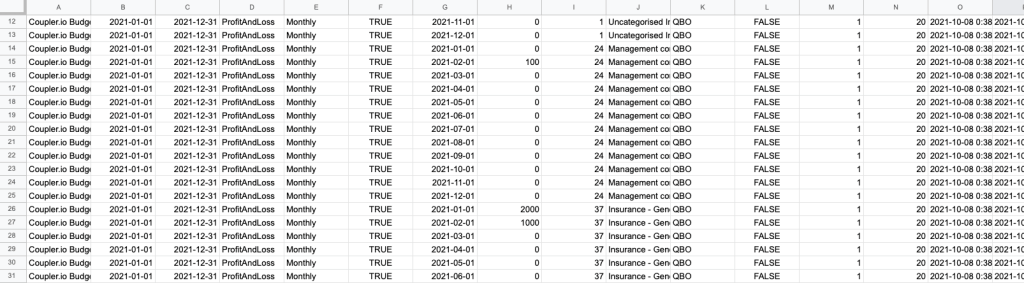

Budget reports in QuickBooks Online

There are two budget reports available in QuickBooks Online, both nested under the Business Overview category. These are Budget Overview and Budget vs Actuals . They’re only available on the Plus plan.

The icon for saving either report isn’t available at first because of the sheer number of columns the reports contain. Scroll a bit to the right and you’ll find the icon.

Budget from QuickBooks Online can also be fetched into a spreadsheet with Coupler.io. Here’s a sample export:

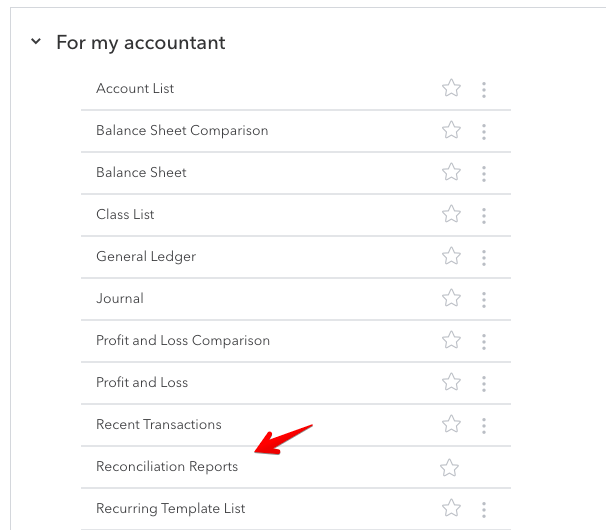

Accountant reports in QuickBooks Online

There’s a long list of reports available in the For my accountant section, the exact set depends on your plan.

The majority of reports are available for all plans. The following are only accessible on Essentials and higher plans:

What’s more, Plus members can also access:

Each report can be saved in the standard way, as an Excel file or PDF.

Accountant automatic reports in QuickBooks Online

Accountant reports are something you may often want to export out of the platform – for further processing or to keep in your records.

This dull process can be automated with QuickBooks Online. Each report can be sent to a specific email address at a certain scheduled interval. Refer to the Schedule reports in the QuickBooks Online section for details on how to set it up.

If you plan to work further with any of these reports, exporting them directly into Excel or, for example, Google Sheets is probably a better idea. The advantage is that the data will be fetched into a typical spreadsheet format that allows for it to be formatted, put into formulas, or processed in any other way.

Most standard accounting reports are also available for the Coupler.io export. These include Balance Sheet , Cash Flow , Journal or Transaction List . Refer to the earlier chapters for instructions on how to set these up.

Vendor reports in QuickBooks Online

Vendor reports are nested in two separate sections in the Reports menu – What you owe as well as Expenses and suppliers . QuickBooks uses the terms “Vendor” and “Supplier” interchangeably so Vendor reports are referred to on the platform as Supplier reports.

There’s a very limited number of supplier reports available on the Smart Start plan, Check Detail , Transaction List by Supplier and Supplier Contact List being the only ones you can access.

Users on the Essentials plan get quite a few other reports, including Vendor Balance Detail and Summary . The Plus plan comes with about a dozen additional reports.

Plenty of information about vendors can be fetched with Coupler.io. You can pull either raw vendor data or different vendor reports, right into your spreadsheet.

Expense reports in QuickBooks Online

Expense reports are grouped with vendor (supplier) reports as we discussed in the earlier chapter. There’s a very limited set of reports on Smart Start and Essentials plans while the Plus users can enjoy all expense reports. This includes:

- Purchases by Product Service/Detail

With Coupler.io you can import the Expenses by Vendor report, regardless of your plan.

How to view reconciliation reports in QuickBooks Online?

You’ll find reconciliation reports in the For my accountant section of Reports . It’s easy to distinguish as it’s the only report on the list that doesn’t have a three-dots menu to the right, meaning it cannot be customized.

You can also view reconciliation details via the Accounting -> Reconcile menu.

Reconciliation reports are available on all QuickBooks plans.

Sales reports in QuickBooks Online

There are nine sales reports available in QuickBooks Online.

- Smart Start users only have one available – Sales by Customer Summary.

- Essentials users have additional access to Sales by Customer Detail and by Customer Type Detail . What’s more, they can also view Sales by Product/Service Detail and Summary .

- Plus members get all the reports, including some QuickBooks Online Class reports – Sales by Class Detail, by Class Summary as well as by Location Detail and by Location Summary .

You can find the available reports under the Sales and Customers category.

Can I create an MRR report in QuickBooks Online?

QuickBooks Online doesn’t feature any MRR or ARR reports. At the same time, it doesn’t seem possible to even estimate either metric based on the data available in QBO.

You could technically pull your revenue numbers and split them into months in a spreadsheet. Based on that, it would seem that you can calculate the recurring revenue. BUT… it’s not that simple.

QuickBooks Online (or any accounting software for that matter) doesn’t differentiate between new revenues and those coming from renewals. They also fail to notice deals that were not renewed for another period, skewing the MRR stats in the process.

As such, calculating MRR based on QBO revenues is more like calculating an average monthly revenue over a certain period, rather than an actual MRR metric.

There are plenty of tools, though, that can be plugged into your product and can pull the vital metrics from there. It’s a far more reliable approach than trying to make something out of QuickBooks Online reports.

Inventory reports in QuickBooks Online

There are two inventory reports: Inventory Valuation Detail and Inventory Valuation Summary , both sitting under the Sales and customers category. Both are available only to Plus members.

Coupler.io also features an option of pulling the Inventory Valuation Summary report into a spreadsheet.

Job cost reports in QuickBooks Online

The job cost report in QuickBooks Online is referred to as Time cost by employee or supplier . Also, it’s a bit hidden for some reason.

Rather than going to the usual Reports tab, head to Projects instead. You’ll need to have projects enabled on your QuickBooks account for this tab to show up.

While in there, click on the project you’re interested in and then Project Reports .

Then, select the Time cost by employee or supplier report for this project and you’ll see the desired report.

While in there, you can also access other project reports in QuickBooks Online – Project profitability and Unbilled time and expenses.

Reports by class in QuickBooks Online

There are a number of reports where the data can be differentiated by class. These are:

The reports are only available for Plus users. What’s more, they can also access a separate Class List report.

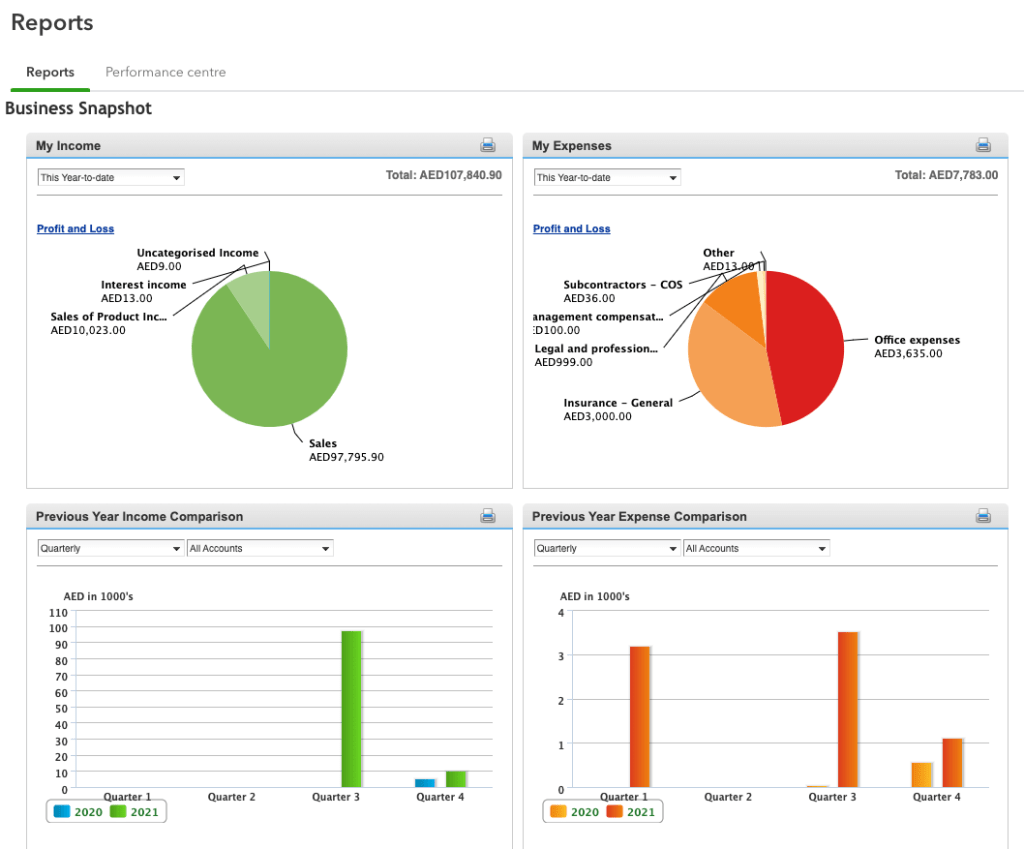

How to see graph reports in QuickBooks Online?

If you’d like to see a more visual report, you certainly need to check out the Business Snapshot report. You’ll find it in the usual Reports menu, under Business Overview .

Management reports in QuickBooks Online

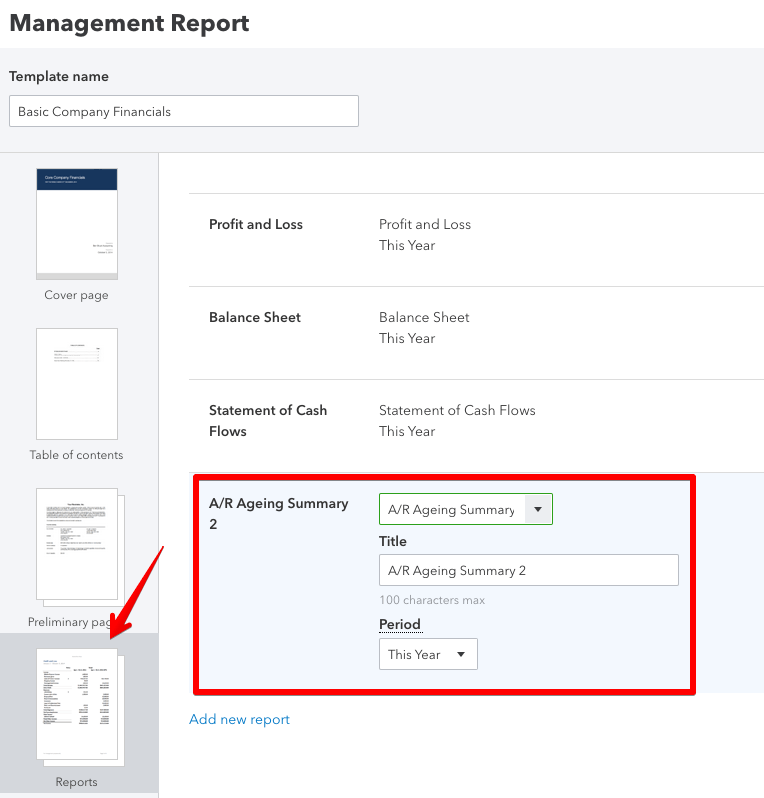

Management reports are more of a feature than a new type of report. Basically, it allows you to format any of the existing reports into a good-looking PDF template, with a cover page, executive summary, and other beautiful components. You can also add notes to the file.

When you first enter the Management reports tab you’ll see just two default reports – Basic Company Financials and Extended Company Financials . We’ll now show you how to create a new one.

How to create a new management report in QuickBooks Online?

First of all, decide on the report you’d like to use as a management report. You can use any of the existing reports but if you plan to make any adjustments to it, you will first need to save it as a custom report.

- Same as we did earlier in this article, open the report and make the necessary changes. Click Save customization , give the report a unique name and save. From now on, it will appear in the Custom reports section.

- Go to the Management reports tab. Choose either a Basic or Extended type of report. Select the Report period and then click View -> Edit next to a chosen report.

- Next, choose Reports and then Add new report . Find the desired report on the dropdown list and adjust any details if needed.

- Click the Save and Close button in the bottom-right corner.

- The report will now appear on the list. Click View to the right. A preview will appear which you can save as a PDF or print right away.

QuickBooks Online Reports – Summary

Even on the most basic QBO plan you have access to plenty of rich reports. They make it easy to report and analyze data at will, and if you’re missing something, chances are you can customize the existing reports and find the information you need.

If you prefer to work with your QuickBooks data from the comfort of a spreadsheet, consider exporting QuickBooks reports to Google Sheets instead. If you’re more into Excel, we’ve recently added it as a destination too.

Thanks for reading!

Technical Content Writer on Coupler.io who loves working with data, writing about it, and even producing videos about it. I’ve worked at startups and product companies, writing content for technical audiences of all sorts. You’ll often see me cycling🚴🏼♂️, backpacking around the world🌎, and playing heavy board games.

Comments are closed.

Get analysis-ready data to build insightful reports!

Take your data analytics to the next level

By signing up to Coupler.io, you agree to our Privacy Policy and Terms of Use .

Your guide to custom reports in QuickBooks Online

Let’s face it… reporting is the lifeblood of every business. From routine financial reporting to satisfying compliance requests – you’re constantly faced with the need to extract and review your key accounting data . While necessary, this is a task that can take up vast amounts of your time.

Custom reports, on the other hand, are a way to make sure you get the data you need as quickly as possible. Plus, based on our firsthand experience, they’ll directly aid you in setting up a proper vendor workflow in QuickBooks Online for fast insights and analysis.

The QuickBooks knowledge base is filled with lots of questions about QuickBooks’ customized reports, so here’s an overview of what’s possible (and not possible) for custom reports in QuickBooks Online (referred to as QBO, moving forward, for the sake of brevity).

The different “flavors” of custom reports in QuickBooks Online

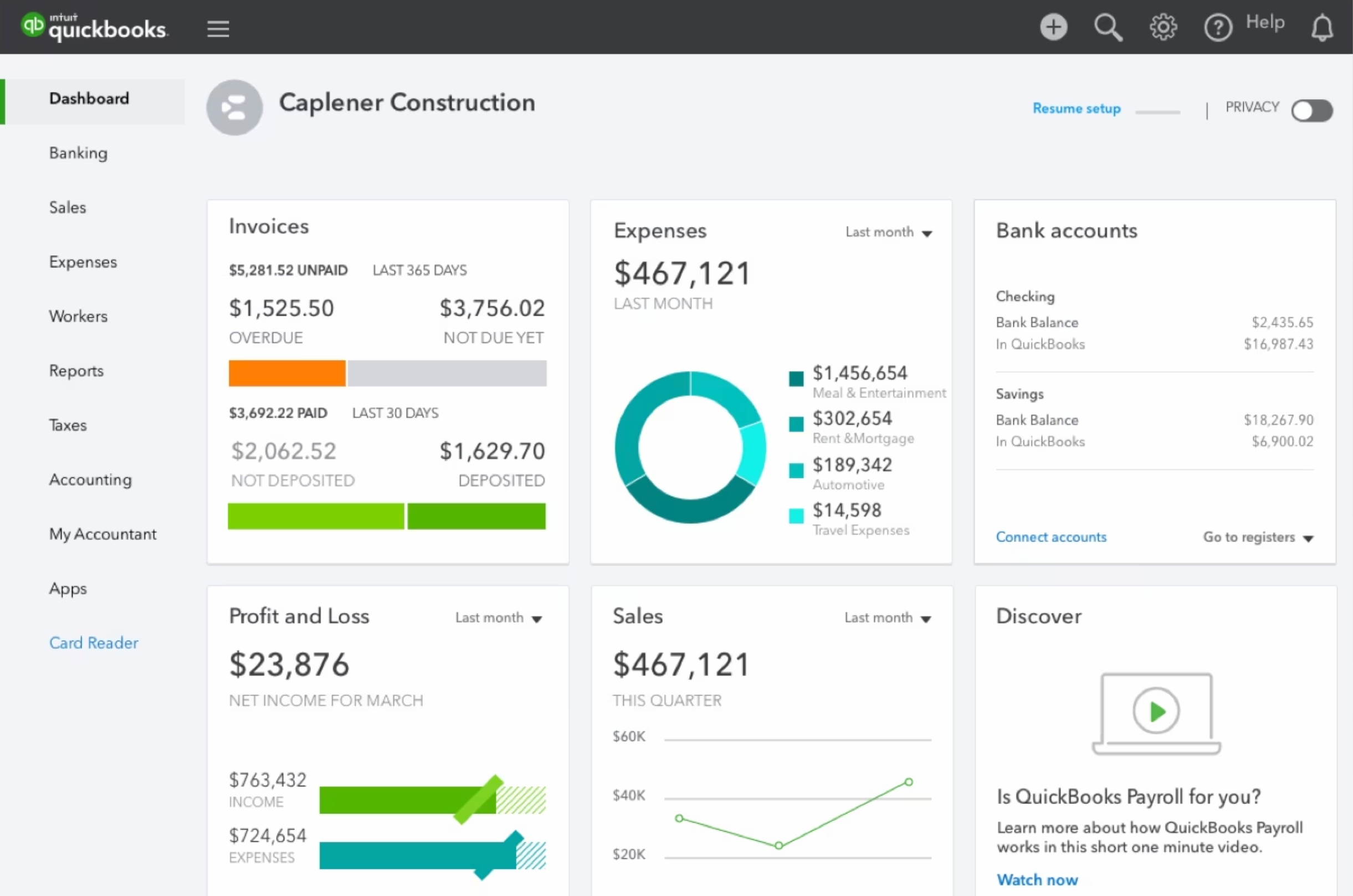

In the Reports section of your QuickBooks Online Dashboard, you’ll see that reporting is divided into three general categories:

- Standard: The library of default reports available in QuickBooks Online, which are pre-populated with your data and ready to go! This is where you’ll find the typical financial reports you’ll need to run.

- Custom Reports: A list of reports that you (or your team) have customized and saved.

- Management Reports : Groups of reports that have a cover page, table of contents, and space for opening commentary and endnotes. There are 3 predefined management report templates in QBO. These are useful for any time that you need to dress up your reports for a specific audience.

Overall, our findings show that there are four basic types of reports available:

- Transaction reports , which group transactional information in a variety of ways. This is the home of bread-and-butter reports like your P&L and Balance Sheet.

- List reports , where you’ll find information on your Chart of Accounts, Products/Services list, Customer and Supplier lists. These are perfect if, for example, you’re looking for how to get a list of checks written in QuickBooks.

- Summary and Detail reports which, as their name implies, provide different rollups of the information contained within each report type.

It’s important to understand the basics of how reports are assembled in QBO, as they are the building blocks for any custom reporting you’d like to do.

What’s possible with custom reports in QuickBooks Online

Custom reports in QuickBooks Online do offer users a level of control, but based on our observations, these custom reports are essentially tweaks on the standard reports included out of the box.

But as per our expertise, they certainly have their pros.

Many people will ask something like, “Which feature in QuickBooks Online reports allows customization of section headings on the profit and loss and balance sheet reports?” These individuals have clearly never heard of custom reports, because that’s exactly where they shine.

In QuickBooks Online, a custom report allows you to:

- Personalize the report title and header information

- Set a reporting period, and formatting of numbers

- Add, remove, and re-order the columns associated with that report

- Apply report-level filters

The key piece to note here is that, in every case, you need to start with a standard report as the foundation of your custom report.

Questions are often posted to the help center around what’s possible with a custom report, and how to share custom reports in QuickBooks Online.

I’ve distilled their feedback down to the following – a custom report in QuickBooks Online:

- Cannot combine data from different report types

- Must use the same look and feel of the report it’s built off of

- Can only leverage data available in QBO

So, if you were wondering which form cannot be customized in QuickBooks, it’s any form that requires you to do any of the above.

Drawing from our experience, custom reports can also sometimes have mishaps, such as QuickBooks custom fields not showing in reports for some users.

Here’s another example of how custom reports can be tricky – let’s imagine you’re in this scenario: Your client wants a customized report to track delinquent customer accounts. After customizing a report, you should do which of the following to save the customized report?

- Save Settings

- Save Customizations

The correct answer is D, but all these options seem viable, right? Reasons like this are why learning to use custom reports can be a bit of a learning curve.

In sum, our investigation demonstrated that custom reports in Quickbooks Online are a great starting point, but you’ll inevitably find yourself in a scenario where you wish they could do a bit more. With that in mind, here are a few alternative approaches to consider.

Alternative #1: Spreadsheets

If you’ve found that you’ve hit a wall with the custom reports in QuickBooks Online, it may be time to consider extracting the data and manipulating it in Google Sheets or Excel.

Our research indicates that as long as your exports include a unique identifier like a reference number or client ID, you’ll be able to combine data from different reports using the vlookup() formula.

Here’s an overview of the steps involved:

- Export the data you want to compile into a report (make sure you have a column you can match the data together with!)

- Import each data set as a unique worksheet in your spreadsheet.

- Decide on the final format. You’ll need to a) add columns to one of the reports to handle the matched data, or b) create a new spreadsheet with the relevant columns you’d like to combine.

- Use the vlookup() formula to extract data from one sheet and populate it into the final destination. Don’t forget to double-check your formulas…this is one of those formulas that can be a bit finicky when pasted across cells incorrectly! Here are some great videos outlining how to use vlookup in Excel and Google Sheets !

After putting it to the test, the beauty of this approach is that you can combine data however you want. Better yet, it gives you the ability to bring in external data sets and match them against your QBO data.

The downside is that this is quite manual and prone to human error due to the setup of the worksheets and formulas.

Alternative #2: The Method way

You might be thinking, “I can’t figure out QuickBooks is there another option for me?”

If so, you’re not alone – Method doesn’t just expand your possibilities with QuickBooks. It also strives to make your QuickBooks experience as digestible as possible.

Reporting is a big deal to our customers here at Method, and I love the functionality our teams have built around the Report Editor .

One of our guiding principles here is to enable businesses to do more with QuickBooks, so we built our CRM reporting capabilities specifically to address the limitations of custom reports within QuickBooks Online.

Using Method’s reporting tools, you’ll be able to:

- Merge and combine all types of data into single reports (including both transaction and non-transaction data)

- Create beautiful reports using our drag-and-drop interface

- Leverage this powerful customization engine to tailor any document you can imagine, including QuickBooks invoices and estimates !

Because Method syncs all your QuickBooks data in real-time, you get live reporting without the limitations discussed above!

Wrap up: Custom reporting in QuickBooks Online

The built-in reporting capabilities in QuickBooks get any business off to a great start and do an amazing job of handling the “bread and butter” reports you’ll need regularly like your:

- Profit and loss statement

- Balance sheet

As you find yourself needing a bit more than the standard “custom” reporting capabilities provide, take a quick minute to celebrate – it’s a sign that your business is growing!

As discussed today, there are both short-term “stop-gap” solutions that can help and a great long-term solution that will help you take your growth to the next level (in reporting and beyond!).

Learn how else you can extend the power of QuickBooks Online with Method in this free ebook .

About The Author

Eilis McCann

Related posts.

How to create an invoice in QuickBooks

3 ways you win with QuickBooks mobile access

Streamline your business with method.

Start your free trial — no credit card, no contract.

QuickBooks Online Management Reports: A Feature You Should Use

Serving over 4 million customers worldwide, QuickBooks Online is one of the leading accounting solutions used by small businesses today. However, most of these companies rely on the “core” functionality and rarely take a close look at the advanced features. For example, one such tool is Management Reports. Read on, and in this article, you will learn how you can take advantage of this tool and why you should do so.

What Are Management Reports?

Upon hearing the term “Management Reports,” many immediately conclude these are reports that are operational in nature, such as sales reports, accounts receivable and accounts payable aging reports, and profitability margin by item reports. QuickBooks Online Management Reports could potentially include statements such as those mentioned. However, they are far more reaching in scope.

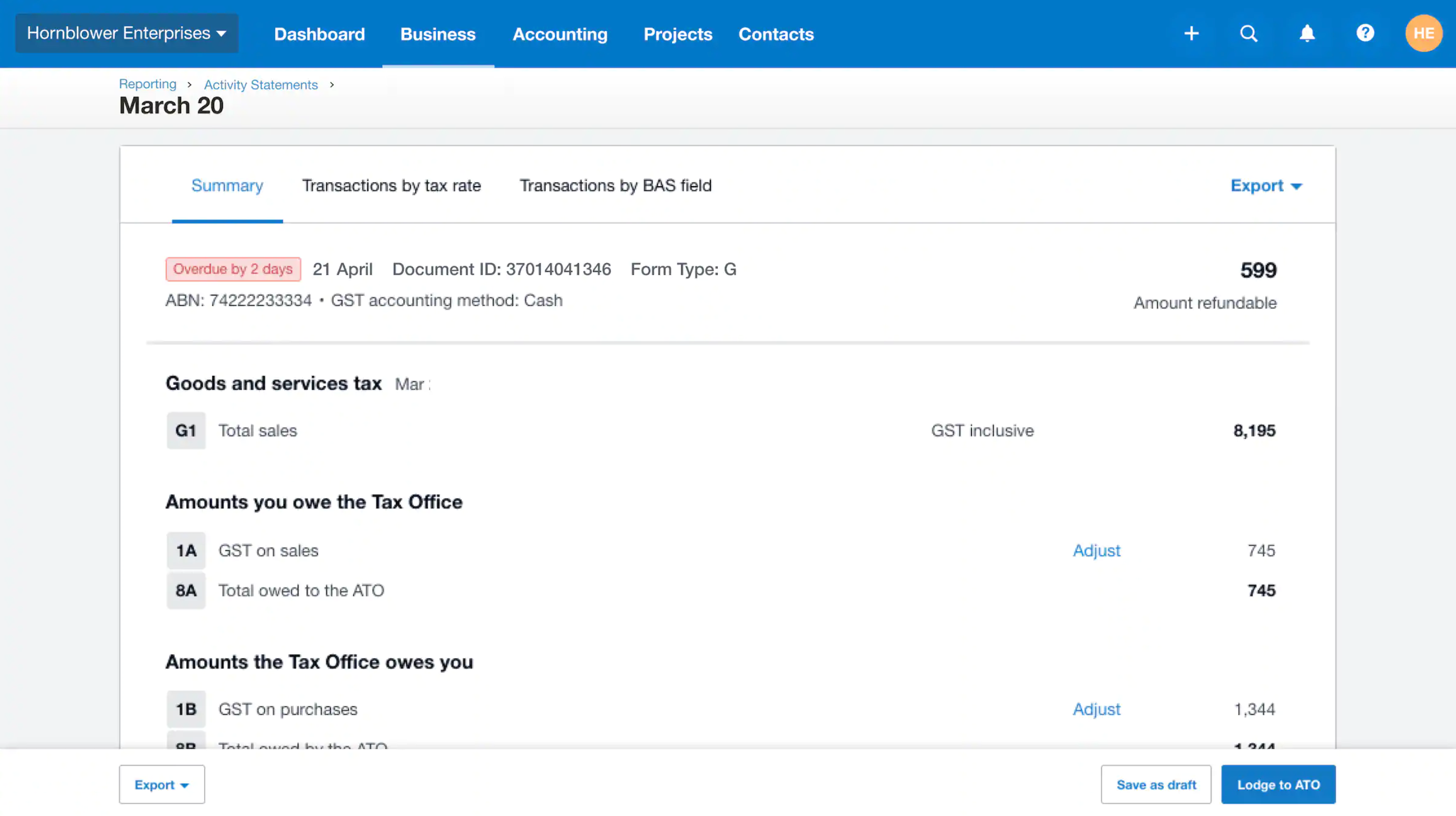

To clarify, Management Reports are “books” of user-defined, presentation-quality, customized reports. For example, these reports can contain cover pages, tables of contents, financial statements, operational information, compilation reports, and even management discussion and analysis commentaries. You can use any of the three pre-built Management Reports available in QuickBooks Online, or you can customize them to meet your needs and save them for future use. Further, you can distribute your management reports directly from within QuickBooks Online, save them as PDFs, or export them as Word documents for further editing.

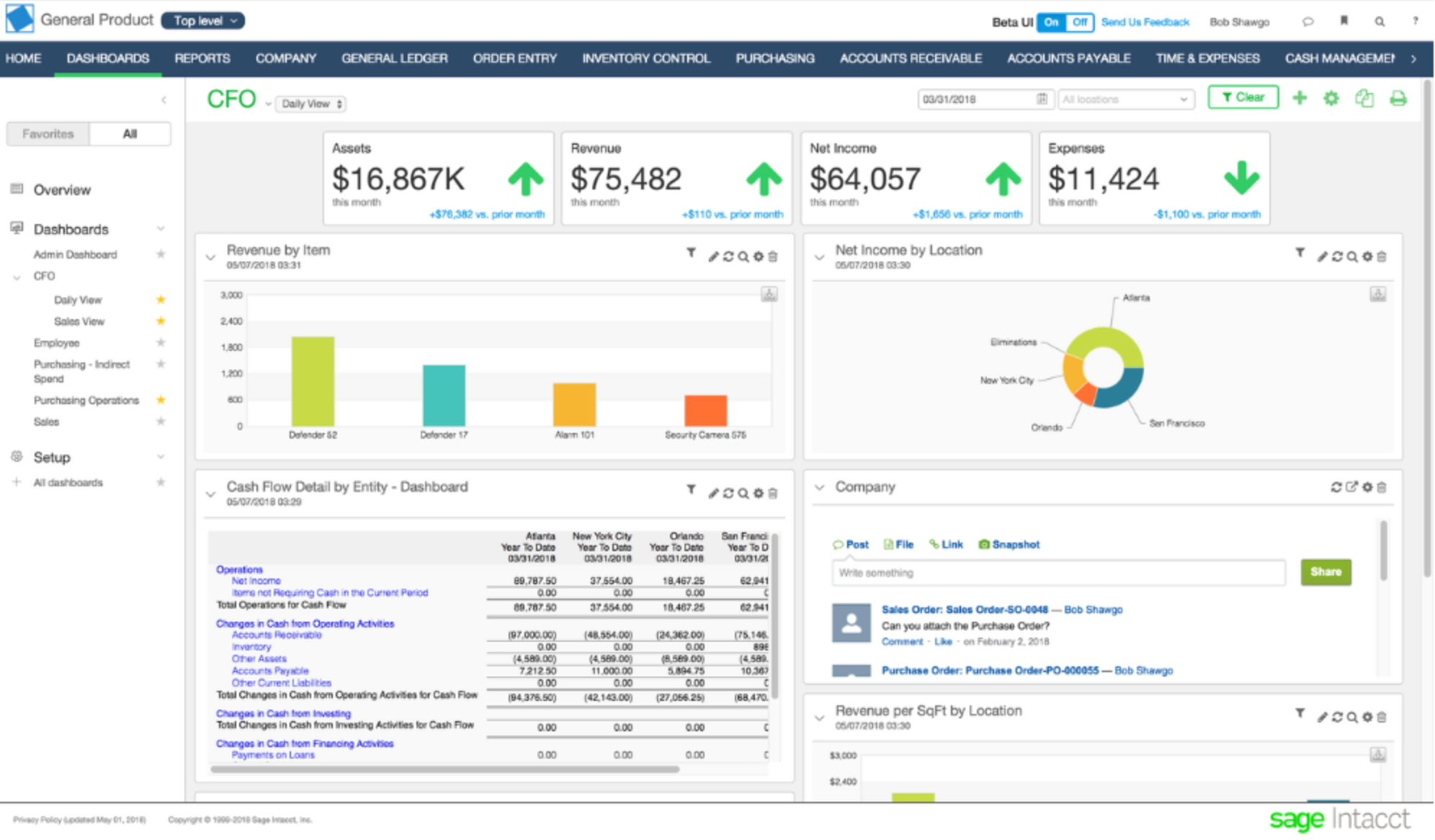

Accessing QuickBooks Online Management Reports

To use the Management Reports feature in QuickBooks Online, click Reports in the left menu, followed by the Management Reports tab. There you will see three pre-defined sets of Management Reports you can use as-is or customize them. Next, clicking View on the Company Overview report allows you to examine this report’s content, as pictured in Figure 1 .

If the report is suitable, can click Send , Export as PDF , or Export as DOCX in the Action column’s drop-down list. Then you can send it via email, export it to a PDF file or DOCX file, or share it using other means.

Customizing Your Management Report In QuickBooks Online

If you need to customize your Management Report, click Edit in the Action column’s drop-down list. Subsequently, the dialog box pictured in Figure 2 opens. Here you can perform the following customizations.

- Change the Template’s name ,

- Edit the Cover Page’s style ,

- Add a logo ,

- Change the Title and Subtitle ,

- Edit the Report Period ,

- Add Prepared by and Prepared date fields ,

- Add or edit Preliminary pages ,

- Add other Reporting objects , and

- Add or edit End notes .

Upon completing your edits, click Save and Close in the lower right corner. Subsequently you can distribute the report using any of the techniques described previously. Of course, having saved the report, you can use it again in future periods, and all your customizations will appear automatically, saving you the time you would otherwise spend customizing that period’s reports.

In conclusion, many QuickBooks Online users fall victim to the notion that they cannot customize their reports when they can. Importantly, the Management Reports feature provides you with a robust set of tools to create a comprehensive report book. Further, you can customize Management Reports to meet your company’s financial and operational reporting needs or those of a client. Therefore, if you use QuickBooks Online, be sure to check out this excellent feature today.

Check Out These QuickBooks-Related Seminar From K2 Enterprises

Eight-Hour Session

- K2’s QuickBooks for Accountants

Four-Hour Sessions

- K2’s Advanced QuickBooks Tips and Techniques

- K2’s Implementing Internal Controls in QuickBooks Environments

Check Out These QuickBooks-Related On-Line Options From K2 Enterprises

Web-based Learning

- K2’s QuickBooks Online – What CPAs Need to Know

- K2’s QuickBooks Online – Tips and Tricks

Check Out This Video Showing How You Can Use The Management Reporter

Tommy Stephens

Related posts.

Details Emerge About QuickBooks Online Bill Payment Options

Enabling Automated Workflows In QuickBooks Online Advanced

Top 25 Management Reporting Best Practices To Create Effective Reports

Table of Contents

1) What Is A Management Report?

2) Financial vs. Management Reports

3) Management Reporting Best Practices & Examples

4) Management Reporting Trends & History

5) Importance Of Management Reporting

6) Types Of Management Reports

7) Management Reporting System Functionalities

8) Best Practices Summary

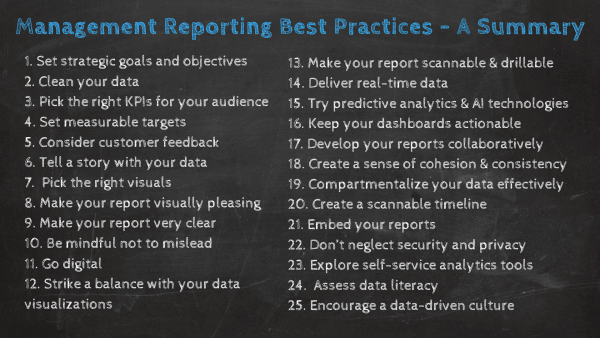

Management reporting is a source of business intelligence that helps business leaders make more accurate, data-driven decisions. But, these reports are only as useful as the work that goes into preparing and presenting them. In this blog post, we’re going to give a bit of background and context about performance management reports, and then we’ll outline 25 essential best practices you can use to be sure your reports are effective.

We’ll also examine examples that illustrate these practices in action created with modern online reporting tools . By the end of this article, making stunning and useful managerial reports will be second nature to you. But before we get into the nitty-gritty, let’s start with the basic definition.

What Is A Management Report?

Management reports are analytical tools used by managers to inform the performance of the business in several areas and departments. Senior executives and leadership use management reporting to drive their strategic decisions and monitor critical KPIs in real-time.

They basically show the worth of your business over a specific time period by disclosing financial and operational information. Reporting for management provides insights into how the organization is doing, empowering decision-makers to find the right path to increase operating efficiency and make pertinent decisions to remain competitive. To do so, many companies use professional management reporting software .

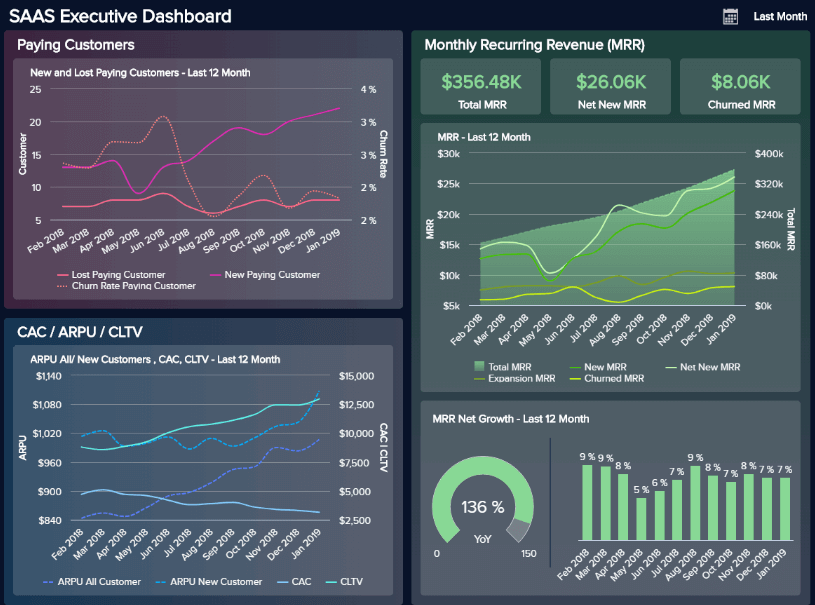

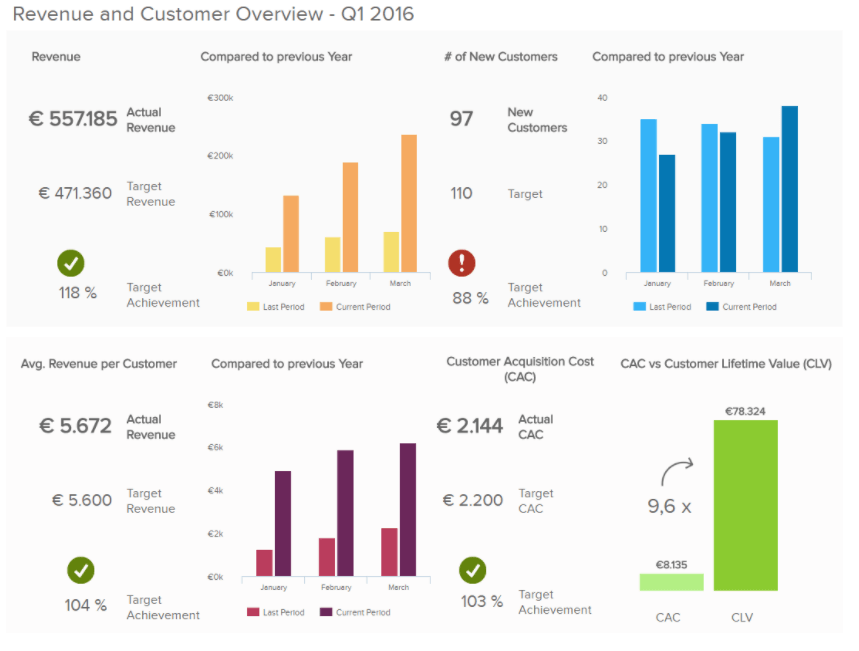

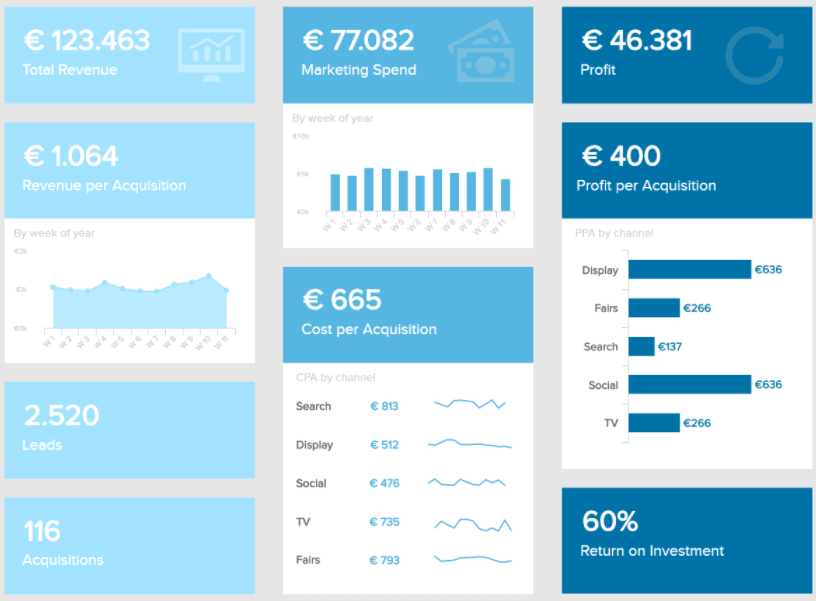

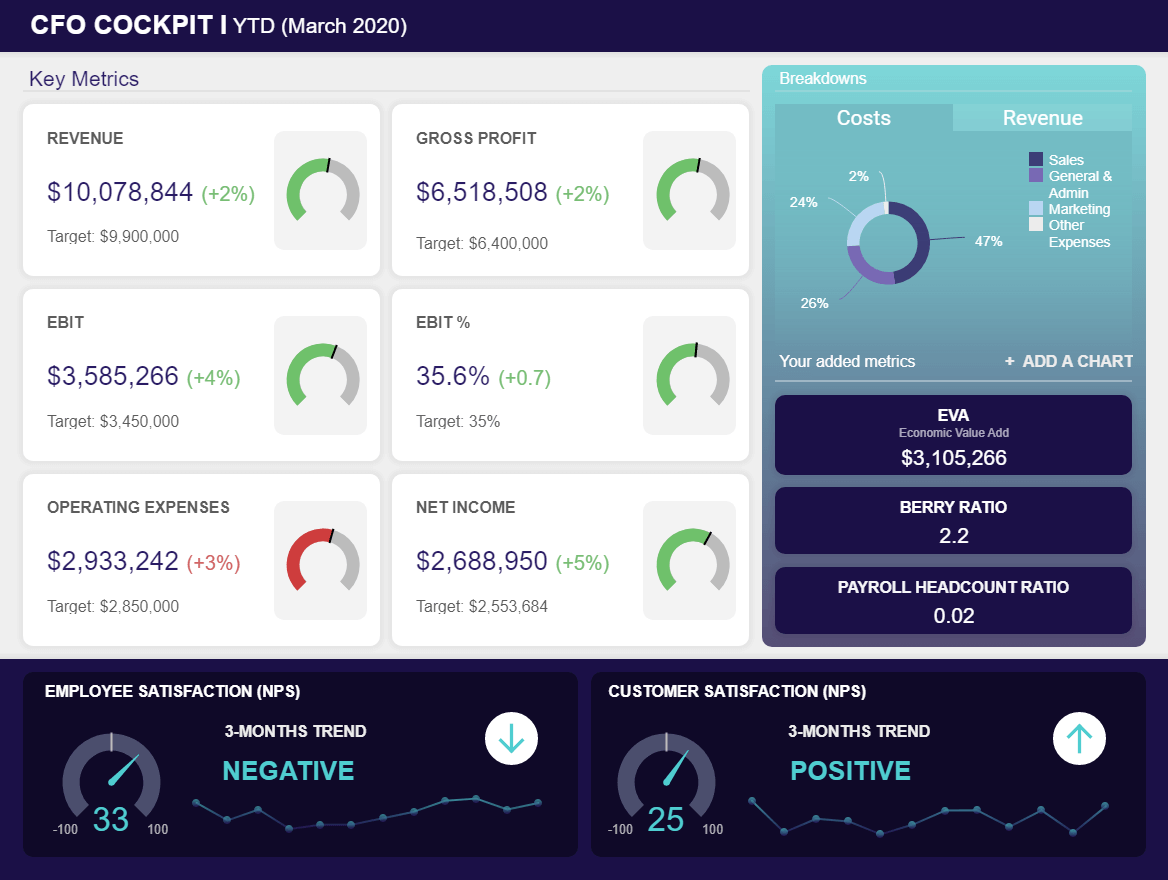

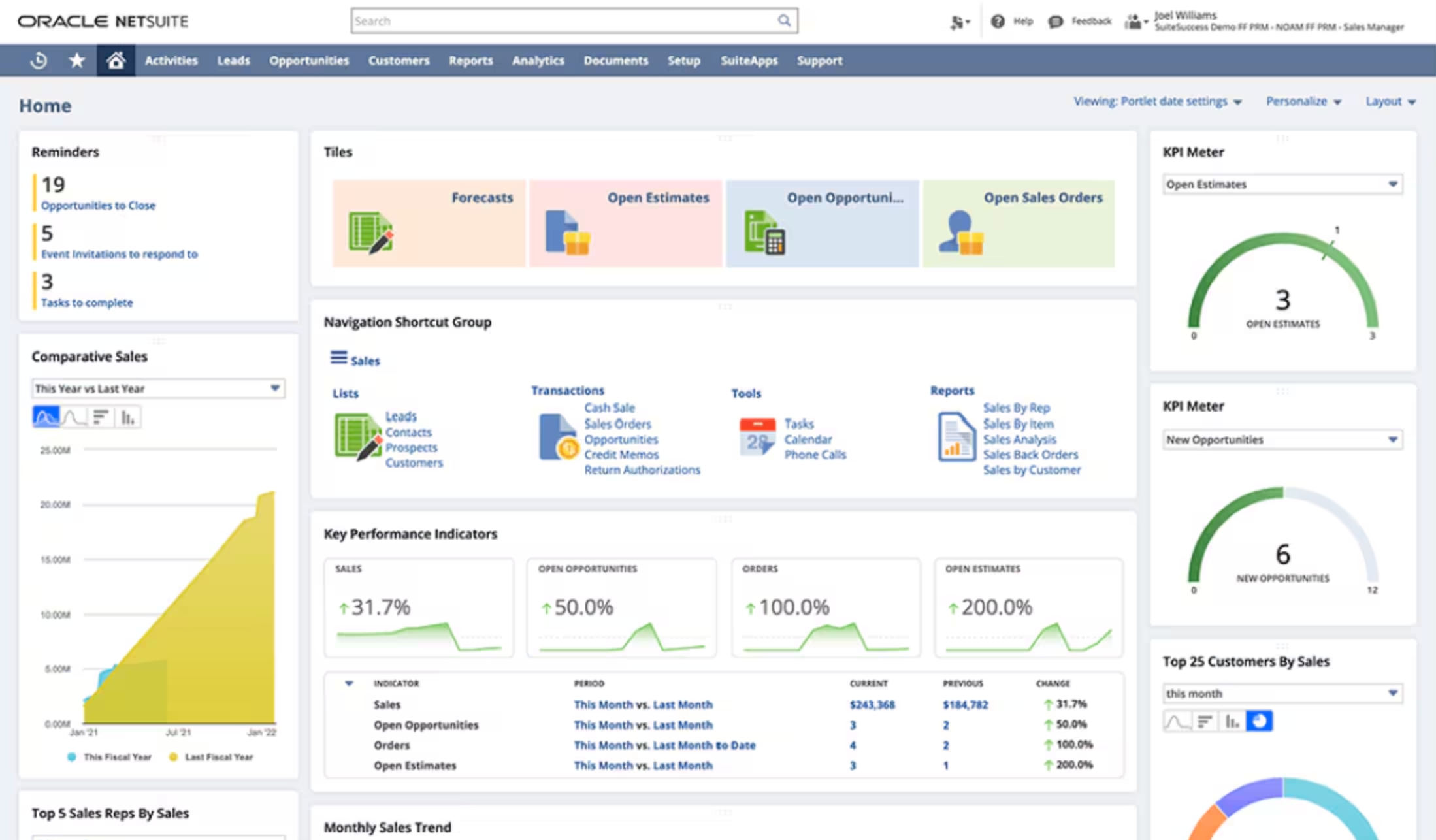

Backed up with powerful visualizations developed with a dashboard creator , no information can stay hidden, eliminating thus the possibility of human errors and negative business impact. The image above is a management report example focusing on a SaaS business. Throughout this post, we will cover various examples for different industries and departments to help you understand the power of these modern tools.

In The Beginning, Financial Reports

Most people in business are familiar with financial reports, which your business is required to keep for external accounting purposes. These reports are generally put out “after the fact” and follow a very clear and established set of guidelines known as Generally Accepted Accounting Principles (GAAP).

While such reports are useful for legal purposes, they’re not ideal for decision-making. They give you a bird's eye view of your business operations but without the actionable insights that are useful for making strategic choices. They’re also slow. As Tyrone Cotie, treasurer of Clearwater Seafoods, said , “…no matter how quickly you compile and release historical financial statements, you never make a decision from them. The challenge for finance is getting timely and accurate analysis that’s forward-looking and helps us make decisions.” This statement is valid today and probably, in the future as well. Why?

Because this mismatch between usefulness and reality comes from the fact that financial reports were never designed to be useful: they were designed to satisfy legal requirements. They were using historical data only.

Trying to make financial management reports useful

The mentioned mismatch led some companies to try to use their financial reports for legal purposes as decision-making tools by including additional information in them. While this approach has some merit, it has one big drawback: increased complexity and time cost. Considering that financial reports have to hit specific legal deadlines and that any additional information will cause them to be prepared in a more time-intensive way, this approach of “hybridizing” financial reports into management + finances is not recommended. Thus, the practice of management reporting separately from financial reporting came about. Managerial reports use a lot of the same data as financial ones but are presented in a more useful way, for example, via interactive management dashboards .

As a Growthforce article states, management reports help answer some of the following questions for a CEO:

- “Am I pricing my jobs right?

- Who are my most profitable clients?

- Do I have enough cash for payroll?

- Should I hire more employees? If so, how much should I pay them?

- Where should I spend my marketing dollars?”

To answer these questions, you will need a financial management report focused not on legal requirements but on business-level and decision-making ones. In essence, analysis reports are a specific form of business intelligence that has been around for a while. However, using dashboards, big data, and predictive analytics is changing the face of this kind of reporting.

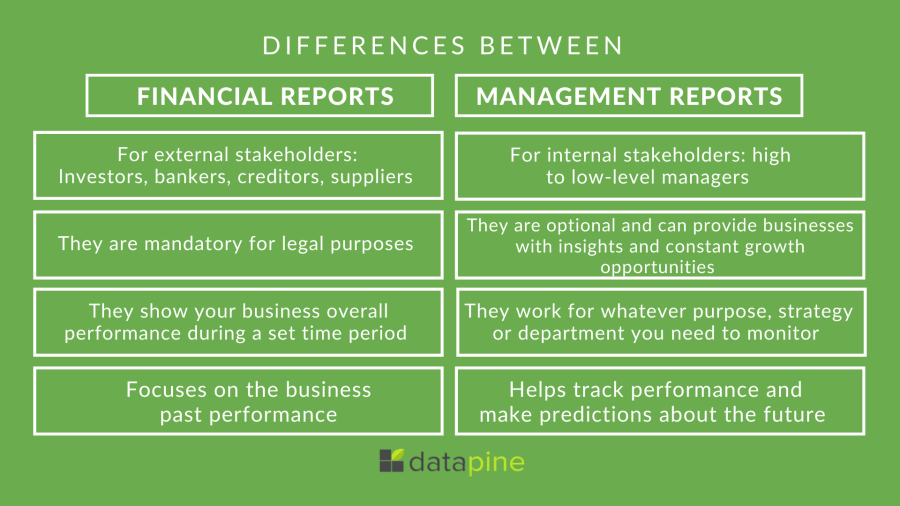

Before moving on to our list of best practices, we leave you an image to help you easily visualize the differences between these two types of reports.

**click to enlarge**

What Should Be Included In A Management Report: Top 25 Best Practices, Examples & Templates

We’ve asked the question: ‘ What is a management report?’ and explored its clear-cut benefits. Now, it’s time to consider the management reporting best practices.

Here, we’ll explore 25 essential tips, looking at management reporting examples while considering how you can apply these principles to different types of managerial reports.

1) Set the strategic goals and objectives

For every report you write, you will need to start with the end in mind. Why do you need that report in the first place? Do you know the key drivers of your business? How can you tell if your pricing is correct? How do you define success? Ask yourself some important data analysis questions that will allow you to address the needs of the report.

Once you know what you are monitoring and why it will be much easier to set the performance indicators that will track each specific aspect of the performance, don’t go further in the reporting process until you have set at least two to three goals.

2) Gather and clean your data

After you’ve set strategic and operational goals for the organization, your next step is to collect the information needed to track the success and performance of your efforts toward achieving those goals. Now, an important point to consider here is to pick only the data that will assist you in tracking your goals. Businesses gather an infinite amount of information coming from customers, sales, marketing, and much more, and tracking everything can become overwhelming and counterproductive. Instead, pick the sources of data that you actually need and move on to the cleaning stage.

Once you have selected your sources, you must ensure your data is clean and ready to be analyzed. When we say clean your data, we mean erasing any duplicates, missing codes, or incorrectly formatted data that can damage your analysis in the future. If, just by reading this, you are thinking, “What a tedious process this must be,” it's because it is. Cleaning your data manually requires a lot of time and effort. That said, there are many online data analysis tools out there that automate this process to save you countless hours of work and prevent any risk of human error.

3) Pick the right KPIs for your audience

OK – so you know that you need to focus on a small number of KPIs. Which ones should you be putting on?

It really depends on your audience – both on their job function and their level of seniority. For example, a junior sales manager and a junior marketing manager are both going to want to see different indicators. And the junior marketing manager will be interested in different data than the head of marketing. Good KPI management is critical in the process of manager reporting. A good way to think about the challenge of picking the correct metrics is to think: what data-driven questions will the readers of this report want to be answered? A sales manager might be interested in which of his reps is performing better, while an inbound marketing manager might want to know which piece of content is performing better regarding new email signups. Only after answering this question you will be able to address your audience’s expectations and benefit from effective reporting. You can also read our KPI reports article, where you can find precious advice on how to pick your KPIs.

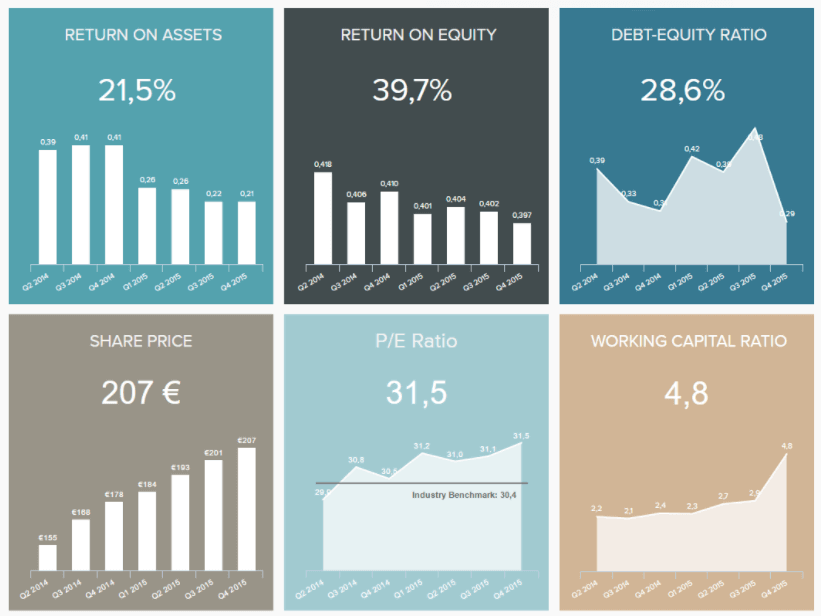

Hereafter is an investment management reporting format that illustrates this practice well. It focuses entirely on variables that investors would care about, including the share price and the price-to-earnings ratio.

**click to enlarge**

4) Set measurable targets and benchmarks

Once you’ve set your goals and defined the KPIs you’ll need to measure them, it is a good practice to set targets or benchmarks to evaluate your progress based on specific values. Let’s explore some ways in which you can define them in the most efficient way possible.

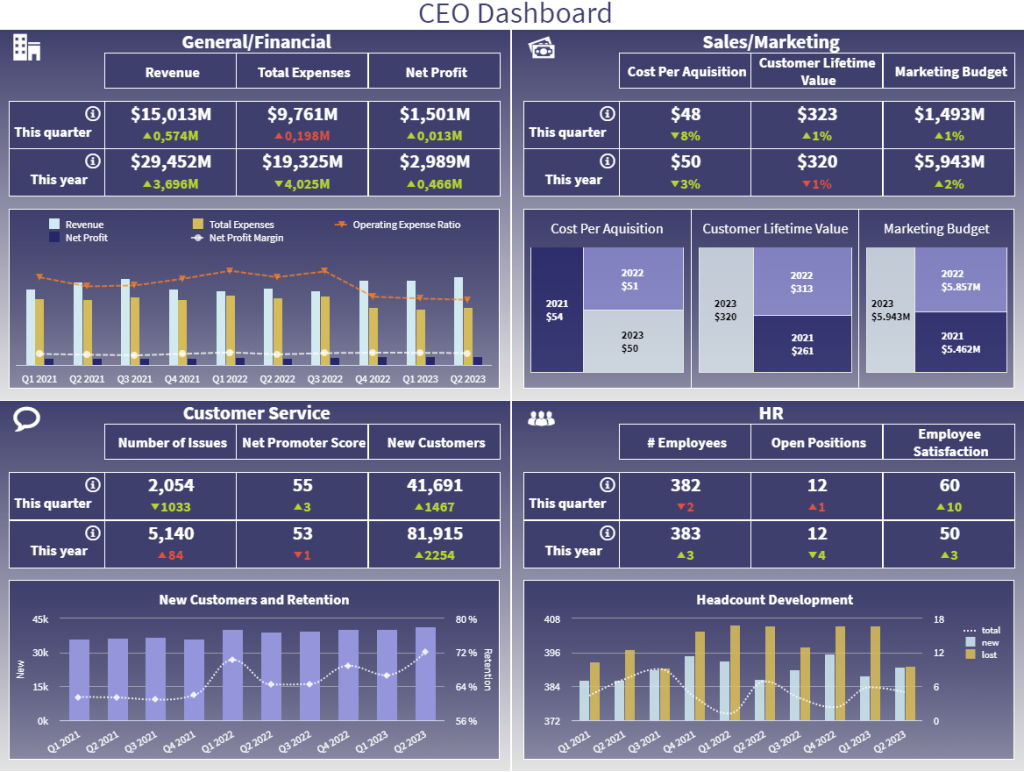

To do so, you first need to understand the difference between targets and goals. On one hand, goals are general strategic objectives that your company wants to achieve, such as increasing revenue compared to the previous year. And on the other hand, targets are the measures that will enable you to understand if you are on the right track to achieving your initial goals. Based on that, you should be able to set measurable, relevant, and achievable targets. Emphasis on achievable. Many businesses make the mistake of setting unrealistic targets and end up being disappointed when they don’t reach them. To prevent that from happening, comparing your performance to the previous period is a good and realistic benchmark to get started. Our example below is a CEO dashboard that gives managers a perfect overview of the organization’s performance compared to the previous period. Let’s talk about it in more detail below.

The CEO template provides insights into 4 critical areas for any C-level executive: finances, sales and marketing, customer service, and HR. Each of the metrics displayed in this report is compared to a benchmark of the previous period, with the colors red and green showing negative or positive development, respectively. Through this, managers can understand if their strategies are performing as expected and quickly spot any issues or improvement opportunities.

5) Take customer feedback into consideration in your reports

An additional tip is to use customer service analytics to draw conclusions from your client's feedback. Customer feedback plays into the overall performance of an organization as it caters to the organization’s ability to meet the needs of its customers. This feedback not only helps teams gauge what they’re doing wrong on their digital channels but also what they’re doing right .

Reporting on insights from feedback surveys can aid in forming a more data-driven digital strategy. For example, it can be leveraged to inform your product roadmap, identify pain points across the website (usability), and boost overall customer satisfaction.

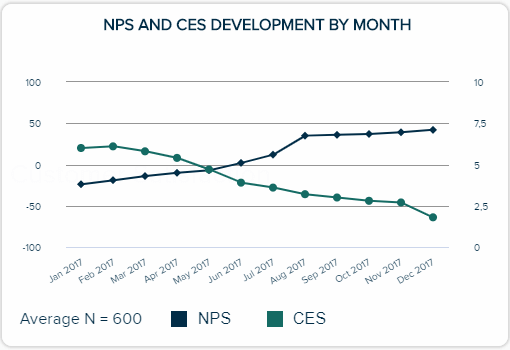

Is it overall customer satisfaction you wish to report on? Dive into your charts and show the rise (or fall) of your Net Promoter Score (NPS). Then take it one step further and analyze open comments associated with your scores to uncover what’s causing the drop. From here, you can formulate a strategy for boosting the organization’s NPS.

Here is an illustration of an NPS (feedback) chart:

6) Tell a story with your data

Our next tip zooms out of hard data and figures to focus more on the style and how to present your raw content. Human beings are primarily persuaded through 3 different types of information: context, content, and meaning. When you tell a story using the insights on your report, you can utilize all of them. This form of storytelling is challenging, but you have a few tools at your disposal and some tips:

- Using time periods and historical data. Stories follow a beginning, middle, and end pattern, and through the use of showing trends over time, you can achieve something similar. For example, you could compare the revenue in Q1 this year to the revenue in Q1 last year.

- Contrasting different KPIs and metrics against each other. For example, showing a target revenue number vs. the actual number this quarter.

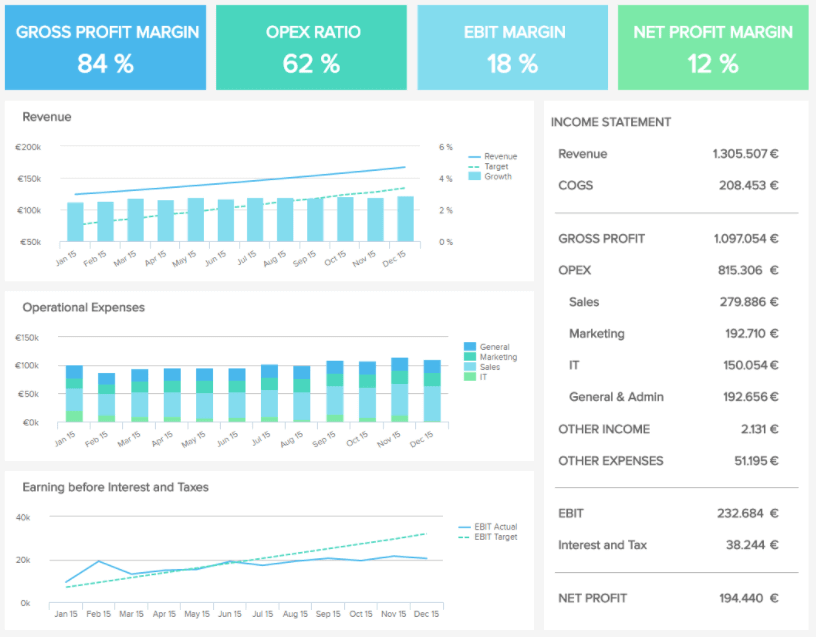

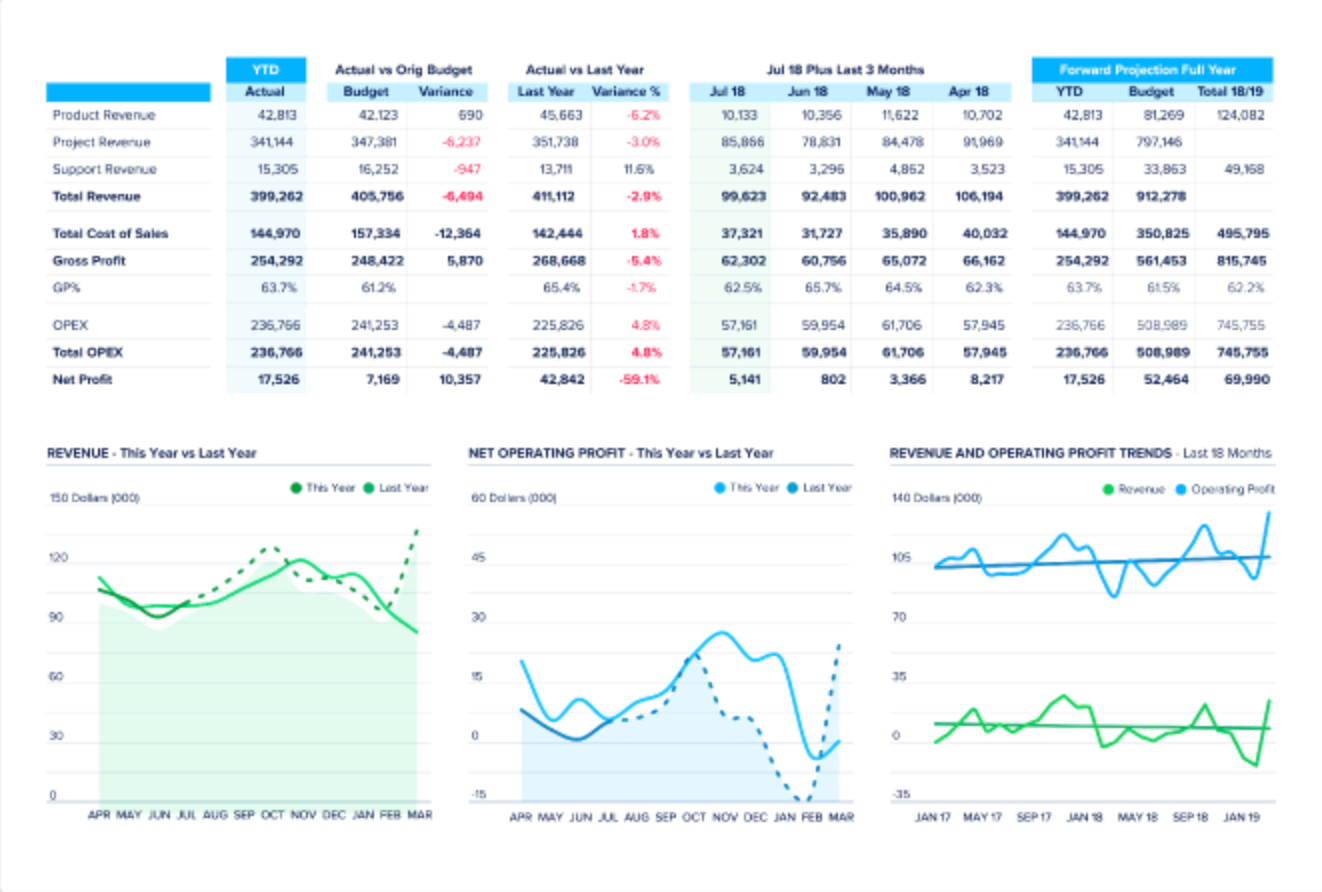

Hereafter is a good example of a management report, mainly thanks to the three large historical graphs taking up most of the display:

Let’s take a real-world example of how you can selectively use metrics to tell a specific story: you are the head of marketing and need to justify your current expenditures on content marketing to the CEO. She doesn’t care about email signups or page visits. No, your CEO is interested in revenue and ROI (an essential element of any effective financial management report). It is your job to connect the KPIs you look at revenue so that your CEO understands how important funding your department is.

You could show her the following variables to tell a story:

- Current email list numbers compared to last quarter

- How many new email list signups you’re currently getting per week on average

- The average email list signups you got per week last quarter

- How much money are you making, on average, for every new email subscriber and calculate the expected ROI

Using all of this information, you can answer the following question: how much new revenue is being driven by your new content marketing strategy?

This is the kind of story that can make or break funding allocation for a department.

7) Pick the right visuals

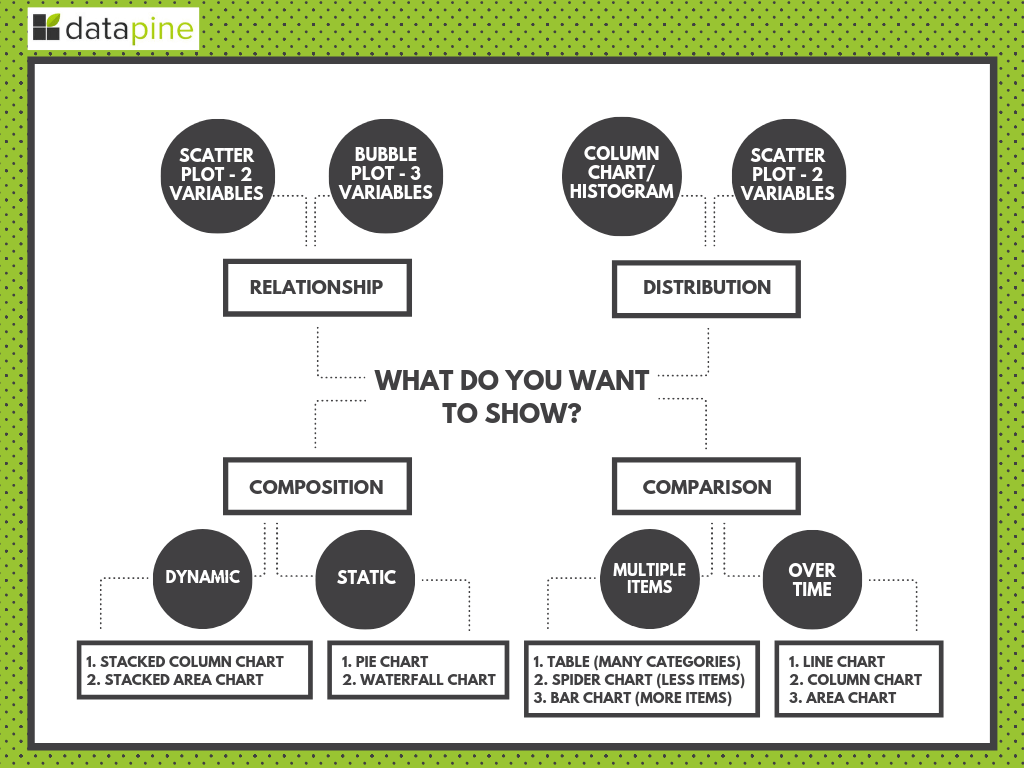

If you ever dealt with analytics and reporting before, then you must be aware of the multiple types of graphs and charts available to visualize your most important KPIs and build your reports. That said, being aware that these graphics exist does not mean you have the knowledge of how to use them correctly. A common mistake when it comes to management reporting is to use the wrong visual. This can significantly harm the decision-making process as the data can be perceived in the wrong way.

The first step you should take to avoid this mistake is to think about the goal of the data you want to display. Are you trying to show the breakdown of total costs? Or comparing costs to a previous period? Understanding the end goal will enable you to pick the right visual to convey the information you want. To help you with this task, below we display a visual overview of the different types of graphs and charts you should use depending on whether you want to compare, find relationships, analyze distribution, or composition.

If you want to dive deeper into this topic, our guide on the different types of graphs and charts will provide all the necessary knowledge and practical examples.

8) Make your report visually pleasing through focus

The human mind cannot process too much data at a time without getting overwhelmed. Getting overwhelmed leads to decision fatigue – which makes it harder for your management team to think strategically. That’s why when it comes to this level of reporting, you should remember the mantra of “less is more.” As a rough rule of thumb, displaying three to six KPIs on a report is a good range, and going too much beyond this is not the greatest idea.

That doesn’t mean that you can’t have other data presented – but you must have a clear hierarchy of visual importance in your report and only give the most important spots to your indicators. Other metrics should occupy secondary or tertiary positions. State-of-the-art online dashboard software allows you to easily build interactive KPI dashboards in no time that will become your prime asset when you’ll need to convey your information.

The following example is good to showcase this practice:

The four KPIs in this report template are prominently displayed:

- Number of New Customers

- Average Revenue per customer

- Customer Acquisition Cost

These metrics are set in context with historical trends, targets for the period, or other metrics like Customer Lifetime Value, causing this focused graph to tell a story.

9) Make your report very clear

In business writing and management reporting, clarity is the primary objective. This has several implications for your report design:

- Follow established dashboard design principles – give plenty of white space, ensure your colors stand out from each other, and select colors carefully.

- Don’t forget the small things – display a date range next to the data, and ensure it’s clear whether a given KPI is good, bad, or neutral. A good way to do this is by comparing expected values to real ones, like the expected revenue for a quarter to the actual revenue of this very quarter.

- Use common metrics that everyone who will read the report can understand and has experience with using.

For more tips & tricks on data-efficient reporting, you can read one of our previous blog posts on how to create data reports people love to read.

10) Be mindful not to mislead

As you learned in our two previous points, making your reports visually appealing and following design best practices is a fundamental aspect of achieving a successful management reporting process. Another important aspect to consider in this regard is to be mindful of how the information is presented to avoid being misleading. As a manager generating a report, it is very likely that you will have a diverse audience which can include people that are not familiar with the data presented in them. For this reason, following some best practices to avoid misleading reports can help you keep your work objective and easy to understand.

- Labels : When integrating several charts and graphs into your reports, labels play a fundamental role in how the data is perceived. For this reason, your labels should be short, clear, and concise. Avoid writing labels that guide the viewer to a specific conclusion or too complicated ones that can make the chart hard to understand.

- Axis: Manipulating an axis is a common form of misleading statistics used by the media and politicians to manipulate the public. A common bad practice in this regard is to start the X axis in a higher number than 0 to exaggerate a comparison between two data points. To avoid this, use your axis correctly, following charting guidelines.

- Cherry picking: This means picking only the data that will make you look good. As a manager, you obviously want to show how great the business is doing. However, showing only good results is a practice that can mislead the audience into believing something that is not the complete truth. Including bad results is a good way to learn and find improvement opportunities.

Your Chance: Want to test a management reporting software for free? We offer a 14-day free trial. Benefit from great management reports!

11) Go digital!

An important best practice for management reporting is to ditch paper-based reports and go digital. Online KPI reporting software is a great asset for your business, as they offer real-time updating capabilities, saves money, and reduces waste.

These digital reports can be made to be interactive, allowing you to get more granular or zoom out as you wish. Moreover, they are collaborative tools that let your team onboard the analytics train and work conjointly on the same report. Another example we will provide you with is the following marketing KPI report:

This is the perfect type of report a management team needs to ensure actionable, data-driven decisions: a high-level overview of the marketing performance is given. Indeed, focusing on the click-through rate, the website traffic evolution, or page views wouldn’t make sense. On the other hand, the big picture of how the marketing department works as a whole will be more appreciated: total revenue generated standing next to the total spend, the profit that came out of it, the return on investment, etc.

12) Strike a balance with your visualizations

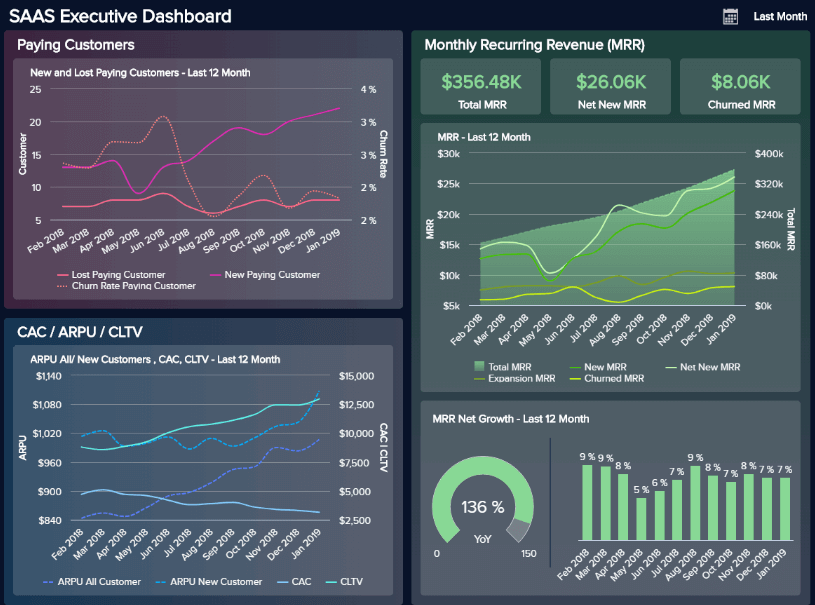

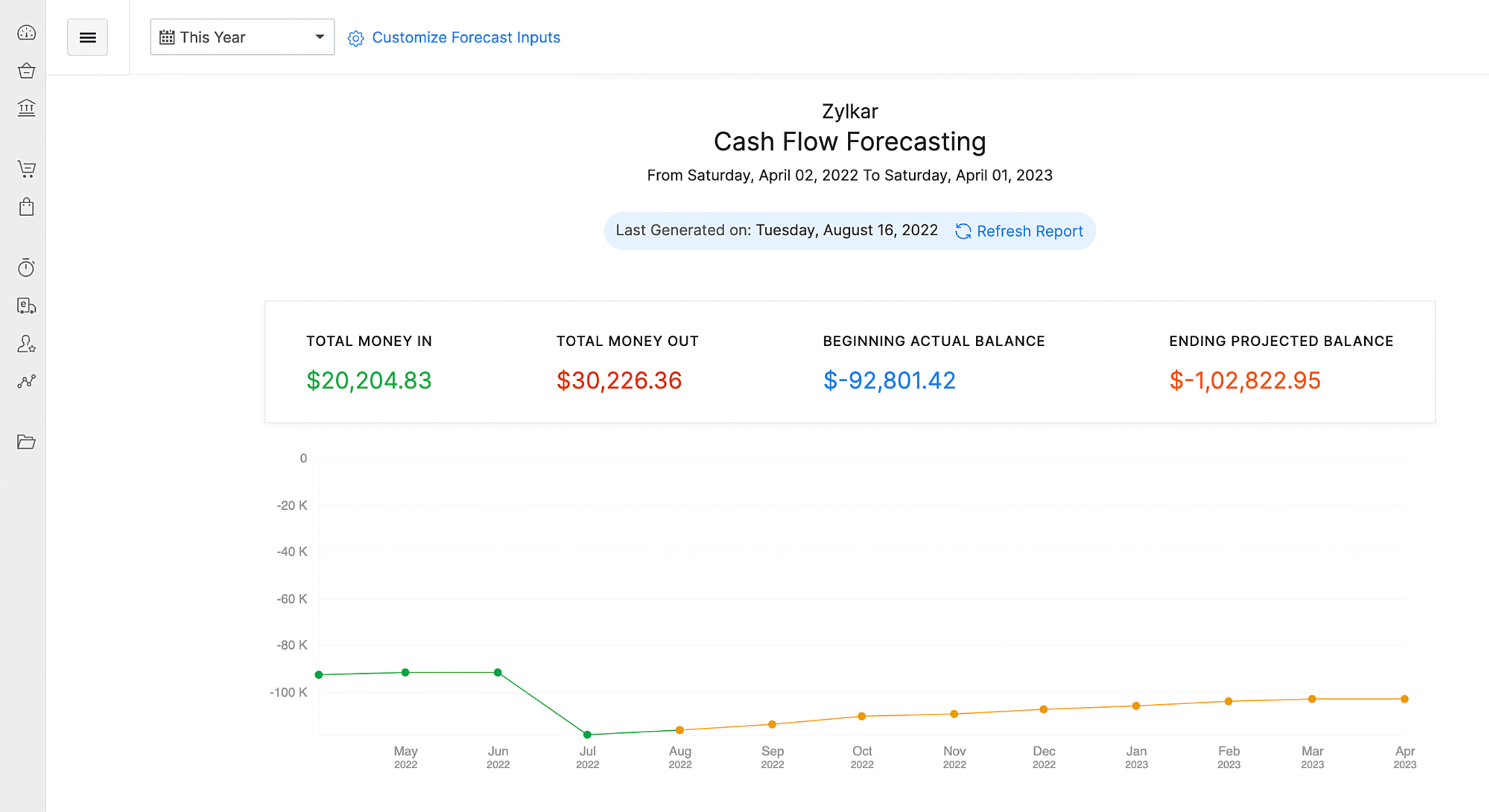

We’ve established that making your report clear is vital to success. Another way of making sure that your management report format is digestible is to make your various visualizations balanced on the page. Our SaaS executive dashboard is an excellent example of a visually balanced format:

The primary focus of this particular example is to provide a customer-centric view of the costs, revenue, and performance stability of your SaaS-based activities from a senior standpoint.

As you can see, our SaaS executive dashboard serves up 4 performance indicators (Customer Acquisition Costs, CLV, ARPU, and MRR) to offer a concise snapshot for senior decision-makers, with each visualization selected based on their ability to offer at-a-glance information without clashing or creating confusion.

When choosing types of graphs and charts, it’s important to consider basic design principles while also considering whether each chart, graph, or display works cohesively to provide essential information without causing conflict or consuming too much time.

By considering the previous tips, testing your visualization choices, and considering your core goals throughout, you’ll create a managerial report that gets real results.

13) Make your report scannable & drillable

It’s clear that going digital with your management reporting system is essential in our tech-driven age. And as we touched on earlier, two of the significant advantages of these systems are interactive functionality and customizable features.

By being able to customize your reports with ease while taking advantage of interactive features, you can build on your data visualization selection and design practices to ensure your management report template is both scannable & drillable.

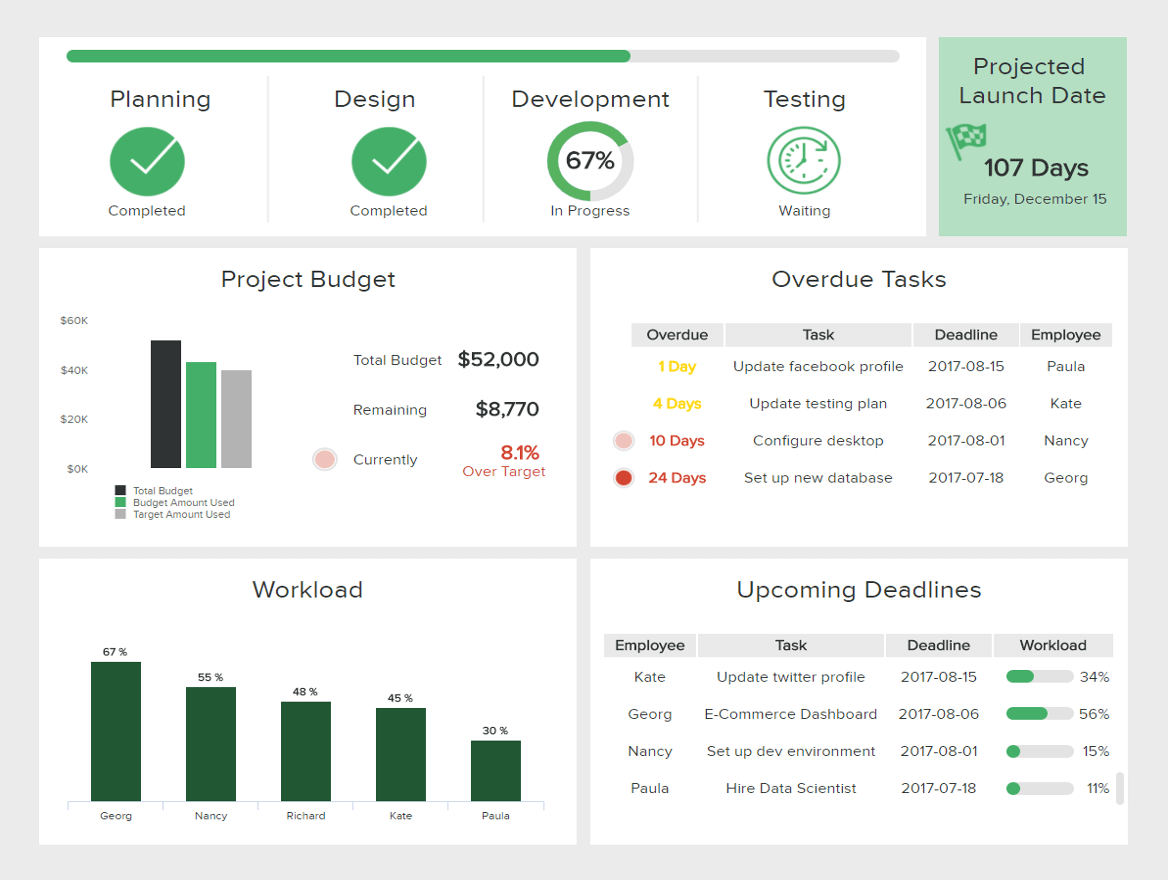

Take this dynamic project reporting example, for instance:

By making customizations and using interactive functions to drill down deeper into particular pockets of information, this IT report sample is effective for quick access to real-time project performance information as well as comprehensive trend-based data.

Working from the top left to the top right and down the project dashboard in a logical format, you can see the dashboard is entirely scannable and customized for cherry-picking important metrics. Here, it’s possible to get a clear gauge of project progress, looming deadlines, budgets, and workloads by simply scanning the page.

Plus, by taking advantage of interactive features and drill-down boxes, it’s possible to dig deeper into your data as required. By embracing customizable and interactive dashboard features, you can build your creations flexibly, working in real-time or with monthly management report tools. If you want to track your progress in a different format, you can take a look at our KPI scorecard article and organize your milestones differently.

14) Deliver real-time data that aligns with your objectives

Regarding major types of management reports, it’s important to understand when to lean on real-time insights. Knowing when to use this kind of dynamic data is the most prominent feature of your dashboard.

We’ve covered the importance of storytelling and selecting a balanced mix of KPIs (for past, predictive, and real-time insights). But what is important to consider with any management report sample is making sure your real-time insights fully align with your objectives.

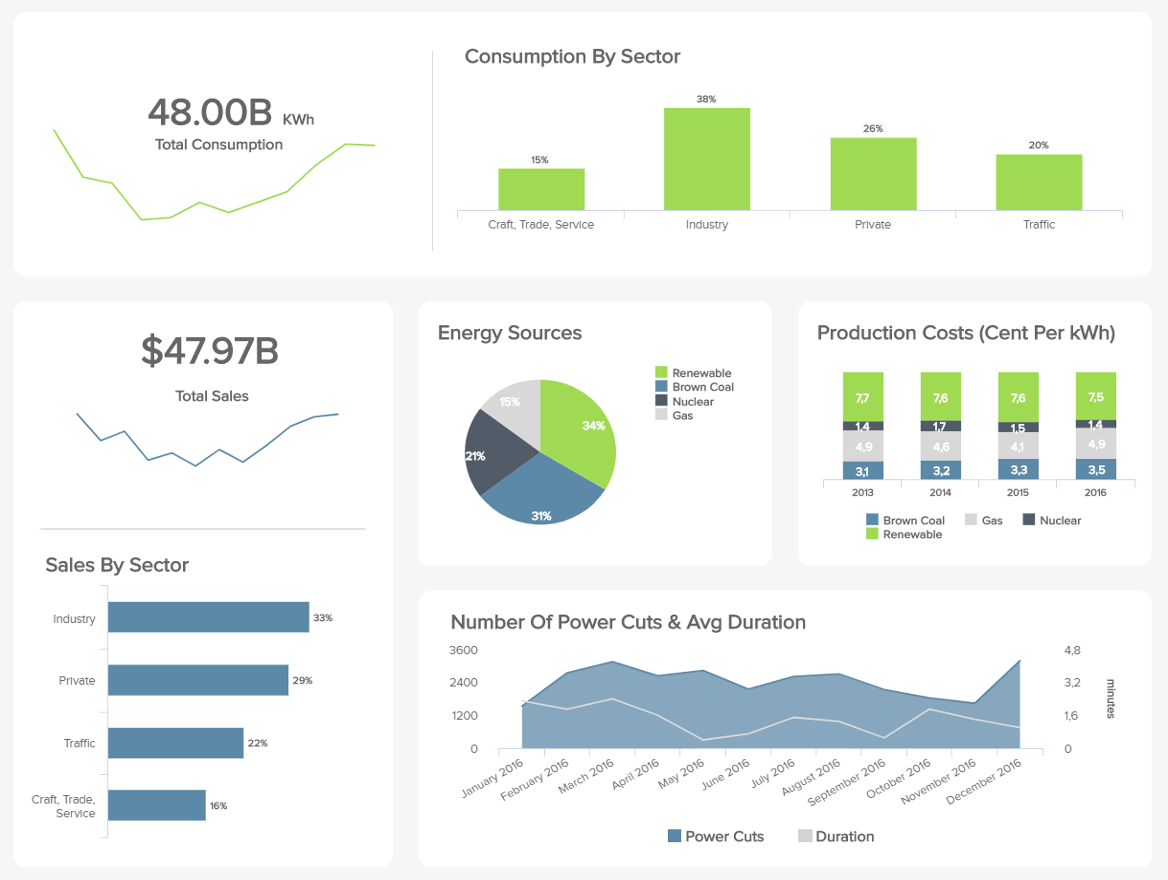

The next of our examples comes in the form of our energy dashboard - a prime representation of well-placed real-time insights:

Energy management is challenging as it requires quick responses to potential issues or inefficiencies to prevent major losses or problem escalations by utilizing modern energy analytics solutions. As demonstrated in this most insightful example, while you can see a mix of data types, the real-time metrics reflect the core aims of monitoring energy consumption and improving powercut management.

When creating your report, here’s what you should do to ensure your real-time data aligns with your primary goals:

- Revisit your key objectives and KPI selections, studying them in greater detail to see whether your real-time metrics “tell a story or paint a picture” that your audience will benefit from.

- Run your report for a week, personally testing it to check if your real-time insights allow you to achieve your goals and make quick, informed decisions.

- Ask other key stakeholders within the organization to test your report and offer their feedback. Based on their (and your) discoveries, make tweaks, changes, or customizations accordingly.

15) Try Predictive Analytics & AI Technologies

Following the line of real-time data, our next best practice is related to advanced management reporting systems. To extract the maximum potential out of your reports, you need to be sure you invest in a tool that will make your process easier, more automated, and more time-efficient. To assist you with this purpose, there are several business analytics tools in the market that can offer you these types of solutions. Let’s look at what you can achieve with these technologies.

Predictive analytics: Unlike not many other solutions out there, datapine provides a predictive analytics tool that takes historical data in order to predict future outcomes in your business performance. Getting these kinds of predictions is valuable as it will let you prepare in advance for the future and spot any potential issues before they happen.

Artificial intelligence (AI): As we’ve mentioned a few times throughout this post, management reports should turn your life easier. For this reason, embracing the powers of AI can take your managerial data to the next level. datapine’s intelligent alerts use neural networks to learn from trends and patterns in your data so they can later notify you if something unusual happens. All you need to do is set predefined targets or goals, and the alerts will set off as soon as a goal is met or something is not going as planned.

16) Keep your dashboards actionable and improve constantly

Expanding on the previous point: whether a financial management report, a monthly management report sample, or any other type of senior dashboard, continual improvements will ensure your offerings remain relevant and actionable.

The digital world is constantly evolving, and as such, business goals, aims, strategies, and initiatives are always changing to adapt to the landscape around them. To ensure your reports work for you on a sustainable basis, you should periodically test each report to check for any irrelevant KPIs while looking for any reporting inefficiencies. This can be done simply by utilizing visual analytics tools that use the power of visualization to ensure your reporting stays on course and improves your business's bottom line.

At this point, you’ll have already laid out the framework for your reports, and by committing ample time to make updates as well as improvements, you’ll remain one step ahead of the competition at all times. Get testing!

17) Develop your reports collaboratively

Managerial reporting systems are designed to offer insight, clarity, and direction.

To squeeze every last drop of value from your managerial reports, you must commit to developing your reports according to the landscape around you—and the best way to do so is as a team.

By taking a collaborative approach to your company's reporting initiatives, you will increase your chances of making tweaks or enhancements that offer a real benefit to your business.

Suppose you're in charge of financial management reporting, for instance. In that case, you should create a tight-knit workgroup of relevant specialists within your organization to gather on a regular basis and assess the relevance of your KPIs or metrics.

With this mix of professional perspectives, you will gain the power to spot any existing report management system weaknesses (outdated visualizations, inefficient reporting layouts, unnecessary data, etc.) to ensure that your accounting management reports not only capture every valuable fiscal insight but work in a way that gives every user the tools to perform to the best of their abilities.

As modern management reporting templates offer flexible 24/7 access across a multitude of devices, it’s possible to develop or evolve your visualizations and insights collaboratively on a remote basis, if required.

18) Create a sense of cohesion & consistency

Concerning financial management reporting best practices, our dynamic financial dashboard is as good as it gets. With a balanced mix of scannable visualizations and KPIs designed to drill down into the four primary areas of CFO management, this particular tool demonstrates the unrivaled value of internal executive reports.

Here, everything is geared towards striking a balance between economic value, improved financial performance, and ongoing employee satisfaction, presented in a logical and digestible format for swift decision-making even under pressure.

One of the main reasons this CFO manager report template works so well is it is functional as well as visual cohesion and consistency. Every key element is neatly segmented on screen, with charts that offer a wealth of relevant information at a glance.

As you can see, everything flows, each element fits into the right place, the colors and tones are cohesive, and it’s clear where you need to look when you need very specific nuggets of information at the moment.

Using this template as a working example, which you can adjust also as a CEO dashboard , you can create various types of reports in management with visual and practical consistency and cohesion at the forefront of your mind. If something appears out of place or creates friction, return to the drawing board and start again until everything is harmonious and offers genuine value.

19) Compartmentalize your data effectively

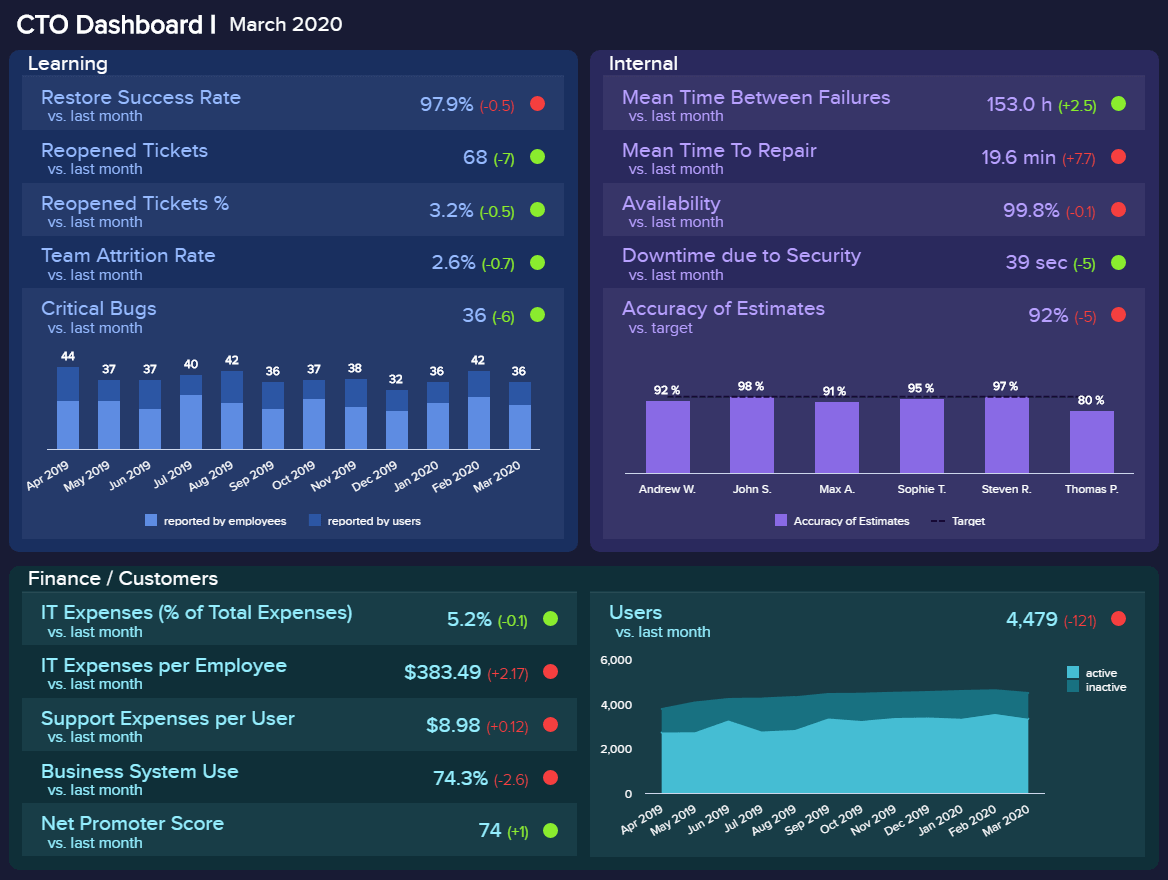

Our striking IT dashboard is a dynamic informational toolkit for anyone leading a company’s technical innovation and progress.

Whether you’re a small, medium, or large business (and regardless of your sector), our CTO-centric management reports template focuses on minimizing technical issues, streamlining tech-based processes, improving team attrition rates, managing new developments, and more.

In addition to its streamlined functionality and sheer reporting power, one of the key reasons this managerial report example is so powerful is its effective compartmentalization. Expanding on our last trip, by focusing on cohesion before considering how you will compartmentalize your insights, you will consistently get the most from your reporting efforts.

We touched on this before, but it’s a vital component of reporting, so it’s worth covering in further detail: once you’ve committed to your data and visual KPIs, examine how each key element fits into your report and place it into the ‘right compartment’ on-page.

Looking at the CTO dashboard, each core branch of information is split into a box under a clear-cut subheading. Within each of these compartmentalizations, there are clearly labeled data, insights, and visualizations.

By drilling down further into how you compartmentalize your reports, you will give yourself the ability to analyze one area of information or grab an entire snapshot at a simple glance. As a result, you will improve your business performance and streamline your decision-making process.

20) Create a scannable timeline

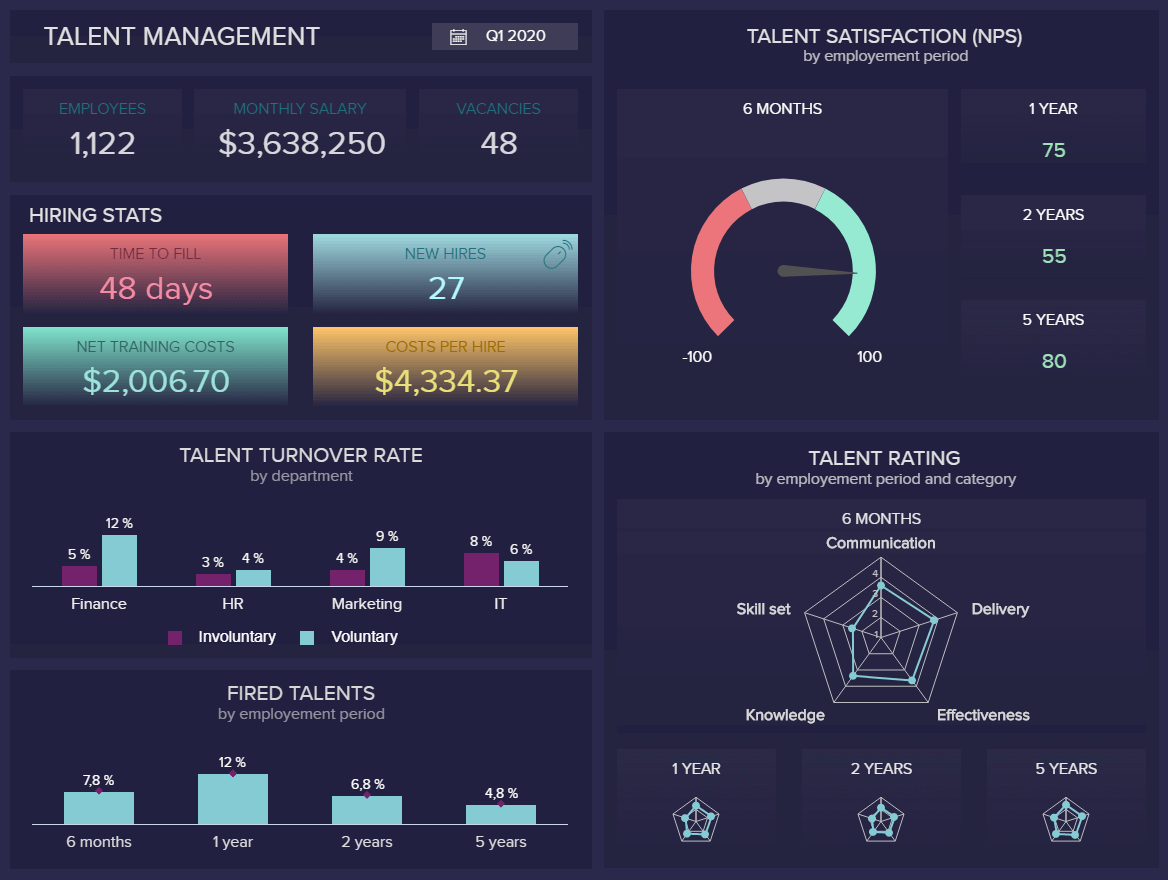

Employee management reporting helps managers make vital improvements to specific functions of the business with clear-cut direction and complete confidence.

Our HR dashboard — a must for any modern HR department — exists to assist personnel-based managers in keeping their employees happy, engaged, and motivated. Employees who feel valued and engaged in the business are generally more productive and more creative, so looking after your talent the right way should be one of your company’s top priorities — no exceptions.

When it comes to HR, managers need to take care of many tasks, which include picking the best payroll system, conducting performance reviews to ensure productivity, hiring the right talents, and more. Putting the talent area into perspective, our HR management reporting template serves up a perfect storm of data-driven insights that covers staff turnover, dismissal, rising talent, and overall satisfaction levels. For example, the talent satisfaction KPI for HR managers gives you a clear overview of whether your business gives enough incentives to satisfy your current workforce.

But not only here, but you will also gain a deep working insight into where you might be going wrong while capitalizing on your strengths and, ultimately, offering the right reward, recognition, training, and support where needed.

What makes this workforce management reporting example so successful is the fact that it provides a solid timeline of information. By working down or across, you can access an excellent balance of historical, real-time, and predictive knowledge with ease.

As such, this report paints a data-centric timeline that will empower any HR manager to examine trends, understand fluctuations in employee engagement rates, and create viable strategies that increase retention while boosting productivity.

The takeaway here? When considering the contents of a good managerial report, it’s always important to look at how your visualizations and design layout create a timeline that allows you to formulate initiatives that will benefit the business both in the moment and in the future.

21) Embed your reports

As we are about to reach the end of this insightful list of tips and best practices, we couldn’t leave out one of the technologies that have revolutionized the reporting landscape: embedding analytics. Essentially, embedding a report means integrating all the functionalities of a business intelligence reporting software , such as dashboards, charts, and more, into your company’s existing system.

Having access to this type of technology is not only way cheaper as your company doesn’t need to invest in creating a system of its own, but it can also provide a great competitive advantage. Embedded dashboards and reports are fully customized to the colors, logo, and font of the organization, allowing employees and managers to enjoy all the functionalities of a reporting system in a familiar environment which can boost productivity and performance.

22) Don’t neglect security and privacy

So far, we’ve covered tips related to the planning, design, and usability of your reports. Now, we will talk about a topic that is often overlooked but is becoming increasingly important, privacy and security. According to research , in 2021, 70% of small businesses reported a cyberattack of some kind. The financial impact of these attacks can significantly damage an organization. It is believed the average cost of an email comprise attack is $130.000. At the same time, ransomware attacks are projected to reach $11.5 million in damages this year.

That said, privacy and security issues affect businesses on a financial level but also on a reputational and legal one. Not protecting sensitive customer and employee data, such as addresses, bank records, phone numbers, and others, can expose them to serious damage that can lead to legal repercussions.

To prevent critical business information from falling into the wrong hands, you should implement strict access controls, data encryption, and data anonymization processes, among other things. Plus, you should train your employees about potential threats and prevent risky behaviors, such as accessing reports on a public network. Tools such as datapine provide a secure environment for your management reporting process. This includes secure sharing options such as password-protected URLs or strict viewing rights to make sure only authorized people have access to the reports.

23) Explore self-service analytics tools

The times when financial or management reports were only meant for analysts or scientists are long gone. In today’s data-driven era, if a business wants to succeed and get an advantage over competitors fully, they need to make sure that everyone in its organization can benefit from data analysis. For this purpose, implementing a self-service business intelligence tool can be the answer.

In simple words, self-service BI refers to the process or tools companies use to analyze and visualize their data without needing any prior technical skills. Management reporting systems such as datapine include a user-friendly interface as well as an intuitive dashboard designer that will allow you and anyone in your business to visualize insights from several sources and create powerful reports with just a few clicks. Businesses that benefit from these types of solutions can extract valuable information into their performance and constantly spot improvement opportunities.

24) Assess data literacy

As mentioned a couple of times already, in order for your management reporting process to be efficient, it is necessary to involve the entire organization. While self-service tools such as the ones we mentioned in the previous point are extremely valuable to achieve this task, there is still a level of knowledge or analytical awareness that needs to be had across all employees for the process to be successful. To do so, assessing the level of data literacy is a great place to start.

Data literacy refers to the ability to understand and communicate using data. To evaluate the level of literacy of your employees, you can carry out surveys to categorize them depending on their level of knowledge. With the results, you can set up training instances to get everyone in the same place with the tools and concepts that will need to be used across the organization’s analytical journey. In time, everyone will be able to generate stunning management reports and use them to collaborate with each other. This leads us to our next and final best practice.

25) Encourage a data-driven culture

Following on from the prior point, by implementing self-service solutions, you will gain an invaluable benefit: a data-driven culture for your business. Your company culture is the blueprint for how your business runs, as well as how everyone within your business interacts or operates internally. Naturally, your internal culture will have a notable impact on the way your clients, customers, and affiliates view your business.